Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Futura Medical (LON:FUM) - up 32% to 36.5p on trading update.

SysGroup (LON:SYS) - up 19% to 34.5p on update.

Renishaw (LON:RSW) - mid cap up 19% to 4080p. Interim results. Expects better H2.

XLMedia (LON:XLM) - up 8% to 6.9p - Exclusive partnership with Star Tribune.

Biome Technologies (LON:BIOM) - up 7% to 110p - trading update.

Springfield Properties (LON:SPR) - up 5% to 83p - £15m affordable housing contract signed.

Summaries

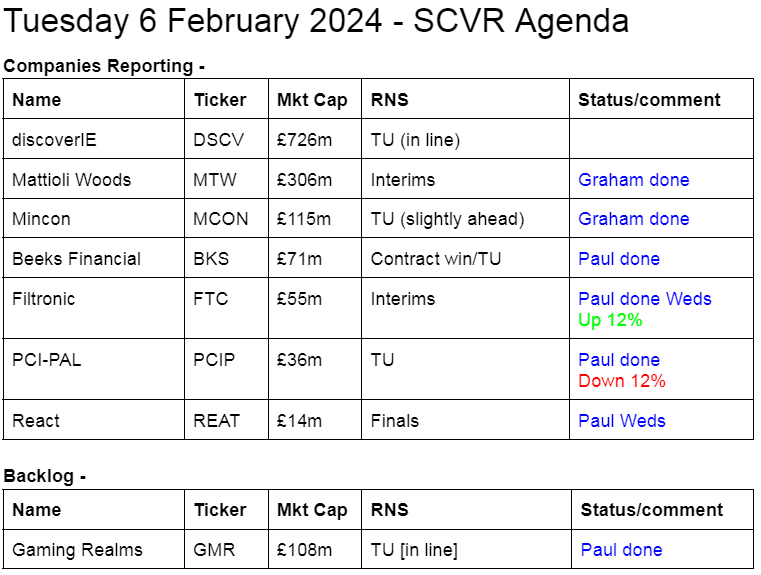

Gaming Realms (LON:GMR) (Paul holds) - Down 2% y’day to 36.7p (£108m) - Trading Update [in line] - Paul - GREEN

Another good year, with this gambling software company having established an impressive growth track record. Valuation still seems reasonable. Healthy balance sheet. Outlook says more of the same. I like it - growth at reasonable price.

Beeks Financial Cloud (LON:BKS) (Paul holds) - up 34% to 145p at 09:24 ( £95m) - Significant Contract Wins & Trading Update - Paul - GREEN

Excellent news re contract wins. Canaccord raises forecast profit for FY 6/2025, and it sounds like there's more potential upside once big contract passes regulatory clearance. Net cash has grown. I see this as an exciting growth share, and it's still reasonably priced.

Mincon (LON:MCON) - up 9% to 58.68p (£137m) - Trading Update (slightly ahead) - Graham - AMBER

Some reassurance for shareholders in this drilling engineer as the full-year EBITDA result is slightly ahead of previously downgraded expectations. Weak industry demand provides a challenge but the valuation here may already reflect the company’s difficulties. Worth a look.

PCI- PAL (LON:PCIP) - down 12% to 49p (£33m) - Trading Update - Paul - AMBER/GREEN

This seems an OK update, broker forecasts unchanged. Organic growth is continuing, and it's now reached breakeven after years of losses. I can't get excited about the growth potential, so am going with a lukewarm amber/green view. Patent case continues to be an expensive distraction, but seems to be going in PCIP's favour.

Mattioli Woods (LON:MTW) - down 1% to 581.5p (£302m) - Trading Update (in line) - Graham - AMBER

A solid update from this collection of financial advisory and wealth management businesses. The outlook for FY May 2024 remains in line and the company posts a small rate of organic growth, despite client assets shrinking slightly. Worth a place on the watchlist, in my view.

Paul’s Section:

Gaming Realms (LON:GMR) (Paul holds)

Down 2% y’day to 36.7p (£108m) - Trading Update [in line] - Paul - GREEN

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, is delighted to announce its pre-close trading update for the full year to 31 December 2023 ("FY23").

“Slingo” is the key product, which is licensed by many online casinos.

Any doubts I had about the business model a few years ago have been dispelled by a highly impressive financial track record -

Despite this impressive record, and the high quality scores, GMR shares are on a modest PER for a growth share - scope for a re-rating, if growth continues maybe?

FY 12/2023 Trading Update -

Headlines -

Record Year

FY23 Record Revenue and adjusted EBITDA* with Growth of 23% and 28% respectively

The Company is pleased to confirm that it expects to report FY23 revenue of c.£23 million and adjusted EBITDA* of not less than £10.0 million, up 23% and 28% respectively year-on-year, in line with Board's expectations. The Company ended the year with £7.5 million of net cash.

It’s just not acceptable when companies only report EBITDA, and ignore all the other profit measures that investors need. So this is poor reporting from GMR.

Thankfully, Canaccord translates the numbers for us, and £10.0m adj EBITDA becomes adj PBT of £5.9m (2022: £3.5m) and adj EPS of 1.6p (2022: 1.2p).

At 36.7p, that gives a PER of 22.9x

Strong growth is forecast by Canaccord to 2.3p for FY 12/2024, a PER of 16.0x, so note that the lowish PER is dependent on a hefty increase in profits/EPS in 2024.

Balance sheet - I’ve checked the last one at June 2023, and it’s good. NTAV is only £8m, but its a capital-light business model with almost no fixed assets, and no inventories. Hence the NTAV is mostly receivables and cash, less a small amount of creditors. No issues here at all, it’s very healthy, and the cash pile has risen further to £7.5m at Dec 2023 year end.

Time to start paying divis, I’d say, as it has the capacity to do so, and it’s a cash generative business. There haven’t been any divis in the past.

Outlook - nothing specific, I think they’re just saying more of the same -

"The expansion into new territories and the addition of 44 new partners demonstrates our commitment to broadening our reach and enhancing player experiences. As we look ahead, we remain focused on delivering engaging content and expanding our footprint in key markets, ensuring that Gaming Realms continues to be a leader in the mobile gaming industry. We look forward to the future and the current year's performance with confidence."

Paul’s opinion - I turned positive on GMR in summer 2023, and it was a podcast mystery share in July 2023 at 31.7p, so usefully up since then. With decent growth in 2023 now under its belt, a good balance sheet, and a reasonable valuation, I continue to see this share positively, so it’s another GREEN from me.

Beeks Financial Cloud (LON:BKS) (Paul holds)

Up 34% to 145p at 09:24 ( £95m) - Significant Contract Wins & Trading Update - Paul - GREEN

Readers have been discussing the unusual volume of trades in BKS in the last few trading days. Today the Scottish-based cloud computing specialist (providing connectivity to financial exchanges) updates us positively.

I should say this is a personal portfolio holding of mine, and it was on my top 20 watchlist for 2024, because the outlook comments pointed towards accelerating growth. I looked through a modest miss against FY 6/2023 targets. The company has been telling us for a while that it’s got several slow gestation, but large contracts in its pipeline.

It sounds like some of the pipeline is turning into contracts now, and these are sticky recurring revenue type contracts remember, but which take a lot of time & effort to negotiate, winning the client’s trust. Beeks has a considerable moat I think.

06 February 2024 - Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce the signing of a multi-million-dollar, multi-year expansion contract for its Proximity Cloud offering, a new win with its Exchange Cloud Offering, and provide an update on a period of continued positive trading momentum in the six months to 31 December 2023 (H1 FY24).

This is very good news -

Having won a number of competitive tenders in H1 FY24, the Company now expects trading in FY25 to be significantly ahead of previous Board expectations for FY25.

Note that is jumping the current year FY 6/2024 and talking about the following year being “significantly ahead”.

Canaccord helps us out with an update note, many thanks. It leaves FY 6/2024 unchanged (Revs £30.0m, adj PBT £4.1m, adj EPS 5.6p).

FY 6/2025 forecasts are now: £39.6m revenue, £6.0m adj PBT, and 8.3p.

Put that on a PER of 20x (not particularly demanding given the strong growth), and I’m coming up with a share price of 166p, or 54% ahead of last night’s price. So BKS shareholders can confidently expect a bonanza I think, as the share price looks likely to put in a considerable upward move. I hope some members here have been patient, and not drifted away through boredom, which is a risk with this type of thing, where there can be long waits between important newsflow.

Exchange Cloud contract win - this is the largest type of contract that Beeks offers, with 2 existing clients. There’s a third one being added -

The Company is also delighted to announce the signing of a conditional contract with one of the largest exchange groups globally (the "Exchange") for its Exchange Cloud offering, a multi-home, fully configured and pre-installed physical trading environment fully optimised for global exchanges to offer cloud solutions to their end users. The deal marks the initial phase of an intended multi-year partnership between Beeks and the Exchange, and completion of the contract is subject to regulatory approval, following which deployment of services and recognition of revenue will commence.

This is the third major international exchange to sign up to the Exchange Cloud offering, demonstrating the significant potential for the offering. Beeks continues to see a building pipeline of opportunities across its Exchange Cloud offering.

Cash position - bears on this stock have criticised it in the past for being cash hungry, as often its contracts require up-front spending on cabling and servers. So it’s reassuring to hear that the cash position looks fine now -

In line with strategy, Beeks has achieved a positive free cash flow position in the period, with unaudited net cash increasing to £5.5m at 31 December 2023 (June 2023 net cash of £4.4m). The Board continues to be confident in achieving results for FY24 in line with its expectations.

Outlook - I’m confused by what this bit is saying - does this mean that there’s more to be added to forecasts from a “conditional” contract once it stops being conditional?

Having won a number of competitive tenders in recent months for projects commencing in the upcoming reporting period and excluding any contribution from the conditional Exchange Cloud contract, the Company now expects trading in FY25 to be significantly ahead of previous Board expectations.

Paul’s opinion - I need to properly digest all this information, but for now it seems clear that today sees a large increase in FY 6/2025 forecast revenue (upped from £34.6m to £39.6m), although a more modest increase in adj PBT (from £5.3m to £6.0m), so it sounds like there must be some additional costs too.

The £71m market cap is now obviously too low, so (writing this at 07:49) I imagine a considerable rise is on the cards, and people waiting for positive newsflow might find it difficult to buy in any decent size. Maybe a 30-50% share price rise today could be on the cards? We’ll soon find out, I like guessing just for fun!

CEO interview - I've fixed up an interview with the CEO of Beeks for my podcast channel early next week. So if anyone can think of any insightful questions, do leave a message below.

PCI- PAL (LON:PCIP)

Down 12% to 49p (£33m) - Trading Update - Paul - AMBER/GREEN

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to announce a trading update for the six months to 31 December 2023 (the "Period" or "H1").

This sounds OK -

Revenue for H1 was in line with management expectations and up 20% year on year to £8.7 million (2022: £7.3 million). ARR at the Period end increased 23% year on year to £14.7 million (2022: £11.9 million), and as expected, H1 was the Group's first reported period of positive EBITDA since its re-launch as PCI Pal in 2016…

Since the Period end, sales have continued to grow strongly…

Cash is tight, but it has a borrowing facility available -

This continued sales momentum is driving the Group towards its profitability objectives. The Group finished H1 with net cash of £0.54 million (30 June 2023: £1.17 million), having paid out £1.1 million in costs relating to the patent case. The Company's debt facility is currently undrawn.

Strategic partnership with Zoom was announced in Nov 2023.

Patent case - was won in the UK (but Sycurio are appealing). US case set for Feb 2025.

The Board believes the risk of any material impact on the business because of the litigation has decreased substantially following its victory in the UK trial.

Paul’s opinion - it’s not obvious to me why the shares have dropped 12% this morning, on what seems an OK update.

Cavendish updates us (many thanks) and reiterates existing forecasts. These show nice revenue growth, and a breakeven adj PBT outcome of £0.1m for FY 6/2024. It feels like this has been a long slog to get to breakeven, after years of losses, but PCIP seems to have got there.

Cavendish has £1.0m adj PBT pencilled in for FY 6/2025. Not madly exciting, but hopefully there’s upside on that forecast.

I was amber/green last time, and that seems about right this time too. I like that PCIP is generating decent organic growth, and has now reached breakeven. Can the business scale up much more though? I’ve got some doubts there, it seems quite niche, and individual contracts are I believe quite small.

Hence overall I think it’s quite good, but doesn’t get me excited in the way that say BKS does (I hold), which I think has a much bigger market opportunity than PCIP.

The patent case has also been an expensive distraction.

AMBER/GREEN.

Graham’s Section:

Mincon (LON:MCON)

Share price: 58.68p (+9%)

Market cap: £137m

It’s a brief full-year trading update from this engineering group (focused on drilling tools).

We last covered the stock in October, when a profit warning was caused by weakness in the mining sector and the cancellation of some construction projects.

Today’s news is a little brighter:

Whilst market conditions continue to be challenging, as the mining and construction markets experience weaker demand, the Group's performance in Q4 was in line with expectations and we expect to achieve full-year EBITDA slightly ahead of the prior guidance of €20 million.

For context, the prior forecast was EBITDA of €28m, before this was downgraded to €20m in October. So the full-year result is still at a significant shortfall compared to where we were before the profit warning.

As previously mentioned, the company has reduced inventories and we should see a decent performance in terms of cash/debt (the company’s net debt was previously €15m).The low leverage multiple should, I think, provide a degree of comfort to investors.

Graham’s view

Not too much to chew on here; the key takeaway is that things didn’t get any worse since October.

It’s probably fair that the shares continue to trade at a substantial discount to pre-October levels:

But that does mean we continue to have a cheap-ish multiple on offer here:

Last time I covered this one, I provided a list of the major difficulties faced by Mincon, and gave a view on whether or not they had been resolved. The remaining issues are:

Greenhammer - a hydraulic hammer system was supposed to be transformational for Mincon and for the mining industry, but it has run into complications. Not resolved yet.

Mining industry - weak industry demand continues to hold back revenues. Not resolved yet.

Balance sheet - the company is making progress on reducing debt. Partially resolved.

I remain neutral on this one, but I’d love to be able to take a more positive stance if news flow improves.

Mattioli Woods (LON:MTW)

Share price: 581.5p (-1%)

Market cap: £302m

Mattioli Woods plc (AIM: MTW.L), the specialist wealth and asset management business, today reports its interim results for the six months ended 30 November 2023.

We already covered the interim trading update from this company last month.

Organic growth is fairly slow at 4%; while recent events here haven’t been too exciting, the long-term picture shows great progress in revenues, with profits hopefully catching up soon.

Declining client asset values have held back progress recently, but they remain substantial at £15.2 billion (only down 0.4%).

PBT for H1 comes in at £7.6m, with after-tax net income of £5.3m (H1 last year: PBT of £4.8m and after-tax net income of £3.0m). So profits are picking up even after all the costs that go with an acquisition-led strategy, e.g. £4m+ of amortisation was charged in H1 both this year and last year.

Dividend payouts keep steadily rising, with the latest interim dividend being 9p (last year: 8.8p).

The cash position supports this at £32.7m (equivalent to 72p per share).

Outlook remains in line with expectations.

CEO comment is happy with the performance:

"The first six months of this financial year saw the Group deliver improved organic growth despite the complex macroeconomic backdrop that persisted throughout the period. Our priority remains the delivery of profitable organic growth and we are pleased to report further progress towards our medium-term strategic goals, with revenue of £59.1m up 8% on the equivalent period last year (1H23: £54.9m) driven by positive performance across our pensions advice and administration, employee benefits and investment management operating segments".

Later in the report, the CEO reminds us that “we anticipate certain revenues will be more heavily weighted towards the second half reflecting increasing demand from clients for end of tax year advice, launch of new products and a higher proportion of pension client year-ends”.

The note from Singer observes that the company typically has a 45:55 weighting between H1 and H2, and they see a full-year adjusted PBT result of £33.9m.

On an unadjusted basis, perhaps we can see full-year PBT of £17-20m?

Graham’s view

This stock tends to fly under the radar but the track record is excellent and I think it deserves a little more attention.

If you value it on the adjusted numbers it is currently offering value, but personally I like to see an attractive valuation even on unadjusted numbers before getting too keen on a stock.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.