Good morning from Paul & Graham.

CEO interview - Beeks Financial Cloud (LON:BKS) [I hold] - I interviewed founder/CEO Gordon McArthur again today, hopefully you might find this interesting. It's gone out on my podcast channel, or the web version is here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

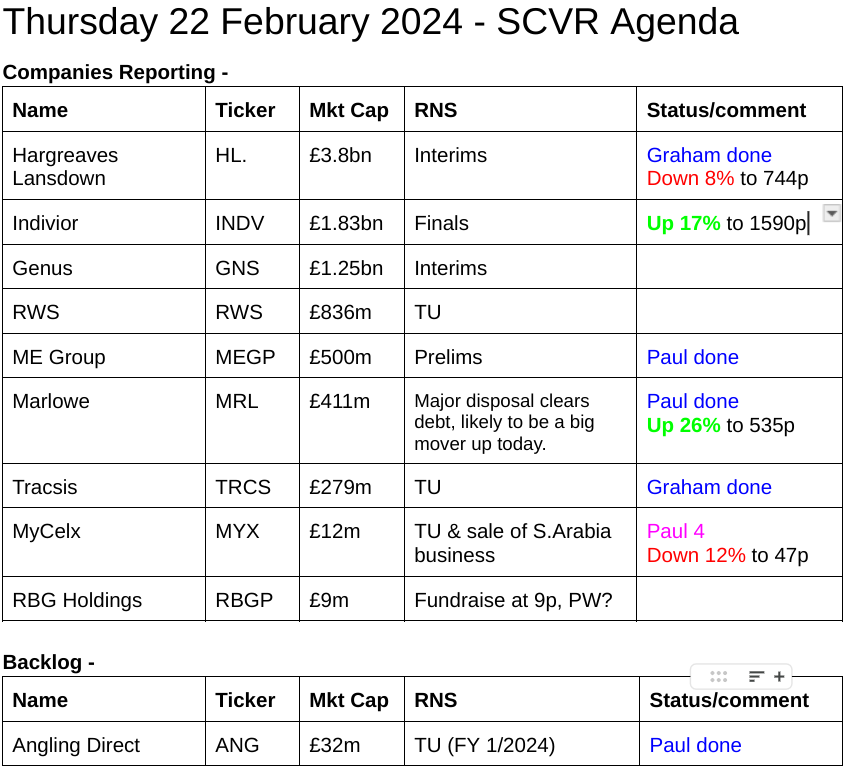

Quiet for small caps, so I've included a few mid-caps too, which we might get round to looking at. As always, this is a list of which companies are reporting, and we can't necessarily cover everything -

Other mid-morning movers (with news) -

Beazley (LON:BEZ) - up 9% to 634p (£4.3bn) - another mid-cap, insurance company saying it’s trading well. Looks cheap on StockReport metrics, and well-capitalised (similar to Cre (TYO:3458) that reported earlier this week). Announces a substantial $300m additional shareholder return, above usual divis. Not my sector, but looks interesting.

Rolls-Royce Holdings (LON:RR.) - up 9% to 358p (£30bn) - market responds positively to strong turnaround FY 12/2023 results. “Strong momentum” for 2024. Surprisingly weak balance sheet though, but the market doesn’t seem to mind! Shares have been a stunning performer in last 7 months, up from 150p to 358p!

Summaries

ME International (LON:MEGP) - 133p (pre-market) £500m - Prelims FY 10/2023 - Paul - GREEN

I review FY 10/2023, which are in line with expectations. This looks a superb business, at a remarkably attractive valuation. Thumbs up from me.

Tracsis (LON:TRCS) - down 4% to 890p (£268m) - Trading Update - Graham - AMBER

An in-line update has been met with softness in the share price, perhaps reflecting the high expectations baked into valuation. H1 numbers are uninspiring but as previously flagged, the company is expecting a big improvement in H2. I’d expect more M&A before too long.

Angling Direct (LON:ANG) - up 2% to 41.5p (£32m) - Trading Update FY 1/2024 [in line] - Paul - AMBER

An in line TU for FY 1/2024, despite disruption to anglers from recent storms. Net cash pile is now about half the market cap (it was almost all of it at start 2023, when I was bullish on the valuation). Trouble is, it's just not a very good business, making wafer thin margins in a very competitive sector. So is this a good use of capital? I'd say not, and shareholders should push for a return of cash. Probably priced about right now.

Hargreaves Lansdown (LON:HL.) - down 7% to 748p (£3.55bn) - Half Year Report - Graham - GREEN

There’s a negative reaction to these results which include evidence of excessive strategic spending and impairments of prior projects, passed off as exceptional items. On a long-term view I do continue to view these shares as too cheap for the market-leading wealth platform.

Marlowe (LON:MRL) - up 22% to 520p (£503) - Disposal & Board Changes - Paul - AMBER

A giant disposal looks set to repay all the (too high) debt, and give scope for about 30% of the market cap to be returned to shareholders in some kind of distribution. Shares are now a special situation, to work out if the remaining business is good value or not. I don't know, so will just mark it AMBER now, up from my last amber/red when debt was worryingly high.

Paul’s Section:

ME International (LON:MEGP)

133p (pre-market) £500m - Prelims FY 10/2023 [in line] - Paul - GREEN

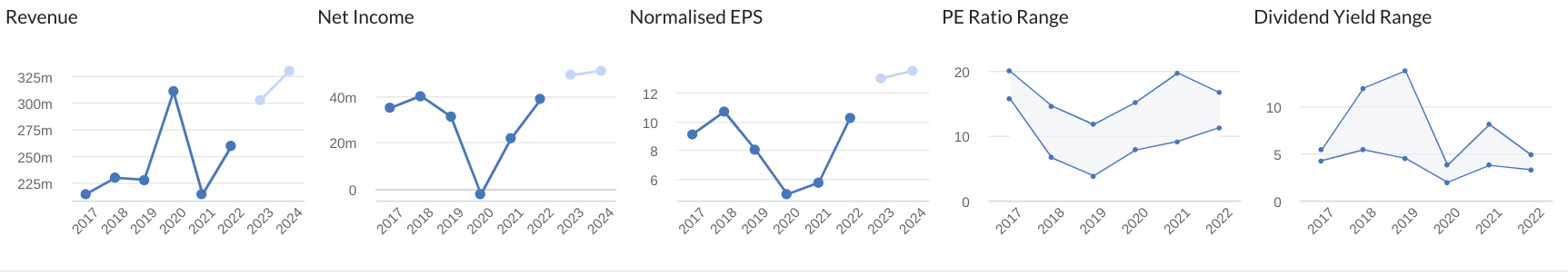

This operator of photobooths, self-service (often outdoor) launderettes, and other self-service kiosks, is one of my favourite value/GARP shares, and made it onto my top 20 share ideas for 2024 list here. So I’ll review it first today.

We last looked at MEGP on 30/11/2024, when Graham reviewed its FY 10/2023 trading update, indicating revenues would be slightly below expectations at c.£298m, but that a focus on profitability means PBT would be at least £67m (top end of guidance).

Here’s the highlights table, and the key PBT number is as expected, so this is in line with expectations as provided in the 30/11/2024 company update -

That’s impressive profit growth.

The PER is 10.0x, using the 13.31p diluted EPS figure above and 132p share price (pre market).

Yield is another key attraction with MEGP shares, and 7.39p divis above yields 5.6%, plus it pays special divis on top sometimes, and is doing buybacks actively too.

MEGP has net cash too, unchanged at £33.9m, despite heavy capex to modernise & expand its booths, and the generous shareholder distributions.

You can see why a lot of us here like this share (it’s the most viewed on Stockopedia so far today).

Broker research is thin on the ground for us. Cavendish has put out a flash note saying today’s results are fine, and that they’ll do a full update at a later date.

The StockReport shows 13.0p broker consensus, so the 13.3p above actual looks a bit ahead, although broker forecasts often contain adjustments, so I need to wait for Cavendish’s update to be certain.

This all (below) sounds positive too - MEGP is clearly a company on the front foot, expanding, and trading at record profitability, which makes its modest valuation even more perplexing! Is this a bargain share? It certainly looks like it to me.

Laundry division - I think the market has missed how important, profitable, fast growing this division is -

Our laundry operations, a key growth driver for the Group, performed particularly strongly and our expansion continued at pace…

I mystery shopped laundry here, after my own washing machine broke and I had to wait a fortnight for a new one, coming away impressed. It’s a niche service, particularly useful for people who are travelling away from home, or need a large machine for washing duvets, curtains, etc. They’re often sited with other self-service machines, in carparks, outside areas of petrol stations, etc, hence low overheads. It’s a clever service that is doing well, so MEGP shares are now much more than just photobooths (the original core business).

Photo booths - maybe MEGP shares are lowly rated because of fears that tech might eventually remove the need for photo booths? People have been saying that for the last 20 years, but there’s no sign of any demise occurring so far, and tech improvements could reinforce the need for these machines, and create a bigger moat maybe? -

Demand for photobooth services remains robust and we continue to develop our relationships with governments and regulatory bodies for our digital and secure photo ID services.

"The modernisation and digitalisation of our business will drive operational efficiencies and improve the services and experience we offer. Our next-generation photobooth is being rolled out at pace, bringing a multi-service offering and seamless user experience, backed by proprietary software. This is just one of many initiatives we are driving forward, underpinned by our strategic focus on digital innovation. We are also working on a range of additional service features and functionalities that could attract more consumers to use our instant vending equipment.

Food division - not going well, with some problems, but it’s very small, so I’m not bothered about this. I still haven’t managed to mystery shop the pizza machines!

Geographies - nearly all the profit comes from continental Europe -

Finance income - was nothing last year, but rose to £1.4m in FY 10/2023, usefully mitigating the £2.5m finance costs. I still don’t understand why MEGP has both a large cash pile, and simultaneously has bank borrowings, does anyone know?

Outlook - none of the “profitable growth” PR fudge here! MEGP directly says that it’s expecting higher profit in FY 10/2024, which I like -

"The Board looks ahead to the future with confidence and, notwithstanding changes in the macro environment, expects the Group to build on the success of FY 2023 and achieve continued revenue and earnings growth in FY 2024."

Stockopedia is showing a modest increase from 13.0p (FY 10/2023) to 13.5p (FY 10/2024). So I think this looks nicely set up to surprise on the upside as this new year unfolds.

Unless something goes wrong, then I think we can probably attribute an >50% probability that MEGP may announce ahead of expectations updates later this year, because it is expanding quite fast with new laundry sites, and talks about improving margins in the commentary too.

Balance sheet - looks healthy to me. NTAV is about £127m, mostly fixed assets of £118m, as I would expect.

Cash is £111m, partially offset by “financial liabilities” (see note 8) of £58m and £32m, £90m total.That comes to net cash of £21m. Note 8 below shows net cash of £34m. The difference is £13m lease liabilities, which I ignore because they are not debt, but are actually future years operating costs. So the real world net cash position is as shown below, £33.9m - very healthy.

Note there is a small £4m pension deficit.

(table above excludes £13m lease liabilities)

Cashflow statement - is absolutely lovely, it gives me pleasure to review such strong figures.

MEGP generated £104m operating cashflow (LY: £88m), which was used mainly as follows:

Tax paid £20m

Acquisitions £5m

Capitalised intangibles £3m

Capex £46m - very considerable, for new machines of course, but entirely self-funded.

Dividends £23m

Overall then, MEGP is a highly cash generative business, which is self-funding its own expansion, whilst paying generous shareholder returns. It also used some of the cash pile to reduce gross debt, which I'm pleased to see.

Paul’s opinion - why is this share so cheap?! I just think it’s the wrong price. I would value this share at 200-250p. Providing nothing unforeseen goes wrong, I think patient investors could do very well here - looking in an attractive income stream, and at some point in the future this share should re-rate, once the UK market recovers from its current malaise.

The owner/managed owns 37%, I wonder if he might sell the business to retire at some stage? So a premium takeover here is an interesting upside possibility.

My view is that the current dislocated UK market is offering us wonderful buying opportunities, so instead of fretting over why things are cheap, and will they ever recover, I am just excited about being offered such marvellous value for an excellent company here.

Angling Direct (LON:ANG)

Up 2% to 41.5p (£32m) - Trading Update FY 1/2024 [in line] - Paul - AMBER

Angling Direct plc (AIM: ANG), the leading omni-channel specialist fishing tackle and equipment retailer, provides the following unaudited trading update in relation to the financial year ended 31 January 2024 ("FY24"), ahead of announcing its Final Results on 14 May 2024.

The Board expects to report overall trading for FY24 in line with market expectations1.

1 Angling Direct believes that current market expectations for the year ended 31 January 2024 are revenues of £83.0 million and pre-IFRS 16 EBITDA of £2.7 million.

Nice and clear reporting there, with a footnote. My only suggestion for improvement would be to disclose adj PBT as well as/instead of adj EBITDA.

Singers helps us out, with an update today, translating £2.7m adj EBITDA into £1.1m adj PBT, and 1.1p EPS.

Revenue is £81.7m (a slight miss blamed on recent storms).

Profit margin is wafer thin, with only £1.1m adj PBT on £81.7m revenue, so it’s a low quality business of little interest to me.

That said, a key feature of ANG’s accounts is that it’s carrying loads of surplus cash, which I like, but it does suppress some quality measures. Maybe we should manually recalculate quality measures at companies with obviously surplus cash, to remove the cash in order to see the true underlying quality of the business?

Like-for-like store sales only grew 3.2% for the year, well below inflation and wage rises.

Online growth was better, at +13.5%

Net cash is £15.8m, up from £14.2m a year earlier.

This supports about half the market cap, but it rather depends what the company intends doing with this cash pile? So far mgt have hoarded cash impressively, it would have been easy to squander it. With such low returns on capital invested, is it worth opening more fishing shops, and tying up loads of capital with fit-out costs, and large inventories?

Shareholders should be pushing for a return of capital I think.

Paul’s opinion - ANG shares were a star performer up 68% on my 2023 top 20 share ideas here. Actually, my 2023 top 20 have continued to out-perform (the spreadsheet is still updating prices live every day), with this (unamended) top 20 now 31% ahead of AIM, with only 5 fallers, and 15 gainers. Not bad going eh!

I put ANG on my 2023 list at 25p because the business was valued at almost nothing, with cash supporting almost the entire mkt cap. Since then it’s risen a lot, so I no longer see such strong support from cash, now about half the market cap.

The business itself is low margin, quite capital-intensive, and unexciting, operating in a very competitive area. So I don’t see much upside on the share price from this level, hence I’ll remain at AMBER, same as the last 2 times we looked at ANG on 17/5/2023 and 23/8/2023.

Shares have good momentum now though, so it might keep rising, who knows?!

Marlowe (LON:MRL)

Up 22% to 520p (£503) - Disposal & Board Changes - Paul - AMBER

This announcement has added almost £100m to the market cap of this overly indebted, highly acquisitive (36 deals in 3 years!) software group.

Today it announces a huge deal - slightly greater than the whole group’s market cap last night -

Marlowe plc ("Marlowe", the "Group" or the "Company"), the UK leader in business-critical services and software which assure regulatory compliance, announces that it has entered into a binding agreement for the sale of certain Governance, Risk & Compliance ("GRC") software and services assets (the "Divestment") to Inflexion Private Equity ("Inflexion") ( the "Purchaser"), for an enterprise value of £430 million on a debt free, cash free basis (the "Transaction")...

representing a multiple of 16.2x proforma adjusted cash EBITDA1 in the year ended 31 March 2023 ("FY23").

Stockopedia shows the existing EV/EBITDA multiple for the whole group at 13.6x, so the disposal looks to be at a premium to the existing valuation.

This sounds like a good deal -

The enterprise value of the Divestment, which accounts for approximately 20% of Group revenues and 40% of Group adjusted EBITDA, represents 121% of Marlowe's market capitalisation as at 20 February 2024 and 121% of Marlowe's market capitalisation based on a 3-month volume weighted average share price as at 21 February 2024.

Use of the cash -

The Group intends to use the proceeds of the Divestment (the "Net Cash Proceeds") to retire in full its current debt facility and return in excess of £150 million of surplus cash to shareholders.

That shareholder return is about 30% of the latest market cap.

The current CEO moves out with the disposal, so a new CEO is being sought.

Paul’s opinion - this completely changes the business, and deals with my main worry at MRL of excessive debt.

Without seeing pro forma accounts/forecasts for the new group, I can’t give an opinion on the new fundamentals. Although now that risk from debt has gone, I’m happy to shift up from amber/red to AMBER.

Despite this looking a decent deal, overall MRL has been a disappointment over the last 5 years. Although I wonder if there might be more hidden value in the group, given that private equity seem happy to pay higher valuations than the UK public market?

Anyone buying or owning now at c.£500m market cap, looks set to receive about 30% of that back in a shareholder return, so the question is whether the remaining, debt-free business is worth £350m? I don’t know, but maybe there could be a special situation here worth researching, for experts who know how to crunch the numbers in this type of situation?

Graham’s Section:

Tracsis (LON:TRCS)

Share price: 890p (-4%)

Market cap: £268m

This is “a leading transport technology provider”.

Writers in the SCVR have often remarked on how expensive it is, and it remains expensive today:

But its acquisition growth strategy has succeeded over the years, leading to a good outcome for shareholders:

Today we have an H1 update for the period to January 2024.

Performance has been “consistent with expectations”:

Key points:

Growth will be weighted to H2 (they’ve flagged this before).

H1 revenue in excess of £36.5m (H1 last year: £39.2m).

Adjusted EBITDA margin 16% (H1 last year: 19%).

The reason for the decline in profitability is higher spend on managers and the sales force, or in the words of Tracsis: “the investments made in the prior year to enhance the Group's senior leadership capabilities and to accelerate the growth of our pipeline of large multi-year opportunities”.

The adj. EBITDA margin is expected to recover over the course of H2.

Cash is virtually unchanged year-on-year at £16.8m, leaving Tracsis “well positioned to continue to invest in its technology base and further acquisitions”.

Exceptional costs: There are £2m of exceptional costs for the full year (mostly incurred in H1) to “transform its operating model and to accelerate its future growth trajectory.”

This sounded vague to me, so I’ve gone back to the full-year results for a reminder of what this transformation plan includes.

The answer is:

“...headcount reductions where roles are duplicated or are no longer required; streamlining our legacy entity and operating footprint; implementing a single groupwide IT support service; and upgrading systems to deliver improved management information.”

When a company has a large and unusual reduction in headcount, I don’t have any major objection to treating the associated cost as an exceptional item. However I’m always a little sceptical when IT and system upgrades are treated as exceptional, because it seems to me that companies always need to do this every few years. At the end of the day, it’s a judgement call for investors.

Outlook

After all the spending on the sales force, the company reckons that its addressable pipeline has doubled in the UK/North America:

We continue to see significant software growth opportunities in the UK and North American rail technology markets, as the industry looks to modernise and adopt digital solutions. The actions taken to transform our operating model and to accelerate pipeline growth leave the Group well positioned to deliver further growth.

Graham’s view

We have baulked at the valuation in this report and I think we can perhaps find some justification for that stance in recent performance.

Unless I’m mistaken, the last acquisition by Tracsis was in March 2022. Without the support of an acquisition to boost things, the company’s revenues and profit margins have begun to decline, although it’s also true that the company has signalled for a stronger performance in H2.

Estimates from Cavendish suggest that Tracsis will post some revenue and profit growth this year, on an adjusted basis:

Revenues to grow from £82m to £85.2m

Adj. EBITDA to grow from £16m to £17.7m

Adj. PBT to grow from £13.7m to £15.6m

Overall, however, I’m struggling to understand why this is valued at its current level. ROCE has been fairly average:

Maybe I just don’t appreciate the underlying quality and the long-term growth opportunity, particularly in the Rail Technology and Services Division.

If you’re interested in learning more about the products in that division, here’s its homepage.

Some of the products do sound monopolistic in nature, e.g. “we have the only Rail Delivery Group (RDG) accredited PAYG ticketing solution” and “we provide 90% of the UK’s delay repay services”.

I’m very comfortable with a neutral stance here.

Hargreaves Lansdown (LON:HL.)

Share price: 748p (-7%)

Market cap: £3.55 billion

(Graham has a long position in HL.)

I turned positive on this one when the shares were trading around 800p; the market doesn’t agree with me yet:

Today we have interim results for December 2023.

Headline numbers:

Assets under administration up 6% over six months (£142 billion)

Net new business £1 billion

Revenue up 5% to £368m

Unfortunately the higher revenues haven’t translated into higher profits; PBT falls 8% to £182m.

Let’s skip down to the financial review and quickly find out the reason for this.

The company argues that “underlying” PBT is up 5%, if you’re willing to look past £39m of adjustments:

The big number here is “strategic investment costs”, which reminds me of the “transformation” spending I’ve just been covering at Tracsis.

There was also £14m of strategic spending in H1 last year. So how exceptional is it really?

I also note that the £21.7m figure that was expensed is not even the full amount; another £3m was capitalised and put on the balance sheet.

Here is the company’s description of what the spend is achieving:

The level of spend has increased as expected during FY24 as we continue to build momentum, commencing new material programmes of work including on Service Transformation, driving improvements to our Helpdesk client experience and efficiency in relation to our Workplace product offering and in relation to the scalability and efficiency of our core payment and reconciliation processes.

I don’t think I can get behind the idea that this spend should be treated as exceptional.

The £14m impairment expense from the table above also doesn’t strike me as exceptional, as it relates to work previously done - and put on the balance sheet - that is now being abandoned:

…£7.2m in relation to software that was developed to support a client financial health check tool and £7.2m on development of a tool to improve efficiency for Financial Advisors for which there is now no intended future use.

It’s worth bearing in mind that HL has a new CEO (joined six months ago).

It also has a new Chief Strategy Officer, with consulting experience, who has been “driving our strategic agenda and digital transformation initiatives forward”.

Personally, I’m in the camp which says that CEOs should be running strategy, not delegating strategy to someone else. It’s just a matter of opinion, and others may disagree. But I strongly believe that a CEO should be driving the agenda of a business and taking responsibility for its strategic success or failure. Otherwise what is the CEO really doing?

In any case, the new CEO and the new CSO at HL clearly feel comfortable ramping up spending and discarding some of the previous projects at HL. Whether or not this is the right course of action, I would not ignore the financial costs associated with these actions.

Other aspects of performance worth highlighting:

Strong market returns: market movements pushed up assets under administration by over £7 billion, so that total AUA has been able to grow strongly even with limited net new business.

Interest on cash: this is of great importance considering the FCA’s involvement in the subject (and the situation at Jarvis Securities (LON:JIM)). HL has retained 41% of the interest it received during the period, passing on the rest to customers. The portion of interest it retains seems to be going down, with c. 36% retained in Q4.

I must say that I agree with HL that these rates are very competitive, being the rates that are passed onto customers:

HL’s revenue on cash has ballooned in recent years as rates have risen. Earning interest on cash is now one of its most profitable activities:

Graham’s view

Despite a few points of worry, I remain bullish on the outlook here.

It’s not terribly expensive:

Returns are enormous:

Besides the heavy strategic spending, bears might also point at the high margin earned on cash and argue that it's unsustainable (as interest rates will eventually fall), is vulnerable to increased regulation by the FCA, or both.

I’m open to that argument but I’m also inclined to think that this risk is priced in already. I’d also point out that revenue from share trading is likely to improve during those times when investors are more inclined to trade regularly.

Even the outlook for platform fees on funds might be quite good, if you share my optimism that net new business will improve. I wouldn’t mind owning a few more shares in this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.