Good morning! With October upon us, we're expecting a normal quantity of news today.

Finished for today, cheers!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Taylor Wimpey (LON:TW.) (£3.65bn) | On track to deliver 2025 guidance range 10,400-10,800 UK completions, excluding JVs, and operating profit c. £424m. | ||

Tate & Lyle (LON:TATE) (£2bn) | SP -10% Slowdown in market demand. H1 rev down 3-4%. FY26 outlook: revenue and EBITDA to fall by low single digit percentage. | BLACK (AMBER/RED) (Graham) Giving this a one-notch downgrade after a significant profit warning that we are told stems from market weakness. While the shares were already trading at a cheap-ish earnings multiple, a leverage multiple of 2.2x prevents me from getting too excited about a quick rebound, and the fact that the company was buying its own shares back at higher levels last year leaves a bitter aftertaste. | |

Greggs (LON:GRG) (£1.64bn) | Full year outlook unchanged. LfL sales +1.5% over the last 13 weeks, +2.2% year-to-date. | AMBER (Graham) [no section below] The target for new openings gets slightly reduced although it will still be a busy Q4: there have only been 57 net new openings year-to-date, but 120 net new openings are expected for the year as a whole. Importantly, the “pipeline remains strong into 2026”, so we should continue to see a little bit of roll-out growth on top of small LfL growth. Overall I see little reason to change from the neutral stance expressed by Roland in July. Profitability is under pressure, but the company is continuing to expand in a disciplined way and improve its distribution capabilities (two new distribution centres to open over the next two years). At a P/E of 12x for a business that is much-loved but currently ex-growth, I think it’s fairly valued here. | |

James Halstead (LON:JHD) (£647m) | Outlook: positive sentiment in North America but low customer confidence in Central Europe. Cautious in the short term. | ||

Renew Holdings (LON:RNWH) (£641m) | Trading in line with consensus (adj. revenue £1,117m, adj. op profit £72m, net debt £6.9m). Record order book. | ||

Kosmos Energy (LON:KOS) (£591m) | Successful re-determination of reserve-based lending facility ($1.35bn). Senior secured term loan with Shell (up to $250m). | ||

MS International (LON:MSI) (£223m) | Contract to supply gun mounts worth $34.5m, and another contract worth $7.6m. No longer-term contracts are available as previously hoped for. | ||

Duke Capital (LON:DUKE) (£145m) | £6m investment into a portfolio of care homes across South East of England, facilitating the acquisition of a freehold care home in Brighton. | AMBER/GREEN (Graham) [no section below] We already had a trading update from DUKE this week, which indicated that quarterly recurring revenue was flat. The transaction announced today is quite large and brings DUKE’s total investment into this care home portfolio to over £20m, on which DUKE earns a 13% yield plus or minus adjustments for revenue growth. I think it’s important to recognise that in many cases, including this one, DUKE’s cash injections enable takeovers by DUKE’s investees. An established, profitable care home might be a low-risk bet, but in other cases the DUKE-enabled takeovers can appear rather risky. In any case I’m happy to leave my moderately positive stance on DUKE unchanged today. | |

Peel Hunt (LON:PEEL) (£133m) | Revenue +37% to £73.8m, cost-savings expected to be reflected in the profitability over this financial year. ECM activity, including IPOs, is beginning to emerge, transactions continue to be weighted towards M&A. | GREEN (Graham) H1 revenues are up 37% with the company well on track to hit the full-year estimates, but do bear in mind that revenues can be lumpy. I'm pleased to read that they have reduced some fixed costs, creating a "leaner and better aligned cost base" - I'd like to see them reach breakeven even in the bad years. This current financial year is shaping up reasonably well anyway, and I do expect a small profit. My main reasons for staying bullish are unchanged: the very strong balance sheet and therefore the potential for a takeover by a larger bank. Even without a takeover, I think investors here should do quite well if the UK equity market returns to anything resembling its former state of health. | |

Defence Holdings (LON:ALRT) (£81.4m) | Classified build focused on edge analysis, identification and decision-support capability. No figures given. | ||

Shield Therapeutics (LON:STX) (£78m) | “This first publication of results confirming the safety and effectiveness of ferric maltol treatment in children as young as 2 months is an important milestone for Shield…” | ||

Victoria (LON:VCP) (£75.7m) | Philippe Hamers has proposed to the Board that he retires from his position as Group CEO around the middle of next year. | ||

Topps Tiles (LON:TPT) (£69m) | FY Adj. Sales +6.8% to £265m, (incl. CTD +18% to £296m), adjusted profit for the year is expected to be in the range of market expectations (£8.3-£9.2m). Expects to finish the year in a net cash position. | AMBER/GREEN (Mark)

This is an inline update but one that gives increasing confidence that the company is trading well in difficult markets. As such, it confirms that the shares are very modestly rated, especially as the cash flow get paid out as a generous dividend. My only real concerns are how representative the adjustments are to the underlying performance and how rangebound the stock is this year, but not enough to change our mostly positive view. | |

Zanaga Iron Ore (LON:ZIOC) (£67.2m) | H1 LBT £$3.5m (24H1:$1.1m LBT), Cash $3.9m (24H1: $90k) following $23m raise in period, $15m of which used to acquire Glencore’s 43% equity stake leading to the termination of Glencore's Offtake Agreement and Relationship Agreement with the Company. | ||

Character (LON:CCT) (£51.3m) | FY to 31 Aug 2025 revenue -20%, PBT at least £1m, FY26 PBT to be higher than FY25. No cash figure given. | AMBER/RED (Mark) | |

Cavendish (LON:CAV) (£46.5m) | H1 revenue +2% to £28m, profitable, cash +15% to £19.8m, solid pipeline of both public and private transactions. Fiscal uncertainty ahead of the November Budget is tempering market sentiment. | AMBER/GREEN (Mark) [no section below] | |

Videndum (LON:VID) (£45.6m) | Brian Morgan appointed Group Chief Financial Officer, previously CFO at Victoria Carpets! | ||

Arrow Exploration (LON:AXL) (£39.7m) | Mateguafa Oeste 1 well exhibited thin oil pay over water, being abandoned due to the lack of an economic discovery. | ||

Pulsar Helium (LON:PLSR) (£35.3m) | Jetstream #1 well sustained helium-3 concentrations up to 14.5 parts per billion. | ||

Litigation Capital Management (LON:LIT) (£30.3m) | Net realised gains of A$22.2m (FY24: A$23.0m) on concluded cases. Total loss of A$82.0m (FY24: Total income of A$44.7m) following trial losses. Loss after tax A$72.9m (FY24: PAT A$12.7m). Net assets down 39% to A$114.4m. Strategic review ongoing, still in discussions with lender. | ||

Upland Resources (LON:UPL) (£24.2m) | Acquisition of Vanguard Drilling’s intellectual property, advanced drilling management systems, and the integration of select senior personnel. No figures given. | ||

Northern Bear (LON:NTBR) (£13.1m) | Currently trading ahead of expectations. Full year EBIT is expected to be broadly consistent with prior year after adjusting out a £1.0m non-recurring profit. Term debt repaid. | AMBER/GREEN (Mark) | |

Orchard Funding (LON:ORCH) (£12.3m) | Loan Book -1% to £66.3m, Total Income +20% to £8.30m, Operating Profit +90% to £4.01m. 1p Interim |

Graham's Section

Peel Hunt (LON:PEEL)

Down 1% to 107p (£131m) - Half Year Trading Update - Graham - GREEN

Peel Hunt, a leading UK investment bank, today issues a trading update for the six-month period ended 30 September 2025 (H1 FY26).

Let’s get up to speed on how this investment bank is faring.

H1 revenues are up 37% to £73.8m; this is far in excess of 50% of the full-year forecast.

I imagine that this will be of little comfort to the company’s IPO investors:

At the time of our IPO in 2021, Peel Hunt outlined clear strategic ambitions. Despite the challenging macro-economic and market environment in the period since, the Group has been successful in delivering against those ambitions. We are now pleased to see this progress reflected in our financial performance.

It’s no surprise that an IPO manager timed its own IPO rather well:

That being said, Peel Hunt’s FTSE-350 client coverage is now very impressive at 57 companies, up from 32 at the time of IPO. Although I can’t help noticing that this is down from 58 companies in their September update!

This is also impressive:

In H1 FY26, we acted as lead financial advisor on 11 M&A transactions with a total deal value of £8.4bn, ranking third in the UK M&A league tables behind only global investment banks

A new Abu Dhabi office is opening. They are already in New York and Copenhagen.

Outlook

This sounds good: “our strong revenue performance is now supported by a leaner and better aligned cost base, which we expect to be reflected in the profitability of the Group over this financial year.”

I did criticise Peel Hunt’s full-year results in June, as the company posted another £3m+ loss; it seems to me that a people-driven business like this should be able to dial its variable costs up and down as appropriate, so that it can always reach breakeven, even in the bad years. Cenkos (now known as Cavendish) always did that in the past.

So hopefully we’ll see some improvement on that front soon.

Turning to the outlook:

Following the typically quieter summer holiday period, trading activity resumed in September. Our Investment Banking pipeline remains healthy, benefitting from several announced transactions expected to complete in the second half of the financial year. While ECM activity, including IPOs, is beginning to emerge, transactions continue to be weighted towards M&A. Despite the ongoing economic and geopolitical uncertainty, we remain optimistic about our performance for the remainder of the year.

Graham’s view

There’s not much here to change my view. We know that there are some signs of renewed interest in UK IPOs, but they remain rare. Despite this, Peel Hunt has succeeded in growing its revenues at an impressive pace and is expected to generate a modest profit this year.

For me, the balance sheet and its potential attractions as a takeover target are a large part of what’s keeping me interested. Net assets were last seen at £89m (March 2025), almost fully tangible and consisting primarily of liquid, short-term assets, including cash. I’m sure that most large, blue-chip banks would be delighted to own this, if they could pick it up for a modest premium over net assets, which is what the current market cap of c. £131m amounts to.

So I’m staying GREEN on this.

Tate & Lyle (LON:TATE)

Down 10% to 406.5p (£1.81bn) - Pre-Close Trading Update - Graham - AMBER/RED

This large ingredients maker has faced some challenges in H1 (the period from April to September):

Overall, we saw a slowdown in market demand as the first half progressed. In the Americas, we expect revenue in the first half to be slightly lower reflecting softer consumer demand. In Europe, Middle East and Africa, revenue is expected to be mid-single digit lower despite slightly higher demand. In Asia Pacific, revenue is expected to be broadly in line after absorbing the impact of tariffs.

The result: H1 revenue will be 3-4% lower, and H1 EBITDA will be “high-single digit percent lower”, i.e. 7-9% lower.

Full year outlook:

While we anticipate the near-term market demand environment will remain challenging, we expect performance to improve as we move into the fourth quarter…

Therefore,for the year ending 31 March 2026, in constant currency and compared to pro forma comparatives, we now expect revenue and EBITDA to decline by low-single digit percent compared to the prior year.

Be careful if you’re trying to match this new guidance against prior forecasts: TATE made a very large acquisition during FY25 (CP Kelco), which has boosted the figures. The key word above is pro forma - we are looking at growth rates that remove the timing effect of when that acquisition occurred.

The company’s official guidance prior to this update was for constant-currency, pro forma revenue growth in FY26 that was “at, or slightly below, the bottom of our medium-term range” (that range being 4-6%).

So revenue growth was supposed to be at or slightly below 4%.

Instead it’s headed to be down by low-single digits; let’s call that -1% to -3%. It’s a downgrade of 5% to 7%.

Turning back to the previous official guidance (published in May), full-year EBITDA was supposed to grow faster than revenues. It’s not clear now whether the EBITDA decline will be better or worse than the revenue decline. So the EBITDA cut is worse than the revenue cut, to my eyes.

Graham’s view

We were AMBER on this previously and I think that a cut to AMBER/RED is in order today, given that this is a serious revenue and profits warning for a company of this size.

I also note that its significantly leveraged: net debt to EBITDA was 2.2x at March 2025, with the net debt figure at £961m.

That’s after the company spent over £200m on share buybacks, at prices that now look rather expensive:

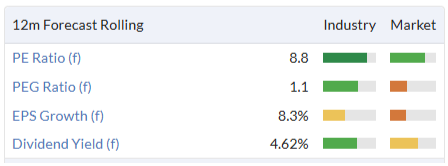

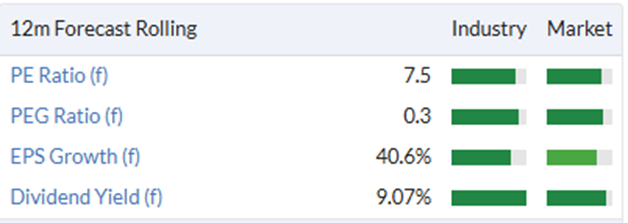

The good news is that it was already on a cheap multiple, before today’s news:

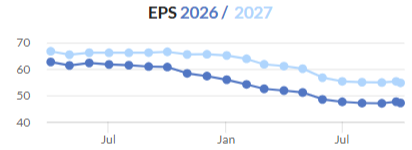

But the trend when it comes to earnings forecasts are generally lower:

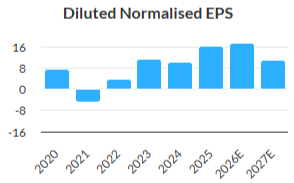

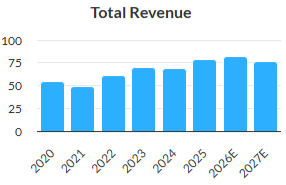

Ingredients is not a sector where I have all that much experience, but I know that Treatt has struggled against the competition. At the much larger Tate & Lyle, it seems to be more about general market weakness rather than direct competition, but in both cases, organic growth has been limited and ROCE has been unexciting. Tate has gone down the M&A route and the CP Kelco acquisition is said to have gone well so far, but I think the negatives still outweigh the positives here for now, especially considering the debt load.

Mark's Section

Northern Bear (LON:NTBR)

Up12% at 106p - Trading Update - Mark - AMBER/GREEN

A nice start to the year so far, no doubt aided by the lack of rain over the summer, benefitting their roofing projects:

Northern Bear confirms that the Group is currently trading ahead of expectations since the publication of the preliminary results on 15 July 2025.

Although I am a little confused by the details:

Based on EBIT for the first half of FY26, the full year outcome is expected to be broadly consistent with the strong underlying profit performance for the year ended 31 March 2025, after adjusting for H Peel & Sons Limited losses and related closure costs in FY25 ("Adjusted FY25 EBIT") and excluding the non-recurring profit noted below.

Broadly, of course, means slightly below. However, in the Full Year Results they said:

The latest expectations for FY26 are for operating profits to remain consistent with the excellent results in FY25 notwithstanding significant investments in both personnel and premises to generate further growth.

So, they say they are trading “ahead of expectations”, but between the Final Results and now trading has gone from “consistent” to “broadly consistent” which sounds more like a slight miss than an ahead statement. Perhaps the kindest explanation is that they didn’t consider the exceptional gain as exceptional when writing the FY results commentary?

Overall, this is relatively minor and not necessarily an issue, as FY25 was very strong in a historical context and benefited from a very mild winter. However, adding to the confusion, the broker forecasts were for EPS to rise anyway:

I think the answer to this conundrum is that they are referring to EBIT, and that interest costs in FY25 had gone up to £368k:

Now they say:

In addition, we are pleased to report a non-recurring operating profit of approximately £1.0 million, which has enabled the Group to fully repay its outstanding term debt of £1.275 million relating to the tender offer settled on 8 December 2023.

This is another mystery - what exactly has generated an exceptional operating profit of this size? If any readers know the details, please post these in the comments.] However, this is at least a good mystery! With the debt reducing by about £1.5m during FY25, this explains how brokers could be forecasting a reduced EBIT but increasing EPS. With the term debt repaid at the HY, this would presumably add to EPS further. I can’t see any updated research in RT, but I can’t see the adj. EPS going up by that much on this update, after all EBIT is still guided to be down slightly. However, on a P/E of around 5, it doesn’t need to.

The big question is will this positive trend continue? The existing forecast are for revenue to fall 7% to £76.2m but because of cost rises, EPS to fall 35%:

A forward P/E of around 9 suddenly doesn’t look as great value. This should benefit from the same dynamics around lower interest charges as FY26, but what investors really want to know is if this positive trading is a permanent shift to better profitability, or merely weather-related? I’m not sure we can judge until there is a prolonged period of bad weather.

Mark’s view

Today’s update seems a little confused. I’m not sure what exactly is “ahead”, and comparing the language around recent trading suggests they are slightly behind where they thought they’d be at the Final Results. Is this about the broker not believing them when they produced forecasts after the FY results? While Adj. EBIT may be slightly down on a very strong prior year, exceptional gains meaning that they have paid off their term debt, and hence have lower interest charges, means that EPS should rise further. This makes them very cheap on forward earnings. However, some doubt remains as to whether this is a fundamental change in the nature of the business, or merely a beneficiary of some unusually nice weather in the UK. Until we get some bad weather, it seems hard to say for definite. In light of this, I keep our generally positive view of AMBER/GREEN.

Character (LON:CCT)

Down 5% at 271p - Trading Update - Mark - AMBER/RED

Forecasts have been suspended here since their April 11th Trading Update when they announced:

The Board's visibility for forecasting sales to USA (which were c.20% of Group turnover in the last financial year) and its ability to assess the financial implications for the Group have been considerably obscured by these events. Consequently, the effect of the imposition of the trade tariffs will be felt in the second half by the Group and, as a result, the Company is withdrawing the market guidance for the year ending 31 August 2025. Despite this, the Board remains confident that the Group will be profitable for the current financial year as a whole.

Their H1 is to the end of February so was unaffected. However, at that time of release in May, we also learnt that:

The uncertainty flowing from the imposition of these tariffs has been felt in other parts of the world as customers have become increasingly cautious and are not committing to orders to our expectations. This is impacting sales in all our key territories. Despite this, the Board remains confident that the Group will be profitable in the current financial year as a whole, although it is too early to forecast short to medium term trading at this juncture.

Today is the first time we get these statements quantified:

Whilst full year revenue has reduced by c. 20% when compared with the previous year as a result of customers reducing their commitments, the Board expects the Group's audited adjusted profit before tax for the financial year to be at least £1.0m.

The numbers:

Doing the maths, this makes the FY revenue around £99m, which means H2 revenue was around £46m, which is down around 31%. The run rate revenue will be even worse as the tariff announcement came around 6 weeks into H2. This is clearly about much more than just US sales dropping off a cliff, as these were only around 20% of turnover in 2025. There is a H2-weighting here, as Christmas ordering normally happens over the summer period. So it is possible that this may be the effect of delays due to uncertainty. However, if they had seen a significant uptake in ordering in September you would expect them to mention it.

In terms of profitability, they made £2.1m Adj. PBT in H1, meaning that they have only lost around £1m in H2. This is actually one of the advantages of a company where the Gross Margins are quite low, at 26.5% in FY25. A £20m reduction in revenue only takes £5.3m out of gross profit. Assuming similar gross margins, they would have generated £12m gross profit in H2 and to lose £1m means they will have had similar costs to the £13.7m H1 costs (made up of £4.1m distribution costs and £9.5m admin expenses). Given they may have had to eat some margin in the US, and freight rates have been coming down, I expect the true figures to be for slightly lower gross profit and lower costs. However, it does suggest that they haven’t been able to (or wanted to) take significant costs out of their admin expenses.

Outlook:

The only outlook we get is:

With a strong product portfolio, backed by a resilient balance sheet and continuing good cash position, the Board looks to the year ahead with optimism, and expects the adjusted profit forecast to increase when compared to the year ended August 2025.

This is quite vague, an improvement could be anywhere between £1.5m PBT to back to 2024 levels of £6.5m. I’m guessing management simply don’t know, as the brokers have kept forecasts suspended today.

Balance sheet:

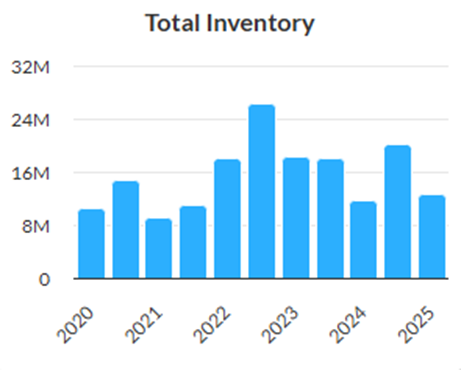

The balance sheet is indeed strong here with around £16m of net cash. (Breaking our general rule on the DSMR that if a company has to say it has a strong balance sheet, it probably doesn’t!). As companies such as IG Design have shown, we have to be careful with seasonality as net cash on a balance sheet date does not necessarily represent the normal position. With Character, in normal times, there is definitely a seasonality with inventory being lower at the half year:

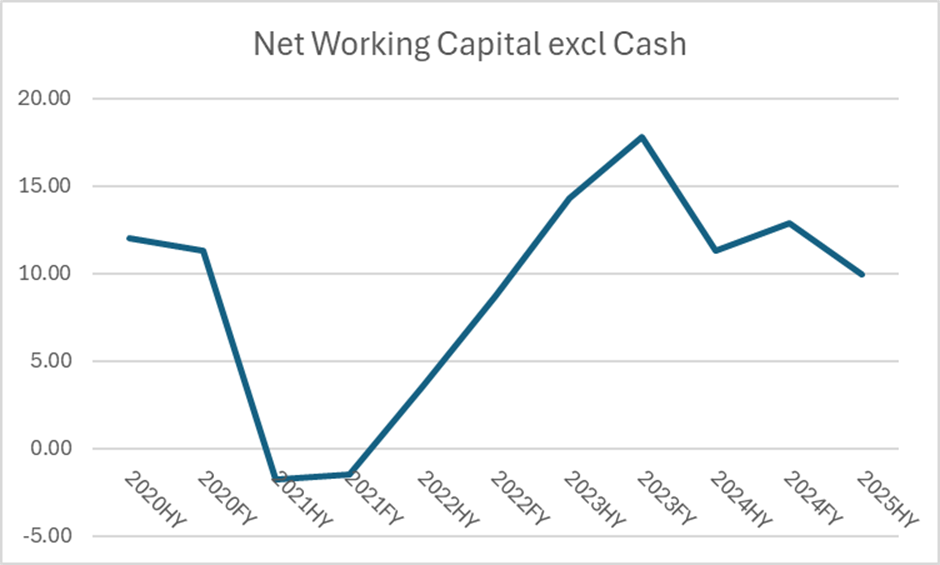

However, given the way it is funded by suppliers, the net working capital tends to show much less seasonality:

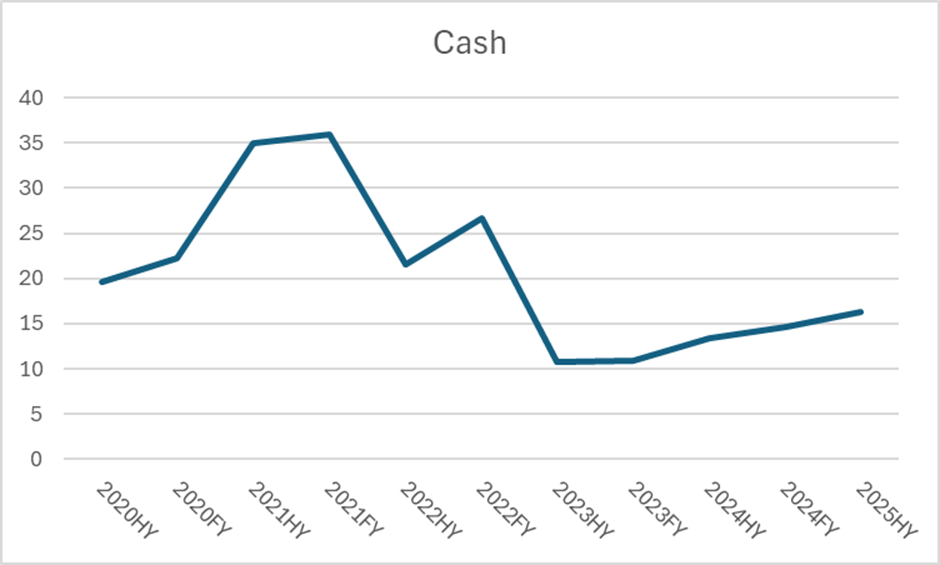

And the cash balance little seasonality at all in recent years:

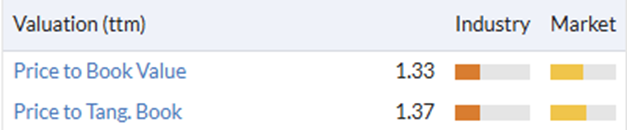

My understanding is that several of their properties are surplus to requirements, or could be freed by consolidation. These would probably be worth more than book value. Although, there doesn’t seem to be any progress/urgency on realising value with these. Property is also only around 30% of their Tangible Book Value and they trade at a premium to book, so it would have to be a very significant uplift in value to make this an asset play:

If they sold some of the surplus property it would bolster their cash resources. However, I have some doubts as to the logic behind their uses of that cash. They reduced their interim dividend but at the same time have been buying back shares:

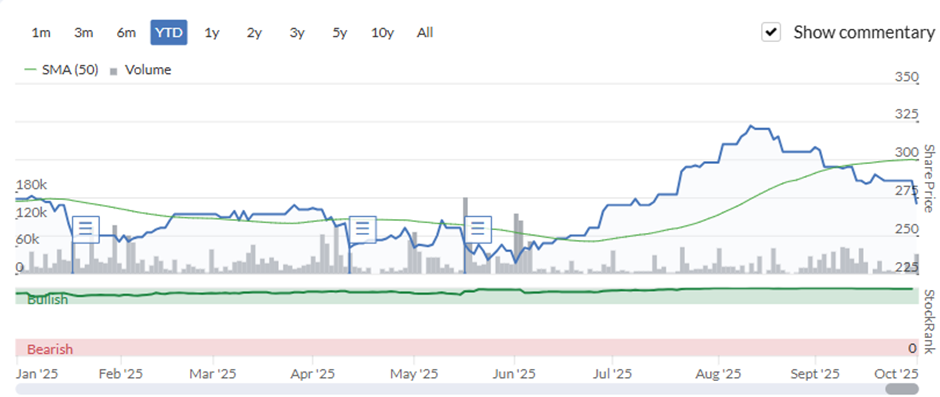

The effect of this on an illiquid stock seems the most likely explanation of why the share price went up between June and Mid-August:

Indeed the shares are flat YTD, despite an absolutely huge profits warning. It has clearly helped shareholders keep a positive view of the company. I am less sure it has added shareholder value buying back stock at a premium to book value and what has turned out to be somewhere in the region of 50x forward earnings. They extended the buyback by £1.0m in May, having completed £1.6m of the original £2.0m. They may well extend again if they reach the £3.0m.

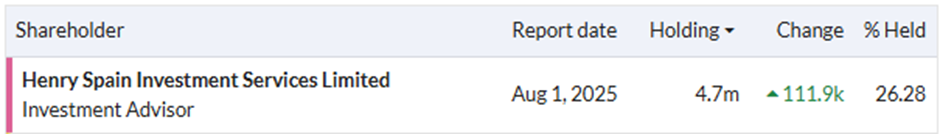

Their largest shareholder has not been put off by the current trading and has been adding recently:

However, having Henry Spain above 25% is not without risks. Their actions over the wind-down of now-delisted Zytronic raise some questions over how they would treat minority holders. While they have no doubt suffered from small-cap/AIM, there is also no getting away from a poor recent investment record.

Of course, these near-term earnings are unusually depressed, and this company has a long history of going through cycles of profitability, and this is reflected in the share price:

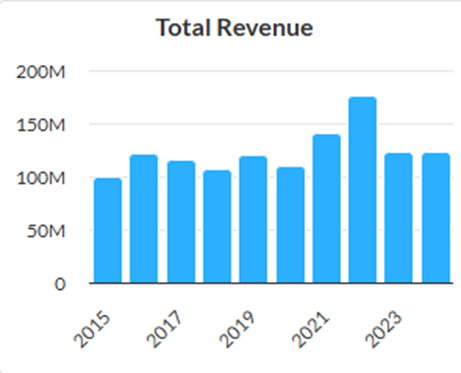

However, it has no real history of revenue growth:

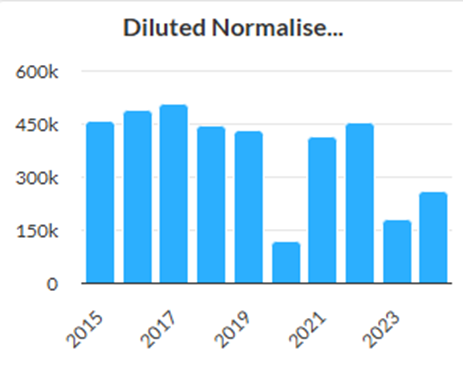

It certainly seems possible that they may return to the 45p EPS eventually, which would put them on a cheap multiple:

However, with FY25’s results this seems a very long way away, and with no long-term growth and little IP, this should be cheap.

Mark’s view

While this is conservatively financed and not shy about using its cash balance to buyback shares, it is not clear if they are actually adding shareholder value by doing so. The short term trading is extremely uncertain and today’s price already reflects expectations of a big bounce-back in trading and profitability. Graham rated this as AMBER at 245p following the HY results, but having done the maths on H2 (Revenue down 31% and £1m loss), I feel a further reduction to AMBER/RED is probably fairer. At least until the company is willing to commit to market forecasts again, or we get news on the realisation of property assets.

Topps Tiles (LON:TPT)

Up 7% at 37.5p - Q4 Trading Update - Mark - AMBER/GREEN

This is billed as a Q4 trading update, but the figures we get are for the FY:

The Group's strong trading performance has continued throughout the second half, resulting in another record year of turnover for the Group of approximately £265 million of adjusted sales, up 6.8% year-on-year.

This is what they said for Q3:

Group adjusted sales were up 10.1% in the third quarter, a notable acceleration compared to 4.1% growth in the first half. On a year-to-date basis, Group adjusted sales were 6.1% higher year-on-year.

So thinking through the logic, that must mean that Q4 sales were up by more than 6.8% but probably less than Q3’s 10.1%. Total FY25 revenue looks slightly ahead of the Stockopedia consensus.

That they are facing cost pressures is not new news which is why this is an inline statement overall, and they helpfully quantify that:

Company compiled market expectations for adjusted profit before tax are in a range of £8.3 million to £9.2 million for FY25

Adjusted PBT last year was £6.3m, so this is a decent increase. Although, this presumably excludes the property costs and other adjustments, plus the losses and exceptionals from the acquired CTD. While many of these sound one-off, they seem largely like things this sort of business should be doing as part of its normal operations.

They are guiding positive adjusted net cash, which is good news, but not a huge difference to the £1.2m net debt at the half year. It will exclude lease liabilities and around £3m of provisions. How we treat net lease liabilities is open for debate, but it is worth noting that liabilities were a whopping £26m more than lease assets at the half year. It is clear that not all their stores are performing as originally planned.

If we are willing to exclude these this looks cheap on soon to be released FY25 numbers and very good value on FY26 forecasts. Today’s trading update must surely give greater confidence that these will be hit:

And as we often point out on the DSMR, if a company with significant housing market exposure is cheap at the moment, it may look even more so in better market conditions.

Mark’s view

The share price has responded positively this morning to what is an inline statement but one that builds confidence in the medium-term future, so I can see why investors will want to own this at the current valuation. My only real concerns are firstly how representative the adjustments are to the underlying performance. However, the cash flow is often very good and supports a high yield which assuages my concern here. Secondly, the shares seem quite rangebound this year:

They seem to respond positively after a trading statement and then fall back as investors climb the wall of worry about the sector. The risk is that today’s initial gain will be sold into, as usual. It perhaps needs a beer sector outlook or an ahead statement to see the shares break out of this pattern. I’m no great chartist, though, so very happy to keep Roland’s previously mostly positive view of AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.