Good morning from Paul & Graham (Paul has been making some contributions from his travels!)

We are all done for today now!

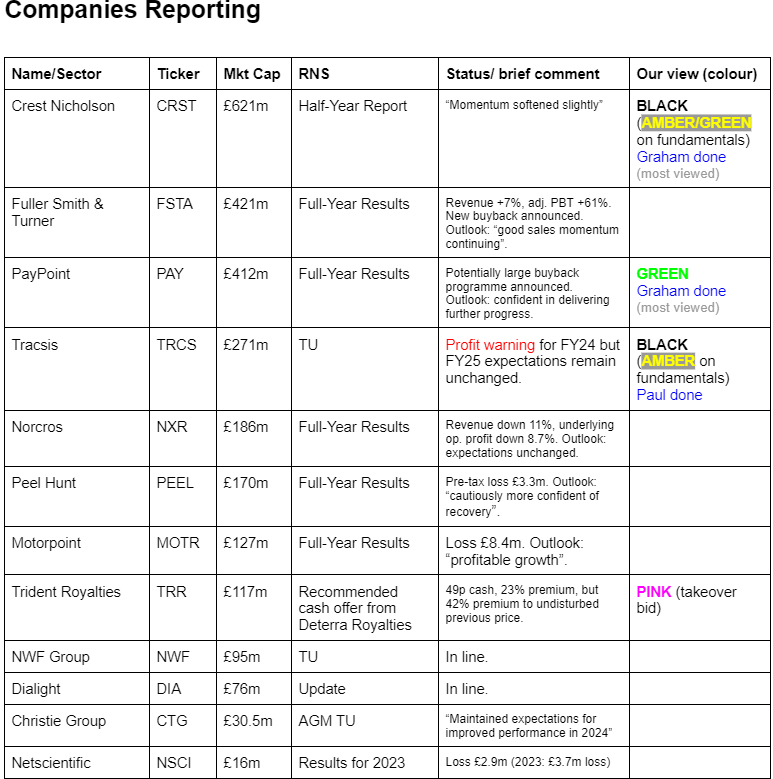

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Mid-Morning Movers

Halma (LON:HLMA) - up 10% to 2581p (£9.85bn) - not one we cover here due to its size, but I’m flagging it here in the movers section, with a +10% market reaction to publication of FY 3/2024 results today. Adj EPS is up 8% to 82.4p, so PER looks well into nosebleed territory at 31.3x. Balance sheet is totally dominated by intangibles from multiple acquisitions, so nothing in NTAV support - which doesn’t matter for such a highly profitable group with a remarkable long-term track record - shares have 10-20 bagged (depending on the starting point price) in the last 15 years. Profit margins are impressively high. It does specialist life-saving products & technology, clearly a lucrative niche, internationally. Outlook comments also sound positive.

Paul’s view - clearly a high quality share, priced accordingly highly, but I certainly wouldn’t bet against this one, given its superb track record.

Wise (LON:WISE) - down 15% to 716p (£10.2bn) - loses £1.8bn of its market cap today on a poor market reaction to FY 3/2024 results. This is the second lurch down, so this challenger bank (or international payments specialist) has now lost almost 30% of its recent peak valuation in April 2024 (although it did achieve a higher valuation temporarily in the first few months after floating in 2021). Quite a volatile share, doing big swings in valuation, suggesting investors haven’t yet quite decided how it should be valued.

I recall looking at the numbers a while back, and it’s demonstrated a large increase in profits, thanks to higher interest rates on customer deposits.

Interesting numbers, with PBT more than tripled to £481m, but it then presents “underlying” PBT up 226% to £242m, which strips out interest income above the first 1%, presumably as it will have to pay that to customers? I see readers are discussing this below.

There’s not much balance sheet support for a £10bn market cap, with only £980m NTAV. Unlike conventional banks, where you can often buy at, or below NTAV. Anyway, no view from me, as I’ve not researched it properly, just flagging the significant share price fall today. The newswire says that’s due to the outlook saying underlying profit growth will slow to 15-20% in FY 3/2025.

Summaries

PayPoint (LON:PAY) - up 1% to 573.8p (£417m) - Final Results - Graham - GREEN

It’s a solid set of results but the real excitement for me is £20m of buybacks this year, with the potential for over £60m to be returned to shareholders over the next three years. With net debt currently at less than 1x adj. EBITDA, and the business trading well, it seems that the company can afford this commitment.

Tracsis (LON:TRCS) - down 9% to 815p (£247m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

Profit warning today sounds minor in the RNS, but is actually losing one third of the forecast FY 7/2024 EPS - quite serious, as it shows TRCS doesn’t have as much visibility as I assumed. UK election blamed, and slower contract signings in the US too. FY 7/2025 is unaffected, but now needs a 64% increase in EPS to hit unchanged forecast. This all makes me ponder the high valuation, which looks too aggressive now.

Crest Nicholson Holdings (LON:CRST) - down 8% to 220.8p (£567m) - Half-year Report [profit warning] - Graham - BLACK (AMBER/GREEN on fundamentals)

Another profit warning and a big cut in the interim dividend payment to go with it. These shares were already trading at a chunky discount to balance sheet numbers so pessimism was already priced in to some extent. Without having much conviction in this statement, I do still see some value here.

Paul's Section

Tracsis (LON:TRCS) - down 9% to 815p (£247m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

Tracsis (LSE: TRCS), a leading transport technology provider, provides the following trading update for the year ending 31 July 2024.

“Impact of UK General Election timing; FY25 expectations remain unchanged”

The PR headline is steering us towards seeing this as a one-off, hence not too important, and that seems to have worked, with only a 9% share price fall in early trades. TRCS shares seem quite tightly held by fund managers mainly, and surprisingly illiquid, so the price can do erratic moves on a few trades, e.g. this morning it’s been marked down 9% on just 16k shares trades printed so far.

What’s gone wrong?

It blames the UK general election -

The pre-election restrictions are temporarily impacting central government, local authority and Train Operating Company decision making and spending across the UK transportation sector. This action is resulting in the rescheduling of certain projects and a short-term contraction of new order activity, that was previously expected to occur in the Group's Q4 financial period.

However, there are also contract delays in the USA -

In the Group's April 2024 Interim Results statement, we highlighted risks in converting our North American pipeline before year end. While these opportunities continue to be pursued, the Board now expects that associated revenue will not be realised within this financial year.

Combined, these two factors have hit EBITDA -

“...strong operational gearing within the business, this will have a material effect on the Group's FY24 adjusted EBITDA margin.”

Mitigating actions - none, as it sees this as a short-term glitch.

Revised guidance -

“FY24 revenue is now expected to be in the range of £80.0m - £82.0m1

1 Analyst consensus range for FY24 revenue was £84.0m to £85.9m, with average analyst consensus being £85.2m, as at 12 June 2024.”

We are sent round the houses a bit with the profit impact -

“FY24 adjusted EBITDA* margin is expected to be slightly higher than the 15.5% delivered in H1 2024 but below analyst consensus market expectations

Broker update - as is often the case, whilst the PR can smooth over the issues in an RNS, the size of the problems only becomes apparent from the big reduction in broker forecast profits. And this is a surprisingly large miss, due to the delayed contracts containing high market licensing revenue.

For FY 7/2024 -

EBITDA forecast comes down from £17.4m to £13.1m

Adj PBT forecast down from 39.7p to 26.7p, making the PER now look much too high at 30.5x - why have a premium rating on a share that has now demonstrated no profit growth in the last 3 years?

FY 7/2025 forecast is unchanged at 43.8p EPS, which now requires a 64% rise vs revised FY 7/2024 numbers. Even if it achieves such a big jump in earnings for FY 7/2025, we’re being asked to pay up front for it, with a forward PER of 18.6x.

Paul’s opinion - whilst the UK election may be a one-off event, we knew it was coming, so the exact timing should not have made a difference to forecasts. Missing numbers by a lot, very near the end of the financial year worries me. It shows that Tracsis is still heavily dependent on lumpy contract wins, since these issues presented as relatively minor have just lopped off a third of the expected EPS. That shouldn’t happen at highly rated companies.

They should be budgeting more conservatively, with some slack to accommodate any unexpected delays.

Which makes me question the high valuation. I don’t want to invest in shares where I have to hope for, and pay up-front for, a 64% increase in profit.

After this significant mishap, I think TRCS shares are now looking much too expensive. There’s nothing actually wrong with the business, so I can’t mark it red or even amber/red just for being too expensive, but I definitely can’t go above our previous view of AMBER on fundamentals. Today’s profit warning does I think demonstrate that it’s not as good a business as people might think, given that profits are fairly unpredictable based on a few contract wins. It doesn’t give the split between the UK election impact, and the problem with US orders.

800p per share looks way too high. I’d be looking at more like 500-600p to even consider taking a position here. Highly rated companies have to hit or beat forecasts, missing them by a mile near the year end is a very bad look.

Graham's Section

PayPoint (LON:PAY)

Up 1% to 573.8p (£417m) - Final Results - Graham - GREEN

I added this one to my list of favourite ideas for 2024, so let’s see what the company has in store for shareholders today.

The main news appears to be a three-year share buyback programme. It’s unusual for companies to announce what they are going to do over a three-year period, but PayPoint have given themselves plenty of wiggle room.

They will return “at least £20m to shareholders over the next 12 months, with the potential to increase in years 2 and 3”. So while there is no absolute commitment to do this, there is a possibility that we are talking about a total buyback programme of more than £60m. That’s nearly 15% of last night’s market cap, so it is a substantial number.

As for the trading performance of the business, here are the highlights.

Net Revenue: up 3.3% in the existing PayPoint business, but up 40% in total if you include the new contribution from Love2shop (what used to be called “Appreciate”):

Underlying PBT: up 0.4% organically, or up 21.5% in total, to £61.7m.

Adjusting items: there are more intangibles being amortised now, so there are more adjusting items than before.

Actual PBT: up 13.1% in total to £48.2m.

Net debt: reduces from £72m to £67.5m.

The company is looking to have a leverage multiple (net debt/adj. EBITDA) of about 1x, i.e. for net debt and adj. EBITDA to be approximately the same.

With adj. EBITDA of £81m and net debt of only £67.5m,, we can understand why the company feels that it can afford to both increase its dividend and embark on a buyback programme.

CEO comment:

“This has been another year of progress for PayPoint where we have delivered a robust financial performance and made further progress towards delivering £100m EBITDA by the end of FY26. These results reflect both the resilience of our businesses and the transformation delivered over the past three years as we unlock further opportunities and growth across our four business divisions.

In the current year, consumer behaviour across a number of our businesses remains subdued, reflecting continued tighter family budgets and a generally flat economy. Our expectation is that the consumer outlook will improve during the course of the year.

Divisional highlights

Shopping - revenues up 3.9% to £64.6m. A mature business mostly serving independent retailers (70% of sites)..

Payments & Banking - revenues down 4.8% to £53.5m. Some parts of this division are in secular decline.

E-commerce - revenues up 61.6% to £11.8m. Super-fast growth at Collect+.

Love2shop - £51.3m of revenues. This business also declined in organic terms but as a newly-acquired division it has boosted PayPoint’s overall growth figure.

I’m still intrigued to see PayPoint’s plans for the Love2shop/Appreciate business, as that’s one that we commented on regularly when it was a standalone business. It includes both the gift voucher business and Park Christmas Savings.

In the commentary today, the company says that gift voucher billings were down “due to the broader caution from larger businesses, particularly with employee rewards”. The corporate sales team has been restructured and furthermore:

There is now a strong pipeline of new business building into the current financial year and much closer alignment with the business development team in PayPoint, driving revenue opportunities within both client bases.

An important synergy already being unlocked is the rollout of physical gift cards to retail locations. 2,600 locations were reached for Christmas 2023 (at multiple retailers), and independent retailers are being reached in the current year.

Other forms of progress have been made at Love2shop, too:

A number of major brands were also added in the year to Love2shop as redemption partners, including B&Q, Currys, Adidas, WH Smith, Matalan & Blackwell’s and a successful refresh of the Love2shop brand was delivered.

Graham’s view

Many investors see this as a business in terminal decline. I agree that’s true for some parts of PayPoint, but I view other parts as stable and others as quite exciting!

Its cash generation has always been excellent, and I’m pleased to see that it’s now directing some excess cash towards buybacks instead of dividends.

At this sort of valuation (modest single-digit PER), I much prefer to see cash being used to reduce the share count instead of being spent on dividends. The dividend yield here is already very large:

In summary: I have zero regrets about putting this on my top 10 list for 2024, and I have my fingers crossed that it continues to trade well for the rest of the year.

Crest Nicholson Holdings (LON:CRST)

Down 8% to 220.8p (£567m) - Half-year Report - Graham - AMBER/GREEN

Let’s investigate the key bullet points from this housebuilder’s interim report:

Revenues down 9% to £257.5m, “reflecting the low level of reservations at the beginning of the financial year”.

H1 completions 788 (H1 last year: 894).

Sales per outlet per week 0.47 (H1 last year: 0.54).

As flagged by Paul in March, the costs associated with previous work have increased. The one-off charge is £31.4m (previous estimate: $15m). “The increased charge is due to a wider scope of the review to cover all completed sites”.

Adj. operating profit £6.2m (H1 last year: £22.1m).

To get this figure, the company treats most of the £31.4m one-off charge as “exceptional”.

Even if we treated the entire one-off charge as exceptional, we would still only get an adjusted operating profit of £12m.

Actual loss after tax (including all costs considered “exceptional”) is £23.4m.

Interim dividend is slashed to only 1p (H1 last year: 5.5p).

Net debt £9m, and the company has a £250m undrawn RCF implying huge amounts of available liquidity.

Outlook

Points on inflation - build cost inflation is “flat year on year and we expect these conditions to continue in the remainder of FY24” (i.e. until October).

The outlook is mixed, with some unhelpful factors at play:

The spring selling season started well with positive housing indicators in an improving macro backdrop. Momentum has softened slightly since Easter, reflecting the volatility in mortgage rates and the expectation of a base rate reduction coming later in the year than previously expected. The imminent General Election is creating some short-term uncertainty, but this is anticipated to be alleviated in July once the outcome is known.

As a result, and including the one-off pre-exceptional charge for completed sites, the Group expects FY24 adjusted profit before tax (APBT) to be between £22m to £29m.

We get the following guidance table:

At the trading update in March, the company said it was looking for 1,800 to 2,000 completions, so this is a reduction of the top end of that range.

The previous consensus adj. PBT estimate was £38.9m, so this is a major profit warning.

And the adj. PBT estimated range is still very wide, making it difficult to treat any earning multiple here with much seriousness.

Note that even at the top end of the range, earnings and margins would still be far below previous levels:

Many of us prefer to focus on the balance sheet with this type of stock, so here are the key points from the latest balance sheet. Net assets are £803m, down from £856m six months previously (due to a combination of dividend payments and the after-tax loss).

Deducting intangibles from the total, we have a TNAV of £774m. The market cap is at a 27% discount to this figure. Or looking at it another way, the share price would need to increase by 36% for the company to trade at its TNAV.

Comment by the outgoing CEO:

We have made some important operational progress in the first half of the year against our strategic priorities. We are on track to achieve a five-star customer service rating, have a clear and comprehensive plan to resolve the legacy and operational issues, and continue to focus on maintaining a strong balance sheet.

"The Group is continuing to focus on completing its low margin sites, with FY23 and FY24 being the peak years of impact and the majority of the remainder expected to be traded through during FY25. Going forward the Group will benefit from its high-quality, higher margin land portfolio, and with an increased commitment to operational efficiency and control, is well-positioned to capture growth opportunities as market conditions improve."

Graham’s view

I tend to agree with Paul that AMBER/GREEN is the right stance for us to take on this share. It’s an attractive discount to NAV, but it’s difficult to have confidence given the provisions/one-off charges that the company has suffered, and of course the profit warnings!. That said, there is still a gap of over £200m between TNAV and the market cap, so there is still a large cushion to absorb future problems.

With the dividend getting cut dramatically, that removes in the short-term one way that value might have been delivered to shareholders. However, it’s understandable that the company might not want to see its net debt position grow much larger.

So how can this play out favourably for shareholders? First, I would almost completely ignore the short-term earnings multiple here. The big question is whether margins will recover to previous levels in future years - this seems plausible to me, based on commentary from the outgoing CEO.

Secondly, will there be more one-off charges? Unfortunately, I’m not able to answer this question, as it’s beyond my pay grade.

Thirdly, is there any other catalyst that might boost the share price? Dividends are out and I assume that buybacks are too, as the company needs to conserve cash in the short-term. The only other catalyst would be some form of takeover. There has been some activity in the sector.

There are too many possibilities here that are beyond my ability to predict, so I can’t be outright positive on this one. However, I do think that portfolios filled with bargain stocks (based on their balance sheet values) tend to do quite well overall. CRST does seem to be a bargain from this point of view.

Note that homes under construction and show homes are considered “inventories” under accounting rules, and are therefore “current” assets. On that basis, CRST is not just a TNAV bargain (based on tangible assets) but is also a “Net Current Asset Value” (or NCAV) bargain, under Ben Graham’s old rules.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.