Good morning everyone! With the New Year reporting season well and truly finished now, I hope your portfolios have survived in good shape!

I'm sorry today's news wasn't very exciting, have a great weekend! Cheers.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£88.9bn | SR94) | European Commission has approved Nucala (mepolizumab), a monoclonal antibody targeting interleukin-5 (IL-5), in adults as an add-on maintenance treatment for uncontrolled COPD. | ||

HgCapital Trust (LON:HGT) (£1.85bn | SR N/A) | 2025 NAV total return 4%, NAV per share £5.62 (latest share price: 403.5p). HGT share price is down 20% year-to-date due to recent decline in listed software shares. “The Board is actively considering a number potential actions (sic) to address the current discount to net asset value using the full set of tools at its disposal, including share buy-backs.” | ||

Victrex (LON:VCT) (£606m | SR63) | Q1 volumes down 4%, revenues down 6%. “Performance in H1 2026 is expected to be weaker than H1 2025, reflecting the weaker end to Q1 and the currency headwind being weighted to the first half.” Full-year guidance unchanged. | ||

Phoenix Spree Deutschland (LON:PSDL) (£158m | SR54) | Overall Portfolio value rose by 1.5% on a like-for-like per sqm basis. Condominium sales outperformed target in 2025: 122 units sold for €36.0m (2024: €9.4m). Sales target for the year was €30m. Early 2026: 14 units notarised for €4.1m, with a further 26 units (€7.0m) reserved and pending notarisation. The company intends to return capital to shareholders in 2026 via compulsory pro rata redemptions of Ordinary Shares. | ||

Berkeley Energia (LON:BKY) (£119m | SR21) | Subsidiary has filed a Memorial of Claim at the International Centre for Settlement of Investment Disputes in Washington, seeking compensation in the order of US$1.25 billion. Allegations that Spain violated multiple provisions of the Energy Charter Treaty. | ||

Everyman Media (LON:EMAN) (£25m | SR42) | New CFO hired from National World plc. Separately, one of EMAN’s NEDs is becoming Interim Creative Director. | RED = (Graham) [no section below] We've been RED on this for a while now, worried about both the sustainability of its financial position and its generally poor financial performance. It's a positive development that a permenant CFO has been hired, although there is still no permant CEO. Also, the news that a shareholder-Director has been given the job of "Interim Creative Director" is interesting but I'm not sure how positive it is. This is a cinema group, after all - can he help them to find cheaper ways to implement their creative vision? From his bio on the company’s website: “The Directors do not consider Mr Dorfman to be independent... due to his shareholding in the Company.” He owns 6% of EMAN and so should be aligned with other shareholders, but is now also an employee. I'll stay RED on this. | |

Tortilla Mexican Grill (LON:MEX) (£22m | SR80) | The existing CEO steps down. The Founder is appointed as CEO. A new UK CEO is also hired. Various other changes. | AMBER/RED ↑ (Graham) I'm still cautious on this, but I'm willing to have a more open mind for the year ahead. The trading update last week was not bad, and these management changes are consistent with some strong ambitions and strategic priorities. | |

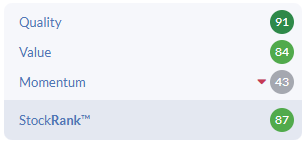

Tandem (LON:TND) (£9m | SR87) | 2025 revenue +6.2%. Adjusted PBT to be slightly ahead of market expectations. Trading at the start of 2026 has been in line with management expectations. Continuing to target revenue growth in FY26 broadly in line with FY25. | AMBER/GREEN = (Graham) This one doesn't excite me any more (it used to be my largest position). It has been around for decades, and profitability remains very limited. It does at least have a strong balance sheet, and the StockRanks love it, so I'm happy to retain our moderately positive view. | |

Huddled (LON:HUD) (£7m | SR9) | Commitments for a proposed subscription of up to £730k of new shares at 1.75p (last night’s close: 1.9p), alongside a debt facility of up to £600k. Retail offer £100k. |

Tandem (LON:TND)

Up 9% to 185p (£10m) - Trading Update and Notice of Results - Graham - AMBER/GREEN =

Tandem Group plc (AIM: TND) designers, developers, distributors and retailers of sports, leisure and e-mobility, provides the following trading update

This company has long been of interest to those who muck about in UK nano-caps/micro-caps.

At one point it was my largest individual position - I think it was my largest position for a few years. But I ended up losing interest in the end.

The share price did have quite an excited period around the Covid era, before dropping back:

Tandem’s shares have been listed for c. 25 years and are one of the big reasons I moved away from focusing on tiny and ostensibly cheap companies

In the end, I concluded that the company was just “not a compounder” - it would occasionally have good news, and occasionally have bad news, but it was probably not going to turn into a much larger and more profitable company.

So far, that conclusion has been correct, but let’s see if today’s trading update changes anything...

Trading Update

Key points:

2025 revenues £26.2m (+6.2%)

Adjusted PBT “slightly ahead of market expectations”

Let’s quickly survey each of the divisions:

Toys, Sports and Leisure: revenue down 17.5%, which reflects “softer demand in certain discretionary categories, changes in retailer purchasing patterns and the timing of product ranging and promotions”.

Bicycles: revenues +37.6%, with mechanical bikes sales up by a remarkable 47.6% and electric bikes up 30%.

Golf: revenues +8.6%.

Home & Garden +30%, helped by “an exceptionally hot summer”.

Outlook:

Trading at the start of 2026 has been in line with management expectations… Management continues to target revenue growth in FY26 broadly in line with FY25, alongside further improvements in margins and profitability, supported by rigorous cost discipline and operational efficiency.

Estimates

Cavendish covers this share, and thanks to them for publishing these forecasts today. The 2026 forecasts are new:

2025 revenue £26.2m (as disclosed in the RNS), and an adjusted PBT of £0.6m

2026 revenue £27.8m, adjusted PBT £0.8m.

Cavendish points out that the shares are trading at c. 0.5x tangible net asset value.

Graham’s view

My view here is unchanged from what I said in September last year.

As I said then, this share does continue to offer intriguing possibilities for value investors, including that strong tangible balance sheet position.

As a reminder, net assets at the interim results were £23.3m, of which £5.5m was intangible. So that’s £18m of tangible value, including freehold property, plus whatever progress has been made since June 2025.

There’s a catch, and it’s a powerful one: the lack of clean, real profits.

After so many years in operation, and especially considering the strong top-line growth, I would have thought that these higher revenues might have translated into meaningful profits.

That doesn’t make it a bad business, but as an investment, it just doesn’t excite me.

Even when it releases good news, I assume that this will be followed 6-12 months later by a reversal.

Take today's trading update for example: there are huge revenue movements in several of the divisions, both upwards and downwards. There's potentially an interesting story in the explanation of why these movements occurred. But the announcement doesn't try very hard to help us to understand. I'm left to conclude that the movements are unpredictable, and that weather or other short-term trends will change the trends this year.

I’m still leaving Tandem on AMBER/GREEN, because it’s performing in line with (modest) expectations and the balance sheet does provide optionality.

The StockRanks also really like it:

Tortilla Mexican Grill (LON:MEX)

Up 4% to 59p (£23m) - Directorate Change - Graham - AMBER/RED ↑

Before getting into today’s Directorate Change (spoiler: new group CEO and new UK CEO), I should take a step backwards. MEX issued a trading update on Wednesday last week, which we neglected to cover.

So without further ado, here are the takeaways from that trading update, covering the financial year ending 28th December 2025:

Revenue +8.5% to £73.8m

UK LfL sales +6.2%.

Adjusted EBITDA in line (figure not given in the RNS).

Net debt £10.7m excluding leases.

Outlook: expecting good improvement in FY26 over FY25.

The Group has had a positive start to the year, with the UK outperforming the market in each of the first three weeks of 2026. We continue to assume that pressure on UK employment could have a downward impact on the consumer economy this year. Cost headwinds seen in FY25 and those announced in the Autumn Budget will continue into FY26 therefore, in line with others in the sector, we will review our pricing.

Estimates: Cavendish left forecasts unchanged, with the following adjusted PBT estimates.

FY25 minus £0.8m

FY26 positive £1.8m

FY27 positive £4.2m

So far, so good.

We’ve been negative on this stock (or more precisely, I’ve been negative on this stock), due to its losses, the net debt position, and the generally poor performance of listed restaurants. But I acknowledge that the trading update and the forecasts for the next two years are not as gloomy as that stance would suggest.

What’s really curious is that the company has just had an OK year, which might suggest that the existing management structure is doing fine, but it’s still choosing to make massive changes.

From today’s announcement:

The founder (and former CEO, until 2014) is coming back to run the business.

New UK CEO hired.

One of the NEDs takes a more hands-on role as “Board Advisor”, “leading UK and European franchise development”.

The existing CEO steps down after eight years.

It’s strange to see a CEO come back 12 years later to run their business again. It’s not unheard of, but when it does happen, it’s usually in some sort of crisis situation where existing management has made a mess of things.

That’s not really the case here. While the share price would suggest that the business hasn’t done terribly well…

… it could also be argued that restaurant chains in general have been very poor listed investments, and that the economy and tax conditions have been unfavourable.

MEX hasn’t diluted shareholders yet, and is forecast to make modest profits this year. So the position is not all bad.

A range of strategic priorities are set out today, including the obligatory mention of artificial intelligence, but I’m impressed by the ambition and the sense of direction. In particular, they say they will “address the short tail of underperforming UK stores to eliminate loss-making stores and drive UK 4-wall EBITDA margin toward 20% as a longer-term goal.” Sounds fine - and hopefully converts into real profits.

I’m inclined to nudge our stance on this up by one notch, to AMBER/RED. Their plans include becoming a successful franchisor, and franchising is a method that does occasionally turn a business into a highly successful investment.

So I’m still cautious on this, and I'm very mindful of the debt load, but I’m willing to have a more open mind on this for the year ahead.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.