Good morning!

Last night, I published my post-Christmas retail review. It was not a bad festive season for the consumer or for consumer stocks: there were a few casualties, but also many "in line" updates, and even a few "aheads". A good environment for stock-picking!

Great news! There has been some fabulous work done behind the scenes here, and we now have our spreadsheet fully up to date: here's the link. Our method of updating the sheet has changed and there might be one or two small issues to iron out, but it will be vastly easier to keep it updated from now on. Cheers!

That's the reports done for the week, thanks everyone!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Babcock International (LON:BAB) (£7.3bn | SR64) | Q3 trading update – strong delivery underpins FY & Babcock announces CEO retirement and succession | Confident in delivering on the Board's expectations for FY March 2026, including meeting the FY26 margin target of 8%. Possible upside to current expectations (depending on the timing of delivery of maritime licences). CEO to retire by the end of calendar year 2026. | AMBER/GREEN = (Graham) [no section below] The defence sector is very hot right now and Babcock’s very strong valuation (£7bn market cap vs. £300m forecast profits next year) reflects this. EPS forecasts have risen consistently over the past year as the company’s growing revenues and margins continue to surprise positively. Beware that the ValueRank is now only “16” and the stock is categorised as a High Flyer. Sentiment couldn’t be much higher than it is right now but if President Trump gets his spending plans approved, perhaps a rising tide will lift all boats in the sector. |

SSP (LON:SSPG) (£1.55bn | SR48) | LfL sales growth 5% in Q1. Guidance remains unchanged, including EPS towards the upper end of range 12.9p - 13.9 (excluding the benefit of a share buyback). £24m out of the £100m share buyback has been completed. | ||

AVI Global Trust (LON:AGT) (£1.09bn | SR N/A) | AVI Open Letter to HVPE Board, Manager, Shareh’drs (similar letter approved by Migo Opportunities Trust (LON:MIGO) today.) | Shareholder in HVPE says “We commend the actions taken in 2025, however, we are firmly of the view that further significant initiatives are necessary and should be explored.” They want capital returns prioritised, and/or a formal sales process. | |

C&C (LON:CCR) (£477m | SR69) | Overall trading is below the Board's expectations. Weak consumer around the Budget, but then Christmas was in line. January has been soft. Adjusted operating profit to be in the range of €70m - €73m. FY27 profits will be similar to the current year. | BLACK (AMBER/RED ↓) (Graham) Plenty of reasons to be cautious about this one, even if it is starting to offer real value in terms of the earnings multiple. But the cuts implied by today's profit warning are significant, and I think a moderately negative outlook makes sense in the short-term. This is quite weather-dependent so perhaps a hot summer can get it performing strongly again. | |

Trufin (LON:TRU) (£113m | SR78) | Contract with a global technology platform for a new game scheduled for release in H2 2026. “Materially enhances Playstack's first-party IP portfolio and increases the value of its overall portfolio.” £6m share buyback. EPS estimates lowered due to the impact of the MIP. | AMBER/GREEN = (Graham) I could get on my high horse and blast Trufin for how they’ve attempted to manage the message they’ve put out today, but I’m not going to do that. I see today’s news as neutral overall, and I’ll leave our existing AMBER/GREEN stance unchanged. | |

Record (LON:REC) (£107m | SR74) | Net flows $3.3 billion. AUM rises from $110.3 billion (Sep 2025) to $115.9 billion (Dec 2025). | AMBER = (Graham) While I’ve long admired this business, it’s still a little soon for us to turn positive again after the November profit warning. Let’s continue to wait and to look for some growth sparks to make it interesting again. | |

Residential Secure Income (LON:RESI) (£106m | SR84) | Like-for-like rental growth of 3.4%. Adjusted earnings per share increased 11% to 5.7p. But property values fell due to higher yields, so EPRA net tangible assets per share fell 15% to 63.3p. | ||

STV (LON:STVG) (£52m | SR43) | FY 2025: revenue towards the top end of the guidance range of £165m-£180m, with adjusted operating profit in line with current consensus of £11.4m. CEO: “The macro-uncertainty of H2 2025 has continued into early 2026 with subdued advertising and commissioning markets persisting, although the upcoming 2026 FIFA World Cup provides an important event for advertisers and viewers alike.” | ||

Eenergy (LON:EAAS) (£19m | SR30) | FY 2025: Revenue of £23.0m. £4m of previously anticipated revenue has slipped into H1 2026. Adj. EBITDA +183% to £1.7m. FY26: Board has increased FY26 revenue expectations to £34.0m, equivalent to an increase of 13.3% and expected Adjusted EBITDA to £4.5m. | ||

Blackbird (LON:BIRD) (£10m | SR3) | Chairman comment: “Adding subtitles and transcriptions is a massive leap forward and they are a significant part of a much bigger story. We are reducing video production timelines from weeks to same-day sign-off…” | This is a Reach announcement, i.e. a non-regulatory press release. |

Backlog

Beazley (LON:BEZ)

Statement regarding Possible Offer by Zurich - Graham - PINK

I just wanted to say a few words about this one before wrapping up.

On Monday, in the middle of the day, Zurich announced that it was interested in buying Beazley at 1280p (a 56% premium to Beazley's prevailing share price). I don't think Zurich currently owns any Beazley shares.

Zurich said that their offer would provide existing Beazley shareholders "immediate and certain cash value for their investment at a level that exceeds what Beazley could achieve over a reasonable timeframe through the execution of its strategy".

The transaction would create a global leader in Specialty insurance with c.$15 billion of gross written premiums, exceptional data availability and underwriting expertise, leading market and distribution capabilities and outstanding reinsurance and technology infrastructures. This combination of two highly complementary businesses would establish a leading global Specialty platform, based in the UK which would also leverage Beazley's Lloyd's of London presence.

Zurich released this announcement with the hope of achieving engagement from the Beazley board.

A few hours later, on Monday, Beazley responded:

Beazley confirms that on 4 January 2026, it received an unsolicited, non-binding indicative and conditional cash proposal from Zurich...1,230 pence per share in cash, which the Board of Beazley unanimously rejected on the basis that it significantly undervalued the Company.

The Board has not yet had the chance to consider Zurich's improved proposal of 1,280 pence per share, received on 19 January 2026.

Yesterday (Thursday), we got the full response: they rejected the proposal "on the basis that it materially undervalues Beazley and its longer-term prospects as an independent company."

They added this rather interesting titbit:

The terms of Zurich's latest Proposal are below the last proposal put forward by Zurich in late June last year and rejected by Beazley, which valued the Company at 1,315 pence per share at an implied equity value of £8.4 billion, equivalent to approximately 2.4x tangible book value as at 31 December 2024.

That proposal never made it out to the public. The share price at the time was only about 930p.

The Beazley board make the following arguments for their existing strategy:

- The track record of returns over past 20 years (total shareholder return 2,200%), "materially outperforming global specialty insurance peers".

- Best-in-class underwriting

- Leadership in Cyber insurance, "one of the most significant structural growth stories".

- Superior returns over the last ten years (average ROE 15.5%)

- $1.3 billion returned to shareholders over the past three years, but still has "a very prudent capital and reserving policy".

Graham's view

The disclosure that Zurich put in an even higher proposal last year strikes me as something of a bombshell. Even though the BEZ share price receded since the time that proposal was made, Zurich's willingness to put forward a 1,315p proposal will require them to at least match that bid (and probably exceed it) if they want to have any chance of getting the bid through on this occasion.

Indeed, at the latest share count, taking into account recent buybacks, the new 1,280p proposal is only worth £7.5 billion - much lower than the £8.4 billion price tag suggested last year. And it looks to me as it the P/TBV multiple attached to the latest deal is noticeably lower than the multiple attached to last year's proposal (2.2x vs. 2.4x).

So I suspect that the 1,280p proposal has very little chance of tempting Beazley shareholders (and of course it has already been rejected by management). Given the excellent returns achieved for so many years, I think I'd be quite happy as a Beazley shareholder to wait and see if Zurich were interested to pay a real premium price. The offer of a little over 2x tangible book value for a business that consistently generates very high ROE is not all that tempting, in my view.

Graham's Section

Trufin (LON:TRU)

Up 5% to 121p (£118m) - Graham - AMBER/GREEN =

There are three RNS announcements from Trufin today:

Playstack Platform Contract

Share Buyback Programme

Playstack Management Incentive Plan

Hopefully the first two will do a good job of justifying the third one!

Playstack Platform Contract

TruFin is pleased to announce that its subsidiary, Playstack Limited ("Playstack"), a leading UK games publisher, has signed a significant contract with a global technology platform for a new game scheduled for release in H2 2026. The game is being internally developed and will therefore be owned exclusively by Playstack.

The multi-year agreement includes a series of contractual payments, as well as performance-based fees payable following the game's launch.

PlayStack already has plenty of titles in the Xbox Microsoft Store (using an unofficial website) so perhaps we can presume that the “global technology platform” is Microsoft?

PlayStack’s most successful title "Balatro" is also sold by Microsoft for Xbox and PCs.

Estimates: the RNS doesn’t help us to understand if the contract changes earnings expectations. It merely says that the contract “underpins TruFin's confidence that it will deliver yet another year of profitable growth in 2026 for shareholders.”

So let’s turn to Panmure Liberum (many thanks to them) for updated earnings estimates.

The revenue forecasts haven’t changed, but the platform deal appears to have de-risked profitability:

FY 26 revenue unchanged (£66.1m).

FY 26 PBT increased 5.5% from £8.7m to £9.2m.

FY 27 revenue unchanged (£67.7m).

FY 27 PBT increased 4.4% from £9.3m to £9.8m.

So far so good, but there’s more to unpack today.

CEO comment:

…with a strong balance sheet, increasing profitability across the Group and growing confidence in our outlook, we believe TruFin is well positioned to deliver disciplined capital returns alongside long-term growth, and I am pleased to announce today a share buyback of up to £6 million.

Share Buyback

As noted above, it’s a £6m buyback.

The Group continues to perform strongly and generate excess cash. The Board continues to believe that the Company's shares trade at a discount to an internally calculated intrinsic value and, as such, the Share Buyback Programme is being initiated in order to further enhance shareholder returns and to reduce the Company's share capital. Any Ordinary Shares acquired as a result of the Share Buyback Programme will be cancelled.

There have already been two share buyback programmes, each for £4m, since August.

In August, they had a cash balance of £18.5m. With £14m of share buybacks announced since then, they are therefore relying on cash profits to refill the pot.

Playstack Management Incentive Plan (“MIP”)

PlayStack is adopting a very large MIP in percentage terms:

“...approval has been given to issue new shares up to a maximum of 15% of Playstack's fully diluted share capital (the "MIP Shares").”

10% of the fully diluted share capital is reserved for the PlayStack CEO, with the balance for “additional members of the senior management team”.

I should highlight that PlayStack and Trufin are distinct entities. The PlayStack CEO, the PlayStack Board and PlayStack shares are all distinct from Trufin, although ultimately owned by Trufin.

So when additional shares in PlayStack are issued, this doesn’t dilute Trufin shareholders when it comes to their ownership of Trufin itself.

Instead, it dilutes Trufin as a shareholder in PlayStack: Trufin will end up owning a smaller percentage of PlayStack. I hope I've explained it well.

The next thing to untangle is the conditions for these new PlayStack shares (“B shares” and “C shares”) to vest:

The B Shares vest and participate in value only if Playstack achieves a minimum equity value ("Hurdle") currently £19.6 million on a future exit event

The C shares participate in value once the Hurdle plus accrued interest, calculated at 12%, has been achieved. As at 22 January 2026 the Hurdle plus accrued interest stood at £45.9m.

Most of the new shares are “C shares”, requiring the higher £45.9m hurdle on an exit event.

Effect of the MIP on estimates: I neglected to mention this earlier, because I wanted to describe what the MIP was first. Panmure Liberum have accounted for the MIP in their new estimates today.

Taking the MIP into account along with the contract news, they have lowered their estimate of the value of Trufin’s stake in PlayStack, from £150m to £137m.

Similarly, with PlayStack potentially owning less of Trufin’s future earnings, they have lowered their EPS estimates for FY26 (from 9.3p to 8.6p) and for FY27 (from 9.8p to 9.1p).

Graham’s view

This is a slightly unfortunate event: when a positive trading update is simultaneously accompanied by a bonus plan that more than fully compensates for the good news!

A very cynical take would be that the contract news and the buyback announcement were at least partially designed in order to soften the blow of the MIP.

Checking the footnotes at the broker note, I see that the adjustment to Trufin’s fair value as a consequence of the MIP is some £16.4m. This assumes that PlayStack itself is worth £155m (which of course is up for debate).

But it’s much nicer to lead with the headline “£6m buyback” than “£16.4m bonus scheme”.

In defence of the MIP, if I’m reading it correctly, then it will only pay out “on an exit event”, i.e. a sale of the company or its assets.

So the probability of it paying out might not be all that high. And if it does pay out, then it might not pay out very much - that would depend on the proceeds.

Furthermore, I think it’s fair to say that the management team at PlayStack should be highly incentivised to increase the value of the company.

So while I could get on my high horse and blast Trufin for how they’ve attempted to manage the message they’ve put out today, I’m not going to do that. I see today’s news as neutral overall, and I’ll leave our existing AMBER/GREEN stance unchanged.

Record (LON:REC)

Up 0.5% to 54.27p (£108m) - Third Quarter Trading Update - Graham - AMBER =

Record plc… the specialist currency and asset manager, is pleased to announce its trading update for the three months ended 31 December 2025 ("Q3 FY26").

There’s very little to dislike about this update.

Key points:

Positive net flows $3.3 billion

Positive market movements, so AUM grows from $110.3bn to $115.9bn.

Fee rates “broadly unchanged”.

Performance fees (£2.4m year-to-date) are slightly lagging last year’s equivalent figure (£2.9m).

Earnings expectations are unchanged.

CEO comment:

At US$115.9bn, AUM ended another quarter at the highest level we have ever reported, following positive net flows and underlying asset growth. We saw strong inflows and growth in underlying assets for Passive Hedging, and a second successive period of inflows for FX Alpha. It was also an excellent quarter for performance fees, with a further £1.6m earned, bringing total performance fees for the year to date to £2.4m."

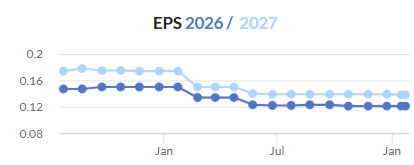

Estimates: Edison have left everything unchanged, including EPS estimates of 3.91p (FY March 2026) and 4.56p (FY March 2027). That puts the shares on 12x next year’s earnings. For context, EPS was 4.93p in FY25.

Graham’s view

We downgraded to neutral after a profit warning in November:

While I’ve long admired this business, it’s still a little soon for us to turn positive again after such a recent profit warning. Let’s continue to wait and to look for some growth sparks to make it interesting again.

C&C (LON:CCR)

Down 10% to 115.6p (£428m / €493m) - FY26 Trading Update - Graham - AMBER/RED ↓

It’s a profit warning from this drinks company:

As the Group approaches the end of its financial year, overall trading is below the Board's expectations. Customer performance across November and early December was impacted by weak consumer confidence associated with the November UK Budget. Our business performance was driven primarily by softer than anticipated demand in hospitality, alongside adverse product mix, as consumers continue to move away from the consumption of wine and spirits, in favour of beer, across the market.

If you’re of legal drinking age, you can review C&C’s brands here. Magners/Bulmers and Tennent’s are their biggest, most well-known brands.

After C&C’s weak performance around the time of the Budget, Christmas was “in line”, but then in January they have seen “continued softness of consumer demand in the market and anticipate that this will continue for the balance of the current financial year”.

New guidance for FY February 2026: adjusted operating profit of €70 - 73m, “reflecting lower operating profits in our Distribution business”.

The Distribution business includes Matthew Clark (the UK’s leading distributor) and Bibendum Wine. These were picked up from Conviviality Plc, after that went into administration.

At the midpoint of the new range, I estimate that this is a cut to profit forecasts of c. 10%.

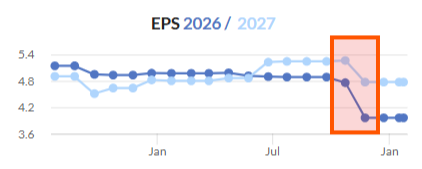

At least forecasts had been stable for many months leading up to this:

Balance sheet

The business remains financially robust with a strong balance sheet, significant liquidity and covenant headroom. The Board remains committed to its capital return plans of returning a total of €150m over the previously announced timescale with €92m already returned as reported in our interim results.

Checking the interim report, I see that net debt excluding leases was €91.5m at that time. Against annual operating profits of €70m+, this doesn’t sound very burdensome.

Outlook for FY February 2027

The Board expects a continuation of the current macroeconomic and consumer headwinds into next year but remains confident in the Group's ability to create value for shareholders in the medium to long term. It is currently anticipated that FY27 profits will be similar to the current year…

This is a deeper cut to expectations than FY2026. Again using the midpoint of the new range (€71.5m), I estimate that this is around an 18% cut to profit forecasts.

Graham’s view

I was neutral on this last year, at a market cap of £580m. I’m glad I was cautious!

At the new market cap of c. £430m / €490m, I do think it’s potentially offering value, given expected annual operating profits of €70m+.

But there are good reasons to be cautious:

The distribution business, by its nature, is probably a low-quality and volatile investment (we saw that when we covered Conviviality)

A significant cut to the profit forecast with only one month left until the end of the financial year is always difficult to swallow.

The cut to the FY27 outlook looks very material.

While the debt load doesn’t look excessive, there is no balance sheet support (intangibles are over €500m).

I’m downgrading this one notch to AMBER/RED, hoping for better news and a hot summer, with large quantities of Magners to be consumed during the World Cup!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.