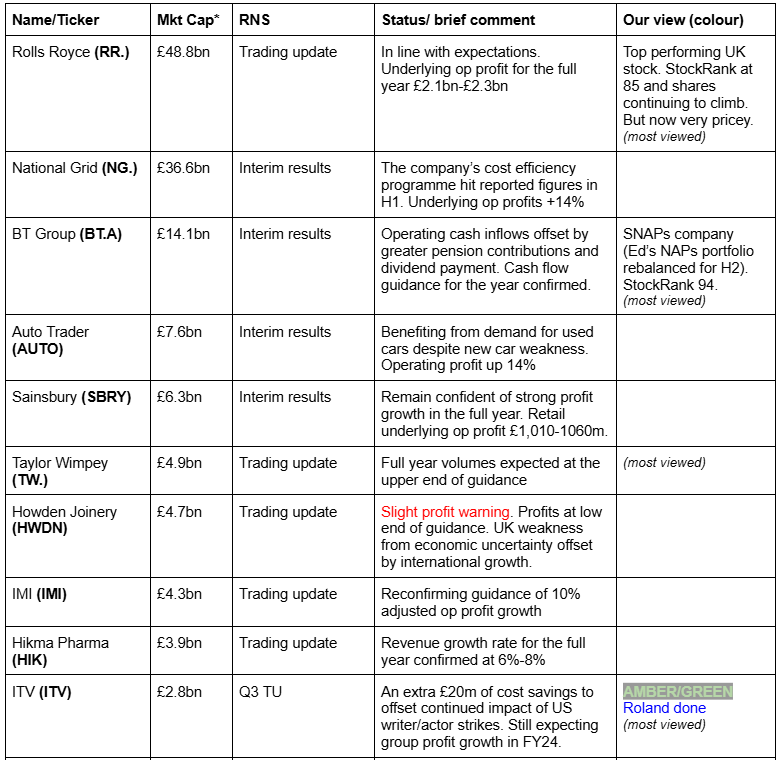

Good morning! And welcome to today's report.

I've made some adjustments to our summary table: the company name and the ticker are now in the same column, freeing up more space for our brief comments. Thank you for all the suggestions yesterday - I hope this is an improvement! Cheers.

1pm update: the report is finished for today. Thanks for all the feedback!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices).

My video explaining/reviewing it. My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Agenda

Short Sections

Novo Nordisk A/S (CPH:NOVO B) - up 4% yesterday to DKK750 (£370bn) - third quarter results - Megan - AMBER

The problem with launching a drug as successful as Novo Nordisk’s Ozempic is that the whole industry wants a slice of the success. Since Eli Lilly launched its own weight loss drug earlier in the year, shares in the Danish pharma company (the largest listed business in Europe) have been sliding.

Results this week suggest that investor concern was perhaps premature. Eli Lilly has struggled to get its weight loss drug off the ground, but yesterday, Novo Nordisk revealed that sales in Ozempic were up 48% on the previous quarter to 17.3bn DKr ($2.5bn), some way ahead of the 15.9bn DKr forecast by analysts.

Ozempic is part of a category of drugs called GLP-1 inhibitors, which support weight loss by stimulating hormones to suppress appetite. It’s a class of drug that has also proven success in patients with type 2 diabetes. Diabetes is at the heart of Novo Nordisk. It was the first company in the world to commercialise injectable insulin for diabetes patients and it now boasts a 33.9% share of the global market.

The combined strength of the weight loss and diabetes indications of the GLP-1 bracket of drugs sent sales in the first nine months of the financial year up 24% at constant currencies to 204.7bn DKr.

Importantly, for investors, Novo’s management confirmed its guidance for the remainder of the year, with sales forecast to rise between 23% and 27%. Shares rose as much as 12% yesterday.

The challenge for Novo Nordisk lies beyond 2024. Pharma companies can never rest on their laurels and enjoy the success of one star drug, they have to keep innovating to avoid the patent cliff (pharmaceutical patents expire after 10 years).

In the first three quarters of 2024 the company has invested 13.3% of its sales into research and development, which is a decent measure compared to some of its peers, but could be higher given gross and operating profit margins at 84% and 47% respectively.

Novo Nordisk is an incredible company, but it’s shares are too expensive at 27 times forecast earnings. And investors should beware a change in momentum from high quality companies. Once momentum reverses, it’s quite hard to regain. AMBER

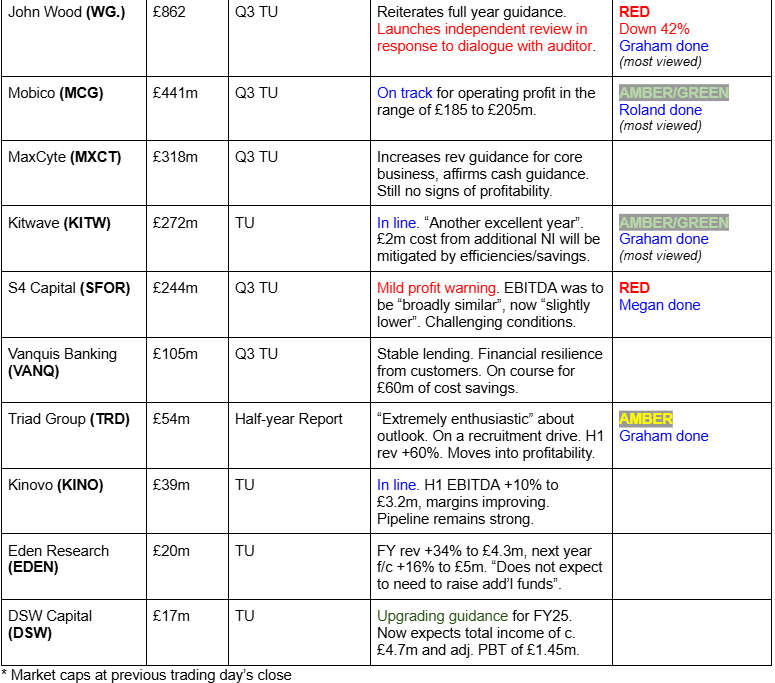

Triad (LON:TRD)

Down 2% to 323p (£54m) - Half-year Report - Graham - AMBER

It has been years since we’ve said a word about this IT consultancy.

The share price has multi-bagged since 2023, giving it a more respectable market cap:

Let’s quickly check the half-year report, to see what all the fuss is about.

It has moved into profitability on significantly higher revenues in the latest H1 period:

The Chairman is ebullient. Some snippets:

The six months' results up to 30th September 2024, reported today, reflect a sound and sustainable transformation…

We are building long term relationships which will enable us to provide additional operational and financial benefits to the public sector and thereby support the new Government in its welcome drive to apply the benefits of digital technology to efficiency and cost control….

Our cash balance is strengthening nicely and reflecting the increase in profits with the usual slight lag due to payment terms. We are continuing our recruitment drive and focusing even more closely on the very highest quality of new joiners.

Interim dividend is maintained at 2p.

Cash improves to £2.9m at the end of H1, up by £0.8m in six months. There are no financial debts, only the usual payables and leases. The balance sheet as a whole gives me no cause for concern.

Graham’s view: I applaud these results, although it’s not clear to me how a £50m market cap makes sense. It’s a consultancy, with very low profit margins, trading at a price to sales multiple of almost 3x. Why? Perhaps we have readers who’ve already studied this in depth, who might chime in?

On valuation, I’d be AMBER/RED but as I’ve not studied it for some time and don't want to put the boot in unnecessarily, I’ll just leave it at AMBER for now.

Summaries

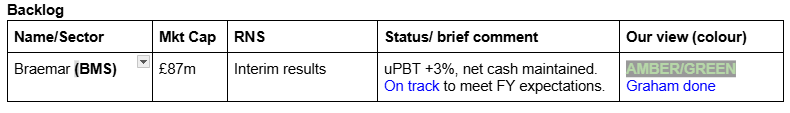

Braemar (LON:BMS) - up 3% yesterday to 274p (£90m) - Interim Results - Graham - AMBER/GREEN

This advisor to the shipping and energy markets has confirmed that it’s on course to meet expectations for FY February 2025. Valuation is on the cheaper end of the spectrum at a single-digit PER (if you’re happy to go along with the company’s adjustments) so I’ve left our mildly positive stance unchanged.

S4 Capital (LON:SFOR) - Megan - down 12% to 34.58p (£242m) - Trading Update - RED

The digital marketing company has reported disappointing revenue figures for the third quarter of 2024 after lower spending from a major client. Revenues for the year are now expected at the lower end of guidance. There is not a lot that I can see to like in this company right now, so am downgrading our view to RED.

Kitwave (LON:KITW) - down 2% to 331p (£266m) - Trading Update - Graham - AMBER/GREEN

This food distributor announces that it believes it has hit expectations for the full-year. Currently trading at a PER of about 10x, I take a look at its recent large acquisition (£60m) and come away with a positive impression. This is a candidate for an upgrade to GREEN in due course.

John Wood (LON:WG.) - down 44% to 70p (£482m) - Q3 Trading Update - Graham - RED

Full-year guidance is reiterated but serious questions are raised around previous results and the value of Wood Group’s balance sheet positions. With net debt last seen at nearly $700m, weak profitability and a balance sheet that’s deeply in the red, I’d steer well clear of this.

ITV (LON:ITV) - down 9% to 65p (£2.6bn) - Q3 trading update - Roland (I hold) - AMBER/GREEN

Ad revenue is up this year but ITV Studios continues to struggle with knock-on impacts from the Hollywood strikes. This update suggests that ITV Studios revenue fell by nearly a third in Q3. A strong Q4 performance and cost-cutting mean that Studios’ adjusted profits are still expected to set a new record this year. I think the value appeal remains, but I wonder if the bear case is getting stronger.

Mobico (LON:MCG) - up 5% to 75p (£457m) - Q3 trading update - Roland - AMBER/GREEN

A broadly positive update from this bus company, flagging up strong progress in Spain and continued challenges in the UK and Germany. FY profit guidance is unchanged while the planned sale of the North American school bus unit remains “on track”, providing a potential opportunity for rapid deleveraging.

Graham's Section

Braemar (LON:BMS)

Up 3% yesterday to 274p (£90m) - Interim Results - Graham - AMBER/GREEN

We had a reader request on this from JASVFS so let’s take a look.

I remember this company as “Braemar Shipping” (or “Braemar Shipping Services”).

It currently describes itself as “a leading provider of expert investment, chartering and risk management advice to the shipping and energy markets”.

Paul studied it in May, eventually concluding with AMBER/GREEN.

Yesterday it published interim results. Key points:

“On course to meet market expectations”, these being revenue of £150.8-154.7m, and underlying operating profit of £17.4-18.4m. Braemar's year-end is in February, so still a few months left to determine the final outcome.

Underlying operating profit in H1 was £7.3m. That’s a nice increase on the prior year (£6.7m) but leaves plenty to do in H2 to meet the full-year target.

Net cash is modest at £3.3m. Not much change there.

The interim dividend of 4.5p is well-covered by underlying EPS of 14.55p, but not so well-covered by statutory EPS of only 6.83p.

Which brings us to the thorny question of adjustments. Fortunately these have declined in the most recent period.

In H1 last year, the company identified £4.5m of “specific items” (i.e. adjustments). This tripled the operating profit of £2.2m to “underlying” operating profit of £6.7m.

In H1 this year, the company makes only £2.7m of adjustments.

This inflates operating profit from £4.6m to an “underlying” operating profit of £7.3m.

The adjustments are:

This again goes back to modern accounting rules which require some acquisition payments to be treated as employment costs. I agree with the logic behind these rules! But I accept that they can make things a little fuzzy for investors.

My suggestion is to allow the £2.3m adjustment for acquisition-related items but to be aware of what this item emphasises: that the acquired company (Southport Maritime) might rely heavily on the continued employment of certain key individuals

Outlook

Market conditions are “healthy” and the forward order book is “strong” at $85.8m (Sep 2024).

The diversification across shipbroking and the growing securities business is delivering a more balanced business with sustainable revenue

Opportunities exist for both organic and inorganic growth with a number of complementary opportunities being considered, and the executive team remains focused on further executing the Group's growth strategy

Balance sheet

There is officially £85m of balance sheet equity but take out goodwill and other intangibles and you’re left with only £11m.

The interim balance sheet has cash of £26m but that’s offset by long-term borrowings of £25m.

Overall, I don’t see the balance sheet supporting the valuation here.

Graham’s view

I’m inclined to leave AMBER/GREEN alone here on the basis that it’s trading at a single-digit earnings multiple so there isn’t a great deal of optimism priced in already.

It does have a respectable track record of profitability and dividends, and quality is not bad.

In summary: I don’t see this one shooting the lights out, but it could be worth a deeper investigation at this level.

Note that the big falls in October relate to media reports around the company’s dealings as they relate to Russia

“Russia” was not mentioned in yesterday’s results announcement and I don’t think Braemar has said much about these allegations. Judging by the bounce back in the share price, perhaps they are not too relevant to the investment case.

Kitwave (LON:KITW)

Down 2% to 331p (£266m) - Trading Update - Graham - AMBER/GREEN

Kitwave Group plc (AIM: KITW), the delivered wholesale business, today announces a pre-close trading update for the year ended 31 October 2024

We’ve been AMBER/GREEN on this one for a while, with Paul’s most recent coverage in September suggesting that the risk of an H2 profit warning had abated.

Today we get a full-year update which confirms that yes, the company believes it has hit expectations for the financial year (FY Oct 2024).

Kitwave IPO’d in 2021 but unlike so many IPOs from that year that turned out to be duds, Kitwave has gone from strength to strength.

The company has a “buy-and-build” strategy in the food wholesale distribution sector. It now has 37 depots in its network, having made 15 acquisitions over the years (including in the decade prior to its IPO).

It appears that the M&A strategy has been a big success. Revenues:

Net profit:

And earnings per share:

All of this growth was achieved without share count dilution - until this year.

In September, the company announced a £70m acquisition (of which £60m was payable upfront). The target: Creed Catering Supplies.

KITW was already carrying c. £50m of net debt and therefore in order to help pay for this new deal, it issued £31m of new equity at 305p, resulting in the creation of 10 million new shares. A small retail offer accompanied this.

So its ambitious growth plans have ultimately resulted in some dilution for shareholders. But lenders and the company’s own cash flow have paid for most of the growth over the years.

Let’s get back to today’s full-year trading update.

Key points:

New 80,000 sq ft. distribution centre in the South West has opened as planned.

Budget: the increase in national insurance contributions was not anticipated and will cost c. £2m annually. KITW plans to mitigate it with “efficiencies and other savings” (not specified).

Summary:

As the Group moves forward, the Board believe the Company is well-positioned to continue to execute its organic and M&A strategy during 2025 and beyond.

CEO comment:

"I am delighted that Kitwave continues to make significant financial and operational progress. We are particularly pleased to have completed three acquisitions in the Period, taking our total to 15 acquisitions since 2011. The trade from Wilds of Oldham and Total Foodservice Solutions has now been integrated into the Group in line with plans, whilst we expect both trade and operational efficiencies from the Creed acquisition to start to be realised in FY 2025.

Estimates: many thanks to Canaccord Genuity for publishing a research note this morning. They reiterate their forecast for FY 24 adj. PBT of £28.5m (+3.4% year-on-year).

With the addition of Creed Catering, they see adj. PBT rising to £35.9m for FY Oct 2025.

Graham’s view

I’m inclined to maintain a positive view on this one, as it combines both a reasonable valuation (PER of 10x, according to both Stockopedia and Canaccord Genuity) with some really nice quality metrics:

I’m curious to check if they paid a reasonable price for the Creed takeover, so let’s take a look. Remember that Creed cost £60m upfront, plus another £10m contingent on performance in the first two years.

Creed’s figures: as of May 2024 it had trailing annual revenues of £130m, EBITDA of £10.2m, and adj. operating profit of £8.3m.

Applying corporation tax, we get a theoretical NOPAT (net operating profit after tax) of about £6m.

So in my mind, KITW has paid a trailing PER multiple of about 10-12x for Creed (£60-70m divided by £6m).

That’s Creed valued on a standalone basis. But within KITW, there should hopefully be synergies that boost performance and make it cheaper, in reality.

Comment by CEO Ben Maxted on the deal:

Creed has an exceptional heritage and is one of the UK's leading foodservice wholesalers, so we are delighted to have reached this agreement which will extend our Foodservice division.

Strategically, Creed will significantly expand our geographical presence, bridging our operations in the North and South and creating a fully integrated national delivery network. In line with our buy and build strategy, Creed is also expected to significantly enhance the Group's earnings along with providing material buying, operational and financial synergies.

I’m going to give this deal the thumbs up on the basis that KITW have probably not overpaid and it’s perfectly consistent with their strategy.

I rarely welcome share count dilution but using some equity to pay for the deal was probably sensible in the circumstances. Net debt is forecast to end the current financial year at £62m.

I’m going to keep us AMBER/GREEN on this one and I could consider switching up to GREEN if the Creed takeover proves to be successful over the next year (assuming no major increase in the share price).

John Wood (LON:WG.)

Down 44% to 70p (£482m) -Q3 Trading Update - Graham - RED

This short trading update has clobbered the share price.

It starts out fine, confirming full-year guidance in a large headline.

This guidance is for “high single digit growth in EBITDA and net debt to be broadly flat compared to last year” (assuming that a disposal completes by year end).

Q3 revenue is up 1% year-on-year.

Q3 EBITDA is “lower than last year” (not quantified) but the company says year-to-date EBITDA is up 4%.

At the interim results, adj. EBITDA was up 8.5% for H1. Assuming an even spread of EBITDA throughout the year, this suggests to me Q3 EBITDA might have been down by about 4%?

It’s at this point that the update starts to go downhill. Here’s the entire section covering the “independent review” (emphasis added):

Following the exceptional contract write-offs relating to the exit from lump sum turnkey and large-scale EPC reported at the half year 2024 results, and in conjunction with the auditor's ongoing work, the Board, in response to dialogue with its auditor, has agreed to commission an independent review to be performed by Deloitte.

This review will focus on reported positions on contracts in Projects, accounting, governance and controls, including whether any prior year restatement may be required. An update will be provided as appropriate following its conclusion.

The results presented in this trading update, and our full year outlook, are before any potential impacts from the independent review.

I’ve had a quick look at the half-year results referred to above and they are horrific: $219m of adj. EBITDA translates to an operating loss of $899m! There are nearly $1 billion of exceptional items.

Admittedly most of the exceptional items are goodwill impairment, but there’s also $140m under the heading of “LSTK and large-scale EPC”, i.e. lump sum turnkey and large-scale engineering, procurement and construction.

As I understand it, these are construction contracts where the contractor (in this instance, Wood Group) takes on the greatest level of responsibility to finish a project and, where a lump sum payment applies, the contractor is exposed to the financial risk of non-payment.

In 2022, Wood Group ceased operating in the LSTK and large-scale EPC business segments. But getting out of business is not so easy when there are very large liabilities between a company and its customers.

From the interim report this year, explaining the $140m of exceptional costs:

We continue to have a significant balance sheet position and claims exposure across some legacy contracts. The closure of these businesses, has reduced our leverage to negotiate commercial close outs and the staff involved have now all been exited from the business, making claims recovery or defence of litigation considerably more challenging.

The $140m hit included $53m of provisions against receivables (i.e. customers refusing to pay), $61m of provisions for additional claims (i.e. Wood Group being pursued by customers) and $26m of final settlements (Wood Group paying out to settle contracts with customers). What a mess.

Graham’s view

I don’t touch companies in this sector and this update from Wood Group doesn’t make me any more inclined to do so. What's worse is that the independent review seems to have been instigated by the auditor, not the company itself realising that it needed to figure out what was really happening with its contracts.

Having said that, you can always ask if a sell-off might be overdone. A fall of over 40% today, wiping hundreds of millions of pounds off the market cap, might be considered a harsh reaction.

But let’s go back to the interim balance sheet.

There were net assets of $2.6 billion. Deduct intangibles and you’re left with a tangible book value of minus $850m.

Now let’s look at some of the other items.

Receivables were an eye-watering $1.6 billion, i.e. multiples of the current market cap.

How much of this can be counted on to convert into cash? I don’t know, but it doesn’t sound as if the company is sure, either. And even if it converted into cash at an acceptable rate, the tangible value of the company would still be deeply in the red.

Checking the H1 income statement, I note that even if you leave out all of the exceptional items, the company still made a loss from continuing operations. Net debt, excluding leases, was nearly $700m.

Unfortunately this has to be a RED from me due what I perceive as extraordinarily high risk and a lack of redeeming features. I tend to be biased against this sector, due to the general complexity of contracts and poor quality of profits. Perhaps a sector specialist would disagree with me, but for now I suspect that my negative bias against this sector is justified in this case.

Megan's Section

S4 Capital (LON:SFOR)

Down 12% to 34.58p (£242m) - Trading Update - Megan - RED

Martin Sorrell’s rationale for starting up a “tech-led, new age” digital marketing firm in 2018, after he was unceremoniously removed from WPP was a sound one. The company he’d left 47 years after he founded it, was struggling to modernise. A fresh start with a tech focus could have been a roaring success.

But for most of S4’s short life, the economy has not played ball. Marketing budgets tend to be the first ones to be slashed in periods of economic frailty and after a promising start, S4 has struggled to grow.

The company operates in three divisions - content, data & digital media and technology services - and all three have posted a material decline in revenue in the first nine months of this year.

Overall, billings have fallen 16% to £621m and net revenue for the year so far is down 13% to £555m. Revenues for the year are now expected to fall by a low double-digit percentage. House broker Dowgate Capital is forecasting net revenue of £748m in 2024 and £763m in 202, down from £873m last year and £892m in 2022.

The trouble, from a revenue perspective, cannot solely be blamed on challenging economic conditions. Global spending on digital media is expected to grow 8.7% to $564bn in 2024, according to media agency GroupM (a WPP company). Publicis, the world’s biggest marketing agency, reported a 7.4% like-for-like increase in net revenues in the first half of 2024 and recently upgraded its guidance.

The following two charts show the difference in analyst expectations for S4 and Publicis respectively:

Instead, S4’s problem seems to lie in its exposure to a handful of major tech clients. Last year, S4 had 12 clients which spent over £10m each and contributed 55% to the company’s top line. This year that number has fallen to 9 and the biggest spending clients have only generated 45% of the group revenue.

Management blames the 42% decline in like-for-like revenues in the technology services business on decreased activity from just one key client. Over-exposure to just a handful of clients is a monumental risk.

The company says ‘operational EBITDA’ (which is a horrible measure of profits) is now expected to be slightly below the previous year. Dowgate Capital forecasts £85m of adjusted EBITDA, down from £94m last year and £124m in 2022.

Reported figures of profitability have been similarly worrying ever since S4 listed. Operating margins have never risen above 2.5% and the company has never reported net profits.

More concerning is the fact that S4 has reported operating cash outflows in both of the last two years. That is a particularly bad sign considering the company’s major debt burden, which stood at £313m at the half year point. Net debt is currently £180m, equivalent to 2.2 times EBITDA and well within the group’s financial covenants, according to management. That’s a relief from a bankruptcy perspective, but it’s never a great sign when a company has to reassure that it’s operating within its financial covenants.

Megan’s view: To my mind, there is not a lot to like about the way this company operates. Digital marketing could be an exciting and highly profitable industry to work in, but S4 has over leveraged and put itself at risk from its over-exposure to a small handful of key clients. What’s more, the company needs to innovate. Digital marketing is accelerating at rapid pace thanks to artificial intelligence and companies in this market are going to need deep pockets and creativity to keep up. Neither of which seem to be available at S4. RED

Roland's Section

ITV (LON:ITV) - down 9% to 65p (£2.6bn) - Q3 trading update - Roland (I hold) - AMBER/GREEN

(At the time of writing, Roland has a long position in ITV.)

ITV Studios is on track to deliver record adjusted EBITA in FY 2024, reflecting efficiency gains and a significant Q4 delivery schedule.

I’ll start with a confession. I have been long and potentially wrong on ITV for quite a while now. Although the stock is no longer a great fit in my portfolio, I’ve kept the position because I believe in the value on offer and I think the strategy and execution have been fairly good. There’s also been a useful dividend.

The StockRanks have also liked the shares, awarding it Super Stock status (until today) and suggesting a potential VM/turnaround opportunity:

Today’s update has had a poor reception, suggesting it may prove a further test for long-suffering shareholders like me. Let’s take a look.

Q3 trading update: ITV’s business essentially has two arms, selling advertising (UK television) and selling programmes (ITV Studios, UK/Europe/USA).

The last couple of years have seen an advertising downturn described by CEO Carolyn McCall as the worst since 2009.

At the same time, last year’s Hollywood writers’ and actors’ strikes had an understandable impact on programme production pipelines. There’s been something of a slowdown in streaming growth as well.

It’s been a tough environment, but during this time ITV has remained in decent shape, continuing its shift to digital (ITVX) and the development of the Studios business.

That brings us to today’s update. Here are the headline figures for the nine months to 30 September 2024:

Group revenue down 8% to £2,321m

ITV Studios revenue down 20% to £1,217m

ITV Media & Entertainment (UK TV) revenue up 4% to £1,524m

M&E: The improved M&E result highlights some recovery in the advertising market and the benefit of the Olympics and World Cup this summer.

The final quarter of the year is expected to be softer for advertising than 2023, due to the Rugby World Cup last year. Pre-budget uncertainty is also said to have held back advertising bookings.

However, I don’t think there’s anything serious to worry about. Digital advertising revenue is continuing to rise (+15% YTD) and streaming hours on ITVX are still rising. Meanwhile, the broadcast business is protecting its share, with a 32% share of linear commercial viewing and 92% of the top 1,000 commercial broadcast programmes.

ITV Studios: unfortunately, ITV hasn’t provided Q3-only figures today. Checking back to the half-year results suggests why – it looks like Q3 was a truly dire period for ITV Studios.

My sums suggest ITV Studios Q3 24 revenue was £348m, down 33% from £516m in Q3 23. In its defence, the company has said previously (and reiterates today) that some of this revenue has merely been pushed back into Q4 and 2025.

Production deliveries are said to be “heavily-weighted” to Q4, leading to a full-year Studios result of revenue down by “mid-single digits”.

Looking further ahead, management specifically identifies £80m of revenue that has been pushed from 2024 to 2025 due to the strikes.

To offset these headwinds, ITV has been cutting costs furiously. In addition to £40m of savings previously announced, the company has revealed another £20m today, split equally between content costs and non-content costs.

As a result, ITV Studios full-year adjusted EBITA (effectively adjusted op profit) is expected to set a new record. For reference, in 2023 ITV Studios generated adj EBITA of £286m, 58% of group total.

Margin guidance is also reiterated – ITV Studios is expected to generate an EBITA margin within the targeted 13%-15% range.

Outlook: I don’t think there’s any formal change in guidance today, but I wouldn’t be surprised to see consensus forecasts edge slightly lower.

Prior to today, forecasts on Stockopedia suggested FY24 earnings of 9.1p per share, comfortably covering the 5p dividend. On that basis, today’s slump has left the stock trading at a potentially cheap seven times earnings with a 7.5% yield.

Roland’s view

Earlier this year, ITV shares received a notable boost when the company announced that its large final pension scheme would no longer require any additional cash contributions. This had previously been a big drag on free cash flow. Paul covered this here.

ITV’s balance sheet continues to look fine to me, fortunately. Footnotes in today’s update note net debt of £437m, or £573m excluding cash earmarked for the ongoing £235m share buyback. This is being done using the proceeds from the BritBox sale earlier this year.

This looks a reasonable level of indebtedness to me, relative to forecast full-year profit of £353m. ITV remains a double-digit margin business with good cash generation and high returns on equity – one of the reason I have persisted with the stock.

However, the bear case here is also worth considering, I think. As I see it, we could argue that ITV Studios will not grow quickly enough to allow the company to escape the drag of its declining core broadcast business. Similarly, while ITVX is growing fast, digital advertising is generally less lucrative than traditional broadcast advertising.

The result could be a perpetual struggle that remains (rightly) on a low valuation, unless a takeover offer materialises.

I’m not quite ready to sell my shares yet, but I am considering it more actively than I have done before.

One reason for this is that the outlook for 2025 has been steadily weakening; earnings growth next year is now expected to be much lower than previously hoped for:

Paul rated ITV as GREEN in May. I would have made the same choice myself at that point.

But after considering today’s update, I think it’s sensible to go down a notch to AMBER/GREEN to reflect what I see as a greater risk of disappointment.

Mobico (LON:MCG)

Up 5% to 75p (£457m) - Q3 trading update - Roland - AMBER/GREEN

we are on-track to deliver FY 24 adjusted Operating Profit in the range of £185m to £205m, in-line with our earlier guidance

We’ve covered this international bus operator extensively this year, so it’s worth checking out the archive here.

Today’s third-quarter update suggests to me that progress remains on track across most of the group’s key divisions, with only a couple of softer areas.

The main headlines look reassuring:

Group revenue up 12% in Q3 versus 2023

Cost saving programmes on track to deliver £40m in 2024 and £50m annualised from 2025 onwards

Cash savings targeted to help reduce debt levels

Plans for sale of North American school bus business “on track”, update in due course

Drilling down, problems seem to be centred in the UK and Germany, with the core Spanish and North American units performing well.

ALSA (Spain): revenue up 23% vs Q3 23. This was boosted by the acquisition of CanaryBus earlier this year, unfortunately the company doesn’t provide an organic revenue growth figure.

However, we can see growth seems to be driven by passenger numbers more than price rises:

Long haul revenue +15%, passengers +14%

Regional revenue +13%, passengers +9%

Urban revenue +8%, passengers +7%

I tend to see an increase in volume as preferable to price-driven growth, especially in a heavily regulated sector like public transport.

ALSA generated 81% of adjusted profit and all of the group’s statutory profit last year, so it’s a key asset.

North America revenue up 19% vs Q3 23.

Revenue from the school bus business rose by 11% in Q3 due to rate increases and additional routes. This positive momentum should help with negotiating a sale.

The WeDriveU business (charter buses, I think) seems to serve corporate contracts and saw revenue rise 29% during the quarter, benefiting from customers consolidating their suppliers.

UK revenue fell by 2% during Q3. This was linked to poor performance at the UK coach business (National Express) which benefited from rail strikes during the same period last year. On a normalised business, Mobico says coach revenue was 4% higher.

The UK coach division remains in turnaround with several improvement processes actively underway.

In UK Buses, revenue rose by 2%, with passenger numbers up 5%. This is being distorted by government subsidies as part of the £2 scheme which are recorded as grant income rather than revenue. So in reality, I don’t think revenue per passenger is falling in the way these numbers imply.

It remains to be seen whether next year’s bus fare cap increase from £2 to £3 will have an impact on passenger numbers.

Germany - this sounds a bit of a mess. Revenue fell by 21% during the quarter, including impact from driver shortages. Negotiations are underway to resolve the problems with the current contracts, which the company suggests are industry-wide, not just relating to Mobico.

Roland’s view

The investment opportunity here seems to be that if Mobico can complete the turnaround or divestment of its non-Spain operations, then profits could rise significantly. In turn this would aid debt reduction and support a higher rating for the equity.

On the other hand, operating buses is generally a low-margin and heavily-regulated business. Mobico’s H1 results showed an adjusted return on capital employed of 7.8% in H1. At this level, the group is hardlycovering its cost of capital, I suspect.

Add in net debt/EBITDA leverage of c. 3x, and I wouldn’t want to pay a high multiple of earnings here.

Hence I would only look at this stock as a trade, not a long-term holding.

Having said that, I can see that a trade has been playing out well so far this year, with the shares up c.50% since July:

If the planned sale of the North American school bus unit brings in enough cash to make a meaningful impact on net debt, I think this could support further gains. So too could a successful turnaround in the UK and Germany.

None of these things are guaranteed, of course.

Looking at consensus estimates for the current year, Mobico shares are trading on 10x FY24 earnings, falling to about 6x earnings in FY25. The dividend is expected to remain suspended in 2025.

On balance, I’m going to maintain our stance at AMBER/GREEN. I think there’s still some potential upside here, but leverage remains a risk and I think the value opportunity is gradually shrinking.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.