Good morning everyone,

I'm writing to you this morning while Storm Eowyn is having a blast. Good luck to everyone affected!

Megan and Mark have kindly provided us with a few backlog sections to get us started.

Podcast: our weekly podcast has been published, this time featuring Ed, myself and Lawrence. Ed discusses the findings of his new article - "The Jump - what to do when share prices react to Trading Statements".

Here are the links:

Spotify, Apple Podcasts, YouTube, and Amazon Podcasts.

1pm: this report is complete, have a nice weekend everyone.

Spreadsheet accompanying this report (updated to 17/1/2025)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Severn Trent (LON:SVT) (£7.4bn) | TU | In line. Accepts Ofwat’s Final Determination for 2025-30. Dividend growth to match CPIH. | |

Burberry (LON:BRBY) (£3.7bn) | Q3 TU | Q3 LfL store sales -4%. After festive period, now more likely H2 will broadly offset H1 loss. | AMBER (Graham holds) |

Paragon Banking (LON:PAG) (£1.6bn) | TU | Full year guidance reiterated. | |

Renew Holdings (LON:RNWH) (£718m) | TU | Rail Sector is behind exps, so FY 2025 will be below exps but still ahead of 2024 (adj. profit £70.9m). | |

Bloomsbury Publishing (LON:BMY) (£533m) | New agreement with Amazon | New long term supply agreement. Reiterates confidence in consensus expectations. | AMBER/GREEN (Graham) Last-minute deal agreed, terms unknown. Valuation somewhat full here? |

Begbies Traynor (LON:BEG) (£148m) | Latest Red Flag Alert | “Critical” financial distress climbs by 50% q-on-q. Hotels, Leisure and Retailers the worst affected. | AMBER (Graham) There could be a wave of insolvencies this year, especially in certain badly-hit sectors exposed to the consumer, higher rates and tax rises. |

Quadrise (LON:QED) (£103m) | Result of Placing and Subscription | Raises £4.5m with an upsized placing, £1m also expected from a Retail Offer. | |

Record (LON:REC) (£95m) | Q3 TU | New equity fund launched. Neutral net flows. Performance fees are helping, revs now slightly ahead. | GREEN (Graham) No major changes to forecasts. I like the value here even if growth may be limited. |

Pulsar (LON:PULS) (£70m) | TU | FY Nov 2024: ARR +£2m at constant currencies to £61.7m. Adj. EBITDA £9m, in line. | |

Works co uk (LON:WRKS) (£12m) | H1 results | LfL sales down 0.8%, in line with exps. Adj. EBITDA loss. Current trading in line. |

Backlog

Zotefoams (LON:ZTF)

Up 7% to 317p - Trading Update - Megan - GREEN

The ‘news’ section of Zotefoams’ corporate website helps explain why the wind has been knocked out of the company’s share price since management announced that it is pausing the active hunt for a commercial partner for its new recyclable packaging. Every one of the company’s latest news stories are about the excitement around ReZorce - the product which is now being shelved.

But this morning’s trading update is a good reminder that there is a lot more to the company than ReZorce.

In the year to December 2024, Zotefoams is set to announce revenues of £147.8m, which is 16% higher than the previous year and marginally ahead of previous guidance of £145.5m.

Strong sales growth has largely been driven by the footwear division, where the company sells its specialist ‘High Performance Product’ foams to the sports industry, where it is used in trainer orthotics. Sales in the HPP division were 37% higher at £80m.

In the industrial markets which Zotefoams serves, including construction and personal protection, demand has been slower, meaning polyolefin sales have been marginally lower. Polyolefin is a synthetic product used in many different industries, which has long provided the backbone to Zotefoams’ sales. But 2024 is the first time the company will report higher sales from its newer ‘High Performance’ foams, which are also sold at higher margins. Operating margins have ticked rapidly upwards at the company over the last five years (from 10% in 2019 to 16% in the last 12 months) thanks to this evolving product mix.

It is worth noting that the company has benefited this year from especially strong demand from Nike, as appetite for fancy new trainers tends to soar in an Olympic year. So it may be that the product mix rewinds slightly again in 2025.

In 2024, the company is set to report adjusted pre-tax profits of £15.6m, up from £13.1m last year and ahead of the previous £14.9m expectations. The adjustments are largely related to amortisation costs on acquired intangibles and an impairment MuCell extrusion (MEL) division (which is mainly the ReZorce development project).

There is a brief comment on the leverage in this trading update, which is expected to fall to approximately 0.9x (from 1.2x at the end of 2023). At the last count, net debt stood at £44.6m after first half net cash outflows.

Megan’s view

This is an interesting business with a good footprint across multiple markets. It’s relatively capital intensive, which isn’t really my cup of tea. But it’s being well managed (the decision not to embark on an expensive rollout of a new product without a commercial partner was a very sensible one).

The share price has fallen to a more reasonable level now that the hype of ReZorce has been removed. I see no reason to change Roland’s previous stance. GREEN

Iofina (LON:IOF)

Down 3% to 21p - Trading Update - Mark - AMBER

This company that produces iodine from the brine produced by oil & gas wells has had record production:

The total H2 2024 production of 358MT was within our forecast range. When combined with H1 2024 crystalline iodine production of 276.1MT, total production for the year was a record for the Company, up 13.4% to 634.1MT compared to 2023 production of 559.3MT.

And pricing has been strong:

The company has benefitted from a strong spot raw iodine price in excess of H1 2024 levels and is currently above $70/kg. Prices are anticipated to remain at these higher levels throughout H1 2025 due to the continued robust global demand for iodine. IPBC product sales have performed particularly well for Iofina Chemical in 2024, significantly surpassing 2023 levels, driven by strong interest from customers.

However, delivery problems mean they actually report a miss:

Consequently, the Group expects to report adjusted EBITDA for 2024 in the region of $7.5m, below the forecast range of $8.5m-$9m. The Company projects that without these unexpected delays, the Group would have met its forecasted adjusted EBITDA target range.

This appears to be a genuine timing issue, as they say:

The recognition of delayed sales in January 2025 has given the Group a stronger start to the year than previously forecast.

Looking more generally at the company, I see their revenue growth has been impressive:

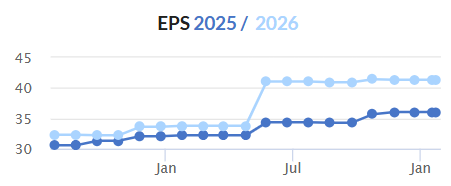

But it is not matched by EPS:

This may be commodity pricing, but I also understand they had to renegotiate long-term supply agreements with suppliers of brine as they were too favourable to the company. Still, if they achieve 2025 forecasts, excluding the impact of the extra shipment, the P/E of around 10 is modest for a growing company. The lack of dividends suggests this growth requires capital. However, internal cash flow and an earlier raise mean that the company is debt-free:

Mark’s view

A miss for pure timing reasons can give a potential opportunity. However, like any commodity play, I think investors will need to do quite a bit of work modelling production and pricing before being able to conclude that this is cheap.I don’t think this has been covered by DSMR before, so I remain neutral until I can do more work on this particular market. AMBER

Graham's Section

Bloomsbury Publishing (LON:BMY)

Down 0.5% to 651p (£531m) - New agreement with Amazon - Graham - AMBER/GREEN

Something dramatic happened between BMY and Amazon.com (NSQ:AMZN) last night.

At 5.51pm, Amazon published an announcement in its News section (emphasis added):

Our contract to sell Bloomsbury titles was scheduled to expire last year. We extended the contract under its current terms several times in an effort to reach an agreement, but despite our best efforts over the last seven months, Bloomsbury has refused to engage in a good faith negotiation to discuss a new contract to sell their titles in our store. Unfortunately, the latest extension expires at midnight on the 23rd of January and after that time, Amazon will no longer be able to sell Bloomsbury print books in the UK, Europe, and Australia, or Bloomsbury Kindle books worldwide.

Later, the announcement was edited to add:

UPDATE: As of 10.30 p.m. on 23 January, an agreement in principle has been reached between Amazon and Bloomsbury, and Bloomsbury books continue to be available for our customers.

Which leads to the following RNS from BMY:

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, has reached a new long term supply agreement with Amazon.

The Board reiterates confidence in consensus expectation.

Graham’s view

My interpretation of this is that BMY has compromised in its negotiations with Amazon. The extent of the compromise is unknown, but what we do know is that it won’t have much of an effect on immediate trading and therefore on the results for FY Feb 2025.

I’m a little concerned by Amazon’s statement that its previous terms with BMY were “far out of sync with other publishers who sell books through our store”. Does this mean that BMY has been enjoying abnormally high but unsustainable levels of profitability through its trade with Amazon? Perhaps because Amazon was desperate to keep Harry Potter available in the past, but is now prepared to negotiate?

Amazon walked away, declared it publicly, and then a deal was abruptly reached. So again, I’m left with the conclusion that BMY must have compromised, to some extent.

This might not be the most popular move but I’m inclined to moderate our stance on this one to AMBER/GREEN, as the market cap of over £500m seems somewhat full to me, given the balance of risks and uncertainties.

It’s wonderful to be the publisher of Harry Potter, and I don’t wish to downplay it, but if that is the main attraction here then I’m not sure how I could justify a more premium valuation than BMY is already trading at. Finding the next JK Rowling or Sarah J. Maas won’t be easy. A better argument for these shares might rest on management's ability to make clever acquisitions using the cash thrown off by its past successes.

Consensus expectations for FY25, according to the company, are for revenue of £334m and adj. PBT of £39.6m. Advisory firm h2radnor were forecasting adj. PBT of £39m as of last October. BMY has been doing a good job of raising expectations over time:

Burberry (LON:BRBY)

Up 12% to £12.00 (£4.3bn) - Third Quarter Trading Update - Graham holds - AMBER

At the time of writing, Graham has a long position in BRBY.

I had a look at this in July last year, on the day of a serious profit warning. It let go of its CEO that day, and immediately hired a new one.

Roland followed up in November with a look at the company’s interim results.

Today we have the Q3 update to the end of December, and fortunately it’s providing a brighter perspective.

Firstly, comparable store sales are down by only 4% for Q3 (vs. Q3 last year). In H1, comparable store sales were down by a far more concerning 20%.

Total retail sales for Q3 are down 7%, made up of:

Comparable store sales: down 4%

Increased selling space: up 1%

FX headwind: down 4%

Next, a look at sales by region. Asia Pac has been a big worry, but we see the following improvements across the regions:

Asia Pac: down 25% in H1, down 9% in Q3.

Americas: down 21% in H1, up 4% in Q3.

EMEIA: down 13% in H1, down 2% in Q3.

How did BRBY do this? Various actions they’ve taken are provided, including a brand reset, enhanced visual merchandising (mannequins are back!), and reuniting their creative and commercial teams in London.

Outlook: this is very impressive in the context that the consensus forecast was for a £66m full-year loss for FY March 2025:

As previously communicated, we are acting with urgency to stabilise the business and position the brand for a return to sustainable, profitable growth, supported by strong cash generation and balance sheet strength. We are confident that our strategic plan will improve our performance and drive long-term value creation.

While we recognise we are still early in our transformation, we are encouraged by the response from customers and partners over the festive period. In light of our Q3 performance, it is now more likely our second-half results will broadly offset the first-half adjusted operating loss, notwithstanding the uncertain macroeconomic environment.

The adj. operating loss in H1 was £41m, so we can look forward to an adj. operating profit approaching that figure for H2. So there has been a huge rebound in profitability in H2 vs. H1.

Graham’s view

As a shareholder here for many years, the thought has of course crossed my mind that I should have cashed out at higher levels.

Two -year chart:

It’s a recovery play and the current valuation (£4.3bn) suggests that the market does see this returning to something that resembles the profitability of the past. Today's new guidance, implying a big rebound in H2, does suggest that this is possible.

Indeed, the share price has doubled since September - a nice reminder that there is no shortage of dramatic moves in the big-caps!

Personally, I continue to believe in BRBY’s brand strength. There has been a generalised slowdown in luxury spending and I think that is the main driver here, although clearly there have also been some internal struggles and disagreements over how to respond.

Gucci is a brand that I like to check when reviewing BRBY. Gucci's Q3 revenue (to Sep) was down 16% on a like-for-like basis. When results are announced, I’ll be curious to see if it also enjoyed a big improvement in the quarter ending December.

Gucci’s parent company Kering (KER), like BRBY, has had a very rough few years in terms of its own share price movement, highlighting again that there are problems across the sector, not just for BRBY:

I’ll leave my stance unchanged at AMBER today as I acknowledge that this is still a recovery play. While BRBY might generate a modest profit in H2, the current market cap does already price in the return to meaningful profitability, which isn't guaranteed although I do think that it's more likely than not, in the next few years.

For patient investors who are willing to wait it out, I do think the stock remains a reasonable hold. And so AMBER seems fair enough to me.

Record (LON:REC)

Up 8% to 51.3p (£102m) - Third Quarter Trading Update - Graham - GREEN

This update was eagerly awaited following the slide in Record’s share price in recent weeks:

Thankfully, some of the fears appear to have been unfounded following this morning’s positive update.

The shares are now down by only about 10p vs. where they were in early December.

I was GREEN on this one in November, at 62p.

Today’s update:

Fee rates “broadly unchanged” (fee erosion is an issue for currency hedging providers).

Performance fees of £1.3m in Q3 bring performance fees up to £2.9m year-to-date.

The result is that revenue is trending “slightly ahead”:

With management fee expectations for the full year unchanged and with £2.9m of performance fees recognised for the nine months ending 31 December 2024, we now expect revenue to be slightly ahead of previous expectations.

Net flows are almost a wash, with growth in the new category “Hedging for Asset Managers” offset by small outflows from the hedging products:

Estimates: Panmure have made no changes to their estimates beyond the addition of this year's performance fees. They had assumed £1m of performance fees in total for H2.

Therefore we have an EPS estimate of 4.9p for the current year (FY March 25), and little change is anticipated for the following years (4.8p of EPS for both FY26 and FY27).

Graham’s view

There are few fireworks here - just some slightly higher performance fees than might have been predicted.

Someone must have been worried about this update, but it has turned out to be a non-event.

I don’t see any reason to change my GREEN stance.

It’s not the most exciting share or company that we cover here, but it has reliably generated profits for many years, has a very strong balance sheet that includes surplus cash, and is diligently trying to grow some new income streams that will complement its existing ones. Maybe they'll succeed, maybe they won't. But with a heavy dividend yield and a cheap-ish earnings multiple, I still like it.

Begbies Traynor (LON:BEG)

Unch. at 92.6p (£148m) - Latest Red Flag Alert Report - Graham - AMBER

Some dramatic numbers here with the number of UK businesses in “critical” financial distress up by 50% in a single quarter.

Worst-hit sectors, said by Begbies to be “in worrying states of financial health”::

Hotels & Accommodation up 84%

Leisure & Cultural Activities up 76.5%

General Retailers up 48%

Food & Drug Retailers up 37%

The definition of “critical” financial distress is when a company has an outstanding CCJ of over £5k against it, or faces a winding-up petition.

Begbies also classifies companies in “significant” financial distress. The number of these rose less sharply: only up 3.5% quarter-on-quarter but still up by 21% year-on-year.

The quote from a partner at Begbies Traynor is suitably depressing:

As we start a new calendar year, there is very little to be excited about. Across nearly every sector, there has been an unprecedented level of growth in the number of firms who are at serious risk of entering insolvency in the next 12 months. The fact that the distress is being felt across almost every corner of the economy highlights how difficult the outlook is for UK businesses right now.

She goes on to say that borrowing costs are will be “structurally higher for the foreseeable future” and that the current position will be exacerbated by tax rises and the higher minimum wage.

Ric Traynor says “I fear 2025 could end up being a watershed moment where thousands of UK businesses 'call time' after struggling to survive for years”.

Graham’s view

Begbies is not a disinterested bystander but I tend to trust their analysis as they do have their finger on the pulse when it comes to insolvencies.

For me, this report is another reminder that we need to stay extra-focused on balance sheet health this year, as the tax rises from April are likely to have a big impact. Also, companies that need to refinance in 2025 need to be analysed with great care.

The simple solution is to focus on stocks that are in rude financial health, so that refinancing is not a concern, and tax increases will not be fatal.

When it comes to BEG I was neutral on it in December at 99p and while there is a chance of windfall profits if a wave of zombie firms decide to call it a day this year, that would only be a temporary phenomenon. I continue to believe that it’s fairly priced around current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.