Good morning!

Sorry if you've been having any difficulties loading this page, I'm told that the developers are working to fix the problem as soon as possible. (EDIT: you shouldn't have any issues now.)

1.15pm: we've run out of time now, cheers!

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Shell (LON:SHEL) (£157bn) | Fourth quarter press release | 2024 “another year of strong financial performance”. 4% divi increase, $3.5bn buyback. | |

3i (LON:III) (£36.8bn) | Q3 performance update | Total return 20% for nine months to Dec 2024. NAV rises from 2261p (Sep) to 2457p (Dec). | |

BT (LON:BT.A).A (£14.3bn) | Q3 TU | “On track to deliver our financial outlook for this year. Year-to-date adj. rev -3%, adj. EBITDA +2%. | |

Sage (LON:SGE) (£13.4bn) | TU | Reiterate guidance for the full year. Q1 revenue +10%. | |

St James's Place (LON:STJ) (£5.0bn) | 2024 New Business Inflows & FUM | “Strong final quarter”, “successful year”. New charging structure on track for H2 2025. FUM £190bn. | |

Airtel Africa (LON:AAF) (£4.9bn) | Q3 Results | Year-to-date revenue down 5.8%, EBITDA down 11.9%. Affected by currency devaluation. | |

Serco (LON:SRP) (£1.5bn) | Acquires leading US defence business | Price is ~£264m in cash. | |

Wizz Air Holdings (LON:WIZZ) (£1.4bn) | Q3 FY25 Results | Load factor 90.3%. Rev +10%. Loss-making (grounding of 20% of its fleet, FX). Net debt €5.1bn. | |

Future (LON:FUTR) (£983m) | Appointment of CEO | An internal hire, he has been with Future for over 20 years. | |

Greencore (LON:GNC) (£810m) | TU | Outlook is in line. Unprecedented labour cost challenge. Committed to offsetting it in full. | |

Fevertree Drinks (LON:FEVR) (£768m) | US Strategic Partnership with Molson Coors | Network of distributors/customers. MC invests £71m in FEVR, FEVR to buy back £71m of its shares. | AMBER/GREEN (Graham) Very exciting deal to take advantage of the opportunity to grow market share in the US. A little expensive in P/E terms but worth it in my view. |

Auction Technology (LON:ATG) (£740m) | AGM Statement | Trading in Q1 is consistent with FY25 outlook. | |

CVS (LON:CVSG) (£737m) | Half Year TU | H1 LfLs -1.1%, softer conditions. Tax changes to cost £11m before mitigation. Outlook in line. | |

Alfa Financial Software Holdings (LON:ALFA) (£608m) | Q4 TU | FY24 op profit +13% to £34m, 5% ahead of exps. Rev in line, costs lower. Well positioned for 2025. | |

Discoverie (LON:DSCV) (£603m) | Q3 TU | In line. Sales for Q3 flat year-on-year at constant FX. Organic performance recovering. | |

Hollywood Bowl (LON:BOWL) (£501m) | AGM TU | In line. Total revenue for FY25 is up 11.3% year-to-date. Well positioned to mitigate NICs/NLW. | |

Resolute Mining (LON:RSG) (£434m) | Quarterly Report | Production slightly <guidance, costs above guidance. Lower production forecast for 2025. | |

Rank (LON:RNK) (£420m) | Half-year Report | Underlying LfL operating profit for FY June 2052 to be slightly ahead of current expectations. | |

Next 15 (LON:NFG) (£346m) | TU | FY Jan 2025 to be at bottom of analyst exps. New business wins to come through in new year. |

AMBER (Mark) |

Tullow Oil (LON:TLW) (£283m) | Ops Update | Considering disposals of non-core assets to accelerate deleveraging. Net debt $1.45 billion. | |

LSL Property Services (LON:LSL) (£282m) | TU | Trading is in line. 2024 revenues were up c. 20%. | |

Fintel (LON:FNTL) (£275m) | TU | Full-year results in line. Revenues up 21% to £78m. | |

XP Power (LON:XPP) (£312m) | Legal Judgement | $19m in total is to be paid by the XP power, $10m above the existing provision. Net debt now 2.65x Adj. EBITDA | |

Treatt (LON:TET) (£261m) | AGM TU | In line. Q1 rev in line with management's expectations, Q2 has started well. | |

Property Franchise (LON:TPFG) (£261m) | TU | In line with market expectations. Revenue +146% to £67.2m due to acquisitions. Net debt of £9.1m. FY25 has started with strong momentum. | GREEN (Graham) A reassuring update with few obvious obstacles to another good performance in 2025. High-quality franchisor at reasonable valuation. |

Ricardo (LON:RCDO) (£218m) | TU | Below consensus expectation for FY 24/25, due to order delays. Net debt £18.5m due to £64.3m disposal of Defence business. | AMBER/RED (Graham) Huge cuts to EPS forecasts on the back of delays and I downgrade my stance. I'm not sure this is very cheap even if profits recover as expected by 2026. |

ITM Power (LON:ITM) (£216m) | Interim Results | Rev. £15.5m (H124: £8.9m), Adj. EBITDA loss £16.8m (H124: £18.1m). Cash £203.1m (H124: £253.7m). FY Rev in line, improved EBITDA losses versus original guidance | |

Somero Enterprises (LON:SOM) (£166m) | TU | Rev in line, profit small miss. Rev $109.2m, Adj. EBITDA $29.1m, cash $29.5m |

AMBER (Mark) |

Saga (LON:SAGA) (£163m) | TU | U/L PBT marginally higher than the prior year, ahead of our previous guidance. Travel U/L PBT in the high single-digit millions. Insurance Broking U/L PBT materially lower than in 2023/24. Insurance Underwriting U/L PBT high-single digit millions. | RED (Graham) RED might be a little harsh given the positive trading update and refinancing announced today, but I've never been a fan of this one and the interim balance sheet had deeply negative tangible value. It still looks to me like a disaster waiting to happen. |

Camellia (LON:CAM) (£131m) | TU | Ahead of expectations. £4-5m loss vs previous £7-9m. |

AMBER/GREEN Mark (I hold) |

Strix (LON:KETL) (£106m) | TU | Ahead of market consensus.Adj. PBT £18m-19m |

AMBER (Mark) |

Scancell Holdings (LON:SCLP) (£100m) | Interim Results | Operating loss £10.5m (FY24: £8.1m). Cash 31 Oct £9.1m. Cash runway to H2 2026 beyond multiple clinical milestones due to £11.3m raise in Dec 24. | |

Futura Medical (LON:FUM) (£94m) | TU | FY24 Revenue and Profit after Tax ahead of market expectations. FY25 revenue will be materially below expectations and, as a result, will make a loss after tax in FY25. Cash of £6.6m. | |

Mulberry (LON:MUL) (£68m) | Strategy Update, TU | In line with the Board's expectations, | AMBER/RED (Graham) Tempted to go fully RED on this but the company is cutting costs and trying a simpler strategy. Fingers crossed for them. |

Science in Sport (LON:SIS) (£58m) | TU | Adj. EBITDA & Net Debt are expected to be ahead of current market expectations. Rev down 17.5% to £51.9m, Adj. EBITDA +105% to £4.2m, Net debt £5.9m. FY25 trading has started well. | |

Flowtech Fluidpower (LON:FLO) (£46m) | TU | Underlying EBITDA is broadly in line with expectations. Rev down 4% to £107.3, Net debt £15.1m (£14.8m FY23) | |

Tissue Regenix (LON:TRX) (£42m) | TU | Rev +8% to $28.4m, Adj. EBITDA above expectations. Cash $1.9m. Review of strategic options is continuing | |

Inspecs (LON:SPEC) (£40m) | TU | 2024 did not meet the full expectations of the Board. Revenue £200.5m (2023: £203.3m), U/L EBITDA £17.5m (2023: £18.0m). Net debt £22.9m. Solid start to 2025. | |

Novacyt SA (LON:NCYT) (£36m) | TU | Rev £19.6m (FY23 £10.6m), Cash £30.5m (£32.9m) | |

Kromek (LON:KMK) (£34m) | Interim Results | Rev £3.7m (24H1 £7.1m), Adj. EBITDA loss £2.3m (£0.1m). Cash £0.6m | AMBER/RED (Graham) Getting out of net debt at least temporarily as a consequence of a large deal with Siemens Healthineers. Could it be a sign of things to come? |

Vianet (LON:VNET) (£30m) | TU | PW. FY25 rev. c£15.7m (FY24 £15.2m), EBITA c£3.6m (FY24 £3.5m). | |

Poolbeg Pharma (LON:POLB) (£26m) | Extension to PUSU Deadline | Positive discussions and due diligence continue re: takeover.. | |

Gusbourne (LON:GUS) (£23m) | TU | Net rev +1%, FY adj. EBITDA loss is expected to be around £0.7m, unchanged on the prior year. Net debt £22.6m. | |

Eenergy (LON:EAAS) (£16m) | TU | Rev +88% to £27.1m Adj. EBITDA £0.4m (-£3.6m). Net cash £2.3m. Significantly improved EBITDA and cash generation in FY2025. | |

Empresaria (LON:EMR) (£13m) | TU | Adj PBT In line. NFI down 6% CC (down 12% reported to £50.4m). Net debt increased to £15.3m (FY23 £10.8m). | |

Merit (LON:MRIT) (£5m) | Recommended cancellation of listing | Expected cancellation 5th March. |

Graham's Section

Property Franchise (LON:TPFG)

Unch. at 410p (£261m) - FY24 Trading Update - Graham - GREEN

We have an in line full-year trading update from “the UK’s largest multi-brand property franchisor”.

As it has now merged with Belvoir (BLV), there is revenue growth of 146%, bringing the total to £67m.

Just over half of total revenue is considered to be “recurring”.

The merger took place in March 2024, with people from TPFG keeping majority control of the combined group.

Franchising: the group now includes 15 brands and manages 153,000 rental properties.

On a like-for-like basis, the management service fees charged to franchisees increased 11% during the year.

Hybrid offering Ewemove saw year-on-year revenue growth of 17%.

Financial Services: a big point of the Belvoir merger was to bring in financial services revenue and this is now £19m for the year.

Licensing: this is a new division after the acquisition of GPEA which included both Fine and Country and the Guild of Property Professionals. Revenues of £7m were generated since acquisition in June 2024.

Outlook

FY25 has started with “strong momentum”. The outlook statement focuses on lettings and financial services:

We anticipate the lettings business to continue to grow in 2025, with the upcoming Renters Reform Bill expected to provide an additional opportunity for the Group, given the tough compliance requirements, to convert more landlords to the managed property model.

We have seen strong demand in January within our financial services business as customers continue to enjoy more affordable rates. The combination of a strong sales pipeline which has increased by 71% to £39.4m (2023: £23.1m) and current mortgage rates give us confidence in achieving a positive H1. H2 will be influenced by the anticipated interest rate cuts.

Graham’s view

I tend to be GREEN on this one. The last time was at 465p in August 2024, when I said that the market cap was “starting to price in the company’s excellent prospects”.

The high for the year was seen shortly afterwards:

Now at 410p nearly six months later, the valuation has cooled down a little:

A few quick points before I conclude this section:

Sales vs. Lettings: Sales are currently outperforming Lettings (as measured by like-for-like management service fees), but the attraction of Lettings is that they anchor performance even when Sales are very poor, as happened in 2023.

Debt: the company is now carrying £9.1m of net debt. This does not concern me in the context of an adj. PBT forecast of £22m for 2024, rising to £30.1m for 2025 (estimates courtesy of Singers). There shouldn't be any problems paying off this debt. Indeed, it wouldn't surprise me if the company remains on the lookout for more acquisitions.

In summary: I remain a big fan of this one and am comfortable with the valuation. I acknowledge it’s not priced at bargain levels, given the sector. But considering its underlying quality, I think it’s still attractive:

Mulberry (LON:MUL)

Up 2.5% to 100p (£70m) - Trading Update - Graham - AMBER/RED

This handbag maker has had a difficult few years. As we reported here in November, the most recent drama concerned the attempt by Frasers to take it out at 130p and then 150p, but this was not entertained by Mulberry’s Singaporean owners.

The company raised £10m in fresh equity last year, an amount that was smaller than its underlying pre-tax loss in H1.

Today we have a triple-barreled announcement.

Strategy Update

The new CEO and the Board are focusing on three priorities: simplification (includes refocus on the UK at the expense of China), brand refresh (as a British lifestyle brand with a new creative team), and finally customer connection (customer insights, personalisation, etc.)

On the cost front, there is a “forensic spending review” as the company seeks to cut operating costs by about 25%. It is amazing how spending at luxury companies can spiral out of control - I’ve seen it at Burberry before (disclosure: I have a long position in BRBY).

2. Appointment of CFO

It’s good to see Mulberry solve this problem quickly, as the departure of the previous FD was announced only last week.

3. Trading Update

Trading over the festive period was “satisfactory”:

In line with the Board's expectations, Group revenue for the period declined 18.3% (-17.1% on constant exchange rates "CER") versus the same period in the prior year, as a result of the continuing challenging macro-economic environment…

The Company continued to take actions to manage costs and inventories during the period to ensure they aligned with revenues.

FY March 2025 will be H2-weighted, but I don’t think anyone is expecting much from these results.

Estimates: Peel Hunt’s estimates can be seen on the StockReport but I don’t think they are worth much given the volatility of MUL’s performance right now.

Graham’s view: I’m going to stick with my AMBER/RED stance.

As it is a very small player in the luxury space, I’ve been worried about MUL, thinking that it might be too subscale to survive.

During this generalised slowdown in luxury spending, even the much bigger BRBY is loss-making and in need of simplification and cost reduction.

If BRBY needs that, then MUL definitely needs it, as it doesn’t have the economies of scale and purchasing power enjoyed by its larger rivals. It simply can't afford to be inefficient. So it is surely doing the right thing by simplifying and going back to basics.

Net debt in November was £16m, with less than £6m of available liquidity.

Normally I would be RED on a company in that position, and perhaps I should be fully RED on this, but I think there is still a chance that MUL can turn things around. Its rich owners (Frasers and the Singaporean billionaires) would surely be interested to bail it out if it gets into difficulty, although of course it's hard to say what effect this might have on smaller shareholders.

I may need to downgrade my stance on this further if there are no green shoots by the time of the full-year results.

Fevertree Drinks (LON:FEVR)

Up 21% to 797.5p (£932m) - US Strategic Partnership - Graham - AMBER/GREEN

This stock gave us an exciting deal announcement with drinks giant Molson Coors ($TAP) this morning

Under an exclusive license agreement, Colson Moors will get involved in the distribution of Fever-Tree, and in supply chain, procurement and the onshoring of US-based production.

Not only that, it’s injecting £71m into FEVR in fresh equity, at a price of 654.2p.

And in a really classy move, FEVR is sending that money straight back to shareholders with a £71m buyback.

It reported a cash balance of £66m as of June 2024, so I guess it doesn’t really need that surplus cash.

Molson Coors will have consented to the buyback. In effect, they are buying out a portion of the shareholder base, making no change to the FEVR’s balance sheet.

It does mean that FEVR will have sold shares at 654.2p and then bought shares at a higher price, given the share price movement we’ve had this morning. So there will be some dilution left over when all is said and done, but it shouldn’t be too large.

In a very confident statement, FEVR say they “will consider the opportunity for further shareholder returns beyond this initial buyback programme”, as the agreement with Molson Coors is expected to result in “enhanced cash generation”.

Comment by FEVR’s CEO:

"Today's announcement marks a transformational step for the Fever-Tree brand in the US. Thanks to the superb work of our US team, we have seen Fever-Tree become the number one brand in both the tonic and ginger beer categories, a remarkable achievement which has redefined the US mixer category amongst consumers and customers alike…

With a national network providing significant scale and muscle, alongside its proven track record, supply chain expertise and clearly stated strategic desire to drive the future of their business beyond beer, Molson Coors are the ideal long-term partner to take the Fever-Tree brand to the next level across the US.

Trading update: adjusted EBITDA for FY Dec 2024 is expected to see a strong uplift, in line with expectations.

The financial highlights illustrate that the US is where most of the growth is:

Outlook: the partnership with Molson Coors will “drive a step change in the quality of earnings” over the medium term.

2025 guidance: low single digit revenue growth, and a short-term EBITDA impact from the US transition.

2026: double digit revenue and EBITDA growth.

Then a sustained uplift in revenue and EBITDA growth.

Graham’s view

Roland covered this in detail in September, taking a neutral stance at 784p.

The share price is only a little higher today, but now have a giant of the US drinks industry getting involved as a shareholder and helping the company to take advantage of its US growth opportunity.

Perhaps I’m getting swept up in the hype, but I feel obliged to upgrade my stance here.

Yes, it’s a little expensive in P/E terms but drinks companies are worth paying up for. FEVR is not just a successful drinks company, but it operates in a niche (mixers) where it’s possible to lock up a very high market share for many years, as Schweppes did. In my view this makes it more attractive than the average, successful drinks business. With Molson Coors on board, I think the excitement is justified.

Saga (LON:SAGA)

Up 5% to 120.1p (£172m) - Trading Update - Graham - RED

It’s a positive update: underlying PBT for FY Jan 2025 is now expected to be ahead of previous guidance and marginally higher than last year.

Underlying PBT last year was £38m, but the unadjusted pre-tax loss was £129m.

All divisions seem to have had a good year with the exception of Insurance Broking, although even that division was in line with guidance.

Insurance Underwriting almost achieved a profitable underwriting result, with a combined operating ratio of just over 100% (this needs to get below 100% to be profitable). The division is to be sold in Q2 for net proceeds of £43m.

Available cash is c. £60-70m, which excludes a £50m undrawn RCF and £10m from the Chairman/largest shareholder Sir Roger de Haan.

Net debt is “slightly lower” than the £615m figure reported for July 2024.

Refinancing: in a separate announcement, Saga announces the full refinancing of its corporate debt.

The new facilities “materially enhance the Group's liquidity position, significantly increase covenant headroom and provide funding certainty”.

They include a £335m term loan, plus another £100m term loan to be used for specific purposes, and a £50m RCF.

Saga’s overall blended interest rate after this deal is 7.6%, which strikes me as a nice outcome for the company given its risk levels.

Outlook: Cruise bookings are slightly higher than where they were last year, as measured by load factors. Travel bookings are 10% higher.

Graham’s view: this share doesn’t appeal to me at all. I may have said this before, but I don’t understand why these different types of businesses should hang together in the same corporate structure. The disposals and partnership agreements announced in recent times are therefore a step in the right direction, in my view.

I especially don’t understand why it needs to use so much leverage. Borrowing to fund cruise ships is understandable, in a sense, but still risky. But why leverage up every other part of the business, too?

The recent interim balance sheet showed the company having equity of £116m but the number becomes deeply negative after you subtract intangibles.

The refinancing announced today and disposals are good news but I continue to view this stock as a disaster waiting to happen. Of course high rewards are possible for those who take high risk.

I’m on the fence between RED and AMBER/RED, but I’m going with AMBER/RED on the basis of the interim balance sheet.

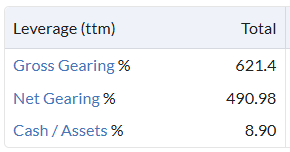

Some leverage numbers from the StockReport:

Kromek (LON:KMK)

Up 29% to 6.8p (£44m) - Multi-year Agreements with Siements Healthineers - Graham - AMBER/RED

After many years of losses, I admit that I gave up on the potential for this one to come good:

Kromek is “a leading developer of radiation and bio-detection technology solutions for the advanced imaging and CBRN detection segments”.

CBRN refers to chemical, biological, radiological and nuclear.

The company has a year-end in April. Today it announces both interim results and a new agreement with Siemens Healthineers.

The interim results are more of the same: another EBITDA loss, bigger than last year’s.

However, the agreement with Siemens is exciting:

Kromek has signed agreements with Siemens Medical Solutions USA, Inc. ("Siemens Healthineers") to enable the production of cadmium zinc telluride ("CZT") detectors for single photon emission computed tomography ("SPECT") application…

I don’t pretend to know what this means but the financial result is that $37.5m will be paid to Kromek in cash in four installments over four years. The first installment is $25m and will be paid in the current financial year.

It’s non-exclusive: Kromek will be able to supply other customers.

New forecasts: Cavendish have issued new forecasts which see the company making an adj. PBT of £4.9m in the current year (FY April 2025), although this is expected to drop back substantially in subsequent years: only £2.1m in FY April 2026, and £1.0m in FY April 2027.

Graham’s view

It looks to me as if Kromek will need to find more deals of this magnitude, on the basis of the forecasts published today.

However, now that they have this one under their belt, maybe it will be easier to find the next?

One of the best aspects of the announcement is that the company is expected to at least temporarily get out of net debt, and have a small year-end net cash position.

Accordingly I’m giving this an upgrade to AMBER/RED.

Ricardo (LON:RCDO)

Down 23% to 270p (£168m) - Trading Update - Graham - AMBER/RED

Roland covered this one most recently - see his January article.

RCDO is exiting defence and focusing on energy/the environment.

Today’s H1 update starts off fine in terms of continuing operations, with order intake up 10% and the order book up 2%. Revenue rose 1%.

Unfortunately, there is some bad news from the now-key “Energy and Environment” segment:

Energy and Environment (EE) delivered strong order growth driven by multi-year contract wins within air quality and policy, but phasing of orders impacted H1 revenue and profit, due to global elections, the delay in spend ramping for UK water asset management plan (AMP) cycles and global macro uncertainties. We expect good profit growth in the second half, with the impact of delays in orders reducing as we go into the next financial year.

There was also a delay in “Rail” due to the California wildfires. The other segments seemed to perform as expected.

Net debt: £18.5m, much lower than before thanks to the Defense disposal, but before spending £51m on the infrastructure advisory firm E3.

Outlook is a fully-fledged profit warning.

Due to the delay in orders identified above we will be below consensus expectation for FY 24/25. We still expect to see good Group organic underlying profit growth for the year, in addition to the profit from the Acquisition of E3 Advisory. H2 will show good profit growth in EE, however due to the order delays described above, will be broadly flat for the full year…

I must say that I dislike the phrasing used. H2 will show “good profit growth in EE” - I think they mean that H2 will be better than H1. But then the full-year result will be flat for that segment.

Estimates: Zeus has an adj. PBT forecast for the current year of £12.4m. Panmure are similar at £12.9m, rising to £15.5m the following year and then £21.8m the year after that

EPS forecasts have been cut by 32% for this year and 48% for next year.

Graham’s view

I’m not sure if I should downgrade this to AMBER/RED. It’s a debt-ridden consultancy group that’s suffering some complications in its key division, after it sold off its most profitable business. Maybe that’s priced in now at the current market cap?

On balance I think I will downgrade it, as the large net debt figure (£60m+) produces an enterprise value of about £230m. Against the pre-tax profit forecasts mentioned above, that seems to me a high price to pay.

Even if we get a recovery in profits by 2026, this doesn't strike me as an obvious bargain at this level. So I think a moderately negative stance is justified.

Mark's Section

Somero Enterprises (LON:SOM)

Down 6% to 285p - Trading Update - Mark - AMBER

A stronger H2 here sees revenue in line:

It expects the Company to report 2024 revenue of US$ 109.2m, in line with previous guidance and market expectations, with H2 revenues improving by 10.8% to $57.4m

As is often the case here, it is North America doing the heavy lifting:

We’ll have to wait for the results on 11th March to see the breakdown by machine, but my expectation is that boomed screeds will again be the bulk of the sales.

All regions showed a decline versus 2023, although it was slight in Europe:

But perhaps more importantly, all regions saw growth in revenue versus H1:

The result is:

Excluding separation-related expenses, the Board expects the Company to report 2024 adjusted EBITDA of US$ 29.1m. The year-end cash position is anticipated to be US$ 29.5m reflecting lower net working capital investment. These estimates remain subject to any audit adjustments.

However, Cavendish describes this as “profit broadly in line” as their previous EBITDA forecast was $30m. They have taken 6% off their EPS forecasts, to give 35.5c for FY24E. The good news is that the cash balance was above their previous $27.1m forecast, but this hasn’t been enough to maintain the dividend forecast, which has been cut by 13%.

The outlook is better, and the company say:

the Board expects trading in 2025 to moderately improve on 2024 with commensurate profits and cash generation.

Cavendish translate this into 4% Revenue growth, flat EPS and a 22.6c dividend, for a 6% yield. These look conservative, given the momentum in North America in H2. However, as usual, it comes down to demand for warehousing and data centres in the US and concrete availability, which can be hard to predict. While the company has an enviable market share in North America, the lack of progress in Europe leaves the company mainly exposed to the US market. The slow pace of development of features demanded in Europe, such as battery power or being able to fit on standard European trailers, has allowed competitors to gain a foothold here. They still have great brand recognition, but the growth that many expected in Europe to match the US may now not be possible.

Mark’s view

Graham rated this AMBER in December. Since then, we’ve had this minor profit warning taking 6% off forecasts, but the share price has dropped 12%, perhaps making them look slightly better value. The newly introduced 2025 forecasts are not exactly inspiring, but they do look conservative, given the momentum in the US. I am slightly more positive than Graham, as I think there is always a chance that some of their innovations (with R&D all expensed) could start to gain traction. Also, with Jack Cooney retiring, this could be a good time for any interested parties to make an offer for what would typically be a cheap rating for a US company. However, without seeing further details of how 2025 trading is progressing, I am not quite ready to change the AMBER rating.

Next 15 (LON:NFG)

Up 1% to 347p - Trading Update - Mark - AMBER

This is a company that investors were talking about last year following a precipitous fall on the loss of a major contract for their “growth consultancy” arm. This made a major dent in their previously growing revenue:

The irony of a “growth consultancy” being unable to grow is not lost on me! But did leave them on a very low P/E for a mid-cap stock:

This piqued my interest enough to write up the company as a StockPitch. I concluded:

Cautious investors may wish to wait until there are signs of momentum reversing in both the financial results and share price before considering this further.

Sadly, this uptick has yet to arrive, as today they say:

Profits are expected to be at the bottom of analyst expectations

Helpfully, they quantify this:

Analyst expectations are currently £107m to £112m for adjusted operating profit

The problem is that this company has huge adjustments. The bulk of them are acquisition-related employee payments, restructuring and amortisation of acquired intangibles. It may be standard practice to exclude these, but given their acquisitive nature, I think it is hard to argue that the majority of these aren’t genuine ongoing costs to the business.

Looks like there will be even more adjustments than usual this year:

Over the last six months the Group has continued to review operations to focus on meeting customer needs while driving efficiency that can fund further investment. Restructuring across the Group will deliver net annualised savings of approximately £40m, of which £14m relates to employees previously engaged within Mach49. Of the residual £26m saving, approximately £9m will have been realised in the current financial year. As a result of this work, the Group expects to post exceptional redundancy costs of approximately £15m in its results for the year to 31 January 2025.

That’s £11m of redundancy costs in H2 alone. The CFO may be among those being rationalised:

The Group also announced its CFO, Peter Harris has informed the Board of his intention to step down from the Board

The good news is that they should save £40m a year going forward. It may be this that means the share price hasn’t reacted negatively to the trading update today.

In terms of outlook, they say:

The Group has maintained, what it believes is, an appropriately cautious outlook for the new financial year.

This suggests that they are confident of meeting future expectations, at least on an adjusted basis. Which will make them look cheap:

Mark’s view

It is tempting to call the bottom here, but considerable uncertainty remains for me. This is highlighted by the CFO leaving. It is common for incoming management to “kitchen-sink” their first set of results and hence make subsequent results look better. Given the nature of the business, there is considerable scope for this to happen (although they will undoubtedly adjust these out!). On fundamentals, I think the balance of probabilities favours undervaluation at the moment. However, I’d want to see at least one period of in-line trading before reconsidering the AMBER rating.

Strix (LON:KETL)

Up 1% to 47p - Trading Update - Mark - AMBER

This seems a confusing statement:

Strix is pleased to confirm that it will report adjusted profit before tax for FY24 ahead of market consensus (as at close on 29 January 2025) and comfortably within the previously announced range of £18m to £19m (on a constant currency basis ("CER")).

In November, they said:

As a result of the above, Strix now expects to report adjusted profit before tax for FY24 in the range of £18m to £19m (on a constant currency basis).

But this was a profit warning, with broker Zeus reducing their estimates at the time from £23.6m to £17.5m. The reason for the disparity was given as:

Zeus factor in a c. £500k impact from currency as the statement indicates ccy pre tax profit will be in the range of £18.0m to £19.0m.

Now Zeus say:

We update forecasts to reflect the improved Q4 trading which leads to a 5% increase in FY24 adj. PBT to £18.4m (prev. £17.5m) and a £4.6m improvement in net debt (excl. leases) to £68.0m.

So this is good news, but not in the wider context of previous downgrades. Nor is it clear what part currency moves have played in these changes. Today, Zeus also upgraded FY25 estimates but downgraded FY26 on lower growth forecast. It is no wonder the share price reaction has been mixed this morning!

One of the issues here has been the debt levels, which led them to cancel their interim dividend In November, they said:

Strix's debt position has remained a priority for the management team, with latest reported net debt leverage at c.2x. Reflecting management's confidence in the underlying business, it remains the intention to reinstate the FY24 final dividend for payment in 2025.

And now:

The net debt position remains a key priority for the management team. Ongoing cash conservation actions have resulted in strong cash generation in the period, allowing the Group to maintain a year-end net debt leverage of below 2x.

2x is an important level as below this they pay a lower interest rate. Given the debt levels, EV/EBITDA is probably the best measure here. At 4.9x on a forward basis, it looks reasonable but not outstanding value. However compares well to the rest of the Machinery, Equipment and Components sector. Only Renold looks cheaper, but the figures exclude the significant Pension Deficit at Renold, which may make Strix (LON:KETL) the cheapest stock in the sector.

Mark’s View

Roland rated this AMBER/RED in November. However, that now looks a little bit harsh as a strong Q4 has swung momentum back their way, and debt is reducing. They are now likely the cheapest stock in the Machinery, Equipment and Components Sector. However, some doubts remain as to whether the weakness in kettle controls is simply market conditions or represents increased competition, and we are likely to see prospects here permanently downgraded. So, that cheap rating may be justified. It's an AMBER for me until we can get a clearer picture of whether kettle controls can return to growth again.

Camellia (LON:CAM)

Up 1% to 4800p - Trading Update - Mark (I hold) - GREEN/AMBER

A short but positive statement here:

Trading is now expected to be ahead of previously communicated market expectations. Adjusted losses for 2024 are forecast in the range of £4-5 million, down from the previous £7-9 million.

In October, they said:

…adjusted losses for 2024 are now forecast in the range of £7-9 million from a previous range of £10-12 million. This improvement is primarily the result of an improved outlook for our Indian operations.

So that’s quite a significant shift over the last four months of the year. The reasons given are:

…better than forecast results in Eastern Produce Kenya and in its Indian companies and increased interest income and foreign exchange benefits following the successful sale of BF&M.

It shows that agriculture is a cyclical business and that investors should not get too elated in the good years, nor too pessimistic in the bad. However, the company is still loss-making, so it shouldn’t pat itself on the back too firmly. What it does, though, is slow the decline in book value. When the company trades on 0.4x TBV, this is important:

Following recent sales, a significant portion of the assets here are cash, and the ongoing share buyback at these levels enhances value. However, I would have preferred a much larger buyback or tender offer rather than them retaining capital to invest in further agricultural businesses for which we have no news yet.

Mark’s view

While it is nice to have an improvement in trading, they are still reporting a trading loss. These things tend to be cyclical, and it is likely that the assets will be productive again at some point. Hence, the main attraction for now is the big discount to tangible book value. Recent asset sales have demonstrated that these do have real value. It is just difficult to predict when the agricultural cycle will turn in their favour. However, today’s announcement could be an early sign of positive trends in their commodities. I don’t see any reason to change the AMBER/GREEN rating from the previous update.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.