Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

CVS (LON:CVSG) - down 19% to 1178p (£875m) - CMA Report & Response - Paul - AMBER

I’m pleased to see the CMA has issued a report titled “CMA identifies multiple concerns in vets market”, and provisionally says it should launch a formal market investigation. Concerns are: inadequate info, weak competition due to sector consolidation, large corporates acting in ways that weaken competition, overcharging for medicines, outdated regulatory framework.

The CMA says it has powers to “intervene directly in markets” if action is required, which includes requiring disclosure of more info, max fees on prescriptions, and ordering disposal of assets/businesses. That last point could be a threat to market leaders, CVS and MediVet. The CMA does have teeth, eg this case where I recall it forced JD Sports to reverse the acquisition of FootAsylum.

Paul’s view - CVS says it has proposed a package of “possible remedies” (no details), which to me implies that it admits there are failings in the vets market, and probably wants to limit the damage! So people buying/holding CVSG shares now are effectively guessing that any actions from the CMA won’t impact its profits or expansion much. The valuation has been hit hard in 2 sharp falls, with the fwd PER now being c.12x. Note CVSG has almost nothing in NTAVs, so there’s no balance sheet support. All up in the air now, so I cannot value this share, but given it’s already almost halved in price this year, I can’t really flag it as red, so I’ll go with AMBER - it's up to you to decide if the risk is now in the price?

Pets at Home (LON:PETS) - down 7% to 257p (£1.22bn) - no announcements yet from the company, but shares continue the downtrend, no doubt impacted by the CMA announcement mentioned above. It’s a different business model from CVSG though, with vets being only a part of PETS operations, although it would be interesting to know what proportion of its profits (as opposed to revenues) comes from its vets operations? Do leave a comment if you have that information to hand. PETS shares look quite attractively valued (fwd PER c.12x, and a generous c.5% divi yield). So there might be value to be had here, once the outlook becomes clearer on any potential damage from the CMA.

Renalytix (LON:RENX) - down 30% to 28p (£28m) - Discounted placing - Paul - RED

Announces a £7.8m heavily discounted placing at 20p, which will enlarge the share count from 100m to 139m shares. It’s nowhere near enough for this prodigious cash burner, and will only keep the lights on “into Q4 2024”, as opposed to running out of existing cash next month. This is a disaster, but SCVR readers hopefully won’t have been sucked into this share with the recent rampy announcements which caused a spike up in share price, because we vigorously rang the alarm bells here 3 times recently saying it was bust without a fundraise (which was blindingly obvious, to be fair), here on 15/2/2024 RED, 29/2/2024 RED, and 4/3/2024 RED.

It’s certainly not out of the woods, and another fundraising is likely to be in the pipeline before the ink has dried on this one. Bizarrely, it’s listed on AIM and NASDAQ - how much does that cost?!

The company is clearly in a very weak negotiating position with anyone prepared to advance it more cash being able to name their price. So it’s now just a gamble on survival, and/or that someone might take a shine to the technology and bid for the company. Personally risk:reward looks terrible to me, and it’s looking a lot like yet another failing cash burning blue sky project that proliferate on AIM unfortunately. It will be interesting to see if Christopher Mills (10% existing holder) took up any of the placing shares. Yet another example of why it's best to avoid blue sky companies that are running out of cash. As small shareholders we have a massive advantage - we can sell at any time. Whereas the institutions are high & dry with large illiquid holdings, and almost have to keep putting in more cash. So they can't afford to get it wrong, whereas we can salvage some money from our errors, if we're disciplined enough to sell. Mr Market provided two lovely speculative spikes for people to sell into recently too. It just doesn't pay to buy into story stocks, they hardly ever work out well.

TP Icap (LON:TCAP) - up 13% to 224p (£1.73bn) - positive market reaction to FY 12/2023 Results which it says is the highest ever EBIT achieved. PER is only 7.7x 29.2p adj basic EPS.

Says its Parameta Solutions business is “highly valuable” and not reflected in the group share price. Looking at exploring options, including IPO of a minority stake in it. Announces another £30m share buyback today. Total divis for 2023 up 19% to 14.8p, yielding an attractive 6.6%. Stronger sterling vs dollar is a headwind.

Outlook - comfortable with current market exps for 2024, and Jan-Feb were “good”. Impressive cash generation, funding generous shareholder returns. Bal sht is OK, c.£350m NTAV. Has lots of debt (bonds), but exceeded by its cash pile.

Paul’s view - I’m not familiar with TCAP, but a brief review of these numbers has really caught my interest. This is definitely worth a closer look - any readers looked at it in more detail? Why is it so apparently cheap?! I wonder if there might be any regulatory worries?

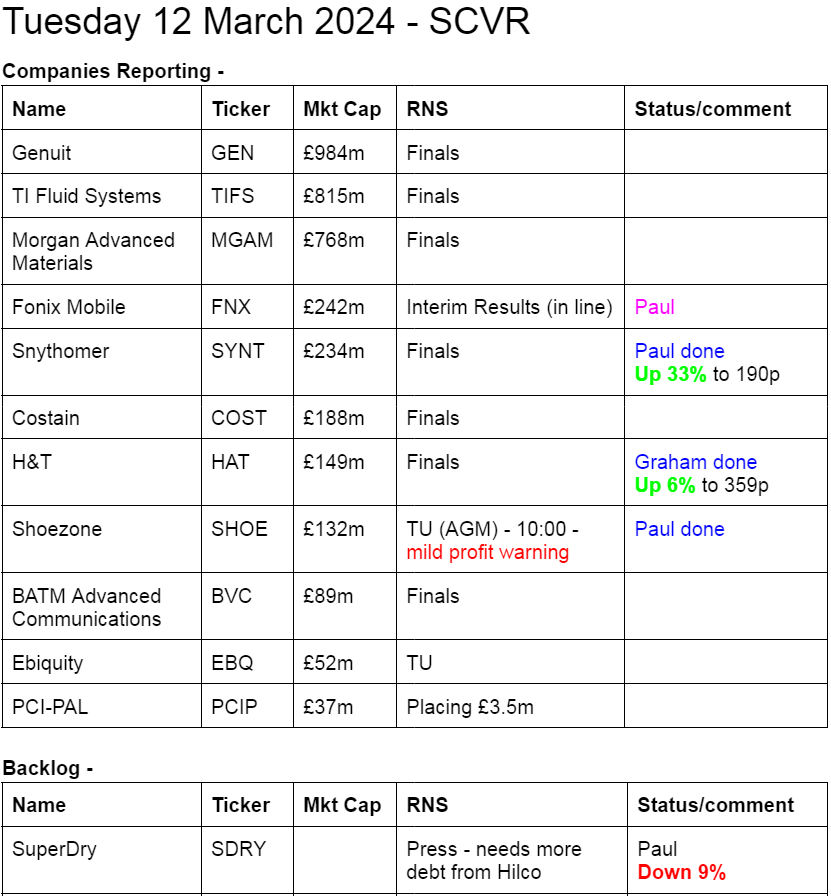

Summaries of main sections

H & T (LON:HAT) - up 5% to 357p (£157m) - Preliminary Results - Graham - GREEN

Excellent numbers here as demand for pawnbroking continues to soar. H&T continues to expand gradually into these booming conditions. Retailing is softer; the company has had to carefully manage its exposure to watches. At about 6x earnings I like this very much.

Shoe Zone (LON:SHOE) - down 8% to 260p (£121m) - AGM Statement - Paul - BLACK (minor profit warning) - GREEN on fundamentals

A minor profit warning "marginally below expectations" so far in FY 9/2024. Looks like recent flaky buyers on a couple of press tips are possibly being stopped out! We need an update from Zeus to quantify the shortfall. If it really is only a slight miss, then I'm happy to keep my positive view.

Synthomer (LON:SYNT) - up 30% to 186p (£298m) - Final Results - Paul - AMBER/RED

A big % riser today, but I'm far from convinced as to the attractions of this potential turnaround. Debt has halved, but is still massive, so no divis for now. Outlook seems quite lacklustre. Maybe brokers have increased forecasts, but that hasn't filtered down to pond life like us yet!

Paul’s Section:

Shoe Zone (LON:SHOE)

Down 8% to 260p (£121m) - AGM Statement - Paul - BLACK (minor profit warning) - GREEN on fundamentals

Annoyingly SHOE is one of a minority of companies who release their AGM trading updates when the market is open, so this came out at 10:00. It should be done at 07:00 so that everyone has time to digest it before the market opens. Note that it didn’t issue AGM trading updates in either 2023 or 2022, so it looks like this was released today due to trading being “marginally below expectations”.

Reasons given are (I’ve reformatted it to make a list) -

At this stage of our financial year, trading is marginally below expectations, due to -

a higher than expected increase in the National Living Wage,

an increase in container costs due to the ongoing situation in the Suez Canal,

higher costs associated with upgrading our property portfolio and

the impact of a slower than expected end to our Autumn/Winter season."

I’m surprised at NLW said to be higher than expected, because the increase was announced some time ago, so should have been budgeted for.

Paul’s opinion - a bit of a disappointment, but it doesn’t sound like a disaster. The share price has given up the recent spike, in the few minutes after the 10:00 announcement (I’m writing this at 10:17 with the mid-price currently 250p). I imagine the recent buyers were probably small traders, as it rose due to being tipped in the Times and a small caps tipsheet. Those type of buyers usually don’t stick around for long anyway.

We’ll have to wait and see what Zeus says, they usually helpfully update things after news.

At 250p I remain positive on this share, as the price has already adjusted for a slight disappointment. So I’ll stick with GREEN.

Newspaper tips spike eliminated today -

Synthomer (LON:SYNT)

Up 30% to 186p (£298m) - Final Results - Paul - AMBER/RED

I’m late to the party here, with a 30% rise today (at 10:48) in this chemicals group’s shares. Although after today’s surge, SYNT shares are still over 80% down in the last 12 months, and over 95% down on the 2021 peak. It got into serious problems with wildly excessivde debt (which we warned about here on 13/12/2022).

More recently, I reviewed poor H1 results on 7/9/2023, along with a large (£276m), discounted equity fundraise (rights issue) that still left it with excessive debt. There was a 20:1 share consolidation, as the share price had fallen into mickey mouse territory.

Has it turned the corner now I wonder?

FY 12/2023 Results -

A challenging year, but decisive actions taken for longer-term growth

Revenue down 16% to £1,971m

Underlying PBT is a loss of £(27.2)m vs a profit of £123.7m in (restated) 2022;

Statutory PBT is a loss of £(106.8)m! So large adjustments (mostly goodwill amortisation) don’t even get it into an underlying profit.

So far, this looks grim.

Balance sheet - net debt has fallen 51%, but is still large at £500m, well above the £298m market cap. Lenders have relaxed the covenants. Note that an EU fine of £38.5m was paid just after the year end, which will have worsened the net debt position.

Pension - a hefty £19m needs to be paid in 2024 into its UK scheme, although this involves some catchup amounts.

NAV is £1,162m, including £989m intangibles, so NTAV is £173m - quite thin for the size of company and heavy fixed assets. Gross bank debt is worryingly high still, so this business is entirely dependent on its lenders.

Cashflow - a strong comment here (but it depends how they measure free cashflow) -

in 2023 we were able to increase Free Cash Flow to £85.7m (2022: £69.2m). Important contributors to Free Cash Flow included £18.0m in cost reductions, £45.7m in lower inventories driven by both structural changes in approach and lower raw materials prices, and some other benefits.

Cashflow statement - interest payable consumes about a quarter of the operating cashflow, then capex is a big number at £84m - so clearly a capital-intensive business, rendering EBITDA meaningless.

Operating cashflow after interest and tax was £150m. £84m of that was spent on capex. So I would say free cashflow was £66m. The company’s headline says free cashflow was £86m.

The big reduction in net debt was mainly achieved from the £266m rights issue, and £190m from disposals (net of an acquisition).

Overall then, yes it did manage to generate some free cashflow, despite posting a PBT loss. It will need an improvement in performance to make any further significant reductions in debt, in my view. Or more disposals (several are pending), but that would have an impact on future profits, and I worry it might be selling off the best bits to raise cash?

Outlook - hardly scintillating! -

… In the medium term, we remain confident that Synthomer's earnings power is more than double recent levels, through a combination of our near-term self-help actions, end market recovery and delivery of our speciality solutions strategy."

… In addition to further progress with our previously announced actions to reduce cost and complexity and to improve site reliability, we have commenced procurement and production cost optimisation programmes which are expected to deliver £30-40m in additional savings in 2024 and 2025. These actions will be partially offset by some increases in operating costs, mainly due to wage inflation and normalisation of bonus accrual.

As a result, we expect to make some earnings progress and be at least modestly Free Cash Flow positive in 2024, even if macroeconomic demand conditions do not improve.

That depends very much on what measure they’re talking about. Since it made a loss in 2023, does this mean the losses are going to double?! That’s probably not what they meant, but I would have liked more clarity on this.

Reducing leverage further towards our 1-2x medium-term target range remains a key priority.

Dividends are not likely any time soon, yes here they confirm -

The Board has confirmed that dividends will remain suspended at least until net debt: EBITDA is less than 3x.

Finance costs are huge, at £65m underlying - this turned an adj operating profit of £38m into an adj loss before tax of £(27)m. As the rights issue happened towards the end of 2023, with debt now a lot lower, I imagine finance costs in 2024 should reduce somewhat, but it’s still a very large number. So I see this as a business that is being run for the benefit of the bank, the employees, and the pension scheme.

More disposals are pending.

Broker notes - nothing available. Forecasts have been in a continuous decline, although given today’s 30% share price rise, maybe some top brokers (who don’t let plebs like us see their research, despite getting privileged access to and guidance from management) might have raised their forecasts? Let’s keep an eye on the consensus figures, which should update later this week, when we will belatedly find out key information that only the privileged have access to today. Level playing field? Doesn’t look that way to me.

Paul’s opinion - I must be missing something here. Based on the information available, I see a struggling, and overly-indebted business, with a fairly lacklustre outlook. Today’s 30% rise must be due to optimism that a turnaround might gather momentum when its markets recover, and the cost-cutting measures.

It’s a £2bn revenues group, so a pick up in its markets could have nice operational leverage.

I’ve got to flag the risk, so it has to be negative still, but given the change in market sentiment, and the big debt reduction (now just a large problem, not an emergency), I’ve decided to moderate my view from red, to AMBER/RED.

As we saw with McBride (LON:MCB) a dramatic turnaround in trading can have a wonderful geared benefit to the equity at highly indebted companies. So this share could see a similar effect, if trading strongly improves in future, which it might do as economies improve. Hence why my underlying view is amber, but due to the poor financial position, that tips it over into amber/red.

I’m quite surprised the market has taken SYNT shares up 30% today, it doesn’t seem justified to me, based on the information I have available.

Today is only a blip on the 1-year chart though -

Graham’s Section:

H & T (LON:HAT)

Share price: 357p (+5%)

Market cap: £157m

H&T Group plc (AIM:HAT), the UK's largest pawnbroker and a leading retailer of high quality new and pre-owned jewellery and watches, today announces its preliminary results for the twelve months ended 31 December 2023 ("the period" or "the year").

These are sparkling results: PBT is up 39% to £26.4m.

You might not have guessed this from the evolution of the share price over the past year:

Highlights from the major divisions:

Pawnbroking pledge book up 28% to £129m, with pawnbroking net revenue up 36% to £69.5m.

Retail gross profits down 19% to £14.4m

Gold purchasing gross profits up 26% to £8.6m

Foreign currency profits up 11% to £6.3m.

The explanation for poor performance in retailing comes back to watches (and maybe its exposure to watches is a partial explanation for the weak sentiment around this stock):

Margins were impacted by challenging trading conditions for certain watch brands in H1, and jewellery sales mix in H2, which includes the peak Christmas trading period.

Net debt finished the year at £32m (last year: £3m). I’ve said before that rising net debt at H&T is usually a good thing because it means the company is very busy, and that’s clearly reflected in today’s results.

The remaining headroom on borrowing facilities is £30m; that should be enough for anything the company might want to do in the short term. As we discussed last month, H&T has a new £25m loan from a company called Pricoa Private Capital.

Number of stores increases modestly from 267 to 278. Personally, I’d be happy with this gradual expansion in benign trading conditions - the business is doing fine, why take on extra risk with over-expansion?

Net assets rise to a new high of £177m. The company has typically been cheap on a price to book value basis, but that can be justified on the basis that ROCE/ROE haven’t been particularly high (financial stocks need high ROE to trade at a high premium to book).

The company is keen to reassure investors on that front: return on equity improves from 9.9% to 12.4%. “The Group remains committed to delivering on its commitment to achieve a target ROE of mid-teens through- the- cycle.” This is not something it has achieved in the past, so the jury’s out on whether it can be achieved in the future.

Full-year dividend is 17p (last year: 15p), covered nearly three times by earnings.

CEO comment:

Pawnbroking is our core business and is attracting increasing numbers of new customers. Throughout the year, we saw record demand for our pawnbroking service and this has continued into 2024, with January being a new record month for lending.

Whilst retail trading conditions, particularly in the fourth quarter, were challenging given pressure on customers' disposable incomes, sales increased year on year by 8% to £48.6m. Pleasingly, demand has remained robust in the early months of 2024.

Outlook is good:

We believe that demand for our core pawnbroking service will remain high as the ongoing impact of inflation on customers' disposable incomes creates record levels of demand for small sum, short term lending, at a time of severely constricted supply. We are also seeing growing demand from customers who are business owners, seeking finance for working capital against pledged personal assets and this formed part of the rationale for the acquisition of the pledge book of Maxcroft.

Further expansion of our store network remains a focus, although this will always be in a controlled and measured manner. It is likely that between 8 and 12 new stores will be opened in 2024.

Estimates from Shore Capital have been trimmed ever so slightly but are essentially unchanged, e.g. adjusted PBT for the current year is still forecast at £33.5m, rising to £36.7m next year.

Graham’s view

I’m still amazed by the volatility of watch prices over the past year. This article from December 2023 describes second-hand luxury watches as highly geared towards interest rates and economic sentiment, i.e. vulnerable to a bust in a period of higher rates and a weak consumer. A major index of watch prices (the “WatchCharts Overall Market Index”) fell 37%.

The Covid era of 2020-2022 saw an artificial boom in the watch industry; in hindsight we can easily say that it was primed for collapse whenever those conditions ended.

Fortunately, H&T has been proactively reducing its watch inventory and limiting its exposure to this situation.

Furthermore, watches are only one part of H&T’s retailing and lending operations, e.g. only 14% of pawnbroking loans are backed by watches.

Watches did represent 25% of retail sales for 2023 (up from 16%), and at reduced margins compared to historical norms.

For me, the big story is the unprecedented level of demand for pawnbroking loans, and H&T’s leading role in this as the biggest pawnbroker.

Where I’m uncertain is the company’s stated goal to achieve “mid-teens ROE through the cycle”. It hasn’t done this in the past and I’m not sure how it might achieve it in future?

One way to achieve this might be to use the balance sheet more aggressively, e.g. with further acquisitions. This wouldn’t be my first choice of strategy and it would require shareholders to be much more alert to any mis-steps.

As things stand, I’m happy to maintain my positive stance on H&T (as I’ve done with its rival Ramsdens Holdings (LON:RFX)). It’s not every day you find a company that was founded in 1897, posting excellent numbers, and trading at only 6x earnings. I remain a fan.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.