Good morning!

Relieved to reach the end of a busy week for the daily report! Have a great weekend everyone.

Spreadsheet accompanying this report: link (updated to 16th December)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Ninety One (LON:N91) (£2.1bn | SR84) | AUM at 31 December 2025 of £159.8 billion (30 September 2025: £152.1 billion; 31 December 2024: £130.2 billion). | ||

Genus (LON:GNS) (£1.75bn | SR56) | H1 adjusted PBT tax of approximately £50m, which is ahead of expectations. Including a milestone payment, adj. PBT is £55.6m. The Board now expects FY26 adjusted profit before tax (excluding the milestone payment) to be moderately above the top-end of current market expectations (£82.7m to £85.0m). | ||

Bodycote (LON:BOY) (£1.33bn | SR85) | Acquires Spectrum Thermal Processing, an Aerospace and Defence focused heat treatment provider based in Cranston, Rhode Island, for a cash consideration of approximately $8m. | ||

Impax Environmental Markets (LON:IEM) (£775m | SR) | Reaction to Saba, their largest shareholder, “in response to Saba's relentless pursuit of short-term objectives at the expense of IEM and the wider UK investment trust sector.” If Saba does not tender all of their shares under this “Continuation Tender Offer” (to be approved by a special resolution), it will be cancelled and an “Exit Tender Offer” (to be approved by an ordinary resolution) will be proposed instead. | ||

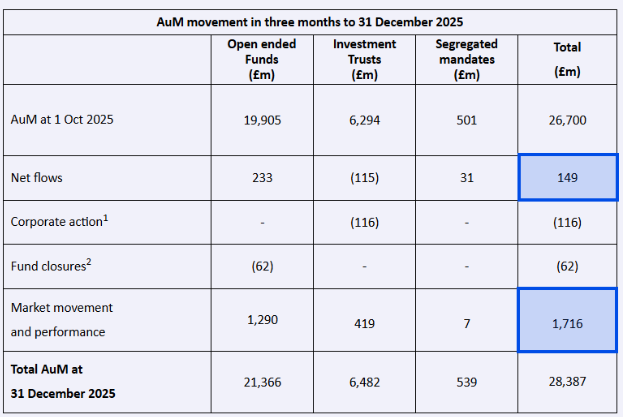

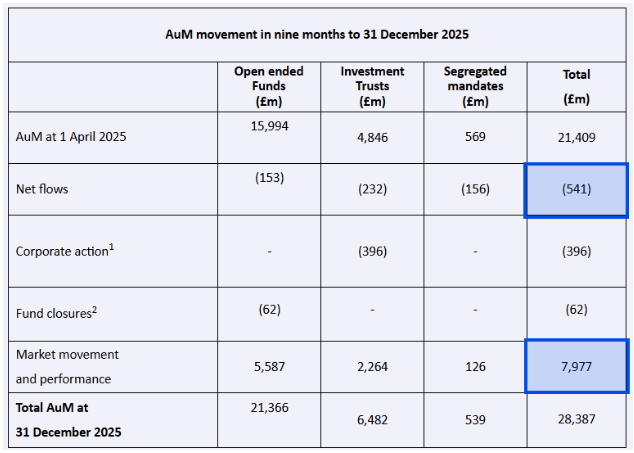

Polar Capital Holdings (LON:POLR) (£599m | SR96) | 31 December 2025 AuM was £28.4bn compared to £26.7bn at the end of September 2025 (+6% over the quarter). Fund performance and market movements of £1.7bn and net inflows of £149m, offset by fund closures of £62m and a £116m return of capital. | GREEN ↑ (Graham) Happy to upgrade my stance on this after a quarter of net inflows, excellent performance fees, and the landmark announcement of a £15m buyback. | |

Johnson Service (LON:JSG) (£535m | SR53) | 2025 revenue +4.3% to £535.6 million. Organic growth 1.4%. Adjusted operating profit growth in line with market expectations, and an improved margin heading towards the 14.0% target. On track towards achieving the targeted margin of at least 14.0% in 2026. | AMBER = (Graham) [no section below] Barring Covid-related disruption to the hospitality sector several years ago, this linen and workwear provider has typically been a solid performer. ROE and ROCE have been good if unexceptional, and EPS forecasts have been sturdy. Today’s update maintains that track record. While investors wait for profit margins and/or the valuation to improve from the current 10x P/E multiple, they are at least enjoying a 4% yield to pay for their time. Sustained buyback activity has also been juicing annual EPS. Given £112m of financial net debt and moderate top-line growth, I’ll cautiously leave us neutral here for now. | |

MJ GLEESON (LON:GLE) (£225m | SR54) | Results for the full year will be in line with current market expectations (FY June 2026 PBT: £24.3m). For H1, will report the sale of 848 homes, c. 6% more than H1 last year. Demand for new homes remained subdued but steady; expect to see an improvement in open market sales through Spring. | AMBER ↑ (Graham) Upgrading this housebuilder to a neutral stance on the back of an "in-line" update with very encouraging forward-looking metrics, and with exciting EPS forecasts in place for FY27 and FY28. This is cheap against its balance sheet and against forecast earnings at the current share price. But I'd like a little more hard proof before taking us back to a positive stance on this one. If you think I'm being a little too cautious, please do bear in mind that this stock issued two profit warnings last summer! | |

Avation (LON:AVAP) (£88m | SR41) | Twelve-year lease agreement for a new ATR 72-600 aircraft with Cambodian Airways. Scheduled to be delivered new in October 2026. | ||

Spectra Systems (LON:SPSY) (£76m | SR71) | Cartor Security Printers (as part of a consortium) wins HMRC contract for production and supply of vape duty stamps. Estimated value £38.4M ($51.84M) including VAT over five years with an option for an additional year. Spectra expects approximately 15% of the total five-year revenue. | AMBER = (Graham) [no section below] 15% of £38.4m is £5.76m, and if we assume an additional year perhaps the value of the contract to Spectra is £7m. Putting it another way, the annual value of the contract is £1.15m. So it’s good news but I’m not sure that it moves the needle massively against forecast group turnover for 2026 of £28.5m. I remain neutral on this one after earnings were downgraded last year. | |

Character (LON:CCT) (£42m | SR49) | Trading conditions remain challenging. LfL sales in four months leading up to Christmas 2025 were down c.11%. H1 sales will be down year-on-year but revenue for the year as a whole to be in line with last year's full year outcome. Due to the mix and enhancements, adjusted PBT will more than double. | AMBER ↑ (Graham) [no section below] | |

Plexus Holdings (LON:POS) (£12m | SR17) | “While our reported results reflect a deliberate investment phase following an exceptional prior year, we made solid operational progress.” | AMBER/RED ↑ (Graham) The latest forecasts from Cavendish suggest we'll see £9.4m of revenue in FY June 2026, generating an adjusted PBT around breakeven (£0.2m). The following year, it's expected we'll see revenues of £11.8m and adjusted PBT of £0.7m. I'd put a wide range of uncertainty around these but even so, the situation is not quite as bad as I thought. Cash at June 2025 was £2.5m, and the Chairman has lent the company £2m since then (at an 8% interest rate). It still looks very high-risk, but I don't think a fully RED stance is justified on the basis of this cash position and the earnings forecasts. | |

Cellbxhealth (LON:CLBX) (£11m | SR7) | Q4 and full year 2025 revenues of approximately £0.4 million and £1.4 million respectively. Cash £7.3m. Reducing costs at all levels, voluntarily delisted from OTCQX. Rationalising its operations at Guildford into one facility. |

Graham's Section

Polar Capital Holdings (LON:POLR)

Up 6% to 628p (£638m) - Aum Update - Graham - GREEN ↑

Polar Capital Holdings plc…, the specialist active asset management group, today provides an update in respect of the three months to 31 December 2025.

It’s very pleasant to see inflows and rising AUM at this asset manager.

The net flows are pretty small (£149m), but anything positive is to be welcomed. Note that they are overwhelmed by positive market movements of £1.7 billion:

The situation is even more stark for the financial year-to-date, where net flows are negative (minus £541m) but where market movements are nearly 15x bigger and are positive (£8 billion):

Performance fees (after staff bonuses) are looking great: £16m in the financial year-to-date, versus only £7.9m in the entire previous year.

These profits were generated “by the Biotech, Healthcare Opportunities and the two Convertible Bond funds, with smaller contributions from the Artificial Intelligence, Healthcare Blue Chip and Japan Value funds.”

CEO comment:

It was a positive end to 2025 for the firm. We delivered net inflows during the quarter and performance fees crystallised above the level accrued at the end of September 2025 and the prior year. The elevated performance fee profits have supported the Board's decision to announce a £15m share buyback programme, signalling confidence in the business and reflecting our disciplined approach to capital allocation, as well as our focus on delivering long-term value for shareholders.

With a market cap well north of £600m, a £15m buyback is not going to radically change the share count, but it doesn’t hurt!

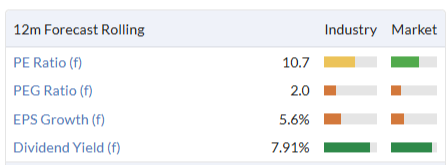

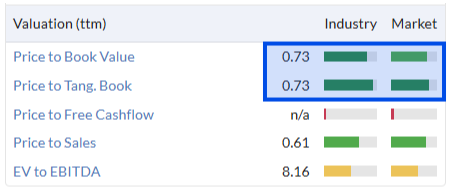

And I’d argue that a buyback is achieving decent value here:

Outlook includes typical commentary on why active management in general has done so badly:

"Although higher rates, volatility and broader dispersion would typically favour high-conviction active strategies, market leadership remained unusually concentrated for much of the year, making consistent outperformance difficult for many diversified approaches. Independent data indicates that, in aggregate, fewer than a third of active managers globally outperformed in 2025.”

In other words: the very largest companies, which have the heaviest weightings in major indices, remained strong in 2025. For active managers - who are typically underweight rather than overweight these names - this makes it very difficult to outperform.

Two-thirds of Polar’s strategies outperformed their benchmarks.

Looking ahead, “client engagement has improved, and the new business pipeline is strengthening”.

Graham’s view

I’ve been consistently positive on this one, although I did moderate my stance to AMBER/GREEN in more recent times.

While a quarterly inflow doesn’t prove that there has been a fundamental change here, I’m happy to use it as a signal for an upgrade back to fully GREEN.

The StockRanks would approve: this is a Super Stock and one with rising Momentum:

In technical terms, this has just broken out of the range it was trapped in since 2022:

The buyback is another interesting signal, even if it’s not huge. I can’t find evidence of any previous buyback by Polar Capital Holdings Plc, only by its trust. So this decision is something of a landmark.

So while I’ve always been pretty optimistic about this one, I think the reasons for optimism today are strong enough to justify escalating my stance!

MJ GLEESON (LON:GLE)

Up 4% to 399.3p (£233m) - Trading Update and Notice of Results - Graham - AMBER ↑

It’s an in-line H1 update from this housebuilder.

Let’s see how they handled Budget uncertainty:

Demand for new homes remained subdued but steady through the Period with buyers' lack of confidence in the current economic environment compounded further by commentary during the run-up to the late Autumn Budget. With Budget concerns fading and following the interest rate cut in December, we expect to see an improvement in open market sales through the Spring selling season. On that basis, we remain confident in our forecast for FY2026.

It’s not all good news for buyers: to offset build cost inflation “and an increasing regulatory burden”, higher selling prices are planned.

Volumes: 848 homes, up 6% on H1 last year.

Other metrics augur well for H2 and for the year ahead:

Net reservation rates are up, even excluding bulk deals (from 0.44 per site to 0.48 per site).

Including bulk deals, net reservation rates have jumped from 0.55 per site to 0.75 per site.

The current forward order book is also much bigger at 978 plots, vs. 597 plots 12 months ago.

Gleeson Partnerships - launched in mid-2024, this initiative has delivered its first homes, but most housing associations that might use it are still waiting for government funding to arrive.

Gleeson Land - 15 planning applications were submitted in H1 (vs. only 2 in H1 last year).

Also, one very large land sale is forecast to go through this year, but it depends on a technical process beyond Gleeson’s control.

Net debt finished H1 at £22.5m which should be a very manageable figure.

CEO comment: reiterates the message.

We are pleased to have delivered a solid performance in a subdued market. We now expect to see an improvement in new home sales through the Spring selling season on the back of last month's rate cut, and as uncertainty in the run-up to the Budget continues to subside.

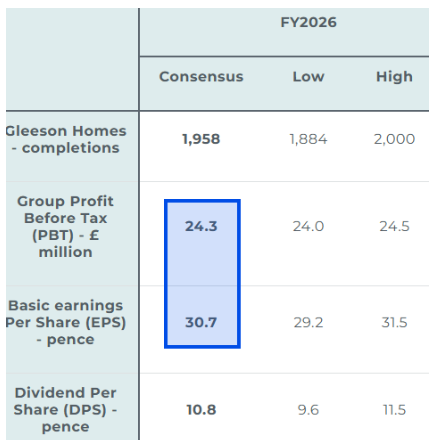

Estimates are helpfully provided on Gleeson’s website: PTB £24.3m, EPS 30.7p (giving a P/E of 13x at the current share price).

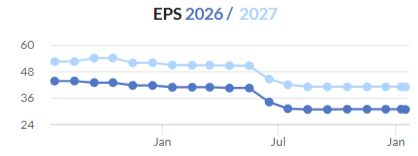

FY27 and FY28 are provided too, and they’re very interesting: EPS is expected to rise to 40.4p for FY27, and then 50p in FY28! I think I’d take FY28 estimates with a large grain of salt.

Graham’s view

This stock gave us some profit warnings last year, in June and July, and we turned cautious/negative on it.

But checking my commentary at the time, I still had hope for the medium- and long-term, due to the valuation on offer (a material discount to net asset value).

EPS forecasts have been stable since then, and today’s in-line update maintains that:

I note that the management structure was simplified around the time of the profit warnings, with regional CEOs being given more control but with the group CEO also taking on more responsibility for the performance at Gleeson Homes.

Given the strong improvement in the forward metrics (the order book and reservation rates), I have no hesitation in taking us back to a neutral stance. Perhaps I should even be more positive than that?

If you have a strong view on the housing market, and a positive one, I do think the potential value on offer is very good here:

The balance sheet argument is a good one, and the EPS forecasts also suggest that it could be very cheap against earnings in a year or two.

So I’ll be happy to take this back up to AMBER/GREEN again at some point, maybe when there is a little more visibility on how the Spring selling season is going, assuming no downgrades to FY27/FY28 forecasts. Of course it might be too late by then! But for now, a one-notch upgrade seems reasonable to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.