Good morning from Paul & Graham!

Today's report is now finished. I'm halfway through SEE, so will finished that tomorrow.

The Week Ahead - today's article is here.

Naked Wines (LON:WINE) - Sky News reports that this troubled wine subscription service has hired Interpath debt advisers to "explore refinancing options". Sounds ominous to me. WINE puts a positive spin on things - "... there may be an opportunity to secure a similar-sized facility that has less limitation on utilisation and more flexible covenants resulting in fewer restrictions on the actions we can take to reduce inventory and drive our broader change agenda." Paul's view - I think it could be in trouble. I can't imagine many lenders would be keen to finance this excessive wine lake, given that the business model has effectively failed to prove it is a viable/profitable business, and now seems in a downward spiral. Massive inventories and/or receivables often hide a multitude of sins. See our archive here for more bearish points. RED.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Bytes Technology (LON:BYIT) - down 13% to 501p (£1.18bn) - Investigation & Trading Update -

Investigation update - longstanding former CEO made large numbers of trades in BYIT shares without disclosing them, but we already knew this from a previous announcement. BYIT claims its values are nothing like its former CEO’s values. How does that work then?

Trading Update (FY 2/2024) - waffly, positive-sounding, over-PR’d update, doesn’t actually tell us whether it’s traded above, in line, or below market expectations. Given the scandal over its former CEO, you would have thought clarity would be a priority.

Chemring (LON:CHG) - up 6% to 370p (£1.0bn) - Funding Awards - £57m funding from EU for Chemring Nobel (Norwegian subsidiary), ammunition production for Ukraine. Another £32m funding has come from the Norwegian Govt to boost production - aiming to double production in medium term. No more info available (no broker notes for the plebs!)

Summaries of main sections

Plexus Holdings (LON:POS) [Paul holds] - 18.0p (at 09:23) £19m - H1 Results - Paul - GREEN

My quick summary below of excellent H1 results - but NB most of revenues (and all the profit) is from a one-off licensing deal, as previously disclosed. No surprises overall.

Focusrite (LON:TUNE) - 272p (down 30% at 08:14) £160m - Trading Update [Profit Warning] - Paul - BLACK (AMBER/GREEN on fundamentals)

Bad luck to holders, as TUNE shares lurch down on a profit warning. Frustrating lack of broker coverage, so I've pieced together my own estimate of revised earnings. With no apparent problems over liquidity, I'm seeing this bombed out share as a potential recovery situation.

Distribution Finance Capital Holdings (LON:DFCH) - up 9% to 27.9p (£50m) £160m - Trading update (ahead) - Graham - AMBER

Good news for shareholders as prudent loss estimates and tight cost control produce a better than expected financial result for 2023. Guidance for 2024 is unchanged. I remain neutral as I wait for this lender to build a longer track record of decent performance.

Currys (LON:CURY) - up 3% to 58.3p (£661m) - Trading Update & End of Offer Period - Paul - AMBER

Potential bid talks are off, as we already knew, so the offer period has ended. A mildly positive trading update says its at the top end of previous guidance. Huge forthcoming pension contributions put me off, and the very low margins.

Marshalls (LON:MSLH) - down 8% to 268p (£678m) - Final Results - Graham - AMBER

The recovery has been delayed as Marshalls publishes a weak outlook statement for 2024, with no expectations for an improvement in profitability. For investors who wish to bet on a surprisingly fast bounce in consumer confidence, this stock may be of interest.

Paul's Section:

Plexus Holdings (LON:POS) [Paul holds]

Up c.10% to 18.0p at 08:41 (£19m) - H1 Results - Paul - GREEN

H1 numbers look smashing, but as they stress several times in the commentary, most of the revenue has come from the Dec 2023 licensing deal with SLB.

H1 revenue up 617% to £5.1m (£4.1m from SLB licensing)

PBT £2.2m vs H1 LY: loss of £(2.1)m

Cash from SLB deal is in receivables, confirmed receipt in Jan 2024, so cash position now fine, c.£5m.

The commentary sounds good, with some nice nuggets for the bulls in there!

FY 6/2024 outlook in line.

There's a new broker note just out from Cavendish, £14.0m revenues, and £3.5m adj PBT for FY 6/2024, I think that's unchanged. It's a massive turnaround from last year, with revenues up about 9x and a move from losses into profits.

Hopefully some more investors might spot the big turnaround underway here? It supports my view that this is a previously successful, profitable company that is coming alive again. It needs to keep winning contracts to keep the momentum going. Downside risk is that a couple of large deals this year might just be one-offs.

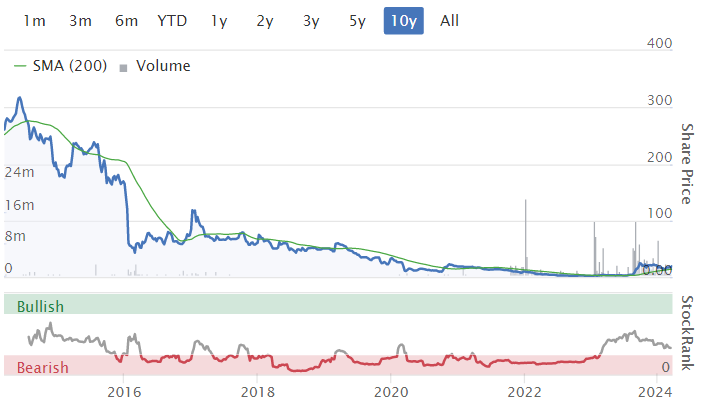

Plexus was the biggest % riser in the UK for 2023 - with most of the rise having stuck -

Although zooming out, this is little more than a blip on a long-term downtrend. Interestingly, there's been little dilution since the previous glory days when it was growing & profitable -

Focusrite (LON:TUNE)

272p (down 30% at 08:14) £160m - Trading Update [Profit Warning] - Paul - BLACK - (AMBER/GREEN on fundamentals)

Focusrite plc (AIM: TUNE), the global music and audio products group supplying hardware and software used by professional and amateur musicians and the entertainment industry, provides the following update on trading for the year ending 31 August 2024 ("FY24") based on trading for the six months ended 29 February 2024 ("HY24").

Bad news I’m afraid -

Challenging market conditions have continued in Feb & Mar.

H1 revenues expected £75m+ (H1 LY: £86.2m)

Revenues for FY 8/2024 now guided as £155m+ (it doesn’t say what the previous expectation was, but the StockReport is showing consensus of £182m)

EBITDA guidance -

FY24 EBITDA is expected to be in the range of £27 million to £30 million with a heavier weighting towards H2 than in FY23.

It did mention an H2 weighting in the Jan 2024 update, so that’s not new.

Broker notes - nothing available - a glaring oversight for a small cap, not getting information out to the investors who create the liquidity, and set the share price (private investors). This is often a problem with owner-managed businesses, as they still act like private companies.

Last year’s figures (FY 8/2023) showed adj EBITDA of £38.6m, so the guided range above of £27-30m for FY 8/2024 is between 22% to 30% down Y-on-Y. Clearly a bad year is underway.

EBITDA of £38.6m turned into real profits (PBT) of £28.8m last year (adjusted), and £22.7m statutory, so quite a lot lower than the meaningless EBITDA. I say meaningless because TUNE is a heavy capitaliser of development spend of £9.2m last year, and £8.4m the year before.

Assuming a similar level of costs between EBITDA and PBT, I reckon FY 8/2024 might be something like £17-20m adj PBT. Take off say 22% tax and PAT would be c.£14.4m, divide by 59.2m shares in issue, and I get to an estimated adj EPS at 24.3p. That’s poor, and brings EPS back down to where it was pre-pandemic, despite the acquisitions made in recent years. So it’s looking increasingly likely that the surge in profits at TUNE were lockdown-related after all, rather than structural growth.

Mind you, at just 272p the share price has fallen a helluva lot, and the PER is only 11.2x based on my 24.3p EPS estimate.

The commentary goes into more detail about delays in launching new products, customer destocking, sales mix, macro factors, etc. The bottom line is that sales and profits have disappointed.

Is it in financial trouble? By the sounds of this, I’d say no, it sounds OK -

As of 29 February 2024, the Group had net debt of approximately £26.0 million (31 August 2023: net debt £1.3 million), with the increase mainly attributable to the impact of working capital phasing across debtors and stock, and with one-off impacts of approximately £5 million due to investment in future technologies and recent acquisitions. This position is expected to largely unwind in the second half of FY24 as our working capital improves and to be close to net cash by the year end. Our £50 million committed credit facilities provide ample liquidity for ongoing operations.

Paul’s opinion - this update is frustrating in only having limited information. We’ll have to wait until broker consensus figures update later this week, to see if my estimate above is accurate or not.

Overall, I think TUNE remains a decent business, with good quality scores. Amazingly shares have fallen c.85% since the lockdown boom peak in 2021. Sure its performance has disappointed, but surely we must be getting close to a point where the shares offer attractive value, and recovery potential?

So I’m leaning more towards seeing this moderately positively for value/recovery, particularly as there doesn’t seem to be any insolvency/dilution risk. It depends though. Is this just a one-off bad year, or is business slipping away to competitors? Its heavy R&D spend is evidence that TUNE has to keep innovating, or risk being left behind.

So I’ll take a risk, and go with AMBER/GREEN on fundamentals, but BLACK to flag the profit warning.

Currys (LON:CURY)

Up 3% to 58.3p (£661m) - Trading Update & End of Offer Period - Paul - AMBER

Currys confirms what we already knew from their announcements, that neither Elliott nor JD.com intend bidding for Currys. Management didn’t seem to want to engage with potential bidders. Elliott’s original 62p indicative price looked too low, and wasn’t likely to be accepted anyway, in my view. This was upped to 67p, but that was also rejected. So at least shareholders now have a benchmark on valuation.

JD.com also walked away, without giving any public explanation, but it was only at “the very preliminary stages of evaluating a possible transaction”.

So that’s that - end of the offer period.

Trading Update - sales “stronger than expected”, and adj PBT guidance for FY 4/2024, is now “at least £115m”, whereas previous guidance was £105-115m range. So moderately positive. NB this includes its discontinued Greece operations, so adj profit will actually be lower.

Will have year end net cash, as Greek disposal proceeds expected near year end.

Pension contributions are rising from £36m pa -

Scheduled pension contributions will rise to £50m in 2024/25 and to £78m for the following three years before a final payment of £43m in 2028/29 within the current agreement. Pension contributions will cease when the actuarial deficit reaches zero.

Paul’s opinion - I can’t get excited about CURY. It’s a very low margin business, and even its aspiration is only to achieve c.3% operating profit margin. With the huge pension scheme payments scheduled, I see little potential for decent divis without taking on debt again. Profit will fall from the Greek disposal. Plus we know know 2 bidders weren’t prepared to pay much more than the current share price for it. So overall then, I can’t muster any enthusiasm to go above AMBER.

Graham’s Section:

Distribution Finance Capital Holdings (LON:DFCH)

Share price: 27.9p (+9%)

Market cap: £50m

DFCH is “a specialist bank providing working capital solutions to dealers and manufacturers across the UK”.

This morning brings some rare (according to the chart) good news for shareholders:

The update is ahead of expectations for 2023, though it doesn’t suggest that there is any need to change expectations for 2024.

Remember that this company announced a profit warning in November, due to a large problem loan. But according to the company’s broker, more than 70% of the £6m impairment associated with this loan has since been offset by the company’s strong trading elsewhere.

The new PBT estimate for 2023 is £4.4m (previously £3m). The reason for the stronger than expected performance is “prudent forecasting of credit loss provisions at the year-end” and “proactive operational cost control by management”.

As for trading in 2024:

The Group is also pleased to report a positive start to the current year, with its loan book, dealer facilities and credit limits continuing to grow year-to-date. The Group's financial and operational performance is in line with the Board's expectations for the year.

FCA review into motor finance commissions: we get strong reassurance on this front.

The Group has not offered products or services that would fall within the scope of the FCA's review, nor does it have commercial arrangements with dealers or brokers of this type. Accordingly, the Group considers it is not impacted by the FCA's current review.

Graham’s view

I had a generally favourable impression of this stock when I reviewed it in April 2023 (share price: 40p), giving it a neutral rating but suggesting that it warranted additional research..

That was prior to the November profit warning, covered by Roland.

As a reminder, DFCH provides inventory finance for a wide range of sectors. For example, the loan that caused all of the recent trouble related to a group of caravan parks.

The company reported balance sheet equity of £99m at the most recent interim report, almost fully tangible. It also claimed that it did not need any fresh equity to grow its loan book to over £800m (from c. £520m).

At a market cap of around half book value, it’s certainly cheap - but then isn’t every other financial stock and especially every other listed lender?

Given the high-ish leverage (that is only going to get higher as they act on this £800m idea) and given the company’s recent impairment experience, which includes confirmation that some larger debtors could individually be responsible for a few percentage points of the entire loan book, I suspect that the market is right to put this one on a cheaper book value multiple than its peers.

The footnotes to the interim report showed that the largest industries in the loan book were “lodges and holiday homes” (30%), transport (22%) and “motorhomes and caravans” (19%).

I also note that most lending is done at an LTV of over 90%.

These facts aren’t boosting my confidence in the story.

Of course, the entire market in financial stocks may be too cheap, including DFCH shares, which implies that I should be taking a positive stance. However, I’ve not seen enough here to make me want to give this one the thumbs up yet: the track record hasn’t yet convinced me that this stock is investment-grade.

“The better part of valour is discretion.” I remain neutral.

Marshalls (LON:MSLH)

Share price: 268p (-8%)

Market cap: £678m

Marshalls plc, a leading manufacturer of sustainable solutions for the built environment, announces its results for the year ended 31 December 2023

The long-term chart here is terrible, but over the past six months Marshalls had built up some momentum, until today:

The financial summary for 2023 illustrates a tough year, including the negative effects of operational leverage::

The statutory numbers don’t inspire much confidence either, and as usual the actual profit figures are much, much smaller than the adjusted numbers:

Operating profit down 14% to £41m

PBT down 40% to £22m

The reason for the decline? “Challenging end market conditions” for the UK’s leading landscaping, building and roofing products supplier.

The company has responded by “right sizing” with £11m of planned savings p.a.

Net debt reduced in 2023 from £191m to £173m (excluding leases) with a year-end leverage multiple of 1.9x adjusted EBITDA.

New CEO started this month. He has had a varied career, mostly recently at Genuit (LON:GEN) where he was the COO for 1 year and 8 months.

Like Marshalls, the Genuit share price has also suffered a lot over the last few years (just out of curiosity, I’ve marked the beginning and the end of Matt Pullen’s tenure as COO with arrows):

Outlook

With the Marshalls share price down this morning, I’m not expecting a sunny outlook statement:

Revenue in the first two months of the year was lower than 2023 and reflects the continued weakness seen in the second half of last year

In line with recent sentiment of UK economic and industry forecasts, the Board expects activity levels to remain subdued in the first half of the year followed by a modest recovery in the second half as the macro-economic environment progressively improves. The start of this recovery is now expected to be slower and more modest than previously assumed. Therefore the Board believes that revenues in 2024 will be lower than previously expected and that profit will now be at a similar level to 2023…

In other words, adjusted PBT of c. £50m is the new normal (and maybe actual PBT of c. £20m, too?).

Adjustments - I will spare you a detailed analysis of this company’s profit adjustments. But I would like to point out that these accounts are miles away from anything that could be described as “clean” when you have adjustments like this:

In particular, I would draw your attention to “impairment charges, restructuring and similar costs”. I have a concern that many companies have large costs that could be described as “restructuring and similar costs” if not every year then at least on a regular basis. See that Marshalls had £13m of these costs the previous year, and then £18m in 2023. And most of these were real cash costs, not simply the writing down of invisible balance sheet items.

Segmental results

The biggest hit in absolute terms to adjusted operating profit was in the Landscape Products segment.

The Landscape segment saw its UK revenues fall 25%, impacted by “lower new build housing and continued weakness in private housing RMI activity driven by the discretionary nature of the segment's domestic products, weak consumer confidence, product price inflation and lower real incomes”.

The Roofing segment saw profits increase in 2023 but that is only because it was acquired part way through 2022. On a like for like basis, profits were down 12%.

Graham’s view

I share the optimism of the Marshalls Board that the medium-term and long-term prospects for the business are probably fine:

Looking further ahead, the Board believes that the UK construction market continues to have attractive medium and long-term growth prospects driven by the structural deficit in new housebuilding, an ageing housing stock that requires increasing levels of repair and maintenance, and the need to continue to improve UK infrastructure.

I’m also optimistic that by the end of the current calendar year, we might see something that resembles a recovery in consumer sentiment.

However, there are many ways to play this recovery and I’m not sure if Marshalls is the most compelling choice. Given the cheapness of so many shares, should it not be possible to find alternatives trading at cheaper multiples, with better balance sheets, cleaner accounts, and similar prospects for recovery?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.