Good morning!

The Agenda is complete!

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Shaftesbury Capital (LON:SHC) (£2.78bn | SR59) | 367 leasing transactions YTD, with £30.2 million of new contracted rent 9% ahead of December 2024 ERV and 14% ahead of previous passing rents. | ||

Kier (LON:KIE) (£978m | SR94) | CFO stepping down after six years. Interim CEO of Wincanton will succeed him. | ||

Discoverie (LON:DSCV) (£583m | SR45) | H1 revenue +3.5%, organic sales +1%. Adjusted opening profit +5% (£30.2m). On track to deliver full year adjusted earnings in line with the Board's expectations. | ||

Victrex (LON:VCT) (£543m | SR64) | SP +7% Full-year revenue +3% CER. Underlying PBT -10% CER. H2 PBT in line with H1. Profit improvement plan underway. FY26 will be “a transitional year”. | AMBER ↑ (Roland) Today’s results appear to be in line with expectations or possibly slightly ahead. While the problems facing the business haven’t gone away, there’s no further downgrade to guidance today. On balance, I am encouraged by the value on offer and the potential for a turnaround and cyclical recovery under the incoming CEO. With the stock trading at c.16-year lows, I think Victrex could be worth a closer look as a contrarian choice. I have added the stock to my own watch list. To reflect this sentiment, I’ve upgraded our view from AMBER/RED to AMBER. | |

Foresight group (LON:FSG) (£532m | SR86) | AUM +4%, FUM +1%. “Core EBITDA” +6%. On track to achieve five-year target to FY29. | ||

Newriver Reit (LON:NRR) (£308m | SR52) | Like-for-like valuation grew by +0.5%. Occupancy 95.3% vs 96.1% in March. Further modest disposals needed to bring LTV within guidance <40%. | ||

B.P. Marsh & Partners (LON:BPM) (£239m | SR89) | Brian Marsh OBE becomes Non-Executive Chairman. CIO becomes CEO. MD becomes COO. | ||

CLS Holdings (LON:CLI) (£228m | SR46) | First three quarters of 2025: “letting activity in-line with 2024, albeit with lower activity than was initially targeted”. Total vacancy fell marginally to 15.0%. | ||

| On Beach group (LON:OTB) (£279m | SR30) | Final results | TTV +11%. Revenue +6%. Adjusted EPS +45% (19p). FY25 growth has continued into the new year with year-to-date TTV +16%. Board is confident in delivering FY26 adjusted PBT of £39-43m, in line with market expectations. | GREEN ↑ (Graham) I’m inclined to upgrade this back to GREEN, despite September’s profit warning, as I just think it’s too cheap at this level. I don’t understand why it doesn’t trade at a P/E multiple in the mid- teens - it’s a successful online consumer brand, with seemingly good growth prospects and a great balance sheet. |

Gooch & Housego (LON:GHH) (£139m | SR68) | Revenue +10.7%, adjusted PBT +46.8% (£11.9m). Net debt £43.9m. “...the Board's expectations for FY2026 are unchanged…”. | ||

Augmentum Fintech (LON:AUGM) (£137m | SR50) | NAV 159.5p. Cash reserves £22.4m. “The fundamental strength of the portfolio provides a stark contrast to this market valuation: our underlying private growth companies delivered solid trading performance, achieving 23% revenue growth and an 8.5% EBITDA margin.” | ||

Mercia Asset Management (LON:MERC) (£127m | SR63) | SP +12% Rev -3.9%, PBT +4.2% to £2.5m. AUM £2,000m (Mar ‘25: £1,988m). NAVps 43.4p. Confident outlook. | GREEN = (Graham) Not much has changed here since I reviewed it last, but the share price is lower and we are now just 15 months away from the March 2027 target date, with the company remaining confident that it can hit its medium-term targets. Even if it doesn’t quite manage to hit them, I still really like the risk:reward on offer. | |

Personal group (LON:PGH) (£105m | SR89) | CFO Sarah Mace is stepping down after 11 years with PGH. She is replaced by Matthew Cohen who is currently CFO of a European insurance business. | ||

Severfield (LON:SFR) (£88m | SR60) | Rev -18%, adj PBT -96% to £0.6m. Order book down 3.4% to £429m since July. £324m for delivery over next 12 months. Steelwork market remains subdued. Mgt expectations for FY26 are unchanged. | AMBER ↑ (Roland) [no section below] An 18% decline in revenue is a pretty poor result for almost any business. In this case it points clearly to the decline in volumes and “competitive bidding environment” Severfield has faced in the market for structural steelwork. Profitability has collapsed and the order book is lower than it was just five months ago. While management cites good visibility for H2 FY26 revenues, broker Panmure Liberum notes lower visibility for FY27. Net debt fell during the half year but is expected to rise above the FY24 year end level of £43.1m by the end of March 2026. As with most companies in this sector, it’s fair to assume some level of cyclical impact, given the depressed state of the construction market. While there’s no guarantee of when a recovery will gain momentum, it seems fair to assume that when conditions do improve, Severfield should benefit. The company says it sees “attractive large-scale projects” coming to market in FY27 and beyond. With broker forecasts remaining unchanged today and suggesting a recovery over the next 12 months, I think it’s fair to upgrade our view to neutral. | |

Topps Tiles (LON:TPT) (£85m | SR50) | Rev +17.5% to £295.8m, adj PBT +46% to £9.2m. Current trading ex-CTD +3.3%, with TPT LFL +2%. Slower sales in early FY26 but remain confident in outlook. | ||

Michelmersh Brick Holdings (LON:MBH) (£79m | SR49) | PW: H2 trading has been ahead of H1, but seen “notable slowdown” in construction final quarter. FY25E rev now exp c.£69m, adj EBITDA c.£12.5m (prev. c.£70m, £14m). | BLACK (AMBER ↑) (Roland) After 18 months of profit downgrades and a 50% share price decline from its 2021 peak, I wonder if we’re near the bottom for this premium brick producer. The market seems to think so, as the shares have hardly moved today despite my estimate of a c.5% downgrade to FY25 consensus expectations. FY26 forecasts have been left unchanged today and if delivered would justify a more positive view, in my opinion. However, my feeling from today’s commentary is that it may be too soon to have much confidence in a rapid recovery. To reflect the mix of value/uncertainty and my broadly positive opinion of this business, I’ve upgraded my view by one notch to neutral today. | |

Celebrus Technologies (LON:CLBS) (£56m | SR41) | Rev -40% to $10.4m, ARR +21% to $15.6m. Adj pre-tax loss of $1.4m, net cash $27.3m. Outlook: focused on closing pipeline opportunities. Board remains comfortable that trading is in line with FY26 exps. | ||

IG Design (LON:IGR) (£45m | SR49) | Rev -13% to $131.4m w/ softer UK demand. Adj op profit -56% to $5.7m. 96% orderbook visibility entering H2. FY26 guidance unchanged for $270-280m revenue, adj op margin 3-4%. | ||

System1 (LON:SYS1) (£27m | SR75) | Revenue -7% to £17.1m, pre-tax profit -90% to £0.3m. “Lower, but ongoing, spend” from many major clients. Continues to trade in line with 23 Sept 2025 guidance. | ||

Haydale Graphene Industries (LON:HAYD) (£23m | SR29) | Signed distribution agreement with Interfloor and received first US orders for JustHeat Pillar. Confident outlook. | ||

Vianet (LON:VNET) (£17m | SR70) | Revenue flat, adj op profit +10.4% to £1.6m. Net debt reduced. Good momentum in H2. Trading in line with FY expectations. | ||

Tpximpact Holdings (LON:TPX) (£14m | SR61) | Revenue -4.3%, adj EBITDA +39% to £3.2m w/ adj EPS of 1.7p. On track to achieve key objectives of 3yr plan. FY26 outlook unchanged, expect adj EBITDA £6-7m. |

Graham's Section

Mercia Asset Management (LON:MERC)

Unch. at 29.56p (£127m) - Interim Results - Graham - GREEN =

Mercia Asset Management PLC (AIM: MERC), the regionally focused, private capital asset manager with £2.0billion of assets under management ("AuM"), is pleased to announce its interim results for the six months ended 30 September 2025.

I’ve been a fan of this growing fund manager for some time, although the share price hasn’t cooperated with me yet:

Let’s see how these interim results are shaping up:

H1 revenue fell slightly to £17.2m (H1 last year: £17.9m).

Operating profit £1.8m (H1 last year: £1.3m).

PBT £2.5m (H1 last year: £2.4m).

So far, so good.

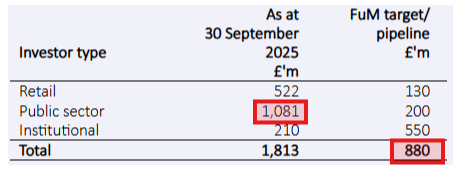

Fund management: AUM has risen 1% over six months to £1.81 billion, with no redemptions. Venture Capital funds such as VCT/EIS don’t work like open-end funds with daily redemptions - it’s much stickier AUM.

The company’s fundraising progress seem to have ramped up in H2: Mercia’s Northern Venture Capital Trust is raising an additional £50m, and a new £35m “North East Accelerate Fund” was launched in October.

Direct investment portfolio: Mericia’s own direct investment portfolio receives a fair value of £131.1m, up by £5m over six months. They have always had their own direct portfolio, and it’s an important part of their history, but it’s no longer necessary. There will be a “pragmatic divestiture”.

I note in passing that the fair value of their direct portfolio is higher than their market cap.

Medium-term targets are on track:

At this mid-point in Mercia '27, we remain confident of achieving our three-year goals of growing AuM to £3.0billion, EBITDA to £10.0million, and EBITDA margin to 26% by 31 March 2027.

£3bn of AUM will be an enormous achievement - as of Sep 2025, it was only £2 billion (made up of £1.81bn of 3rd-party funds, and £187m of "proprietary capital”).

H1 EBITDA was £4.2m, and the EBITDA margin was 24.6%, so it’s less of a stretch to imagine that they could generate £10m of annual EBITDA and an EBITDA margin of 26%.

Market conditions are mixed:

Fundraising conditions remained challenging during the period for EIS, while our VCTs are on track to deliver strong capital raisings supported by wealth manager relationships and an increasingly strong investment performance track record.

The Autumn Budget is only mentioned twice in this report, and they do not mention the cutting of VCT tax relief for individuals, from 30% to 20%. Here’s what the CEO has to say as far as the outlook is concerned:

The second half of FY26 is set to build on the strong operational and financial momentum of the first. Fundraising activities remain robust, with a growing pipeline across all capital pools that we manage…

We expect a strengthening domestic market through to the conclusion of our Mercia '27 strategic plan, with recent successful IPOs signalling renewed confidence. Historically, venture activity accelerates six to nine months after public markets reopen and we're already seeing those early signs. We are optimistic for continued progress in 2026 and beyond.

Graham’s view

I don’t see how I can do anything except maintain my positive stance on this.

I would have liked to read more of a reaction from the company on the Budget, but it’s worth pointing out that retail investors are only responsible for a fraction of AUM. Local authorities and the British Business Bank are more important, with over £1 billion of the AUM in the “public sector” category:

The table above also shows £880m of AUM that’s currently targeted or in the pipeline for March 2027. This is an organic figure so it could be bolstered by acquisitions. This helps us to see how the company plans to stretch for that £3 billion AUM target.

Balance sheet tangible equity is £155m, including £34.5m of cash - fuel for an acquisition perhaps?

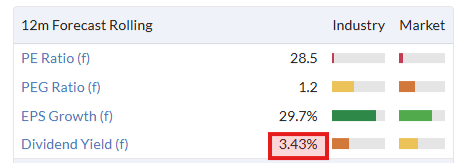

Another nice use of the cash is buybacks and dividends: a £3m buyback is ongoing, and the dividend is increasing:

The P/E multiple is currently very high but this is clearly a balance sheet story as much as an earnings growth story.

So what's my conclusion? Not much has changed at Mercia since I reviewed it last, but the share price is lower - offering better value, as far as I'm concerned - and we are now just 15 months away from the March 2027 target date, with the company remaining confident that it can hit its medium-term targets. Even if it doesn’t quite manage to hit them, I still really like the risk:reward on offer.

On Beach group (LON:OTB)

Up 12% to 215p (£317m) - Final Results - Graham - GREEN ↑

I only downgraded our stance on this by one notch in September, which in hindsight looks like questionable seeing as the market cap is lower by over £80m since then.

On the other hand, the market really likes today’s full-year results:

Total transaction value +11% (£1.25bn)

Revenue +6% (£121m)

Adjusted PBT +20% (£35m)

This is perfectly consistent with September’s trading update, which said adjusted PBT would be £34.5-35.5m.

The adjustments applied to the earnings are £3.6m of share-based payments and another £1.3m of “exceptional items”. I’m inclined to disallow the SBPs, so for me the real PBT number is £31.4m.

Cash is still very impressive at £91.7m. But let’s check why it has reduced by about £5m since September 2024. From the cash flow statement:

Nearly £35m of after-tax cash inflow from operating activities

Zero net impact from investing activity. Development spending fully funded by interest on cash and some small asset disposals.

£40m outflow from financing activities: £31m share buyback, £5m of dividends, and then some smaller items.

Any buyback news today? No. The latest £25m share buyback announced in September has completed. What we do have is a big increase in adjusted earnings per share (up 45% to 19p), turbo-charged by the buybacks.

This effect will continue in FY September 26, as the most recent buyback continued to reduce the share count at the start of this financial year.

Outlook is positive and in line with market expectations:

FY26 adjusted PBT to be £39-43m (nice progress from the £35m just achieved).

Winter bookings +15%, summer bookings +8% (“confident in delivering another record summer)

Their medium-term ambitions are: TTV of £2.5bn, EBITDA of £100m, Adjusted PBT of £85m and EPS of 38.7p, by FY29. They say they are on track with this. That would be a doubling of EPS from the current level.

CEO comment:

“Demand for On the Beach holidays remains strong and, despite the broader consumer environment, booking trends indicate that consumers will continue to protect their holiday. Our Winter 25/26 forward order bookings are currently 15% ahead of last year as customers travel to our key destinations during the winter months. Bookings for Summer 26 are encouraging and give us confidence that we will deliver another record summer.

It is indeed quite interesting that in a difficult consumer environment, holidays appear to be one of the last things that get cut.

Later in the report, they mention a consumer survey which found that “spending on holidays for the next 12 months is the most protected discretionary category for consumers, ahead of health and well-being, home improvement, hobbies, leisure and all other buckets of discretionary spend.” Perhaps an annual holiday is less “discretionary” and seen more as a staple by most?

Graham’s view

The CEO also struck a very positive tone in September, but it seems to me that their confidence in hitting those FY29 targets has increased since then.

In September, he said they were “focused” on the targets, and would update further in September.

Today, the language has adjusted to say that they are “on track” for those targets.

FY 29 is still quite a long time away, with much that could go wrong between now and then, but I do take it as another sign that the new financial year is going very well.

Some other reasons I like this share:

Strong cash balance, mentioned above, and tangible balance sheet equity of £100m.

Cheap earnings multiple for a successful online business, P/E only 7x based on FY27 forecasts.

A focus on “stickiness” (repeat business from customers using their app).

I’m inclined to upgrade this back to GREEN, despite September’s profit warning, as I just think it’s too cheap at this level. I don’t understand why it doesn’t trade at a P/E multiple in the mid- teens - it’s a successful online consumer brand, with seemingly good growth prospects and a great balance sheet.

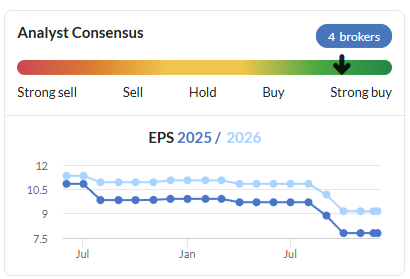

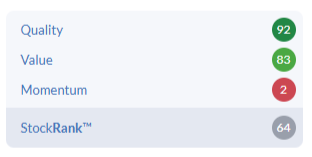

The StockRanks are more cautious, so make of that what you will:

Roland's Section

Michelmersh Brick Holdings (LON:MBH)

Down 1% to 85p (£78m) - Pre-Close Trading Update - Roland - BLACK (AMBER ↑)

We were AMBER/RED on Michelmersh in September after the premium brick maker warned on profits. Unfortunately today’s update is another profit warning, albeit slightly less severe.

In my view, the wording of this announcement was not as clear as it could be – management seems to switch between positive and negative comments, before restating expectations without any reference to previous guidance.

Here’s a summary of the main points – this update covers the year to date, ahead of Michelmersh’s year end on 31 December:

H2 trading and profitability has been ahead of H1, but there has been “a notable slowdown” in construction activity levels during the final quarter – blamed on the economy and Budget uncertainty;

Michelmersh has continued to see “positive order intake levels”, underpinning the forward order book. However, the company mentions “a collaborative approach to pricing” (price cuts?) and admits to “more uncertain timing of brick despatches”;

The company has bought back £1.8m of shares so far this year and expects to complete the £2m buyback announced in April by the end of the year;

Following investment in its facilities, “a more normal production operating rhythm” has continued during H2. This is expected to deliver improved profits going forward.

Outlook

The company provides revised guidance:

With the change in market conditions in the fourth quarter, the Board expects revenue for the year to be c.£69.0 million with adjusted EBITDA of approximately £12.5 million

Checking back to the interims, previous guidance was for the FY25 result to be “broadly reflective” of FY24, when Michelmersh reported revenue of £70.1m and adjusted EBITDA of £14.0m.

So today’s new guidance equates to a 11% cut in EBITDA expectations.

However, crunching the numbers does suggest Michelmersh’s EBITDA margin may be recovering:

FY24: 20.0%

H1 2025: 16.5%

H2 2025 (implied): 19.9%

This recovery seems encouraging to me, supporting the company’s claim that operations are returning to normal after a period of investment and disruption.

Net cash: due to weaker trading in Q4, cash guidance has also been cut. The company now expects to end the year with “a broadly cash neutral balance sheet”. Previous broker forecasts had been for a net cash position of c.£5m.

This will mean that net cash has fallen from £11.0m (FY23) to £6.0m (FY24) to approximately zero (FY25E).

Updated estimates

In the absence of clear guidance from the company, we do have access to updated forecasts from brokers Cavendish and Canaccord Genuity – many thanks.

These firms’ analysts appear to have interpreted today’s revised guidance slightly differently:

Canaccord FY25E adj EPS: 6.7p (-13% vs 7.6p previously)

Cavendish FY25E adj EPS: 8.1p (-4.2% vs 8.5p previously)

Averaging the two gives me a figure of 7.4p, which is 5% below the current Stockopedia consensus of 7.8p.

Both brokers have left FY26 forecasts largely unchanged, apparently following management guidance.

Roland’s view

Earnings forecasts for Michelmersh have tumbled over the last year and are now more than 30% below summer 2024 levels:

However, this is another UK small cap whose share price peaked in 2021 and has been drifting lower ever since. The Michelmersh share price is now down by almost 50% from its April 2021 peak of 160p:

Based on June’s half-year accounts, the stock is now trading 13% below its net asset value of 97.7p and only slightly above its tangible net asset value of 78p.

Profit downgrades have now continued for c.18 months and the share price decline has been spread over several years – this combination arguably fits the profile for a long-term reversal Ed discussed recently. What’s missing, of course, is any concrete evidence of improving momentum.

Ultimately, this is a cyclical construction-related stock. Early signs of a recovery in margins seem to support the company’s claims operations are getting back to normal and my feeling is that the business has well-invested facilities and some decent products.

The operating leverage inherent in this high fixed-cost business model should mean that a return to sales growth could feed through to a nice recovery at the bottom line.

What’s missing is any sign of improving trading – today’s commentary on the order book and despatch volumes did not seem entirely reassuring to me.

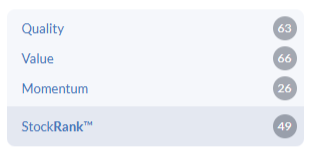

The market has hardly reacted to today’s profit warning and I am inclined to take a similar view. On the assumption we are at a low point in the construction cycle, I think Michelmersh could be approaching the point where it’s a convincing cyclical/value play. The StockRanks support this view too, with higher Quality and Value ranks and Contrarian styling:

Current forecasts suggest a forward P/E of 11 and covered 5.4% dividend yield – that doesn’t seem too demanding to me for what’s (hopefully) a low point for profits.

There’s no certainty of a recovery next year, of course. And there’s always the risk the business will be less well managed than in the past. But on balance I think it’s fair to assume volumes will improve at some point. On balance, I am going to take a chance and upgrade our view to neutral today.

Victrex (LON:VCT)

Up 7% to 666p (£581m) - Preliminary Results - Roland - AMBER ↑

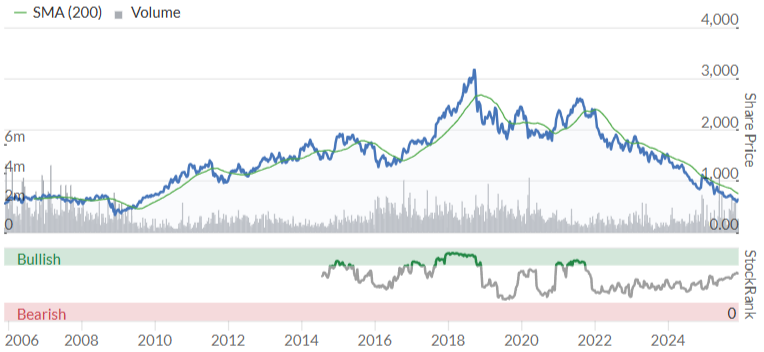

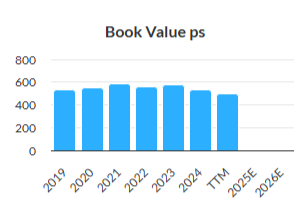

Remarkably, this specialist polymers business is now trading close to its book value – a few years ago, this multiple was around 4x! This decline is reflected in the share price chart – Victrex is currently trading at 16-year lows:

The market has reacted favourably to today’s results, perhaps purely because they do not contain another profit warning. Investors will be hoping that the relentless cycle of downgrades may finally be over:

These results will be the last under the current CEO Jakob Sigurdsson, as his successor James Routh (currently CEO of AB Dynamics) will pick up the baton from 1 January. This means there’s a risk that forward guidance and strategy could change somewhat next year when Dr Routh takes charge.

With this caveat, let’s take a look at today’s results, which cover the year ended 30 September.

FY25 results summary

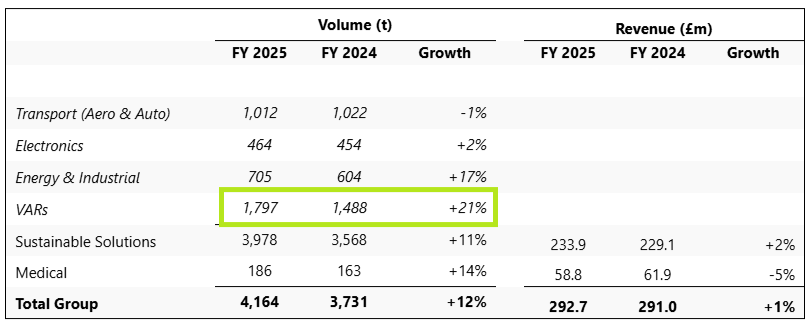

Victrex’s main product is a polymer called PEEK. It’s effectively a very strong plastic. The company produces PEEK components for a variety of industries and also sells it as a raw material to valued-added resellers (VARs). VAR sales are inherently lower margin than sales of finished products.

One of the problems Graham commented on when the company warned on profits in July was the adverse sales mix in the business – essentially, Victrex has been selling more lower margin volume and fewer high-margin products.

Today’s results highlight this trend:

Volumes up 12% to 4,164 tonnes

Revenue up 1% to £292.7m

Gross Profit down 1% to £132.6m

Gross margin down 0.9% to 45.3%

Underlying pre-tax profit down 21% to £46.4m

Underlying EPS down 15% to 43.9p

Full-year dividend unchanged at 59.67p per share

In fairness, currency effects were a substantial headwind last year. But the divisional trading summary highlights how the strongest growth and highest volumes last year were in the lowest-margin VAR segment:

The impact of this decline is made clear by the decline in the average selling price, which fell by 10% to £70/kg.

Competitive pressures and a lack of pricing power in certain markets seem to be a concern:

Like for like (LFL) pricing was robust across key end markets outside of VARs and Energy & Industrial, with more competitive pressure in VARs.

In cases where price has reduced, this has reflected the opportunity to regain business (for example in Energy & Industrial) or has been in response to competitive activity, including from less established Asian manufacturers.

Worsening this theme is the continuing loss of sales in the high-margin Medical Spine market, where Victrex is losing sales to alternative materials in the US and suffering pricing pressure in China:

As expected, Medical revenues overall were 5% lower, driven by Medical Spine (26% of revenues) with porous and titanium based products continuing to regain market share in US Spine, and the challenge of Volume Based Pricing (VBP) on Spine in China. Non-Spine revenues were up 7%.

As Graham highlighted in July, losing sales to alternative materials is a far more serious concern than cyclical trends, which can usually be expected to reverse over time. If US healthcare buyers are moving away from PEEK to choose different spinal products, there doesn’t seem any obvious reason why they should return.

I’m not going to delve too far into the details of Victrex’s various operating markets, which include aerospace, automotive, oil and gas and consumer electronics. There’s plenty of detail in the RNS for anyone interested.

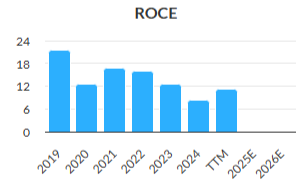

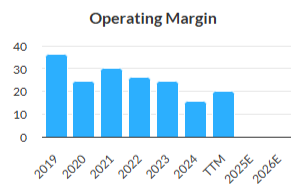

Profitability: in the past, this was a fairly high margin business with strong quality metrics. Unfortunately these have declined steadily:

My sums suggest a further decline in ROCE to 7.9% last year, while the group’s operating margin fell to 13.6%. Prior to FY24, operating margins were routinely over 20%:

A recovery in average selling prices or higher-margin product sales could rapidly repair Victrex’s profitability, but as things stand this remains a concern for me. ROCE of c.8% is likely to be broadly in line with the company’s cost of capital. This means that in terms of generating real value for shareholders, the business is probably standing still.

We can see this reflected in Victrex’s book value per share, which has gone nowhere in recent years:

Cash flow, balance sheet & dividend: the dividend of 59.6p was held last year but was only covered 0.7x by adjusted earnings of 43.9p.

More importantly for me, my sums suggest that free cash flow of £46.3m was not quite enough to cover the c.£52m cost of the dividend.

As a result, net debt rose by £3.7m to £24.8m during the year – management admits this “largely relates” to the payment of last year’s dividend.

The outgoing CEO has justified this by introducing an updated capital allocation policy allowing the dividend to be maintained as long as net debt remains in a range of 0.5x-1.0x EBITDA. While I agree this level of leverage should be comfortable for a business of this kind, I don’t really agree with the principle of borrowing money to fund dividends.

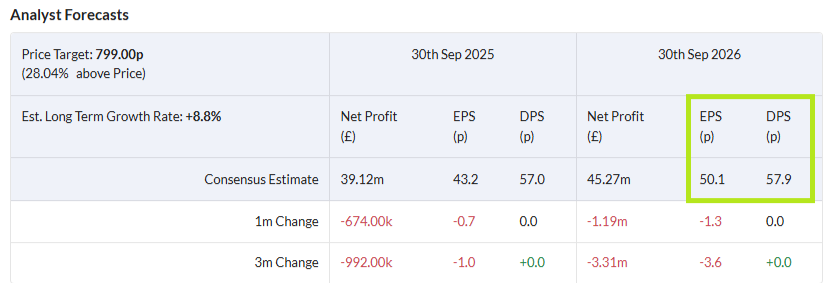

With a new CEO starting on 1 January, I would not be surprised to see a dividend cut next year unless there’s strong evidence of a recovery in earnings. I’d note that current forecasts for next year also suggest the payout will remain uncovered:

Outlook

Fortunately – and perhaps unsurprisingly given the impending change of management – there are no further downgrades today.

Instead, there’s more general guidance for FY26 suggesting a modest recovery in profitability is possible:

Volumes: low to mid-single digit % growth

ASP: broadly stable, similar sales mix

Gross margin: flat to slightly ahead (45.5%-46.5%)

Currency: £2m-£3m adverse impact at current rates

Targeting “solid progress on FY25; H2 weighting to reflect normal seasonality and FX headwinds”

As shown above, consensus forecasts suggest earnings could rise by 14% to 50.1p per share next year, putting Victrex on a FY26E P/E of 13.

If the dividend was held, it would provide a yield of c.8.5%.

Roland’s view

Cyclical headwinds have certainly made some markets more difficult since 2022.

But to understand the company’s broader lack of progress in recent years, I think it’s useful to put today’s FY25 results in context.

In FY18, total volumes were 4,407 tonnes, of which VAR sales were 1,766 tonnes, or 40%.

In FY25, total volumes were 4,164 tonnes (-5.5% vs FY18), with VAR sales of 1,797 tonnes making up 43% of the total.

The average selling price in FY18 was £73.97/kg, 5.4% higher than the FY25 ASP.

My main concern about this business is the risk that Victrex’s PEEK capabilities are just not as special as they once were.

The outgoing CEO’s strategy during his eight years in the role was to try to develop new valued-added products (“mega programmes”) in various key markets, but success seems to have been mixed. As with almost everything, it seems lower-cost Chinese manufacturers have become a more serious competitive threat.

However, everything has its price. With Victrex shares now trading at just 1.4x book value despite remaining profitable and paying a (mostly) supported dividend, I think the business may be starting to look cheap.

The StockRanks also view Victrex as a Contrarian stock, with high quality and value:

The big caveat to this positive view would be if macroeconomic or competitive conditions remain hostile.

Lower volumes would be an obvious concern, but perhaps the bigger risk in reality might be that Victrex’s ability to sell value-added products at higher margins continues to weaken. In that scenario, then the current valuation could be high enough.

Graham took an AMBER/RED following July’s profit warning. It’s been five months since then and we’ve had no further downgrades to guidance. In addition Victrex shares are still cheaper after this morning’s gains than they were in July.

To reflect the lack of any further downgrades and the apparent value on offer here, I’m going to revert our view back to AMBER. On balance I think this is probably still a decent business; I’ve added Victrex to my own watchlist for further research.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.