Good morning from Paul & Graham!

I've added 3 more sections to yesterday's report (ELCO, VLG , and CHG) - apologies for these being late.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Companies Reporting

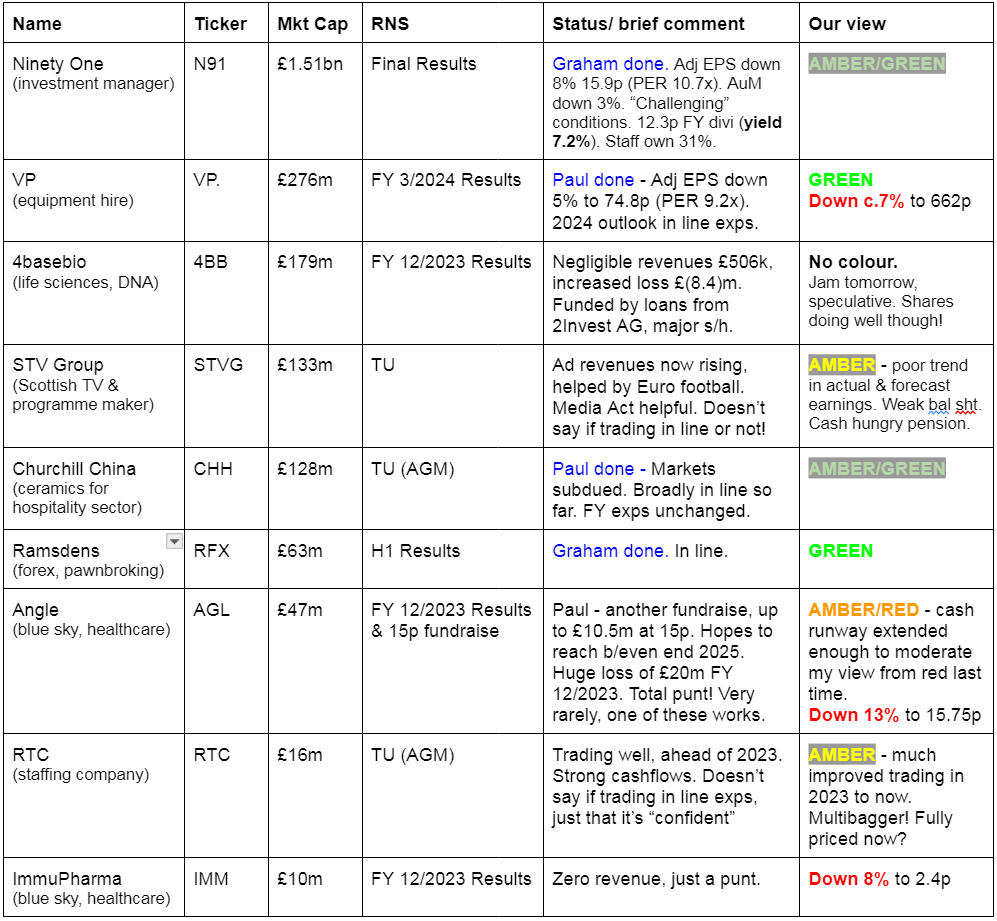

Graham and I are wondering if I've created a monster with this multi-coloured, multi-functional list?!

Other mid-morning movers (with news)

B&M European Value Retail SA (LON:BME) - down 6% to 513p (£5.14bn) - Negative market reaction to today’s FY 3/2024 results & outlook. Adj EPS is up 1% to 36.8p (StockReport says consensus 37.9p). Higher tax charge seems to have blunted the bigger improvement in PBT.

Excellent long-term track record. I’m not sure what disappointed the market today?

Tasty (LON:TAST) - up 29% to 1.55p (£2m) - Court approved restructuring plan yesterday. Ditches loss-making restaurants. Now has 38 sites trading, from previous 54. Mgt state that a £0.9m loss in FY 12/2023 should improve to a £1.2m profit in FY 12/2025. Interesting to see that creditors may participate in an “upside fund” if company recovers. No divis to shareholders in 2024 or 2025. Seems fair to me - creditors agreeing to a hefty haircut should get some of the potential upside too. De-listing risk must be significant at £2m mkt cap, or would the Kayes have done that by now if they intended to do so? Could be a vehicle to rebuild, try out new formats, who knows?

Summaries

Ramsdens Holdings (LON:RFX) - down 2% to 193.2p (£61m) - Interim Results - Graham - GREEN

Trading is in line at this diversified financial services provider (pawnbroking, travel money, jewellery retailing and gold purchasing). Nearly all metrics are moving in the right direction with a favourable macro backdrop and good execution of its growth strategy. At a PER of 8x, I continue to like this one.

VP (LON:VP.). - down c.3% to 670p (£269m) - FY 3/2024 Results - Paul - GREEN

Profit dropped a little, but I think that's acceptable given tough macro, also one division has needed a sort-out after disappointing. Valuation seems modest, and there's a lovely reliable 5.8% dividend yield whilst you wait for recovery in macro, and the chance of a takeover bid given the 73-year old Chairman has already indicated in 2022 that he would be amenable to a sale (he owns 50%). Shares still look cheap to me, even after a decent bounce lately.

Ninety One (LON:N91) - down 6% to 160.4p (£1.44 billion) - Final Results - Graham - AMBER/GREEN

This fund manager has been seeing large net outflows and its AuM is on the decline. However, as is often the case in this sector, profit margins remain high and the company can still afford to pay large dividends. I’d like to study this one in more detail but for now I’m happy with a moderately positive view.

Churchill China (LON:CHH) - down 4% to 1,115p (£123m) - Trading Update (AGM) - Paul - AMBER/GREEN

Broadly in line so far this year, but reckons it can hit the FY 12/2024 forecasts. Nice business, reasonably priced, and with strong balance sheet. Bid target? I think it could be.

Paul's Section

VP (LON:VP.)

Down c.3% to 670p (£269m) - FY 3/2024 Results - Paul - GREEN

Vp plc, the equipment rental specialist, today announces its audited Final Results for the year ended 31 March 2024…

Unremarkable numbers below, with adj EPS down 5.3% (although macro has been tough in the building sector) - note that the adjustments are large this year, with statutory PBT only just above breakeven at £2.8m, so I’ll have to look into those.

“Challenges in some end markets”

Borrowings - VP secured some really cheap private placement notes (£93m) during the zero interest rate period (kudos to management for being shrewd). We need to factor in higher finance costs when these expire & have to be replaced with more expensive funding. It also renewed the £90m RCF this year.

Owner/managed - is usually a good thing. VP is 50.3% owned by Chairman, Jeremy Pilkington. He mooted selling his stake back in 2022, but that was abandoned. He’s 73 now, so I would guess the exit here is likely to be an agreed takeover bid, with a major holder who is highly motivated to get the best price for everyone.

Dividends - are generous at just over half of earnings. 39p total divis for the year is a lovely 5.8% yield, probably capable of rising further in future years as the construction sector recovers. VP boasts a 30-year uninterrupted track record of paying divis - although there was a blip during the pandemic, but it caught up with a special divi instead of the usual pattern, which is splitting hairs -

Adjustments - mainly a £27.7m impairment re Brandon Hire Station. New management in place, “starting to have a positive impact”. As a goodwill write-off, this is non-cash, so not a concern.

Outlook - sounds consistent with what we’re hearing from other companies, so no particular surprises here, and there’s obvious upside once general construction & housebuilding markets improve (probably in 2025) -

Audiocast - this is a nice touch. A recording of the analyst meeting will be available as an audiocast at 10:30.

Balance sheet - NAV of £153m becomes NTAV of £124m. Adequate rather than particularly strong, I would say.

Interest-bearing debt is £131m, which is 51% of its hire fleet (property plant and equipment of £257m), which feels about right to me - funding its fleet half equity, and half debt.

Everything else looks as I would expect for a hire company, including lease entries that reflect its branch network.

Cashflow statement - again, all looks as I would expect. Strong cash generation at the top, almost unchanged from the previous year. Negative working capital movements last year reversed into positive this year, which reassures me.

Hefty capex of £71m, to replace hire fleet items, partly offset by £25m sale proceeds of older items.

It paid down a bit of debt, and spent £15m on divis.

This all looks fine to me, perfectly healthy.

Paul’s opinion - I’ve always had a positive impression of VP shares. The stock market doesn’t seem to take much interest in VP, with the shares often very thinly traded, with a ridiculous quoted bid/offer spread, which has put me off from buying them on a number of occasions.

I think it would be better off as a private company, so let’s hope the 50% owner/manager can find a buyer prepared to pay a nice premium for it, that’s the most likely exit route and could be lucrative for shareholders. If it doesn’t sell, who cares, as you get a nice 5.8% dividend yield. Once construction markets improve, there should be further upside on this share as earnings are likely to rise. I much prefer the more reliable VP to riskier, accident-prone Speedy Hire (LON:SDY)

Equity Development has a modest increase in adj EPS to 75.9p for FY 3/2025, and 81.7p the following year. If construction markets are in full swing again by then, I imagine there could be upside on these fairly modestly set forecasts. I’m thinking maybe 90-100p adj EPS could be on the cards taking a say 2-year view. Put it on a PER of 10-12x and I get 900p-1200p as a share price target. Actual price today is 670p. Unless I’m missing something here, this share looks a bargain to me, for patient investors. One to go on my “buy the dips, if you’ve got any spare cash” list! It’s got to be GREEN. It was a gift at last autumn’s c.500p, but has risen a fair bit since.

Stockopedia agrees, with a green StockRank for the last 3 years, and it’s classified as a “Super Stock” -

Churchill China (LON:CHH)

Down 4% to 1,115p (£123m) - Trading Update (AGM) - Paul - AMBER/GREEN

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide…

This is another share (same problem as VP) where the quoted bid:ask spread is ludicrously wide, putting people off trading the shares. Often the actual prices are well within the quoted spreads, so why on earth do the market makers do this? There must be a reason, but it’s unhelpful anyway.

I’m surprised this share isn’t down more than 4% today, at this less than stellar update - is it glass half full, or half empty?! -

"Whilst markets remain subdued, trading remains broadly in line with management's expectations. Productivity and yield continue to improve as a result of activities in manufacturing.

The Board's expectations for the year remain unchanged."

That sounds to me like they’re a bit behind plan, but hope to recoup it later. Not the ideal situation.

No broker notes available to plankton like us!

Consensus is about 80p, for a PER of 13.9x - quite reasonable compared with the inexplicably high PERs this share historically traded at. Although I think the risk of it not achieving that number could be a little higher after today’s update.

Superb balance sheet is strongly positive I feel. This gives me comfort that there’s plenty of financial reserves in the event of anything going wrong, and we don’t have to fear dilution. Also it increases the chance of a private equity bid, because they could self-fund the bid premium using CHH’s own surplus capital. After I’ve licked clean my dinner plate in restaurants, I flip it over to see who made it. The answer is usually either Churchill China, or Steelite. Note that the latter was bought out by Arbor Investments in Dec 2019.

I was AMBER/GREEN on CHH last time, on 12/4/2024, and think I can just about hold onto that again this time.

Graham’s Section:

Ramsdens Holdings (LON:RFX)

Down 2% to 193.2p (£61m) - Interim Results - Graham - GREEN

I’ll be chatting with management later this morning - and thanks to everyone for submitting questions to help me with that!.

Before that, let’s quickly review the interim results to March. Many positives in the highlights:

Revenue +12% to £43.8m

PBT +8% to £4m

5 new stores bringing the total to 167. 4 additional stores are opening in H2.

Interim dividend up 9% to 3.6p.

Current trading/outlook: trading is in line with expectations. New websites launching for pawnbroking and gold buying.

CEO comment excerpt:

…We are continuing to invest in our long-term growth including opening carefully selected new stores, investing in our exceptional team, and further developing our customer proposition. This includes our new service-specific websites that will launch in the second half as well as the recently launched pre-paid travel card. These investments are ensuring that we continue to provide the best possible service to our growing customer base irrespective of which Ramsdens service they choose and through which channel they come to us…

Financial review: admin expenses grew 9%, a little slower than revenue growth of 12%. Entry level salaries were re-based in line with the increase to Real Living Wage.

Balance sheet has net assets of £47.8m (almost entirely tangible), with a net cash position of £3.8m.

FX Service: currency exchanged up 6%, gross profit up 3%. The mismatch is explained by foreign currency sales growing at a faster rate than foreign currency purchases (lower margins are earned on foreign currency sales).

Pawnbroking: loan book increases 12% to £10.8m. There is a 67% rise in the amount “past due” (from £700k to £1.2m), and RFX says this “is impacted by one customer with high value lending which had expired at the Period end”.

If this customer defaults, I’m sure that Ramsdens will be absolutely fine, but I must say I’m a little concerned that I may have underestimated the company’s exposure to high-value loans.

Jewellery retail: revenues only up 1% here, but gross profits up 6%. “The economic conditions have had an impact on our retail operations”.

Precious metals purchasing: revenues up 35%, gross profit up 25%. Some interesting comments here:

The economic conditions have positively impacted our purchase of precious metals. The gold price is higher and there has been more media coverage generating greater customer awareness of the service. This has led to the weight of gold being bought increasing.

Ramsdens has an overall “strong stock position”, and is therefore smelting a higher percentage of the gold it’s buying.

Estimates: Liberum leave their profit estimates unchanged with the proviso that H1 PBT is higher than expected, with positive implications for the full-year result. They do increase their net-cash estimate for the full year. The EPS estimate is 24p for the current financial year, rising to 25p next year.

Graham’s view: I see little reason to change my positive view on this one, as the company continues to benefit from various tailwinds including tourist demand (albeit fewer people have foreign currency to sell back to Ramsdens after their holiday), a high gold price and sturdy demand for pawnbroking loans.

I am slightly concerned about the “past due” number in the loan book.

The store expansion continues at an evolutionary pace, with the company giving itself plenty of time to see how its new stores are doing.

Valuation remains attractive:

It’s true that the shares are trading at a premium to book value (market cap higher than balance sheet net assets), but this can readily justified for a company earning these sorts of returns:

Overall, I’m happy with these interim results, and I intend to post up my notes from management Q&A for you tomorrow.

Ninety One (LON:N91)

Down 6% to 160.4p (£1.44 billion) - Final Results - Graham - AMBER/GREEN

We don’t normally cover this one, and it's a little too big for this report, but I’d like to take a look at this fund manager.

The three-year chart isn’t too encouraging. It has paid out quite chunky dividends during this period at least (over 40p in aggregate).

For 2024, it is distributing another 12.3p to shareholders, not quite matching the 13.2p paid out in the previous year.

Key financials:

AuM down 3% to £126 billion

Net outflows £9.4 billion, not quite as bad as £10.6 billion the previous year. However, outflows in H2 were higher than outflows in H1.

PBT up 2% to £216.8m

The 12.3p dividend is covered by earnings per share (18.4p actual, 15.9p adjusted).

Comment on the outflows:

The primary driver of net outflows was equities, particularly from global strategies, followed by European and UK equities. Notwithstanding this, there were net inflows into some of our focus areas such as sustainable and international equities. Fixed income net outflows were driven largely by emerging market sovereign strategies, which countered net inflows into inflation-linked, liquidity and income strategies…

Founder-CEO comment excerpt:

"Ninety One, and many other public-markets-centric active investment managers, faced headwinds over the reporting period. Despite these conditions, we delivered robust financial results. Looking ahead, we remain confident of the underlying strength of our business and the long-term relevance and quality of our proposition to clients….

Asset classes: equities are nearly half of AuM (£58.4 billion, down 2%), with Fixed Income in second place (£31.9 billion, down 3%).

Client locations: this is an “Anglo-South African” business, and the largest client geography is Africa (£51.3 billion, +0%). The second is the UK (£24.2 billion, down 3%).

Most AuM is from institutional clients (£80.5 billion).

Fund performance seems disappointing in the short term and medium term, only 43% of portfolios (measured by value) having a positive active return on a 3-year time horizon. However I will give the company a lot of credit for reporting in this way, instead of only reporting their performance against other funds.

Most of N91’s mutual funds (61%) are outperforming other funds on a 3-year timeframe.

Graham’s view

£1 invested in N91 stocks gives £87.50 of AuM: for me, this suggests we are looking at a cheap fund manager stock.

The value metrics were quite good last night:

Of course the problem is that the company is currently in reverse gear, in terms of AuM and flows. It’s also going into reverse gear in terms of adjusted profits:

I note that even in a difficult year, the adj. operating profit margin remained very impressive at 32%. Another reminder of why I like the fund management sector: even in tough years, profit margins can be far higher than you’ll ever see in some other industries!

At this stage, I still need to study N91 in more detail before I can take a stronger view. But for now, I’ll take an AMBER/GREEN stance. The StocksRanks like what they see, too:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.