Good morning from Paul & Graham!

Today's report is now finished. As it's a big report today, to jump to any company section, just press CTRL+F and the ticker.

The Week Ahead - editorial & reader comments on larger caps, is up here - click here to read it.

Mello Monday is tonight at 17:00 - highlights include fund manager Chris Boxall, whose insights are always fascinating and enjoyable. Chris is a walking encyclopedia on small to mid caps, and isn't known for holding back his opinions on the things that matter! Highly recommended. I'm also looking forward to hearing from Galliford Try Holdings (LON:GFRD) which I wanted to cover last week, but it slipped through the net, so this might save me a job. GFRD's StockReport shows forecast earnings in an uptrend, and a 5.4% dividend yield, so a nice once for value investors.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

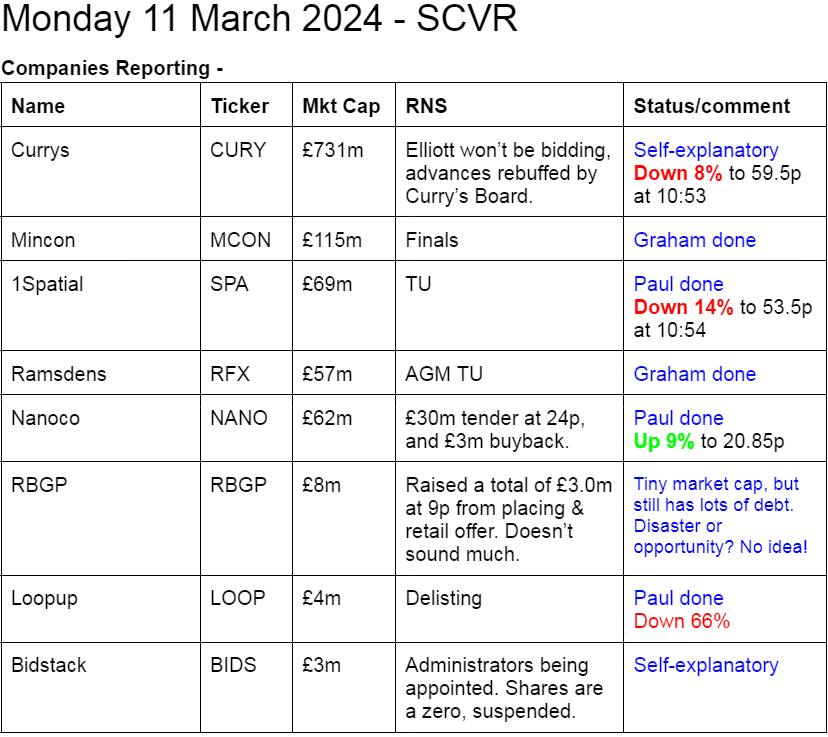

Companies Reporting

Our list should be up here just before 8am, then updated throughout the morning - please remember we can't usually cover everything! -

Other mid-morning movers (with news) -

MTI Wireless Edge (LON:MWE) - up 12% to 41p (£36m) on 2023 Results, and a (fairly small) extension of the share buybacks.

Additional info since posting the above:

FY 12/2023: Revs $45.6m, down 1.5% (up 2% CC). PBT up 12% to $4.8m. Net cash flat at $8.1m. Share buyback up from $200k to $700k, nearly 2% of the market cap. Strikingly high forecast dividend yield of 7.7%. Outlook: 2024 started well (in line). Increased pipelines in all 3 divisions. 2024: “another year of growth and increased returns for our shareholders”. Says benefiting from higher defence spending by clients. Paul’s view - a strange little group, but it’s been listed a long time, and has a good track record of paying generous divis, with a modest PER and sound balance sheet. Might be worth a closer look, if you’re prepared to invest in a micro cap based overseas. 2 dominant shareholders own 41% combined. Not sure why it’s listed anywhere, let alone in London?

Touchstar (LON:TST) - up 6% to 100p (£8m) on FY 12/2023 Trading Update - revs & profits “broadly in line”. But EPS will benefit from lower tax charge and lower share count from buybacks. “Confident” outlook for 2024, saying revenue & profits should go up. £3m net cash. Quite an interesting little company, I’ve followed it for years, but seems to be struggling to scale up significantly. Is it worth the listing costs? Could probably double profits if it went private.

Hercules Site Services (LON:HERC) - Up 9% to 32.5p on AGM Statement released at 09:22 - daft, as they should be pre-announced at 07:00, so everyone can react before the market opens at 08:00, instead of having to rush to interpret it whilst the shares are in live trading.

Vanquis Banking (LON:VANQ) - down 36% to 80p (£204m) - BLACK (2024 profit warning) - used to be called Provident Financial, it’s a sub-prime lender. In the FTSE 100 previously - today hitting a 34-year low! Graham reviewed it in Jan 2023 here. Disastrous share price performance. Trading update today is taken as a profit warning. FY 12/2023 results expected to be £25m adj PBT, same as 1/2/2024 TU. But FY 12/2024 now expecting profit “materially lower than market consensus expectations” (of £75m adj PBT). NOT involved in FCA review of motor finance commissions. But has received “significant levels of 3rd party complaint submissions”, so seems to be in the crosshairs for ambulance-chasing lawyers maybe? “Vast majority” of complaints rejected, but costs of dealing with them “likely to materially impact the Group’s profitability in 2024”. It’s now saying substantially below -

“Allowing for the factors described above, the Group expects to deliver adjusted PBT for 2024 which will be substantially lower than market consensus, resulting in a low single digit adjusted ROTE. “

Divis - 1p for 2023, and 1p planned for 2024. So that’s the 7% yield out the window.

Paul’s view - looks a mess, for special situation investors only I’d say.

Nanoco (LON:NANO) - up 8% to 20.7p (£67m) - Proposed Shareholder Return - Paul - AMBER

This is such an usual situation - a tiny tech company that ended up in litigation with Samsung, and won! This had been rumbling on for years, and you can see from the chart that this share became a gambling chip in 2022 on the amount of the award to NANO, which ended up disappointing.

NANO has now received £58.8m after costs. It’s returning £30m to shareholders in a tender offer at 24p, for up to 38.5% of the issued shares. Individual shareholders can opt to tender none, some, or all of their shares. I’d guess that uptake is likely to be very strong, particularly from institutions, as a liquidity event. There’s also going to be a £3m buyback.

It expects to have £23m net cash after the tender offer to “support” the remaining business, which sounds like more cash burn to me, this company's speciality!

There are 324.4m shares in issue, so if the full 38.5% are tendered (likely, in my opinion), then that will reduce to 199.5m shares outstanding. The buyback might retire another 14.4m shares (£3m at 20.8p current share price), giving a final reduced share count of c.185m. That implies a future, reduced market cap of c.£38m (at current 20.8p/share), for a group with net cash of £23m. That looks potentially interesting, but it depends how fast, and on what, the cash pile is going to be spent on?

Winning a large legal case against Samsung seems to be telling us this technology has value.

Could this be a cheap entry point into proven tech? Or, is this going to be another false dawn from a serial jam tomorrow cash burner? I have no idea, you decide! Could be a fun punt maybe, but needs a lot more careful research.

Loopup (LON:LOOP) - down 68% to 0.65p (£1.3m) - Trading Update & Delisting - Paul - GREY (delisting)

Not a surprise to SCVR readers, as we’ve been warning about the need to raise more cash for over 2 years, with increasing stridency - eg SCVRs -

- 15/2/2022 - needs another fundraising.

- 29/9/2022 - 5p placing done, not enough, needs more cash. Very high risk.

- 14/12/2022 - Uninvestable, could easily be a wipeout.

- 14/9/2023 - another fundraise (or delisting) practically certain, so best avoided. RED.

Today’s update is quite interesting, these are always worth reading when a company de-lists. It says being listed is not helpful for raising more money (hardly surprising, as they’ve repeatedly tapped investors for cash, and squandered it on a considerable scale, so we can all see how lousy the company & its management have been!)

Stripping out the substantial costs of a listing, and raising money privately, makes complete sense to me.

Trading - there’s good revenue growth in % terms, but the core business is admitted to still be at an early stage, £2.8m revenues in 2023 (and hefty losses).

Bank of Ireland are owed £6.0m (it wants half back funded from the proposed £9m equity fundraise), due Sept 2024, discussions being held to extend facilities include a requirement to delist and raise fresh funds after delisting. That’s an interesting point, that banks may encourage problem companies to delist.

LOOP intends to raise £9m privately, so dilution coming for existing shareholders, although interestingly it says fresh equity will be raised at 1.75p per share, “irrespective of any share price movement in the interim” (shares are currently 0.65p in the market). However, scrap that, as there’s a sting in the tail! -

… although the Directors may adjust this price depending on the investment offers which are presented to the Group as part of the proposed fundraising. There is no guarantee that the proposed fundraising will be concluded on the terms indicated, or at all.

It says raising £9m would not be possible on AIM. Too right! 4 private investors have indicated a total of £6.2m funding, again subject to delisting and refinancing the bank debt. So it looks as if LOOP could survive as a private company. Further funding would then be sought from private equity or venture capital - good, that’s the correct way to fund early stage, cash burning companies, not flogging shares to gullible punters on AIM.

Delisting requires a 75% shareholder vote, which should be a formality since a no vote would mean insolvency I imagine.

Anyway, that's almost certainly the end of LoopUp as a listed company.

Summaries of main sections

Ramsdens Holdings (LON:RFX) - up 7% to 192.5p (£59m) - AGM Trading Update - Graham - GREEN

We have an “in line” update from Ramsdens. There’s a standout performance from gold purchasing (gross profits up 20% YoY) and forex is doing well in advance of the key summer period. I remain a fan of RFX which appears unduly cheap at a current PER of about 8x.

Mincon (LON:MCON) - down 2% to 53p (£103m) - Final Results - Graham - AMBER

This Irish engineering group reports decent EBITDA (€21m) vs lowered expectations. I continue to like many aspects of Mincon but can’t take a positive stance until outstanding problems are resolved: the “Greenhammer” project, net debt and weak industry demand.

1Spatial (LON:SPA) - down 11% to 55p (£61m) - Trading Update - Paul - AMBER/GREEN

Bit of a muddled update today, which the market doesn't like. I run through the detail below, and am (just about!) keeping a moderately positive view, as I think this is an interesting company, in a potentially lucrative space. Even though the numbers don't particularly impress at this stage.

Paul’s Section:

Firstly, some shorter sections that I did over the weekend for backlog items -

Headlam (LON:HEAD)

193p (£156m) - FY 12/2023 Results - Paul - AMBER

(carpet & other floorcoverings distributor, UK market leader)

Quick review - 2023 results were poor. Revs down 1% to £657m, but underlying PBT down 70% to £11.0m (statutory PBT £7.1m, so adjs aren't huge). U/L EPS 11.0p (2022: 35.5p). Divi 10p (2022: 17.4p) - divis look unaffordable to me, given poor cashflow & quite heavy capex, resulting in a big rise in net debt. Bal Sht overall is good though, due to big freehold property, £200m NTAV is well above mkt cap of £151m.

Weak demand in 2024 so far. Expect medium term recovery. OK going concern statement.

Paul's view - disappointing. I'm wondering again whether poor performance is all cyclical, or might be hurt by increased competition from LIKE? Very difficult to value this share now, as no idea what normalised cyclical earnings will be? PBT margin is now under 2%. It says volumes are 20% below normal, so if that recovers, profits could shoot up. But will it recover, and if so, when? Note that staff costs were 14.2% of revenues in FY 12/2022 Annual Report, but 43% of gross profit. So it's being hit hard by higher employee costs in 2023, combined with soft demand. It employed 2,197 staff in 2022, costing avg £36.5k salary (excl employers NICs, etc).

Likewise (LON:LIKE)

18.8p (£46m) - Trading Update - Paul - AMBER

(Smaller, challenger flooring distributor, run by ex-CEO of HEAD - who has just sold c. £450k of shares the day before a TU - how is that allowed? Although the TU was OK). Confident of meeting 2024 market exps. Similar low profit margin to HEAD, but at least it's growing.

Overall, at this stage, I'm not convinced either HEAD or LIKE shares are attractive. It depends how an economic recovery might play out. An improving housing market should trigger improved demand for residential carpets, so who knows?

Stelrad (LON:SRAD)

112p (£142m) - Results FY 12/2023 - Paul - GREEN

Stelrad Group plc ("Stelrad" or "the Group" or "the Company", LSE: SRAD), a leading specialist manufacturer and distributor of steel panel and other designer radiators in the UK, Europe and Turkey, today announces its audited financial results for the year ended 31 December 2023.

A very quick skim of the results has left me with a positive impression. I think the building supplies sector is a good place to find cheap, cyclical recovery shares, and this one looks worth considering for that basket of shares.

Key numbers for FY 12/2023 -

Revenue down 3% to £308m

Adj PBT down 29% to £17.3m - a tough year, but not a disaster.

Adj EPS down 29% to 13.6p = PER 8.2x - could we be at or near low point of the cycle earnings maybe? So a low PER, on low point earnings, might turn out to be a good entry point, I’m wondering.

Value metrics look great - forward PER 7.4x, and forecast yield 7.0%.

Net debt initially looks too high at £60.4m (excl leases), albeit down 12% vs LY. As with all companies, we need to know the average daily net debt number.

Net debt is 1.47x EBITDA, which is arguably not alarming, depending on your view.

NTAV is OK at £50m, and this includes £31m freehold property, which is about half net debt, which I tend to offset against net debt, so overall I think the bal sht/debt position is probably OK.

Cashflow statement - impressive. Even in a subdued year, it managed to pay generous divis, fund capex, and reduce debt.

Outlook is in line, no change.

No broker research available - a basic mistake from the company, surely? Why would a small cap have Investec as their broker?

Biggest shareholder has 49.6% (had 80% pre-IPO, banked £70m from partial sale at IPO).

Floated Nov 2021 by Investec, now almost half the IPO price of 215p, at 112p.

Paul’s opinion - looks a nice cyclical recovery value share. Readers have previously told us that heat pumps require larger radiators, so we could be entering a period of growth for SRAD possibly?

ITV (LON:ITV)

70.5p (£2.86bn) - FY 12/2023 Results - Paul - AMBER/GREEN

Large & complicated business, so I’ve only done a quick review of the numbers. Caught my eye when it announced £235m net proceeds from selling JV to BBC, and intends to spend the whole lot on share buybacks. This is on top of an already generous 6.8% forecast dividend yield. This is possible thanks to very impressive free cashflow, at £361m in 2023, which rose vs 2022 despite a fall in adj PBT (down 41% to 396m). Adj EPS down 41% to 7.8p in 2023. Mentions tough advertising market (but that could recover maybe?) High growth in streaming (so why did it sell Britbox?). Pension deficit has been cash-hungry, but it expects contributions to fall in 2024. Growth in advertising as economy rebounds? Many new Chinese electric car brands are about to land, I noticed one was sponsoring TV awards show last weekend on ITV.

Paul’s opinion - I’ve not done much research, but on an initial skim, this looks potentially interesting I think. Obviously you have to weigh up whether its core business is in slow structural decline, or could rebound? Worth a closer look I think, hence AMBER/GREEN.

Elementis (LON:ELM)

136p (£801m) - FY 12/2023 Results - Paul - AMBER

FY 12/2023 - adj EPS flat at 10.8c (8.4p) = PER 16.2x (forecast PER for 2024 is 14.0x)

Big reduction in debt from disposal, now down to 1.4x which looks manageable.

Divis being resumed. Outlook - good start to 2024. Macro uncertain. Self-help & growth programmes underway.

Paul’s opinion - looks like a moderate turnaround is underway, so there might be some upside, possibly? But for now, it looks priced about right to me, just on a very quick review.

Robert Walters (LON:RWA)

418p (£302m) - FY 12/2023 Results - Paul - AMBER

RWA describes its performance as “resilient”, which is not how I see a 63% drop in PBT to £20.8m (2022: £55.6m).

Forecasts have been stuck in a painful downtrend still -

Dividends - held at 23.5p total for the year (unch 2022) - healthy 5.6% yield.

That’s not quite covered by earnings, which were 20.1p in 2023.

Outlook - 2024 so far “remained muted”. Says it will “significantly strengthen our business”, details to come in the autumn (!) at a CMD.

This is interesting -

“Our collective experience trading through previous market cycles tells us that when conditions do improve, the inflection can be rapid, and we therefore have strong conviction in our decision to maintain our core consultant capacity, whilst sensibly managing our cost base.”

Balance sheet is healthy and ungeared. NTAV is £131m. Cash pile of £96m still healthy, but reducing, thanks to generous divis and £10m pa buybacks.

Paul’s opinion - poor results, no doubt about that. However, it’s a cyclical business, so sooner or later I imagine earnings should improve.

It’s well-financed, so could comfortably withstand another year or two of poor trading, if that were to happen.

Sooner or later, it should see a cyclical recovery, so I think for patient investors, EPS could get back to the 40-50p historical level (not much change in shares in issue in recent years), put that on a PER of say 12-15, and I would have a target price of 480-750p once economic conditions have improved. Is that enough upside on the current price of 418p though? I can’t say it massively excites me, as it might be a say 2 year wait to get there. Plus of course there’s always the chance conditions may not improve, and shares could lurch down again, nobody knows.

For me then, and for the moment, it’s just AMBER. Although I suspect we could be at or near the low point for earnings, so I probably should be more forward-looking and see the upside recovery potential.

1Spatial (LON:SPA)

Down 11% to 55p (£61m) - Trading Update - Paul - AMBER/GREEN

1Spatial, a global leader in Location Master Data Management ("LMDM") software and solutions, is pleased to provide an update on trading for the financial year ended 31 January 2024 ("FY2024").

The initial market reaction is negative, shares down 11% with someone hitting the bid repeatedly with 10k sales. Only 170k shares printed so far, and there could be bigger orders working in the background, so I tend not to take too much notice of the initial market reaction, which can sometimes be wrong.

Revenue growth looks modest - although is exactly in line with the broker consensus of £32.1m shown on the StockReport -

Total revenue for the year is expected to be no less than £32.1m (FY2023: £30.0m) with approximately 55% (FY2023: 50%) represented by recurring revenue. Within recurring revenues, software term licence revenue has increased by approximately 70% to £8.7m (FY23: £5.2m) with double digit growth across the UK, US and Australia.

Profitability - I was about to start a rant about EBITDA not being real profit, but it also mentions PBT below, but that sounds as if it has some one-off costs in it. Why not also mention adj PBT (which is my preferred measure, providing the adjs are reasonable)? Strange reporting here -

Despite the impact of inflationary cost increases, adjusted EBITDA is expected to be no less than £5.5m (FY2023: £5.0m) and reported profit before tax not less than £1.0m (FY2023: £1.0m), reflecting increased finance costs due to the high interest rate environment and certain exceptional charges relating to the restructuring.

Cash position - is down, and sounds tight, maybe that’s why someone is selling this morning - fears of a placing perhaps?

The Group's net cash was £1.1m at 31 January 2024 (£3.1m at 31 January 2023), reflecting the increased investment into the business, targeted restructuring activities and timing of certain working capital flows, which have reversed since year end.

Why didn’t they quantify the working capital flows, and give us the current cash position?

Maybe I should set up a consultancy business, to teach companies how to update the market properly? It feels like that’s what we’re doing here sometimes - picking up on their mistakes.

Outlook - this bit sounds good, but no numbers -

We ended the year with significant momentum, successfully closing a number of high value, multi-year contracts across all territories. These agreements provide a strong foundation for the sustained growth of our Enterprise operations in FY25…

With a healthy sales pipeline, strong order book and increased recurring revenues, the Board is confident that the progress made over the past year is set to continue.

Says it’s going to spend more on sales & marketing for new products.

Broker update - Equity Developments clear the fog a little with a brief update note today, which says that the £1.0m PBT is below its estimate of £1.8m. Not sure if I should mark this as a profit warning or not? I suppose it is a mild profit warning, so yes I'll flag it as BLACK.

Paul’s opinion - I was amber/green when I briefly reviewed SPA on 11/1/2024, but I think today’s update has dampened my thoughts on it. Also I’ve quickly reviewed the last H1 results, and see a fairly weak balance sheet. There’s only modest revenue growth in 2023, and no progress on profitability. Although often it’s better for smaller software companies to invest heavily in product development where they have the opportunity.

It’s a close call whether to drop down to just amber, but on balance I’ll stick with AMBER/GREEN on fundamentals despite this muddled update. The reason being that I like this space, and think there could be a long-term opportunity with this share perhaps?

Note that similar IQGeo (LON:IQG) has a very much bigger market cap, despite being not much larger in terms of revenues.

Graham’s Section:

Ramsdens Holdings (LON:RFX)

Share price: 192.5p (+7%)

Market cap: £59m

This “diversified financial services provider” issues an AGM update for the first five months of the financial year: from October to February inclusive.

Trading is “strong and in line with the Board’s expectations”.

Bullet points for the four major Ramsdens services:

Foreign currency gross profit up c. 3% year-on-year.

Pawnbroking loan book up £0.4m in five months to £10.7m

Jewellery retail revenue “broadly flat” (slightly lower?) but with an improved mix (fewer premium watches), so jewellery gross profit is up c. 5% year-on-year.

Precious metals purchasing gross profits up c. 20% year-on-year.

The steady expansion of the store estate continues, with five new stores over the five months. Total estate now 167 stores.

Funding: £10m RCF with Virgin Money replaced by £15m RCF with Bank of Scotland, “on more attractive terms”.

Outlook: the Board is “highly confident in the Group’s continued growth prospects and its expectations for the current year”.

Estimates: Liberum estimates are for PBT of £10.5m this year (FY Sep 2024) rising to £10.9m next year. Some divisions are performing better than expected, and others worse, but the net result for headline numbers is no change.

Graham’s view

There’s no need to change my view on this one, as expressed in January. I said at the time that the company offered “net cash, a good yield, store expansion, and a proven business model at a cheap P/E multiple”. The share price is actually a little cheaper now than it was when I looked at it in January (192.5p today vs 205p then)

P/E and yield metrics as of last night:

It’s important to bear in mind the factors at play here vs. something like H & T (LON:HAT). With Ramsdens, each of the four divisions makes an important contribution to gross profits. However, the biggest contributor is foreign currency (tied to tourist demand) and the second biggest is jewellery retailing.

In that sense, I would say that Ramsdens is the more optimistic investment: you are betting mostly on demand from tourists and jewellery buyers, rather than betting on demand from borrowers.

It’s also an optimistic investment in the sense that the company is making a gradual but large increase to its store portfolio, spreading out geographically.

But this morning’s rising share - in response to a merely “in line” trading update - suggests that investor expectations have been more on the pessimistic end of the spectrum.

Mincon (LON:MCON)

Share price: 53p (-2%)

Market cap: £103m / €121m

Mincon Group plc… the Irish engineering group specialising in the design, manufacture, sale and servicing of rock drilling tools and associated products, announces its results for the year ended 31 December 2023.

The table of financial highlights shows a tough year in 2023:

Please note we covered the full-year trading update last month which confirmed that full-year EBITDA would be “slightly ahead” of €20 million.

This followed a profit warning in October (the second and larger fall in the chart below).

Estimates have been moving in one direction only:

Turning back to today’s report, here are some of the key points.

Revenue contraction driven by disruption in the mining industry (mining-related revenues down 16%)

Other revenues similar to last year (water well/geothermal revenues up 3%, construction revenues down 2%)

Net debt reduces from €55m to 45m, using one of Mincon’s definitions of net debt that includes all liabilities.

A more generous interpretation of net debt would only include loans and borrowings. Calculating this myself, what I would call “financial net debt” has reduced from c. €26m to c. €20m. That being less than one year’s EBITDA, the company should be able to handle this much debt without too much difficulty.

And it’s worth mentioning that the company expensed €4m of R&D in 2023, and expects this to decrease in 2024.

Also, the company commissioned €10.5m of new capital equipment in 2023, but “this reflects a peak of investment in the near term, with capital equipment expected to be less than depreciation levels in 2024”.

These two factors both suggest that the cash flow performance in 2024 should be better than 2023, although of course many other variables will be at play.

The dividend at Mincon has been unchanged for many years and remains unchanged this year. 2.1 cents per share, paid out in two equal instalments. It creates a modest yield at this valuation:

CEO comment

2023 has been a challenging year for Mincon in terms of revenue, profitability and ROCE. Revenue in H2 2023 was lower than expected due to a number of factors, notably a slower than expected recovery in mining revenues as customers ran down their inventories and the continuation of more muted conditions in exploration drilling, while we also experienced delays to anticipated commencements on some construction projects during the period.

Geographically, the main weaknesses were APAC (down 15%) and Africa (down 22%).

Greenhammer

This eagerly anticipated new product ran into problems in Australia last year. Maybe 2024 will be the year it finally succeeds? Here’s the update:

During the year, we continued our collaboration on the Greenhammer project with a major rig manufacturer and this is ready to start drilling on a copper mine in Arizona. We are confident that this approach will realise the potential that this product offers. Following this strategic decision, we elected to discontinue the previous testing on our own rig in Australia during the year.

Recent trading / outlook is positive although the company is clearly still challenged by current conditions:

…The subdued market environment in H2 of 2023 has continued into H1 2024 although we have begun to see some improvement in our order book. We are working hard to improve our competitiveness and input costs which together with potential improvement in the market environment gives us more confidence around performance in the second half of this year. We must also continue our work on delivering on the promise of our development projects. We also need to complete our root and branch review to put a stable base under the business to both deal with the challenges and realise the significant opportunities ahead.

Graham’s view

I’ve been neutral on this stock as it fights its way through various challenges.

Last October, I highlighted the five major challenges facing Mincon (supply chain, freight, Greenhammer, mining industry conditions, and net debt).

Let’s review progress again:

Supply chain: resolved.

Freight: resolved.

Greenhammer: still not resolved. Hoping for better progress this year.

Mining industry demand: not resolved as the market remains subdued. Some possible signs of green shoots but it’s too early to say for sure.

Net debt: while the current debt load looks manageable, I believe that the company could still earn decent ROE/ROCE without having a substantial net debt position (it did this before). Therefore I would like to see net debt reduce further, which I think is a goal that the company shares. Partially resolved.

In conclusion, I think I need to remain neutral on this one. I still think it’s a better-than-average company and worth researching, but maybe it’s fully valued at this level? StockRanks are all grey:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.