Good morning from Paul & Graham!

Graham writes: For readers who are interested in Ramsdens Holdings (LON:RFX), I have a management call with them tomorrow morning. Instead of asking my own questions as I did last time, I'd like to ask the community here for any questions you might like me to put them. Please let me know in the comments. Thank you in advance!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

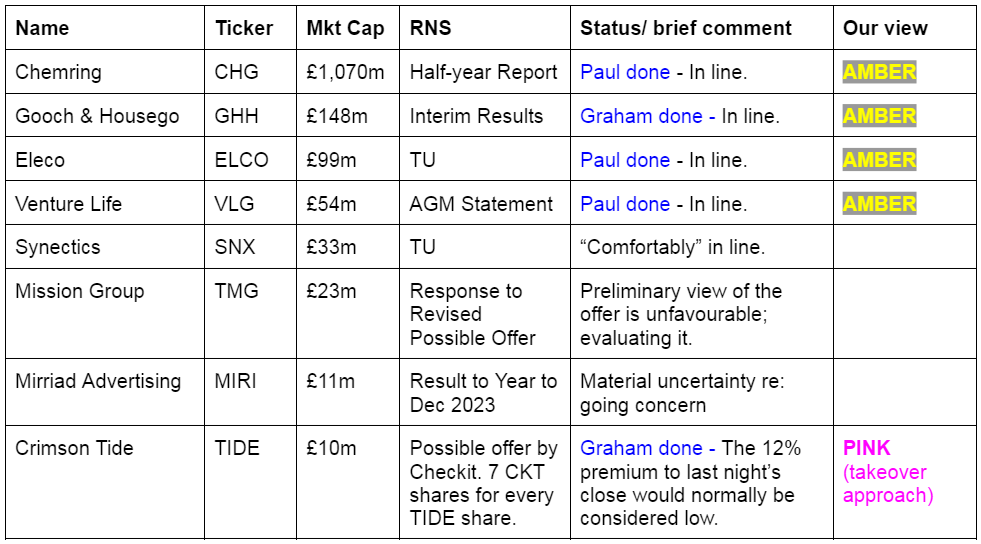

Checkit (LON:CKT) / Crimson Tide (LON:TIDE) - up 10% to 179p (£12m) - Possible offer for Crimson Tide - Graham - AMBER

An interesting suggestion from Checkit that they merge on an all-share basis with Crimson Tide. It does seem that the two companies may have potential synergies but the emphasis on stock market valuation multiples, liquidity and the investor base suggest to me that Checkit is at least partly motivated by possible future fundraising efforts. I agree with TIDE's Board decision to reject the proposal. It's now up to TIDE shareholders to have their say.

Gooch & Housego (LON:GHH) - down 4% to 550p (£142m) - Interim Results - Graham - AMBER

This photonics company posts weak-looking interim results but it's important to point out that full-year expectations are unchanged. The company continues to pay out dividends, despite net debt, even slightly increasing their interim dividend due to confidence in the medium-term outlook. For investors who share their confidence now could be a fine entry point. Personally I'd maintain caution after several years of lacklustre financial performance.

Chemring (LON:CHG) - 395p (£1.07bn) - Half Year Report - Paul - AMBER

Shares have shot up recently as the defence sector gets re-rated up. H1 figures are not brilliant, with profit down 10%, but a very large order book and positive outlook suggest a better H2. PER of almost 20x looks up with events to me. Balance sheet is surprisingly capital-intensive with particularly large fixed assets and inventories. Big shareholder returns funded from increased debt upsets me. Bright future considering European countries are now re-arming. Price now up with events I think.

Eleco (LON:ELCO) - 117p (£97m) - Q1 2023 [sic] Trading Update - Paul - AMBER

In line with expectations, which isn't enough for me, given how expensive the shares are now looking. It's a nice business, showing reasonable growth, and a high proportion of recurring revenues. My only quibble is with the valuation, that doesn't offer me good enough upside to want to get involved.

Venture Life (LON:VLG) - 41p (£52m) - Trading Update (AGM) - Paul - AMBER

In line with expectations update. I've never been keen on this share, but it's starting to look a bit more interesting now.

Paul’s Section:

Chemring (LON:CHG)

395p (£1.07bn) - Half Year Report - Paul - AMBER

Shares of this defence group have reached a new 5-year high.

The £1,041m order book certainly jumps out of the page at me.

Record order book, full year expectations unchanged, strong long-term prospects

H1 revenue is up 8% to £223m

Adj PBT £22.7m (down 10%)

Adj diluted EPS down 11% to 6.6p

Net debt has shot up to £75.3m (from £25.0m a year earlier) which it says is due to capex, but it has also been doing a big share buyback.

Outlook - aspiration to raise revenue to £1bn by 2030, about double forecast FY 10/2024, which includes assumptions about further bolt-on acquisitions.

The Board's expectations for 2024 are unchanged, with heavier H2 weighting of operating profit as previously communicated in February 2024. Approximately 93% (H1 2023: 90%) of expected H2 revenue was in the order book at 30 April 2024

Valuation - broker consensus is shown on the StockReport as 20.2p for FY 102/2024, giving a PER of 19.6x

Balance sheet - is surprisingly large, so this is quite a capital-intensive business.

NAV is £351m, and becomes NTAV of £226m after deducting the 3 types of intangible assets (mostly goodwill from acquisitions, but also includes £17.5m in capitalised development spend).

Fixed assets (property, plant & equipment) is very large at £261m.

Inventories seem excessive at £124m, so asking management why is a key question for any webinar or meeting.

Cashflow statement - H1 saw operating cash inflow (after tax) of £19.1m, which was more than all absorbed by heavy capex of £34.2m (a big increase on the £11.6m in H1 LY). It also spent a lot on shareholder returns, which surprises me, given that it generated negative free cashflow due to the heavy capex. £12.5m was paid out in divis in H1, and a large £29.7m spent on buybacks, funded by increased debt - not something I approve of. Buybacks should only be done from surplus cashflow in my view, not funded by debt.

Overall then I do have concerns over management strategy to fund shareholder returns from debt, whilst also spending heavily on capex.

Paul’s opinion - only a brief look, but I can see why the shares are doing well, given the large order intake and £1bn order book, giving nice visibility. Defence-related shares have been buoyant lately, due to the ongoing Ukraine war, and the well-publicised need for hollowed out militaries in Europe to be rebuilt.

That said, the H1 figures in isolation are not particularly good, with profit down, but the longer term trend looks good -

I’d say the price now looks up with events, and it needs an ahead of expectations trading update in future to propel it further, in my opinion.

So good company, but a PER of about 20x seems fully priced to me. We’ve seen a similar thing with my favourite defence sector pick, Cohort (LON:CHRT) which has moved up from a PER of about 12 to also about 20x. Therefore this looks like a big sector move where personally I’d probably be banking the profits, having made a nice and fast profit. So let’s go with AMBER.

Eleco (LON:ELCO)

117p (£97m) - Q1 2023 [sic] Trading Update - Paul - AMBER

There’s obviously a typo in the heading and the main body of the text, which says it’s a Q1 2023 update, which of course should say Q1 2024. This is sloppy, and to me indicates that there isn’t a proper review process for issuing correct RNSs. They don’t seem to have issued a replacement RNS correcting it either. What other financial controls are weak, I wonder?

Eleco is a niche software business, for the building industry. It’s always struck me as a nice enough business, with a decent track record, but a puzzlingly high valuation. Software businesses are often valued highly, particularly where they have good recurring revenues, which ELCO does. There are frequent takeovers too, so private equity and trade buyers are often happy to pay up for growing software companies.

Results for FY 12/2023 were good, with adj PBT up 17% to £4.2m, and adj EPS up 11% to 4.0p (2023 PER of 29.3x)

Trading so far in FY 12/2024 is in line with expectations -

"We are pleased to report that the business continues to perform well with a solid trading performance over the first four months of the financial year. The Board remains confident in the outlook and trading remains in line with market expectations for the full year.

Share price - an unusual comment here on its own share price, which is not really the done thing. I prefer the line that we run the business, you set the share price, which is what most companies say to investors -

It is good to see that the hard work and delivery has started to be recognised in the share price, with a 45% increase over the past 12 months. We look forward to driving further growth across the Group in the years ahead."

Balance sheet - I checked back to FY 12/2023, and it’s not great, with c.zero NTAV. The cash pile of £10.9m has come from customers paying up-front, as is often the case for recurring revenues software companies. So not a concern, but if the company keeps doing more acquisitions without raising equity, then they're in danger of hollowing out the balance sheet, and leaving even less scope for divis (which are small).

Cashflow statement - also for FY 12/2023 is OK, but note that post-tax operating cash generation of £5.9m (less £0.6m leases further down, so it’s really £5.3m) was all spent on capitalised development spending of £2.26m, and acquisitions of £3.8m. This is why the divis are so modest at a yield of only 0.8%, because shares are expensive, and there’s not much available cashflow. Although the acquisition spending of £3.8m is discretionary, so theoretically if it doesn’t do any more acquisitions then it could afford to maybe double or triple the divis, but at this hefty PER, this is not likely to be an income stock. It’s more about growth.

Paul’s opinion - we’re told it’s in line with expectations for FY 12/2024, with consensus at 4.4p, rising to 5.5p in FY 12/2025, the PERs are 26.6x and 21.3x, so effectively we’re being asked to pay in full, up-front for the next c.18 months growth. Software companies are often valued highly, on stretched multiples of EBITDA, but that’s not a valuation method I’m comfortable with, I'll stick with PER.

Growth is good, but not spectacular.

Overall then I think ELCO looks a good business, but the shares seem expensive to me. I’d want an ahead of expectations update to justify the strong recent share price rise. Hence it has to be AMBER, but good luck to holders.

Venture Life (LON:VLG)

41p (£52m) - Trading Update (AGM) - Paul - AMBER

Venture Life (AIM: VLG), a leader in developing, manufacturing and commercialising products for the self-care market…

Trading is in line -

The business continues to perform well and our increased focus on promoting the VLG owned brands is delivering pleasing results, with an additional 35 new listings secured within UK retail since the beginning of the year. We remain confident about the outlook for the year ahead and our ability to deliver full year performance in line with management's expectations.

Broker forecasts - have been increased previously, which is usually a good sign -

Paul’s opinion - neither Graham or I have thought much of this company in the past, due to figures being dominated by large adjustments, and it having too much debt. Borrowings are quite large, and shown within current liabilities, although an update on 19/4/2024 stated that they have been renewed for 3 years, which reassures me. Forecasts are now showing a nice trend of growth, and a low forward PER.

So maybe it’s time to give this share a fresh look? It’s always struck me as a rather peculiar company with opaque numbers, but on a fresh look today, it looks better than I expected. For now we’ll stick at AMBER, but if it gets another decent update under its belt, I might flirt with the idea of moving up a notch to amber/green.

Graham's Section

Crimson Tide (LON:TIDE)

Up 10% to 179p (£12m) - Possible offer for Crimson Tide - Graham - AMBER

This is an announcement by Checkit (LON:CKT), “the augmented workflow and smart sensor automation company for frontline workers”.

From a value perspective, I didn’t find Checkit particularly enticing when I looked at it back in September, due to ongoing cash burn. Income statement overview:

I’m surprised to find that it’s on the acquisition trail. Less surprising, given Checkit’s cash burn, is that there is no cash on the table for the bid target: only more Checkit shares.

It has been a while since we covered Crimson Tide (LON:TIDE), too: Paul was neutral on it last year. It owns mpro5, “a leading provider of personalised mobile workforce and field service management software solutions”.

The possible offer values each TIDE share at 7 CKT shares. In money terms that’s 182p, a 12% premium to last night’s close. TIDE shareholders would own 30% of the enlarged group.

Strategic rationale

At first glance, I’m inclined to believe that the two companies might be a good fit together. Here’s what Checkit have to say:

The board of directors of Checkit (the "Checkit Board") believes that the combination of Crimson Tide and Checkit presents a compelling strategic opportunity to create a scaled workflow software company and furthermore believes that a company of this increased scale would present a more attractive investment opportunity for all shareholders than either business as a standalone entity.

They go on to suggest that there could be “higher valuation multiples” for the enlarged company and improved liquidity.

But what about synergies between the company’s products? Checkit see cross-selling/upselling opportunities, and also:

The Checkit Board believes that the combination of Crimson Tide's and Checkit's product sets will, in due course, provide an enhanced product offering that will benefit both companies' customers.

Previous talks: some bombshell information is given regarding previous attempted talks. Here’s the timeline:

Jan 2024: Checkit submitted a similar proposal to Crimson Tide. TIDE rejected it.

April 2024: Checkit asked Crimson Tide for talks; TIDE said no.

Today: Checkit goes public to enable shareholder discussions.

Checkit CEO’s comment:

"The Checkit Board has long believed that the combination of Checkit and Crimson Tide is an obvious and positive strategic step for both companies. We believe it will position the enlarged entity as a market leader in workflow software solutions, leveraging the strengths of both organisations for enhanced profitability and competitive advantage whilst being more attractive to existing and potential new investors. Most importantly, the Checkit Board believes that the combination of the two businesses has the potential to deliver value for both sets of shareholders…

Graham’s view

The main point for me is that the two companies seem to have quite different risk profiles.

Checkit is the riskier of the two, and is more dependent on the stock market for fundraising.

Crimson Tide is more stable, with smaller losses. Its cash balance is limited at just £3.3m (Dec 2023), but they haven’t been burning it very quickly in recent years..

From Checkit’s point of view, thinking about valuation multiples (and maybe future fundraisings?) it makes sense to want increased scale and liquidity, and a broader investor base.

But from Crimson Tide’s point of view, it makes sense to me that they would want to carry on with their existing plans, instead of being 30% of a larger, probably riskier group.

So if I was a TIDE shareholder or board member, I’d be inclined to reject this proposal.

TIDE’s Chairman Mr. Whipp is a 10% shareholder, and it sounds like his answer is a definite NO.

Perhaps Checkit will be able to convince some fund managers of the merits of their proposal?

TIDE’s top shareholders:

Gooch & Housego (LON:GHH)

Down 4% to 550p (£142m) - Interim Results - Graham - AMBER

Gooch & Housego PLC (AIM: GHH), the specialist manufacturer of optical components and systems, today announces its interim results for the six months ended 31 March 2024.

This company is still quite disappointing in financial terms, with low profit margins only getting lower:

It’s an interesting choice to pay an increased dividend despite the net debt figures shown above. They do this “given the Board's confidence in the outlook for the Group and our plans to improve operating profit returns to mid-teens over the medium term”.

Key bullet points for H1:

Revenue down 5.3% on an organic constant currency basis. Destocking is blamed (GN note: this problem seems to have been resolved in several other industries, but not yet for GHH.)

Order book grew very slightly in H1, and “continues to grow, substantially de-risking H2 revenue”.

Full year expectations are unchanged; execution risks to H2 remain but have been reduced

CEO comment:

"Despite the reduced demand in our industrial and medical laser markets persisting longer than expected, the medium term outlook remains positive underpinned by a strong order book and healthy pipeline with the Group well positioned to benefit from increased demand levels as a result of operational and supply chain improvements.

"The market dynamics for G&H's technologies and capabilities remains strong in all our target sectors supported by the focused progress the Group has made to establish the foundations to accelerate the delivery of our strategy."

Outlook

Whilst reduced demand levels from our industrial and medical laser markets have persisted longer than we had expected we are well positioned to benefit from recovering demand levels which are now expected in the early part of FY2025…

In the first half of the year the Group started to reduce its borrowings which were increased in the second half of FY2023 to fund the acquisitions of GS Optics and Artemis. We have reduced our inventory holdings and expect to make further progress in this area in the second half of the year allowing us to reduce our borrowings further.

Our order book remains at a healthy level and we have substantially all of the orders needed to support the expected increase in revenues and profitability. The Group is involved in complex development and production programmes some of which are dependent upon inputs from both our customers and suppliers in order to progress to their expected timescales. Nevertheless, our expectations for FY2024 are unchanged.

Graham’s view

I’ve really wanted this company to come good for a long time, but the promised land of high margins and fat profits remains elusive.

Directors remain confident, continuing to pay out dividends and laying out in some detail their strategic plans for the future.

For investors tempted to nibble at it, here are the latest value metrics according to Stockopedia:

Once again, I can’t avoid a neutral stance on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.