Good morning and welcome to Friday's report!

I'd quickly like to send a huge shout-out to everyone who contributed to the report this week (Megan, Roland, Mark and Keelan) for producing so much content while I've been under the weather. These reports would have been far thinner and less interesting if they hadn't done so. Cheers!

1pm: today's report is finished. Thanks for dropping by.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

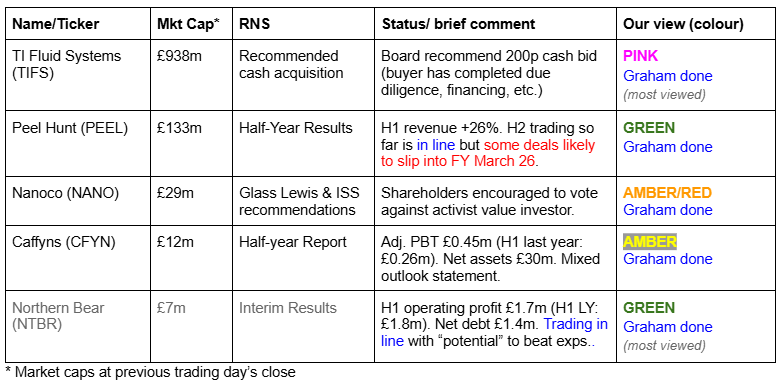

Companies Reporting

Summaries

Peel Hunt (LON:PEEL) - down 2% to 106.25p (£130m) - Half-year Results - Graham - GREEN

Today’s outlook statement could be interpreted as a mild profit warning, as revenue in the pipeline is likely to slip into the following financial year. However, there are no official market expectations for this stock. I am encouraged by 26% revenue growth in H1 and remain hopeful that IPO and fundraisings may recover in the medium-term.

Northern Bear (LON:NTBR) - up 8% to 54.75p (£8m) - Interim Results - Graham - GREEN

Strong results with 83% of full-year EPS already in the bag as NTNR heads into the seasonally more difficult and usually quieter H2 period. I’ve thought NTBR was cheap for some time and in the absence of the share overhang that was affecting the stock until June, perhaps its valuation can improve.

Short Sections

ECO Animal Health (LON:EAH)

Up 6% yesterday to 69.5p - Interim Results - Mark - AMBER/RED

There seems to be a big mismatch between how Eco Animal Health view themselves:

…a rapidly growing global animal health company

And how their customers view the demand for their products:

Group Revenue decreased 13% to £33.2 million (H1 2023: £38.0 million)

This means losses are increasing:

Loss per share of 2.50p (H1 2023: loss per share: 1.93p)

This is despite capitalising significant amounts of R&D:

Research and development ("R&D") expense and amounts capitalised were in aggregate a cash investment of £4.1 million (H1 2023: £3.6 million).

Which means their cash balance is decreasing. Although it remains significant:

Cash balances decreased to £18.3 million (30 September 2023 £20.6 million)

However, only £6.9m of that cash is held outside of China:

They have managed to get cash out of China recently, subject to a 5% dividend tax. However, they also say:

On a day‐to‐day basis, the Board considers the cash held in the Group's joint venture subsidiary in China to be unavailable to the Group outside of China; accordingly, cash management and funds available for investment in R&D is based upon the cash balances outside of China.

Personally, I’d exclude this from any valuation. After all, it can be hard to ensure corporate interests are aligned when it comes to partially owned foreign subsidiaries.

Broker Equity Development say that these interims point to a stronger second half. Indeed, they will need to be to hit forecasts. They also say that the adjusted EBITDA outlook is reiterated. However, adjusted EBITDA is not a sensible measure for a company that capitalises so much R&D. Nor is EV/EBITDA a good valuation metric including cash in Chinese JVs.

No doubt, management will point to a payback on that R&D at some unspecified point. However, this is outside of any reasonable forecast window, so we have to go with what we have. A forecast P/E of 34 and no dividend:

Mark’s View

Graham gave this an AMBER when he looked at it following the profit warning in October given the potential for that R&D spend to generate future products that may improve the business prospects. However, for me, with those benefits appearing out beyond any reasonable forecast window, and the risks associated with Chinese subsidiaries and JVs, it is an AMBER/RED.

TI Fluid Systems (LON:TIFS)

Up 2% to 192.4p (£981m) - Recommended Cash Acquisition - Graham - PINK (takeover)

Perhaps this is just a formality, but I wanted to mention that the takeover of TIFS at 200p has been finalised with due diligence and documents complete (see coverage in October). Now shareholders will need to vote on it.

35% of shares have promised or indicated that they will vote for the deal to go ahead, so I would say that it’s likely to proceed. Completion is expected during the first half of 2025.

This one spent most of its life on the stock exchange below its 255p IPO price:

I withdraw my AMBER/GREEN stance as I expect the takeover to go ahead.

Caffyns (LON:CFYN)

Up 6% to 449p (£13m) - Half-year Report - Graham - AMBER

Another tiny company finds its way into today’s report. This is a group of car dealerships in Sussex and Kent run and owned by many Caffyn family members.

Today’s interim income statement is not the most important part of today’s announcement, in my view. There is £450k of underlying operating profit, including £140k from the sale of a personalised numberplate.

What I really want to point out is balance sheet equity of £30m, including freehold properties at 16 of their 18 locations, so that the stock is trading at less than 50% of NAV.

Normally I’m inclined to take a positive stance when I see this, but I should also point out that the company has been availing of temporary banking covenants after it generated a loss in the previous financial year. It is expected to return to normal banking covenants in June 2025.

Additionally, it has a pension deficit, based on accounting rules, of £7.6m (down from £10m at the beginning of H1). This is already taken into account in the NAV calculation, and may not be a problem, but it does suck cash out of a business whose profitability has not been reliable in recent years.

For these reasons I’ll cautiously take a neutral stance on this one for now, but others may wish to investigate it in more detail.

Nanoco (LON:NANO)

Down 2% to 14.65p (£26m) - Glass Lewis and ISS recommendations - Graham - AMBER/RED

I’ve been AMBER/RED on this stock due to excessive cash burn - see coverage in August.

The company’s position is that it is exploring “an orderly sale of the Group’s trading business (including IP)”, with the goal of continuing to return surplus cash to shareholders.

Its cash balance was £20m as of July 2024, and it then spent £3m to finish a share buyback. The cost base is £6m.

The current controversy relates to an attempt by a Cayman Island-registered fund (“Milkwood”) to appoint two people to the Board of Nanoco. Apparently - according to the Chairman of Nanoco - Milkwood’s intention is to retain surplus cash and convert Nanoco into an investment company.

Today’s news: the two main proxy advisory services, ISS and Glass Lewis, who advise institutions on how to vote their shares, have both recommended voting against Milkwood’s resolutions.

Graham’s view: Milkwood only owns 8% of Nanoco and my instinct is that investors are more likely than not to organise against them so that cash is returned rather than retained in the company. But I don’t know which way the vote will go.

I’m leaving AMBER/RED on this as, like Milkwood, I have doubts about the inherent value of the underlying business, and the stock is now trading at a premium to its shrinking cash pile. Let's see if they can sell the underlying business for a decent price.

Graham's Section

Peel Hunt (LON:PEEL)

Down 2% to 106.25p (£130m) - Half-year Results - Graham - GREEN

I left this on my best ideas list for two years running. Despite reaching 140p a few times, it hasn’t held onto these gains:

Today’s interims show some progress:

Revenue £54m (+26%)

PBT £1.2m (H1 last year: £0.8m loss)

Adj. PBT £4.6m (H1 last year: £0.5m loss).

Unfortunately I don’t think the adj. PBT measure is worth emphasising, as it excludes share-based payments which are a real cost.

While I’m on that point, some observers may be put off investing in this when they realise that staff bonuses have eaten over 70% of available PBT.

I have sympathy with that point of view but I think the point of investing in Peel Hunt is to bet on a recovery in the IPO market - not on a continuation of the conditions that produce results such as today's.

According to EY, there were only two IPOs in London in Q3: one on the Main Market and one on AIM.

With thanks to EY who created these charts, here is the historical fundraising picture for the Main Market:

And here is the historical fundraising picture for AIM:

I don’t think it’s an exaggeration to say that both IPO markets have been dead since 2022.

Is this a “new normal”? If it is, then I’m wrong to have Peel Hunt on my best ideas list.

But I still find it hard to believe that current conditions are representative of the future.

I do expect that the very largest firms may choose the US over London for the foreseeable future - e.g. European fintech Klarna (value c. $15 billion) has chosen to list in New York.

But for small-caps and mid-caps, AIM and the Main Market should remain strong contenders, in my view.

Let’s turn back to Peel Hunt:

Net assets are an impressive £95m, covering a large chunk of the market cap, and only £2m of this figure is intangible.

CEO comment (emphasis added):

"We were able to capitalise on improving market conditions in the first few months of FY25, most notably executing two IPOs, collecting material M&A fees and generating increased trading revenues.

However, the recovery slowed over the summer period and investor sentiment was impacted in the last few weeks of the period due to concerns around the UK Budget, particularly in relation to AIM.

We welcome recently proposed policy initiatives, including pension reforms and HM Treasury's call for evidence to support a growth and competitiveness strategy for UK financial services, which are designed to increase investment and liquidity in UK risk assets."

On market conditions and fundraisings, Peel Hunt notes that despite a year-on-year increase, “overall activity remains below historical averages” (no surprise there).

They say that “IPO activity appears to be gradually resuming” although I'm not sure exactly what they are basing this on.

On bid activity, they note 19 active bids for FTSE-350 companies as of the end of September, compared with just two in 2023! My conclusion: UK stocks are cheap.

Outlook: there are no brokers/analysts providing estimates for Peel Hunt, but this outlook reads like possibly a mild profit warning to me, as some revenue in the pipeline slips into the next financial year:

Trading in the first few weeks of our second half is in line with management expectations. Although we have a solid pipeline of corporate transactions, including M&A and IPOs, we expect a degree of uncertainty to persist in the short term and consequently some of these transactions are more likely to execute in our next financial year….

Graham’s view

I’m a broken clock on this one: my assumption is that IPO conditions on AIM and the Main Market must improve at some point in the next few years, and my belief is that Peel Hunt will look very cheap if/when this happens.

In 2021, the year that Peel Hunt IPO’d, they generated an incredible £197m in revenues. Perhaps a year like that will not be seen again, but it shows what is possible when market sentiment is strong.

Northern Bear (LON:NTBR)

Up 8% to 54.75p (£8m) - Interim Results - Graham - GREEN

I did not intend to cover this, due to the market cap which is really too small for this report. However, it is 6th on our “most viewed” list so I will give it a mention!

NTBR was last seen in this report in May, when I was GREEN on it at 56p.

It’s a family of businesses providing building services “throughout Northern England and beyond”.

The stock has looked cheap for some time but failed to break out of a range of c. 40p-60p:

Canadian investor Jeff Baryshnik was trying to get out of it for some time and I believe that he created an overhang of shares - he eventually got out of it in June this year.

Today’s results show operating profit of £1.7m (H1 last year: £1.8m) on revenue of £37.6m (H1 last year: £36.9m). NTBR says that the H1 results are ahead of expectations, but then in the outlook statement it says it is trading in line with expectations!

I’ve noted similar confusion before, where the RNS needs a little bit of interpretation to help make it clear what they are saying.

From the outlook statement:

The Group has traded very well during the first half of FY25 and has the potential in the second half to trade ahead of strong prior year results and market expectations. This is on the assumption, inter alia, that current market conditions remain, the additional investment in operations continues to meet revenue expectations, and that there is no major weather-related disruption which had a significant impact in H2 FY24.

The recently-appointed Chair says:

"I am pleased to report that we remain in a strong financial position and have continued to make good progress against our medium-term objectives. This has been possible in the main by a combination of continued investment, organic growth and focus on cash generation, which has underpinned the results in the period.

Net debt is £1.4m, but the company points out that this is “a snapshot at a particular point in time and can move by up to £1.5m in a matter of days”. They helpfully disclose that net debt moved between £0.1m and £2.5m during the period, with an average of £1.5m. If only every company reported like this!

Option scheme: there are 13.8m shares outstanding, and NTBR recently granted 1 million options to staff, exercisable at 52p from October 2027 for those who are still with the company at that time. It implies max dilution of 7% but maybe this is a good way to promote retention?

Management: the FD is leaving but will stay until March 2025.

Estimates: Hybridian note that H1 is usually stronger than H2 for NTBR. Last year, for example, storms and rainfall impacted its roofing activities. However, the company has “already produced 8.4p EPS, which is 83% of the full year 10.1p forecast”.

Graham’s view

I can’t avoid the conclusion that surprises here are more likely to be the upside than to the downside, although this is another view I’ve held for some time.

According to Hybrdian, the dividend for the current year is pencilled in at 2p for a yield of 3.6% at the current share price.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.