Q&A with Neil Woodford, at the LVIC, 20 May 2015

They saved the best until last at LVIC this year, with Neil Woodford ("NW") , the star fund manager doing a Q&A session with the day's host, David Shapiro, which ran for about an hour from 5:30 to 6:30pm. I took detailed notes, so below is close to verbatim. I hope this is useful & interesting, for people who were not able to attend the event in person.

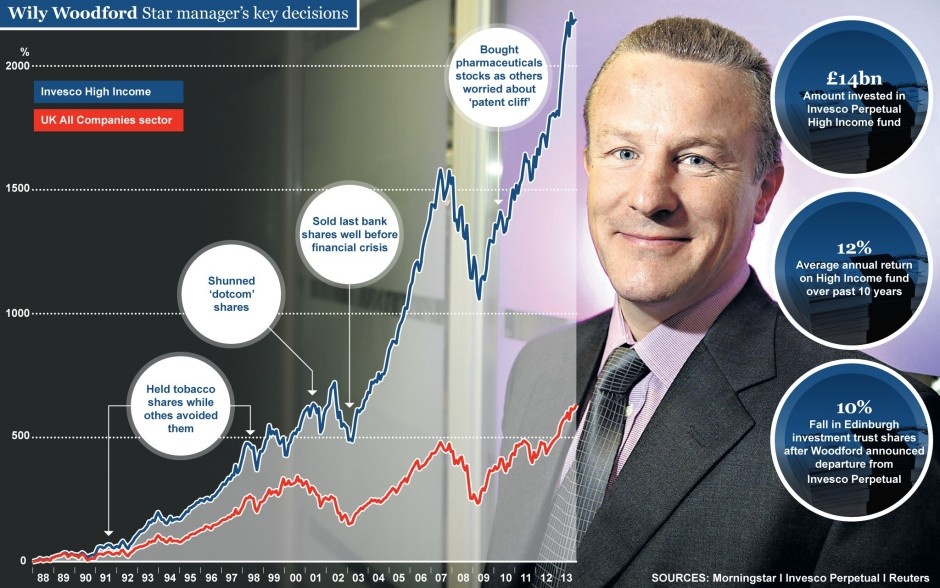

Woodford spent 25 years at Invesco Perpetual, taking it from a small boutique fund manager, to a big company. In 2014 he set up on his own firm, Woodford Inv Mgt, and has been highly successful raising funds, with a fresh approach including lower fees, and complete transparency (fund holdings are published in full).

(image courtesy of telegraph.co.uk)

Unfortunately David Shapiro ("DS") got a little carried away with his introduction, and it went on, and on, and on, with audience members and Woodford himself starting to look a little nonplussed! We're here to listen to Woodford, not you! I could hear myself think. Eventually Shapiro stopped talking, and Woodford paused for a moment, then quipped, "You want me to wade in?!"

Woodford said that he'd had a couple of jobs in fund management prior to Invesco, in the 1980s, but "wanted to run money myself, not by committee - that doesn't deliver what the clients want". "I wanted to be held accountable, and be recognised".

DS: What changed (at Perpetual)? (i.e. why was he happier at Invesco & stayed there 25 years)?

NW: The early 90's Budgets opened up the market for funds - tax changes. We started with just £14m in the Invesco High Income Fund in 1988. When I left it was £13bn! That wasn't all capital growth though! {chuckles from audience}. I learned a huge amount - you never stop learning.

DS: Did you enjoy things less once Invesco had become a big company?

NW: Yes. Fund management works best as a cottage industry. I mean active fund management anyway. A small, team-based infrastructure is best. Over time, the scale of Invesco Perpetual became displeasing.

DS: Did the asset base get too large at Invesco for decent returns?

NW: No. A large asset base is NOT an impediment to good absolute returns.

DS: Did you challenge the high fee structure over the last 25 years, when you were at Perpetual?

NW: As a fund manager working for someone else, you can't control these things. The great thing about setting up my own fund mgt company is that I can structure it to best suit the clients - low costs - no legacy issues - open and transparent.

Not having layers of compliance stopping us from communicating with clients how we want to.

DS: Talking of which, do you feel you left problems behind when you left Perpetual? They were hit with an £18.6m fine after you left! Did someone mess up on your watch?

NW: {looking somewhat taken aback. Paused} Ummm... {awkward laughter} The FCA's report is a good read! It explains what went wrong. I don't want to go into the process, at a public forum like this.

DS: Would you do anything differently?

NW: The problems were about reporting. We hadn't communicated what was happening in the portfolio. What I learned is that we need to be industry-leading in our compliance. So we don't use derivatives now. We have strong compliance. I feel safe and comfortable now.

DS: You do things differently. Not just bottom up, you get the big sector calls right too. How?

NW: I did a degree in economics, but I left Uni knowing nothing about economics! Just a lot of complex mathematical stuff, which I hated! I learned how economies work from fund management.

All businesses are affected by macro factors - be it growth, taxation, forex, trade, etc. These macro factors are all important in helping me form a view on medium & long term prospects. I have no idea on the short term. You then marry your macro analysis with the stock specifics.

Bottom up stock analysis is only looking at half the picture. You have to combine it with a macro view.

DS: Are you still bearish on the UK economy? Did you miss the big upward move in the housebuilding sector as a result of your macro views?

NW: Everyone has sins of omission. You can't catch every move. I set out to deliver absolute returns, and I try to build a portfolio that does the job.

It's impossible to pursue the perfect portfolio - but you'll never achieve it.

DS: What is the extra ingredient that you bring to things?

NW: I don't worry about what other people do. Portfolio construction is not science, or even pseudo-science. A lot of people hide behind science. It's more heart than judgement. You're trying to assess the FUTURE. You can't be scientific about that!

However, the past is a really helpful guide to your view of the future.

Valuation is key. You've got to buy at the right price.

Companies, management, the economy - these can all change.

If you do the work, you can make an informed judgement.

We base our expectations on the median outcome for a company - i.e. not the bull case or the bear case.

DS: How do you value early stage companies for your new £800m fund?

NW: On the same basis as more mature companies, but we flex the assumptions. You can value pre-revenue companies. But first you have to be sure that the technology will actually work. Then you can project forwards.

There's more uncertainty with early stage companies. So we flex the uncertainties, we build a model, then risk adjust it. So we might use a 20-25% discount rate, halve the size of the addressable market, etc.

We get very, very close to businesses we invest in. I've learned skills over the years, to make the process better.

DS: Are you competing with Private Equity?

NW: No. PE usually fund established businesses. We're not doing that.

Innovation in the UK has been terrible at being commercialised. Probably ARM is the only UK company that's scaled up. Yet we (the UK) lead the world in Universities, Nobel prizes, science & innovation, but we're absolutely rubbish at commercialising this science. This is very much due to the absence of early stage, patient capital.

Therefore the opportunity for our new fund, is that we can invest in unbelievably good technology, at very low prices.

DS: Is an open-ended fund structure better, or closed-ended?

NW: We do both. I've done open-ended for 10 years. The Regulator allows 10% in illiquid investments, in open ended funds. I've gone up to 4-7% ish. Closed ended is the best structure.

DS: You withstood the tech boom in 1998 to 2000, which must have been difficult. With Tesco, you sold Warren Buffett a pup! How do you withstand a bad patch?

NW: You have to accept periods of under-performance. If you can't weather them, then get out of the kitchen! The pressure mounts. You need investment anchors - discipline and an approach which stands the test of time. Trust your discipline. That got me through the tech bubble, when everyone else seemed to have embraced it.

That was an incredibly difficult time for me. Tony Dye (aka Dr Doom, a fund manager who warned in the late 1990s that stocks were over-valued and due a correction - article here) did lose his job. At the time, the Lex column got it right - they said he may be right, but it's too late to save his job.

If you don't have discipline, then you capitulate at the worst possible time. That was an incredibly draining time for me, but I've gained strength from it.

Turning to Tesco (which Woodford sold his fund's shares to Warren Buffett, before the big drop), I didn't realise the full extent of what was going wrong. It had already become a drag on our performance. I became less confident in how Tesco was deploying fresh capital - they were doing things I thought of as "flag planters". I saw poor returns on incremental capex.

However, we didn't foresee the rise of the discounters (Aldi, Lidl).

After listening to a 30 min conference call with the CEO, I thought to myself, Tesco's problems are structural, not cyclical. So we sold £700m Tesco shares in a week! I can move quickly when I need to, despite being a long-term, patient investor. We didn't know at the time that Warren Buffett was the buyer.

At this point David Shapiro joked that the difficult questions were over now, and he would throw Neil over to the audience for questions. I will number these, as the identity of all the questioners is not known to me.

Q1: Does the UK trade deficit worry you?

NW: I do worry about UK structural headwinds, yes. Recent growth in the UK economy has not come from exports or financial services. The quality of UK growth is very poor. It's the worst trade balance in 30 years.

In the recent General Election, we heard lots of propaganda about the economy. But in my view the growth targets, and deficit reduction targets, are unrealistic. We're repeating the mistakes of the past.

I'm hopeful for the UK's medium and long term prospects, if we can nurture and scale technology companies, but that's some way off. I worry about what's driving UK growth.

Q2: Why is Verseon (LON:VSN) listing on AIM, when it's an American company, and how can you have confidence in it? (this is a recent IPO in which Woodford has taken a 10.5% holding)

NW: We think it fits our criteria to grow, and be disruptive. We make a judgement based on experience. The company has been going for 10 years already, so it's further through the technology risk stage than people perhaps realise - it's already jumped hurdles. We're very excited about it.

Why AIM? Management are scarred from a previous experience listing on NASDAQ, with a previous venture. The listing requirements are less on AIM, and the intention is to quickly move to a full listing.

Q3. One of your holdings, Utilitywise (LON:UTW) has had questions raised about its accounts. What is your view?

NW: There was one research note in particular which questioned their accounts. Quindell and HelpHire were cited as warnings in that research note, by this analyst.

We've done extensive due diligence on Utilitywise, and are completely satisfied with their accountancy, cashflows, and the future outlook.

We're extremely relaxed. The valuation is ludicrous. We think the analysis was inaccurate - not malicious, but just poor. We've used recent weakness to buy a lot more.

Q3 (follow up): who checks these things?

NW: Saku (Sasha) and Paul (Lamacraft) focus on early stage businesses, whereas Stephen (Lamacraft) and I look at FTSE 350 stuff, and international. Utilitywise falls between the two, so we've all looked at it together, and we've met the company.

We work very closely as a team. Three guys work for me, have delegated responsibility to a team of researchers. I pull the trigger.

Q4: Fees - what is reasonable?

NW: The financial services industry has been guilty of over-charging in the past.

What offends me the most, are high fees for closet index trackers. What is the solution to that? Should it be outlawed by regulators? No. The answer is more transparency. Investors will vote with their feet (as they have with Tesco!). That process is underway, but is slower than expected.

People are happy with our fees at Woodford Inv Mgt, but it's not the main reason they choose us. The whole industry needs to change - it embarrasses and offends me.

We out-sourced all of our back office, and IT. So we've variabalised (good word!) our fixed costs - and we pass on the savings to our clients.

People have a right to know what we're doing with their money!

Dull, and late reports to clients are just not good enough!

We publicise our portfolio on a monthly basis. Not everyone internally was in favour of this!

We also use social media to communicate with clients.

Q5: What do you look for in management, at early stage companies?

NW: Early stage skills may not be the right skills for commercialisation of the technology. We work with management to get them to understand this. The best entrepreneurs understand that their skills will only take the business so far.

Founders can be control freaks! Sometimes you have to wait for them to run out of money, to implement the changes that are needed.

We are in genuine partnership with founders. Our job is to remove the headache of inadequate capital for them.

That concluded the Q&A session, so David Shapiro thanked Neil Woodford, and we retired for drinks & networking.

My opinion - Woodford really is a class act, and someone I will definitely be following more closely, now I've heard from the horses mouth what his approach is. I've bolded above the parts that were key points for me, so no reason to repeat that.

I hope you found this report useful & interesting.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.