Good morning,

Happy Friday! Today I'm hoping to look at some backlog items that were requested by readers or are otherwise interesting. So far I have EVPL, INPP and BAG on the list.

Today's Agenda is now complete (added RCDO and SMWH).

I'll be adding some Backlog items through the afternoon - please continue to check back.

4pm: all done, and hope you're happy with the brief coverage of various backlog items. Have a nice weekend!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

| WH Smith (LON:SMWH) (£1.4bn) | Sale of High Street Business | SP -4% Gross cash proceeds £52m, net cash £25m. Creates pure play global travel retailer. Trading in line. Background notes: The High Street division generated “trading profit” of £32m on revenues of £452m in FY August 2024. With 500 stores being sold, the average store is valued at £150k. | AMBER/GREEN (Graham) [no section below] This sale price strikes me as underwhelming. Perhaps the loss of the name WH Smith from this division (to be rebranded “TG Jones”) is a major reason for the discounted sale? I leave our mildly positive stance unchanged as 85% of SMWH’s trading profit is from the Travel business which will now have management’s undivided attention. |

BBGI Global Infrastructure SA (LON:BBGI) (£1.0bn) | Full Year Results | Nav per share 142.7p. On 6th February, announced a Board-recommended offer at 147p. General meeting on 10th April. | PINK (under offer). |

| Ricardo (LON:RCDO) (£160m) | Strategy Update | Response to Science (LON:SAG) . Says SAG wants to control RCDO without paying a takeover premium. Trading in line. | AMBER/RED (Graham) One good outcome from Science Group's involvement is that it has prompted Ricardo to promise a business and strategy update for next month, which may contain more info than Ricardo would otherwise have felt obliged to publish. |

Smiths News (LON:SNWS) (£129m) | TU | Solid performance, on track to deliver results in line with expectations. | GREEN (Graham) The company reminds us that at least 91% of revenue is contractually secured through to 2029. The collapse might come in 2030 but I'll keep my optimistic stance on this for now. |

Good Energy (LON:GOOD) (£90m) | Un-audited Results | 2024 profit in line. PBT +16% (£6.6m). Revenue fell with energy costs, but gross margin improved. | PINK |

LMS Capital (LON:LMS) (£18m) | Full Year Results | NAV £36.2m, NAV per share 44.8p vs. share price 21.3p. Year-end cash balances £13.5m (including cash at subsidiaries). | PINK (“Managed Realisation”) The Board have signalled their intention to pursue an orderly realisation of the portfolio and return capital to shareholders. |

Roebuck Food (LON:RFG) (17m) | Full Year Results | Revenue £11.6m, operating loss from continuing operations £1.7m includes acquisition costs £1.1m. | |

Parkmead (LON:PMG) (£14m) | Interim Results | Cash £6.8m. Disposal to generate £14m plus contingent consideration of up to £120m. | |

Plexus Holdings (LON:POS) (£12m) | Interim Results | Sales -43% (£2.9m). Pre-tax loss £1.3m. Cash £1.4m. Exc. a one-off deal, organic revenue up £1.9m. | N.B. has conditionally raised £3.5m subject to approval at a general meeting on April 7th. |

Westminster (LON:WSG) (£9m) | Interim Results | Revenues +26% (£3.7m). Gross margin falls to 33%. Pre-tax loss £1m. Raised £1.2m recently. |

Ricardo (LON:RCDO)

Up 1% to 261p (£162m) - Strategy Update - Graham - AMBER/RED

The friction between SAG Holdings (NAQ:SAG) and Ricardo leads to another RNS.

Science Group has demanded the removal of Ricardo's Chairman. It is the Board's understanding that, if this demand is met, Science Group will seek to replace him with the Executive Chairman of Science Group. This would give Science Group effective control of the Board without paying a premium for that control.

The Board believes Science Group's actions are being taken solely for the benefit of Science Group and its own shareholders and are contrary to the interests of Ricardo's other shareholders.

Even though I have a moderately negative stance on Ricardo, I have some sympathy for their position. They didn’t seek out this conflict. And unless Science Group can get a much bigger stake than 16% - or convince other Ricardo shareholders of the correctness of their position - then Science Group isn’t entitled to demand major board changes.

Ricardo notes that thanks to the disposal of its defence subsidiary and various acquisitions it made (and perhaps overpaid for?), its Environmental & Energy businesses now account for c. 85% of operating profits.

One positive effect of Science Group’s agitation is that it has prompted Ricardo to produce a “Business and Strategy Update” for publication in mid-April. This will include:

YTD 2024/25 trading and outlook;

Actions the Company is taking to further reduce costs and improve cash generation in the near and medium term; and

Greater detail on the Company's plans to focus on environmental and energy transition solutions.

Graham’s view

See my comments in January to see why I turned AMBER/RED on Ricardo: a significant debt load, a major profit warning, and a moderately high earnings multiple for an average-quality business even if it hits downgraded forecasts.

The big question for me is what Science Group sees in it. The most logical explanation I can find is the one given by Ricardo itself: a potential opportunity for Science to control a £160m market cap business in the consulting sector, even though Science doesn’t have the funds to buy the business outright.

Smiths News (LON:SNWS)

Down 1% to 52.8p (£131m) - Graham - GREEN

Mark has been AMBER/GREEN on this newspaper/magazine delivery business, while I've been GREEN on it.

Today the company has reiterated a very interesting fact: that I remember it saying before:

Smiths News has officially secured long-term contracts covering 91% of its newspaper and magazine revenues through to at least 2029, providing a solid foundation to support its medium-term growth ambitions. Smiths News continues to maximise its market-leading early-morning, end-to-end supply chain capabilities

I remember being a little sceptical of this but the company clearly wants the market to take it to heart!

If that puts a floor on revenues through 2029, is it possible that the revenue decline might be less than the 9% shrinkage implied? If revenue falls by only mid-single digits by 2029 that should mean several more years of big dividends that are well covered by earnings:

The question is whether we see some kind of final collapse in newspaper and magazine readership. Or - and this may be wishful thinking - could we see it actually hit a trough at some point?

Today's update from Smiths News describes a "solid trading performance across H1" with the full-year performance tracking in line with expectations.

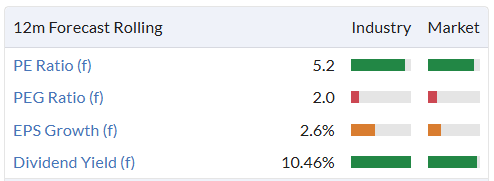

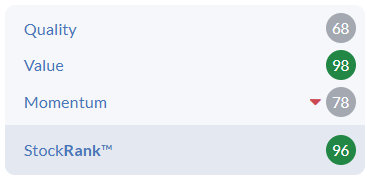

It is categorised as a Super Stock:

And it passes my favourite stock screen:

So where does it go from here? As with the likes of Reach (LON:RCH), I'm attracted to contrarian "cigar butt" stocks like this, where there is the prospect of a few more puffs of profitability to justify the current market cap.

At the most recent full year results, it reported average net bank debt of £12m which was down by over 50% on the previous year.

I think a very large part of the future value here rests in management's investing capabilities, as the core business may ultimately be in a terminal decline but the company will have available cash flow to invest in bolt-on acquisitions and other "adjacent growth initiatives". This is perhaps riskier than the average stock I might go GREEN on, but I remain comfortable with this stance for now.

Backlog items (please check back through the afternoon as I work on this).

- EVPL done

- INPP done

- BAG done

- LTHM done

- JHD done

Everplay (LON:EVPL)

Up 18% this week to 271p (£395m) - Final Results - Graham - GREEN

everplay group plc, a leading global independent ("indie") games developer and publisher of premium video games, working simulation games and children's edutainment apps, is pleased to announce its unaudited final results for the year ended 31 December 2024

This is the renamed Team17, creator of the Worms games franchise.

I was reasonably positive about it at the interim results last year.

This week we had full-year results with the following highlights which on their face seem to justify my positive stance:

Revenue +5% (£166.6m)

Adj. EBITDA +46% (£43.5m)

PBT £25.3m (last year: £1.1m loss)

Cash improves to an impressive £63m (from £43m).

The back catalogue is key to performance at this Group, which arguably reduces the risk as it doesn’t rely on new blockbuster performances every 6-12 months. The back catalogue generated 86% of group revenues in 2024, higher than its six-year average of 76%.

Consider this review of performance at the subsidiary which still carries the original name of the group:

Team17 revenues fell by 5% as some new titles failed to meet management expectations and some titles were moved into FY2025. There was, on the other hand, strong double-digit growth in the back catalogue. More than 80 titles contributed towards back catalogue revenues in period, encompassing over 1,200 Digital Revenue Lines (up from over 900 in FY 2023)

Away from Team17, the other subsidiaries delivered much better revenue growth, up 22% and 25% respectively.

Dividend: we have a maiden dividend of 2.7p.

Outlook:

The Group has made a good start to FY 2025, supported by the momentum from the festive season promotions. As a result, the Board remains confident that the Group can deliver an improved trading performance in FY 2025, marginally ahead of current market expectations, and remains well positioned for continued growth over the medium to long term.

Market expectations are not included in the announcement.

Graham’s view

“Indie” games are an interesting investment idea. They lack the enormous resources that go into flagship games titles, and in general they can sometimes look unimpressive, but they often still command a loyal following.

With Team17/everplay, I think we have probably my favourite example of an indie games developer. Worms launched an “Anniversary Edition” 25 years after the original which I played as a teenager (how to make me feel old!) and continues to attract a following.

Despite being an indie games company, I actually think this business might be less risky than some developers of flagship titles, due to its diversification and thriving back catalogue.

With rising momentum and a near-perfect QualityRank, I’m happy to upgrade my stance on this to GREEN.

I see that the dividend forecast on the StockReport was only 1.4p, with the actual proposed dividend being nearly twice as high. The ValueRank might get a boost when this is updated:

I should add a gentle reminder that the largest shareholder Debbie Bestwick (with 18%) is currently a NED. She sold 10% of her stake back in November at 210p and it wouldn't surprise me in the least if she continued to diversify out of the business over time.

International Public Partnerships (LON:INPP)

Unch. at 110.9p (£2.1bn) - Full Year Results - Graham - AMBER/GREEN

This investment trust was suggested by a reader. It's FTSE-250 listed and invests in offshore energy infrastructure ("OFTOs"), various public-private partnerships, and other businesses in the infrastructure theme.

From its homepage I see that it has a 72% UK weighting with other important weightings in Belgium, Australia and Germany.

Yesterday it published full-year results with the following key points:

- NAV decreased to £2.7 billion (Dec 2023: £2.9bn), "primarily driven by an increase in interest rates".

- PBT was around breakeven

A low correlation with FTSE All-Share of 0.4 is mentioned - they are clearly targeting a certain type of risk-averse institutional investor by mentioning this.

I note that fee changes have been agreed with the investment manager so that they will be partially incentivised by the market cap of the company, not just its NAV. In other words, they will be motivated to try to close the discount to NAV!

The Board aren't satisfied with this discount at all:

"The Company's portfolio continued to show resilience during the year with strong underlying performance, despite a persistently challenging market environment for listed investment companies."

"The Board continues to believe the share price at which the Company is currently trading relative to the NAV materially undervalues the Company. Reallocating capital to enhance value for shareholders continues to be the primary focus for the Board and Investment Adviser, having realised c.£260 million through asset recycling in the 18 months to 31 December 2024. The realisation proceeds achieved were in line with the last published valuations. The Company is continuing its divestment programme in order to increase the quantum of capital able to be returned to shareholders with an enhanced target of returning up to £200 million."

Outlook: they are again targeting risk-averse institutions with this message (where I have added the bold).

Despite the persistent challenges facing the sector, which are contributing to sustained upward pressure on discount rates and consequent valuation challenges, listed infrastructure continues to represent an attractive long-term investment.

The Board believes that the implied projected net returns of 10.7% on an investment in the Company's shares, with a current dividend yield of 7.6%, represents an attractive 5.6% premium to that offered by a 30-year UK government bond.

Graham's view

I'm happy to give this an AMBER/GREEN. I've not studied it in detail but the sector in general is cheap. With a NAV per share pf 144.7p, this trades at a 23% discount. Or looking at it another way, investors would make a return of 30%+ from the current level, purely from a narrowing of the discount to zero (on top of the underlying return).

We've seen so much corporate activity in the trusts area recently, with many of them going private, my working assumption is that they are all undervalued until proven otherwise!

In fact, I've recently bought a trust for my personal portfolio for the first time. I've bought Pantheon International (LON:PIN) and look forward to writing up some analysis of it for you at some point in the not-too-distant future.

INPP is targeted at investors with a low risk tolerance and personally it doesn't match up with my risk appetite, so it's not something I'd consider investing in personally. But for those who match up well with its risk levels I can see that it might be be attractive. I'm AMBER/GREEN on this.

A G Barr (LON:BAG)

Unch. at 623p (£697m) - Full Year Results - Graham - GREEN

This Glasgow-based drinks group was previously on my small-cap watchlist. I rather meanly removed it due to its recruitment last year of an unlucky CEO.

I do still view it as a fabulous company.

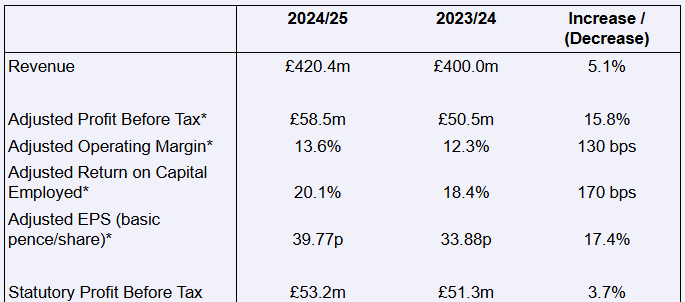

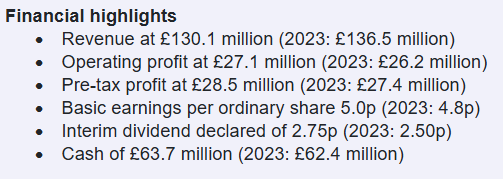

Here are some headlines from its results for FY Jan 2025. And kudos to the company for getting these out in March!

The adjusted PBT result is higher than the estimates published in January.

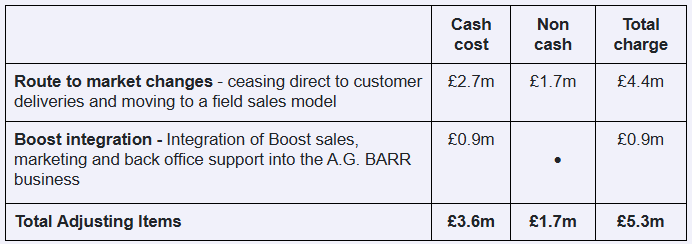

Let's explore why statutory PBT failed to grow; here are the adjusting items.

The adjusting items "comprise costs associated with our business change programme to improve efficiency and unlock growth".

I tend to not allow these types of adjustments, or to only partially allow them. It's too easy for sneaky CEOs to put a range of inconvenient costs into the adjusting items bucket. An optimist will argue that they are non-recurring costs. A pessimist like me will argue that non-recurring costs are a fact of life!

The company offers guidance that it's planning to spend £1m this year to simplify and integrate the business into a single organisation. So hopefully that will be the main adjustment and we'll see a cleaner result for FY January 2026.

The main brand is IRN-Bru and it's great to hear that it continues to do well. Rubicon also had a "standout performance". I note that the 3 core soft drinks brands - IRN-BRU, Rubicon, Boost - generated 66% of total revenue, and collectively grew 8.4% year-on-year.

Outlook - in line.

CEO comment:

"2024/25 was a successful year for the Company. I would like to take the opportunity to thank my colleagues across the business who delivered these excellent financial results.

Looking forward, we have a refreshed strategy centred on growth and are committed to our long-term financial targets. I am confident that successful execution of our plans will see another year of positive progress towards our long-term goals."

Graham's view

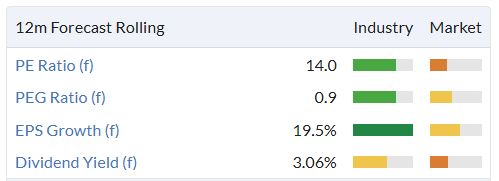

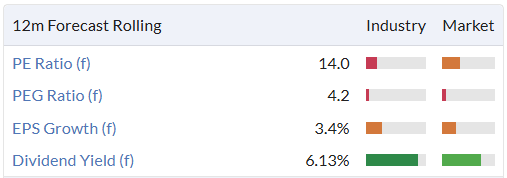

This is still a fabulous company in my view. Stockopedia calculates it as a High Flyer (high Quality and high Momentum) but the Value on offer doesn't seem too bad either:

Their core drinks brands appear to be as strong as ever. I'm happy to leave my positive stance unchanged.

James Latham (LON:LTHM)

Up 4% this week to £10.87 (£219m) - Trading Statement - Graham - AMBER/GREEN

We had a brief update yesterday from this trade distributor of timber, panels, and decorative surfaces.

Revenue for the year to 31 March 2025 remains in line with market expectations, with volumes slightly up on last year. Cost prices have remained stable throughout the year, but the market for timber and panel products remains competitive.

We continue to invest in order to keep improving our service levels. We anticipate that our profit before tax will be in line with market expectations. The Company's balance sheet and cash balances remain strong.

I'm happy to leave our prior stance unchanged - AMBER/GREEN by Mark in November.

Checking SP Angel's December note, I see that they "marginally" reduced their forecasts for FY March 2025 to revenues of £359m and net income of £19m (and it's nice to see no difference at all between net income and "adjusted" net income.

I also note a net cash forecast of £74m which helps to takes the sting out of fears that this might be trading expensively:

Growth is minimal - revenues are expected to fall slightly - so I expect that the main reason to hold this would be a high level of bullishness on the macro outlook.

James Halstead (LON:JHD)

Down 1% this week to 146p (£608m) - Interim Results - Graham - GREEN

James Halstead plc, the AIM listed manufacturer and international distributor of floor coverings, announces its results for the six months ended 31 December 2024.

Floor coverings are one of the trickiest sectors in my experience. But James Halstead has pumped out some decent results in a tough year:

Exec Chairman comment:

"Against the backdrop of difficult markets, we are pleased to have raised profits underpinned by improved margins and reductions in overheads. We remain confident of the Group's medium-term prospects, despite short-term confidence weakness in Europe, and anticipate another year of progress.''

The decline in revenue is attributed primarily to "restrictions on government spending in several key markets".

In the UK (43% of turnover), sales were flat. By contrast, central Europe was down 8% and Australia was down 12%. North America was up 7%.

The accounts are presented cleanly and the company records cash inflow from operations of £25m, although this is down on the prior year due to increased inventories.

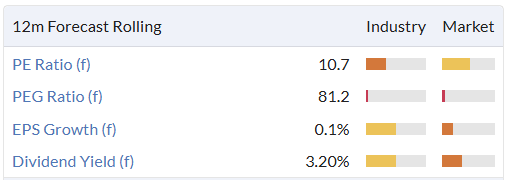

Cash stands at £63.7m and the dividend increases 10%.

There's an impressive yield:

Outlook excerpt:

[Restricted government spending] will change, we believe, over the course of 2025 and we would expect to see a stimulation to sales. Additionally, the UK housing sector has continued to be subdued but the reform of planning and mandatory targets should pave the way to push through the acute housing crisis again giving us confidence in improved demand.

We are pleased to see that H2 has started well and in January 2025 UK sales, which are the bedrock of the Group, were 9% ahead of the comparative.

Graham's view

The note re: inventories has caught my attention and I see that inventories finished H1 at £87m. Revenues in the prior year were £274m to give some context; it's worth bearing in mind that inventories are a significant drain on cash but I wouldn't yet be concerned by this factor. The company cites shipping delays and launch stocks being needed for new ranges and these strike me as reasonable explanations for a relatively small year-on-year increase in inventories.

Paul was GREEN on this last October and I do respect Halstead's solid track record, the strong balance sheet, the clean accounts and the family-based ownership with family members still running the company.

If its growth prospects were similar to LTHM I'd probably be AMBER/GREEN on this one too, but given that Halstead's UK sales are up 9% in H2 and earnings forecasts on the StockReport do suggest some growth is on the cards, I'm happy to leave the GREEN stance unchanged.

With that said, I end the report here. Cheers!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.