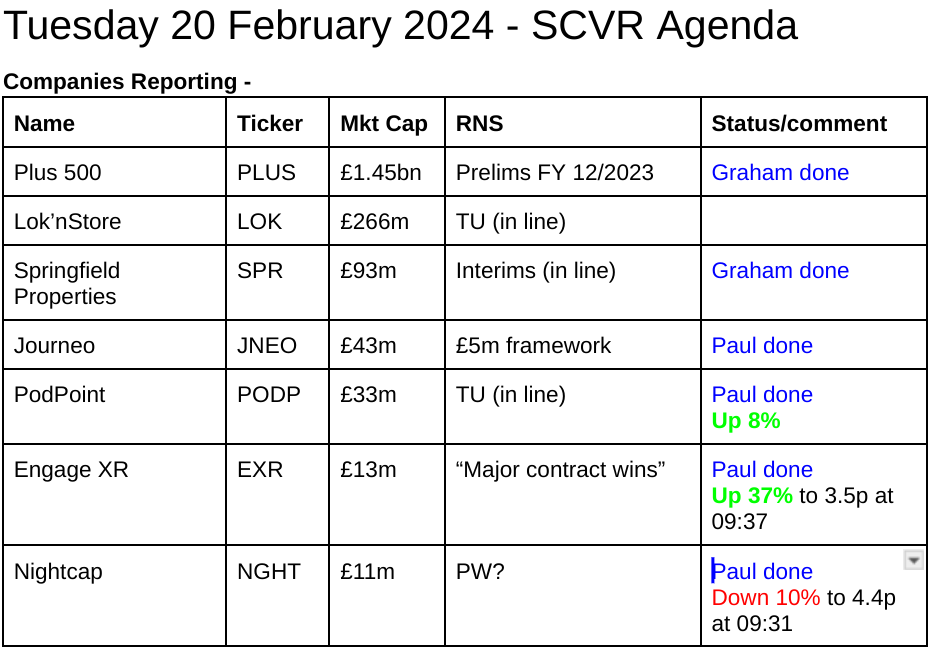

Good morning from Paul & Graham!

Live Masterclass - is tomorrow (Weds) from 18:00 - full details here. The series on finding multibaggers was absolutely brilliant, and I'm sure this latest one will be too - the subject being:

Forensic stock analysis masterclass: How to get the most out of the StockReports in 2024.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Quiet again -

Other mid-morning movers (with news) -

Mobico (LON:MCG) - down 11% to 74.9p - audited results for FY 12/2023 are now delayed by up to a month, due to audit problems. Onerous contract in Germany requires additional provision of £40-70m. Guidance unchanged though -

The Board continues to expect Adjusted1 EBIT for FY 2023 to be within the range of £175m-£185m, as provided in the Q3 trading update on 12 October 2023. Covenant gearing is anticipated to be broadly in line with the half-year position and with significant headroom.

Revolution Beauty (LON:REVB) - down 6% to 26.3p (£mkt cap) - changes its auditor. BDO “resigned by mutual agreement”, and MHA appointed. The year end is in 8 days’ time, so this is not a typical time to be changing auditors! Has there been a falling out I wonder? BDO confirms nothing required to be brought to the attention of shareholders, which is standard.

Summaries

Journeo (LON:JNEO) - 262p (£43m) - £5m Framework Agreement - Paul - GREEN

A pleasing contract win, although it's spread over 4 years, and is already baked into existing forecasts, so reassuring rather than exciting. I remain positive on this share overall, which has been transformed by new management and acquisitions. Still reasonably-priced too.

Nightcap (LON:NGHT) - 4.9p (pre-market) £11m - Acquisition, Trading update, and fundraise - Paul - RED

Presented in reverse order, this is actually most importantly a nasty profit warning - current trading is "far softer" than expected. It raises £1m from existing shareholders at 6p, and makes a small acquisition from the administrator in a pre-pack deal. I suspect equity might end up being worth nothing, for this struggling chain of unremarkable bars.

Springfield Properties (LON:SPR) - down 5% to 74.3p (£88m) - Interim Results - Graham - GREEN

These interim results are poor but full-year expectations are unchanged. Net debt should reduce quickly as working capital unwinds and as proceeds are received from land sales. This housebuilder is not without risk but the odds may be favourable with a TNAV of £145m.

ENGAGE XR Holdings (LON:EXR) - up 37% to 3.5p (£18m) - Major Contract Wins - Paul - AMBER/RED

A £1m+ contract win in the M.East sounds impressive. Plus a smaller existing contract is extended. However, the reality is that EXR is small, heavily loss-making & cash-burning, so the shares are a long shot. That said, I do see speculative potential here, that £1m contract is attention-grabbing.

Plus500 (LON:PLUS) - up 2% to £18.63 (£1.48 billion) - Preliminary Results - Graham - GREEN

Today’s full-year results are ahead of prior expectations but in line with January’s trading update. The cash balance ($900m+) is remarkable and allows a further $175m to be directed towards dividends and buybacks. I am positive on all stocks in this sector.

Pod Point group (LON:PODP) - up 8% to 23.4p (£36m) - Trading Update [in line] & Board changes - Paul - RED

Horrendous losses continue, and another big loss is forecast for 2024 too. So in line with terrible expectations. The cash pile is forecast to almost completely disappear, so does it matter if shares are now priced below net cash? New CEO appointed, let's hope she can make radical changes needed to create a viable business out of the existing mess.

Paul’s Section:

Journeo (LON:JNEO)

262p pre-market (£43m) - £5m Framework Agreement - Paul - GREEN

I’ll start with this company, as it’s fresh in my mind from reviewing it here -

28/11/2023 - GREEN - 216p - ahead exps TU.

12/2/2024 - GREEN - 249p - in line TU FY 12/2023. Vague but positive-sounding outlook.

We were rather late to the party here at the SCVR, only picking up quite slowly on the transformational acquisitions and performance of this transport-related tech products/services group.

Today’s news is that it’s won a significant sized £5m contract -

Journeo plc (AIM: JNEO), a leading provider of information systems and technical services to transport operators and local authorities is pleased to announce the award of a new Framework Agreement ("Agreement") with a Northern Transport Partnership ("Partnership"), following a competitive tender process.

Revenue will be recognised through to Jan 2028, so about 4 years.

Revenue for FY 12/2024 is forecast at c.£48m, so this deal isn’t particularly material to revenues, if we assume maybe £1-2m might be recognised this year, out of the £5m total? It depends on the phasing of the supply of goods and services though, which we’re not told.

Ahead of expectations? No, because this deal was within the expected pipeline, but it does improve visibility.

CEO comments are upbeat -

Russ Singleton, Chief Executive of Journeo plc, commented: "We are delighted to continue this relationship with the Partnership, installing our latest technology to enhance the passenger travel experience. This latest agreement follows a highly successful year in 2023 of contract awards and purchase orders which together have built a strong order book. With each new contract we are demonstrating our innovative approach and technical expertise, which in turn is creating new opportunities and building momentum in the business."

Paul’s opinion - a pleasing contract win, but I don’t see this announcement on its own moving the price much (writing this at 07:54).

My main reservation with JNEO is whether it can keep the contracts rolling in, or whether it’s just enjoying a flurry of big, one-off contracts. So each contract win announcement reassures on that point.

Shares look priced reasonably, on 11.4x forward EPS forecast. I probably wouldn’t want to chase the price much higher than that though.

Overall, I remain positive on JNEO shares, so am happy to stick with GREEN.

Things started to dramatically improve from 2021 - all the more impressive, since this 5-bagger has happened in a nasty bear market for small caps - well done to subscribers who spotted the opportunity much earlier than we did! -

Nightcap (LON:NGHT)

4.9p (pre-market) £11m - Acquisition, Trading update, and fundraise - Paul - RED

I’ve renamed the announcement today, which is actually titled “Acquisition of The Piano Works and other matters”

Piano Works - acquisition is costing £200k (being paid piecemeal in monthly instalments), buying its assets in a pre-pack administration. Which does raise questions about the quality of the business, as with NGHT’s other formats too. It traded at breakeven for FY 6/2023, we are told. My thinking is that if they’ve already gone bust, there’s a good chance they might not be very good businesses, even after a restructure. Although the commentary today says it was forced into administration due to an onerous lease in Soho. The format is to be rolled out to more sites, and sounds quite interesting - live music with audience participation, I might have to mystery shop it!

As a group, NGHT has so far failed to demonstrate any consistent profits. Although it has been through a nightmare trading environment in recent years, in common with the whole sector, so it’s difficult to judge what the steady state level of profits (if any) would be. There are further big hikes in staff wages coming in April 2024, as a further blow to this sector where wages typically make up 30-35% of revenues, up to half gross profit. It’s very difficult to make any profit at all from bars. Even the large chains, with their greater buying power, are only managing slim profit margins at present. Could a recovery in the economy gradually improve things though? Who knows!?

I did a review of NGHT here on 11 Jan 2024, and came away unimpressed, AMBER/RED. Problems being that it’s loss-making, has too much debt, and management pay is excessive.

Equity fundraising - is with existing shareholders, and is at a premium price, 6p (last night’s close was 4.9p), to raise £1m - which looks a good deal. It says this is to fund the Piano Works acquisition, but it clearly isn’t - it’s to fund the precarious state of the group overall, which is obviously strapped for cash.

Convertible loans - terms are amended, to extend maturity from Sept 2025 to Sept 2026, and lower the minimum conversion price from 12p to 10p. I think that seems fair.

Trading update - it’s a profit warning - and it sounds bad, “far softer” trading -

Following positive Christmas trading, as announced on 10 January 2024, the Group's trading since the start of 2024 has been far softer than the Board expected, in line with reports from across the hospitality sector.

It confirms that an important lease is terminating shortly, which is something that I believe was first revealed via a whistleblower by Tom Winnifrith.

New guidance -

As a result of the above factors and their impact on the second half of FY 2024 in particular, the Board expects that, whilst revenues for FY 2024 will be in line with expectations, adjusted EBITDA* is expected to be in the range of £2.0 million to £2.5 million.

* IAS 17 Earnings before interest, tax, depreciation, amortisation, share based payments, exceptional items, acquisition related transaction costs and pre-opening costs.

The only note I can find is an old one (June 2023) from Allenby, which forecast £5.1m IAS 17 adj EBITDA. So the new guidance of £2.0m to £2.5m looks a large drop.

The £5.1m old EBITDA forecast turned into a loss before tax of £(336)k. So the new guidance implies this will probably have ballooned to a LBT of something like £(3)m or worse.

Paul’s opinion - I didn’t like this share to start with, and it strikes me that the new guidance means NGHT is now heavily loss-making.

Therefore I’m shifting down from amber/red, to RED.

With too much debt, greedy overpaid management, and now heavily loss-making I think, the future looks very grim for equity, which I suspect might end up being worth nothing.

Hence I’ll be steering clear of this share at any price, because I think it’s worth zero. Sector read-across for other struggling bars eg. Revolution Bars (LON:RBG) also looks grim, so I'm resisting the urge to bottom fish with either of these shares, as the risk of things ending badly is now looking quite elevated. I note that the remnants of the old Luminar nightclubs business recently went into administration again, for the umpteenth time.

ENGAGE XR Holdings (LON:EXR)

Up 37% to 3.5p (£18m) - Major Contract Wins - Paul - AMBER/RED

This Irish company is involved in virtual reality, or metaverse. It floated on AIM in Mar 2018, so the story is getting a bit stale by now I think.

As you can see in the graphs below, the solid (actuals) blue blobs show a rising revenues trend, but at a cost of substantial, and worsening losses - which does make me wonder if they’re buying in revenues by offering deals at below cost? That’s what the figures are suggesting -

In the absence of any facts/figures showing that this is a viable business, we’ve been consistently negative, RED, on this share. Remember that nobody pays us to give a distorted positive view on any company, unlike the army of PR people out there, this is independent, and brutally honest analysis here.

Checking my previous notes, I was unimpressed with weak H1 results on 11/9/2023, but noted it had good cash reserves to continue trading for maybe another 18-24 months from then.

Then on 19/12/2023, EXR issued a bad profit warning, saying contract delays had caused large slippage of revenues, now falling way below forecast.

Looking at it with fresh eyes today, I’m intrigued by the share price being up 37%, although that’s only a 1p rise to 3.5p.

Major contract win - said to be in 7-figures, so probably just over £1m I’m guessing.

The client is an (unnamed) large Middle Eastern company, in education & training, and the contract is partnered with accountants PWC.

Contract extension - said to be in 6-figures, this is with a US bank that’s an existing customer. I’m encouraged that an existing customer wants to extend the project, which implies they’re probably happy with the services provided to date.

Outlook - nothing specific, but generally positive-sounding comments today -

As previously announced, the last financial year was impacted by delays in signing some contracts and therefore some revenues the Group had hoped to be recognised in FY23 will now be recognised in FY24. The Group's sales pipeline continues to grow, and the Group continues to see strong demand in the education, training and development verticals…

… we expect education, training and development to be the primary driver of revenue this year.

Our understanding of the needs of customers in these areas has accelerated during 2023, and we are better placed to target and win more business as a result. We are also pleased that our pipeline is beginning to convert again, after customers delayed signing contracts in the second half of last year.

We believe 2024 will see growing interest in spatial computing / metaverse services as Apple releases its Vision Pro headset in February and new devices are expected to be released from Sony, Samsung, Google, and Meta later this year. Overall we are excited at the opportunity before us and believe that the Group is well placed to take advantage of the increasing interest in spatial computing and the metaverse."

Cash - nothing is said about the current cash position, but I suppose this is a contract win announcement, not a full trading update.

Paul’s opinion - I’ve been rather dismissive of EXR in the past, because the figures were so bad. It’s not possible to value this share accurately, since it’s a heavily loss-making, cash-burning jam tomorrow share.

Cavendish withdrew forecasts after the Dec 2023 profit warning, so ignore the outdated forecasts shown on the StockReport (I’ve just green blobbed the office, asking for these outdated figures to be removed).

However, today’s contract news, particularly the 7-figure M.East deal impresses me considerably. This is clearly telling me that the product must be desirable to a big customer. It also shows the company has international reach.

Where we’re in the dark, is whether this can all be turned into a profitable company before the cash runs out?

Is £18m an attractive valuation for what can only really be a complete punt at this stage? For me personally, I’d say no, it’s not cheap enough to give me attractive risk:reward. For me, I want the potential of a 5-bagger, to get me to take the risk of losing maybe half my money in 6-12 months if things don't go to plan. But I am intrigued by the possibilities. I suspect it’s likely to burn through the existing cash, and need another fundraise in late 2024 or 2025. Cash burning micro caps always say they have enough cash to reach breakeven, but that’s hardly ever true in reality. I’ve seen numerous jam tomorrow companies tell us that they don’t need another fundraise, then go on to do multiple additional fundraises!

Overall, I’ll shift up from red to AMBER/RED, to reflect that this share is a long shot, but there does seem to be potential here maybe?

Note below the chart may seem to show a cheap share, but the share count has risen from 193m to 525m. So the market cap when it floated was about £19m (10p * 193m shares), compared with today's almost the same market cap of £18m (3.5p * 525m shares in issue).

Pod Point group (LON:PODP)

Up 8% to 23.4p (£36m) - Trading Update [in line] & Board changes - Paul - RED

Pod Point, a leading provider of Electric Vehicle ('EV') charging solutions in the UK, is pleased to announce the following trading update ahead of audited full year results for 2023 to be announced in April.

This is one of the worst business models I’ve ever seen. It embarked on a suicidal squandering of a large cash pile, with resulting immense damage to shareholder value, as you can see -

This is the latest update today -

Group results are expected to be in line with previously announced guidance of revenue of at least £63m and adjusted EBITDA loss of no greater than £16m.

At 31 December 2023, net cash was £48.7m, slightly ahead of the guidance of at least £47m.

Zeus says (note dated 20/11/2023) that £(16)m EBITDA turns into a loss before tax of £(24.3)m. This note was issued after the company’s restructuring plans were announced in a Capital Markets Day (CMD) held on 16/11/2023 - details here.

Guidance for FY 12/2024 is another huge loss, £(14)m, with only £15m in net cash expected to remain by end 2024. EDF (largest shareholder) has provided it with a £30m borrowing facility, suggesting that PODP is expecting to burn up all its remaining cash pile.

Investors might be looking at PODP and saying that the market cap is attractive at £36m, being well below the company’s own net cash pile of £48.7m at Dec 2023. However, as the company is planning to burn the entire cash pile, then I would value its cash at nil. Unless activists get involved, unseat the board, and stop the cash burn. Which won't happen because EDF owns 54%, so controls PODP. It sounds like the existing restructuring costs (exiting loss-making activities) will consume cash in closure costs.

New CEO - the original evangelical clown running PODP was sacked a while ago, and a permanent replacement has now been found -

Melanie Lane as Chief Executive Officer ("CEO") with effect from 1 May 2024. She will succeed Andy Palmer, who has acted as Interim CEO since 6 July 2023 during the course of the executive search and appointment processes.

She seems a good fit, with relevant experience -

Melanie joins the Group from Shell Recharge Solutions ("Recharge"), having led the standalone unit following its acquisition by Shell in 2017 to become a prominent e-mobility solutions provider across key EU markets. Prior to her time running Recharge, Melanie led extensive and successful turnaround programmes for Shell's Aviation and Retail units, which delivered significant operational improvements, resulting in strengthened competitive positions and profitability.

Paul’s opinion - as things stand, it’s a total basket case. Whether the new CEO will be able to create a viable business out of the existing mess, who knows? There’s an obvious need for a large scaling up in the provision of EV charging points, but that in itself doesn’t make a good business model. PODP has very little recurring revenues at the moment, it basically instals EV charging points at below cost, which is very philanthropic and public-spirited of them, but not something I find attractive as an investor.

The depleting cash pile, and backing from major shareholder EDF, does at least buy it some time to see if a revised business model can be implemented.

This share remains bright RED for me.

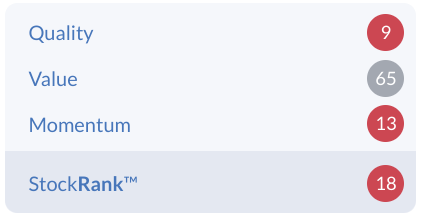

Stockopedia also takes a dim view, although note the value score is quite high, so the algorithms must have detected the big discount to cash -

Graham’s Section:

Springfield Properties (LON:SPR)

Share price: 74.3p (-5%)

Market cap: £88m

We took a quick look at this one yesterday, as the company announced a land sale to help meet its debt reduction targets.

Today we have interim results for the period ending November 2023. Here are the key figures:

Revenue falls 25% to £121.7m (includes a 26% fall in the largest segment, private housing, and an 82% fall in contract housing).

Gross margin up 70 basis points to 14.7%

Operating profit down 37% to £4.8m

PBT down 80% to £1.2m

Net bank debt rises to £93m but of course the company has been taking action since November to reduce this.

It’s clearly been a very tough period. Completions fell by 36% to 432, “reflecting entering the year with a lower forward order book due to challenging market conditions”.

Demand was impacted by “high interest rates, mortgage affordability and homebuyer confidence”.

On the brighter side, as we’ve discussed before, the company has re-entered the contract housing market, with £40m of affordable housing contracts having been signed for delivery in H2 of this year and beyond.

As the net debt level can’t be justified given historic/prospective levels of profitability, Springfield are taking the following steps:

Only commencing building homes when they are reserved.

Admin expenses reduced to £12.6m (H1 last year: £14.7m)

Land sales of £18m agreed so far.

No dividend payments until debt is reduced.

Outlook is in line with expectations, “including meeting target to reduce net bank debt to c. £55m by 31 May 2024”.

There are “initial signs of recovery” in private housing reservations, and “advanced negotiations” for more land sales. A rent cap in Scotland is due to expire on 1 April 2024.

Build cost inflation is stabilising around 2.5%.

CEO comment excerpt:

"The fundamentals of our business and our position within the Scottish housing market remain strong. We have one of the largest land banks in Scotland with over 6,421 owned plots, 86% of which has planning permission, and a further 3,217 acres of strategic land… while there remains uncertainty in the near term, with our position having been strengthened through the decisive action that we have taken, we remain confident in Springfield's prospects."

Graham’s view

The profitability figures are obviously very poor, but it’s to be expected given that the six months to November 2023 were some of the toughest months in the housing market for many years.

Springfield’s share price has reflected the malaise:

Looking ahead, adjusted PBT for the current year (FY May 2024) is forecast at £10.1m by Equity Development, rising to £13m for FY May 2025.

The adjustments to these figures don’t seem too heavy, e.g. in H1 the only exceptional items were £0.9m of restructuring expenses associated with the company reducing its ongoing cost base. So the numbers are relatively clean.

One of the main reasons I’ve been positive on this share is the balance sheet, and we have a fresh balance sheet from the company to look at this morning.

Total assets are £327m, about 98% of this figure being tangible assets. Assets mostly (£277m) consist of “inventories”.

Total liabilities are £176m, including long-term bank borrowings of nearly £100m.

Net assets are therefore £151m, or about £145m in terms of tangible net assets.

Against a market cap of £88m, I continue to view this as potentially offering investors a bargain.

However, this does hinge on the company’s debt reduction plans and its ability to continue operating profitably or at least without incurring heavy losses as it makes its planned asset disposals. As the company itself highlights, the upcoming expiry of the rent cap in Scotland will be important from the point of view of bringing PRS investors back into the sector.

It’s not my highest-conviction share by any means but I do suspect that risk/reward remains attractive at this level. It seems to offer value both on the balance sheet and against its forecast earnings, and it’s a “Super Stock” with a StockRank of 94.

Plus500 (LON:PLUS)

Share price: £18.63 (+2%)

Market cap: £1.48 billion / $1.87 billion

The headline here is “FY 2023 results significantly ahead of market expectations” but the company is referring to previous upgrades. Today’s results are in line with the January trading update from the company.

Key points:

2023 revenues down 13% to $726m

2023 EBITDA down 25% to $340.5m

Cash balance down 3% to $906m

As this Israel-headquartered company reports in US dollars, I also translate its market cap to dollars and get $1.87 billion.

That leaves an enterprise value of $964m for the business after deducting the cash balance from the market cap. But it’s important to bear in mind that the company needs to hold hundreds of millions of dollars for risk management purposes, to help shield it from adverse market movements. So we have to be a little bit careful if we want to value it on its enterprise value.

Shareholder returns

EBITDA of $340m translated to $271m of post-tax net income, allowing for very significant shareholder returns to be announced today. $175m will be paid to shareholders: $100m in the form of a new buyback, plus $75m in dividends.

Shareholders at Plus are well-acquainted with high returns, having seen $350m of buybacks and dividends announced last year.

Strategy

A wide variety of new platforms, licences and products have been achieved, for example:

Retail trading platform in Japan went live.

New licences in the UAE and the Bahamas.

Futures trading platform for retail traders in the United States (link).

Like its UK rivals CMC Markets (LON:CMCX) and Igg (HKG:799) (which I hold personally), Plus now offers a conventional share dealing service.

Outlook is “confident”.

Graham’s view

I think the company has presented these results extremely well, considering that there was a 17% fall in the number of active customers.

Even this sharp fall-off in customers was presented as a positive:

The number of Active Customers during FY 2023 remained robust at 233,037 (FY 2022: 280,769) thanks to the Group's customer retention, monetisation and activation technological capabilities.

New customers onboarded also fell off, from 106,00 to 91,000.

One of the major worries around this stock over the years, at least from my point of view, has been the quality of Plus’ customers - are they experienced and sophisticated traders who will keep an account open for several years, or are they beginners who will bust their account quickly and give up in less than a year?

One simple way to analyse this is to compare active customers vs. new customers.

This logic might be too simple, but here goes:

The company had 280,000 active customers during 2022.

It then onboarded 91,000 new customers during 2023.

Adding together, this implies up to 371,000 active customers during 2023.

But the actual number of active customers during 2023 was 233,000.

Take the difference. This implies that during 2023, 138,000 customers from 2022 became inactive.

This chain of logic suggests that half of the active customers in 2022 became inactive during 2023. This churn requires a great deal of ongoing marketing spend to replace inactive clients, but Plus has demonstrated over the years that it is very good at this.

Average revenue per user increased from $2,966 to $3,116 (5%), so those customers who did continue to trade remained active. They also deposited significantly larger amounts, with the average deposit up by 25% to $10,300.

I’m going to stick with my positive stance on these shares, as I don’t think it would make sense to remain neutral on Plus while I am so positive on its UK rivals.

After so many years of profitability and having reached this scale, it has become a credible, diversified, international trading services provider. They point out today that since IPO in 2013, they have delivered $2.1 billion to shareholders in dividends and buybacks.

And yet they continue to trade cheaply (along with the rest of the sector):

The StockRank is remarkable:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.