Good morning from Paul!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers -

Sondrel (Holdings) (LON:SND) - down 22% to 9.5p - the pump & dump continues to unravel? It’s almost out of cash, so needs to get a fundraising done, pronto.

Summaries

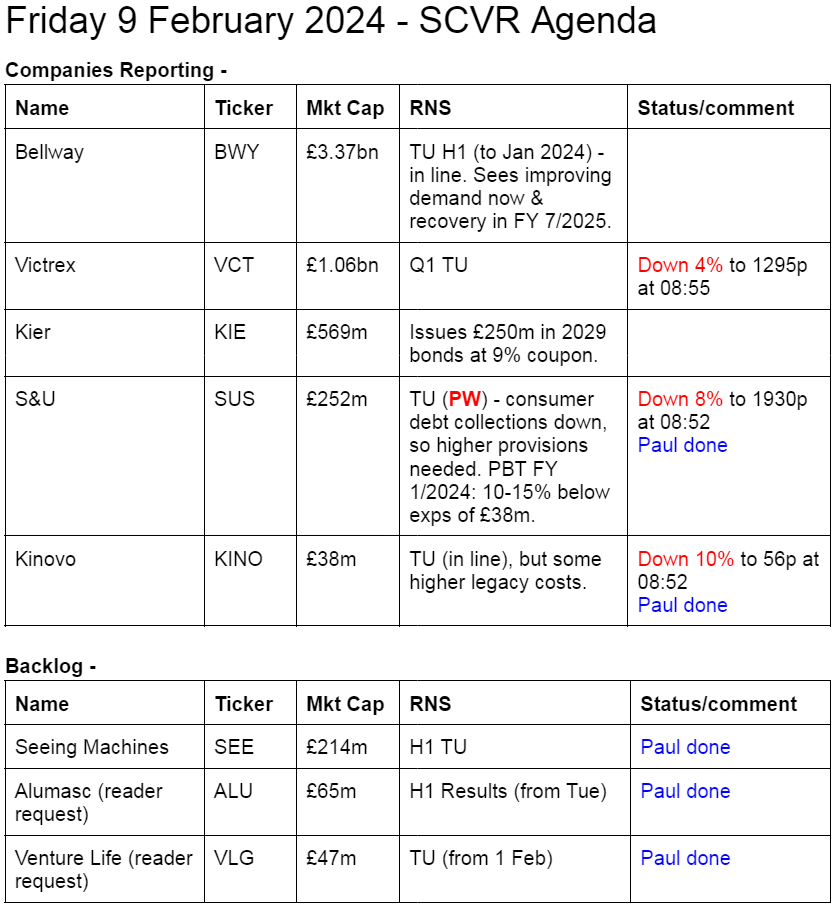

Seeing Machines (LON:SEE) - down 2% y’day to 5.15p (£214m) - H1 Trading Update - Paul - RED

A trading update yesterday misleads us over the cash position, by ignoring the $40m convertible 2026 loan. So it actually has a growing net debt position. Will need another fundraise late in 2024 I reckon. Then it has the timebomb of the 2026 convertible repayment to think about. On the upside, revenues are growing, and it thinks cashflow breakeven is possible in Jun 2025. That's not good enough risk:reward for me, so I'm sticking at RED.

S&U (LON:SUS) - down 8% to 1,937p (£235m) - Trading Update [profit warning] - Paul - BLACK (PW flag) - AMBER on fundamentals

This specialist lender for car financing, and property bridging loans, mentions tough conditions requiring a higher bad debt provision. This has knocked back FY 1/2024 profit guidance by 10-15%. It's not a disaster, and I find the valuation metrics attractive, so I'm viewing this moderately positively overall. Although there are regulatory worries, and we can't be sure how quickly consumers recover from the cost of living crisis.

Kinovo (LON:KINO) - down 10% to 55.5p (£35m) - Trading Update [in line, pre-exceptionals] - Paul - RED

My first review of this niche property services business. It initially looked quite good, until the sizeable legacy issues (re a former building division) are considered. Costs and delays have increased legacy provisions to a level which I think makes the already weak balance sheet look precarious. So high risk of a dilutive placing, I suspect. Why get involved, when it's not even particularly cheap for the core business?

Alumasc (LON:ALU) - 179p (£65m) - Interim Results - Paul - GREEN

Readers asked me to look at recent in line H1 results. I'm glad they did, as this looks a smashing value share. I think it's too cheap, with upside on future earnings and a possible re-rating onto a less mean PER. Thumbs up from me, but as always, this is just on a quick review, so you need to do your own more in-depth digging.

Venture Life (LON:VLG) - 37p (£47m) - Trading Update - Paul - AMBER

A bit vague in places, so I need to see the full year numbers before forming a firm judgement. But at best I'm lukewarm on a quick review.

Paul's Section:

Seeing Machines (LON:SEE)

Down 2% y’day to 5.15p (£214m) - H1 Trading Update - Paul - RED

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the "Company"), the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, provides a trading update for the six months to 31 December 2023 ("H1 2024") and quarterly Key Performance Indicators ("KPIs") for the quarter ended 31 December 2023.

H1 revenue of $25.6m, up 5% reported, or 28% up excluding some prior year one-offs.

ARR up 22% to $14.5m - doesn’t seem a lot, considering SEE has been trying to commercialise its tech for about 20 years.

Cash of $22.2m at end Dec 2023, and $13.9m cash burn in H1. So another cash fundraise looks to be on the horizon I’d say - probably mid to late calendar 2024?

Graham and I regard the updates from SEE as being misleading, because it only reports gross cash. Checking the last balance sheet at 30 Jun 2023, there was a $40.3m loan within non-current liabilities. This forms part of a $47.5m convertible loan note from Magna International, maturing in Oct 2026 (see note 21 in the last Annual Report). Conversion price is 11p, so with shares in the open market less than half that level, presumably the holder would prefer to be repaid in cash in Oct 2026, rather than convert. So that looks like a ticking timebomb. Magna is a large Canadian car parts manufacturer - so this is an impressive strategic investment in SEE, but I do worry about how it may ultimately hand control to Magna, if SEE is not able to repay it in 2026. Plus SEE has already burned through over half of the cash it received from Magna.

Looking ahead, the growing industry demand for fatigue and distraction solutions to support enhanced transport safety, combined with our market leadership position, production pipeline, proprietary AI technology and balance sheet strength, leave us well positioned to meet FY2024 expectations and cash break even run rate during FY2025."

For a start, it doesn’t have a strong balance sheet. NTAV will probably be down to about $7m by Dec 2023 (I’ve estimated this as $21m NTAV at June 2023, less $13.9m cash burn in H1 to Dec 2024). It’s also has net debt of about $(18)m at Dec 2023 - being $22.2m gross cash, less the $40.3m convertible loan disclosed at June 2023.

So clearly the 8 Feb 2024 trading update which doesn’t mention the convertible loan at all, is highly misleading.

Upside potential - there is lots of detail in the TU about deals with car manufacturers. It says these total lifetime value of $366m. What’s the lifetime though? Revenue was $58m last year, which resulted in a $(15.6)m loss before tax. So on a c.50% gross margin, it looks like breakeven revenue would need to be about 53% higher, at $88m pa. That’s just to breakeven remember, let alone make any profits or cashflows to repay the convertible loan.

Paul’s opinion - revenue growth is happening, and the contract wins sound impressive. Yet SEE remains loss-making and cash-burning. There’s a financing timbomb, well 2 actually - the existing cash pile could run low, or out, in about a year. Plus it has to work out how to repay the convertible loan to Magna in 2026. Dilution in the past has been excessive, with now c.4.16 billion shares in issue!

Overall then I think the £214m market cap is looking optimistic, and doesn’t give me an attractive risk:reward. Hence I’ll stick at RED, because of the weak balance sheet with substantial debt, depleting cash reserves, and inadequate growth rate to transform the numbers. By the time SEE is actually making a decent profit, we might be seeing driverless cars coming onto the market, so it may not have a particularly long lifetime for this driver alertness product - over 20 years to commercialise it, then obsolete after a few more years maybe?

SEE would make a good case study in why it's best to avoid blue sky projects - they take many years to reach commercialisation, require numerous rounds of equity financing, and spend most of the time overvalued due to overly optimistic hype. SCE is another good example of it taking an eternity to reach commercialisation, and the value being destroyed due to repeated delays & equity dilution.

Here's SEE over its 20 year period as a listed company -

S&U (LON:SUS)

Down 8% to 1,937p (£235m) - Trading Update [profit warning] - Paul - BLACK (PW flag) - AMBER on fundamentals

S&U PLC, the specialist Motor and Property Finance financier, today issues its trading update for the period from its statement of 12th December 2023 to the Group year end on 31st January 2024. S&U's full year results will be announced on 9th April 2024.

My summary of today’s update -

Profits impacted by these factors -

…poor consumer confidence, continuing high interest rates, cost of living pressures and regulation…

Significant drop in collections from customers -

…live monthly repayments at Advantage for the second half of the year were 90% of due (H1 23: 94%).

Increased bad debt provisions required.

Profit warning - new guidance for FY 1/2024 - this is crystal clear, and not a disaster -

Thus, our group profit before tax for the year ended 31 January 2024 is likely to finish between 10% and 15% below consensus expectations of c£38m.

It sees these problems as temporary -

Nonetheless, we expect a solid rebound; hence our continued funding investment in both businesses of £15m during the period…

In the meantime, the decline in collections referred to above is reflected in a percentage of due 4% lower than Advantage's habitual 94%. This may be partly seasonal and is expected to partly recover in the coming months. The actual levels of bad debts and voluntary terminations remain within budget.

Discussions with FCA have “deepened”, and some process changes made, not clear what financial impact this will have.

As you can see below, forecasts were already on a steadily declining trend, with another drop flagged today - which will update on this graph next week probably -

All of which has been reflected in a softer share price since the peak at end 2021, plus of course a wider bear market in small caps over the last 2 years -

SUS also does property bridge loans, secured on properties. There’s a nice summary here of progress -

Thus again, the watchwords for Aspen are ambition tempered by caution. Net receivables now stand at just over £130m (2023: £114m) as the business achieved its budgeted annual gross lending target of £144m, and has also just achieved an impressive historical milestone of £500m of gross lending. Collections have been slower in the period, as refinancing and sale processes take longer. This followed an excellent performance for the year as a whole, when repayments (excluding retentions) at £126m were more than 50% up on 2022/23. Hence loan book quality remains good. Of 167 loans, the number of loans beyond term is 15 (December 23: 16).

Funding - again, self-explanatory. SUS borrows in bulk, and then lends in smaller, higher interest cost deals, that’s its business model.

Group borrowing now stands at £224m against £192m last year. Group funding facilities of £280m provide comfortable headroom for the sustainable growth path expected over the next two years. However, these funds come at an increased and not readily transferable cost, and the past year has seen interest payable by the Group rise to £15.1m from £7.5m last year.

Dividends - a slight cut to the 2nd interim divi, from 38p LY, to 35p this time. Nothing to worry about there. Yield is about 7%, and looks reliable (and growing) - great for income seekers.

The long-term track record on divis is remarkable - note the change c.2010 to paying 3 divis per year, instead of 2, which needs to be taken into account -

Chairman’s words are nicely down-to-earth I think - as you usually find at owner-managed businesses - it’s controlled by the Coombs family -

Commenting on the Group's performance and outlook, Anthony Coombs, S&U Chairman, said: "Faced with an array of challenges ranging from weak consumer confidence, cost of living pressures, funding costs and regulatory activity, 2023 has not been a vintage year for either S&U or the specialist financial services sector. Given the underlying strength, resilience and expertise of our Group, I fully expect a resumption of S&U's habitual and robust profit growth in the years to come."

Valuation - some very attractive metrics here, and note it’s close to being fully NTAV backed, giving a lot of downside protection. Although note these figures will change a bit when the data updates with the latest broker changes today -

Paul’s opinion - Graham usually covers this one, and has written positively about it a lot in the past. Although I see he went down from green to amber on 12 Dec 2023, being spooked by the Skilled Person Review, and the more bearish language from the Chairman.

There are such attractive valuation measures here, and an excellent long-term track record from prudent owner-managers. This really makes SUS stand out. I think a lot of "challenger" type lenders come a cropper in recessions, because they take on risky loans in order to grow fast. Whereas SUS has been in this game for decades, and seems a prudent operator. Hence why I think it's worth a look, even though this might be seen as a really bad point in the cycle to look at lenders of any type, in particular specialist lenders, when defaults are rising.

It’s not really a sector I would want to invest in though, especially at a time of apparently increasing stress on consumer budgets (but that could rapidly change from April 2024).

We can’t get away from a softer patch of trading at the moment, and this is a profit warning, but it doesn’t strike me as a serious or ominous profit warning today. Could it warn on profits again is a key question? Maybe, maybe not, who knows?

Downturns can also shake out flaky competition, giving more market share to better run, more established companies like SUS.

EDIT: I totally forgot to mention the current controversy over mis-selling of car finance. Some readers have picked up on this, and are discussing it below in the comments. It would have been helpful for SUS to have said something about this today, which it didn't. Hmmm, maybe I should leave it at AMBER after all, which was Graham's last view. Yes, I think I'll do that, so editing the original from amber/green, just to be on the safe side. We can always go back up again at a later date.

Kinovo (LON:KINO)

Down 10% to 55.5p (£35m) - Trading Update [in line, pre-exceptionals] - Paul - RED

Our SCVR coverage of this share stopped in late 2021, as Jack used to cover it, and must have moved on to his job in the city around that time.

So I’ll take a look with fresh eyes today, as it looks quite interesting - what seems a near death experience in 2022, and it’s 6-bagged since those low!

What does Kinovo do?

Kinovo plc (AIM:KINO), the specialist property services Group that delivers compliance and sustainability solutions, provides the following trading update.

It floated in Mar 2015.

Reviewing recent RNSs -

1/9/2023 - KINO announced it had received an indicative possible offer at 56p cash from Rx3 Holdings, owned by Tim Scott (linked to 29.6% shareholder I think) . Mgt said they would not recommend such a bid, after consulting other shareholders.

5/9/2023 - HSBC has renewed borrowing facilities to 31/5/2024, removing material uncertainty in last going concern statement.

19/9/2023 - Rx3 Holdings issues a statement saying it will not be bidding. Unusually it also airs some dirty linen in public -

Rx3 remains concerned over the unresolved and hence open-ended issues that persist with regard to the DCB projects that the Company has stated that it believes will be finalised by the end of 2025 at a cost of £18m with £14m expected to be recovered from clients and subcontractors.

Having not been permitted access to perform due diligence, nor having received a response from the Company seeking to clarify or counter any of the points made in the Rx3 Announcement, this has heightened Rx3's concern and resulted in it deciding not to proceed with any offer. Rx3 will continue to seek further clarity as to the contractual position and the Company's financial exposure regarding the DCB projects.

Clearly then, this share is complicated, and I’m already starting to lose interest, due to the size of the liabilities mentioned above by Rx3. That’s obviously what caused the share price to collapse in 2022. What happens if it can't recover £14m from third parties?

28/11/2023 - Interim results look OK. Revs £30.3m (up 2%), adj PBT £2.6m (up 25%), notes H2 weighting to profits. Outlook in line with FY exps. Weak balance sheet with what look like stretched creditors. NTAV is negative at £(3.4)m.

Trading update today - starts off positively -

The continuing business continues to perform well with particularly strong margins reflecting the mix of works and continued effects of management's implementation of the strategic repositioning.

Discontinued operations - this is the problematic contracts from its former construction division, called DCB Kent. There have been some delays & increased costs -

As a result of these delays, the total net costs incurred have increased to £7.1 million as at 31 December 2023 including additional procurement, warranty and remedial costs. Kinovo are seeking to recover some of the additional costs incurred through claims and recoveries, but the total pre-tax net cost to complete is therefore expected to be a material increase from the previous estimate of £5.72 million.

That looks very onerous in the context of its weak balance sheet and modest cash position & bank facilities. I don’t have enough detail to properly assess this, but my inkling is that KINO seems to be in a precarious financial position, and could well need to do a placing, to bolster its balance sheet.

Outlook - tries to reassure us, and to be fair, the core business does look fairly decent -

Without accounting for additional works crystalising from Kinovo's pipeline as the Group enters its peak trading season, revenues for the year ending 31 March 2024 for continuing operations are expected to be approximately £65 million (FY23: £62.7 million), reflecting a different revenue mix of projects contracted to date, with electrical services continuing to perform strongly. Adjusted EBITDA is expected to be significantly ahead of last year (FY23: £5.5 million) and not less than £6.2 million, being in line with management expectations. This demonstrates the Board's continued confidence in the strength and resilience of the continuing business and its significant growth potential. Cash balances will reflect the aforementioned costs incurred and the outcome of any potential recoveries from the DCB projects, supplemented by cash generation from the continuing business.

The good news is that adj EBITDA of £6.2m mostly turns into adj PBT - Canaccord (many thanks) has put out a note today, with £5.8m adj PBT forecast.

Paul’s opinion - the core business looks fairly decent, but not something that’s ever likely to attract a PER of more than about 10, given the sector.

Forecast adj EPS is 6.9p gives a PER of 8.0x, but it comes with all the baggage of these large disputed old building contracts, and a weak balance sheet that doesn’t (I think) have the capacity to pay out the cash needed to close off the disputes.

So shareholders are left hoping that the core business can over time generate the cash to settle historic problems, and that the bank will remain supportive - with a bank renewal to just May 2024 recently not inspiring much confidence, as it looks like a stopgap.

The UK small caps market is awash with value opportunities at the moment, where we can buy good businesses on modest valuations, and with strong balance sheets. So why get involved in something complicated, problematic, and inadequately financed like KINO?

Personally I’ll be keeping clear, and flagging the high risk with a RED view for now. It might well survive and prosper, but even if it does, I can’t see that much upside on the existing share price. So at this stage, I think risk:reward seems poor, which is pretty much what the potential bidder said when they pulled out.

That said, the stock market seems to be looking through the problems -

Alumasc (LON:ALU)

179p (£65m) - Interim Results - Paul - GREEN

This came up as a reader request recently. We’re not an on demand service of course, but we try to accommodate reader requests, if people spot something interesting and flag it up to us with good reasons.

The quickest of glances at the StockReport has immediately caught my eye, with some attractive key numbers below that I’ve highlighted -

Also, I like the building products sector, as having potential for a recovery, with some attractively low valuations still available in places.

This came out on Tuesday 6 Feb 2024 -

Alumasc (ALU.L) the sustainable building products, systems and solutions Group today announces results for the six months ended 31 December 2023.

The CEO’s summary seems impressive given tough macro -

"We are very pleased to report an encouraging first half in which we continued to outperform our underlying construction markets. As expected, UK sales were resilient in a challenging environment; and coupled with strong overseas sales, Group revenue and underlying profit before tax grew by 6% and 12% respectively. We have again demonstrated the resilience of our business model with its multi-markets exposure.

Outlook also sounds fine -

"The Board remains confident in achieving full year expectations, despite the expected continuation of UK demand headwinds and the further delay of a significant export contract in Hong Kong."

Broker forecasts have been edging up recently too -

H1 figures -

Revenue up 6.4% to £47.8m

Good underlying operating margin of 14.1%, indicating pricing power.

Underlying PBT up 12.4% to £6.3m - remember that’s just for a half year.

Adjustments look smallish, since statutory PBT is £5.6m

Underlying EPS 13.0p in H1

Net bank debt looks fine at £7.4m (after spending £6.5m on an acquisition)

Broker update - thanks to Cavendish, who update us, expecting 25.1p adj EPS, for a PER of 7.1x, which strikes me as a modest valuation, with upside potential on both the earnings, and the rating.

Balance sheet is OK, but not strong. NTAV is about £8m.

There’s cash of £7.2m, and bank debt of £14.6m, so net debt of £7.4m - not excessive.

Note the pension deficit of £4.8m, which seems to be a cash drain of about £0.6m pa, down from £1.0m last year. So I’d say valuation of the shares needs a small downward adjustment to reflect this liability, but it’s nowhere near a dealbreaker.

Cashflow looks fine to me.

Paul’s opinion - on the quickest of reviews, I think this looks a smashing value share.

Thumbs up from me. Thanks to the readers who badgered me into looking at it!

Venture Life (LON:VLG)

37p (£47m) - Trading Update - Paul - AMBER

Venture Life (AIM: VLG), a leader in developing, manufacturing and commercialising products for the self-care market, announces a trading update for the year ended 31 December 2023 ("FY23"). The Company expects to publish its results for FY23 in early April 2024.

FY 12/2023 revenue is c.£51m, up 16% helped by an acquisition (+5% on a LFL basis)

EBITDA in line with expectations (no figure given)

Normalised inventories improved operating cash generation to £9.5m (up 70%)

Gearing reduced to 1.25x EBITDA (1.1x post year end)

Price rises will raise margins in 2024.

The commentary is all a bit vague and mostly fact-free.

Looking back H1 results were nothing to write home about, and finance costs stand out as heavy, tipping it into a statutory loss before tax of £(1.3)m for H1.

The balance sheet at June 2023 was weak, with NTAV of £(2)m.

Bank debt was excessive, at £16.9m gross, less £3.7m cash = £13.2m net debt at June 2023. That’s too much gearing,although it sounds as if the position might have improved in H2.

Cavendish has put out a recent update (many thanks). Note that the large £11.6m adj EBITDA only turns into £2.5m adj PBT. So I would need to see the full published accounts to see how all the numbers fit together, there’s not enough information in today’s update.

Paul’s opinion - VLG strikes me as unremarkable. It seems a hotch-potch of small-selling branded personal care products. There’s been a lot of dilution over the years, and its track record hasn’t been very good.

Directors bailed out at the right time, banking millions at 90p in Nov 2020.

Overall then, I’m a bit sceptical, but will grudgingly go with AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.