Good morning! Roland will be here soon, but for now we have coverage from myself (Graham) and Megan.

It's a busy day for news, with lots of companies reporting interim results.

That's a wrap for today (12.45pm). See you tomorrow!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

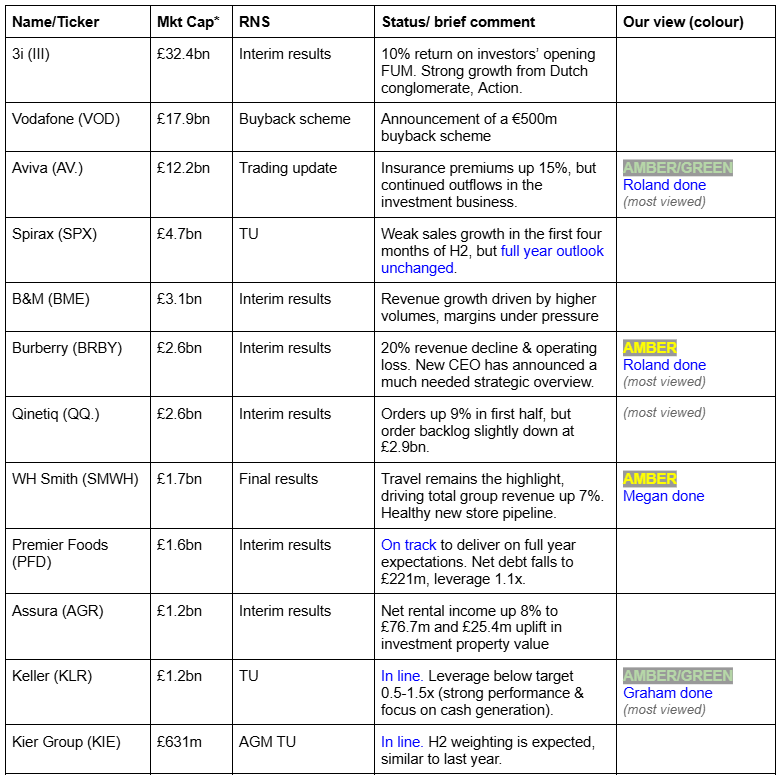

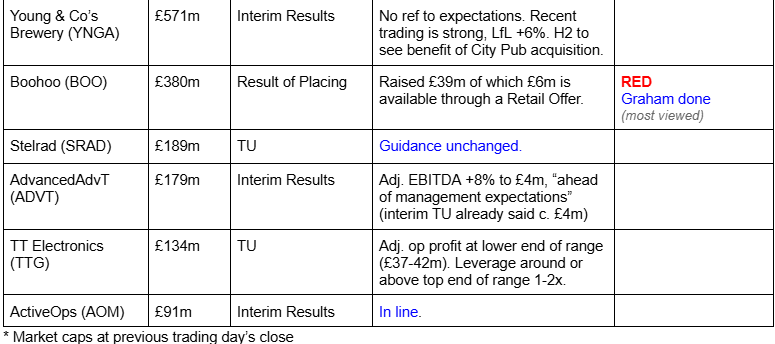

Companies Reporting

Summaries

WH Smith (LON:SMWH) - up 1% to 1313p (£1.7bn) - Preliminary Results - Megan - AMBER

Continued strong sales growth in the travel business helped to offset the ongoing weakness in the high street. Margins are also recovering in the travel business. But the company remains highly geared which is a cause for concern. And the debt-fuelled earnings growth doesn’t quite justify a price to earnings ratio of 13.4. But I am still hopeful that management can take advantage of the opportunity for growth in the travel sector.

Keller (LON:KLR) - down 12% to £14.37 (£1.05bn) - Trading Update - Graham - AMBER/GREEN

This update includes some mixed/negative commentary, especially in relation to European trading. H2 will be weaker than H1, which enjoyed some temporary advantages. The market dislikes it but the statement is ultimately “in line” and so I’m happy to leave our mildly positive stance unchanged.

Burberry (LON:BRBY) - up 14% to 838p (£3.0bn) - Interim results - Roland - AMBER

Burberry’s half-year results are dire, as expected, but the company isn’t in financial distress and has a credible turnaround plan under new CEO Joshua Schulman. However, I remain concerned about broader market conditions and the difficulty Burberry may have in regaining its former premium valuation rating.

Spirax (LON:SPX) - up 5% to 6665p (£4.9bn) - Trading Update - Megan - AMBER/RED

This morning’s trading update has eased some concerns that things are only getting worse for the engineering business. The company has managed to avoid warning on its expectations again. That doesn’t mean it’s turned a corner. Global industrial production remains weak and the company’s debt position is troubling. But I’ll keep my eyes peeled for a sign of recovery, because this has been a fantastically high quality company in the past - and it hasn’t missed a dividend payment for 56 years.

Aviva (LON:AV.) - up 4.6% to 475p (£12.7bn) - Q3 trading update - Roland - AMBER/GREEN

A solid third-quarter update from the FTSE 100 insurer, albeit highlighting some pressures from elevated severe weather claims in Canada and net outflows in asset management. I think the 8% dividend yield looks sustainable on a medium-term view and remain a fan of this stock as a high-yield pick.

Boohoo (LON:BOO) - up 1% to 30.3p (£385m) - Interim Results & Fundraise - Graham - RED

Results and a fundraising announcement were published at the unusual time of 5.23pm last night. The pre-tax loss widened to £27m with the company proposing to fill the hole with a £39m fundraising. While Frasers and the existing Boohoo Board battle it out I think standing aside, at a distance, is safer.

Short Sections

Experian (LON:EXPN)

Down 3% yesterday to 3748p (£35.2bn) - Half-Year Report - Megan - GREEN

There isn’t much to dislike about Experian from a quality perspective.

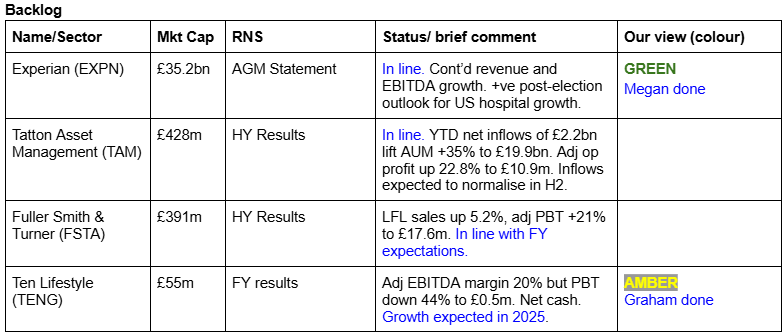

The company’s data network and customer relationships mean it poses high barriers to entry for its competitors and boasts considerable pricing power. Gross margins consistently exceed 80%.

Operating margins have averaged 22.3% over the last five years and rose to 23.6% in 2024. In the FY2025 interim numbers published yesterday, underlying operating margins tipped over 24%. The benchmark EBIT margins (calculated by only taking into account ongoing business activities) were almost 28%.

Return on capital employed (my favourite measure of quality) has been similarly impressive. Over five years it has averaged 17.5% and rose to 19.5% in 2024. That means that for every £1 invested, the company generated 19.5p of profits. I ideally like to see a ROCE of over 20%, but a five year average of 17.5% isn’t to be scoffed at.

And this profitability means the company is well placed to keep investing in its service. Capital expenditures have risen consistently over the last ten years and were the equivalent of 8% of revenues in the first half of FY2025. One slight concern is that the company’s capex to depreciation ratio tends to be less than 1, meaning the company is spending more money maintaining its existing assets than investing in new ones. That is unusual for a tech company of its quality, but as long as capex continues to increase, I am not too worried.

And there are still signs of quality elsewhere in the cash flow statement. Operating cash inflows are always significantly higher than operating profits (an operating cash flow conversion of over 100% is what I like to see in a high quality company). Free cash flow in the first half of the financial year was 77% - slightly shy of the 80% that I like to see, but still not bad.

Management has taken that free cash flow and invested heavily in acquisitions. A total of £818m of purchases, plus £370m of dividends paid widened the company’s net debt position, but as net gearing remains under 100%, I am not too concerned.

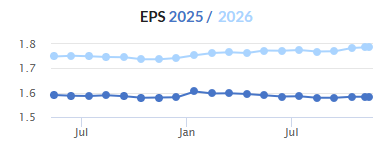

The problem for those looking for an entry point is the valuation - the price to earnings ratio rarely falls below 30 and the pace and consistency of earnings growth doesn’t quite manage to justify that. In 2023, earnings per share were lower than the previous year. What’s more, broker expectations have been pretty flat all year - the company delivers against its expectations, but nothing more.

But should we expect more?

Megan’s view: The quality credentials boasted by Experian are a rare find in the UK. As is the company’s exposure to the upside in the proliferation of generative AI. For value investors, Experian will never be especially attractive, but I am not a value investor, so this company hits a lot of the numbers that I like to see.

Sure, earnings aren’t consistently beating expectations, but 11% EPS CAGR over 5 years is pretty impressive, especially as it’s a faster pace of growth than revenue. GREEN

Graham's Section

Ten Lifestyle (LON:TENG)

Down 1% to 56.9p (£55m) - Preliminary Results - Graham - AMBER

Ten Lifestyle Group plc (AIM: TENG) the global concierge platform driving customer loyalty for global financial institutions and other premium brands, is pleased to announce its preliminary results for the year ended 31 August 2024.

It has been a tough year for those watching the share price here:

The company provides a gateway to exclusive services, typically for the customers of private banks and other institutions catering to the wealthy. The idea is “to improve the engagement and retention of their most valuable customers”.

It has been a while since we’ve covered it in this report. Let’s quickly get up to speed with how it’s been doing.

FY August 2024 results:

Revenue fell very slightly to £62.9m, not helped by a currency headwind.

Adj. EBITDA up £0.8m to £12.8m

Small PBT of £0.5m (last year: £0.9m)

Active members fell slightly to 349,000.

Management make the reasonable point that their numbers had sharply increased in FY 2022 (possibly a post-Covid bounce), and then again in FY 2023. So FY 2024 serves as “a period of consolidation”.

Current trading/outlook: there are some signs of life that revenue will improve in the new financial year.

We expect to continue to convert our strong pipeline of contract opportunities with global financial institutions and premium brands, with new contract developments since the start of the financial year expected to deliver revenues from H2 2025. Since the end of the year, we won a multi-year Extra Large contract in the USA with an existing global client, initially worth £5.0m per year in corporate revenue and a Medium contract in AMEA with a new client.

Net cash ended the year at £4m, no major change there.

In September, just after the new financial year began, TENG raised £6m in a placing at 63p. The purpose: to support the new “Extra Large” contract, and also to generally strengthen their balance sheet.

That seems reasonable to me - their tangible net asset value at year-end (before the placing) was only £2m, and their working capital (current assets minus current liabilities) was negative to the tune of several million pounds. It makes sense that they would want to bolster their position, although it’s a shame that the new contract could not deliver cash quickly enough to do that by itself.

Graham’s view

After many years of losses, I’m pleased to see that TENG is now operating in the black:

I wonder what a long-term competitive advantage in this space would look like. Here’s an example of TENG outlining its advantages over competitors:

Our unique "not available on the internet" assets, such as exclusive tables at top restaurants, tickets for sold-out shows, exclusive events, and value-add benefits at hotels, empowered by our AI technology, delivers value for our members via our digital self-serve and high-touch channels. This advantage sets us apart from mass-market AI interfaces reliant on publicly available assets.

I’ve been quite dismissive of TENG in the past (see here for example) and was RED on it at 94p last year.

Some reasons to be more positive on it now:

The placing has strengthened the balance sheet and given some breathing room.

It is winning business from competitors. Revenues are forecast to increase by c. 8% in FY 2025, per the latest research note by Singers.

The share price and market cap are both significantly lower than they were when I looked at it last year (down by 30% - 40%).

As the picture looks to have improved for new investors at this level, I’m happy to switch to a neutral stance now.

Keller (LON:KLR)

Down 12% to £14.37 (£1.05bn) - Trading Update - Graham - AMBER/GREEN

Keller is “the world’s largest geotechnical specialist contractor”.

Well done to Paul for taking a mildly positive stance on Keller this year - see the most recent coverage in August.

Today’s trading update is in line with expectations and confirms that the company’s leverage multiple (net debt/EBITDA) is destined to remain below KLR’s target range of 0.5x-1.5x.

The company has been making more cash than it knows what to do with, with the result that the leverage multiple has fallen as follows:

June 2023: 1.2x

Dec 2023: 0.6x

June 2024: 0.3x

Dec 2024: to be confirmed, but once again below 0.5x.

According to the research note published by Panmure in August, the company’s net debt was forecast to reduce from £237m (Dec 2023) to £113m (Dec 2024), and to continue falling from there.

The summary of trading sounds fine:

Whilst the current macroeconomic environment presents both opportunities and challenges across our markets, the overall performance of the Group, together with our continuing record order book and the groupwide focus on improving project execution, gives us confidence for the short and medium term.

However, looking at the detail of each division, there are a few points of possible concern:

North America: sounds fine overall, but "profitability has tempered as expected” at Suncoast (concrete company), “reflecting the reversion of pricing to more normalised levels and lower residential trading volumes”.

Europe/Middle East: weak European macro environment and weak activity levels in European residential/commercial sectors, plus a competitive pricing environment. Not much to cheer about here.

Asia-Pac: “robust” performance.

I note that there will be a "modest" first-half weighting, i.e. H2 is not expected to match H1’s performance. H2 was "buoyed by some historical items and contractual items".

CEO comment concludes:

The Group's record order book and geographically diverse portfolio provides both visibility and resilience in the current mixed economic conditions, underpinning our confidence as we close the year.

Graham’s view

The greater than 10% fall in the share price seems a little harsh for what is, ultimately, an “in line” statement.

I can only interpret it as profit-taking in a stock that has had a very strong run up (doubling since last year) and where investors might feel that the outlook is not as straightforwardly positive as it was before. Things can turn quickly in construction and engineering, and investors may have reasonable concerns after reading the mixed commentary in Keller’s update this morning. The recent upgrade cycle could easily turn into a downgrade cycle:

From my point of view, I’m inclined to keep our AMBER/GREEN stance. Perhaps I’m too attached to strong balance sheets, but the trajectory of net debt is very attractive to me. According to the analysts, it could be close to reaching a net cash position by Dec 2026. Granted that a lot can happen between now and then! But for me the declining net debt takes a good deal of the risk out of the equation.

Therefore, while this is not a sector I love, I am happy to maintain a mildly positive stance at this valuation:

The StockRanks are even more impressed than I am:

Boohoo (LON:BOO)

Up 1% to 30.3p (£385m) - Interim Results & Fundraise - Graham - RED

Boohoo published its interim results last night, along with news of a proposed fundraising.

Results are poor, as expected, as the company’s business model has not been working for some time now. It seems that competition and price pressures have caught up with it.

Key points from the H1 results to August 2024:

Gross Merchandise Value down 7.3% (£1.18bn)

Revenue down 15% (£620m)

Gross margin 50.7% (H1 last year: 53.4%)

Adj. pre-tax loss £27m (H1 last year: loss of £9m)

H1 operating costs were £300m, so the company is well ahead of its cost-cutting targets. Here’s a comparison of income statements in which I’ve highlighted the reduction in operating costs:

Without that reduction in costs, the adj. EBITDA result could have been much, much worse.

Net debt increased to £143m (six months previously: £95m). New debt financing agreement signed in October.

FY25 outlook: H2 EBITDA to be stronger than H1 (H1 adj. EBITDA was £21m). Capex will be significantly reduced.

Fundraising: in a simultaneous fundraising announcement we learn that £39m is raised, of which up to £6m can be claimed by smaller investors in a Retail Offer.

Details: 127 million new shares at 31p. The Founder/Chairman picks up 50 million while Frasers picks up 39 million. These amounts might be scaled back a little, depending on the demand seen in the Retail Offer.

Rationale for the Fundraise:

The proceeds of the Fundraise are intended to be used:

to part satisfy the first tranche which will become due to be paid under the Term Loan of £50 million by the end of December 2024; and

provide additional strategic flexibility to maximise value for all shareholders as part of the Group's Business Review [GN note: this is too vague!]

Graham’s view

£39m is only a portion of the outstanding net debt so I don’t view this fundraising as providing a fundamental solution to the company’s situation. It does at least demonstrate that the Chairman (and his family), along with Frasers, are still interested in financially supporting the company.

With the shares down by over 90% from their peak, one would hope that they might see some value at this level!

Unfortunately, this continues to look to me like a case of a broken business model. Boohoo in its original form competed on price and fast deliveries, and now it is not able to do this effectively, or at least not able to do it profitably. In an important sign of retrenchment, the US distribution centre has been closed.

Frasers and Boohoo are now locked in a battle over who should run it - Debenhams CEO Dan Finley or Mike Ashley from Frasers. The war of words is getting heated, with Boohoo describing Frasers as a competitor, not a partner, and saying things such as:

Frasers appears intent on disrupting boohoo's Business Review and acting only in its own commercial self-interest. Frasers has prior history of this sort of corporate behaviour

Frasers wants to appoint both Mike Ashley and Mike Lennon, an insolvency/restructuring expert, to the Boohoo board.

For investors who aren’t currently involved in this stock, I don’t see any reason to get involved at this stage.

Either the Boohoo Board are right, and they are being lined up for a cheap takeover by Mike Ashley and his insolvency expert, who are keen on disrupting their business plans.

Or maybe Frasers, owning 27%+ of Boohoo shares, are right. If they are right, then there is a leadership crisis at Boohoo, the existing Board have lost their ability to manage the company, and the new borrowing facility is “terrible” - too short-dated and expensive, forcing Boohoo “to undertake drastic corporate actions”.

Either way, I’d have zero interest in getting involved. It’s tempting to go RED and I think that’s what I’ll do, as I’ve been sceptical of management/governance here for some time and the walls seem to be closing in on them.

Megan's Section

WH Smith (LON:SMWH)

Up 1% to 1313p (£1.7bn) - Preliminary Results - Megan - AMBER

I recently commented that whenever I visit Greggs (which is quite often) it’s always pretty busy. The opposite is true of my (less frequent) visits to WH Smith (LON:SMWH). That is, unless I am at an airport.

A decade ago, high street sales and profits from the stationary company were £684m and £58m respectively, equivalent to 59% and 44% of total revenue respectively. The company operated out of 604 stores and boasted a presence in almost all of the UK’s major high streets. In final results announced today, high street sales fell 4% to £452m (in line with guidance), while headline profits were flat at £32m. There are now just 500 WH Smiths stores on the UK’s high streets.

But in 2024, this weak high street performance doesn’t matter much. The travel business is thriving with sales up 11% to £1.5bn and trading profits up 15% to £189m, representing a slight widening of the margins. The company operates out of 1291 travel hubs around the world.

And so, while in 2014 weakening high street sales and profits caused a drop in the company’s overall operating performance, it barely made a dent in these numbers. Overall revenues rose 7% to £1.9bn and pre-tax profits were up 16% to £166m.

The company’s shift from UK high street stalwart to global travel hub store operator has been crucial in ensuring the survival of WH Smith. The company has managed to outlast many of its high street peers, including Toys R Us, which has begun opening concession stands within WH Smith stores.

But the expansion of the travel estate has perhaps not provided the pace of growth in revenues and profits that many investors would have wanted. The company’s share price was storming upwards until 2020, when global lockdowns derailed growth and hurt operating margins. Neither the growth strategy nor margins have fully recovered and the share price has trodden water ever since.

More worrying is the debt position which took a big leap up in 2020 and has continued to widen. Net gearing is currently 342% and the current ratio is less than 1, meaning the company doesn’t have enough readily available assets to pay its short term liabilities.

Megan’s view: There is a lot to like about WH Smith’s transformation. Expansion in travel hubs gives an almost limitless scope for growth and it’s good to see margins in these locations continuing to rise.

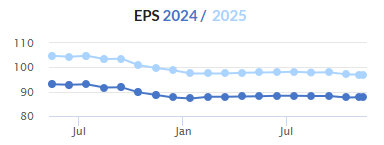

But debt fuelled growth is always a bit of a red flag for me, especially in an era of high interest rates. High finance costs have not helped the company’s earnings growth and analysts have downgraded expectations a number of times this year.

I’d like to see more ambition and less debt before I turn more positive. AMBER

Spirax (LON:SPX)

Up 5% to 6665p (£4.9bn) - Trading Update - Megan - AMBER/RED

Investors who have long searched for an opening into engineering giant Spirax (LON:SPX) (formerly Spirax Sarco) might see the recent share price trajectory as something of an opportunity.

But beware any optimism. Spirax is a lesson in the dangers of investing in high quality companies that fail to live up to expectations. Operating margins have been falling since 2021, profits have declined and earnings, that fell in FY2023, are expected to be lower still in the current financial year.

The problem with this decline in earnings is that, despite the share price fall in recent months, shares aren’t actually looking especially good value, trading on a price to earnings ratio of 20 times and a PEG of 2.7.

In years gone by, that might have seemed like an entry point, but the quality ratios at Spirax are also diminishing. ROCE, which used to average 20% fell to 12.6% last year. In 2022, the company raised £509m of new debt to finance acquisitions. This borrowing came at an interest rate of 4.8% which more than doubled interest costs that year. Operating cash inflows since then have continued to be impressive, but not enough to make a material dent in the debt. Net borrowings at the end of October were £642m and the company’s net gearing stands at a slightly concerning 70%.

So what has gone wrong at this former high flyer and does this morning’s trading update suggest any signs of a turnaround?

Macro conditions

Part of the problem lies in the macroeconomic conditions. Global industrial production growth was just 0.3% in 2023, compared to 2.1% in 2022 and the weakness continued into 2024. Industrial production contracted in Germany, France and the US in the first half of the year - markets that represent 40% of group sales. China (10% of company sales) has seen a material decline in opportunities compared to previous years, with customers seeing a major contraction in their capital budgets. In the first half, management at Spirax chopped their expectations for China for the remainder of the year.

This morning’s numbers show that this former key growth market remains weak. Overall, global industrial production growth for the second half of the year is expected to be even weaker than expected, at 0.9% (excluding China) compared to the 1.5% that was forecast in August.

Management

There has also been considerable overhaul in the senior management at the business in recent years. In January, Nicholas Anderson retired after ten years as chief executive and the company’s finance director was replaced in July. There will also be a new chairman at the start of next year. Added to the name change, the lack of consistency hasn’t provided an awful lot of reassurance to investors.

Balance sheet

Then there is the borrowing. The major increase in debt sent interest expenses up 3-fold in 2023 and they were higher again in the first half of the 2024 financial year. Lower profitability has also impacted the company’s ability to invest in its operations. Capital expenditure fell from £51m in the first half of 2023 to £44m in the first half of the current financial year, equivalent to 5% of sales. Capex fell below depreciation expenses in 2023, which is a red flag for a lack of investment in future growth opportunities.

Meanwhile, the sales mix hasn’t flattered margins. In 2023, revenues were flat in the Steam Thermal Solutions business and they fell in Watson-Marlow Fluid Technology - these two divisions had contributed 97% of operating profits in the previous year. The sales growth has instead been provided by the low margin Electric Thermal Solutions business, which contributed 23% of sales in 2023, but just 8% of operating profits.

But this morning there has been some good news for both the Steam Thermal and Watson-Marlow businesses. The former has returned to organic revenue growth and sales at the latter have stopped declining rapidly. Overall, investors seem relieved that the outlook for the remainder of the year has not worsened further. Management has maintained its guidance for 2024 for mid-single digit revenue growth and no change in adjusted operating margins, despite the concerns about currency headwinds.

Megan’s view

I retain a soft spot for Spirax because it was the company that taught me how to identify quality shares. For now though, the cash inflows remain the only ongoing levers of high quality and there is a lot of work to do before this starts to make a dent in the debt position.

The company does still boast high barriers to entry and opportunities for growth (if the market recovers) so I will keep looking for signs of a recovery. But for now I remain on the fence. AMBER/RED

Roland's Section

Burberry (LON:BRBY)

Up 14% to 838p (£3.0bn) - Interim results - Roland - AMBER

(At the time of writing, Roland has a long position in Burberry.)

We are acting with urgency to stabilise the business and position the brand for a return to sustainable, profitable growth, supported by strong cash generation and balance sheet strength.

As a Burberry shareholder, I’ve been looking forward to these interim results in the hope they’d provide some new clarity on the situation and outlook at this troubled fashion group.

New Chief Executive Joshua Schulman has a strong pedigree in mid-market luxury (he previously ran Coach and Michael Kors). Can he deliver a turnaround at Burberry – and more importantly, can he restore some of the shareholder value that’s been destroyed over the last few years?

I covered Burberry in a Stock Pitch back in July, outlining the investment case and problems facing the company as I saw them. That article is available here and makes for useful background to the business.

Let’s take a look at today’s results and strategy update.

H1 25 financial summary: there’s no getting away from it. Burberry’s financial performance over the six months to 30 September 2024 was dire:

Revenue down 22% to £1,086m

Like-for-like store sales down 20%

Operating loss of £53m (H1 24: profit of £233m)

Free cash outflow of £184m

Dividend suspended

Net debt of £1.4bn (Sept 23: £887m)

Sales performance: geographically, the Asia Pacific region saw a further deterioration during the second quarter, while the rest of the world saw a (relative) improvement in Q2. However, there was bad news everywhere:

In terms of product lines, Burberry’s core outerwear/soft ranges outperformed their accessories ranges. "Accessories" include the company’s ill-advised attempt to compete in ultra-luxury leather goods such as handbags – not a market where it has a competitive advantage:

Stories of Burberry leather goods being heavily marked down in outlet stores highlight the problem here – the company has sharply increased its pricing but failed to elevate its brand to capture suitable (full price) customers.

Inventories & working capital: today’s results show inventories of £596m at the end of the half year. That compares to £526m one year earlier. Indeed, as far as I can tell, today’s inventory figure is the highest ever reported by the company.

Another figure is rising, too. Inventory provisions rose by £29m to £102m during the half year. This reflects stock where the realisable value is believed to be less than the cost.

This suggests to me that the company’s “Accelerated plan to address inventory overhang and restore scarcity” may involve some brutal discounting and stock write-offs.

Balance sheet: excluding lease liabilities, Burberry moved from a FY24 net cash position of £63m to a net debt position of £278m during H1.

This reflects the collapse in profitability, paired with seasonal outflows/inventory build and continued store capex.

For me, the ongoing capex bill is a reminder of a potentially more serious problem. The company has £1.3bn in lease liabilities relating to its stores. If some of these prove to be overrented or unsuitable for future requirements, Burberry could be saddled with expensive loss-making stores for some time yet.

An impairment charge of £24m (FY24: £9m) was made against right-of-use assets (essentially store leases) in H1, suggesting this could be an issue worth watching.

Strategy update: the strategy commentary in today’s results is a remarkable buzzword salad, even by corporate PR standards. But I think it boils down to a few key ideas:

Focus more closely on areas where the company has “brand authenticity”. In other words, products people associate with Burberry and admire – outerwear and some other clothing.

Fix pricing mistakes and (probably) abandon a move to target the ultra-luxury segment

Maximise the heritage value and British identity of the brand, which helps to differentiate it

Improve store productivity by stocking more items people actually want to buy (“core category amplification”) and emphasising brand identity

Outlook: Burberry cautions that rebuilding the business won’t happen overnight. While Mr Schulman is confident he can return to £3bn annual revenue over time, the outlook for the remainder of this year is highly uncertain (my bold):

We are confident that our strategic plan will improve our performance and drive long-term value creation. In the short term, with our all-important festive trading period ahead and an uncertain macroeconomic environment, it is too early to determine whether our second-half results will fully offset the first-half adjusted operating loss.

In other words, Burberry may well report a full-year loss for the year to March 2025. If this happens, it would be the first time in the company’s 20+ year history as a listed business.

Roland’s view

The strategy being put forward by Schulman looks sensible to me and is as I expected. His track record suggests that he does know how to drive commercial performance from mid-level luxury brands.

On the other hand, even if he’s successful, I wonder if Burberry may struggle to regain its former luxury valuation. Tapestry (NYQ:TPR) (which owns Coach) and Capri Holdings (NYQ:CPRI) (Michael Kors) both trade on low double-digit P/Es with and appear to generate mid-teen operating margins during normal times.

Viewing Burberry through this lens suggests to me that a return to £20+ share prices could be a tough ask.

On balance, I think there could be a worthwhile turnaround opportunity from current levels.

But the uncertainty around near-term company performance and broader luxury market conditions means that I have no choice but to retain Graham’s previous neutral stance at this early stage in the company’s turnaround.

Aviva (LON:AV.)

Up 4.6% to 475p (£12.7bn) - Q3 trading update - Roland - AMBER/GREEN

We are confident about the outlook for the rest of 2024 and beyond, growing the dividend and achieving the Group’s financial targets.

Insurer Aviva’s 8% dividend yield is a notable attraction, even among the high yielders of the FTSE 100 financial sector. Today’s update shows more progress in key areas, so I’m not surprised there’s been a favourable reaction in the share price.

Q3 highlights: I’ve been a big admirer of Aviva’s turnaround under CEO Amanda Blanc. After slimming down the business, she has focused on rebuilding momentum in the group’s core operations in the UK, Ireland and Canada.

Today’s results show continued progress and suggest the group is on track to meet its medium-term targets.

General insurance (e.g. home, motor, commercial): premiums written rose by 15% to £9.1bn during the first nine months of this year. The company says this growth was “balanced” between price rises to offset inflation and new business wins.

However, hail, wildfire and flooding events in Canada resulted in a high level of natural catastrophe claims. Based on estimated claims costs the company expects its Canadian business to have a combined operating ratio (COR) of 110% for Q3 (Q3 23: 104%). What this means is that total claims costs and expenses are expected to exceed premiums received by 10%, resulting in an underwriting loss.

Fortunately, performance in the UK and Ireland was more profitable.

Aviva reports an overall undiscounted COR of 96.8% for the first nine months of 2024. Offsetting investment income against this figure results in an improvement to 92.8% – not a bad result for general insurance, which is a competitive market.

Protection & Health: one area of growth for Aviva is health insurance and other protection type products. Sales during the first nine months of this year rose by 22% to £403m (9M 23: £330m).

This growth was driven by “double-digit growth in Health in-force premiums” and the acquisition of AIG’s UK protection business earlier this year.

Multi-policy customers: Aviva is a well-known brand. A core element of the group’s growth strategy is to expand its direct relationship with its customers.

Over the last four years, customer numbers have risen by 1.2m to 19.6m. In the UK, 5m customers now have more than one policy and the company is focused on increasing this metric. Management hopes to increase these numbers to 21m and 5.7m respectively by 2026. These numbers underpin the group’s financial targets.

Retirement: annuity sales and bulk annuities have been another area of growth. Bulk annuity sales doubled to £6.1bn during the first nine months of this year, lifting total retirement sales to £7.3bn.

The company says that as of today, it has written £7.8bn of bulk annuities in 2024, thus meeting its 2022-24 target of £15-£20bn.

Aviva Investors: the group’s asset management business is not the largest in this market, with assets under management (AUM) of just £238bn.

Performance in Q3 was a little mixed as well, with net outflows of £1.7bn. These were due largely to the impact of run-off in heritage business and divestments. However, external net inflows of £0.6bn were insufficient to replace these expected outflows.

Solvency II coverage: this is the main regulatory measure of surplus capital.

Aviva’s Solvency II cover ratio fell from 205% to 195% during Q3. Capital generation did not cover the combined impact of Canada insurance claims, capital required for new business, and dividend outflows.

However, the position remains comfortable in my view and within the group’s target range.

In addition, the group’s Solvency II debt leverage ratio reduced during the quarter to 29.5% (HY24: 31.5%) following some debt redemption and new issuance.

Outlook: Aviva says it remains confident of meeting its 2024-2026 operating targets:

These underpin the company’s dividend guidance for “mid-single digit growth” in the cash cost of the dividend.

This is reflected in broker forecasts, which have remained fairly stable this year:

Roland’s view

As far as I can see, Aviva is in good financial health and is performing fairly well. While asset management inflows remain relatively weak, this is a problem being faced by most UK asset managers.

The valuation looks reasonable to me and I wouldn’t have any problem buying at this level. With a dividend yield of 8%, only minimal share price gains are required for a stock to provide a total return ahead of the long-term UK market average.

If the current dividend growth policy can be maintained, I would imagine there could be further upside here. I’m happy to take an AMBER/GREEN stance at this time.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.