Good morning! Thank you to Roland for taking care of everything yesterday while I dealt with some childcare problems.

Recent IPOs: Shawbrook (LON:SHAW) and Princes (LON:PRN) have announced that they are joining the FTSE-250. The full list of quarterly changes is published on lseg.com.

Trustpilot (LON:TRST) bear raid

Down 26% to 141p (£565m) - (No RNS) - Graham - AMBER =

Trustpilot is down 26% today on a bear raid by New York-based short-seller Grizzly Research. Thanks again to f6317 for mentioning it and bringing it to my attention.

This short-seller has credibility on Wall Street, and the market is taking this attack very seriously indeed. You can read the short report here ("The Trustpilot Mafia"), alleging that there are "obviously fake positive reviews and reviews for paying companies". There is "a concerning pattern of obviously fake reviews". I will attempt to read the entire report later today.

Trustpilot's shares did get overheated last year, and I took them off my annual watchlist. However, I'm inclined to think that this a dangerous long-term short: if it has true "mafia"-like power, this suggests an incredible degree of market power.

I always keep an eye out for businesses whose customers actively and publicly complain, and yet who continue to pay for the service. To me, this is suggestive of a monopoly.

The role of Google is important here, as explained by Grizzly Research: Google puts Trustpilot scores high in search results, which makes it necessary for businesses to pay Trustpilot in order to protect their reputations.

However, Grizzly suggests that Google might not always rank it so highly, if they think that Trustpilot's content is starting to damage Google's reputation.

This is not impossible, but I do think it's rather speculative. A key reason for Trustpilot's high Google ranking is that many consumers will voluntarily click on Trustpilot when it is offered to them. Grizzly's thesis seems to require that both Google and broader consumer audiences will disengage from Trustpilot, when they realise that the Trustpilot scores lack credibility.

I can't say I agree with this prediction. This might be one of those cases where the accusations of the short-seller and other critics have some merit, but in practise they are only right if they manage to convince millions of ordinary consumers that they are right. A sort of self-fulfilling prophecy, if you were.

Roland was AMBER on this last time and I'll leave our stance there today. I acknowledge that the stock's valuation is a little aggressive (ValueRank only 6).

But I think there's a binary outcome here. Either the company is going to maintain its monopoly on consumer scores for business, or it isn't. There isn't much middle ground. Because of that, I don't think this stock can be valued in a traditional way.

We're all done for today, thank you for dropping by. Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Rio Tinto (LON:RIO) (£89.5bn | SR77) | 2025 Capital Markets Day. Strategic pillars and immediate focus areas: 7% production growth in 2025, 3% compound annual production growth to 2030. | ||

Vodafone (LON:VOD) (£22.6bn | SR88) | VOD’s African subsidiary is acquiring 20% of Safaricom, taking its stake to 55%. 15% acquired from the Government of Kenya. Safaricom is Kenya's largest telecoms company, with a market capitalisation of €7.7 billion. €1.36 billion to be paid to the Government of Kenya. | ||

Balfour Beatty (LON:BBY) (£3.5bn | SR79) | On track to achieve full year earnings expectations. Order book to grow by around 20% for the year. Revenue +5%. Underlying profit from operations to be ahead of the prior year. Average monthly net cash at the top end of the previously guided range. | ||

Frasers (LON:FRAS) (£3.26bn | SR93) | Expects FY26 APBT of £550m to £600m, including the expected loss from XXL ASA. Previous guidance was the same but excluded the result from XXL ASA. | ||

International Workplace (LON:IWG) (£2.3bn | SR49) | Investor Event in New York City includes “reiteration of our medium-term guidance and guidance for 2026”. | ||

AJ Bell (LON:AJB) (£2.11bn | SR64) | Revenue +18%. PBT +22% (£137.8m). “Management remains confident in the outlook.” “We have an exciting market opportunity in front of us and a clear strategy to drive organic growth.” | ||

Yellow Cake (LON:YCA) (£1.29bn | SR69) | Value of uranium holdings +27% to $1,778m. NAV $1,957m. NAV per share £6.06 (share price: £5.38). | ||

SSP (LON:SSPG) (£1.17bn | SR34) | Sales +7.8% (at constant FX). Operating profit +12.7% (constant FX) to £223m. Net debt £574m excluding leases. FY26 Outlook: trading has gained momentum. Confidence in delivering towards the upper end of the EPS range (12.9p - 13.9p at October FX rates), excluding the benefit of the share buyback. | ||

Watches of Switzerland (LON:WOSG) (£1.11bn | SR88) | Adjusted EBIT of £69 million, up 6%. Trading is in line with expectations, “well placed as we enter the Holiday trading period”. Reiterates FY26 guidance. | AMBER = (Mark) [no section below] I knocked this down a notch on the H1 trading update on tariff concerns. Since then the rate on Swiss imports has been dropped from 39% to 15%. (I’m sure the gold Rolex desk clock and a $130,000 engraved gold bar given to Donald Trump by a group of Swiss billionaires had nothing to do with this!) However, the share price is up a further 15% since then meaning that the valuation looks in line with the latest news. Despite upgrades, the EPS consensus remains lower than it did in June, when the share price was lower. As both Graham and I have said in the past, the lack of clean accounts, brand ownership or quality metrics means the 11x forward P/E looks about right. | |

Baltic Classifieds (LON:BCG) (£1.06bn | SR25) | Revenue +7%. EBITDA +7% (€35.2m). “...we expect revenue growth for the second half of the year will be above that of H1 and will accelerate into double digits for FY2027.” | ||

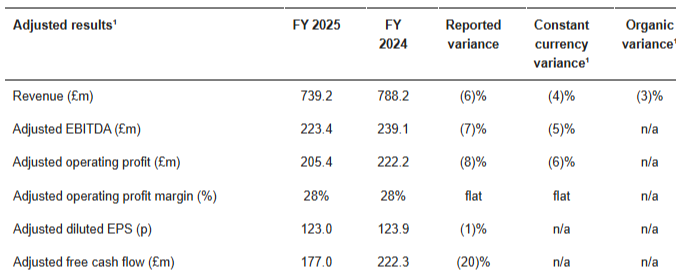

Future (LON:FUTR) (£576m | SR77) | Revenue -6% to £739m (-4% CCY), Adj. Op Profit -8% to £205.4m, Adj EPS -1% to 123p, Operating cash flow -18% to £188.3m. Net debt £276.4m (FY24: £256.5m). The Group is expecting modest organic revenue growth in FY 2026, in line with current consensus. Stable adjusted EBITDA margin. Second half weighting expected as initiatives/changes will deliver in H2. | AMBER/GREEN = (Mark - I Hold) The results are in line, the adjustments don’t seem too bad, and the balance sheet looks stronger than in the past. There is still no tangible asset backing, and an H2-weighting for FY26 means some risk remains. This means that I can’t bring myself to upgrade our stance today. Growth here is unlikely to shoot the lights out, but I think the AI-risk is overblown. The company is adapting to these trends and their own product offerings in this space are already generating sales. The shares are on a very low valuation multiple and the business is generating a lot of cash which is being used for bolt-on acquisitions, share buybacks and dividends. I am happy to keep our mostly positive view. | |

Morgan Advanced Materials (LON:MGAM) (£573m | SR43) | Aim to grow revenue ahead of GDP, achieve adjusted operating profit margin of 12% by 2028, 1-1.5x leverage. Pausing buy-back programme as part of focus on balance sheet resilience. | ||

Discoverie (LON:DSCV) (£564m | SR44) | Trival, a Slovenian-based designer and manufacturer of communication antennae and masts for defence and professional applications acquired for an initial cash consideration of €45.5m (£39.9m) + €7.2m deferred/contingent consideration, funded from existing debt facilities. Trival generated €12.7m (£11.1m) of revenue in FY24. Expects to be earnings accretive from completion. | AMBER = (Mark) [no section below] discoverIE are paying around 4x Sales for this acquisition, which seems a high price compared to their own 1.3x Sales. They do say it has a “an adjusted operating profit margin that is well above discoverIE's medium-term target of 17%”, but are coy about telling us the actual figures. The acquisition is earnings-accretive, but seeing as it is debt-funded, this is a low bar. Leverage increases from 1.3 to 1.8x as a result of this transaction, adding to the risk somewhat. Overall, it is just hard to get excited about a company with flat 5-yr revenue CAGR, and single-digit 5-yr EPS CAGR on a 15x forward P/E. An expensive acquisition doesn’t change that view. | |

ITM Power (LON:ITM) (£447m | SR41) | H1 Revenue of £18.0m, Adj. LBITDA of £11.9m, Cash of £197m. FY26 guidance remains unchanged: Revenue £35-40m, Adj. LBITDA loss £27-29m, Cash at year-end £170-175m. | ||

Property Franchise (LON:TPFG) (£321m | SR72) | Full year adjusted profit before tax expected to be at least in line with market expectations (£30m). Expects further growth across the divisions in FY 2026 and looks to the future with confidence. | AMBER/GREEN = (Graham) I view this as a high-quality business and a quality stock. However, given the lack of obvious growth opportunities in the short-term, perhaps it’s not that far away from fair value? The top line is only expected to grow 2-3% for the next few years, and the PEG ratio is 1.5x (i.e. the earnings multiple is much higher than anticipated profit growth). | |

ASA International (LON:ASAI) (£175m | SR83) | Both underlying and reported net profit for 2025 will significantly exceed the current company compiled consensus for FY 2025 of USD 48.3m. | GREEN ↑ (Graham) | |

Duke Capital (LON:DUKE) (£143m | SR58) | Cash revenue -3% to £13.2m, FCF flat at £5.9m. 1.4p dividend flat on 25H1. Confident in the Company's ability to deliver attractive returns and long-term value to shareholders. | AMBER/GREEN= (Graham) [no section below] Solid results from this specialist investor, and the market cap is almost unchanged since the last time we checked in on Duke's progress. Recurring revenue is up 3% year-on-year, and I think this is the key metric. Total revenue is affected by the timing of investment exits, so recurrijng revenue is more meaningful. H1 free cash flow of £5.9m is unchanged year-on-year, despite the lack of exits in H1 this year. Looking ahead, the company expects 5% year-on-year growth in recurring revenue in Q3. The big picture is that little has changed. The stock continues to trade at a discount to balance sheet NAV of £175.5m and I continue to think that it offers some value here, with the usual provisos - the main one being that I believe management will want to raise fresh equity again, whenever the opportunity presents itself. So that could put a cap on share price gains. I do think the shares may be a little undervalued here, and I agree with management that rate cuts should be highly beneficial for them. DUKE's share price has never properly recovered since rates rose back in 2022. | |

Premier Miton (LON:PMI) (£94.7m | SR87) | £10.3bn AUM down 3%, Adj. PBT -6% to £11.5m, Ad. EPS - 13% to 5.5p, Cash £31.3m (FY24: £35.9m). Final Dividend held at 3p giving 6p for the FY, flat on FY24. Cautiously optimistic that conditions will improve over time. | AMBER/GREEN = (Mark) | |

Metals One (LON:MET1) (£28.6m | SR4) | £4.4m gross proceeds raised by issuing 220m new shares at 0.02p/share, a 41% discount to last night’s close. Oak Securities appointed joint broker. | ||

Medpal AI (LON:MPAL) (£25.8m | SR8) | During November 2025, processed 28,789 prescription orders through its automated pharmacy operations representing approximately £280k of revenue = more than 90% month on month growth. Can issue up to £2m worth of shares to Clear Capital to sell into the market with a floor price of 5p. | ||

Eco (Atlantic) Oil & Gas (LON:ECO) (£25.4m | SR9) | Navitas pays $2m for option to farm into Orinduik Block offshore Guyana for $2.5m. Navitas will become 80% WI and operator on farm in. Navitas also granted option to farm into Block 1 CBK offshore South Africa for $4m to become operator with 47.5% WI. | ||

80 Mile (LON:80M) (£23.5m | SR52) | £2m before costs raised by issuing 400m new shares at 0.5p, a 3% discount to last night’s close. | ||

Mind Gym (LON:MIND) (£12.6m | SR18) | H1 Revenue -33% to £13.5m, LBITDA £1.0m (25H1: EBITDA £0.8m), LBT £2.5m (H125: LBT £0.9m), Net Debt £1.0m (25H1 Net Cash £0.7m) Outlook: Full year revenues remain in line with expectations, H2 weighting, adj. EBITDA expectations unchanged. | ||

Galileo Resources (LON:GLR) (£10.4m | SR16) | Mapping over a total area of approximately 70km2, with collection of 109 rock grab samples for assay. Phase 2 Reconnaissance Drilling program is anticipated in the first half of 2026. | ||

Shearwater (LON:SWG) (£10.1m | SR50) | 3-yr contract extension with a leading British mobile network operator, worth £7.3m over 3 years, £3.5m recognised in FY26. | AMBER/GREEN (Mark - I hold) [No section below] |

Graham's Section

ASA International (LON:ASAI)

Up 8% to 189.75p (£190m / $254m) - Graham - GREEN ↑

I looked at this microfinance group for the first time in September, coming away impressed by its growth rates and intrigued by its cheap earnings multiple (5x).

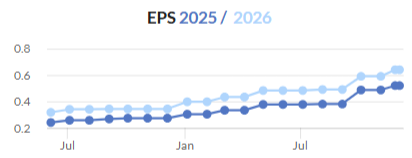

A few months later, the forward earnings multiple has been compressed by the passing of time (as high EPS forecasts in future years come closer), and also by these EPS forecasts getting raised. The FY25 forecast has increased from 38p to 52p.

However, these upgrades have not come quickly enough, as the company now says that it’s going to “significantly exceed” the £48m net profit forecast:

Building on the sustained momentum seen during the first half of the year, the 2025 full year outlook remains positive with improved business and financial performance driven by continued strong client demand and loan portfolio growth. Accordingly, the expectation is that both underlying and reported net profit for 2025 will significantly exceed the current company compiled consensus for FY 2025 of USD 48.3m (as of the date of this announcement).

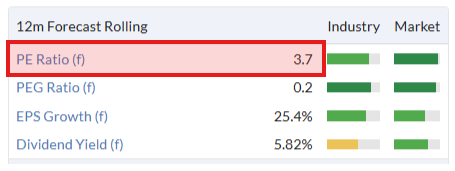

For a company with a market cap now of still only £190m, this makes for an extraordinarily cheap multiple.

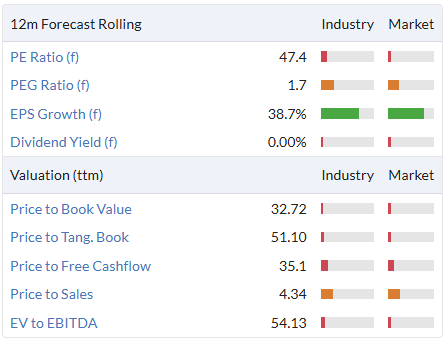

Last night’s valuation metrics:

If net profit for FY December 25 turns out to be $53m, then we have a trailing multiple of 4.8x. The forward multiple, based on expected growth, will be significantly lower than this (as shown in the table above).

Balance sheet equity was £101m at the interim results.

Graham’s view

Things to watch out for? Well, I’ll be curious to find out the role that currency movements might be having on reported results: the dollar has been having one of its worst years since the 1970s. This benefits a business like ASAI that earns profits in exotic currencies across Asia and Africa, but reports in dollars. When foreign currencies appreciate, dollar-denominated profits do, too.

Dollar index year to date (courtesy of marketwatch.com):

Indeed, the dollar is currently at a 5-week low.

ASAI is reminding me a little of IPF (which I hold), another provider of small loans in foreign jurisdictions whose stock traded at extraordinarily cheap earnings multiples.

I suppose it could be argued that from a UK/European perspective, ASAI is much more dangerous than IPF in terms of the foreign country risk that’s involved. While IPF is active primarily in Eastern Europe, ASAI has most of its branches in countries such as Pakistan, the Philippines, and Nigeria. An investment here involves accepting not just the political risks of investing in distant lands, but also the currency risk of making loans in rupees, pesos and nairas.

This risk is mitigated by diversification across 13 countries, and I’d be inclined to think that this diversification does go a long way towards lowering the risk of problems in any individual country. But I can understand nevertheless why the market would want to put this stock on a low rating, and might not value its earnings and its growth in a normal way. A period of weakness in Asian/African currencies could prove to be a significant headwind.

But for someone like myself who is a fan of IPF and whose IPF investment has been very successful so far, I’m inclined to look positively on ASAI as potentially the next investment of this type that I could consider.

As noted above, I acknowledge that today’s earnings beat could be driven to some extent by currency movements - although that's not the message from ASAI. ASAI says their success is being driven by “continued strong client demand and loan portfolio growth”.

Regardless, I think it’s right in general to be positive on companies that are beating earnings expectations. ASAI has developed a nice track record of this and is still cheap, so I’m fully positive on it now.

Property Franchise (LON:TPFG)

Up 3% to 520.85p (£332m) - Pre-Close Trading Update - Graham - AMBER/GREEN

There’s pleasant news from this estate agent group, for FY December 2025:

We are pleased to report significant organic growth during the period, with full year adjusted profit before tax expected to be at least in line with market expectations.

H2 revenues (in the four-month period to October) are said to be up 11% year-on-year.

New Estimates

Canaccord Genuity has published on this today. Some of the key forecast changes from CG are:

FY25 sales forecast nudged up only slightly to £85.4m (from £84.2m).

FY25 adj. PBT forecast improves to £30.4m from £29.8m.

Net debt is now expected at £7m rather than £8m.

Looking ahead to FY26 and FY27, there aren’t any major changes.

One really nice feature of the outlook is that the company is expected to reach cash breakeven next year, and the move into net cash in FY27. That’s despite also paying a dividend that yields over 4% at the current share price.

Turning back to today’s update for a few more titbits:

Current trading remains strong, with an operational focus on continuing the rollout of the Privilege programme across the Group. With the Renters Rights Bill now confirmed for the 1 May 2026, this crystallises the importance of the Privilege programme which is designed to protect our franchisees and landlords from the potential impacts of the legislation, whilst also generating an additional income stream for the Group.

Whilst the increased property taxes on landlords in the Government's budget were disappointing, we anticipate this to have a limited impact on the business going forward with the changes likely to drive further rental inflation as landlords pass these costs on to tenants.

Graham’s view

With the Belvoir merger having bedded in for some time now, we can get used to more normal growth rates from TPFG and indeed growth is only forecast to be about 2% next year.

This is a mature business and if revenue growth is only going to run at 2-3% for the next few years, it will be difficult for profits to grow particularly fast! Even with operational leverage, profit growth will be less than 10%.

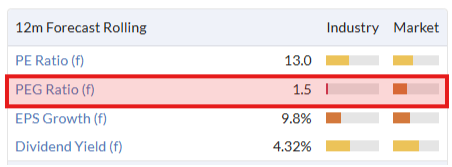

This creates an expensive PEG ratio, as the earnings multiple is much higher than the anticipated growth of earnings:

I’ve been a fan of TPFG for a long time, and I really liked it on a single-digit earnings multiple. That seemed too low for a capital-light franchisor earning high-quality, royalty-like income.

At this slightly higher valuation, however, I do have to be more cautious:

The company benefits from fairly stable, recurring revenue in lettings, although again this looks like another low-growth sector given current landlord sentiment. It’s still great to have this counterbalancing the more cyclical activity in sales.

And I would like to learn more about the company’s “Privilege” programme (“a set of lettings focused initiatives to support landlords and tenants”).

I’m not going to change my stance that this is a high-quality business and a quality stock. However, given the lack of obvious growth opportunities in the short-term, perhaps it’s not that far away from fair value?

Mark's Section

Future (LON:FUTR)

Up 11% at 667p - 2025 Full Year Results - Mark (I hold) - AMBER/GREEN =

FY25 doesn’t look like a year to write home about:

Things are a little better on a constant currency basis, but like many companies at the moment, they can’t escape weak market conditions.

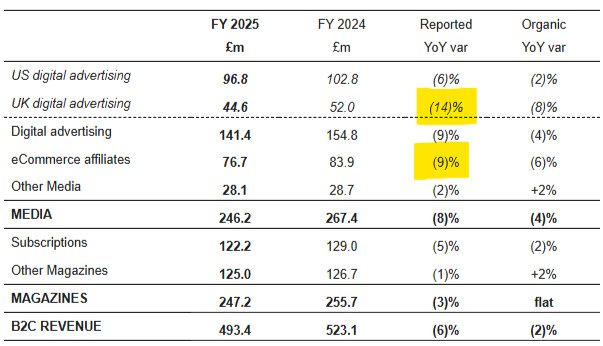

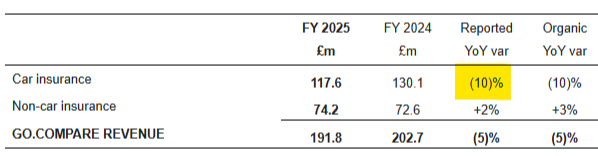

Segmental Breakdown:

Breaking out the different market segments, we can see where they were weak. In their Consumer-facing business, it is UK Digital Advertising and eCommerce that declined the most. Magazine subscription revenue actually held up well:

For GoCompare, it was car insurance coming up against strong priors:

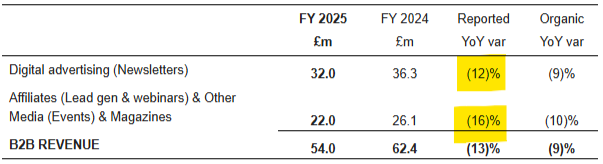

And in B2B, customer spend was down across the board:

It is worth looking at these details here, as these don't look out of line for what we would expect in the current difficult advertising and business climate. One of the big fears investors have here is that the business will be disrupted by AI. The affiliate marketing part of the business looks most vulnerable here. For example, instead of reading an article in TechRadar listing the 20 best laptops of 2025 under £600 (and clicking through to retailers to purchase, earning Future a commission), computer shoppers may choose to simply ask ChatGPT to give them a list of the best laptops at the lowest price. There may be disruption in the future, but I don’t see any obvious signs of this so far.

The company have also started to directly address this issue in their results commentary:

…only 16% of our total revenue is impacted by website sessions directly - a number I am convinced is lower than what many thought. So, with that in mind, the AI risk is lower than most people assume.

More importantly, however, AI represents opportunities for us…We are already starting to monetise our ability to make ourselves and our clients visible on large language models (LLMs). Our brands have the scale and authority to be influential in LLMs. As a new trend emerges of citations growing increasingly concentrated and, in time, more important for businesses on LLMs than on Search Engine Optimisation (SEO), new opportunities are opening for us. As such, we are standardising our approach, from audience to editorial to sales playbook, and we will keep refining our go-to-market strategy. To date, we have already secured contracts from major tech and luxury groups.

I am always a little wary of companies that say AI is a great opportunity, not a threat to their business. However, contract wins back up the idea that they do have some valuable IP in this space.

Earnings:

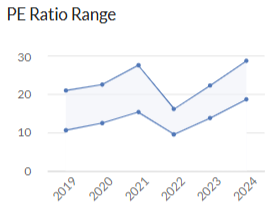

Despite the weak revenue, EPS holds up well and is essentially flat on the year. This is helped by a 7% reduction in the shares in issue due to the ongoing buybacks. Adj. EPS comes in bang on the consensus figure in Stockopedia. This makes the sub-5x P/E on last night’s close look very cheap for a mid-cap business, and I can see why the share price has responded positively to what are in-line results; when the share price chart looks like this, the market is essentially pricing in a miss:

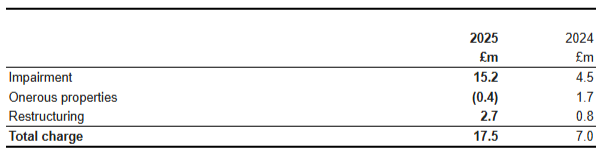

We have to be a little wary, though, as there is a big gap between the adjusted and statutory results. Here are those adjustments:

Impairment is a non-cash write-down of the value of their Australian price-comparison operation, Mozo, and it seems fair to exclude this. Restructuring has jumped, and it always rankles with me when companies expect investors to reward them for the positive impact on the bottom line from restructuring, but ignore all the costs of doing so. In this case, the exceptional restructuring charge is less than 3% of PBT, so it doesn’t have a significant impact on valuation metrics.

Balance sheet:

Although I hold shares here, I have been reluctant to make this a large holding due to the balance sheet. There is no tangible asset backing, only intangible net assets. The current ratio has also not been encouraging, having been significantly less than 1 in the recent past. While this may not be unusual for this type of business, it added to the risk in a declining revenue environment. In these results, the current ratio is 0.96. This is still low compared to some companies, but it is up from 0.69 the year before and is driven by a big reduction in payables, reducing risk.

The flip side of this is that financial debt has gone up from £296.2m to £304.0m. Leverage is up slightly at 1.3x (FY 2024: 1.1x), but this doesn’t look excessive. They have £290m of debt headroom. This doesn’t look like a significant risk, but the debt is large enough that investors may want to use EV valuation metrics as well as market cap ones.

Cash flow:

The reduction in payables means that cash generated from operations reduces to £188.3m from £230.0m in FY24. This flows to FCF, which reduces to £97.7m from £148m the year before. Despite this drop, the shares trade on just 9xEV/FCF.

Shareholder returns:

In the past, this cash flow has been focused on growth through acquisitions. Today, they are following what they call a more balanced acquisition strategy. There is space for bolt-ons, but not large strategic acquisitions. In today’s presentation, they said there is “plenty of cash to be pointed towards growth, organic or bolt-ons”. However, the big change is how much cash is allocated to shareholder returns. They have been buying back shares for some time now. Today’s news is a big increase in the dividend:

£99.5m returned to shareholders during the period, comprising £95.8m through share buybacks (FY 2024: £67.0m) and dividends of £3.7m (FY 2024: £3.9m). On 1 October 2025, there was just under £30.0m remaining on the £55m share buyback programme. We've announced today a new additional share buyback programme of up to £30.0m and a 5x increase in the dividend to 17.0p.

The yield was less than 1% so a 5x increase is still only a 2.5% yield on the current price. This still won’t be attractive to income seekers, but combined with the buyback, the overall shareholder yield is very good.

Outlook:

For next year, they are guiding modest revenue growth, H2-weighted and in line with current consensus. In the medium term, they say they “expect sustainable revenue growth of 2-4%”. These aren’t ground-breaking and won’t attract growth investors. However, things are better when it comes to margins, which remain very strong:

The Group continues to expect to deliver a stable adjusted EBITDA margin of around 30% supported by a more efficient operating model.

In the result presentation, they were clear that these margins didn’t depend on a recovery in macro conditions. They expect cash conversion to be at least 95%.

Mark’s view

These results have assuaged some of my concerns with the company. The results are in line, the adjustments don’t seem too bad, and the balance sheet looks stronger than in the past. There is still no tangible asset backing, and an H2-weighting for FY26 means some risk remains. This means that I can’t bring myself to upgrade our stance today. However, the very low valuation multiple and strong cash generation that is being used for bolt-on acquisitions, share buybacks and dividends mean that I see positive returns from current share price levels. I am happy to keep our AMBER/GREEN rating.

Premier Miton (LON:PMI)

Down 8% at 54p - Full Year Results - Mark - AMBER/GREEN

The market didn't like these results this morning. Although looking at the chart, you could argue that it is just a reversal of the undue optimism shown by investors at the end of November:

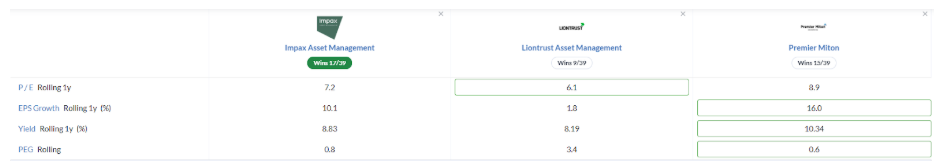

Many asset managers have been weak after recent results, although the Premier Miton share price has held up surprisingly well this year compared to the likes of Liontrust and Impax:

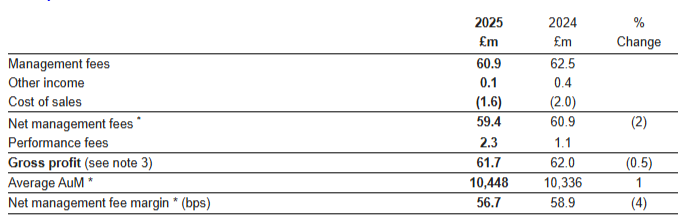

End of year AUM figures were already known, and are fairly resilient at just 3% down year-on-year. Average AUM is up slightly, but like many asset managers, they will have faced some fee pressure in the current market environment. Combined with slightly lower cost of sales, this means net management fees are only down 2%:

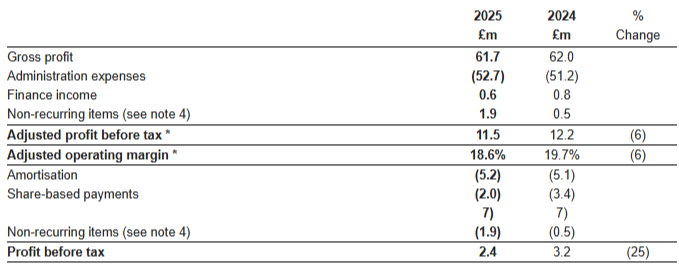

Interestingly, they have seen an increase in performance fees. Admin expenses rise slightly, which means that Adjusted profit before tax falls 6% to £11.5 million:

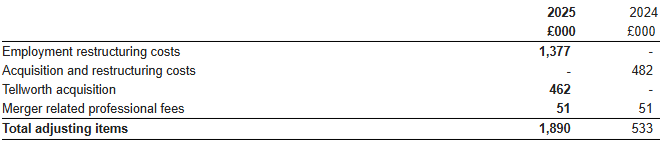

Adjusted EPS comes in at 5.5p, which looks a small miss on the 5.63p consensus in Stockopedia. There is a huge gap between adjusted and statutory figures. It is normal to exclude amortisation as a non-cash charge. However, both SBP and non-recurring items make a significant difference to the PBT. These are the details:

While these do look to be one-off, they will largely be cash costs. They are getting the benefit of these, but it is worth noting that the initial £3m saving is included in these results:

We continue to carefully manage our costs to enhance future returns for our shareholders. In April 2025, we announced annual cost savings of £3 million which were delivered by the year end. In October 2025 we noted a further £2 million in annualised savings to be delivered by 30 September 2026. These efficiencies will help offset the impact of a weaker flow environment, should it persist in the near term.

These cash restructuring costs are part of the reasons that cash has declined:

Cash balances were £31.3 million at 30 September 2025 (2024: £35.9 million)

The other reasons are payments of £1.1m due to their purchase of Tellworth Investments and that they paid an uncovered dividend. Unlike Liontrust and Impax, they haven’t cut their dividend, and income seekers will be pleased that this is maintained today at 6p for the full year. They say:

We therefore propose an unchanged full-year dividend of 6.0p, representing a payout of 109% of adjusted EPS. We recognise that this is marginally uncovered by our earnings for the year although our balance sheet strength and capital resources provide comfort on this decision.

We will continue to keep our dividend policy under review, ensuring it supports the market confidence essential to navigating Premier Miton successfully through these evolving conditions.

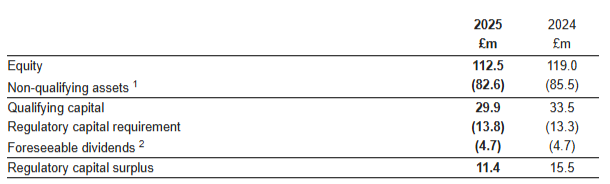

Unlike many peers, they helpfully provide what their capital surplus is:

Dividends cost £9.4m last year, so they should be fine to maintain the payout if they meet forecasts for 6.53p EPS (I can’t see any updated broker coverage in Research Tree, so assume this is still valid), and don’t have any significant capital commitments.

Outlook

Given this backdrop, the outlook really matters. Here’s what they say:

We are in a fast changing market with high levels of volatility and uncertainty, bringing deep structural consequences for many parts of the UK's investment industry. Resilience and adaptability are essential for business success. We continue to see attractive opportunities for many of our fund strategies and we are seeking growth and ways to create value in industry consolidation and reshaping. Market developments over the past few years have been particularly challenging for us yet we have shaped a business that is well placed to secure its purpose and objectives. There are sound reasons for us to remain ambitious and optimistic while careful about how we navigate these near-term market conditions. We look forward to 2026 with energy and confidence.

This is a bit vague for my liking. Having energy and confidence isn’t the same as meeting market expectations! This bit also seems a little off:

We also continue to explore strategic transaction opportunities to enhance shareholder value. Attractive inorganic growth opportunities are those that could expand our scale, introduce new investment capabilities, or provide access to new client segments. We recognise that astute execution of M&A activity will remain critical in an industry that will continue to present opportunities for inorganic growth. Our disciplined approach and proven track record position us well to identify and pursue these opportunities.

They won’t want to get close to a zero regulatory capital surplus. I can see them being able to execute a modest acquisition. However, anything that will move the needle would seem to require either a significant reduction in dividend, or fresh equity. I can’t see either of these going down well with shareholders.

Valuation:

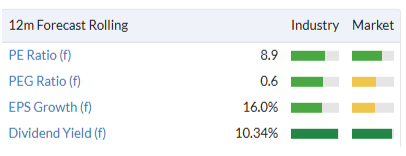

If those FY26 forecasts are realistic, then this looks cheap for a cash-generative, asset light business. Especially one that has strong recovery potential in better market conditions:

That yield is particularly attractive. However, maintaining it will be dependent on short-term earnings, in my opinion. It is also worth noting that, after recent share price falls, the yield on Impax and Liontrust (who were forced to cut their dividend payout in the end), is now approaching Premier Miton’s. However, they are now cheaper on earnings despite similar downward trends:

Mark’s view

When Roland reviewed this in October, it was a SuperStock. However, a declining Momentum Rank means that it has a strong StockRank but a neutral designation:

This may give some more algorithmic investors pause for concern. After all, peers have been much weaker and Premier Miton will have been, at least partially supported by its high yield. This was maintained today, but keeping such a high payout over time requires improved profitability, and fewer cash exceptionals.

Picking which asset manager will be the winner from a very cheaply-rated sector looks like an impossible task to me. As such, I think that holding a basket of stocks is the best way of gaining exposure to a potential recovery. Despite some concerns, I still think Premier Miton has a place in that basket, so am happy to keep our AMBER/GREEN view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.