Good morning! And thank you to Roland for editing yesterday's report while I was struck down with flu.

Please give a warm welcome to Mark Simpson as he rejoins us today. Mark does take an interest in commodity stocks and wrote an article about how to gain an edge in this sector yesterday - see here.

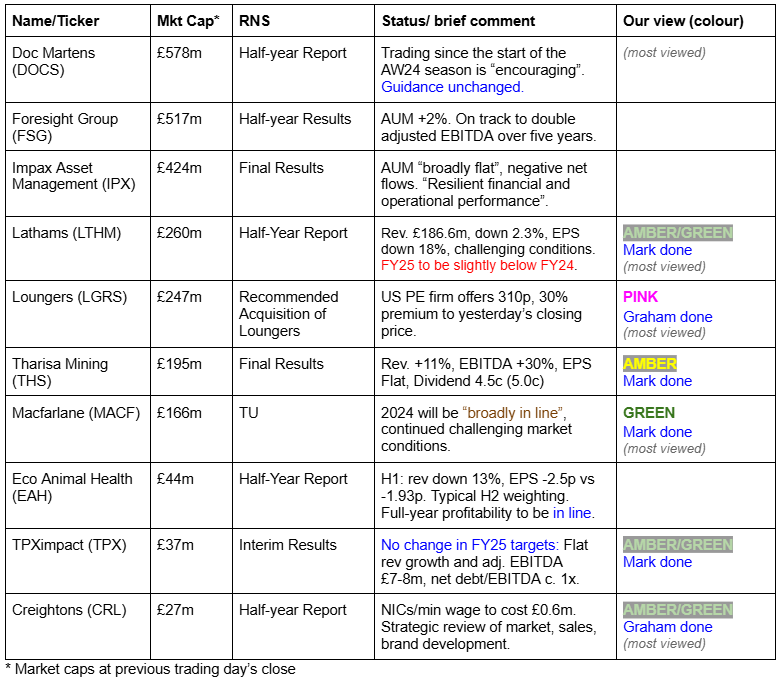

I saw there was a huge amount of comment yesterday about the market caps of the stocks we cover in this report. My expectation is that we are carrying on with mostly the same coverage as always, but with some changes on the margin as each member of the writing team naturally has their own particular areas of interest and expertise.

Megan has created a survey where you can vote on the market segments you want to read about (or don't want to read about). Please take a minute to vote if you can, dragging the segment you are most interested in up to the top of the list and then continuing by order of preference. Thank you!

12.50pm: that's all we've got time for today, cheers!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

Companies Reporting

Summaries

Loungers (LON:LGRS) - Recommended acquisition of Loungers - Graham - PINK (takeover)

A cash offer comes in from US private equity at 310p and 40% of the shareholder base are already committed to it. Based on my own calculations of prospective earnings at LGRS and my cautious attitude to café/bar/restaurant shares, it seems like a reasonable exit price to me.

Tpximpact Holdings (LON:TPX) - down 4.5% to 38.2p (£37m) - Interim Results - Mark - AMBER/GREEN

The shares remain on a modest rating if forecasts are to be believed. The H1 results show significant improvement at the bottom line, but much to do in H2. The company seems confident in performing well in H2 and beyond and these results give some measure of increasing confidence in that. Some caution is required since the adjusted figures exclude restructuring costs that have been all too common recently. The balance sheet looks okay, although it has no tangible asset backing to fall back on. Overall, I retain my AMBER/GREEN rating.

Tharisa (LON:THS) - up 2% to 65.5p (£195m) - FY Results - Mark - AMBER

It is hard to be negative on a company with a forward P/E of around 3. However, in this case, all their operating cash flow and then some is due to go on developing the Karo PGM mine in Zimbabwe. It is certainly possible that this is a great investment that will come on stream just in time for a new PGM boom. However, in the meantime, the forecast move to significant net debt significantly ups the risk. Cautious investors may want to adopt a wait-and-see approach. Hence the AMBER rating.

James Latham (LON:LTHM) - Down 10% to 1167p - Half-Year Results - Mark - AMBER/GREEN

While I can’t see updated forecasts, the outlook here reads like a minor profits warning, and the market has taken it as such. A number of factors mean that an expected improvement in H2 now looks unlikely. A P/E of 11 isn’t expensive, but it isn’t cheap either for a distributor that has no near-term growth prospects. However, those who believe this is just a dip and the long-term growth will continue from a well-run business will see this as a buying opportunity.

Short Sections

Macfarlane (LON:MACF)

Down 1% to 103p (£166m) - Trading Update - GREEN

The Board anticipates the Group's performance for 2024 will be broadly in line with its full year expectations.

Broadly is market code for slightly below, of course. This is a strong business operationally, but they can’t escape their end markets, which are described as “challenging.” This means revenue to date is down 4%. Note that this is an acquisitive company, so like-for-like figures will be worse. However, they appear to be able to largely mitigate the effect of the revenue decline. Their broker, Shore, only takes 2% out of their EPS forecasts for FY24. FY25 & 26 EPS is reduced by 4%, but this is due to the impact of NI increases, where the company says:

The increase in employers' national insurance rates and National Minimum Wage announced in the UK Government Budget on 30 October 2024 will increase the Group's costs by c£1.5m annually from April 2025. Mitigation actions are currently being reviewed to minimise the impact.

Even making these adjustments, the company is pretty cheaply rated:

The yellow here is more about how cheap the sector is than any objective valuation concerns.

Mark’s view

When Paul last looked at this in August, he said:

I’m comfortable to stick at GREEN on the good long-term fundamentals. A slightly soft patch in current trading doesn’t alter the big picture that this is a good business, at a reasonable price.

Since then, we’ve had a minor downgrade, but the share price is down too. Although the potential upside from stronger trading appears to have moved further into the future, I see little reason to change this as a long-term view.

Graham's Section

Loungers (LON:LGRS)

Up 28% to 304.5p (£317m) - Recommended acquisition of Loungers - Graham - PINK (takeover)

Loungers have published their interim results along with the news of this recommended takeover.

Paul covered the H1 trading update here.

Takeover offer: 310p in cash, offered by the US firm Fortress Investment Group.

The proposed 30% premium to the prevailing share price is around the bare minimum I look for.

LGRS shareholders are also offered the choice to accept “Rollover Units” in the new holding company, but these units will be “unlisted and non-transferable (except in very limited circumstances)” which does not sound very appealing.

Comment by the Chairman of LGRS:

"We remain very confident about Loungers' future prospects and the half year results that we announced separately today clearly demonstrate the strong momentum that we have in the business…

We are more ambitious than ever and we see Fortress as being an ideal partner to help us take Loungers into the next phase of its growth journey. We believe that the Acquisition represents a compelling proposition for all of our stakeholders and will allow us to execute our ambitious growth plans even more decisively and effectively."

The MD at Fortress highlights his company’s experience in UK consumer businesses, as Fortress previously bought Majestic Wines and Punch Pubs.

The bid: fair value?

While I tend to think bars and restaurants should trade cheaply, I still think that shareholders should be paid a very full price if they are going to agree to a takeover offer. Today’s offer is worth £338m.

The announcement describes the valuation as 8.1x FY April 2024 adj. EBITDA (before site pre-opening costs).

Since I don’t trust EBITDA for capital-intensive businesses like this, I would be more inclined to value it based on actual earnings, but I am willing to exclude site pre-opening costs as they are purely investment in growth.

For FY 2024, PBT was £11.4m and pre-opening costs were £4.2m, so I would be willing to use a PBT figure of £15.6m and apply tax on this to get adjusted net income of £11.7m (up from £8m the previous year, applying the same calculation).

Looking at today’s interim results, there is continued strong growth (revenue +19%) and I calculate that adjusted net income over the six month period was £6m (H1 last year: £4.3m).

Based on the growth trajectory, it therefore looks to me as if the company might be on track to generate an adjusted net income figure this year of £16m+.

The current-year adjusted PER for the offer from Fortress is therefore in the region of 21x (£338m divided by £16m).

Graham’s view

Personally I would view this as a fair offer for a company in this sector.

The analyst at Singers Capital Markets does not agree, and has come out with a research note headlined “low cash bid which should be rejected”, arguing that the bid is “on the low for a business with an excellent track record, a differentiated offer and a significant growth runway”.

However, I calculate that according to their forecast for adj. EPS (FY April 2025), the PER for today’s bid is over 25x. Based on anticipated growth, this falls to 17x by FY 2027. Again, my personal view is that the price is fair.

40% of LGRS shares are already committed to vote in favour of the deal, including the shares owned by Lion Capital and the Chairman Alex Reilley:

With 40% already committed, I think it’s more likely than not to go through, although there is still a chance for it to be held up. I wonder where Slater stand on it - I presume they are included in the 40%, but they aren’t mentioned in today’s announcement.

Creightons (LON:CRL)

Down 7% to 36.75p (£23m) - Half-year Report - Graham - AMBER/GREEN

Roland covered the H1 trading update from Creightons here.

Today’s interims see the share price giving back some of its recent gains, but it’s still slightly higher than it was when the H1 trading update was released.

There is no analyst coverage of this company available anywhere:

Let’s take a look at some of the key elements of this report.

Revenues fell year-on-year by £0.5m to £27.1m.

Gross margin improved to 44% (from 42.2%) “as a result of cost reduction and SKU rationalisation” (SKUs = distinct products).

Adj. operating profit improved to £1.7m (from £0.5m).

Checking the income statement, I see that the increase in operating profit was driven by 1) a nearly £500k decrease in distribution costs, and 2) a greater than £400k reduction in administrative expenses.

Distribution costs fell “as a result of the decision to exit the majority of third-party logistics providers and bringing picking and packing of finished goods in house”.

The reduction in administrative expenses seems mostly attributable to spending cuts at subsidiary Emma Hardie, now fully integrated, as Creightons “re-evaluates its strategy for the brand”.

Net cash is £1.5m, vs. net debt of £1.7m a year ago. A dividend for £0.3m was paid during H1 (in September).

Strategy: Creightons has three revenue streams: Branded (its own brands), Private Label (creating products for brands owned by retailers/supermarkets), and Contract Manufacturing.

Looking back at last year’s report, I see that the company has been diverting resources away from Contract.

Creightons says today: “Contract sales continue to be challenged through contract customers being overstocked and the inability to obtain credit insurance.”

Private Label and Branded revenues are the key revenue streams now, and Private Label is the main source of growth:

Private label has seen significant growth as a result of new customer wins, and our dominance in the market of being highly innovative, increasing pace of NPD delivery and exceptional quality and strength of service.

Branded revenue remains in retreat due to the cull in SKUs - probably good for the company long-term, but it holds up the numbers in the short-term.

P/E multiple

Roland ran some numbers earlier this month and came up with an FY25e P/E multiple of 10x.

I can update this for 1) the improved cash position, and 2) operating profit of £1.7m was higher than the lower bound suggested by the trading update.

I’ll use an upgraded net income forecast of £2.5m, and I’ll deduct £1.5m of net cash from the market cap. On that basis I get a cash-adjusted PER estimate of 9x (Roland got 10x).

Graham’s view

This is part-manufacturer, part-brand owner. I primarily think of it as a manufacturer.

As manufacturers normally (and rightly) trade at cheap multiples, I’m not sure if I’d be comfortable upgrading this one to GREEN today. By all accounts the new CEO (since March) is excellent and worth backing. But as someone who previously owned CRL shares, I’m also keenly away that the market can get carried away with this one:

Tangible assets are £15m and the purchased intangible assets should have some value, too, consistent with a market cap of £23m.

I’m therefore happy to leave this one where it was, at AMBER/GREEN.

Mark's Section

Tpximpact Holdings (LON:TPX)

Down 4.5% to 38.2p (£37m) - Interim Results - Mark - AMBER/GREEN

Coincidentally, I reviewed this company when I was last on the DSMR following its Trading Update for the period reported today. This means the headlines are already known:

Revenue of £37.8m (H1 2024: £41.6m), a decrease of 9.2% reflecting market headwinds; Adjusted EBITDA2 up over 15% to £2.3m (H1 2024: £2.0m)

This means that profitability is up significantly in H1 versus last year:

Adjusted diluted earnings per share up strongly to 1.2p (H1 2024: 0.5p)

However, there is a big gap between the adjusted and statutory figures:

Reported diluted loss per share improved to (3.6)p (H1 2024: (10.2)p)

So, it is worth checking if these adjustments seem reasonable. Here, note 7 gives us the breakdown:

Excluding the amortisation of intangibles is fairly normal these days, and I think this is acceptable as long as the company isn’t capitalising significant amounts of intangibles. This figure is zero for these six months and negligible in previous periods so that seems ok. Share-based payments is a huge debate. Many companies exclude them, but they are a real cost to shareholders. They are just not necessarily a cash cost equal to what the option pricing models suggest they are for accounting purposes. Perhaps the best solution is for shareholders to exclude them for profits but always use the fully diluted share count for EPS.

I have less patience for companies excluding restructuring costs when they seem to restructure every year. Indeed, in some companies, such as consolidators in declining industries, restructuring is their core business! That isn’t the case here. However, these costs are material and appear to be recurring in nature. Shareholders will want to quiz management about the exact nature of these costs and when they will end, in any management calls. TPX will be presenting on InvestorMeetCompany at 11:30 today.

With these results, we also get to look at the balance sheet. Here the current ratio looks reasonable at 1.37:

There is little in the way of tangible asset backing, and almost all the assets are intangible:

However, net debt is down, and it appears without them playing games with working capital:

Net debt (excluding lease liabilities) as at 30 September 2024 of £7.9m (31 March 2024: £7.1m; 30 September 2023: £12.8m)

This is good news, but it is also worth bearing in mind that they have a lot to do in H2 to meet forecasts:

That works out to be £46.5m revenue and c.3p of EPS. However, they re-iterate what they said in the last trading statement:

No change in FY25 targets: flat revenue growth for the year and Adjusted EBITDA in the range of £7-£8 million, and net debt of around 1x EBITDA

FY26 target of like-for-like revenue growth of 10-15% reaffirmed

Mark’s view

The shares have bounced following the last trading statement as confidence has built in their ability to deliver in line with expectations. Despite this, the shares are still trading on a very modest rating. Having now seen the balance sheet and cash flow statement, I don’t see anything to be concerned about. However, investors need to interrogate those restructuring costs, as the value here is in the company's ability to generate high earnings and cash flow and it is no good if these continually go out in below-the-line costs. Overall, I retain my AMBER/GREEN rating, though.

Tharisa (LON:THS)

Up 2% to 65.5p (£195m) - FY Results - Mark - AMBER

Tharisa was recently covered by Keelan in his review of the PGM commodity sector. I also showed how companies such as this could be modelled by investors, here.

Being dual-listed on the JSE, Tharisa tends to include only a summary of its results in the RNS and then guide us to its website to see the full picture. These are a tale of two commodities. It was the best of times, it was the worst of times. Chrome production increased, as did pricing. But PGM production was flat, with a significant drop in the average price received:

Chrome production at 1 702.6 kt (FY2023: 1 580.1 kt)

o Average metallurgical grade chrome concentrate prices up 13.7% at US$299/t (FY2023: US$263/t)

PGM production at 145.1 koz (FY2023: 144.7 koz)

o Average PGM basket price retreated by 28.1% with average prices received at US$1 362/oz (FY2023: US$1 893/oz)

The net result isn’t bad, increasing revenue and significantly higher EBITDA:

However, that increase disappears as we go down the income statement, as increasing net interest costs and taxes bite. However, this was expected and EPS is in line with consensus forecasts:

This gives a very low P/E of just 3. On top of this, there is net cash. However, this is something investors don’t like to see:

Assuming there are no audit problems, a company having a large debt with an even larger cash position suggests one of three things:

There are large working capital flows, and the balance sheet date is unrepresentative of the rest of the year.

The cash is restricted in some way, perhaps by capital controls.

The cash is committed elsewhere.

There may well be a bit of 1. and 2. but 3. is the major factor. While competitor Sylvania Platinum (LON:SLP) is realising the benefit of chrome production and developing a JV to produce that, Tharisa is doubling down on PGMs and developing a large mine in Zimbabwe called Karo. This means capex for the year came in at a whopping $195m. This is despite Tharisa slowing the Karo development in response to continued low PGM prices:

This dwarfs the dividend payment of c.$11m, and investors will feel disappointed that this has been moderated in response to these continued capex demands to 4.5c versus 5c the previous year.

Looking forward, committed capex is much less:

Total capital commitment at the financial year end totalled US$46.9 million (Karo Platinum: US$22.6 million): Contracted for property, plant, and equipment – US$46.1 million Authorised but not contracted for property, plant, and equipment – US$0.8 million.

However, I expect that they will spend far more than the current commitments. Broker Tamesis, are forecasting a whopping $325m spent on capex in FY25. Production also has the ability to increase slightly in FY25:

Production guidance for FY2025 is set between 140 koz and 160 koz PGMs (6E basis) and 1.65 Mt to 1.8 Mt of chrome concentrates

The midpoint of those ranges is above FY24 actual production. Chrome prices have moderated slightly but remain at reasonable levels:

There is little sign of a recovery in PGM prices, but they don’t need to for Tharisa to generate significant operating cash flow. Broker Tamesis hasn’t updated their model following these results, but after the Q3 production, they had 34c of EPS pencilled in for FY25, which means the Stockopedia consensus for a drop in EPS may now be stale. The problem is that Tamesis also forecast net debt to balloon to $178m due to the capex spend, making this much riskier than in the past.

One final thing to be careful with when it comes to miners is how long they have left. In this case, 17 years is a reasonable life-of-mine at Tharisa, especially when the P/E is 3.

The Tharisa Mine’s (South Africa) remaining useful life of mine and infrastructure based on the remaining open pit life of mine and excluding future potential underground development, is currently estimated to be 17 (2023: 18 years) years.

Mark’s view

It is hard to be negative on a company with a P/E of less than 3 which generates significant operational cash flow. However, the capex forecast by the broker Tamesis is so huge that it eats that cash flow and more. This makes them particularly high risk, as they will be in a net debt position and have operations in challenging jurisdictions. I can’t help feeling that if the company simply mothballed the Karo mine and returned the cash earmarked for capex in dividends, the share price would be significantly higher. From this point of view, the most sensible course of action may be to wait to see how that development pans out. Hence, I think this only gets an AMBER rating at the moment. The risks of a waiting strategy are that PGM prices take off and transform the Karo business case or that the business gets taken over. Tamesis point out that:

The share price is trading on PE multiples of 2.6x and 2.4x FY24 and 25 and EV/EBITDAs of 0.7x and 0.7x using a static net cash figure. These are based on essentially spot PGM and Chrome price so believe are conservative. If the market doesn’t react soon and rerate the stock, then we would expect industry to further consolidate.

However, I can’t help but think any potential acquirer would take the same approach as me and wait to see how the Karo development goes, risking paying a bit more for much greater certainty of outcome.

James Latham (LON:LTHM)

Down 10% to 1167p - Half-Year Results - Mark - AMBER/GREEN

I can’t see any updated forecasts from broker, SP Angel,, but it is clear from the market reaction and momentum Rank that many expected better:

As a distributor, they are at the mercy of market prices. So, while volumes are actually up 4.1%, revenue declines

Revenue for the six months ended 30 September 2024 was £186.6m, down 2.3% on £190.9m for the same period last year. Cost prices on both timber and panels have remained stable throughout the first half of the year but there are signs of price weakness in some of our commodity products.

Margins are impacted by EU regulation shifting hardwood supply to the UK:

Gross profit percentage, which includes warehouse costs, for the six-month period ended 30 September 2024 was 16.3% compared with 16.8% in the comparative six months.

50bps doesn’t sound a lot but for a distributor whose overall gross margin is low, this can have a big effect:

Operating profit was £11.3m, down £3.2m compared with £14.5m operating profit for the same period last year. Profit before tax was £13.6m compared with £16.4m for the same period last year. The tax charge of £3.4m represents an effective rate of 25.3%, reflecting the UK basic rate of corporation tax. Earnings per ordinary share were 50.5p compared with 61.5 p for the same period last year.

With distributors, it is always worth checking the cash flow as price changes either way can exaggerate profit changes due to FIFO accounting (First In, First Out). In this case, the operating cash flow paints a similar story:

Things don’t appear to show any sign of near-term improvement either:

The second half of 2024/25 has started with similar volumes to the previous six-month period to 30 September 2024, with similar margins. We were expecting the market to show signs of improvement in the second half of this year but so far this has not materialised. We have seen considerable challenges in our marketplace, including a significant competitor going into administration and others looking to quickly turn inventories into cash, which has affected short-term margins in some product groups.

Simply doubling EPS would see full-year numbers of 101p, a miss on forecasts, but a slight one. It is tempting to think that a 10% share price fall represents an opportunity. However, this still puts them on a P/E of 11. While not expensive, it isn’t cheap for a company without any sign of near-term growth.

Mark’s view

When Paul reviewed this in August, he rated it GREEN due to the long term performance of the business. I’m torn about this one. While I agree this is a quality business, it is also a distributor and is not immune to market forces. Hence, the outlook has undoubtedly soured since Paul last looked at it. Hence I am going for GREEN/AMBER to reflect that greater short-term uncertainty.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.