Good morning, just Paul today!

I'll leave it there for the day and the week. Have a lovely weekend, and don't miss my next thrilling podcast instalment this Sat or Sun :-)

Last call for Mello Chiswick, which is next week! The schedule of excellent speakers has gone live now. It's great for meeting & socialising with other investors too, and you get to meet management at Warpaint London (LON:W7L) - I think they deserve a beer or two from happy shareholders!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

List of Companies Reporting

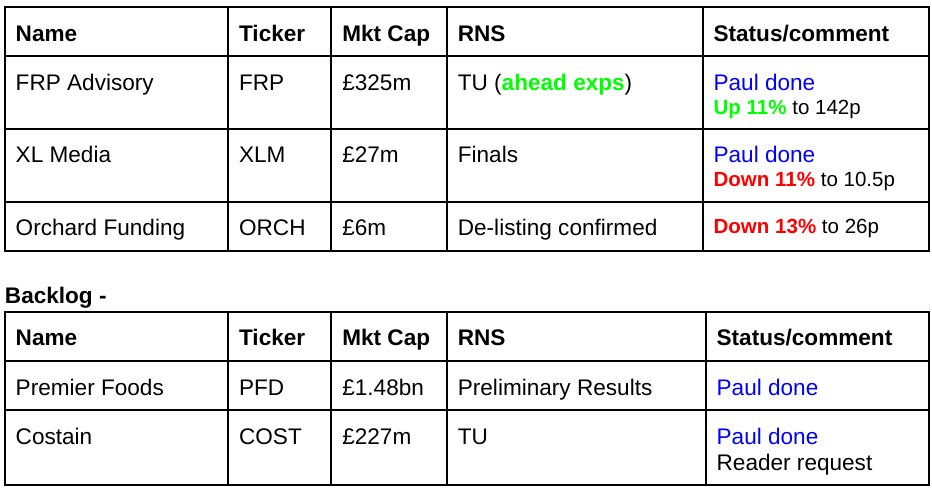

Slim pickings today, but I won't relax as sometimes the RNS plays tricks on us, and a load more announcements come through later! In any case, we've got mountains of backlog stuff to keep me busy, so there will be a full report up by 13:00 UK time.

Other mid-morning movers (with news)

Fireangel Safety Technology (LON:FA.) - up 35% to 5.75p (£11m) - Conditional approval of takeover - Paul - PINK (RED on fundamentals)

The takeover bid has been on hold for a while, awaiting UK national security clearance. Today this has been granted, subject to several conditions. The bidder says “ISE is considering the Approval Conditions in order to determine whether it considers them to be reasonably acceptable to it (as is specifically required in order for the NSIA Condition to be satisfied).” FA seems to have issued an identically-worded RNS itself.

Paul's view - As usual, due to the huge number of rule 8.3 and 8.5 announcements, it’s difficult to find the original takeover bid RNS. This seems to be it here from Oct 2023, where the price is a very generous 7.4p cash - I say generous, because FA’s performance has been utterly dire, and I would have valued its equity at zero personally. Given that it’s already been a long and tortuous process, the potential for this bid to fall through is probably significant (without inside information, we don’t know how much risk). So the upside is getting paid 7.4p in the bid happening. The downside risk if the bid falls through? It could easily be a zero I think, and the bidder could just buy the assets out of administration. With such unfavourable risk:reward, I’d say 5.0p bid price in the open market today looks an attractive lower risk option.

Summaries of Main Sections

Premier Foods (LON:PFD) - 170p (£1.48bn) - Preliminary Results FY 3/2024 - Paul - AMBER/GREEN

Decent results yesterday, beating expectations. I remain moderately positive on this foods manufacturer, despite a strong rise in share price it still looks reasonably priced. Especially as the pension deficit has now gone.

Frp Advisory (LON:FRP) - Up 12% to 143p (£364m) - Full Year Trading Update [FY 4/2024] - Paul - GREEN

Announces a good beat against market expectations for FY 4/2024. The outlook also sounds healthy, and all parts of this insolvency/advisory business seem to be doing well. Balance sheet is nice, with net cash. It has to be GREEN. BEG also worth a look, given the favourable backdrop for this sector.

XLMedia (LON:XLM) - down 11% to 10.5p (£27m) - Final Results - Paul - AMBER

FY 12/2023 results are only of passing interest, since a large disposal was done post year end (see SCVR 21/3/2024). I dislike this sector (digital marketing for gambling companies) because profits can evaporate so easily when the advertising algorithms change, outside XLM's control. At least the balance sheet worries have now been sorted, so I can just be neutral overall at AMBER.

Costain (LON:COST) - 81p (£227m) - AGM Trading Update - Paul - GREEN

An in line update yesterday. It's better than I thought, so thanks to the reader who persuaded me to circle back to it today! Very good cash position, and improving margins mean this looks to be headed for useful increases in EPS. Still looks cheap, providing nothing goes wrong, even after strong recent gains.

Paul’s Section:

Premier Foods (LON:PFD)

170p (£1.48bn) - Preliminary Results FY 3/2024 - Paul - AMBER/GREEN

It’s been another busy week here, where we couldn’t cover every company reporting. So as you know, we have to prioritise, and we follow what you’re most looking at (using the “most viewed” widget on the home page), then we focus mostly on ahead of expectations updates, and companies where we think there’s potential upside in the share price, and large % daily movers. PFD slipped through the net yesterday, and befuddled by the 1-hour time difference here in Gozo, I got up too early today, so let’s make use of the time!

PFD is a large food manufacturer, with well-known brands, such as Mr Kipling. I did a quick review on 6/3/2024 and concluded positively at AMBER/GREEN, based on a reasonable valuation, good performance, rising forecasts, decent profit margins for the sector, and best of all - the ending of pension scheme deficit payments in 3/2025, which opens to the door to more generous divis.

Results 3/2024 -

“Full year ahead of expectations and return to volume growth in Q4”

Revenue up 15% to £1,123m

Adj PBT up the same, +15% to £158m

Adj EPS up 6.4% to 13.7p (PER 12.4x)

Net debt down £39m to £236m incl leases, and £223m excl leases, with “lowest ever” gearing of 1.2x EBITDA

Pension deficit cash payments suspended from 1/4/2024.

“On track” for FY 3/2025 expectations.

That all looks pretty good to me. I like the very good 14.1% PBT margin, demonstrating its brands have good pricing power.

Pensions - important to note that these are still giant schemes. Total assets now £3.57n, and liabilities £2.96bn. Both numbers can move around a lot, but this is still a large accounting surplus of £602m. In the past I’ve always focused on the actuarial deficits of pension schemes, because that’s what determines the cashflows. Although as pointed out by I think it was davidjhill here recently in an excellent reader comment, higher interest rates have changed everything, so that the actuarial and accounting deficits in pensions schemes are tending to converge. That’s such a good point, and it means that deficit recovery payments are sometimes reducing or even stopping. Therefore shares which traditionally had pension scheme problems are now becoming investing opportunities in some cases, as the cash payments into the schemes stop. Might this be good news for other companies, e.g. Reach (LON:RCH) , Renold (LON:RNO) , and Norcros (LON:NXR) spring to mind. Note that Wincanton saw an end to its pension contributions, and shortly afterwards received a takeover bid approach. So this is certainly a very interesting area to investigate for possible bargains, although pension scheme accounting is certainly not simple. Also unexpected events could cause deficits to potentially resurface, eg if Govts find they cannot cope with higher interest rates, and fall back on QE and free money again. We’ve got to consider all potential risks, and huge pension schemes still worry me, even if they are in an accounting surplus.

Dividend - only a final is paid, no interim. 1.728p is far from generous, at a yield of only 1.0%, so with pension payments stopped, there must be scope to increase this?

Balance sheet - is large & complicated. NAV is £1,327m. To make sense of it, I will eliminate several lines: £992m intangible assets, £810m pension asset, £(209)m pension liabilities, and £(153)m deferred tax. Getting rid of those strips it back to what I see as the core balance sheet, at NTAV of £(113)m - not great, but also not a deal-breaker for a business that is strongly profitable & cash generative. So it gets a cautious thumbs up from me, although I’d like to see borrowings continue to reduce. Lease liabilities are very small, so I suspect it must own a fair bit of freehold property. Note 11 to the 2023 Annual Report shows £55m in land & buildings, which seems to be at depreciated cost, rather than valuation - so a good question to ask management is to reveal the market value of that property?

Cashflow statement - looks healthy. It’s a genuine cash generator, and note it spends some of that on capex (not huge at £25m) and is making a series of small acquisitions (self-funded without equity raises). The cash generation would enable the dividends to quadruple - so dividend paying capacity here is much larger than the 1% existing yield.

Paul’s opinion - I’ve got to move on now, but this all looks good to me. Despite a very strong share price recovery, PFD still looks reasonable value to me. I like it. AMBER/GREEN is maybe a bit too stingy, but this type of business probably wouldn’t command a premium PER, so taken with the debt of c.20% of the market cap, maybe the current valuation is in the right ballpark? So I’ll stick with a moderately positive view, AMBER/GREEN.

Note that Asian Nissin Foods owns 24%. Bid potential? It looks too small, but could be part of a larger group maybe - worth investigating.

Stockopedia likes it too, with a StockRank of 97 -

Frp Advisory (LON:FRP)

Up 12% to 143p (£364m) - Full Year Trading Update [FY 4/2024] - Paul - GREEN

FRP Advisory Group plc, a leading national specialist business advisory firm, announces a trading update for its full year ended 30 April 2024 ("FY 2024").

Double digit revenue and profit growth ahead of expectations; confident for the year ahead

Excellent trading performance ahead of expectations

FY 4/2024 revenue expected to be £128m, up a striking 23%

Pity they use EBITDA as a profit benchmark - but I can forgive that, as it’s a substantial beat of £5m, 16% above market forecast -

adjusted underlying EBITDA* of £37 million, up 37% on the prior year (FY 2023: £27 million), both exceeding current market consensus**.

** Current consensus FY 2024 market expectations for revenue and adjusted EBITDA of £123 million and £32 million respectively.

Outlook is positive -

Activity levels across all our locations and pillars are encouraging. As a result, we start our new financial year with confidence of making further positive progress."

General market comments are quite interesting - just confirming what we already knew -

- Tough year for many companies due to “increases in interest rates, inflationary pressure, higher costs of living and general market confidence.”

- Company administrations rose by 22%.

- Sectors - construction & retail highlighted as suffering the most.

- Difficult raising finance, as banks tighten lending criteria.

- More positive signs are appearing, but cost base and financing will remain difficult for some.

Back to FRP -

FRP’s restructuring (ie insolvency) division has grown market share from 14% to 16%.

Other divisions also busy.

Acquisitions - 2 done in the year, 1 post year-end, and more in the pipeline.

Cash collection improved in H2.

Net cash £29.7m at 30/4/2024 (up from £22.9m a year earlier) - looks healthy to me.

(I've checked the last balance sheet at 31/10/2023, and it’s good, with NTAV of £53m - no issues here)

Headcount increased 19%

Forecasts - Cavendish (many thanks) issues revised numbers this morning. FY 4/2024 is now 10.0p, (PER of 12.8x at yesterday’s closing price), and it’s only pencilled in 10.3p for FY 4/2025, which I suggest looks too modest, given the upbeat tone and increased number of administrations and restructurings.

Paul’s opinion - looks nice, I would expect a 10-20% share price rise (I've not looked yet!), although these insolvency firms don’t tend to attract particularly high valuations. Begbies Traynor (LON:BEG) is the other one, which might be worth taking a look at too.

FRP is a good business I think, and it seems to manage the conflict between partners and outside shareholders well.

You get a c.4% dividend yield, which is OK. Even though the economy looks set to gradually improve, insolvency firms tend to have rich pickings for several years into a recovering economy, as often it’s the working capital strain of a recovery that finishes off financially precarious businesses. Plus of course higher interest rates is likely to have an ongoing impact, as banks can’t just roll over problem loans if interest payments are not being met, as was previously possible in the 0% interest rate era.

For these reasons, I think we have to be GREEN on both FRP and BEG.

XLMedia (LON:XLM)

Down 11% to 10.5p (£27m) - Final Results - Paul - AMBER

XLMedia (AIM: XLM), a sports and gaming digital media company, announces audited results for the year ended 31 December 2023 ("FY 2023").

Underlying trading was around breakeven, which turns into a massive statutory loss due to a $44m impairment charge.

The 2023 numbers are academic now, since a large disposal deal was done post year-end, which I reported on here on 21/3/2024. This sorted out the previously weak balance sheet, and XLM said it would look at distributing some surplus cash to shareholders.

Certainly the 31/12/2023 balance sheet was uninvestable, due to obviously stretched creditors, eg for deferred consideration, taxes, etc.

Outlook doesn't excite much (as it only mentions unreliable EBITDA which often doesn't turn into real profits or cashflows), and there’s a considerable wait for any (unknown size) shareholder return from the recent disposal -

Although to be fair, Cavendish helps us out with forecasts today, saying adj PBT should be $2.3m in FY 12/2024. So maybe the shares are priced about right currently?

Paul’s view - the substantial disposal shows there was some value in its gambling marketing websites. Although I think most of the proceeds is likely to be consumed with costs, and sorting out stretched creditors. What does that leave? A not very exciting, and very small business that’s having to cut costs, based in Tel Aviv. There must be simpler ways to make money, than trying to work out what’s likely to happen in future with XLM. Given the major improvement in balance sheet, my previous warnings are no longer needed, so I’m happy to remain at AMBER. This sector usually disappoints, as lucrative online marketing strategies often seem to have a short life cycle before they’re crushed by rule changes at Google, etc. That’s what has happened before both at XLM, and many similar type of companies, so I tend to avoid all of them, even though they usually look cheap on a PER basis (usually because the market has figured out that earnings are probably not sustainable).

The 10-year chart puts everything into perspective -

Costain (LON:COST)

81p (£227m) - AGM Trading Update - Paul - GREEN

Editors are supposed to make sense of this garbage -

“Costain helps to improve people's lives by creating connected, sustainable infrastructure that enables people and the planet to thrive. We shape, create and deliver pioneering solutions that transform the performance of the infrastructure ecosystem across the UK's transport, energy, water, and defence markets.

We are organised around our customers anticipating and solving their challenges and helping to improve performance. By bringing together our unique mix of construction, consulting and digital experts we engineer and deliver sustainable, efficient and practical solutions.”

If they’d included AI, platform, and diversity/inclusion, then we would have had a full house of current buzzwords!

Why couldn’t they just say: we build roads, water/sewers infrastructure, repair railways, and whatnot?

Looking back, we’ve been positive about Costain, mainly on valuation grounds, despite neither me or Graham really wanting to invest in the sector (low margin contractors) because they so often go wrong -

23/8/2023 - H1 results, Graham saw striking value at 51p/share, so was green.

10/1/2024 - In line TU for FY 12/2023, I also saw value at amber/green, and flagged the pension scheme as something to be aware of.

Trading in FY 12/2024 so far is in line with expectations -

Costain confirms that trading for the period is in line with Board expectations and the Group continues to have a high-quality forward work position that aligns with its strategic plans for both the Transportation and Natural Resources divisions.

Cash position - interesting disclosures here, and it’s great to see average cash becoming a (much needed) more widely reported measure. Clearly this is good news here -

“The average weekly net cash position from 1 January to 30 April 2024 was £168.8m (of which £60.4m was held in joint ventures). The average weekly net cash position for the same period last year was £122.9m (of which £57.2m was held in joint ventures).”

Splitting hairs a bit, but I wonder what they precisely mean by “average weekly cash”? It would be worth asking management if there’s a webinar. That could be the net cash figure on Friday nights, averaged over the period. Or it could be the average net cash figure throughout that week, which would really be an average daily cash balance. Does it matter? Well it might do. It depends on when supplier payment runs are done. For a made-up example, If customers pay COST on Mondays, and suppliers are paid on Fridays, then taking the Monday night cash figures and averaging them would show a much better picture than taking the Friday night net cash figures and averaging those.

Also, I presume the cash within JVs would not be available to COST to distribute to shareholders, so that leaves about £108m of the company’s own cash. Very good for a £227m market cap. We’ve debated before to what extent this cash is COST’s and potentially distributable? I think we should remember that it raised a lot of cash c.2020-21, when the share count more than doubled. I remember that, and the specific reason given at the time was to reassure customers, who demanded balance sheet strength from contractors. Although that was also during the pandemic, when such concerns would have been probably heightened, and maybe not quite so relevant now?

Another point to consider is that COST should be earning a healthy finance income from its cash pile, so it’s not being wasted sitting around doing nothing. If you adjust out the cash for valuation on an EV basis, then obviously EBITDA would lose the finance income from the cash pile.

Outlook - this margin improvement sounds very good, which combined with finance income on its cash balances, could point to nice earnings growth in 2025 -

The Group is in line to deliver its margin targets of an adjusted operating margin run-rate of 3.5% during the course of 2024 and 4.5% during the course of 2025. While the Board is mindful of the macro-economic backdrop, it remains confident in the Group's strategy and medium to long-term prospects.

Broker forecasts - looking at a Liberum note from March 2024, it has 12.3p for FY 12/2024, and 13.8p for FY 12/2025. It also says COST has stopped doing fixed price contracts (so presumably higher inflation no longer a threat), and has scope to do 20p EPS at its target earnings - which would possibly support a share price of say 140-200p in due course - nice upside from today's 81p if the upside case plays out as planned.

Paul’s opinion - it’s clearly too cheap, providing nothing goes wrong. I’m happy to leave the cash as it is, rather than adjusting for it in valuation terms. That gives you a cushion, and the tiny divis are a good indicator that the cash isn’t really free to be distributed. That said, the net current assets at 31/12/2023 was positive £92m, so actually the cash probably is at least partially surplus. Hmmm, this is looking more interesting.

It’s definitely GREEN anyway, I do like this, and my reservations about cash, divis and pension deficit are actually fairly minor compared with the striking value on offer. If the pension payments stop, as we were discussing earlier with PFD, then that could be another upside catalyst.

Very poor long-term, and the share count has more than doubled, but it strikes me that the problems seem to have been resolved - great StockRank now too -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.