Good morning!

That's it for today (12pm). See you next time!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

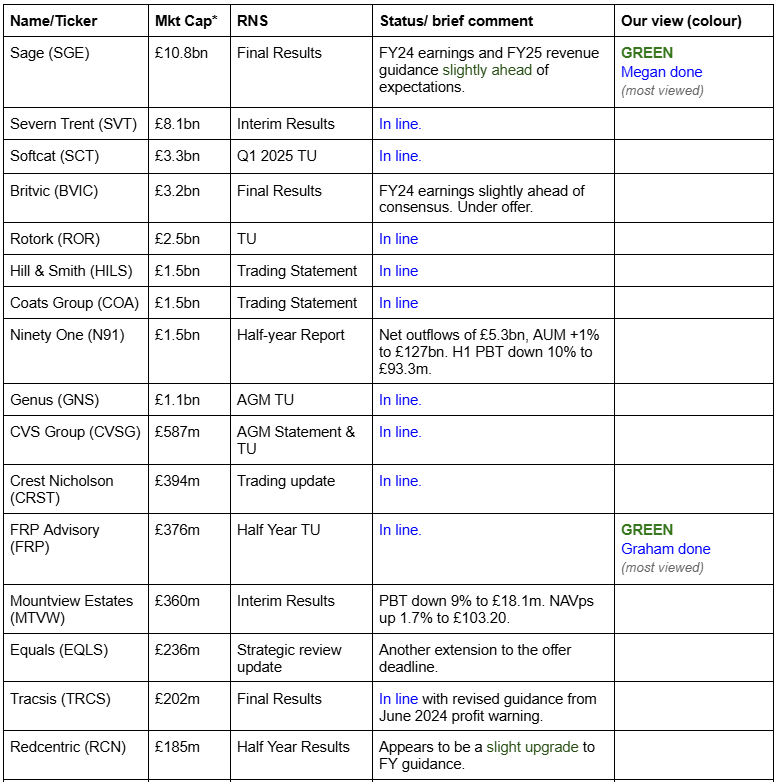

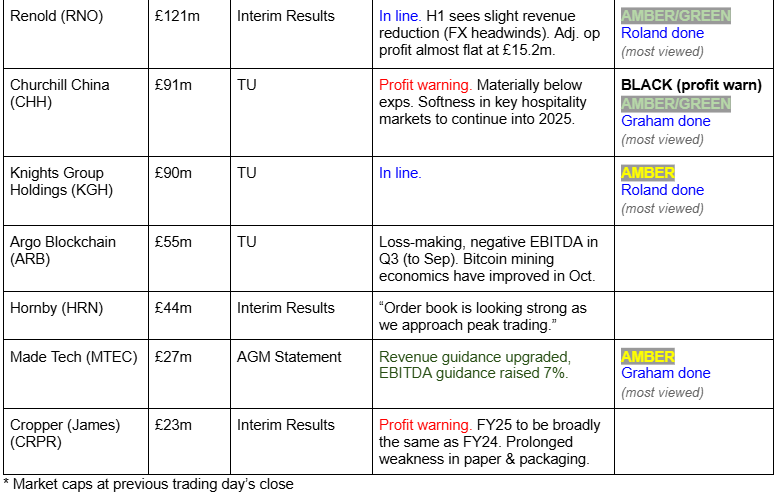

Companies Reporting

Summaries

CML Microsystems (LON:CML) - down 12% yesterday to 226p (£37m) - Half Year Results - Graham - AMBER/GREEN

This semiconductor developer conceded yesterday that if current conditions continue, it will struggle to meet forecasts. Existing forecasts are for revenues of £24m and adj. PBT of £2.1m. With the company still holding cash of £15m, I think it could be worth a second look.

Churchill China (LON:CHH) - down 27% to 600p (£66m) - Trading Update (profit warning) - Graham - BLACK (AMBER/GREEN)

A severe profit warning with 2024 is now shaping up to be materially below expectations, as the usual seasonal uplift has not appeared. Looking ahead, CHH also reduces expectations for 2025 on the grounds of higher NICs affecting both itself and its customers. I keep our mildly positive stance unchanged as this is possibly not far off deep value territory.

Sage (LON:SGE) - up 16% to 1250p (£10.8bn) - Results for year ended Sep 2024 - Megan - GREEN

Spectacular results from the accounting and software company, alongside the announcement of another massive share buyback scheme have added to the momentum Sage shares have enjoyed since the election of Donald Trump. Management has also hiked expectations for next year. And with quality metrics ticking back up to their historic highs, I think this is now worthy of its lofty PE ratio.

Renold (LON:RNO) - down 6.7% to 50.2p (£112m) - Interim results - Roland - AMBER/GREEN

Full-year expectations are unchanged from this industrial chain manufacturer, but there’s underlying weakness in some core markets and increased debt from acquisitions. The shares look cheap but investors may want to consider the ongoing cash drain to service the pension deficit.

Frp Advisory (LON:FRP) - up 6% to 156p (£385m) - Half Year Trading Update - Graham - GREEN

Leaving our positive stance unchanged as FRP gives a very nice update with more than 50% of full-year revenue and adj. EBITDA already in the bag. Net cash of £13m is left after a busy period for acquisitions which has seen the company’s impressive growth trend continue. More of the same please.

Knights group (LON:KGH) - up 5% to 113p (£97m) - HY trading update - Roland - AMBER

Today’s half-year update shows a respectable 3% increase in adjusted pre-tax profit margins, lifting HY adj PBT by 26%. However, I’m wary of the scale of adjustments employed by this legal services business. I’d like to see a full set of accounts before forming a stronger view, so am remaining neutral for now.

Short Sections

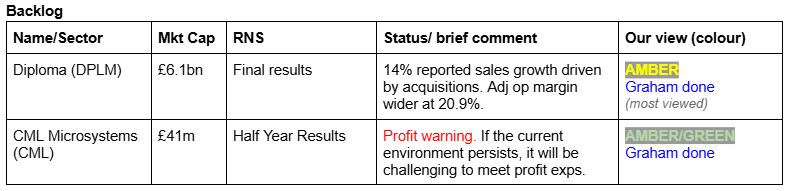

Diploma (LON:DPLM) - down 8% to £41.74 (£5.6 billion) - Preliminary Results - Graham - AMBER

This was mentioned in the comments thread yesterday, as readers noted it fell 8% despite posting what appeared to be solid results with a positive outlook for FY Sep 2025 (organic growth c. 6%, plus net growth from acquisitions announced to date of 2%, and an operating margin of c. 21%).

According to a Thomson Reuters alert, citing LSE data, the FY 2024 result was a very slight miss in terms of revenue (£1.36bn vs £1.37bn forecast). They also said that the adj. operating profit result (£285m) was below forecast, but according to their own figures that wasn’t true.

I can understand the frustration that holders might feel when a stock reacts in an exaggerated, downward fashion to results that seem absolutely fine. When this happens to a highly-rated stock, I interpret it as profit-taking: highly-rated, successful stocks tend to be sensitive to any perceived miss, however slight.

Reflecting its high quality DPLM trades on a forward PER of 25x, and has a ValueRank of only 9.

Made Tech (LON:MTEC)

Up 16% to 21.5p (£28m) - AGM Statement - Graham - AMBER

This is a busted out 2021 IPO, but its share price found a floor earlier this year:

Today’s AGM statement reports that “Sales Bookings” (the value of contracts awarded) is at £37.5m for the year-to-date, versus £36m for the entire prior year.

The board now anticipates that, as a result of these encouraging sales bookings and ongoing delivery momentum, Group revenue for FY25 will be ahead of market expectations set at the start of the financial year. Adjusted EBITDA is expected to increase as margins are maintained, and the Group continues to be on track to generate positive free cash flow in FY25.

Unlike other companies that have been at the sharp end of the new government’s tax increases, Made Tech is a supplier to the public sector and is therefore a potential beneficiary of government spending trends:

The commitment to digital transformation that the UK Government signalled in the recent Budget is expected to unlock a number of further public sector digital transformation programmes in early 2025, and in particular following the UK Government Spending Review in Spring 2025.

Graham’s view: MTEC had £8m of net cash as of May 2024, so the enterprise value is only £20m for a business with forecast revenues of £38m and forecast adj. EBITDA of £2.8m (with thanks to h2Radnor for the estimates).

Unfortunately the company’s track record of converting adj. EBITDA to real profits looks poor to me, so the best I can do for now is AMBER

Graham's Section

CML Microsystems (LON:CML)

Down 12% yesterday to 226p (£37m) - Half Year Results - Graham - AMBER/GREEN

CML Microsystems Plc which develops mixed-signal, RF and microwave semiconductors for global communications markets, today announces its unaudited results for the six months ended 30 September 2024.

I note that CML’s broker Shore Capital left forecasts unchanged, despite the following sentence in yesterday’s outlook statement:

…given the investment efforts to unlock future financial and operational gains alongside the protracted US building permit process and related costs, if the current trading environment persists, it will become challenging to meet management's full year expectations for trading profitability.

Explaining their decision not to change forecasts (an unusual one, in my view), Shore observed that “there may be opportunities in the near-term to unlock exceptional value from the Group’s non-operational property assets”. They left the revenue forecast at £24m and the adj. PBT forecast at £2.1m.

The overarching message from CML’s report was that trading was “resilient”, despite the industry-wide and macroeconomic challenges they face.

For a list of industries they serve, see here - wireless & satellite, 5G network infrastructure, internet of things, and aerospace/defence.

The headline financial numbers were:

Revenue +18% to £12.5m (H1 last year: £10.6m) but this includes £3.5m from an acquisition.

Profit from operations £0.6m (H1 last year: £1.6m).

Without the revenue gains from the acquisition, it looks like revenue would have been down 11% organically.

Cash balance: £15m. That supports a decent chunk of the market cap. Zero borrowings.

The interim dividend is unchanged at 5p (total cost to the company less than £1m).

Comment by the MD, again emphasising resilience:

The progress we've made this period despite the ongoing headwinds in some industrial markets showcases the resilience and adaptability of our business model…

While market conditions remain subdued in the near term, our ongoing investments, strategic initiatives and a strong balance sheet lay the foundations on which to build sustained, meaningful growth in the medium term.

Graham’s view

I try to be reasonable when a company is suffering temporary problems and some of the problems in this report are very likely to be temporary in nature, such as delays in getting building permits from local authorities in the United States.

“Customer inventory management” (AKA destocking) also gets a mention. CML has been talking about this for a while: see Paul’s commentary in July.

With an enterprise value now of only £22m, I’m wondering if I should upgrade this to GREEN, as a value play? Especially if those property sales materialise and bump up the cash even more, the enterprise value here could start to look very low indeed. The EV/sales multiple is already below 1x.

The shares have been under pressure for some time:

On balance, I’m inclined to leave this one at AMBER/GREEN. There is upside potential from a recovery in trading, from new product development, and/or from property sales. The cash pile helps to support a chunk of the valuation. And it is still profitable, albeit marginally so.

I think there’s more to like here than to dislike. AMBER/GREEN it is.

Churchill China (LON:CHH)

Down 27% to 600p (£66m) - Trading Update (profit warning) - Graham - AMBER/GREEN

The H2 profit warning has landed - see Paul’s commentary in September when a subdued outlook statement raised concerns that this might happen.

Unfortunately this is about as bad a profit warning as it gets, with weak trading expected to continue into 2025.

Year to September: revenue below expectations, but profit not affected as significantly. No huge surprise there; at the interim results, CHH said that markets were subdued and they were dependent on the normal seasonal uplift in the final four months of the year.

Q4 to date: “the Company has not seen the normal seasonal uplift in order intake from, particularly, the independent sector”. As a result, full-year profitability will be “materially below market expectations”.

Looking forward to 2025, the recent UK budget is named as an issue both for CHH’s customers and for CHH’s own cost base - a rotten combination.

It is anticipated that this softness in our key hospitality markets will continue into 2025 driven by the effects of the UK budget and political uncertainty in some key European markets. In addition, implications of the recent UK budget will materially impact the cost base which can only partially be offset by price increases.

The result: cost cuts at CHH, and a reduction in the profit forecast for next year, too.

Chairman comment:

"The current macro-economic uncertainty combined with significant increases in our cost base creates near term challenges. We are, however, confident that our core strategy will continue to deliver growth as markets improve."

Estimates: brokers Investec do not make their reports easily accessible to the public. The prior forecast was for nearly 80p of EPS, which was already looking optimistic before today’s profit warning:

Graham’s view

We were AMBER/GREEN up until now, on the basis that the company had a strong balance sheet with net cash (£8m as of June 2024) and net assets of £60m, including freehold property.

The market cap (£66m) is now only a little higher than net assets.

I’m therefore inclined to leave this at AMBER/GREEN, despite the profit warning. That’s not a statement about what I think might happen with the share price in the short-term, it’s more a reflection of my view that this is a fundamentally sound business with plenty of assets to see it through a period of economic weakness.

With the share price down by nearly 30% today, after quite a long period of negative momentum, I think there’s a chance that this is heading into deep value territory - and I wouldn’t want to be neutral or negative on it if that happens.

The most obvious downside risk is that higher NICs create a problem for the hospitality sector that lasts for several years, permanently reducing demand and shrinking the size of CHH’s business. After a period of high inflation and a cost of living crisis, the embattled sector is now facing a higher tax burden.

I tend to find that businesses can adapt to higher taxes, although it does take some time. Perhaps by 2026, both CHH and its customers will be comfortable with the new circumstances?

Incidentally, I would urge CHH to make a set of forecasts available to the public. With a market cap well below £100m, and a free float smaller than that, why not make it easier for small investors to access information about the company’s prospects?

Megan's Section

Sage (LON:SGE)

Up 16% to 1250p (£10.8bn) - Results for year ended Sep 2024 - Megan - GREEN

Final results from accounting software group Sage are truly fabulous.

Sales are up 9% to £2.3bn, with like-for-like numbers up across all three of the group’s operating regions.

Software subscription sales, which are recurring, now account for 81% of group revenue. And as accounting software is not the easiest thing to unravel once it’s embedded into a business, these sales are very sticky and reliable.

That means that when management says that sales in FY2025 are expected to be 9% higher (which is an improvement on previous forecasts), myself and the market have great faith that these numbers will be achieved.

As is common with software companies, cost of sales is incredibly low at Sage meaning gross margins tend to exceed 90% (92% in FY2024). But the margin number that I am especially impressed with in these numbers is operating margin.

Sales and administrative expenses fell FY24 compared to FY23, despite the massive hike in sales. That means that the company has spent less to achieve more. Operating margins are 19% - creeping back towards the 20% mark that I like to see in very high quality companies.

I also like the annual recurring revenue number which is £227m higher at £2.3bn, with £190m of that coming from new customers. The company hasn’t split out marketing and sales expenses in these numbers, but presumably they weren’t massive given the decrease in overall cost of sales.

Revenue retention is at 101%, which reflects low churn and an increase in average revenue per customer thanks to price rises and upselling new products.

Underlying earnings are 23% higher at 32.1p, ahead of previous expectations, which had been hiked slightly during the year.

These numbers also continue Sage’s strong track record of turning profit into cash. Operating cash inflows have materially exceeded operating profits in every one of the last ten years. In FY24 the company reported free cash inflows of £524m - a 30% increase on the previous year and equivalent to cash conversion of 123%.

That cash has been put to work in the business via £24m of capital expenditure (primarily invested into research and development) and £34m of acquisitions. The company also uses its cash to reward shareholders, spending £199m on dividends and £348m on share buybacks in FY2024.

The company has today announced a 6% hike to the dividend (to 20.45p) and a further £400m share buyback programme.

Megan’s view

The only thing I can find to complain about in these numbers is the fact that management hasn’t split out where it is spending its money. Otherwise, the company is fully deserving of the 16% hike in its share price following this announcement.

Overall, Sage’s shares have been trending upwards since the election of Donald Trump. As a major provider to small and medium sized businesses in the US (39% of sales come from the US), the company could be a big beneficiary of pro-business domestic policies of the incoming president.

This isn’t a value play. But with forecast earnings expectations likely to be boosted following these numbers, there could still be further gains to come.

Sage has long been one of the UK’s highest quality operators. I have grown nervous in recent years by the slight decline in operating margins and ROCE, and a stagnation in operating profit growth (despite continued revenue increases). My preference in the sector has instead been for US company Intuit (NSQ:INTU) which has reported double digit CAGR in revenues and profits over the last five years.

But Intuit is trading on an even greater earnings multiple to Sage and if the British company can start generating the same sort of results as its US counterpart, it could be rewarded with multiple expansion as well. GREEN.

Frp Advisory (LON:FRP)

Up 6% to 156p (£385m) - Half Year Trading Update - Graham - GREEN

FRP Advisory Group plc, a leading national specialist business advisory firm, announces a trading update for the half year ended 31 October 2024 ("H1 2025").

This is a confident update, with FRP expecting to meet full year expectations for FY April 2025 (revenue £146.7m, adj. EBITDA £39.5m).

Some bullet points:

H1 revenue +32% to £77.6m (23% organic growth, 9% growth from acquisitions)

Underlying adj. EBITDA +44% to £22.3m

I note that the company has already achieved more than 50% of full-year expectations in terms of both revenue and adj. EBITDA.

Restructuring

I tend to associate FRP’s name with financial trouble (at other companies) and there has been no shortage of trouble in recent months.

FRP worked on the restructuring of the Body Shop in H1. Then in the run-up to the Budget, there was “a spike in the number of solvent liquidations”, due to uncertainty and economic stagnation in advance of that Budget.

The topic du jour is the Budget’s hike in National Insurance contributions, and they are again relevant here:

The increase in employers' National Insurance Contributions announced in the recent budget is likely to put further pressure on businesses with large workforces and lower margins. The retail and hospitality sectors in particular, which were already navigating post-Covid debt service and other inflationary cost pressures, are expected to face additional financial challenges.

Corporate Finance & Debt Advisory: the pipeline of new opportunities is “solid”. Three acquisitions were made during H1 (two in corporate finance, one in debt advisory).

Forensic Services: “relatively buoyant… especially in litigation and contentious insolvency related matters”.

Financial Advisory: this also saw an increase in pre-Budget activity.

Net cash at the end of October was £13m, down from £39m as of April 2024. As we noted above, a number of acquisitions took place during H1.

CEO comment:

FRP has delivered another strong performance in the first half of the year, reporting increased revenue and profits. In line with our proven strategy, we continued to be acquisitive, strengthening the Group with four acquisitions across three of our service pillars. In doing so, we have enhanced our offering and are even better positioned to provide optimum solutions for our clients.

"I am confident that we will make further progress in the remainder of the year, as we support corporates through the entire business cycle."

Graham’s view

As with Begbies Traynor (LON:BEG) I think there is an argument to hold these shares from the point of view of providing some counter-cyclical exposure: a hedge against economic weakness.

It hasn’t all been plain sailing but the shares are approaching highs that have not been seen in nearly two years:

As an investment category, the professional services sector always makes me nervous due to its labour intensity - companies in this sector don’t strike me as likely compounders of value. But I’m happy to leave our GREEN stance on FRP unchanged for a variety of reasons:

Excellent H1 numbers leave them well-placed to hit (maybe exceed?) full-year forecasts

Valuation is not demanding at 14x earnings, but do watch out for the adjustments that will be made to the headline figures.

The company tends to run a net cash position and not to over-extend itself, despite its active acquisition strategy.

So I think I can leave this one GREEN with a healthy conscience.

Roland's Section

Renold (LON:RNO)

Down 6.7% to 50.2p (£112m) - Interim results - Roland - AMBER/GREEN

Underlying full year expectations unchanged

This morning’s half-year results from industrial chain manufacturer Renold seem broadly reassuring at first sight. However, they’ve been cautiously received by the market and I think they may flag up some potential concerns.

While full-year expectations have been left unchanged, I think today’s numbers highlight the sluggish top line growth I mentioned when I last looked at the shares in September.

H1 results summary: the company describes today’s results as resilient, with improved margins, despite ongoing market uncertainty:

Global markets continue to be uncertain, with activity levels in both mainland Europe and China recovering more slowly than initially anticipated. However, material and labour cost inflation is now reducing.

Revenue for the six months to 30 September rose by 0.6% to £123.4m on a constant currency basis, while adjusted pre-tax profit was flat at £11.3m.

On an adjusted basis, operating margin improved to 12.3% (H1 24: 12.0%). Adjusted earnings for the half year rose by 10.5% to 4.2p per share.

However, results at a statutory level were somewhat weaker. Operating profit fell by 17% to £13.4m while interim earnings dropped 25% to 3.3p per share.

The difference between the two was driven by costs relating to acquisitions (£1.2m) and amortisation charges (£0.6m). While I recognise that some of these are one off in nature, Renold has made regular acquisitions in recent years.

In my view, excluding all of these costs may be unduly flattering to results – but as always, this is an individual decision for investors.

Spain flooding: the company says that its YUK manufacturing facility in Valencia (acquired in 2023) was affected by recent flooding. The financial impact is expected to be c. £10.5m. The majority of this is expected to be recovered from insurance, except for a c.£1m deductible.

Fortunately, Renold’s logistics facility in the region was unaffected – this accounts for 70% of the group’s business in Spain.

The company does not “expect any medium term material impact” from the flooding.

Chain division: this is the company’s larger business, accounting for nearly 80% of revenue and a similar proportion of profit.

The acquisition of Canadian company Mac Chain (see here) was completed on 9 September, around three weeks prior to the end of the half year.

The company says that Mac contributed £1.2m of revenue during the period and is performing in line with expectations.

However, without this bought-in growth, the group’s Chain division would have reported a drop in revenue for the period, even at constant currencies:

The main area of weakness was in Europe, where Chain sales fell by 1.8% at constant currency. Softness in Germany and Switzerland was blamed.

Disappointingly, the company decided not to share actual figures for these markets, even though positive figures for other countries (UK +4.6%, France +17.7%) and other regions (Americas +0.9%, Australasia +20.4% and India +17%) were included.

This leads me to think that the fall in sales in Germany and Switzerland may have been quite severe.

Reassuringly, order intake for the chains division increased by 4.8% at constant currency to £92.6m.

Torque Transmission: performance in this division also benefited from forex tailwinds, with revenue at constant currency up 2.8% to £29.6m. On an equivalent basis, divisional operating profit rose by 11% to £5.1m, giving an improved 17.2% operating margin (H1 24: 16.0%).

The company says that growth in the US, Chinese and French markets offset weakness in Spain.

Long-term military contracts are said to be continuing as expected, supporting the increase in profitability.

Order intake was boosted by a £10.6m order for the Royal Canadian Navy. Excluding this lumpy deal, order intake at constant exchange rates rose by 3.6% to give a closing order book for this division of £43m.

Balance sheet & cash flow: net debt rose by £13.9m to £42.2m during the half year, due largely to a £22.2m outflow relating to the acquisition of Mac Chain (a further £2.4m is deferred).

This level of debt gives a multiple of 1x EBITDA which looks manageable to me, albeit not ideal given the increased cost of debt – finance costs totalled £3.9m for the half year.

The pension deficit is also a significant factor here. Although the deficit fell slightly to £52.7m during the half year, cash payments in the UK and Germany are expected to total £6.9m this year. That’s equivalent to almost 30% of forecast pre-tax profit!

Finance and deficit reduction payments eat into a company’s free cash flow. In this case, I think the deficit contribution explains why the dividend is expected to be held at just 0.5p (covered 15 times by earnings!):

Free cash flow: my sums suggest underlying free cash flow of £4.8m for the half year, equivalent to 74% conversion from net profit of £6.5m. I think the main reason conversion isn’t greater is the cash outflow to pensions, which isn’t reflected in the income statement.

Outlook: Renold’s order book at the end of the half year was £80.8m, down slightly from the “historic level” of £83.6m reported at the end of September last year.

Full-year guidance has been left unchanged:

Board remains confident of delivering underlying full year results in line with market expectations

With thanks to broker Cavendish, I can see that earnings forecasts for the year to 30 March 2025 are unchanged at 7.5p per share. This prices Renold on a P/E of 6.7 with a 1% dividend yield.

Roland’s view

I think Renold is a good business that’s probably reasonably priced. I would hope to see a cyclical recovery over time.

However, I can’t ignore the underlying weakness in revenue, increase in debt and hefty cash outflows to address the pension deficit. In my view, these factors justify a relatively modest rating for this stock, despite some strong quality metrics:

When I last looked at the shares in September, I went GREEN. Having considered today’s results I’m inclined to moderate my view slightly to AMBER/GREEN to reflect the apparent weakness in some core markets and the increased leverage on the balance sheet.

Knights group (LON:KGH)

Up 5% to 113p (£97m) - HY trading update - Roland - AMBER

Confident in delivering a FY performance in line with market expectations

Legal services business Knights Group drew an AMBER rating from Paul when he considered the company’s full-year results in July.

Today’s trading update covers the six months to 31 October 2024 and appears positive and highlights a substantial improvement in profit margins.

While revenue for the first half of the year is expected to have risen by 5.4% to £79.4m, Knights expects to report a 25.9% increase in underlying pre-tax profit to £14.6m.

This reflects a 3% increase in pre-tax profit margin to 18.4% (HY24: 15.4%, HY23: 12.6%).

This is certainly an impressive progression in margins, but I think there are a couple of points to consider here.

Profit adjustments: these are adjusted profit figures. As Paul highlighted in his review of last year’s results, this company is quite an aggressive adjuster. Last year’s pre-tax profit of £14.8m was translated into an underlying pre-tax profit of £25.3m:

I imagine that this year’s statutory profit figures will be similarly lower. This may not affect the scale of the margin improvement, but it does impact the actual level of profitability and the valuation of the stock.

For example, last year’s reported pre-tax margin was 9.9%, versus an adjusted PBT margin of 16.9%.

For context, Knights Group is a serial acquirer of legal businesses. From what I understand, the majority of the charges that are adjusted out of the underlying PBT figure (see above) probably reflect actual cash costs.

Personally, I’m not comfortable excluding these costs from my view of profits. So I’d probably want to wait for the half-year results before drawing too many conclusions about Knights’ improved profitability.

Balance sheet & acquisitions: net debt rose to £50.1m during the half year (Apr 24: £35.2m), reflecting £8.9m of acquisition-related outflows. The company has secured an increase in committed debt funding from £70m to £100m, providing further headroom for acquisitions.

The current level of debt looks manageable to me, but I’d note that debt is being drawn down for deferred consideration as well as new deals. This suggests that cash flows from the acquired businesses are not fully funding deferred payouts.

On a similar note, there was a slight increase in debtor days to 33 days (H1 24: 31 days).

Outlook: I don’t have access to any updated broker notes today, but consensus forecasts ahead of today’s update suggested adjusted earnings of 23.7p per share for the current (FY25) financial year.

This estimate would price Knights shares at less than five times forecast earnings, with a well-supported 4.5% dividend yield.

However, I estimate that my preference for using reported earnings would be likely to give a P/E ratio closer to 10-11. This is more consistent with the 4.5% dividend yield, too. To me, this suggests the market may already be pricing the stock fairly, based on real distributable earnings.

Roland’s view

Today’s update seems broadly positive and suggests the company’s quality metrics may be improving.

However, given the company’s approach to profit adjustments and its rising debt, I’m wary about drawing too many conclusions from today’s update.

My feeling is that the shares are probably quite reasonably priced, and perhaps offer some value at this level.

Without seeing a fresh set of accounts, I don’t have a strong conviction here, so I’m going to maintain our view at AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.