Good morning!

I'm afraid we have a few profit warnings in the mix today.

12pm: It's a clean sweep of the RNS lineup today. See you tomorrow!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Sigmaroc (LON:SRC) (£814m) | FY TU | 2024 earnings “modestly ahead” of consensus, improved margins. FY25 outlook unchanged. | AMBER (Roland) |

Speedy Hire (LON:SDY) (£124m) | TU | Profit warning. Challenging start to Q4 (Jan-March), ongoing macro uncertainty. Net debt £123m. | BLACK (AMBER) (Graham) The economy and CP7 are singled out as reasons for this severe profit warning. Long-term it might still be a winner but I'd prefer to be neutral as we saw a similar profit warning in early 2024. Too accident-prone. |

Ultimate Products | TU | Profit warning. PBT estimate cut by 36% for FY25 to £11m, cut by 27% for FY26 to £13.7m (Zeus). | BLACK (AMBER/GREEN) (Roland) |

Churchill China (LON:CHH) (£68m) | TU | Year-end trading was in line with exps. No change to Nov 24 guidance. Markets remain challenging. | AMBER/GREEN (Roland holds) |

Frenkel Topping (LON:FEN) (£45m) | TU | 2024 adj EBITDA flat at £8m. FUM +17% to £1,560m. FY results to be in line, outlook confident. | AMBER (Graham) My initial take is that this is at fair value. An argument could be made for cheapness (forward PER 8.5x), but it’s not jumping out at me. |

EnSilica (LON:ENSI) (£41m) | £10m funding award | £10.4m award from UK Space Agency to develop components for mass market satellite broadband. | AMBER/RED (Graham) |

Safestay (LON:SSTY) (£15m) | TU | Rev +2% to £23m in 2024, adj EBITDA -4.4% to £6.5m. Fwd bookings +27% at 1 Jan 25, confident in adj EBITDA growth. | AMBER (Roland) |

Graham's Section

Speedy Hire (LON:SDY)

Down 28% to 19.75p (£92m) - Trading Statement - Graham - BLACK (profit warning) / AMBER

Speedy’s year-end is in March:

Speedy, the UK's leading tools and equipment hire services company, operating across the construction, infrastructure and industrial markets, provides the following trading update for the ten months to 31 January 2025.

Unfortunately, it turns out that January has been a difficult month for the company.

Several factors are mentioned.

Firstly, due to the “widely reported economic downturn”, there has been a “slower post December shutdown recovery across the majority of our customer base”.

Renew Holdings (LON:RNWH) said that Network Rail’s delays relating to its “Control Period 7” were responsible for its recent profit warning, and Speedy also gives this a mention. It sounds like there is no room for complacency for any investor who might be affected by CP7.

Trade & Retail channel: Speedy has re-engineered this small part of its business (only 1% of revenue last year), but “it is taking longer to achieve the expected levels of hire revenue which we now anticipate achieving during first quarter FY2026”.

Joint venture in Kazakhstan: a significant downturn in performance due to the early shutdown of major contracts.

Net debt rises year-on-year to £123m.

A note on this: it’s normal for equipment hire companies to use a moderate amount of leverage and in this case of Speedy it targets a leverage multiple of 1.5x (leverage is defined as net debt to EBITDA, where EBITDA is calculated the old-fashioned way, i.e. pre-IFRS 16).

Speedy’s net debt should reduce from its current level by year-end but it’s still higher than last year and so the company acknowledges that its interest charge will be higher than last year. The interest charge last year was nearly £13m.

Outlook

We remain committed to the delivery of our Velocity strategy providing benefits for Speedy for the long term. We are focused on what we can control, and we will continue to manage our cost base and balance our investment decisions in response to the current economic climate.

The Group has a promising pipeline of growth opportunities with new and existing customers, and should benefit from increased government spending on infrastructure projects. Nevertheless, with the challenging start to our final quarter and ongoing macroeconomic uncertainty, the Board expects lower than anticipated profitability for the full year.

Estimates

Thanks to Panmure for getting fresh estimates out this morning.

They have reduced their FY25 EPS forecast by 42% to 2.1p (last year 2.3p).

They have reduced their FY26 EPS forecast by 28% to 3.3p.

Net debt (excluding leases) was supposed to finish the current financial year at £98m, but it is now forecast at £115m.

Panmure says that 9.2p of EPS is still achievable “eventually” when operational gearing works in Speedy’s favour, but they do not have 9.2p of EPS in any of their forecasts out to FY27.

One other observation I might make is that while today's trading update does not mention Speedy's dividend policy, the current rate of annual dividend - 2.6p per share - will not be fully covered by this year's EPS, based on the new forecast.

Graham’s view

We haven’t expressed a view on this one since AMBER/GREEN last April.

Scroll back to this time last year - Jan 30th 2024, to be precise - and I see that Paul explained that “Forecasts are slashed as a variety of fairly minor-sounding problems combine to cause a 35% drop in broker forecast earnings for FY 3/2024.”

Here we are a year later and we see forecasts getting slashed again, for a variety of reasons.

Last year, among the reasons, the company blamed “weakness in some of our end markets and seasonal product lines”, i.e. macro was blamed last year, too.

This year, I think many other companies will agree that the economy is not providing a supportive backdrop for trading.

But the bottom line is that, as an investment, Speedy is highly accident-prone. Even if the myriad of factors that drive these profit warnings are entirely beyond the company’s control, I don’t think it matters - I can’t have faith in this company’s financial progress. I’d rather invest in something where less can go wrong.

On that basis I don’t think I can maintain our moderately positive stance on this one, even at a cheap valuation.

After the share price fall this morning, the shares now trade at a PER of 6x FY March 2026 forecasts.

That sort of earnings multiple seems reasonable to me. Hopefully the company can kick on and achieve the operational gearing that is envisaged for it, eventually producing annual EPS of 9p. But I don’t think anyone can assume this will happen soon, after the second major profit warning in a year here.

So while I agree that there is speculative upside, I think the market is right to price this share as if it won't materialise for a long time.

As an American President once said: “Fool me once, shame on you. Fool me - you can't get fooled again.”

EnSilica (LON:ENSI)

Up 5% to 44p (£43m) - £10.38m UK Space Agency Award - Graham - AMBER/RED

EnSilica (AIM: ENSI), a leading chip maker of mixed signal ASICs (Application Specific Integrated Circuits), is pleased to announce that it has been awarded £10.38 million funding over the next three years from the UK Space Agency for a development project under its Connectivity in Low Earth Orbit ("C-LEO") programme…

ENSI will “develop a family of semiconductor chips to support future generations of best-in-class, highly integrated, mass market satellite broadband user terminals. The terminals will be capable of connecting with various satellite constellations and will leverage advanced semiconductor technology.”

The UK Space Agancy will fund up to half of the cost of the overall project.

ENSI has a £9m debt facility (announced in Nov to refinance existing facilities). Perhaps it can fund some/most of the remaining cost itself? Although its finances have been under some pressure - more on this in a moment.

CEO comment:

We are honoured and proud to have won this highly significant award from the UK Space Agency under the C-LEO programme, as we believe satellite communications is an incredibly important sector for EnSilica and one that is fast expanding globally.

This funding will enable us to advance our technology and bring innovative solutions to the satellite broadband market, with the project expected to be hugely beneficial to society, offering resilient internet connectivity in times of crisis, as well as providing high speed internet connectivity in remote communities not well served by terrestrial networks.

Estimates

I don’t see any change to the estimates at Allenby, but they point out that if Ensilica wins a supply deal for its chips relating to Starlink terminals, that would be material.

Singers have taken a slightly different approach, estimating higher costs in the short-term and therefore making some modest adjustments to EBITDA and free cash flow forecasts for the next two years.

For context, their new adj. EBITDA forecasts are £4.8m (FY May 2025) and £8.6m (FY May 2026).

Consistent with Allenby’s message, they say that “long-term opportunities should more than compensate” for marginally lower cash flows in the short-term.

Graham’s view

I was RED on this at the full-year results published in November (share price at the time: 44p), as the going concern note stated that the company would not be able to survive the new financial year without additional financing and the receipt of expected revenues from existing customers. This was even after taking into account the refinancing of the company’s debt facilities.

Since then, we’ve had an “in line” trading statement at the AGM, a $30m 10-year contract, and today’s UK Space Agency news.

I’m therefore happy to upgrade this to AMBER/RED as I must presume that ENSI’s counterparties including the UK Space Agency have done the due diligence required to ensure that ENSI is not very likely to collapse over the next 12 months.

If ENSI hits its forecasts for the financial year that starts soon - FY May 2026 - then I expect investors to do extremely well. These forecasts include £38.1m of revenue and adj. PBT of £5.5m. Throw in a Starlink-related contract and this could be a huge winner.

But I need to keep my feet on the ground. At the moment there seems to be a great deal of latent potential, but the value is highly uncertain. I think AMBER/RED is fair for now.

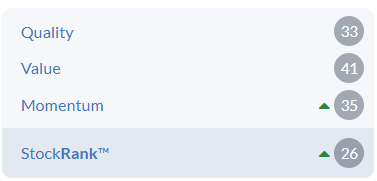

ENSI's risk classification on the StockReport is "Highly Speculative" and the StockRank is only 26. At least Momentum is recovering:

Frenkel Topping (LON:FEN)

Unch. at 35.4p (£45m) - Trading Update - Graham - AMBER

FEN is “a specialist financial and professional services firm operating within the personal injury and clinical negligence marketplace”.

2024 is in line with management expectations.

While there is no growth in adj. EBITDA for the year (flat at £8m), and the company has moved into a net debt position, there has been nice growth in funds under management:

Within funds under management, the “discretionary” funds (which I presume involve higher fees) are up by an impressive 26%.

The company made a small, bolt-on acquisition in April 2024 (price £3m). It has also announced various partnerships and joint ventures over the past two years. My point is that I think the growth numbers shown above are mostly organic.

Cost of higher NICs/NMW: the cost is estimated at £500k p.a. The Board “will work hard to mitigate this external headwind as far as possible through pricing and technology efficiencies”.

Outlook: continued positive momentum in January, and confidence for the start of the new financial year.

Estimates: Cavendish have reduced their 2025 EBITDA forecast by £0.2m to reflect the impact of higher NICs/NMW that can’t be mitigated this year. The new EBITDA forecast for this year is £9m, converting to adj. PBT of £7.6m.

Graham’s view

My initial take is that this is fairly valued for a professional services firm:

I note the argument from Cavendish that this is cheap for the sector, if you compare FEN vs. a group of IFAs, Legal Services and Business Consultants. They suggest that the cheap rating is due to concerns around a FEN subsidiary that have now been resolved (“Partners in Costs”), and regulatory risk to do with the FCA’s new standard, “Consumer Duty”.

As I don’t study this one regularly, I’ll accept the risk of splinters and sit on the fence with a neutral stance. Maybe there is an opportunity here, but I’m not sure. I was neutral when I looked at FEN back in 2023, when the share price was 56p. It has fallen by more than a third since then, so if anything I should have been more sceptical the last time I checked it out. On the other hand, after falling steadily for some time, perhaps it now offers some value?

Roland's Section

Ultimate Products (LON:ULTP)

Down 21% 79.8p (£68.9m) - H1 2025 Trading Update - Roland - BLACK (AMBER/GREEN)

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its trading update for the six months ended 31 January 2025 ("H1 2025").

Unfortunately today’s update is a profit warning. Brokers Shore Capital and Cavendish have both cut their FY25 earnings estimates by 36%. FY26 estimates have also been cut.

Let’s take a look.

Weaker than expected trading: Ultimate Products says it’s still suffering from tough air fryer comparatives (this boom is now fading) and has seen subdued market conditions in the UK.

H1 revenue fell by 4.7% to £79.4m, although within this international sales rose by 12% to £29.1m. This seems to indicate that UK revenue fell from £58.2m to £50.3m in H1, a fall of 13.6%.

This effect was most notable in Q1, when Group sales were down 9.3% year-on-year. However, trading improved in Q2, with sales down by a more moderate 2.2%.

Ultimate also notes a number of cost pressures, including £2m of additional shipping costs in H1 due to higher rates.

Order book: the company entered calendar year 2025 with an H2 order book up “an encouraging” 24% year-on-year.

However, just one month later, the H2 2025 order book is now up only 13% year-on-year. Demand from some retail customers is said to have eased – I get the impression there has been a sharp drop in new orders.

International performance remains stronger, with forward orders up 20% year-on-year.

Outlook: revenue guidance for the year ending 31 July 2025 has been cut:

Therefore, the Board believes that the Group's full year revenues will now be broadly flat compared with the prior year.

For context, last year’s revenue was £155m. Prior to today, Stockopedia consensus showed group revenue rising by 10% to £171m this year.

The company says full-year EBITDA is now expected to be £14-£16m, around 25% below previous consensus of £20.6m.

Updated estimates: Shore Capital and Cavendish have both issued updates through Research Tree today, translating Ultimate’s comments into updated earnings estimates. Many thanks.

Cavendish: FY25 EPS cut by 36% to 9.3p (previously 14.6p)

Shore Capital: FY25 EPS cut by 36% to 9.5p (previously 14.8p)

Both brokers have also cut their FY26 forecasts by around a quarter.

Roland’s view

Today’s profit warning is Ultimate’s second in 12 months, following a cut to guidance in May last year:

However, even before today’s big drop, Ultimate’s share price had fallen by nearly 30% since the Autumn Budget:

My feeling is that the market has been pricing in further weakness and a likely dividend cut. While today’s update confirms the company intends to maintain its 50% payout ratio, this suggests the payout could fall by 36% to around 4.7p per share this year (FY24: 7.38p).

Personally, I’ve admired the longer-term progress of this business and am encouraged by the apparent progress on international growth.

Ultimate has some well-known brands and has seemed well managed to me, with strong quality metrics and good cash generation:

My main concern is probably that the value positioning of the company’s brands could leave it open to intense competition on price.

Today’s drop leaves Ultimate Products trading on around eight times 2025 forecast earnings, with a c.6% dividend yield (based on revised estimates).

The company has said today that it intends to maintain leverage at 1x EBITDA, as in the past, so it doesn’t look like the balance sheet is becoming unduly risky.

I would imagine there’s still some risk of one further profit warning. But on balance, I think these shares could now be at a level where they are starting to offer value. I’m going to maintain our AMBER/GREEN view.

Sigmaroc (LON:SRC)

Down 1.4% 72p (£810m) - Year-end Trading Update - Roland - AMBER

This lime and minerals group (building materials) is notable for the buy-and-build strategy it’s pursued since listing, in particular last year’s £1bn acquisition of European lime assets from industry heavyweight CRH.

These deals have left a burden of integration work and debt, but SigmaRoc appears to be handling these successfully and trading well:

2024 underlying earnings and EPS modestly ahead of consensus expectations, driven by transformational investment to create a leading European lime and minerals platform.

Today’s update covers calendar 2024. Helpfully, the company has included like-for-like (LFL) figures as well as headline numbers reflecting last year’s acquisitions:

Revenue expected to be up 72% to c.£998m

Pro forma revenue down 2% LFL

Underlying EBITDA expected to be up 90%, exceeding £222m

Pro format EBITDA up 2% LFL, reflecting integration progress

Today’s upgrade appears to be driven by improved profit margins rather than underlying sales growth.

Underlying EBITDA margins improved to 22.3%, increasing 220bps YoY

Updated estimates: helpfully, SigmaRoc have also provided an updated earnings per share estimate in today’s update. This ensures that investors without access to broker notes are not left at a disadvantage:

Underlying EPS expected to be around 8.3p, approximately 10% ahead of consensus [specified as 7.6p] and 3% ahead of prior year

I can’t fault the clarity of guidance here. Personally, I find that encouraging, as it suggests to me the company has good financial controls and has a clear story to communicate to shareholders.

Operating commentary: management says that pro forma LFL volumes fell by 4% last year, reflecting weaker market conditions in residential construction and some industrial markets.

However, the company has continued to make progress integrating the CRH assets and streamlining its portfolio. A number of non-core Belgian and French assets were sold for €49.5m (7x EBITDA).

Talks are also underway to replace the bridging finance facility used for the CRH transaction with a lower-cost long-term loan.

Encouragingly, net debt leverage on a covenant basis is expected to have closed the year “below 2.1x”, down from 2.3x at 30 June 2024. Half-year net debt was reported at just over £500m.

While I feel this level of gearing is relatively high for a business of this kind, the numbers are moving in the right direction.

Outlook: there’s no change to guidance for the current year. Based on current consensus numbers, this suggests SigmaRoc’s earnings could rise by 12.6% to 9.4p per share in 2025.

That puts the stock on a 2025 forecast P/E of eight, which could be quite reasonable if deleveraging continues:

Roland’s view

There’s clearly a cyclical element to demand and pricing for the kind of products SigmaRoc sells. But at the same time, in general this type of business will only have limited competition in any given geographic area, as long-distance transport is generally not economically attractive.

This is also a capital intensive business – SigmaRoc’s profitability metrics are consistently low:

Today’s update suggests the company is making good progress with what I see as the riskiest part of its strategy – integrating large acquisitions and reducing debt to a safer level.

However, given the relatively high level of debt and low profitability I am going to stay neutral for now, at least until the company’s full accounts are published. AMBER.

Churchill China (LON:CHH)

Down 6.5% to 575p (£63m) - Full Year Trading Update - Roland holds - AMBER/GREEN

At the time of publication, Roland has a long position in CHH.

Churchill China shares are down as I write, but I would argue today’s brief update from this leading manufacturing of crockery for the hospitality trade is broadly positive.

The business finished 2024 trading in line with revised expectations, after November’s nasty profit warning:

The Company is pleased to confirm that trading in the final two months of the year met the Company and market's expectations and that there is no change to the guidance issued in November 2024.

Market expectations are cited as being for a pre-tax profit of £8.5m.

This looks consistent to me with Stockopedia’s consensus earnings figure of 57.9p per share, pricing Churchill on just over 10x 2024 forecast earnings, with a covered 6% dividend yield.

Outlook: Chairman Robin Williams says that conditions remain “challenging” but the company is continuing to make improvements to productivity and yield in its factory.

Mr. Williams says the business remains well positioned to capture a recovery in demand:

with an unparalleled service offering and an innovative and differentiated performance product.

Roland’s view

Graham covered Churchill China in more depth in November. He noted that he thought the shares were “possibly not far off deep value territory”.

My view is similar and I recently bought some shares. I believe Churchill’s differentiated product, strong balance sheet and long track record should support an eventual recovery.

I’m going to maintain our view at AMBER/GREEN, reflecting the uncertain near-term outlook.

Safestay (LON:SSTY)

Down 1.5% to 23.2p (£15m) - Trading Update - Roland - AMBER

We last covered this European hostel operator at the end of February 2023, when Graham took a look. The shares have not done much since then, but the operating environment has evolved as the impact of the pandemic has moved further into the background.

I thought it might be interesting to update our coverage today and see how the situation has changed over the last two years. This stock has traded much higher in the past and trades at a significant discount to its June 24 book value:

2024 trading update: today’s update covers the 12 months to 31 December 2024. Revenue is in line with the broker consensus shown on Stockopedia:

Revenue up by 2% to “a record” £23m in 2024

Adjusted EBITDA down 4.4% to £6.5m

Forward bookings at 1 Jan 25 of £4.7m, 27% higher than at the start of 2024

Debt refinancing into a new £16m 5yr term loan with £2.5m RCF

The top two numbers suggest to me that Safestay’s pricing or its cost base came under pressure last year. It seems pricing was the issue.

Safestay’s operating metrics show the company selling more beds and improving occupancy in 2024, but at lower price points:

Total Bed Nights rose by 10% to 931,688, with 37% booked direct or without commission payments (2023: 32%);

Occupancy rose by 3.8% to 75.2%;

Average Bed Rate down 10% to £21.40

Total Revenue per Available Bed (Total RevPAB) down 2% to £18.56

Revenue from ancillary sales helped to cushion the decline in bed rate, but this still suggests a tough trading environment.

We can get some context on this by looking at the recent update from Hostelworld, which is a large online travel agent specialising in hostels. It recently reported “an 8% decrease in net average booking values year-on-year”.

This seems to suggest that falling bed rates are a sector headwind and that Safestay’s performance is broadly in line with the wider market.

Current trading & Outlook: Safestay expects the macro backdrop to “remain challenging” this year.

The company cites the 27% YoY increase in forward bookings as evidence that its marketing and brand-building efforts are delivering results.

Management says the international hostel market remains large and fragmented and that Safestay will continue to look for expansion opportunities, including “less capital-intensive routes to market such as franchising partnerships and management contracts”

Financial guidance is limited but suggests some headline growth in 2025:

The Board is confident of achieving further strategic progress as well as revenue and adjusted EBITDA growth in 2025.

Roland’s view

When Graham covered Safestay in 2023 he suggested that it would be good to see occupancy returning to pre-Covid levels of c.75%. This has now happened.

He also noted the company had previously said it would be self-funding when it had 20 sites – this should happen shortly. Safestay had 17 sites in operation at the end of last year and three in development.

Today’s refinancing news and the company’s mention of capital-light growth options certainly suggest to me that Safestay’s management expects further expansion to be self-funding.

Unfortunately, there’s clearly some weakness in the hostel market at the moment that’s limiting pricing (but not necessarily demand). We don’t know how long this might last.

In addition, I’d have to note that EBITDA is not necessarily an ideal metric to use for a business where the depreciation charge reflects the need for regular building maintenance and lease expenditure. In 2023, EBITDA of £6.8m translated into operating profit of £2.5m, for example.

At a balance sheet level, I can see some value here. The latest accounts (June 2024) showed net tangible assets of £21.5m, versus today’s market cap of £15m.

On the other hand, profitability is relatively low and I’m not sure Safestay is generating enough real profit to justify trading much closer to book value.

I’m going to remain neutral for now until the company’s 2025 results are published and/or more detailed outlook commentary becomes available. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.