Good morning, it's Paul & Graham here!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

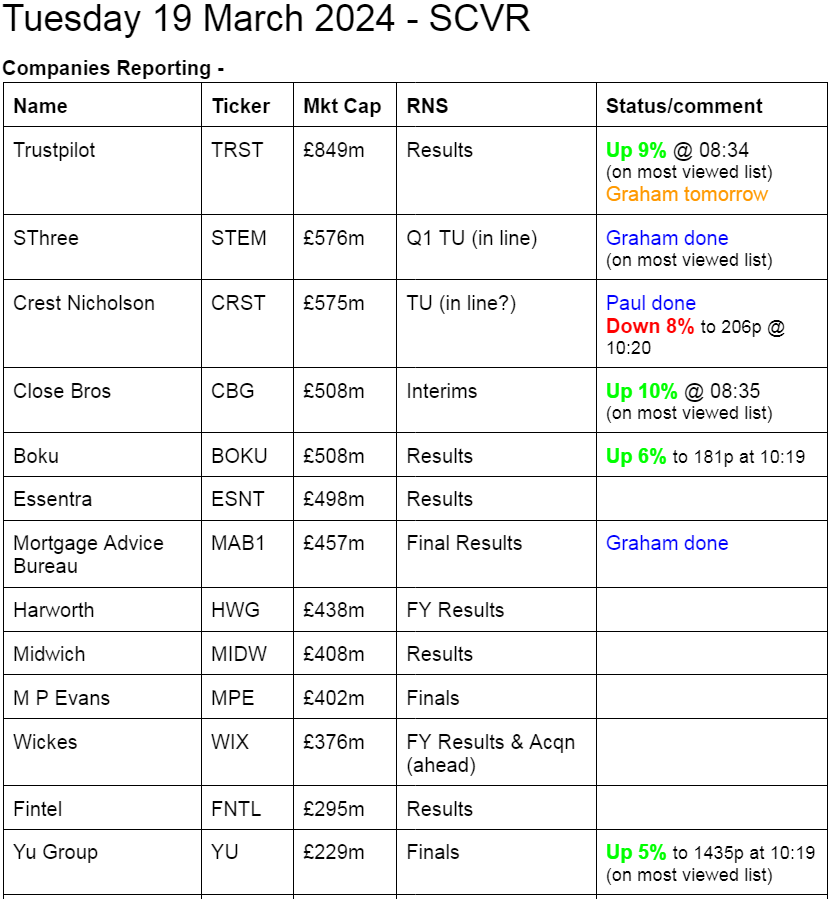

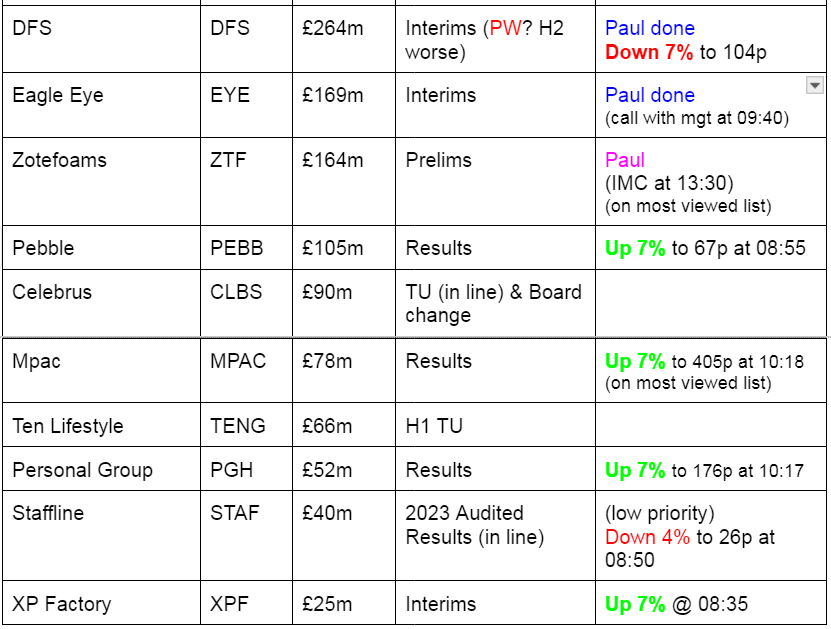

I'm trying to avoid going into meltdown when looking at how large the list of companies reporting is today! As usual we can only do some of these, not all. We prioritise (1) ahead or behind expectations updates, (2) big price movers, (3) "most viewed" list on the home page, (4) companies we like and think are good value.

Summaries of main sections

Crest Nicholson Holdings (LON:CRST) - 224p (pre market) £576m - Trading Update - Paul - AMBER/GREEN

Lack of clarity on overall trading in this AGM update, but it sounds as if they're in line. However, more legacy problems have emerged, with another £15m estimated liability for remediation. Worryingly, external consultants appointed to review existing provisions - what's the betting another hefty provision will be required? High, I reckon! So I'm moderating from green to AMBER/GREEN. It's still a big discount to NTAV, and might attract a bidder, but these legacy issues are troubling.

DFS Furniture (LON:DFS) - down 7% to 104.8p (£246m) - Interim Results [with profit warning] - Paul - BLACK (on fundamentals: AMBER/RED)

Soft H1 results, with little profit. Also it warns that FY 6/2024 adj PBT guidance reduced by £10m to £20-25m due to soft order intake in Jan & Feb. Red Sea delays could have a minor impact too. Awful over-geared balance sheet is the main problem - hence me having to be AMBER/RED, even though I quite like the business and its recovery potential once consumers relax the purse strings later this year maybe?

SThree (LON:STEM) - down 1% to 419.5p (£566m) - Q1 Trading Update - Green - GREEN

Full-year expectations for this STEM-focused recruiter are unchanged. Their cash balance remains enormous allowing them to easily ride out continued softness in Technology and Life Sciences and their strategic shift away from Permanent recruitment.

Mortgage Advice Bureau (Holdings) (LON:MAB1) - down 3% to 776.9p (£444m) - Final Results - Green - GREEN

2023 results are poor vs. 2022, as expected. However, their market share grew, the dividend is unchanged, and they are seeing initial signs of recovery in the mortgage market. Normal growth to hopefully resume in 2025. Shares not cheap but I still like the quality on offer.

Eagle Eye Solutions (LON:EYE) - unch 570p (£169m) - Interim results - Paul - GREEN

I dig into the H1 results, with everything looking as expected, in line. Cashflow is the only weak bit I found. A brief chat with management today was interesting, and I'm hoping to do a proper CEO interview. This remains one of my favourite UK growth shares, although valuing it is tricky.

Zotefoams (LON:ZTF) - up 6% to 356p (£173m) - Unaudited preliminary results FY 12/2023 - Paul - GREEN

Good numbers for 2023, ZTF seems to have shrugged off tough macro. I remain of the view that this is a decent business, fairly priced, but with free upside from the ReZorce project, which looks close to either success or failure.

Paul’s Section:

Crest Nicholson Holdings (LON:CRST)

224p (pre market) £576m - Trading Update - Paul - AMBER/GREEN

This housebuilder gives an AGM trading update today, for FY 10/2024 to date.

It’s a frustrating update, with lots of detail, but no clear statement about performance vs market expectations, which is supposed to be the whole point of trading updates.

The main issue is that more defects on old sites have surfaced, estimated £15m cost of remediation. Appointing consultants to assess adequacy of its existing provisions - that sounds ominous, I’m not the only one worried about this, as CRST shares trade at a significant discount to NTAV due I think to repeated problems surfacing with legacy sites. Who knows what other skeletons are in the closet here?

Current trading - this all sounds reassuring, and confirms the general view that the sector is beginning to recover -

- Reservations in line with expectations.

- “Reduced activity” before Christmas, “stronger performance from mid-January”

- Sales prices in line with expectations.

- Cancellations - “remained at normalised levels”.

- Lower building activity is resulting in “lower labour costs in some areas” - interesting.

- Build cost inflation overall “has largely stabilised and at a level lower than prior year” - ambiguous, presumably it means the rate of cost inflation is lower, not that actual costs are lower.

- Planning system remains challenging - same as all the housebuilders are saying.

Outlook - interesting, but I would have preferred a simple statement that they’re trading in line with expectations -

The Group continues to focus on optimising value and expects FY24 completions to be in the range of 1,800 to 2,000 homes, with completions weighted approximately 35/65% in favour of the second half of the year, reflecting the opening order book and the low level of reservations in the first two months of the financial year. Sales prices are expected to remain stable in FY24. Net debt at the end of February 2024 is tracking lower than expected as a result of lower build and land spend and this trend is expected to continue in the remainder of the financial year.

Paul’s opinion - the additional £15m remediation costs today is c.3% of CRST’s market cap, so the share price being down almost 5% in early trades (at 08:09) looks a sensible market reaction - ie factor in a bit more bad news than what is disclosed.

It’s all very well CRST shares trading at a c.30% discount to NTAV, but how many more unexpected liabilities are going to pop up from old sites, each of which undermines both NTAV and confidence in the company?

Appointing external consultants to review its provisions says to me this could be a can of worms, with the risk of them kitchen-sinking the legacy issues with another large provision.

The whole industry is grappling with remediation costs re the Grenfell tragedy, and CRST has additional problems for its own sites, which seems to be escalating rather than being resolved.

The amounts involved are not ruinous though, and checking CRST’s last balance sheet, it’s ridiculously strong, so I think the company could absorb the costs of even more remediation problems without any solvency worries.

I see dividends are forecast to be slashed this year.

Overall then, it’s a straightforward choice with housebuilders - pay a premium to NTAV for the better companies (eg Vistry (LON:VTY) ) or get a valuation discount for CRST because it’s been so accident-prone.

Not far above 5-year lows, and with no dilution over this period, could this share be a bargain? Possibly, it depends!

DFS Furniture (LON:DFS)

Down 7% to 104.8p (£246m) - Interim Results - Paul - AMBER/RED

DFS Furniture plc, the market-leading retailer of living room and upholstered furniture in the United Kingdom, today announces its interim results for the 26 week period ended 24 December 2023 (H1 FY24)...

Weak H1 results, with only £8.7m adj PBT (up 23% on H1 LY) on £505m revenues.

Statutory PBT was c. breakeven at £0.9m

Checking back, and ignoring pandemic distortions, H2 seems to be the seasonally stronger half.

Order intake down 10% on LY, below plan of -5%

Market share gains, with 38.5% claimed UK market share - so this is very clearly the market leader, and I think it’s a good business, nicely poised for a consumer recovery.

Net bank debt is way too high at £134m, and was accumulated in a reckless strategy to fund shareholder returns - this is my main issue with DFS shares, and due to the elevated risk (and cost) of bank debt, I’ve previously seen this share as amber/red.

Outlook - to save typing, here it is in full (all interesting) -

Balance sheet - as always, this is the deal-breaker for me.

NAV was £233.6m at 24/12/2023, which includes £536.4m intangible assets. Deduct those, and NTAV is negative £(303)m. Although that includes negative lease entries of £(95)m net liabilities - so there must be a fair few loss-making sites with onerous leases. Adjusting out all the lease entries improves NTAV to a still very bad £(208)m.

In a nutshell, for non-accountants, the whole business is financed by trade credit (suppliers allowing DFS to pay for the products after it’s sold them), and the bank.

DFS management seem to have learned nothing from the pandemic, in that they’ve geared up the balance sheet again after almost going bust and being forced into a (well supported admittedly) equity fundraise when business ground to a halt in the 2020 lockdown.

Paul’s opinion -

Bear view -

The H1 figures and outlook are poor, and it’s got a dangerously geared balance sheet.

Bull view -

As the clear market leader, and historically strongly profitable business, it should be well set up for a consumer recovery that is looking increasingly likely from April 2024 big pay & benefit/pensions increases.

The debt arguably leverages up the returns for equity, so in a recovery, worries about debt/dilution would recede, with all the benefit flowing to equity.

Overall, I can see both points of view, and there’s merit in both.

Note that a Polish furniture manufacturer Adriana, owns 9.4% of DFS, so could it possibly come into play as a takeover target I wonder?

I’ll stick with AMBER/RED, purely to flag up the considerable balance sheet risk, but I do like the actual business. It wouldn’t surprise me to see this share double in a consumer recovery, if it started issuing ahead of expectations updates later this year, so it is quite tempting, providing the bank manager doesn’t get cold feet.

Eagle Eye Solutions (LON:EYE)

Unch 570p (£169m) - Interim results - Paul - GREEN

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to announce its unaudited interim results for the six months ended 31 December 2023 (the "Period" or "H1 2024").

This is one of my favourite growth companies. We’ve followed it for years, and it’s great to see a small cap formerly jam tomorrow company actually succeed (the odd one does!)

The investment case here is strong organic growth, recurring revenues, great client list of international retail groups [typically supermarket chains], very little customer churn, and proven results for its customers from bespoke loyalty/rewards schemes, and genuine use of AI (not just a buzzword!)

Figures & outlook in H1 results today are in line with expectations, no surprises.

Key numbers -

H1 revenues up 20% to £24.1m

Recurring revenues 78% of the total, which should reduce the risk of any profit warnings in future, because most of the revenue is already in the bag before each year starts.

Period end ARR (annualised recurring revenue) £35.4m

H1 adj PBT £2.6m (up 49%)

Adj net cash £7.8m, says it has a bank facility too which it doesn’t envisage needing to use again.

Outlook - sounds fine -

We have entered the second half of the financial year with good momentum. Our sales pipeline has increased considerably versus this time last year, with EagleAI now accounting for 30% of the pipeline, demonstrating the strong interest in the product. As the wins previously announced go live, we will see continued growth in all areas of Win, Transact and Deepen revenue.

Trading since the Period end has continued well, providing confidence in the delivery of another year of profitable growth, in line with the Board's expectations.

I had a brief call with management this morning, and indicated that I dislike the phrase “profitable growth”, as it’s meaningless, and doesn’t necessarily mean that profits will grow at all! Management said we hear what you’re saying, what we mean by this is that the business is past the previous cash burning, loss-making stage, it’s just to reinforce that.

And to be fair, it does clearly state that FY 6/2024 should be in line with expectations.

As you can see, it’s been quite a long haul, but EYE has clearly moved from speculative, into credible growth company territory now its profitable -

Most of the growth has been organic, although it bought a small French competitor mainly for its tech and its team about a year ago, called Untie Nots.

Broker research - many thanks to Shore Capital who make their notes available on Research Tree. It’s forecasting FY 6/2024 adj PBT little changed from last year, at £4.2m. This is adj diluted EPS of 12.0p, so a lofty PER of 47.5x - expensive yes, but adj PBT is forecast to double to £8.0m two years later, and the strong ongoing revenue growth makes that seem credible to me. So investors are effectively having to pay for 2 years growth up-front, which is a challenge for value investors!

Longer term the target is to reach £100m+ revenues and 25% EBITDA margins.

I told management I don’t like EBITDA.

Management remuneration - I also challenged this, especially the generous 2023 LTIP awards, saying that some of us had concerns. Management defended this, saying it was a scheme worked on for about a year, in conjunction with major shareholders, and the dilution isn’t excessive, and is based on stretch and super-stretch targets - see this excerpt from the 2023 Annual Report, I don’t suppose anyone would mind if the share price got to hurdle 3 or above, from its current 570p -

Capital Markets Day - Feb 2024 presentation setting out the longer term plan is here.

Balance sheet - looks OK, about £6m NTAV. Cash of £9m, it also reports adj net cash of £7.8m. This type of business tends to have little need for capital, although big customers do like robust balance sheets. So I think it should let the cash accumulate before paying any divis in future. It hasn’t paid any divis in the past, because this is a growth company.

Cashflow statement - not great, it has to be said.

Capitalised development spend is high, and rising, £3.5m in H1. This, and adverse working capital movements, saw a £1.3m cash outflow in H1.

I’d be looking to see cashflow improve in the future. I can imagine cashflow would be an area that any bears on EYE shares would latch onto. However, in my experience at fast organic growth companies, the cashflow can lag behind during the growth phase, and then often follow on later. If it doesn’t, then there’s a problem!

Paul’s opinion - no change, I really like EYE as an impressive tech growth company, which seems to be highly credibly in its niche, with lots of big name retailers on its client list. I asked about churn on my call today, with only Sainsburys being a major client that’s winding down due to its focus on Nectar.

Is its talk about AI just using a fashionable buzzword? Management says no, it not only handles billions of data items, but has competing algorithms, which challenge & learn from each other, so competitors can do simple loyalty schemes but nothing as sophisticated and personalised as what EYE does.

My view is that the impressive compound growth from big name clients, globally, tells me everything I need to know.

How to value these shares? That’s the most difficult bit. I always say that EYE looks expensive, which it does, but it’s gone almost sideways for the last 3 years, during which time the business has made great strides in performance. So you could argue its better value now, than previously.

For full disclosure, I hold a tiny position personally, just to keep it on my portfolio page, as a reminder that I want to buy some more if the price dips down at any point, and if funds are available.

Also, my brief call with management today went well, and I’m hoping to get them on for a CEO interview on my podcast channel at some stage.

Five year chart below - is it poised for another leg up, I wonder?

Zotefoams (LON:ZTF)

Up 6% to 356p (£173m) - Unaudited preliminary results FY 12/2023 - Paul - GREEN

I like the way it splits out the core foams business, with a strong rise of 22% in PBT to £17.2m, from the group total (which includes the loss-making ReZorce development project) of £12.8m PBT (up 5%). Personally I’m happy to value this share on the core business only, as the ReZorce project can be shut down if it doesn’t work.

On ReZorce it says -

If it works, this could provide exciting upside on the share price. If it doesn’t work, then the losses would be eliminated as the project is closed down. Any time travellers in the house, please tell us how it works out! For the rest of us, we can only guess, and apply probabilities.

Outlook - the detail sounds a bit mixed, but overall it concludes -

We have made a positive start to 2024, with overall sales ahead of the previous year's record first quarter…

while we remain mindful of the uncertain economic backdrop, 2024 is expected to be another year of good progress for Zotefoams".

Input costs “remain relatively stable”.

Quality scores - bears have questioned ZTF, saying it’s capital intensive and low quality. It’s true that it is capital intensive, but Stockopedia’s computers say that it generates a decent return from those assets. The quality score is 90, and the quality metrics are all green -

The commentary touches on this today -

Zotefoams targets improvements in the Group's return on capital over the investment cycle, while recognising the short-term impact on the return of sizeable capital investments during their construction and early operations phases, where they initially run at lower utilisation and mix optimisation levels. When Zotefoams embarks on investment in a major expansion or new location, such as the installation of extrusion and high-pressure capability at our existing Kentucky, USA site, which we commissioned in 2018, or the most recent investment in foam manufacturing at the Poland site, commissioned in 2021, we take into account the importance of scale and dilution of heavy infrastructure cost over a (future) second or third line. As such, the first step is invariably more dilutive to capital return than any subsequent investments…

Starting in 2015 with a programme to add the first and second stages of the Zotefoams manufacturing process into the USA, continuing with the addition of HPP capacity in the UK to support the Footwear opportunities and ending with the commissioning of the Brzeg, Poland, manufacturing facility in 2021, Zotefoams experienced a period of high capital investment. Over this period, we invested £91.4m in property, plant and equipment, of which £67.1m, or 73%, was directed to growth. With this programme complete, and over the medium term, the Group expects to return to levels of capital expenditure more in line with depreciation.

Balance sheet - looks fine to me. NAV of £116m becomes NTAV of £106m.

Net bank debt is £30.2m (I’ve deducted £1.4m leases) (up 13%), but the leverage multiple is fine at 1.2x (covenant limit is much higher, at 3.5x). To me, it’s just not an issue - particularly because ZTF has considerable freehold property supporting the borrowings indirectly.

I’m not sure why the bank debt is shown in current liabilities. Note 4 is odd - saying it becomes repayable each 3 to 6 month “loan interest period”. Elsewhere in the commentary it says the bank facility has a renewal date of March 2027.

So that’s a query point.

Cashflow statement - operating cashflow was static at £24m in both 2023 and 2022, but adverse working capital movements in 2023 absorbed half of that, £12m. So that’s another query point. It should be swings & roundabouts long-term, but worth asking the question.

Capex wasn’t particularly high in either 2023 (£5.7m physical, and £2.7m intangibles) or 2022 (broadly similar figures).

Overall then, I’d want some reassurance from management that the negative working capital movements are set to reverse in 2024.

Forecasts - many thanks to Singers for publishing its research. I know a lot of work goes into these. It makes very minor tweaks to 2024 and a 5% rise to 2025 forecasts, but that’s too far out in the future to be relied upon (generally, not just for ZTF).

22.3p adj EPS for 2024 means a PER of 16.0x, which I’d say is probably about right. Although remember that includes losses of £3.7m for ReZorce, strip that out, and the multiple on the core business is a good bit lower.

Paul’s opinion - I like the core business, it’s good, and sailed through both the pandemic and the energy crisis, so we know it’s well managed and has pricing power.

Shares are reasonably priced on the core business I think. Yes I do accept it’s capital intensive, that is a fair point, but the returns are OK from the capital utilised I think.

ReZorce is then thrown in for free, and the upside from this is genuinely exciting.

So it remains a nice each-way bet in my opinion. Still GREEN for me.

For disclosure, I should add that I only hold a placeholder position, to remind me to buy more (similar to EYE above) when funds permit.

Graham's Section

SThree (LON:STEM)

- Share price: 419.5p (-1%)

- Market cap: £566m

This is a Q1 update; SThree’s financial year ends in November.

SThree plc… the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics ('STEM'), today issues a trading update covering the period 1 December 2023 to 29 February 2024.

FY 2024 is still expected in line with expectations at this early stage.

Key points:

Net fees down 6% “against a record prior year performance and the ongoing challenging backdrop”.

Contract fees are now 84% of the total and they fell 2% year-on-year.

Contractor order book down 1%; it provides “sector-leading visibility with the equivalent of c. 4 months of net fees”.

Net cash is up year-on-year to £97m. The strong balance sheet has been one of the big attractions here for years.

CEO comment:

"Once again, we have delivered a good performance against a strong comparative and within a market environment that remains difficult from a new business perspective. Whilst the sentiment we are reporting is much the same as the prior period, the strength of our Contract extensions continues to be a particular highlight, demonstrating our clients' need to retain critical STEM skills and flexible talent.

Regions and countries - net fees were down across Europe except for the Netherlands which saw continued strong demand for Engineering and Technology talent.

Japan did very well but from a low base:

Demand for Life Sciences has been on the decline ever since the Covid boom, and Technology has also been softening, with the result the Engineering is now responsible for a much bigger slice of the pie:

Graham’s view

At the end of the day, this is an “in line with expectations” update so few people are likely to have any reason to change their view on this stock today.

The weakness in the core “Technology” segment is a slight concern but over the long-term I’d feel more comfortable in this area of recruitment (focused on software development and Salesforce) than I would with recruiters in many other areas.

Valuation remains modest (and remember that the PE Ratio doesn’t adjust for cash on the balance sheet):

And it has an extraordinary StockRank of 98:

With Permanent Recruitment now only responsible for 16% of SThree’s net fees, the ongoing decline of that category will be less and less relevant to SThree’s future results.

So I’m still positive here and wondering if the share price can get back to the highs seen last year?

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 776.9p (-3%)

Market cap: £444m

This stock made it onto my 2024 best ideas list despite already generating a return of 60% in 2023. It was a strong contender for banking gains and moving on, but I decided to stick with it for a while longer. Let’s see how it’s going to repay my loyalty!

Results for 2023 aren’t good against the prior year: as we all know, 2023 was a tough year in the mortgage market.

Revenue +4% to £240m (organic revenue down 4%).

Adjusted PBT down 15% to £23m

Actual PBT down 7% to £16m

The total value of the mortgages (including transfers) they helped to complete fell by 8%. The number of advisors in the MAB network fell by 4% (to 2,158).

Dividend is unchanged at 14.7p.

You could be forgiven for asking why I’ve made such a fuss about this share, given the weak year-on-year performance.

One key reason is that if this is what the company can do in a really really bad year, then I’m still excited to see what they can do in a good year!

House purchase lending fell 23% in 2023; in that context, I think MAB’s performance was very good!

They estimate that their market share of new mortgage lending improved from 7.5% to 8.3%.

Refinancing work became more important in 2023 and accounted for 35% of revenues (2022: 32%).

Profitability was hit by rising administrative expenses which reflect “the planned further investment in the Group’s growth strategy”.

CEO comment:

Against a very challenging backdrop in 2023, MAB continued its exceptional track record of outperformance and market share growth in all market conditions…

He also covers the outlook but let’s go straight to the outlook section for that.

Current trading is in line with expectations:

Following the modest improvement in trading towards the end of last year, we have seen a very positive start to 2024 across both purchase and re-financing, including a long-awaited recovery in Buy-to-Let activity… mortgage rates have reduced notably, the availability of mortgage products has increased, and mortgage underwriting criteria are starting to signal a more positive outlook.

Although we expect it will be the second half before we see organic adviser growth recommence, our AR firms are eager to resume their growth plans and are preparing to do so now…

Graham’s view

Perhaps I’m too easily persuaded, but I agree with MAB when they say:

It is very rare to see such a severe downturn in UK purchase related mortgages as the one we have experienced, and it significantly affected what would otherwise have been an incredibly strong year for MAB. This was clearly a setback for the business but only one of timing.

That being the case - 2023 being an unusually bad year for mortgage lending - I’m excited to see what MAB can do this year, especially in H2, and then in 2025.

I also remain very interested to see Fluent Money succeed. This was bought for £72m so it’s important to get value from this deal, but the timing of the acquisition could not have been any worse (mid-2022).

MAB shares are not cheap but I would expect growth to pick again sooner or later. They do say “we do not see normal growth in organic adviser numbers resuming until 2025”, so some patience is likely to be required.

Therefore, while I do still believe in the long-term future of this company, and I give it the green light, I could also understand if the share price drifted until the business rediscovers its underlying momentum.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.