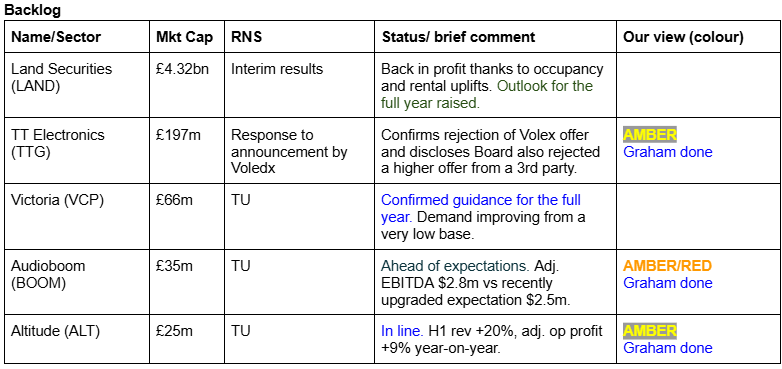

Good morning! Graham here with a few backlog sections from Friday, including TTG's response to the offer from Volex.

12.45pm: that's a wrap! With thanks to Megan for her contribution on Cerillion. All done for now.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

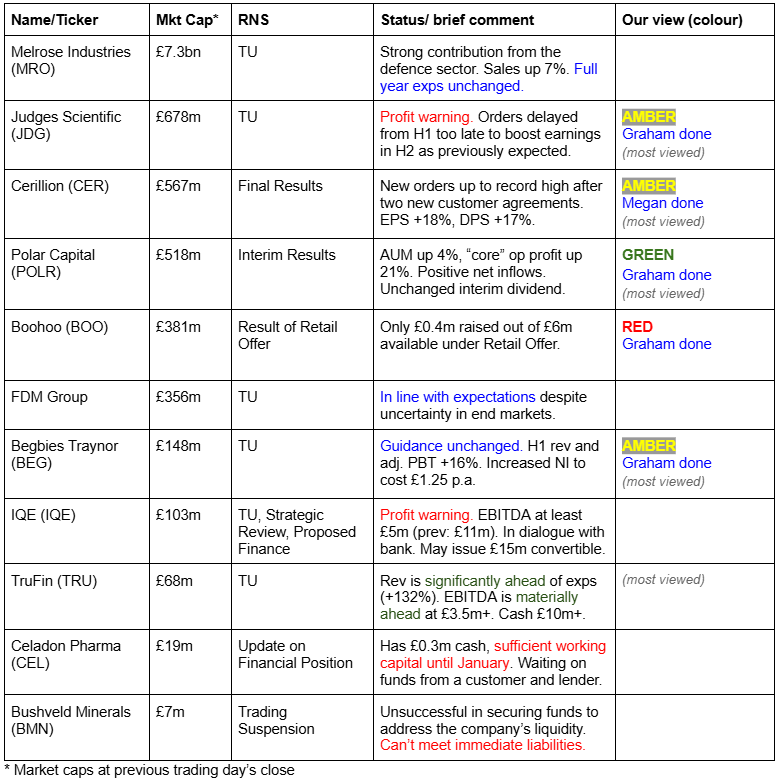

Companies Reporting

Summaries

Altitude (LON:ALT) - down 16% to 28.5p (£73m) - Trading Update - Graham - AMBER

This update was in line with expectations and ALT’s broker left forecasts unchanged. However, it seems that investors were expecting faster growth and better progress in H1. As things stand, H2 revenues must jump to nearly £20m (H1: c. £14m) if the company is to meet forecasts.

Cerillion (LON:CER) - Up 4% to 1955p (£555m) - Final results - Megan - AMBER

A very impressive set of financial results with earnings per share ahead of the expectations which were only raised in late October. With two significant new customers the order book and outlook for the next year is very healthy. But debtor days have risen, raising questions about the terms Cerillion might be having to offer its customers.

Polar Capital Holdings (LON:POLR) - up 6% to 540.5p (£549m) - Unaudited interim results - Graham - GREEN

An excellent set of results prompting analysts to upgrade forecasts for FY March 2025. We already knew that AUM had risen 4% in H1, but it has already risen another 5% since. Market movements will have played their part but net inflows have too, as this is one of the very few UK active fund managers attracting inflows.

Judges Scientific (LON:JDG) - down 14% to £88 (£681m) - Trading Update (profit warning) - Graham - AMBER

The profit warning we were worried about has materialised as orders have not been signed and delivered to customers in time. Revenue, EBIT and EPS forecasts are materially downgraded with a new EPS forecast of 270p-300p. I admire this company for its past successes but can’t take a positive stance on it at this valuation.

Short Sections

Audioboom (LON:BOOM)

Up 5% on Friday to 225p (£37m) - Trading Update - Graham - AMBER/RED

A very short update on Friday revealed that FY Dec 2024 is heading to beat recently upgraded expectations, with adj. EBITDA now forecast at $2.8m (previously $2.5m).

The explanation given is:

This performance has been driven by the continued strong revenue growth from Showcase - our scalable, higher gross margin, tech-based advertising marketplace, which recognised 49% more revenue in October 2024 versus the same period last year.

Graham’s view

I’ve long been sceptical of this company, but will try to keep an open mind.

H1 this year saw positive adj. EBITDA of $0.3m but the company did still record an operating loss due to nearly $1m of share-based payments along with various other smaller charges. So these payments to senior staff fully wiped out the adj. EBITDA for the period.

For the full-year 2023, BOOM’s share-based payments had an official cost of $2.8m.

If there is a positive feature of share-based payments, it’s that they don’t reduce the company’s cash balance. BOOM’s cash was last seen at $3.3m at the Q3 update.

Cavendish have published a helpful note - their price target is 1300p (!) on the basis that the company should trade at a price to sales multiple of 3.5x.

BOOM’s podcast advertising marketplace Showcase is said to be a big hit with advertisers, growing revenues 49% year-on-year.

Paul was AMBER/RED on this last time and that seems about right to me, reflecting some ongoing risk of dilution despite the progress made.

TT electronics (LON:TTG)

Up 40% on Friday to 111p (£197m) - Response to announcement by Volex - Graham - PINK/AMBER

On Friday afternoon, after we had wrapped up this report, TTG responded to the approach from Volex (covered here).

Earlier, Volex had disclosed to the market that it made two proposals to the TTG board, and that TTG had not engaged with either of them.

The second bid was worth c. 140p per share or £230m: the amount varies with the VLX share price, as it’s a mix of cash and shares.

Besides confirming that the TTG Board “unanimously rejected the Volex Proposal as fundamentally undervaluing TT Electronics”, we got this bombshell announcement on Friday afternoon:

The TT Electronics Board also announces that it has recently received and rejected an all-cash indicative proposal from another party at a significantly higher value than the Volex Proposal. There are no ongoing discussions with this party.

Graham’s view

I thought the Volex proposal was not unreasonable, given TTG’s recent problems and debt load.

Now we know that someone else was willing to pay “significantly” more. Is this 160p? Higher?

With the shares closing on Friday at 111p, up 40% but still at a significant discount to where the rejected bids came in, it looks like the TTG Board may get to retain their independence for the time being. M&A is inherently unpredictable but I suspect that the news of another party making a higher all-cash offer is likely to put the dampeners on Volex’s efforts.

Begbies Traynor (LON:BEG)

Unch. at 94p (£148m) - Half-year trading update - Graham - AMBER

I’ve been neutral on this professional services group around this level (see coverage in July).

Today’s H1 update is in line with expectations, these being full-year adj. PBT of £23 - 24.3m.

The year-end is in April, so H1 has just finished in Oct.

Key points: revenue and adj. PBT both up by c.16% (mix of organic and acquired growth).

Net debt is immaterial at £4m.

NI contributions to increase by c. £1.25m per annum. “We are reviewing options to mitigate the impact where possible”. This does not affect FY25 but it does affect FY26.

Downgrades: FY April 2026 sees its adj. PBT forecast marked down by 5% at Canaccord, from £24.5m to £23.3m, due to the higher NICs.

Graham’s view

I like Begbies and have a great deal of trust in it after its many years on the stock market. As it’s a professional services business, I would continue to argue that it’s priced correctly at a PER around this level (calculated using heavily adjusted earnings numbers).

Boohoo (LON:BOO)

Unch. at 29.8p (£378m) - Retail Offer Result - Graham - RED

On Thursday we covered BOO’s fundraising efforts: £39m of fresh equity, of which £6m would be made available to smaller investors in a Retail Offer.

The results of the Retail Offer are in. BOO are “pleased to announce” that the Retail Offer has so far raised c. £0.4m, or 7% of the amount that was available.

It appears that the appetite of other investors to take part in this exercise was very limited indeed. The Chairman (M. Kamani) and his family, along with Mike Ashley’s Frasers, will get to keep pretty much all of the shares they signed up for.

As you might guess from Thursday’s report, I share the apprehension of those who turned down the Retail Offer.

Graham's Section

Altitude (LON:ALT)

Down 16% to 28.5p (£21m) - Trading Update - Graham - AMBER

This is “the leading end-to-end solutions provider for branded merchandise”.

It has been around for a long time, changing its name to “Altitude” in 2008.

Profits have been hard to come by, although revenues have been ticking up in recent years:

Friday’s update has disappointed the market. However, the update itself says they are “in line with expectations”, and the broker Zeus left their forecasts unchanged.

Here’s the latest on progress in US colleges:

The Group's disruptive collegiate Gear Shop solution continued to expand in HY25. Since the end of FY24, the Group has signed a new university into the programme and is in negotiations with another. The team has successfully launched its 7 previously reported contracts and commercial trading within these spaces has commenced.

Graham’s view

We have an obvious disconnect between the message the company has put out, the message from the broker, and Friday’s share price reaction.

Something I would highlight is a large H2 weighting, which in my experience tends to be associated with a higher risk of a future profit warning. H1 revenues are expected to be up c. 20%, or around £14m.

However, the full-year revenue forecast is nearly £34m, implying nearly £20m of revenue in H2.

I don’t know if that’s achievable, but I think it’s important to flag it.

Staying neutral on this makes sense to me as I don't have conviction that we're looking at a company of above-average quality. See the presentation by management for IMC in July with a detailed explanation of their various activities.

Adj. PBT is forecast to come in at £2m this year, rising to £3m next year (FY March 2026).

Polar Capital Holdings (LON:POLR)

Up 6% to 540.5p (£549m) - Unaudited interim results - Graham - GREEN

This fund manager continues to impress. Here are the key points from today’s interim results to September:

AUM up 4% to £22.7 billion

AUM up another 5% since then to £23.9 billion as of 8/11/2024.

Core operating profit up 21% to £27m

PBT up 9% to £23m.

Interim dividend: this is left unchanged at 14p.

CEO comment concludes this way:

"Looking ahead, visibility on actively managed equity flows for the industry remains unclear. However, given our compelling long-term investment performance and remaining capacity in a broad range of active, specialist and differentiated thematic, sector and regionally focused fund strategies, we are confident that we can continue to perform for our clients and shareholders over the long term."

Flows: inflows into UK active managers have been rare, but Polar is one of the few that have managed it.

As previously disclosed at the Q2 AUM update in October, Polar saw net inflows of £472m in H1. For context, that’s about 2% of the AUM with which it started the period.

Market movements also provided a boost of several hundred million pounds, resulting in the overall 4% increase for the period.

Fund performance: there’s quite a lot of change in these numbers compared to where they were at the interim results in March. Note that performance is measured in terms of the percentage of AUM within Polar’s open-ended funds that’s in the top 50% (top two quartiles) of its peer group.

The 3-year performance is much worse now: it has deteriorated from 91% in March to 77% in September.

The 5-year performance, on the other hand, has improved from 86% to 97%.

These numbers really matter when it comes to future inflows and outflows and I think they are still fine, but I’d keep an eye on that 3-year performance figure.

New fund launch: an International Small Company Fund was launched in September, representing “an important strategic milestone”.

For now, Technology and Healthcare remain the key strategies for Polar, accounting for nearly 60% of AUM.

Insurance and EM/Asia are also worth mentioning: EM/Asia in particular saw net inflows of over £900m, without which Polar would have seen net outflows in H1.

Estimates: many thanks to Equity Development for a detailed note this morning.

I observed in July that Polar had already hit the AUM target set by Equity Dev for FY March 2025.

On the back of continued growth, it makes sense therefore to see upgraded forecasts.

AUM: old forecast £23.5m, new forecast £24.4m.

Revenue: old forecast £199.6m, new forecast £205.2m.

Core operating profit: old forecast £52.7m, new forecast £53.9m.

H1 Adjustments: “core” operating profit leaves out certain items such as goodwill and impairment (£6m total charge), share-based payments (£1m charge) and “other income” which is a complex combination of financial gains and losses. While I do think that core operating profit is a useful metric, we should always remember to look at the final profit and loss figures.

For H1, Polar’s unadjusted, after-tax net income rose from £15.6m to £16.6m.

Graham’s view

I see no reason to change my positive stance here.

The stock is a little cheaper than it was last time I covered it, offering an excellent yield even with no change in the dividend.

I’ve flagged above some of the key issues I’d watch out for. How are Polar’s funds performing on a 3-year view against their peers? Are the adjustments still reasonable, and are the unadjusted net income figures acceptable? Even as the company diversifies into new strategies, does it remain strong in its traditional technology and healthcare strategies?

For now, everything in the garden is rosy and this remains one of the few truly high-performing UK active fund managers.

Judges Scientific (LON:JDG)

Down 14% to £88 (£681m) - Trading Update (profit warning) - Graham - AMBER

This is an old favourite, but one where I’ve had some concerns in recent times.

In September, at the interim results to June, the possibility of a profit warning was flagged with the company describing “continued challenging market conditions and short-term vulnerability to the timing of orders and revenue”.

Unfortunately, the market didn’t quite manage to price this in sufficiently and the actual profit warning has seen a 14% share price fall.

Here’s the confirmation:

As announced at the time of the Group's Interim Results in September, several of our Group businesses had experienced a challenging first half, driven by difficult market conditions and the deferral of some projects into H2 or 2025…

As anticipated, H2 will show progress compared to H1. However, achievement of the expectations for the full year, which were revised downwards in July, was reliant upon the crystallisation and delivery of certain orders. We now believe these will not all occur in time to deliver against the expectations before the end of the year.

The flagship acquisition of recent years, Geotek, has secured a new contract. JDG disclose this morning that excluding this contract, its total order intake would be down 1.6% year-to-date, “indicating that the general level of orders across the Group has not yet recovered to the growth path traditional for our Group”.

New estimates: according to JDG, 2024 EPS is now expected at 270p - 300p. The prior forecast at broker Shore Capital was 349p. This implies an EPS miss of between 14% and 23% against prior expectations.

Looking at some of the other key ingredients to the full-year forecast, Shore have reduced their revenue estimate by 6% to £133m and their EBIT estimate by 19% to £27m. So we have operational gearing in reverse - profits falling at a faster rate than revenues.

Balance sheet: net debt (excluding payables but including acquisition-related debt) was £52m as of June 2024. That doesn’t seem too stretched against profitability and I note that Shore’s dividend forecast is unchanged.

Graham’s view

I’ve been quite consistent on this one, I think - I view this as an excellent company but with a couple of question marks hanging over it:

Can it make successful acquisitions now that its previous success (with small acquisitions) has turned it into a bigger company? Does its previous approach still work at a large scale?

When will growth start to pick up again? China/HK is only responsible for c. 10% of revenues but demand from that region seems to have collapsed, does JDG have a fundamental problem here?

JDG spent £80m on Geotek in 2022; what has the company learned and was it worth the price paid? So far, it seems to have had a negative effect on ROCE and increased the volatility of the overall business.

At the new, lower EPS forecast, JDG’s PER is between 29x and 32.5x.

I want to upgrade my stance on JDG some day, but as the PER remains high and as the business continues to struggle to grow, I can’t do this yet. I’m remaining neutral until something changes.

The ValueRank is only 5:

Megan's Section

Cerillion (LON:CER)

Up 4% to 1955p (£555m) - Final results - Megan - AMBER

There are plenty of good things to be written about software group Cerillion (LON:CER). These final results for the year to September 2024 show why this remains such a popular stock, with a PE ratio that has touched 30x since 2019.

This is the sort of valuation that requires closer inspection. Sure, if you had been put off by the PE ratio in 2019 you’d have missed out on over 900% share price returns and a total of 51.1p of dividends (equivalent to a 2019 yield of 27%). But can the company continue to deliver?

Strong numbers

Total sales for the year to September 2024 rose 12% to £43.8m, with 11% recurring revenue growth (to £15.5m, or 35% of the total).

The company generates revenue from two key divisions: software revenue (that includes licence fees for new projects) and service revenue (for ongoing implementation projects for existing customers). Presumably, the majority of the company’s recurring revenue comes from the latter operating division, where sales are much easier to predict.

The new orderbook and pipeline remain strong. In the 2024 financial year, Cerillion won two major new customers that brought in combined orders of £19.2m. It is unclear how much of those orders were delivered in the period under review, but management says both contracts have the potential to expand further.

At the end of the financial year the new order book stood at £38.1m, up 21% on the previous financial year, while the back-order book remains strong at £46.9m (£37.7m of which is sales that have been contracted but not yet paid for). The total pipeline of potential orders stands at £262m.

A masterclass in expectation-setting

In FY2024, both gross and operating profit margins widened (to 80% and 42% respectively). Pre-tax profits were up 22% to £19.7m and earnings per share slightly ahead of expectations at 51.7p.

And this is where Cerillion’s management provides a lesson for other executives to learn from. Forecasts are never over-optimistic and reported numbers tend to come in ahead of expectations. It was as recently as late October that the company told the market that the order book was stronger than expected, prompting brokers to forecast 49.4p EPS for 2024 and 52.8p for next year.

Any red flags?

Based on almost all standard measures of quality, there is a lot to like in these numbers. Return on capital employed remains at an impressive 36%, compared to a five-year average of 23%.

Cash conversion is slightly below what I would like to see, but operating cash inflows rose 15% to £11.2m, equivalent to 60% of operating profits. Capital expenditures remain low at £1.5m, but still higher than depreciation. Free cash flow conversion was 63% and the company’s total cash position rose to £29.8m at the end of the year.

But there are two items in the financial statements that worry me a little.

The first is the amount of time it takes for the company to book revenue to customers it has billed. Debtor days were 54.9 this year as trade and other receivables rose 54% to £8.1m, equivalent to 18% of total revenues.

The second slight red flag for me is the amount of operating costs that are sunk into staff. Personnel costs rose 9% in the year and accounted for 57% of total operating expenses. Although checking the staffing numbers from last year's annual report reveals that only 19 of the 324 staff worked in sales and marketing, with 270 employed in support and development.

Megan’s view:

Cerillion boasts the kind of numbers that I like to see in a stock. The market it is operating in is growing and margins suggest that the company has good pricing power. The order book and consistency of growth provides some justification for the lofty price to earnings ratio.

But the increase in debtor days does perhaps suggest that management is having to offer new contracts on less favourable terms than it has in the past. For that reason I am going to stay on the fence. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.