After a solid 2017, most of the 60 guru-inspired investment strategies tracked by Stockopedia hit turbulence in 2018. Much of the trouble started in the second half of the year - and the worst of it unfolded in the final three months. After a decade of powering market returns, growth and momentum strategies pulled back sharply. Whether it’s the start of a new trend is unclear. Either way, stock market investors finished 2018 feeling pretty bruised.

About the Guru Strategies

2018 was the seventh full year of us tracking the Guru Strategies in the UK, with slightly less performance history for Europe and the United States. Over time, these models have been a handy gauge of what’s working in the market and how different styles react to different conditions.

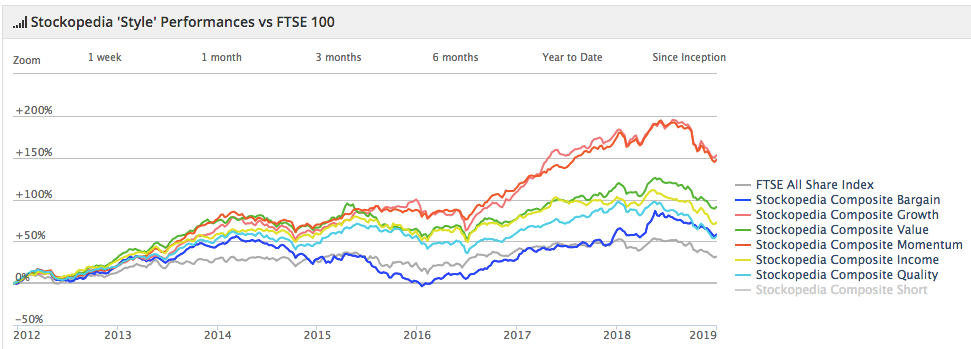

Not only do they show what’s working, but they also show when trends start to change. Through the lens of of the gurus, we get to see how different styles of investing - spanning Quality, Growth, Value, Bargain, Income and Momentum - interchange with each other.

Over the past seven years, which covers a good chunk of the boom in equities since the financial crisis, it’s clear just how successful the growth and momentum trades have been (see the orange and red lines in the chart below). That performance actually accelerated in the after the EU referendum in June 2016. In fact, it’s fair to say that both styles were still strong right up until last summer.

But as the year wore on, the bull faded fast. In the US, the prospect of rising rates and trade disputes were just two of the reasons why the S&P 500 finished the year down 6 percent. In the UK, the same concerns mixed with a host of domestic economic and political uncertainties sent the market sliding. The FTSE All Share closed the year down 13.0 percent, while the more speculative AIM All Share finished with a fall of just over 18 percent.

Index / Strategy Composite | H1 2018 | Full Year 2018 |

+0.6pc | -12.5pc | |

-0.8pc | -13.0pc | |

+0.5pc | -15.6pc | |

-1.5pc | -16.6pc | |

+5.1pc | -18.9pc | |

+3.1pc | -18.2pc | |

+1.7pc | -6.2pc | |

-3.9pc | -13.0pc | |

Guru Strategy Composite | +2.4pc | -11.7pc |

+2.2pc | -9.3pc | |

+5.9pc | -9.3pc | |

+10.5pc | -2.4pc | |

+1.6pc | -11.2pc | |