Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

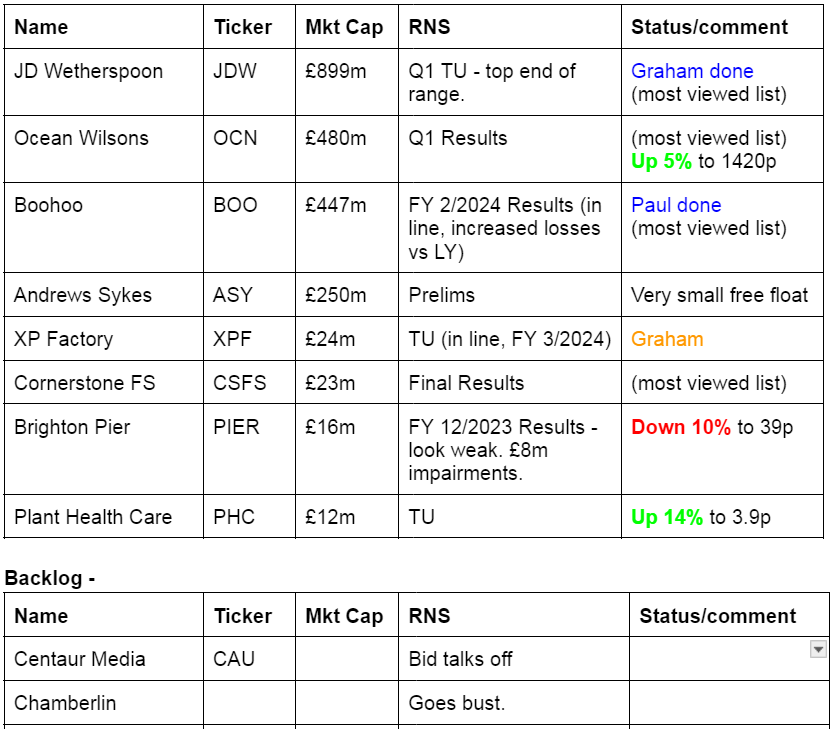

Companies Reporting

Other mid-morning movers (with news)

Mobile Tornado (LON:MBT) - up 42% to 1.35p (£6m) - Contract win in M.East - Paul - RED

Says that it has won a competitive tender process for specialist communications services. Reckons its software is better than the competition. No indications given as to the scale of this contract.

“This contract, in a key target market, is a testament to the changes we made early last year and the Board looks forward to increasing sales momentum as 2024 develops."

Paul’s view - I checked last H1 results to see if this is a possible turnaround? Mostly recurring revenues (good) but only c.£2.5m pa. Close to breakeven. BUT - huge issue - it’s got an insolvent balance sheet, with £10.5m of “borrowings” from 58% shareholder InTechnology. Therefore I see the equity as uninvestable until it sorts out the balance sheet, with a much-needed equity raise (or maybe a debt for equity swap?).

Light Science Technologies Holdings (LON:LST) - up 10% to 2.7p (£9m) - Final Results FY 11/2023 - Paul - AMBER/RED

Improved trading, and cost-cutting, reduces its loss before tax by 58% to £(1.1)m.

Outlook comments seem over-the-top. Cash looks tight, and NTAV c. zero. Almost doubled share count in a fundraise in April 2023 at just 1p/share. Probably won’t be the last fundraise in my view. I can’t see any evidence of a viable business here yet.

Oxford Cannabinoid Technologies Holdings (LON:OCTP) - down 66% to 0.12p (£2m) - Intended Cancellation of Listing - Paul - GREY (delisting)

This one only listed in May 2021. Says that the listing no longer helps it raise funds or develop its drug programmes. Says that it has “no near term cash flow concerns, and remains debt-free”.

I agree completely with this bit below - the stock market is no place for early stage, zero revenues, multi-year cash burning drug development companies -

"The UK capital markets are facing particularly challenging times and many biopharma businesses like ours are re-evaluating whether it is the right home for them. We believe that the market is significantly undervaluing OCT. This has a negative impact on our ability to raise the capital necessary to drive our programmes at a price that the Board believes would be acceptable noting the current market capitalisation.

Alliance Pharma (LON:APH) - down 10% to 28.8p (£155m) - Delayed Accounts - Paul - RED

Audit delays means it’s not ready to publish FY 12/2023 accounts today as planned (AIM companies have 6 months). This is the second time audited accounts have been delayed, but no explanation as to why, what are the audit problems? It keeps repeating this line -

Alliance reiterates that the details provided in the full year trading update on 29 January 2024 remain accurate.

CEO Peter Butterfield is stepping down, with a new CEO starting shortly, 13 May 2024.

Paul’s view - late accounts, and the CEO stepping down, is bound to spook investors. The forward PER is only 7, but one look at the last balance sheet shows a horribly negative NTAV, and way too much bank debt of c.£120m gross. This is expensive, costing about £6m in finance costs in H1. There was a CMA investigation mentioned in H1 results. Also 38% of shareholders voted against the interim dividend, preferring reinvestment in the business (and presumably debt reduction).

For the time being I think APH looks too problematic. I think it over-expanded using too much debt, and hence looks quite high risk to me. I wonder if the audit delays might be over going concern testing? That would be my guess.

Summaries of main sections

J D Wetherspoon (LON:JDW) - up 3% to 752p (£929m) - Trading Update - Graham - AMBER

It’s a positive update with profits for FY July 2024 expected “towards the top end of expectations”. I’m intrigued by the realisation that the company bought back £34m of stock in H1 for cancellation, and the suggestion that it made £271m of free cash flow last year. Will need to keep an eye on developments here.

Boohoo (LON:BOO) - down 4% to 33.9p (£429m) - FY 2/2024 Results - Paul - AMBER

Poor results, with a move into losses, even on an adjusted basis. Balance sheet relies on a fully drawn £325m borrowing facility, which seems odd considering it also held £230m in gross cash. Cashflow was poor in FY 2/2024. There are some positives in the outlook though, with cost-cutting and warehouse automation underway. So I don't see it as a basket case. Chinese competition now means it's very difficult to make any profit, so not a sector that appeals to me any more.

Paul’s Section:

Boohoo (LON:BOO)

Down 4% to 33.9p (£429m) - FY 2/2024 Results - Paul - AMBER

This share doesn’t really interest me these days, because it doesn’t make profits any more. That is because Chinese competition (particularly Shein) has undercut it on price, selling direct to consumers. All the other bear points on BOO were irrelevant as it turns out (ESG, etc), it’s Chinese competition that is the crux of why profits have collapsed, and hardly anyone spotted that when it began.

Can BOO get those profits back, is the key question? Personally I doubt it, but with many smaller competitors disappearing, maybe online fast fashion might end up a concentrated market, served by Shein, Boohoo, and maybe a few others?

Some key numbers for FY 2/2024 -

Revenue down 17% to £1,461m

Gross margin up from 50.6% to 51.8%

Adj EBITDA is not a reliable profit measure, but it’s down 7% to £58.6m

Adj PBT is a loss of £(31.0)m, much worse than £(1.6)m in FY 2/2023.

Statutory PBT is much larger at £(159.9)m, so very large adjustments of £103m, as usual in this sector.

There’s no way a positive spin can be put on these figures, they’re poor.

Share based payment charges are excessive, given that BOO is no longer profitable, at £17.5m in FY 2/2024, and £32.0m in the prior year. I don’t think management or staff should be given cheap or free shares when the business is loss-making.

Another concern is a big deterioration in net cash/debt, which was £5.9m net cash last year, and £95m net bank debt at FY 2/2024. Obviously growing debt at that pace is not sustainable, and we need to check the covenants on that debt. It says this increase in debt is due to capex and inventory growth. I would have expected inventories to fall, given that revenue is down 17%.

During the prior year the group secured a new £325 million rolling capital facility, increasing from the previous £100 million facility. The facility remains fully drawn at the end of February 2024.

Encouraging comments in the outlook -

Improving trend of revenue declines - is it approaching the bottom of this cycle, I wonder? -

I am particularly encouraged with the ongoing trend of improved performance in our core brands which saw GMV down 9% in H124 and down just 4% in H224 demonstrating increasing momentum and validating our strategy to focus on these brands which are much loved by our customer base…

The group is now well positioned to return to growth, and we are focused on ensuring that growth is both sustainable and profitable.

Balance sheet - NAV is £280m, less intangibles of £104m, giving NTAV of £176m.

The one item I’m not happy with is the gross borrowings of £325m, this seems too much. Why does it need this level of borrowings, when it had £230m in gross cash?

I need to see average daily net debt, which I suspect might be a good bit worse than the year end snapshot.

Cashflow statement - net cashflow from operating activities has dried up, £137m last year, only £2m this time FY 2/2024. Subtracting all the other costs (eg lease payments, capex, £32m capitalised development spending, £15m shares purchased for the EBT, etc), and the total cash reduction in the year is £(101)m. That is not good.

Paul’s opinion - poor figures, and if these trends worsen, then BOO could be in trouble. Although I think the actions they’re taking to improve performance, and stem the cash outflows, seem sensible.

We might end up with a business operating at about cash breakeven, but I don’t think there’s much realistic chance of a return to big profits.

How to value this share? The current market cap of £429m looks about right to me, so I’ll go with AMBER.

The sector has completely changed since the days of £4-5bn market caps for Asos, Boohoo, and THG. None of them make any profits now, and Boohoo was the only one that was consistently profitable in the good times. It’s probably dawned on all of us that this sector is just a lousy place to do business now that the Chinese are cutting out the middlemen. Intriguing potential upside if Western Govts ban Shein and others from selling direct to consumers, but how likely is that?

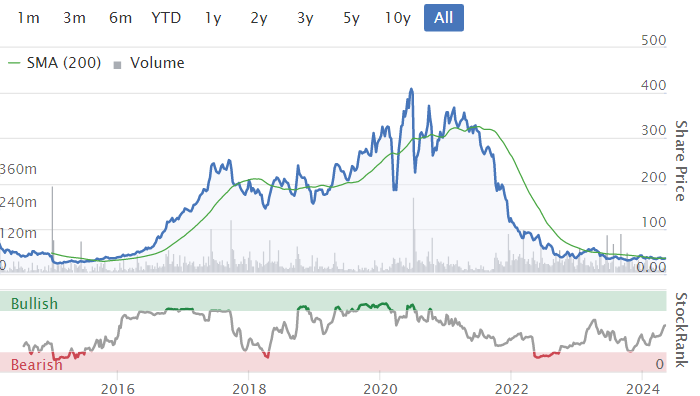

Things have completely changed in recent years, with profits and growth collapsing -

Graham’s Section:

J D Wetherspoon (LON:JDW)

Up 3% to 752p (£929m) - Trading Update - Graham - AMBER

This is an update for the “13-week period to 28 April 2024”, i.e. for the Q3 period. JDW’s financial year ends at the end of July.

The company is trading well and the bottom line is that profits for FY July 2024 are expected “towards the top end of market expectations”.

Headline growth number: like-for-like Q3 sales are up 5.2% year-on-year..

Adjusting the calculation to exclude a bank holiday which occurred in Q3 last year, but not in Q3 this year, the company calculates that the like-for-like sales growth was 6.0% - this is definitely the best measure of sales performance, in my opinion.

The interim results (to January) showed LfL sales growth of 9.9%, so Q3’s growth hasn’t quite matched that performance.

Property - exited 18 pubs and opened two new ones. The 18 disposals resulted in a cash boost of nearly £7m.

17 more pubs are on the market/under offer, representing just 2% of the estate (809 total pubs).

Net debt of £685m, down from £694m at the interim results.

Checking the most recent interims to better understand the financial profile, I see that this net debt figure only relates to bank debt: JDW also has lease liabilities of c. £418m.

71% of pubs are freehold.

So in summary: JDW does own most of its pubs, but it also has very significant bank borrowings on top of the lease liabilities for those pubs it doesn’t own.

Outlook statement provides lots of colour, e.g.:

"Traditional ales, which were very slow in the aftermath of the lockdowns, are increasing momentum, with Abbot Ale, Ruddles Bitter and Doom Bar showing good growth, as indeed are ales from the many small and micro brewers with which we trade.

"Also selling well among younger generations are Au Vodka from Swansea and XIX flavoured vodkas, the latter promoted by the hugely popular Sidemen.

"Wine has been on the comeback trail, with Villa Maria Sauvignon Blanc, from New Zealand, popular among Wetherspoon representatives of the chattering classes.

Graham’s view

Paul has been consistently “AMBER” on this for a while, on valuation grounds, and I’m inclined to agree.

The shares have had a great recovery run over the past eighteen months, although they do still trade below pre-Covid levels:

On simple earnings multiples, they are not obviously cheap:

No dividends have been paid since 2019, although I note that the company (with very little fanfare) bought back £34m of its own shares for cancellation in H1, equivalent to paying a 4.5% yield! A very interesting decision. The company argues that its free cash flow last year (FY July 2023) was £271m, but there is a lot to unpack in that calculation.

I’d be inclined to go AMBER/GREEN or GREEN if it was obvious to me that the company could afford to buy back a meaningful percentage of shares, or to start paying a regular dividend again. However, given the existing market cap (£900m+) and the debt pile, it seems to me that that stock is fully valued and that any regular dividend would offer only a modest yield. However, I’m open to changing my mind here if the free cash flow keeps flowing and if the quiet buybacks keep happening.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.