Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

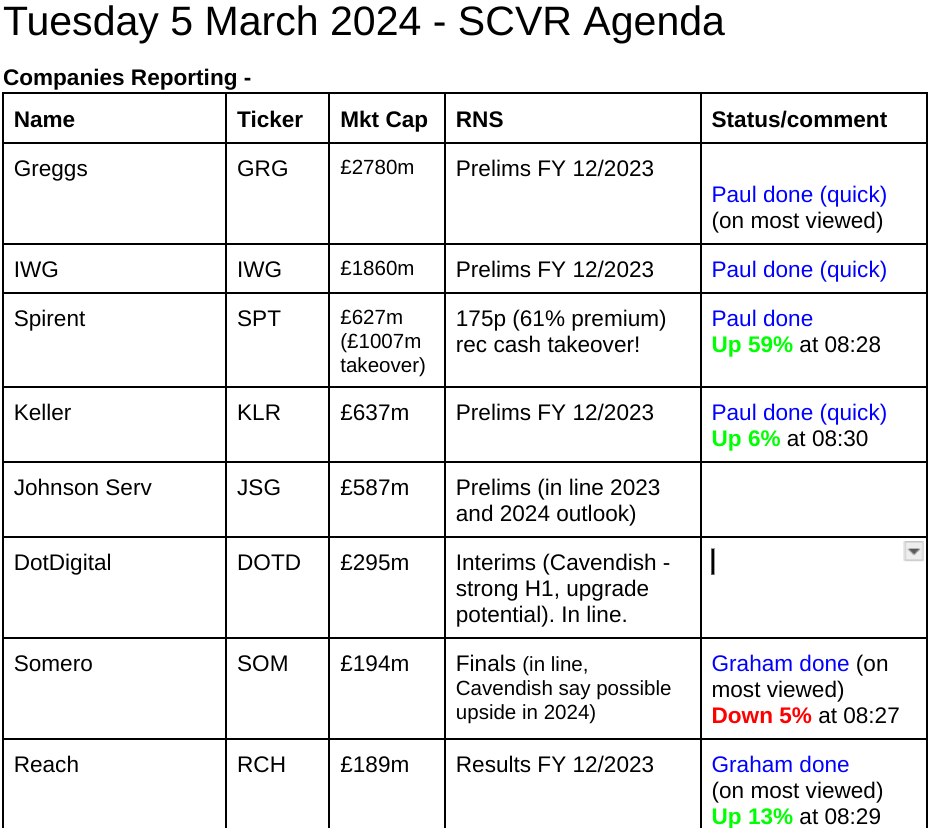

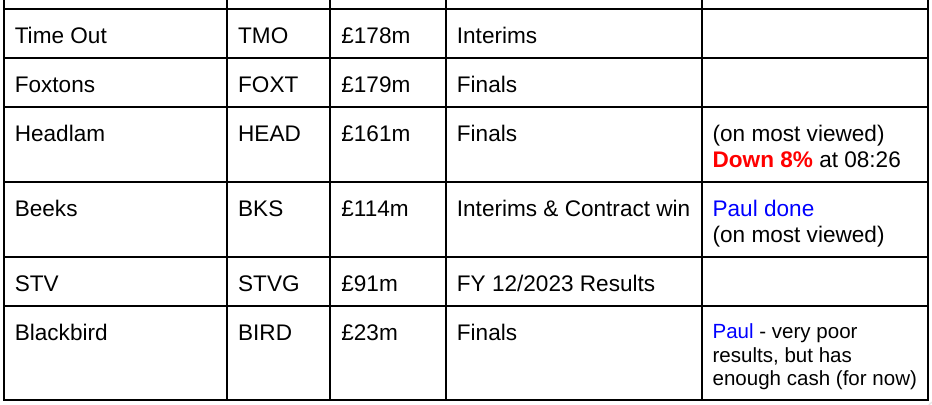

Obviously we won't be able to cover all the companies reporting today, but will select what we (and you, via the home page most viewed widget) are interesting, and the biggest price movers too -

Other mid-morning movers (with news) -

Inchcape (LON:INCH) - down 10% to 609p (£2.5bn) - automotive distributor. FY 12/2023 results look good, with adj PBT up 35% to £502m. Adj dil EPS up 30% to 83.7p (PER 7.3x). Outlook caution might have triggered selling today? - “Outlook - moderated growth in the short term, accelerating in the medium to long term”. Bal sheet - only £349m NTAV. Finance costs have gone through the roof on P&L due to higher interest rates.

Oxford BioMedica (LON:OXB) - up 5% to 175p (£175m) - in line TU for FY 12/2023. Revised future guidance. Paul’s view - complicated accounts, cash burning on big R&D spend, but looks adequately funded for now. Too speculative for us at this stage, not really possible to value shares on a value or GARP basis. Looks like shares are trying to find a bottom?

Summaries of main sections

Spirent Communications (LON:SPT) - 108p (pre-market) £627m - Recommended takeover - Paul - PINK (takeover)

Cash takeover bid from a US competitor Viavi is at a lovely 61% premium. I think the price seems fair, given poor FY 12/2023 results, and cautious outlook. Let's hope a higher competing bid might appear, as with WIN!

Reach (LON:RCH) - up 10% to 65.7p (£209m) - Annual Results - Graham - GREEN

The investment thesis is slowly playing out as Reach makes the monthly contributions into its enormous defined benefit pension schemes, and the last phone hacking cases are settled. Stubbornly high operating profits relative to the enterprise value remain tempting.

Beeks Financial Cloud (LON:BKS) [Paul holds] - unch 172p (£114m) - Interim Results & Contract win - Paul - GREEN

In line with expectations for FY 6/2024. A large contract win is also announced. I recap on my current thoughts below, after a quick catch up call with management. I think the big recent share price recovery is fully justified, and medium-longer term, this continues to be probably my favourite GARP share.

Somero Enterprises (LON:SOM) - down 5% to 382p (market cap £182m) - Final Results - Graham - AMBER

Somero posts results in line with expectations, and forecasts for 2024 are left unchanged. These include flat revenues and another fall in profitability as the company invests in European expansion. I’m still a little concerned about US competition and staying neutral.

Quick Comments

Greggs (LON:GRG) - up 2% to 2760p (£2.82bn) - FY 12/2023 Results - Paul - AMBER/GREEN

Good figures, but adj dil EPS is only up 5.4% to 123.8p (PER 22.3x looks fully priced to me). Divis - 16p interim (paid already) + 46p ordinary + 40p special = 102p total for 2023, yield of 3.7%. Gaining market share, now a record 8.2%. Wider product range, opening hours, and lots more new sites planned. Outlook good, but unchanged -

“Greggs has started 2024 well, with like-for-like sales in company-managed shops growing by 8.2% in the first nine weeks. As we have previously reported, inflationary pressures are reducing and we have improved visibility of costs in the coming year. There is no change to management's expectations for 2024…”

I wonder if consumer spending might pick up after April's big pay rises, allowing GRG to beat 2024 forecast? Balance sheet is fine, with net cash of £195m.

Paul’s view - an excellent business, but share price reflects that, so priced about right I’d say. I’m happy to stick with AMBER/GREEN, meaning that I really like the company, but shares look a bit expensive.

Iwg (LON:IWG) - down 2% to 180p (£1.83bn) - FY 12/2023 Results - Paul - RED

A brief skim of the results shows lots of adjustments for inconvenient costs, but statutory results show another year of losses. Terrible balance sheet, with NTAV of negative £(1,043)m. I don’t see any attraction to this share at all, on fundamentals. Anyone else looked at it, and maybe you could explain the bull case to me?

"The Group remains cautious in its outlook and continues to focus on driving efficiencies and cost control. As a result, we are confident that 2024 EBITDA will be in-line with management's expectations..."

Keller (LON:KLR) - up 7% to 935p (£681m) - FY 12/2023 Results - Paul - AMBER/GREEN

Good numbers here - underlying dil EPS up 53% to 154p (PER 6.1x). Net bank debt down 33% to £146m. Total divis for year up 20% to 45.2p (yield 4.8%). Outlook -

“ our current level of trading together with our robust order book mean that we enter the new year with confidence.”

Modest pension deficit payments to end in Aug 2024. Balance sheet NTAV c.£400m, looks OK overall, although gross bank debt seems higher than I would like.

Paul’s view - I like it, and will stick with my AMBER/GREEN from last review on 17/1/2024.

Spirent Communications (LON:SPT)

108p (pre-market) £627m - Recommended takeover - Paul - PINK (takeover)

Marvellous news for SPT shareholders this morning - a recommended cash takeover at 175p - a big premium of 61% to yesterday’s close.

Technically, it’s 172.5p + 2.5p dividend.

Requires shareholder approval, and regulatory approvals.

Viavi is a NASDAQ listed company in the same sector, so it’s an industry buyer rather than a financial buyer - its market cap being about 3 times the size of Spirent pre-takeover premium, so quite a large acquisition for Viavi.

FY 12/2023 Results are out, but there’s not a lot of point in me reviewing those, as this agreed takeover bid has emerged. Adj EPS fell 60% to 7.6p. Outlook comments sound cautious, expecting difficult market conditions to continue in 2024 and maybe even 2025. Hence the Board decided the takeover bid offered more immediate value to shareholders.

Paul’s opinion - a 61% premium looks generous at first, but zooming out on the chart below, you can see that 175p isn’t such a generous offer when compared with c.300p peak share price in the last 3 years.

Spirent performed badly in 2023, we reported on its profit warning on 4/10/2023, and again on 17/2/2024 where I commented on its terrible 2023 results, but signs of a turnaround in the outlook comments.

However, cautious outlook comments today suggest if SPT remains independent, that shareholders would have to wait a while for a big share price recovery. So I think accepting the bid (whilst hoping for a higher counter-bid from someone else, as happened with Wincanton (LON:WIN) makes sense).

A 61% premium is clearly something nice to put in the bank, allowing shareholders to recycle the money into another cheap UK mid-cap..

Beeks Financial Cloud (LON:BKS)

Unch 172p (£114m) - Interim Results & Contract win - Paul - GREEN

Contract win - is impressive, with an unnamed major bank. I think this was already in the forecasts/pipeline, and has had a long gestation measured in years so it’s pleasing to see it result in a contract. This was won in a competitive tender process, and BKS says it doesn’t compete on price, so it isn’t the cheapest.

Revenue will be £5m over 5 years, with associated up-front capex of c.£1m, and some front-loading of the revenues/cash receivable, if my understanding is correct. Beeks has listened to investor concerns about previously heavy up-front cash outflows, and has made favourable adjustments to deals since then. As before, the key point is “land and expand” - ie contracts nearly always start off small, then build as clients gain confidence in the system. Hence why growth produces such good compound annual growth rates - a lot of it is organic growth from existing customers, as well as winning new, larger contracts. Clients are very sticky, with low churn especially at the medium to larger end.

Will it need to do another placing? No. Shareholders asked BKS to stop coming back for smallish equity raises, so it raised more than it needed last time. Should be cash generative now. Only caveat is if they win a gargantuan deal, then a top-up placing might be possible, but obviously that would be from a position of great strength. So I’m not worried about any further dilution, which hasn’t been excessive in the past anyway. The owner’s eye means the founder doesn’t want to dilute unless it’s absolutely necessary.

Interim Results

Beeks Financial Cloud Group Plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2023.

Everything seems as expected in these H1 numbers.

Revenue £13.0m & annualised monthly recurring revenues £26.6m are both up 25% - excellent organic growth that is compounding nicely (revenue was only £5.6m in its first full year as a listed company, FY 6/2018).

Revenue for FY 6/2024 is forecast at £29.1m (Progressive), rising strongly to £38.5m in FY 6/2025, due to larger deals kicking in. This could still turn out to be conservative, as nothing has been included for a recent large exchange win, until it passes regulatory clearance.

Profitability - pick a number that suits! Many of us don’t like adj EBITDA, but tech investors and takeover bids do use multiples of this metric, so it would be foolhardy to ignore it, in my view. This was £4.6m in H1, up 28%.

Underlying PBT is up 113% to £1.4m in H1 (an H2 weighting is expected due to organic growth)

I regard share option charges as staff remuneration here, as all staff are shareholders (it’s not a perk for Directors at Beeks, very unusually). So I add back that £1.1m charge, getting to just above breakeven really as my interpretation of the real world level of profitability. Hence I’m happiest with the statutory PBT of £158k in H1, loss of £(762)k in H1 LY.

Capitalised development spending is reasonable for the size & type of business, at £1.4m per half year. Staffing levels have been stable, reinforcing that BKS should see more operational gearing from now, as bigger revenue deals kick in, on to a largely fixed overheads base.

Balance sheet - looks fine to me, with £25.4m NTAV.

As mentioned above, management don’t expect to need another placing, and the cashflow statement shows I think the first time it’s generated cash, with debt repayments exceeding the small reduction in gross cash.

This is work in progress anyway, with FY 6/2025 being what the company call a “tipping point” where significant contracts kick in, onto a largely fixed cost base.

Outlook - in line with expectations for FY 6/2024.

Future Growth and Outlook

We see expansion potential across the vast majority of existing customers and we are focused on the continued execution of our land and expand strategy.

Our high proportion of recurring revenue means we are confident in delivering results for FY24 in line with Board expectations and as previously announced, FY25 trading is anticipated to be significantly ahead of prior Board expectations.

Our core focus for the second half remains the conversion of our significant pipeline. We find ourselves with a firm financial footing as a profitable and cash-generative business, and we are well-placed to continue seeking to achieve growth acceleration in the current year and beyond.

Founder CEO comments - this strikes me as more bullish than the more measured tones in the past -

"The consistent growth we continue to demonstrate, combined with our confident outlook for this and next year, underline the size of the opportunity we are addressing. Financial markets are still only at the start of the journey to the cloud. With our proven offering and growing tier 1 customer base, which includes some of the largest financial organisations in the world, as well as our increasing profit margins and cash generation, we have never been better placed to seize the opportunity. Our focus for the second half remains the conversion of our significant pipeline."

Paul’s opinion - I’ve been bullish on this share for a long time, and it’s great to see the company clearly at a positive tipping point.

That said, the market has reflected this, with a big recovery in share price recently. Although it’s still well below the valuation when Beeks was a much smaller company. So it can be viewed either way - people are bound to bank some profits after such a big rise, but I’ve noticed two fund managers mention BKS positively in recent interviews, so maybe instis will be buying up the shares that smaller traders are selling? Who knows, over time this sort of short-term noise is irrelevant.

As a bull on this share (and with a small personal position in it, <1% of my personal portfolio), I’d like to buy some more when cash is available. So I’m hoping that profit-takers might erode some of the recent price gains! On fundamentals though, I think the recent share price recovery is fully justified by excellent newflow, and longer term I see considerable potential for further share price rises, before the company is eventually sold - the stated aim of management.

I think bears on this share are right in that their interpretation of the historical figures does make sense - lack of cashflow, no real profits, etc. However, investors are not buying the past, we’re buying the future - and things seem to me obviously set up for substantial growth in profits and cashflow as larger deals kick in, for investors who are prepared to be patient.

Chart since listing -

Graham's Section

Reach (LON:RCH)

- Share price: 65.7p (+10%)

- Market cap: £209m

A reassuring headline:

FY23 Progress on our digital strategy, long-term uncertainties resolved

As readers will be aware, this stock has struggled under the weight of concerns over an enormous pension deficit, legal liabilities and declining newsprint revenues.

The result is a chart that looks like this:

And valuation metrics that don’t appear to make sense:

I’ve been positive on this one, taking the view that management are running it for cash and for the ultimate benefit of shareholders.

Let’s dive into these full-year results a little.

CEO comment:

"This year we have successfully gained clarity on two significant long-term uncertainties in pension funding and Historical Legal Issues. With the end of these issues in sight, we have significantly reduced our obligations and have a clear path forward for the business.

Pension review

Reach’s various pension schemes are valued every three years; the valuations for December 2022 “are progressing” and should be finished before the March 2024 due date.

Going into footnote number 15 of today’s report, we can see in detail how much cash Reach is currently expecting to plough into its pension schemes every year. Some of these numbers were known already:

MGN scheme. £219m deficit. £46m contributions p.a. until Jan 2028.

Trinity scheme. £57m deficit. £5m contributions p.a. until 2027

MIN scheme. £74m deficit. c. £8m contributions p.a. until 2029.

EN88 scheme. £25m deficit. c. £3m contributions p.a. until 2026.

So total contributions are still expected to be around £60m p.a.

However, we are gradually getting towards the point when the contributions will no longer be necessary. The footnote also says this:

…the funding deficits in all schemes are expected to be removed before or around 2029 by a combination of the contributions and asset returns.

And the total amounts payable by Reach according to the current schedule are:

2024: £60.9m

2025: £60.9m

2026: £61.8m

2027: £59.8m

2028: £12.5m

2029: £8.6m

The final numbers remain unknown, as they depend on asset returns and all of the other variables that go into a defined benefit pension scheme. But if things go according to plan, contributions are expected to shrink dramatically from 2028, with all of the deficits eliminated in 2029.

So there are probably just four more years, including the current year, in which Reach will be run primarily for the benefit of its pension funds.

Legal liabilities - this old problem (arising from the phone hacking scandal) continues to rumble on but the end is in sight here, too:

December's High Court judgement provides a resolution on time limitation for Historical Legal Issues. This means that a significant number of outstanding claims can be resolved, and this should largely bring an end to future claims. The expected cost of settling has reduced by £20.2m

The provision that remains outstanding for this issue is now just £18.2m, which is “the current best estimate of the amount required to resolve this historical matter”.

Coming up with an enterprise value - adding together the current schedule of pension contributions (yes, this ignores the time value of money) and the legal provision I get total liabilities of £283m. Let’s treat this as debt and add it to the market cap (£209m). We could also add on financial net debt at year-end (£10m) and say that the enterprise value for Reach is about £500m. Investors could pretend that this is the market cap of the company.

Operating numbers:

Revenues down 5.4% to £569m

Print revenues down 2% to £439m, digital and other revenues down by 15%-17%.

Print volumes down 17%.

Digital revenues continued to disappoint:

Revenue has been impacted by lower advertising demand during a period of macroeconomic uncertainty alongside a material reduction in page views. Major platforms including Facebook have deprioritised news content over the year which in turn has driven a reduction in referral traffic for publishers across the sector.

Adjusted operating profit is £96.5m, down 9% year-on-year.

Actual operating profit is £46.1m, after a wide range of adjustments.

The adjustments are complicated but I tend to agree that they are substantially one-off items.

For example, they include nearly £27m of restructuring costs as Reach implemented a headcount reduction plan.

They also include a £20m impairment as the user of a print site sub-leased by Reach went into administration.

Outlook

Decline in online traffic will impact Q1 2024, but digital should see “growing momentum” thereafter.

On track for 5-6% reduction in operating costs in 2024.

Jan and Feb 2024 have been “robust”, full year outlook unchanged.

Graham’s view

I remain optimistic that long-suffering Reach shareholders might see a decent outcome here.

It will take a few more years to rectify the pension deficits, but with every month that goes by, shareholders can feel more confident that the end is in sight.

I also note that the print business is still the largest source of revenues by far, and its financials aren’t shrinking as quickly as you might think that they are, thanks to cover price increases. But I must admit that the 17% decline in volumes is striking - are printed newspapers headed for extinction, or is there a floor we might reach soon?

I’ll continue to give this share the thumbs up. As I said last year, it’s likely to be a low-quality punt. But the value on offer is tempting, with just under £100m of adjusted operating profit in 2023 vs. an enterprise value (including pension liabilities) of £500m.

Somero Enterprises (LON:SOM)

Share price: 382p (-5%)

Market cap: £182m

Lots of negative numbers in these full-year results, but the headline is positive:

A healthy North American market and significant contributions from Europe and Australia drive strong finish to 2023

The “exceptional” 2022 performance makes for difficult year-on-year comparisons. The results are in line with expectations:

Revenues down 10% to $120.7m

PBT down 19% to $33.2m

Cash flow from operations down 12% to $24.4m

$20m was paid out in dividends during 2023, along with a small buyback, so that there is almost no net change to Somero’s year-end net cash, which finished the year at $33m.

(Note that Somero’s share buybacks are designed merely to offset dilution from employee bonus schemes, not to reduce the share count.)

Strategic highlights - “investment in international markets yielding positive results” - Somero is building out in Europe and Australia.

New Year highlights - expecting more of the same in 2024.

Non-residential construction remains healthy with customers reporting high activity levels and extended project backlogs, and expect market conditions to remain consistent in 2024

Three new products launching in 2024, including the first step toward electrification with the launch of the S-940e in January

Broker Cavendish has made no changes to forecasts, which they describe as “pitched conservatively”. The estimates for 2024 include unchanged revenue ($120.7m) and another mild fall in profitability, with adjusted PBT falling to $31.6m.

The outlook statement confirms the above, explaining that profits are falling due to “modest incremental investment including the new Belgium service and training center and the annualised impact of strategic resources added in 2023…”

CEO comment snippets:

…we have been working hard to lay the foundations for accelerated growth overseas and so it is gratifying to see our efforts beginning to pay off. While trading in the US was subdued by factors outside of our control, the underlying market remains active and healthy.

2023 was one of our busiest and most productive years in terms of product development…

Looking ahead, the outlook is positive, with customers continuing to report high levels of activity and healthy backlogs. While the timing and extent of a return to more normal trading conditions in the US remains challenging to predict, our confidence in the long-term prospects for our home market remains resolute.

Graham’s view

Paul and I both have a generally positive impression of this company. It has been run with a very solid balance sheet despite paying out a very nice dividend stream to shareholders over the years.

Quality metrics have been excellent, hinting at a strong competitive position that enables unusually strong margins:

However, personally I have been neutral on this stock since last year.

Of course, the cyclical nature of the construction industry has been a concern and 2023 was one of those years when the company took a few steps backwards, due to macroeconomic forces.

But I have also started to worry more about Somero’s competitive position. Please bear in mind that I am not an expert in this area - I am simply someone who has at various times over the years searched for alternatives to Somero’s products online.

Several years ago, I would struggle to find much online evidence of competition.

Nowadays, things are different. The websites for European competitors remain unimpressive (although better than they were several years ago), but the US has Ligchine which seems to be a direct competitor and is also able to export around the world. In 2020, Somero unsuccessfully claimed that Ligchine had infringed its intellectual property.

With some niggling doubts about competition, I’m therefore sticking with my neutral stance on Somero. I am sure that macro forces are also very important, but maybe competition is also restricting the company’s financial performance?

I could very well be overthinking this. With a StockRank of 98 and a nice cheap valuation, Somero could still offer great value here:

Paul adds: I've had a quick look, and my view is a bit more bullish than Graham's a rare occasion when we would colour code it differently. I understand Graham's excellent point about competition - very high margins and other quality scores do tend to attract competition in lots of sectors. However, for me the numbers & valuation are too attractive to be anything other than green. Especially as 2024 forecasts look conservative, and we could see upgrades. There you go, 2 opinions for the price of 1, what more could you ask for?!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.