Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Sondrel (Holdings) (LON:SND) - bonkers mover of the day! Up 140% to 14.25p for this almost-bust chip designer. Company issues statement noting press speculation (Daily Mail article pumping it here), saying it doesn’t comment on customer links. It does say continues to trade in line, and has demand remains strong. It needs to get emergency fundraising done, this looks like a pump to help get placing done maybe?

British American Tobacco (LON:BATS) - large cap up an unusual 7.4%, on beating full year forecasts. PER 6x, yielding >10%, selling cigarettes.

Hardide (LON:HDD) - down 23% to 7.5p - FY 9/2023 results show reduced loss of £(1.2)m. Slow start to FY 9/2024. Seeking cash & debt from investors to meet short term cash constraints. Sounds serious - discounted placing now seems a high risk.

DS Smith (LON:SMDS) - up 12% to 314p - mid-cap with generous divi yield notes media speculation, and confirms it has received a "highly preliminary expression of interest" from larger rival Mondi (LON:MNDI) about a possible offer. Takeover Panel rules now kick in.

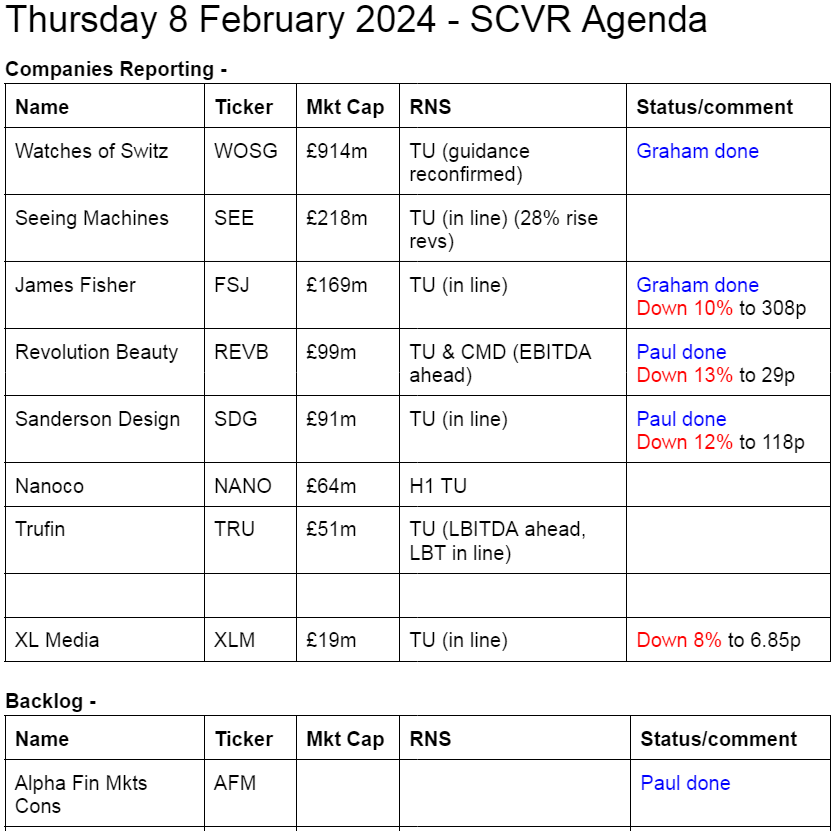

Summaries

Revolution Beauty (LON:REVB) - down 8% to 29.5p (£94m) - Trading Update & CMD - Paul - AMBER/RED

Not a bad update today, with adj EBITDA guidance raised, although it's not much above breakeven when translated into real world profit. Bank renews for 12 months. A very ambitious growth strategy is outlined, with a CMD coming. I see high risk of an equity fundraise being needed here, so be aware of that risk. Could be an interesting turnaround though, so worth keeping an eye on.

Sanderson Design (LON:SDG) (Paul holds) - down 17% to 105p (£70m) - Full Year Trading Update [in line] - Paul - AMBER/GREEN

In line with expectations year end update for FY 1/2024 - a year where strong licensing income offset a weaker performance in the core business, as we already knew from previous updates. Expectations for the new year are trimmed about 7%. Superb balance sheet protects downside. I like it a lot still, but am moderating my view slightly to reflect lower profit guidance today.

Watches of Switzerland (LON:WOSG) - up 3% to 391.8p (£939m) - Q3 FY24 Trading Update (in line) - Graham - AMBER

Market seems relieved there is no further bad news from this luxury retailer. USA trading well but UK/Europe suffering from weak demand in part due to absence of VAT free shopping. Valuation is starting to look tempting in my view; hoping to see decent full-year results.

Alpha Financial Markets Consulting (LON:AFM) - down 10% y’day to 335p (£384m) - Trading Update - Paul - AMBER/GREEN

Our first ever look at this specialised staffing group, and I reckon it looks pretty good. Dropped 10% yesterday on a mildly negative trading update, but forecasts have only been slightly reduced, so I don't think it really qualifies as a profit warning, more an adjustment. Ambitious growth plans, and it's paying a 4.2% dividend yield. Looks worthy of you taking a closer look, just based on my quick initial review.

James Fisher And Sons (LON:FSJ) - down 13% to 292p (£147m) - Full Year Trading Update (in line) - Graham - RED

It might be a little harsh but I’m giving this marine services business the thumbs down as they seem to be having some trouble paying down their debts, while at the same time simplifying operations and getting back to profitability. High-risk, high-reward if they succeed.

Paul’s Section:

Revolution Beauty (LON:REVB)

Down 8% to 29.5p (£94m) - Trading Update & CMD - Paul - AMBER/RED

CMS is Capital Markets Day for anyone unfamiliar. These are events designed to drum up interest in the company with institutional investors and analysts, and can sometimes be a warm-up act for an equity fundraise. Or management trying to get the city on side for its strategy.

Revolution Beauty (AIM: REVB), the multi-channel mass beauty innovator, will today hold a Capital Markets Event for institutional investors and sell-side analysts. The Group is also providing a brief trading update for the 2024 financial year.

So far REVB has been a disastrous 2021 float, with all sorts of problems emerging. It survived a near-death experience when accounting irregularities were found, shares were suspended, then a battle for control in 2023 (with Boohoo taking a stake and forcing changes).

I would say currently the jury is out as to whether the turnaround is working or not.

I’m pleased to say we spotted the accounting problems here in the SCVRs, and warned people away from it in 2022, well before things went seriously wrong.

However we like turnarounds, so I’m happy to look at it with fresh eyes each time it reports.

The headline is aspirational rather than factual -

New leadership team outlines strategy to accelerate profitable growth and ambition to deliver retail brand sales of £1 billion by 2030

Ah, that ambiguous phrase “profitable growth” that is so fashionable at the moment. What does it actually mean? Very little! It’s designed to sound like profits are growing, without actually directly saying so. It could mean a wide range of things, including growing revenues, whilst profits falling to almost zero. That would still be profitable growth. Such a silly phrase - do the PRs actually think this fools us?!

Existing revenues are c.£200m, so growing that to £1bn over the next 6 years is certainly an ambitious target. Note the CFO is Neil Catto, formerly long-serving CFO of Boohoo in the glory days, who certainly knows a thing or two about rapid growth in eCommerce.

Maybe they should ask for some tips from Warpaint London (LON:W7L) who are showing the way to achieving strong global growth in affordable cosmetics.

The strategy outlined today by REVB just sounds like sensible basic stuff to me - eg cost-cutting of £10m over 3 years, reducing number of product lines to focus on key products, developing the brand name, maximising retail/distribution partnerships, especially in the USA.

Trading update for FY 2/2024 -

Sounds like slower revenue growth, but higher margins, hence higher overall EBITDA -

At the time of its half year results announcement in November 2023, Revolution Beauty expected to deliver adjusted EBITDA of not less than double-digits and high single digit revenue growth for the 2024 financial year.

As noted above, the Group has accelerated the rationalisation of lower margin SKUs, successfully driving margin improvement. As a result of this greater focus, FY24 adjusted EBITDA is now expected to be between £11 million and £12 million, and revenue growth is expected to be in the low single digits.

Any broker updates today? No, nothing available unfortunately. The company needs to speak to some brokers about getting information out to private investors, who are the main market for its shares whilst institutions are mostly hiding in the basement, and dealing with redemptions!

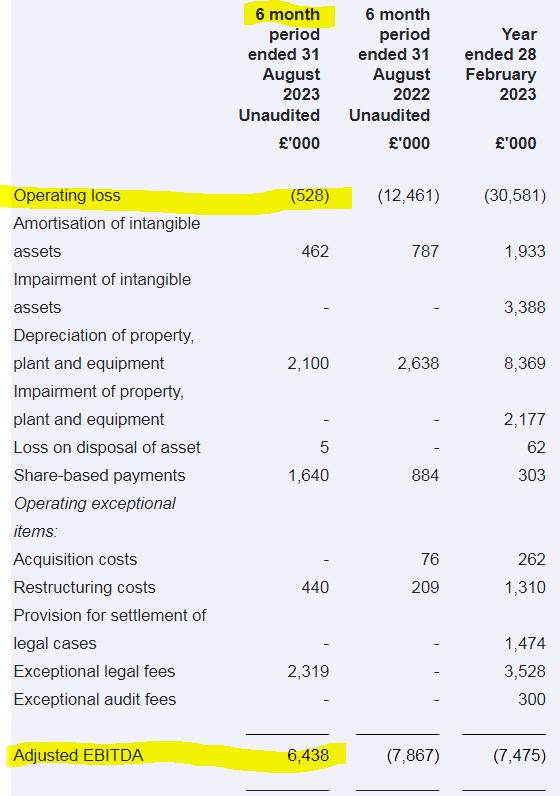

Looking at its last interims, to 31 Aug 2023, it did £90.4m revenue (up 20%), £6.4m adj EBITDA, and PBT of only £0.4m. Net debt was £(23.8)m.

The last balance sheet was weak, with negative £(15)m NTAV. A £16m deferred consideration creditor worries me, as it doesn’t have the cash to pay this. Or could it be paid in shares maybe? That needs looking into. Inventories & receivables also looked too high. So it clearly still has balance sheet issues, and I would say an equity fundraise looks a considerable risk for existing shareholders, who might not have access to a discounted placing.

So investors have to decide whether to wait for a fundraising to sort out the balance sheet, avoiding dilution risk. Or whether to just gamble on the turnaround working, and hope for the best re dilution.

My caution is reinforced by a “material uncertainty” going concern note with the last interims.

Also see note 3 in the interims, “Correction of prior period errors”, includes a £4.9m provision for allegedly breaching music copyright in social media posts. Although it reckons £3.6m can be reclaimed from its insurers, so it doesn’t look too bad overall, but reinforces what a minefield social media can be, if staff accidentally use copyrighted images & music.

Here’s a useful table which shows how £6.4m adj EBITDA in H1 turned into a £(528)k operating loss. Some of these items (eg exceptional legal costs) would be OK to adjust out I think, as non-recurring.

Overall then, the new guidance today of £11-12m adj EBITDA for FY 2/2024 is pointing towards H2 being slightly less profitable than H1, which is a bit disappointing to me given that H2 includes the buoyant Christmas period.

It seems that real profits (at the PBT level) would be small overall, hence I can’t get excited by the £11-12m EBITDA forecast.

The company needs to get some proper numbers out via brokers, instead of forcing us to try to work out the numbers manually.

Bank borrowings - this sounds good news, as the company is completely dependent on its bank borrowings at the moment -

The Group has also signed a 12-month extension to its £32 million Revolving Credit Facility (RCF). The RCF will now run until October 2025 on unchanged terms.

Although 12 months isn’t a major commitment from the bank, and is maybe another sign that a placing is likely later in 2024 to repair the weak balance sheet?

Paul’s opinion - quite an interesting share, but £102m market cap is already pricing in a considerable improvement in profits, which are currently only low if we include all costs.

I’d say dilution risk from a placing looks high, and in current nervous small caps markets, who knows what terms a fundraising would be on? The risk is that small shareholders get heavily diluted by institutions who name their terms. Boohoo are notoriously tough negotiators, and owning 27% of REVB, they would be in the driving seat for any fundraise I imagine.

Overall, I’m happy to watch from the sidelines, and will go with AMBER/RED for now, to flag the risk of dilution from its weak finances. Whilst also recognising that trading is a bit ahead of previous guidance, although only really a bit above breakeven in real world profit terms.

As a trading share, this could get interesting, if more investors start to buy into the turnaround potential, who knows?

Sanderson Design (LON:SDG) (Paul holds)

Down 17% to 105p (£70m) - Full Year Trading Update [in line] - Paul - AMBER/GREEN

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, is pleased to announce its trading update for the financial year ended 31 January 2024.

Results in line with expectations with profitability driven by Licensing

Revenues down 3% at £108.5m

Underlying profits c.£12m (LY: £12.6m)

Net cash £16.2m at end Jan 2024, slightly up on 6m ago.

A table provides more detail, with the quick version being that revenues were down in UK & Europe, partially offset by growth in USA.

More importantly, high margin licensing revenue has really bailed out the rest of the business, up 68% to £10.9m. Without that success, profit would have been much lower.

Outlook comments strike me as sensible, and hopefully there might be upside as consumer spending & housing markets begin to recover in 2024? -

Licensing has become a significant strategic pillar for the Group whilst, geographically, North America continues to be a key growth market. We intend to focus on these two growth drivers and also take advantage of any other international growth opportunities.

Whilst trading conditions are expected to remain challenging in the UK and Europe, at this early stage of the current financial year ending 31 January 2025 the Board's full year revenue outlook remains unchanged.

Certain cost pressures are expected, including the increase in the Real Living Wage and property-related costs, such that profitability in the current financial year is expected to be similar to that of the year ended 31 January 2024…

The Group has a strong pipeline of product initiatives in the year ahead, including the strategic focus on the Sanderson brand. Giles Deacon's capsule collection of Sanderson designs has just been launched, and last year's successful launch of the Disney Home x Sanderson collection brings further potential in the current year.

Broker updates - both Progressive and Singers update today, very helpful.

Singers has 12.8p adj EPS for FY 1/2024, and 12.5p for FY 1/2025.

Progressive uses the same adj PBT forecast of £12.0m, but arrives at higher adj EPS figures of 13.4p and 13.3p, not sure why - maybe it’s assuming a lower tax charge?

Note that Progressive has lowered FY 1/2025 forecast by 7% at the EPS level, so I suppose we should see this as a minor profit warning, ie lowering forecasts a little. Hence today’s 7% dip in share price does make sense.

Paul’s opinion - I think SDG has weathered the tough consumer macro environment very well in FY 1/2024. That’s down to a highly successful year with licensing - some of the deals do repeat, but others are one-offs, so it’s not necessarily quite as high quality revenue as in other licensing businesses which have longer-term income streams.

Looking at the H1 results, if we assume licensing revenue is almost pure profit, then it means the rest of the business was really only operating around breakeven, with all the £6.8m H1 adj PBT coming from the £6.9m licensing revenues. Which does raise the question, why bother with manufacturing and branded products at all? Isn’t it just an overhead? Why not concentrate on just licensing, and become a pure IP company?

Maybe the licensing only happens because the designs are so visible from selling fabrics and wallpapers? Those would be good questions to ask management.

Overall, it’s proven resilient in a tough environment, and seems to be capable of producing around 12-13p EPS again, with possible upside if a consumer/housing recovery gains traction in calendar 2024, as seems likely.

There again, there needs to be a recovery from the core business, in order to replace potentially weaker licensing revenues, if FY 1/2024 turns out to have been a lucky one-off for big licensing deals? Who knows how it will pan out?

Is the valuation reasonable? Yes, I think so. Using c.12.5p EPS, the 118p share price is only a PER of 9.4x - leaving plenty of scope for shares to rise, if earnings meet or beat forecasts.

There’s also risk, if FY 1/2025 cannot match the prior year’s licensing receipts, and the core business continues to struggle. It could go either way.

Valuation is also strongly underpinned by a terrific balance sheet, with c.£60m NTAV, including £16m cash - that’s surplus cash too, as net current assets is a very strong £42m when last reported (and no long-term liabilities of any significance).

So even in a downside scenario, there’s no threat to solvency or risk of dilution.

On balance I see it positively, but I’ll soften slightly from green to AMBER/GREEN, to reflect the 7% lowering of profit forecasts for FY 1/2025. It’s worth noting there is a risk of a profit warning at some stage, hence why this share is cheap (it’s tempting to keep some powder dry, to nip in and buy on any future profit warning, but that risks missing out on a recovery).

For full disclosure, I’m only holding a tiny position in it at this stage, to keep my foot in the door.

Stockopedia really likes it, with a StockRank of 98.

Alpha Financial Markets Consulting (LON:AFM)

Down 10% y’day to 335p (£384m) - Trading Update - Paul - AMBER/GREEN

This company floated in Oct 2017, and I’m struggling to understand why we’ve never looked at it here in the SCVRs before?! It must have just slipped throught the net.

The track record looks fairly decent - and note the consistent divis throughout the pandemic -

The lighter blobs above (forecasts for 2023 and 2024) show quite a large increase in forecast earnings, so is there some risk to those forecasts not being met, I wonder?

Here’s the full share price graph since it listed -

It seems to be an acquisitive management consulting group, hiring out just over 1,000 consultants, and reporting NFI (net fee income) as revenue - so a specialised staffing company by the looks of it.

Balance sheet is almost all intangible assets (goodwill & similar), there was only £9m of NTAV at Sep 2023, so no asset backing to speak of.

Cashflow statements show it’s generating cash, and using it to pay for acquisitions and growing divis (now yielding a fairly healthy 4.0% pa, covered about 1.8x).

So far so good, this looks quite decent on my first look at AFM shares.

The forward PER is 13.6x, which also looks reasonable.

Trading Update (published yesterday morning)

Alpha FMC (AIM: AFM), a leading global consultancy to the financial services industry, provides a trading update for the year ending 31 March 2024 ("FY 24").

Q4 slower than expected. Mentions competitive environment, and longer sales cycles, so some client projects delayed.

Revised guidance (it’s so annoying when companies don’t disclose what the previous guidance was, wasting our time trying to find it) -

Consequently, the Board now expects the Group to deliver FY 24 results showing net fee income growth of up to 5% against the prior year and adjusted EBITDA of approximately £42m - £43m at a slightly improved margin on the first half.

In the current market environment the Group has maintained consistent day rates, a selective approach to hiring into key growth areas, and continues to manage actively its cost base. The Group also maintains a strong net cash position.

There’s no broker research available to us.

I’ll try to piece it together from the H1 figures, which showed: revenue 115.6m (up 7.5%), adj EBITDA £20.1m (down 10.5%), and adj PBT £18.4m (down 13.6%), adj EPS of 11.8p (down 16.2%).

The FY 3/2024 guidance of £42-43m adj EBITDA implies H2 is slightly higher than H1, at £21.9-22.9m.

Adj EPS looks to be heading for about 25p for FY 3/2024. Looks like I’m almost bang on there, as Stockopedia has overnight updated consensus broker forecast from 26.0p to 25.3p.

Hence this looks like only a minor trim to broker forecasts, so small that it hardly justifies being labelled as a profit warning.

FY 3/2025 forecasts have also been slightly trimmed, from 27.4p to 26.3p. Again, no great shakes, so I’ve decided not to label this as a profit warning, more a minor adjustment.

This graph puts things into perspective - not a cause for alarm -

Outlook comments sound OK to me -

The Group continues to see robust client demand and has seen higher sales wins in recent months, while maintaining a strong pipeline of new business opportunities. These factors, together with the strong long-term structural growth drivers that underpin demand for Alpha's services and the Group's compelling proposition to clients, gives us confidence that the Group remains well positioned for continued growth, in line with our ambition to double the business again by 2028.

Luc Baqué, Chief Executive Officer, commented:

"The challenging market environment previously reported remains prevalent. While trading is improving in the second half it has not recovered at the pace we envisaged when reporting our interim results, as the market continues to rebalance supply and demand. However, we continue to see improving market conditions and with the Group's ongoing strong pipeline, leading expertise, strong propositions and multiple growth opportunities, we remain well positioned for future growth."

Paul’s opinion - is purely based on my first ever initial review of AFM, not deep research, which I have to say is quite positive. It looks like a specialist staffing company, which has grown impressively (albeit with some dilution - no. shares 90m in 2018, 114.5m now), whilst making acquisitions and paying a decent dividend yield.

It sounds like there’s scope for trading to improve in a recovering economy, and it’s remained pretty robust during the pandemic and more recently. It’s making nice margins, and generating cash. All for a PER of 13.1x, hardly demanding.

So AFM gets an initial view of AMBER/GREEN from me, as I quite like the look of this.

Graham’s Section:

Watches of Switzerland (LON:WOSG)

Share price: 391.8p (+3%)

Market cap: £939m

We have an “in line” update from Watches of Switzerland this morning, on the back of a dramatic profit warning seen last month:

This stock had exceeded our small-cap limits for some time, but is now firmly below the £1 billion mark again.

Here are the Q3 highlights (Nov to Jan, as the year-end is in April).

Q3 revenue down 1% at constant FX, down 3% at actual FX.

Year-to-date revenue up 1% at constant FX, down 1% at actual FX.

E-commerce revenue down 15%.

As disclosed in the January profit warning, UK demand for luxury discretionary purchases was worse than expected in the run-up to and beyond Christmas.

Drilling into performance by geography, there are much stronger numbers from the US as compared with UK/Europe. US year-to-date revenue is up 10% to £502m, with WOSG “gaining market share in the fragmented US luxury watch market”.

In the UK and Europe, by contrast, year-to-date revenues are down 5% to £656m.

There was particular weakness in non-branded jewellery “where we saw unusually high levels of promotional activity” and generally consumers were “allocating discretionary spend to other categories such as fashion, beauty, hospitality and travel”.

In a sign of a shrinking market, WOSG maintains that it increased market share despite falling revenues.

The UK has seen “minimal return of tourist spending due to the lack of VAT free shopping”.

However, perhaps there is light at the end of the tunnel with recent reports that VAT-free shopping could possibly make a comeback. Since 2020, the UK is one of the few countries that doesn’t offer the incentive to tourists.

Indeed, WOSG says today: “We are encouraged by the UK Office for Budget Responsibility's review of VAT free shopping for tourists; we have not included its reintroduction into our guidance.”

Outlook for the financial year is unchanged, i.e. revenues £1.53 -1.55 billion (about the same as the previous year) with an EBIT margin of 8.7%-8.9% (down from 10.7% the previous year). No change in trading conditions is expected.

Graham’s view

I’ve always found this share quite interesting as a way for investors to participate in the luxury space. The downside, of course, is that it’s just the retail end of the space. There is no brand ownership, only long-standing (and hopefully very secure) relationships with brands.

Rolex, for example, would be worth billions if its shares were listed. But instead it is owned entirely by a private Swiss foundation. And unfortunately for us, it is the brand owner who gets to keep the enormous luxury gross margins, not the poor retailer who takes all of the risk of flogging them to customers.

These shares do offer much better value than they did before:

The PER has fluctuated but is sharply down from where it was in recent years:

For me, this is in territory where you could argue that it’s a respectable value share, if you’re willing to make some compromises on quality.

Excluding leases, the company last reported net cash of £16m (for October 2023). Lease liabilities were substantial at £460m. For a retailer, the balance sheet didn’t stand out to me as being particularly strong or weak.

Overall I’m leaning towards taking a positive stance on this one, due to the cheap valuation. But this sector (retail) does make me nervous and I’ve learned from experience that we need to be extremely selective. Maybe if we see a nice clean set of full-year results I’ll be able to take a positive view on WOSG.

James Fisher And Sons (LON:FSJ)

Share price: 292p (-13%)

Market cap: £147m

I don’t normally look at this marine services group but thought that the 13% share price drop was worth commenting on.

The last few years have been tough for shareholders here:

Roland commented on it in September 2022. Profitability had collapsed, the company was showing a high degree of leverage (net debt £172m, or nearly 3x EBITDA), and it had suspended its dividend for the first time in 20 years.

Onto today’s update:

Overall underlying trading in the second half was resilient and in line with market expectations. The Group has continued to make further early progress with its transformation during the period, focusing on operational improvements and simplification.

It’s strange to see a share price fall 13% on an in line update, but the wording of the announcement doesn’t inspire confidence. Why not simply say that trading was in line, instead of “overall underlying trading”?

The next paragraph discloses some good and bad news. Excerpts:

“...North Sea IRM (inspection, repair and maintenance) and decommissioning conditions continued to be challenging.”

“While revenue from larger project orders within Defence was lower than anticipated in the year, as procurement timelines were extended by customers, the division retains a solid pipeline and is still expected to deliver an improved year-on-year performance in 2023…”

If revenue from larger projects was lower than anticipated, then surely this is a miss against forecasts? Even if the revenue will appear in 2024.

Net debt has increased during calendar year 2023, from £133m to £140m. This “reflects the additional financing and restructuring costs incurred in the year”. At least it is lower than the level it reached when Roland was looking at during 2022.

CEO comment:

…I am encouraged by the progress across the three divisions. We are building the foundations for recovery and are seeing the benefits of the operational improvements being implemented. We remain fully committed to our ongoing portfolio simplification, which should further strengthen our balance sheet, as well as the investment in capability that will provide a platform for sustainable growth.

Graham’s view

The company has an impressive heritage dating back to 1847 and is 22% owned by a charitable foundation. But when I look at the directors, I see that most of them have been hired in the last few years (one NED has been there since 2014, another NED since 2018, and the other six are more recent than that). So I’m not sure if the long heritage and the stewardship of a charitable foundation will help very much in 2024.

Overall, I’m not seeing very much to like here. It appears that the company’s ROCE performance wasn’t too bad, prior to 2020, but the company has been loss-making since then. Net debt isn’t coming down very quickly - it actually went up in 2023. On balance, I’m going to have to give this stock the thumbs down

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.