Good morning from Paul & Graham!

Did we miss anything good in the frenzy of trading updates in January? We've got a bit of spare time this week, as newsflow is quietening down, so I've come up with an idea! If you would like us to look at a small to mid cap share, and you can make a good case for it that engages our interest, we'll review it here! Reader suggestions in the comments below, with the most thumbs ups, we'll review the top 3 this week.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other morning movers -

t42 IoT Tracking Solutions (LON:TRAC) - Nanocap. Up 45% on agreement - potential revenue of $7.5m, but “no guarantee” of quantity, timing, or revenues! Desperately weak bal sheet, needs a fundraise. Still hasn’t reached agreement with holders of CLNs.

Superdry (LON:SDRY) - continues rising, up 12% to 52p, on hopes that Dunkerton might bid for it with private equity backers. It’s possible, but why would they be generous to minority shareholders, when the company’s in such a mess?

Summaries

Porvair (LON:PRV) - 660p (pre-market) £305m - FY 11/2023 Results - Paul - GREEN

One of my favourite shares - quality at reasonable price probably sums it up best. As expected, results have come in ahead of modestly set forecasts. Lovely balance sheet. Cashflows mainly being used for bolt on acquisitions. Modest divis. Outlook sounds fairly confident. I continue to view this share positively as a long-term investment idea.

CMC Markets (LON:CMCX) - 149.6p (+13%) (£419m) - Cost Reduction and Efficiency Plans - Graham - GREEN

CMC appears to have caught the market by surprise with the announcement of a 200-person reduction in headcount, leading to £21m of annualised savings from next year (FY March 2025). Revenues have surprised to the upside and now costs to the downside.

Bidstack (LON:BIDS) - 0.19p (-65%) (£2.5m) - Cost Reduction and Efficiency Plans - Graham - RED

Ominous news here, looks like it's heading for disaster.

Paul’s Section:

Porvair (LON:PRV)

660p (pre-market) £305m - FY 11/2023 Results - Paul - GREEN

Porvair plc ("Porvair" or the "Group"), the specialist filtration, laboratory and environmental technology group, announces its results for the year ended 30 November 2023.

Record revenues and profits.

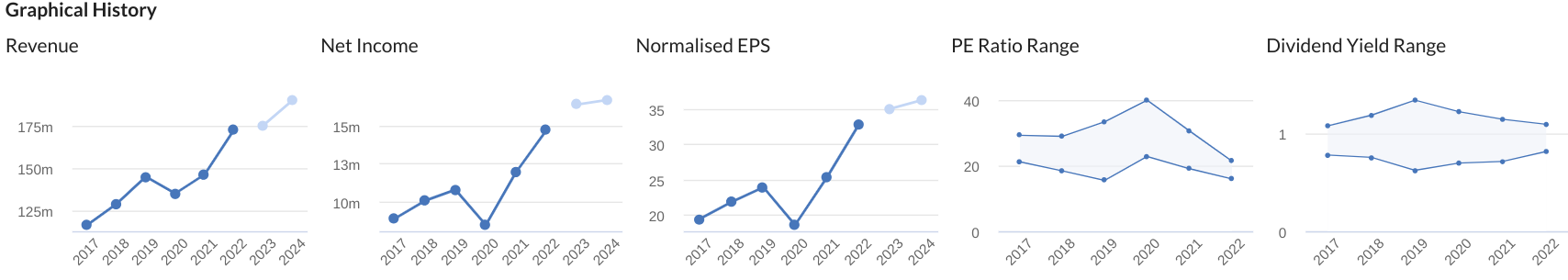

Background - Porvair has been on my radar for years, and I added it to my top 20 list of ideas for 2024, being impressed with its multi-year performance, and the valuation had come into reasonable range (after previously being over-priced). Our previous 3 comments here -

3/7/2023 - AMBER - pricey at 664p (PER 19x), good H1 results & outlook.

15/9/2023 - GREEN - 598p good entry point? Likely to beat forecasts.

5/12/2023 - GREEN - 624p - trading ahead of expectations. Acquisition.

FY 11/2023 results -

Revenue up 2% to £176m

Adj PBT up 10% to £21.4m - attractive 12.2% PBT margin

Adjustments are small, and relate to acquisitions (costs and amortisation), which is OK.

Adj EPS is 37.2p both basic & diluted (no share options?) PER 17.7x

This looks an earnings beat, with 37.2p being ahead of 35.0p consensus.

Dividends small, but well-covered at 6.0p (full year). The dividend-paying capacity would be a lot higher, but cashflow is prioritised to fund acquisitions instead.

Strong balance sheet NAV £140m, less £83m goodwill = NTAV £57m.

Net cash (excl leases) £14.1m

Cashflow is healthy, and is used in this order - acquisitions, capex, dividends.

Outlook -

After a record 2023 the Board is optimistic for 2024 and beyond. There is much to look forward to as the year unfolds: opportunities afforded by acquisitions; strong order books in aerospace and petrochemical; demand recovery in Laboratory; and new products in Seal Analytical and elsewhere. In the first half of 2024 these should offset near-term headwinds of adverse foreign exchange and de-stocking in US industrial consumables, which seems to have a few more months to run.

The Group's fundamental demand drivers have not changed. Porvair remains well positioned to take advantage of tightening environmental regulation; the growth of analytical science; the need for clean water; the development of carbon-efficient transportation; the replacement of plastic and steel by aluminium; and the drive for manufacturing process quality and efficiency. It is these trends that drive the Group's consistent longer-term trading record and enables the Board to look ahead with confidence.

No broker updates available.

Paul’s opinion - good results, very much as I was expecting. We’ve been pointing out here for a while that forecasts looked beatable, because strong H1 results and a positive Q3 TU were already in the bag.

I remain of the view that this looks a high quality business, with a conservative balance sheet providing safety, that recycles most of its cashflows into making complementary acquisitions within its areas of expertise (hence less likely to make mistakes).

It’s not the cheapest share out there, but given the fairly upbeat outlook, it really should manage 40p+ EPS in FY 11/2024, so at 660p it’s now valued at about 16.5x current year earnings, which I see as an attractive price for a good business, with a hold forever type of investment strategy. Shares have 10-bagged in the last 14 years, so patience has been a real virtue here.

I’m happy to stay at GREEN.

Graham’s Section:

CMC Markets (LON:CMCX)

Share price: 132.8p (pre-market)

Market cap: £372m

This is another positive update from a share which found itself on both Paul and my favourite ideas lists for 2024.

The key point about CMC’s current situation is that it’s trading at a point of extreme operational leverage: small incremental revenues can drop down to the bottom line and make all the difference between a profit and a loss. (This stands in contrast to companies who already have high operating margins, so that small increases in revenues don’t have a large percentage impact on their profitability.)

At the interim results (covered in November) CMC reported a £2m loss on net operating income of £123m.

In January, as covered by Paul, net operating income guidance for FY March 2024 was upgraded from £250-280m to £290-310m.

And today we have news on the cost front. Unfortunately it’s not good news for staff, as CMC are planning a 17% reduction in headcount:

In its interim results announcement on 16 November 2023, CMC indicated that the business was reaching the peak of its investment cycle and a cost review was planned for H2 focused on driving efficiency through its global operations. The review has been successfully completed and as a result the Group will be reducing global headcount by approximately 200 positions, representing circa 17% of existing headcount.

Financial impact: a one-off cost of c. £2.5m in the current year, but annualised savings of £21m in FY 2025.

This news was not yet priced into forecasts, as it represents “an 18% reduction against consensus staff costs”.

Today’s update also confirms that a variety of other cost-saving/efficiency measures have been taken and continue to be targeted, in addition to staff reduction.

Trading remains in line with the previous update.

Graham’s view

Analysing shares can be simple sometimes (maybe analysis is best when it’s simple?).

The investment thesis here has consisted of three simple ideas: revenues can improve, costs can stabilise, and then the operational leverage will see profits pick back up again.

First, revenues can improve cyclically when volatility picks up off its current low levels. Here is the VIX volatility sentiment, which as you can see has been quite depressed of late:

The recent trading update hinted at sentiment recovering to some extent, with higher levels of interest in trading, even without much volatility in the market.

On the cost front, it was flagged by Lord Cruddas, and we were reminded in today’s update, that CMC’s investment cycle had “peaked” as it rolled out new products both at home and internationally.

However, I must admit that while I was optimistic that costs could be reduced, I did not expect such a radical change as a 200-person reduction in headcount. That £21m annual saving could transform results, if it’s true that this labour is surplus to requirements now that the company’s pace of product roll-out is slowing down.

Both forces (rising revenues and falling costs) appear to be moving in the right direction, so clearly I’m going to keep my positive stance on this share. Hopefully FY March 2025 will be the year when we see CMC returning back to healthy profitability as it was before.

Bidstack (LON:BIDS)

0.19p (-65%) (£2.5m) - Cost Reduction and Efficiency Plans - Graham - RED

The wheels may be coming off this video game advertising company for the final time, as the company notes procedural difficulties in relation to planned funding from its largest shareholder, Irdeto. Irdeto has thus far failed to provide documents needed in order to facilitate a legally required vote on their proposed £2.4m convertible loan note. Oddly, Bidstack has already drawn down £0.6m under the facility, but will not draw down any more tranches given the circumstances. I wonder if they are planning to use the £0.6m they’ve drawn?

They have also received EUR €3m from commercial partner Azerion to settle a long-running dispute and set up a new collaboration between the two companies.

Despite these cash inflows, Bidstack’s working capital position “remains tight”. The cash balance is only £1.4m which is thought to be sufficient to last until the end of March. Restructuring advisors have been appointed and asset sales are possible. I wouldn’t bet on anything being left for shareholders when all is said and done. This much talked-about stock appears to be heading for a sad end.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.