Good morning! It seems that we have a quiet Monday for company news.

12.45pm: this report is done now. Thanks for dropping by!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

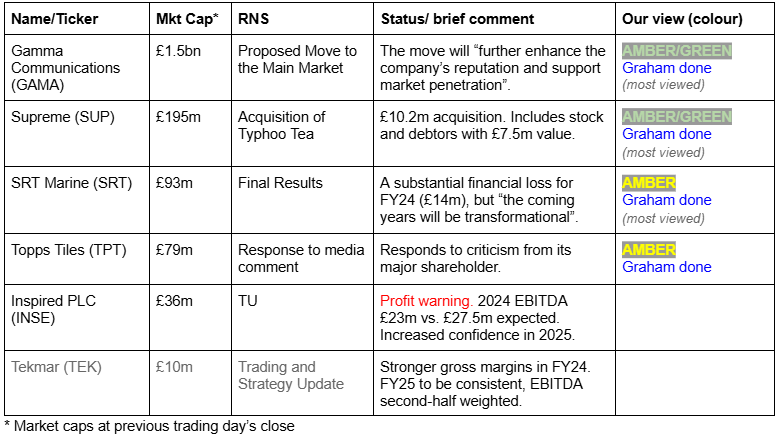

Companies Reporting

Short Sections

Mercia Asset Management (LON:MERC)

31p (£133m) - Interim Results - Graham - GREEN

Last Thursday we had results from regional fund manager Mercia.

I’ve been positive on this one (e.g. in July at 33p) due to what I perceive as deep value and an interesting growth story, but the market has not agreed with me yet:

In recent times, the company has focused more on investing 3rd-party funds rather than investing its own funds. These 3rd party funds grew only marginally during H1, from £1.63 billion to £1.65 billion. The year-on-year growth rate is far more impressive: up 31%.

Year-on-year FUM growth translated to 19% year-on-year revenue growth (to nearly £18m), and this allowed for a 34% increase in EBITDA (to £3.7m).

Year-on-year comparisons using EBITDA make some sense to me here, in order to exclude something that I believe would distort a year-on-year comparison: interest received by MERC on loans to investees.

See that the company benefited from investee loans in H1 last year, but not in H1 this year:

If we are studying this primarily as a manager of 3rd-party funds, then I think the EBITDA number is more relevant.

If all you care about is the bottom line, the company did generate pre-tax profit of £2.4m in H1, up from £1.4m in H1 last year.

Net assets were almost unchanged during the six-month period, finishing at £187m. Strip out intangibles and we still have £152m, which is 15% above the market cap.

Direct investment portfolio: c. £4m (net) was invested in the portfolio during H1. I place more emphasis on the performance of the 3rd-party fund management business now.

Flows: there were gross fund inflows of £57m during H1, all in the “Private Venture” category, which is effectively Venture Capital (it includes VCTs and EIS).

Cash was unchanged at £46m, with no borrowings.

Outlook doesn’t give too much away numbers-wise, but is very confident on strategy, e.g.:

Mercia, with its investment discipline, debt-free cash position and sustainable, long-term private capital deployment business model, has a stable AuM position and a clear strategy through which to continue its growth trajectory. As institutional funds look to impactful, domestic and regional allocations, I remain confident that Mercia is well placed to benefit from this capital transition.

Graham’s view

I continue to believe that there is a lot of business available at this price, when we consider that there is a discount to tangible NAV and a growing fund management business.

However, I acknowledge that this is a complicated picture with both a direct investment portfolio and a 3rd-party fund management business (that includes multiple asset classes) to be analysed. There is no one valuation method that we can rely on, as it’s clearly a situation where both the balance sheet and the income statement have to be included.

Gamma Communications (LON:GAMA)

Up 1% to £15.92 (£1.5bn) - Proposed Move to the Main Market - Graham - AMBER/GREEN

This B2B communications company has been one of the largest AIM companies for some time.

It is currently #5:

In my view, when a company is large enough that it would be able to consistently stay within the mainstream FTSE-350 Index, it should strongly consider going to the Main Market.

In the FTSE-350, you are guaranteed support from the likes of the iShares 350 UK Equity Index Fund and will pop up on the screens of more fund managers and international investors.

You’ll have to leave the light-touch, self-regulatory AIM regime, but companies at this scale should not have any difficulty in doing this.

The cut-off at the bottom of the FTSE-350 in terms of market cap is only around £400m, so all of AIM’s top 10 would have a chance to qualify, if they moved across.

I applaud Gama’s decision:

The Company is in the process of appointing advisers and, subject to FCA approval, expects to move to the Main Market in mid-2025. The Company will provide further updates as specific timeframes are confirmed. The Board believes that a move to the Main Market will serve to further enhance the Company's reputation and support market penetration as Gamma continues to grow in different jurisdictions.

Graham’s view: I’ve not studied the fundamentals of this company today, but I just wanted to point out that the move from AIM to the Main Market could be something to watch out for, especially when it comes to the largest companies.

For these companies, in a context where AIM has been shrinking for years, perhaps light-touch regulation and (reduced) inheritance tax relief might no longer be seen as sufficient perks to keep them around? Especially when there is another world of fresh investment potentially available on the other side of the LSE divide.

As for the merits of GAMA itself, I note that it passes 7 long screens and has a StockRank of 85 - and so I’ll leave our prior AMBER/GREEN stance undisturbed.

It published interim results in September which showed good continued growth and said that full-year adjusted EPS would be “at the top of the range of market expectations”.

Supreme (LON:SUP)

Up 5% to 176p (£195m) - Acquisition of Typhoo Tea - Graham - AMBER/GREEN

Roland already covered the interim results from Supreme last week, but they are back again with news of an acquisition.

The headline is:

Strategic acquisition of leading consumer brand further diversifies Supreme

I’m not a tea-drinker and have never tried Typhoo Tea, perhaps informed readers can let us know what the USP is?

The details around the transaction remind me why I like it when my companies acquire businesses out of administration: the buyers often achieve excellent value.

Cash price £10.2m

Includes stock and trade debtors with value £7.5m

"We are not taking on any liabilities" - CEO Sandy Chadha speaking with Paul Hill (link).

The company description is impressive given the small deal size:

Established in 1903, Typhoo Tea was the first pre-packaged tea brand in the UK and has since expanded its product offering from traditional black and decaffeinated black teas to now include white and lemon instant flavours, herbal and fruit tea infusions, and a selection of coffees across a portfolio of brands including the iconic Typhoo brand but also QT, Lift, and Heath & Heather. Today, Typhoo Tea supplies all the major UK supermarkets and discounters as well as health food store, Holland & Barrett.

Typhoo’s revenues in FY 2024 were £20m, but it made a loss of £4.6m. Within SUP, it will use “a capital light, outsourced manufacturing model, which the Board believes can generate a gross profit margin of around 30%, with a much reduced overhead base”.

Graham’s view

This strikes me as very good news from SUP.

The main point is that it helps to diversify away from vape into a much safer product category. Vape contributes 55% of revenues and an even larger majority of SUP’s profits currently.

Secondly, cross-selling opportunities are mentioned in today’s announcement. It can’t hurt for SUP to have its foot in the door with more retailers.

Thirdly, the CEO interview with Paul Hill mentions licensing opportunities; it's not possible to quantify the upside here but it sounds like another nice opportunity for SUP and its shareholders.

In terms of financing the deal, SUP reported net cash of £2.3m at last week’s half-year results, putting it in a good position to use its bank facilities for this deal.

And remember that working capital of £7.5m is included in this deal. It looks like SUP are receiving great value as their reward for moving quickly. Typhoo only went into administration on Wednesday.

In summary: this deal gets two thumbs up from me. I leave Roland’s AMBER/GREEN unchanged.

SRT Marine Systems (LON:SRT)

Down 4% to 40p (£89m) - Final Results - Graham - AMBER

Earlier this month I looked at SRT’s fundraising plans as shareholders were being lined up for yet another round of dilution.

I’ve always been sceptical of this one. However, my stance in recent times has been neutral as we wait to see the financial impact of a $200m+ contract in Kuwait, along with some other contracts including a large one in Indonesia.

That impact is not yet visible in today’s full-year results for the 15-month period ended June 2024.

(The fact that it’s a 15-month accounting period is arguably a red flag in itself, as the company has explained that its financial ratios over 12 months would not have been good enough to let it bid for a contract it was seeking.)

For the 15 months to June 2024, SRT has reported revenues down by more than 50% to £15m, and a pre-tax loss of £14.4m.

But the future is said to be brighter than ever: £320m of system projects are expected over the next two years, along with “a further pipeline worth up to £1.2bn”.

Graham’s view

I think that SRT’s “pipeline” number can safely be ignored, as usual. What I can’t ignore are signed contracts.

Meaningful revenues should be about to drop over the next two years:

As of the publication of this report, we have commenced work on our recently announced $213m contract with the Kuwait Ministry of Interior and are pleased to advise that the final administrative processes on the other contracts are nearly complete and thus expect work to commence at the beginning of the second half of the new financial year. Whilst the combination of increased overheads and delayed revenues has resulted in a significant loss for the period, these extensive preparations have placed us in a good position to successfully implement these multiple system projects within the expected two year time frame.

The broker Cavendish has still not dared to publish any specific financial forecasts for FY June 2025. This seems sensible to me as the profitability associated with SRT’s system contracts is entirely unclear.

My strong tendency is to be RED or AMBER/RED on SRT but for now I can only wait and see what happens with the new set of contracts.

Topps Tiles (LON:TPT)

Unch. at 39.9 (£78m) - Response to Media Comment - Graham - AMBER

A little bit of controversy here this morning after TPT’s 30% shareholder decided to go public with strong criticism in a letter dated 28th Nov (link here - PDF), and the contents of this letter made their way into the media.

The shareholder, MS Galleon, is a Vienna-based holding company, and it is concerned about “strategic missteps and operational failures undertaking [sic] by TPT’s senior leadership team”.

These include the “disastrous” acquisition of a competitor by TPT in August this year - and I must say that the criticism from MS Galleon appears valid at first glance, at least in terms of the numbers presented.

They also criticise “long term margin erosion”, “falling organic growth”, “a complete failure to adapt to an evolving retail landscape”, and “poor financial performance versus peers”.

TPT management have hit back today with a response briefly covering the points raised. On the acquisition, they say that it was "strategically compelling”. On overall performance, they say they have flat organic revenue since 2019 vs. a UK tile market down by 20%.

Graham’s view: it can be tricky to disagree with a 30% shareholder, especially in public, but the response from TPT reads well to me. Hopefully the two parties can have a constructive relationship where they learn from each other’s views - even if that is less entertaining than a bust-up.

TPT seemed fairly valued to me the last time I reviewed it, and that remains the case today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.