Good morning!

Let's kick things off with a backlog section on Serabi from Mark.

All done for the day and for the week, see you next time!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Ocean Wilsons Holdings (LON:OCN) (£342m) | A response to Arnhold’s open letter (external link) which described the merger with Hansa as “deeply flawed and unfair”. | PINK (Graham) I get into the weeds of this a little bit, trying to understand the arguments made by each side. In the end my sympathies are with the shareholder, although I think that OCN are right about the technical details of the merger. | |

James Latham (LON:LTHM) (£223m) | 6m initial investment for the land, then £39m over two years to construct and fit out the warehouse. | ||

Avacta (LON:AVCT) (£223m) | SP +13% Deferral of several bond payments. £3.25m equity placing at 50p to settle the quarterly bond payment for October. | RED (Graham) [no section below] This one always seems like a basket case, and there is no change today as its convertible bondholders agree to defer two of their quarterly payments next year (Jan and April 2026) out to October 2027, although bondholders will have options to accelerate payments before then. Bondholders will benefit from a lower conversion price (75p instead of 88.7p) and will also benefit from a £3.25m equity placing, that will be used to settle their October 2025 payment. There is speculative potential with Phase 2 trials planned for next year, but as the equity looks unsafe to me, I have to be RED. | |

Serabi Gold (LON:SRB) (£149m) | H1 Gold production +14% to 20.545koz. EBITDA +102% to $26.3m. AISCC flat. $30.4m cash balance (31 Dec: $22.2m). | AMBER/GREEN (Mark) Production and cash are known, so the new information is sales and costs. Sales beat my expectations as they catch up with production. However, there is a huge jump in costs in Q2 which isn’t fully explained in the narrative. If I assume the Q2 cost profile for the rest of the year, I now get a risk of a material miss on PAT compared to the current broker consensus. However, not all is lost, even if my current estimates based on Q2 cost profile going forward prove closer to the reality, the stock remains on a P/E of around 4, with net cash. This still looks too cheap to me. The big question is if the market cares more about valuation or the estimate momentum? As a value investor, I’m sticking with the valuation-based view, at least until we have more information. | |

John Wood (LON:WG.) (suspended at £127m) | Sells North American Transmission & Distribution engineering business for $110m. | PINK | |

Carclo (LON:CAR) (£35m) | Rev -8.6% (£121.2m). Adj. EBITDA +12.3% (£16.4m). Outlook: “expect to continue this positive trajectory through FY26”. | AMBER/RED (Graham) A large pension deficit, a more expensive debt facility, and a red flag issue (failing to publish its annual report on time): I think a high degree of caution is appropriate here. This company has many mouths to feed and shareholders can't be particularly high on the list of priorities. |

Backlog

Serabi Gold (LON:SRB)

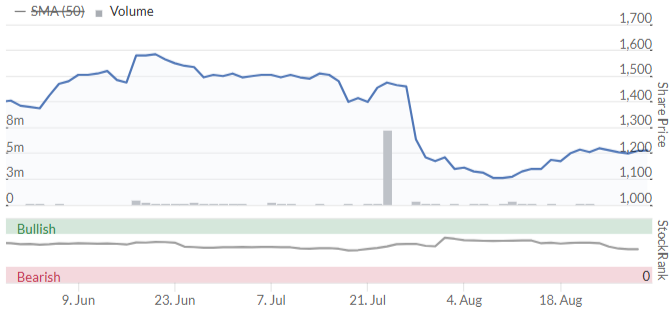

Up 4% to 205p - Results to 30th June - Mark - AMBER/GREEN

Production and cash figures here are already known:

Gold production for the first half of 2025 of 20,545 ounces (corresponding six-month period of 2024: 18,010 ounces).

Cash held at 30 June 2025 of $30.4 million (31 December 2024: $22.2 million).

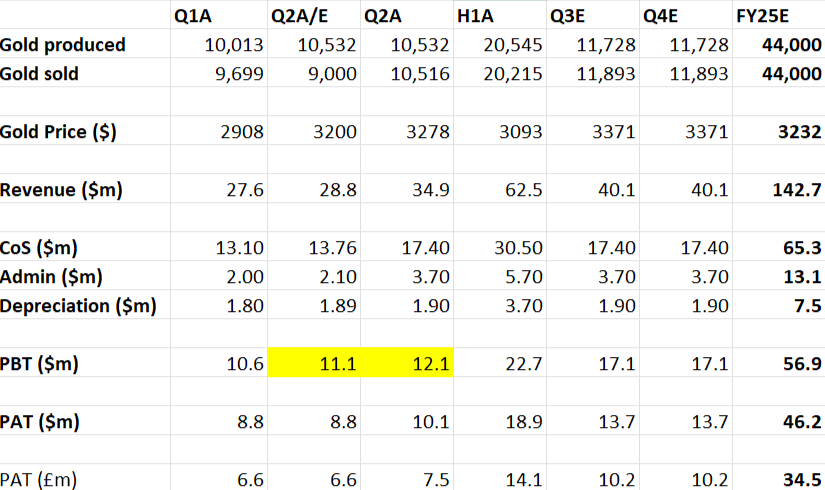

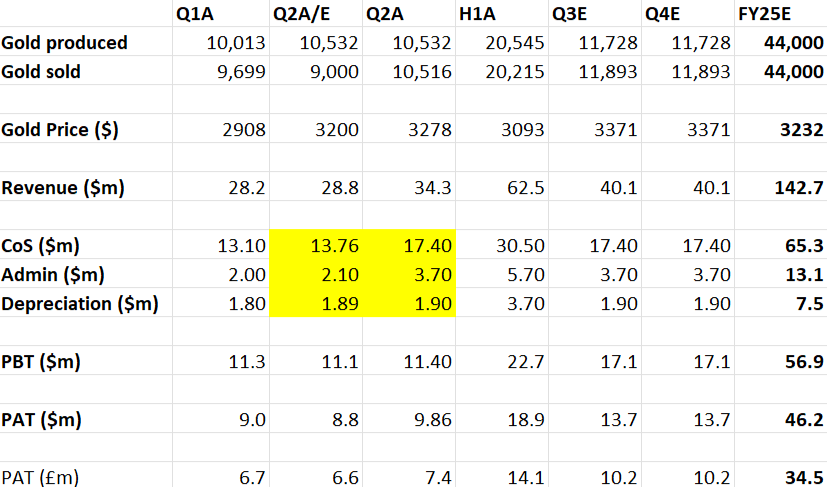

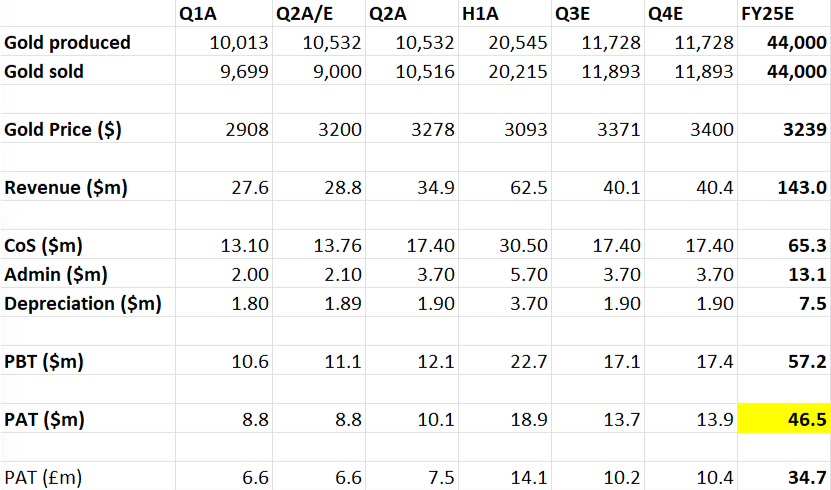

What matters in these results is sales and costs. Here it is a mixed bag compared to what I modelled following the Q2 production results. Sales beat my expectations for Q2, but with production guidance the same this just moves revenue forward. Together with a higher Q2 gold price than I modelled this means that PBT for Q2 beats my expectations:

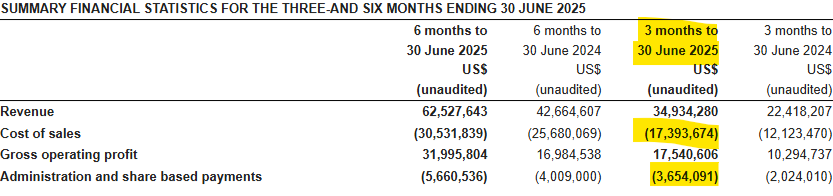

However, costs have also increased significantly for Q2:

And here’s what these look like in my summary model:

The only comments they make about this are:

While mine development expenditure has increased year-on-year, the investment continues to underpin our growth and expansion plans. All-In Sustaining Costs (AISC) for the period were $1,792 per ounce, reflecting both inflationary pressures and the increased development activity. Nevertheless, the Company continues to deliver strong margins, underpinned by the high gold price environment and improved production profile.

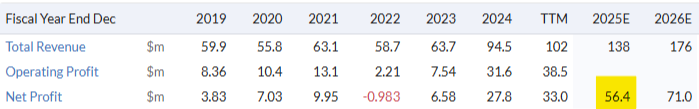

So, in the absence of other information, I think we must assume the Q2 cost profile is more realistic going forward. This takes a big chunk out of my PAT estimates which now stand at $46.2m for the year, whereas previously I estimated $55.6m. At the time, the PAT looked like it would be a healthy beat on expectations. However, since then the consensus estimate has increased from $49.9m PAT to $56.4:

Presumably this is on a higher gold price, but even if I put current spot into my model for Q4, I still get a reduced figure of $46.5m:

This is some 18% below consensus estimates.

Mark’s view

It may be too early to panic, as high costs for a single quarter don’t necessarily mean that these will be significantly higher going forward. However, in the absence of a clear explanation, there will be many, including myself, who will want to take the conservative view. So, with a single set of results I have gone from thinking they will beat expectations, to the risk of a material miss. This adds to my existing concern that a H2-weighted production profile can be risky in this industry.

However, not all is lost, even if my current estimates based on Q2 cost profile going forward prove closer to the reality, the stock remains on a P/E of around 4, with net cash. This still looks too cheap to me. The big question is if the market cares more about valuation or the estimate momentum? As a value investor, I’m sticking with the AMBER/GREEN rating. At least until we have more information.

Graham's Section

Carclo (LON:CAR)

Shares suspended at 47.4p (£35m) - Full Year Results - Graham - AMBER/RED

These are results for the year ending March 2025.

On the LSE’s main market, companies have four months to publish their annual report (it is six months on AIM).

As Carclo failed to meet that requirement, its shares have been suspended during the month of August.

That is a huge red flag, but Carclo has insisted that it has been trading well: a July trading update confirmed that FY March 2025 was ahead of expectations and that the company expected its margins to continue to improve.

What Carclo does: they have a “CTP” division (Carclo Technical Plastics) that manufactures and designs various complex products and parts - this seems to have a healthcare focus. They also have a “Speciality” division focused on parts for aerospace and for optics/LED.

Results highlights: these results are very backward-looking now, but let’s cover the main points.

Revenue -8.6% (£121.2m(

Adj. EBITDA +12.3% (£16.4m)

Operating profit £7.6m (previous year: £1.7m)

Net income £0.9m (previous year: loss of £3.4m).

The depreciation charge for the year is £6.5m and I don’t know why we’d leave that out of the calculations for a manufacturing business. So my instinct is to completely ignore EBITDA.

Operating profit of £7.6m is an impressive figure given the low market cap, and that’s after suffering over £2m of refinancing costs. These were “legal and professional costs”.

Debt position

The debt situation looks complicated. As of March 2025, total loans and borrowings were £30m, or about £22m if we exclude leases. And on the balance sheet date - 31st March 2025 - Carclo was “briefly overdrawn due to timing of cash flows, however, the balance was immediately repaid… with no adverse consequences”.

The new arrangement is with a lender called “BZ Commercial Finance”, and involves a £27m term loan and a £9m RCF. The previous lender - HSBC - has been fully repaid.

BZ is charging a higher margin over base rate than HSBC: according to the announcement in April, there was an increase of 1.75% over the previous facilities.

Pension deficit

Also in March 2025, the pension deficit was revalued by actuaries at £64.5m (as of March 2024). Carclo agreed to pay £5.1m in April 2025, then £3.5m annually until 2029, and then indexed annual payments starting at £5.8m until 2037.

An accounting valuation was also carried out and came up with a deficit of £51.7m as of March 2025. Higher life expectancy assumptions were primarily responsible for this having increased by £14.5m compared to March 2024.

Carclo also mentions having made a loss on its “liability driven investments” (LDI). LDI funds were at the heart of the gilt market crisis in 2022, and are designed to hedge interest rate risk for pension funds.

Interest rates increased in FY25, which is a good thing (it reduces the present value of liabilities). However, LDI funds did their job in hedging rate risk, both positive and negative, and so the value of Carclo’s LDI funds fell, causing the pension fund to make a loss of £8.7m.

Outlook

Now that I’m clear on the latest debt and pension deficit situation, I’m not sure if I care too much about the trading outlook! It sounds like the company’s pensioners and lenders will have to be their priorities (and rightly so!).

We’ve generally been AMBER/RED on this one - my last time was in December 2024.

Anyway, here’s the outlook:

The success of the strategic actions taken in recent years to turn the business around are bearing fruit and their success is evident in the improved operational and financial performance reported for FY25. The Board expects the Group to continue this positive trajectory through FY26 with continued margin expansion and positive cash generation, notwithstanding an increasingly complex global backdrop…

Growth in the medium-term will focus on accelerating expansion in the Life Sciences sector, where demand for high-precision solutions continues to grow and continued momentum in our Speciality Division, particularly in the aerospace sector. Strong cash flow performance, an improving net debt position and the new borrowing facility with BZ provide a solid financial platform for this growth.

They finish the outlook statement by promising “enduring value for all our stakeholders”; shareholders are indeed just one constituency, among many, that the company needs to care for.

Graham’s view

I think AMBER/RED continues to make great sense here.

Checking the balance sheet for one final sense-check on the company’s position, I see that it has negative equity of £12m. Exclude intangibles from the calculation and the number becomes minus £34m.

With that hole in the balance sheet, I can’t take a positive or even a neutral stance here.

In other industries, e.g. highly profitable software or media businesses, I can sometimes look past weak balance sheets. But in engineering and manufacturing, I can’t. There is also the red flag issue that the annual report could not be published on time.

I have no idea how the share price might react when the shares begin trading again, but I’d have little interest in getting involved here.

Ocean Wilsons Holdings (LON:OCN)

Unch. at £12.11 (£344m) - Response to Arnhold LLC’s Letter to Shareholders - Graham - PINK

OCN has hit back at a public letter published by one of its shareholders, Arnhold LLC.

Let’s examine the initial letter from Arnhold first.

They say that their clients own approx. 900,000 shares of OCN. I think this makes them a 3.2% shareholder.

They note that OCN shareholders are set to receive HAN/HANA stock worth approximately £12 (at market prices) in exchange for each of their OCN shares.

This matches up with my calculations, which have fluctuated between £11.57 and £12.30, depending on the latest price of HAN/HANA shares.

This compares poorly with a net asset value of OCN stock that is over £20 per share (but of course HAN and HANA shares are trading at deep discounts to their NAV, too).

Arnhold notes that Hanse, which is a 33% shareholder in OCN, will receive OCN’s investment portfolio rather than new HAN/HANA shares.

So from Arnhold’s point of view, Hansa will get “full value” for their OCN shares, while other shareholders will not.

Arnhold argues that the market agrees with its view that the merger is negative for OCN shareholders, on the basis of the behaviour of the OCN share price:

It does appear to be the case, as I’ve said before, that the OCN discount widened in response to the proposal, in the direction of the c. 40% discount at which HAN/HANA has typically traded.

Arnhold says that the rising price of HAN/HANA stock indicates that the market believes the deal favours Hansa.

They also note that 58% of the OCN portfolio is simply cash, and on that basis they argue that the companies should not be merged as if £1 of the OCN portfolio is worth £1 of the Hansa portfolio. They seemingly think that, ceteris paribus, a cash-rich portfolio should be viewed as worth more than a portfolio of funds.

I can understand their frustration that a cash-rich portfolio would be sold at a large discount. But I'm not sure if there is any fairer way of carrying out a merger of two portfolios.

In order to determine the exchange ratio of OCN vs. HAN/HANA shares, the NAV of each portfolio was used. Arnhold says that in making this calculation, and determining the value of its stake in OCN, Hansa did not use the market value of OCN shares, and instead used an inflated value (perhaps the £20 NAV per share?).

They say that as Hansa's investment management company will be the fund manager of the combined group, the interests of Hansa are not the same as the interests of other shareholders.

This bit is fairly damning:

…Arnhold calculates that the Combination would result in the shareholders of Ocean Wilsons receiving approximately £12.00 per share in illiquid new Hansa shares. Hansa published NAV as of 22 August 2025. Instead, by distributing to its shareholders the US$449 million of cash that it currently holds, Ocean Wilsons could pay almost the same amount in a cash dividend of £11.75 per share, and such a distribution would still leave £8.41 per share remaining invested at Ocean Wilsons (primarily composed of its investment portfolio). As a result, even winding up Ocean Wilsons over time and paying all shareholders the net asset value of their investment would be a preferable alternative to the Combination from our perspective, and would, in our view, result in the shareholders of Ocean Wilsons receiving significantly higher value than the Combination.

As alternatives to the merger, Arnhold would also prefer buybacks or for OCN to simply continue in its current form.

Let’s turn to OCN’s response.

First, they reiterate the positive points of the deal.

a) create a differentiated, scaled-up investment vehicle with over £900m of net assets.

b) unite two complimentary portfolios under the same investment manager.

c) realise cost efficiencies by spreading fixed costs over a larger asset base at a low ongoing charges ratio that is “materially more competitive” than current arrangements.

They go on to defend the merger on the basis that each company is being valued on the basis of its contribution of assets to the combined group.

In their words:

The proposed Combination comprises the merger of two investment portfolios and, as such, it is the NAV of each company (and the respective contributions of Ocean Wilsons’ and Hansa’s shareholders to the NAV of the combined group), that should determine the exchange ratio. This is a customary approach when looking to combine two investment portfolios and Ocean Wilsons’ share price is simply irrelevant for these purposes, as Ocean Wilsons’ shares will not form part of the investment portfolio of the combined group, whereas its assets will.

When it comes to valuing Hansa’s stake in OCN, they say that it would make no sense to value it at market prices:

Arnhold’s preferred approach of valuing Hansa’s shareholding in Ocean Wilsons at market value would have led to an arbitrary and unfair outcome whereby an interest in the same underlying assets (i.e., Ocean Wilsons’ investment portfolio) would have been valued in two different ways as part of the same transaction. In other words, Hansa’s contribution of its interest in Ocean Wilsons would have been valued on a different basis to Ocean Wilsons’ contribution of the same assets.

Graham’s view

On the technical details and the logic of the merger calculations, I think OCN are correct.

When merging investment portfolios, the fairest outcome is to compare the NAVs of each and then distribute shares in the combined group accordingly. That is what is being done here.

That said, I do understand Arnhold’s frustration with what is happening.

They (or their clients) have held shares in an investment vehicle trading at a discount to NAV.

When a catalyst appeared (a disposal) that generated a mountain of cash and simplified OCN’s portfolio, they could have reasonably hoped for a huge cash dividend and/or large buybacks over time.

They did get a £109m tender offer in July, taking out 20% of outstanding shares.

But it’s a reasonable stance that they’d want even more than this.

Instead, their OCN investment is getting rolled into a larger vehicle under the same investment manager. This larger vehicle has historically traded at an even larger discount to NAV than OCN has.

So I do understand Arnhold’s frustration. Their hope for a faster catalyst to narrow the discount has been pushed out indefinitely.

But there is no easy remedy: HAN/HANA shareholders would be reluctant to accept a mix of the portfolios which saw them disadvantaged.

I still think that this could ultimately work out quite well for OCN shareholders if it goes ahead: lower fees and larger scale could help to boost performance and attract new investors who might narrow the discount.

But there is no guarantee that this will happen. And when investment vehicles are trading at discounts that are anywhere in the region of 30-40%, I tend to think that their managers should be attempting to close that discount as a priority. But sadly, that is not what we see in reality.

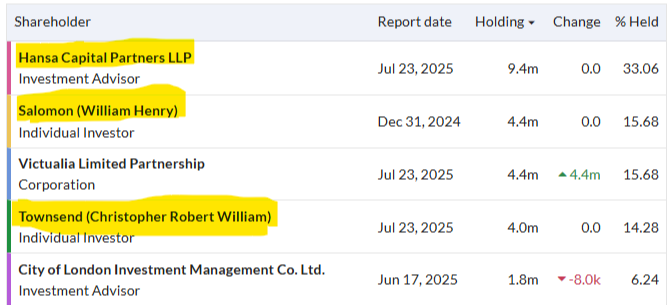

It comes down to OCN shareholders and what they are willing to approve. But it's not a fair fight: well over 50% of OCN shares are held by Hansa or by Hansa-connected individuals.

So if I try to summarise what has happened: Arnhold were hoping for a more decisive catalyst that would bring the value of their OCN investment closer to NAV, such as more dividends and buybacks. They were also happy to wait for the discount to close by itself over time.

Instead, Hansa and OCN have agreed between them - and Hansa as the investment manager clearly does have a large stake in the decision - to attempt a different type of catalyst (a merger). Whether or not this catalyst will help to generate value for OCN shareholders is not clear to me.

If I was Arnhold, I’d probably also wish for dividends and buybacks rather than a merger. But that’s the problem with value investing - you can wait many years for a catalyst, and then you get one that you didn’t want!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.