Good morning! Hoping for another batch of "ahead" updates, but yesterday will be hard to beat...

Today's Agenda is complete.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Rio Tinto (LON:RIO) (£103bn | SR77) | Copper production +11% in 2025, ahead of guidance. Pilbara iron ore flat. Aluminium production +3% (upper end of guidance). 2026 production guidance unchanged. | ||

Experian (LON:EXPN) (£29.6bn | SR62) | Q3 revenue +12% (+8% organic), in line with expectations. FY26 expectations unchanged. | AMBER/GREEN (Roland) [no section below] This credit data company is the top faller in the FTSE 100 today. It’s also down by 25% over the last six months. It’s a business I’ve always admired, but not been willing to pay the price for. So I’m interested to see if a buying opportunity could be opening up. At first glance, today’s reaction seems harsh in response to Q3 organic revenue growth of 8%. From what I can see, the market’s disappointment today appears to reflect the in-line guidance and potential external pressures on the business, in the US in particular. Newswire commentary suggests falling interest rates could support a recovery in lending (positive), while possible negatives include a new US programme allowing mortgage lenders to access credit scores directly without using companies such as Experian. I don’t have a strong view on the near-term outlook but remain convinced this is a high-quality business that’s likely to perform well over longer periods. The valuation is starting to look potentially interesting to me, too. The StockReport suggests a trailing free cash flow yield of 3.6% and FY26E P/E of 24. I’m not quite there yet on price, but if Experian shares continue to fall with no downgrade to forecasts, I think the stock could come onto my radar as a possible long-term buy. | |

Pearson (LON:PSON) (£6.0bn | SR73) | £350m share buyback programme. First tranche of £175m to complete by 21 May 26. | ||

ICG (LON:ICG) (£5.9bn | SR82) | Fee-earning AUM of $85bn, +1% QoQ, +11% YoY. $36bn of dry powder, completed $4.4bn fundraising. | ||

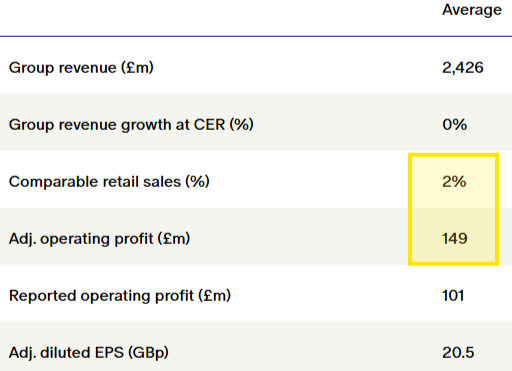

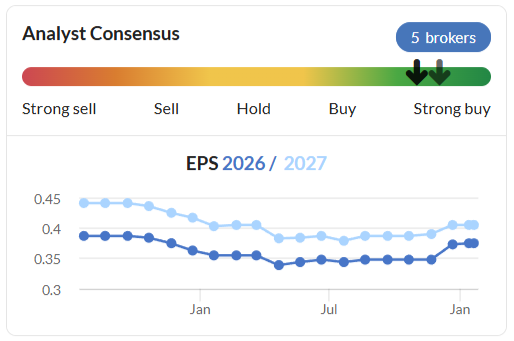

Burberry (LON:BRBY) (£4.4bn | SR57) | Q3 revenue +1% to £665m. Comparable store sales +3%. Expected FY26 adj operating profit to be in line with consensus of £149m. | AMBER = (Graham holds) Forecasts in the market suggest that profitability is about to bounce back next year, with earnings per share of nearly 40p pencilled in for FY March 2027 (the financial year starting in less than two months). From that perspective, the P/E multiple is 32x. | |

British Land (LON:BLND) (£4.1bn | SR66) | Strong leasing momentum, with 151 deals averaging 8.5% ahead of ERV. FY26 expectations unchanged for adj EPS of at least 28.5p. | ||

Aberdeen (LON:ABDN) (£4.0bn | SR90) | AUMA +9% to £556bn, with positive market movements offsetting net outflows of £3.9bn. FY25 adj operating profit to be in line with expectations. FY26 adj op profit to be at least £300m. | ||

JD Sports Fashion (LON:JD.) (£3.9bn | SR78) | Q4 revenue +1.4% (-1.8% LFL). YTD revenue +2.2% (-2.1% LFL). Improved sales in NAm, weaker in Europe and UK. FY26 adj PBT to be in line with market exps, expect free cash flow of c.£400m. | ||

Hochschild Mining (LON:HOC) (£3.1bn | SR74) | FY production in line with revised guidance. Gold equiv. -10.5% to 311.5koz. AISC “marginally above” guidance of $1,980-$2,080/GE oz. 2026 guidance 300-328k GE oz with AISC of $2,157-$2,320/GE oz. | ||

Drax (LON:DRX) (£3.0bn | SR99) | Acquired Flexitricity Limited from Quinbrook for £36m. Provides optimisation and route-to-market for flexible energy assets (e.g. battery storage). | ||

Quilter (LON:QLT) (£2.6bn | SR85) | Q4 AUMA of £141.2bn, +5% vs Q3. Q4 core net inflows of £2.4bn, FY25 core net inflows of £9.1bn. | ||

Premier Foods (LON:PFD) (£1.47bn | SR79) | Strong Christmas, Q3 Branded revenue +5.2%, total revenue +4.1%. Expect FY trading profit at upper end of expectations (£193.0 to 198.2m). | AMBER/GREEN = (Roland) Today’s update suggests continued good progress across the group’s core UK brands and its newer growth initiatives. My overall impression is positive, with the caveat that this isn’t a business I’d want to pay a very high multiple for. It’s also worth noting that the company’s house broker – presumably well-informed – does not see the need to change its forecasts today, as they were already close to updated guidance. On balance, I don’t see any reason to alter our broadly positive view today. | |

Currys (LON:CURY) (£1.39bn | SR96) | Peak LFL revenue +6%, H1 revenue +4% LFL. Gross margin improvements. Adj pre-tax profit to be £180 to 190m, ahead of consensus exps of £180m. | GREEN = (Graham) No reason to change my stance after an "ahead" update. The shares continue to trade on a PER of 10x and I don't object to the company buying back its own shares at this level. While they might not be buying back at a very steep discount to fair value, I still view this as a reasonable use of surplus cash and something that can help contribute to EPS growth over the medium-term. Also, I think this strong update says a lot about robustness of the UK consumer, with modest like-for-like growth from Currys UK&I division. | |

Elementis (LON:ELM) (£940m | SR68) | 2025 revenue to be in line, adj operating profit “marginally ahead” of consensus. | ||

J D Wetherspoon (LON:JDW) (£824m | SR49) | LFL sales +4.7% in 25 weeks to 18 Jan, total sales +5.3% YTD. Costs higher than expected, H1 profit likely to be lower than last year, currently anticipates FY profit “slightly below” FY25. | AMBER/RED ↓ (Graham) Downgrading our stance on this by one notch after a mild profit warning that comes on the back of another cautious trading announcement in November. With operating expenses increasing all the time and margins naturally very low, this continues to look vulnerable to more bad news. | |

Workspace (LON:WKP) (£793m | SR49) | Enquiries lower in Q3, but letting conversion improved. LFL occupancy +0.9% to 81.2%, with LFL rent/sq ft -1.4%. £106m of disposals secured. Trading in line with expectations. | ||

Serica Energy (LON:SQZ) (£774m | SR91) | 2025 production -20% to 34,600 boepd, in line with guidance. Revenue -17.3% to $601m. Net debt $200m at 31 Dec 25. 2026: expect production “over 40,000 boepd”, with the potential to reach 65kboped following completion of recently announced acquisitions. | ||

Volex (LON:VLX) (£756m | SR90) | 9M revenue +14.8% to $902.7m, benefiting from Data Centre demand. FY26 revenue and adj operating profit now expected to be ahead of consensus ($1,152.3m & $112.7m, respectively). | AMBER/GREEN = (Roland) Volex appears to be executing well and profiting from the AI Data Centre boom. While performance in other parts of the business appears to have been flatter in Q3, I continue to think that the outlook and valuation are broadly positive, so my view remains unchanged today. | |

Galliford Try Holdings (LON:GFRD) (£528m | SR95) | Trading ahead of the prior year, and the Board's expectations. Now expects full-year revenue to be towards the upper end of expectations and for adjusted profit before tax to be slightly above the top end of expectations (current range: £46.8m to £47.7m). Average month-end cash for 2025 was £189.9m. Strong pipeline of medium and long-term opportunities. Panmure Liberum FY26E EPS +4.3% to 36.8p Cavendish FY26E EPS +9.1% to 40.2p | AMBER/GREEN = (Roland) [no section below] In October, I suggested that “the shares could still be reasonably valued”. One area where I may have underestimated growth potential is the “significantly enlarged AMP8 water framework programmes”. The company’s focus on infrastructure is said to be aligned with Government spending plans and should provide decent long-term visibility. Today’s upgrade is relatively mild, but has pushed FY26E EPS forecasts up by between 4% and 9%, depending on which broker estimate you use (see left). Changes to revenue forecasts are much smaller, suggesting to me that the bulk of today’s upgrade is driven by the business achieving stronger margins than expected so far this year. I remain positive but somewhat cautious, given the low-margin nature of this business – hence my view is unchanged today. | |

Everplay (LON:EVPL) (£486m | SR57) | Adjusted EBITDA for FY 2025 in line with current market expectations (£48.5m). Exited a low-margin distribution business, which is a headwind to revenues. Revenues therefore broadly flat and below expectations. “New release line up for 2026 is set to be one of everplay's most exciting and extensive to date.” | BLACK (revenue warning only, adjusted EBITDA in line. £173.6m revenuew was expected, actual revenue will be broadly flat on last year’s £167m). | |

Avacta (LON:AVCT) (£231m | SR24) | FDA clearance of the Investigational New Drug (IND) application for the Company's second program FAP-Exd (AVA6103), the first pre|CISION® peptide drug conjugate based on the highly potent topoisomerase I inhibitor, exatecan. | ||

Kenmare Resources (LON:KMR) (£227m | SR47) | Achieved production guidance. Capital expenditure will be significantly reduced in the year ahead. Primary operating focus for 2026 will be on value over volume. Annual production guidance for 2026 is therefore lower than in recent years. Further reduction in pricing assumptions to cause an impairment charge that is not anticipated to exceed $300 million for the year. | ||

City of London Investment (LON:CLIG) (£197m | SR97) | Cooper Abbott was President and Chairman at Carillon Tower Advisors which he founded and built into a $70+ billion global asset management company. | ||

Avingtrans (LON:AVG) (£179m | SR79) | H1 trading to 30 November 2025 was in line with management expectations. “We remain confident in our ability to meet market expectations for FY26…” | ||

Foxtons (LON:FOXT) (£155m | SR54) | Acquisition builds on the Group's strategy to grow non‑cyclical, recurring Lettings earnings whilst also expanding the Group's footprint into Birmingham. Initial consideration of £3.2m, with a further £0.8m deferred. FleetMilne’s recent revenue and PBT were £1.5m and £0.2m. | ||

KEFI Gold and Copper (LON:KEFI) (£148m | SR35) | Final documentation with respect to the US$240M Loan Facility is fully signed. $100m of equity-risk capital is undergoing final documentation. Additional offerings which are “not dilutive at the plc or asset level” for $36m are being considered. Following the December placing, a number of works related to the Tulu Kapi Gold Project have commenced or advanced this month. | ||

AFC Energy (LON:AFC) (£137m | SR13) | Completion of the first build of new generation LC30 30kW liquid-cooled fuel cell generator. Now undergoing operational testing and producing power in accordance with its design specification. | ||

Shield Therapeutics (LON:STX) (£119m | SR36) | In line with guidance, achieved positive operating cash flow in Q4 2025 (“a significant milestone”). FY25 total revenues c. $50m ($32m in FY24). ACCRUFeR® contributed $46m of this and saw 21% growth in average net selling price to $223 and 33% growth in total prescriptions to c.199,000. | ||

Journeo (LON:JNEO) (£84m | SR87) | Revenues for FY25 of £55m (2024: £50m), with adjusted PBT slightly ahead of market expectations at £5.7m (2024: £5.0m). “We enter 2026 with confidence in delivering on another year of significant growth.” Cavendish updated forecasts: | GREEN ↑ (Roland) [no section below] Today’s ahead update is Journeo’s third broker upgrade in four months. The company is effectively telling us that Journeo’s adjusted pre-tax margin for the year is now expected to be 10.4%, versus 10.0% previously. This improvement in profitability outweighs the slight downgrade to revenue guidance, which is cut from £56m to £55m. My reading of this is that costs have come in slightly lower than expected for some reason. This is obviously good news, although I’d be more excited if revenue was also being upgraded as that would indicate a potential increase in sales growth. Stripping out the year-end net cash balance of £12m gives me a cash-adjusted FY25E P/E of 15, falling to a P/E of 12 in FY26. I don’t think this looks too expensive for a business that’s generating high-teens returns on capital and is expected to report 25% earnings growth in 2026. I’m going to take a chance today and upgrade our view to be fully positive. | |

Andrada Mining (LON:ATM) (£79m | SR26) | Conditional, staged earn-in agreement. ACAM could provide up to $51 million in staged funding to accelerate the exploration and development of the Brandberg West polymetallic prospecting licence. | ||

1Spatial (LON:SPA) (£76m | SR26) | 73p per share in cash. 57% premium. Follows on from the announcement of an agreement in principle in December. Irrevocable undertakings and non-binding letters of intent to vote in favour for 52.45% of shares. | PINK | |

Ilika (LON:IKA) (£66m | SR19) | First revenue-generating purchase order from Cirtec Medical (Cirtec) for the supply of Stereax electrodes, marking the commercial transition of this strategic partnership. | ||

Getbusy (LON:GETB) (£42m | SR38) | Group ARR +8% (cc) to £22.6m. Revenue at least £22m (+ 5% cc) and adjusted EBITDA £0.3m, in line. Net cash £0.9m. Company “well positioned to deliver material cash returns to shareholders in the medium term”. | ||

Headlam (LON:HEAD) (£37m | SR32) | Full year results in line with expectations, with trading in the final months of 2025 having been as expected. | ||

Tan Delta Systems (LON:TAND) (£24m | SR25) | 2025 revenue is expected to be c. £1.2m, 20% ahead of management expectations as of Sep 2025. Cash c. £1.5m with no debt. 2026 pipeline of interest remains strong. |

Graham's Section

Currys (LON:CURY)

Up 5% to 132p (£1.47bn) - Profit guidance above market expectations - Graham - GREEN =

It’s an excellent trading update from this retailer that has impressed us so much over the past year or so, covering the 10-week period to 10th January 2026 (referred to as “Peak”).

Key points:

Like-for-like revenue growth accelerated to 6%

UK +3% with progress across the board in recurring service revenue (+7%) credit adoption up to 25%, B2B sales +21% and new categories +42%.

Nordics +12%, “a standout performance” (important because Nordics are 40% of the total group).

Market share gains in both the UK and Nordics.

Outlook (bearing in mind that year-end is in April):

Group adjusted profit before tax is expected to be £180-190m, +11-17% YoY and ahead of consensus expectations

£50m share buyback programme underway, bringing total cash returned to shareholders to c.£75m for the year.

Expect year end net cash to finish above £100m target

The £50m buyback is not news - it has been going on for a while.

The big news is of course the “ahead of consensus” PBT. The company helpfully points out that the consensus forecast is £180m, and that is now the lower bound of official guidance.

Clear and detailed guidance is provided on a range of important inputs such as interest and capex, but these are largely unchanged.

CEO comment snippets:

"Our Omnichannel model is winning. We gained market share in both UK&I and Nordics, in both stores and online, and our fastest growth was where customers use both channels together. This is a competitive advantage we'll keep building....

In the UK&I, we grew sales in our core business and the growth areas we've targeted. Our sales to small and medium-sized businesses grew by +21%, iD mobile reached 2.5 million customers, and credit adoption of 25% was double that of five years ago. These are all sources of higher-margin and recurring revenue. We maintained healthy underlying gross margins which, alongside cost savings, are offsetting unhelpful cost headwinds."

Longer-term guidance: there is an unchanged target EBIT margin (3%), capex is to remain below £100m annually, and exceptional cash costs should be kept below £10m for the upcoming financial year FY April 2027. All of this sounds fine.

Pension contributions will be £13m per annum for five years, starting next year.

Balance sheet net cash is to remain over £100m: this is excellent. I wish more retailers were as careful as this!

Grahams’ view

Over the years, we’ve seen so many mishaps in the retailing sector, that I am sometimes tempted to avoid it completely. But there are exceptions.

Over the last year, we’ve been very positive on Currys (LON:CURY). Originally, around the time that higher NICs were announced, I was impressed by management’s transparency.

Since then, they’ve continued to report with what I perceive to be a very high degree of clarity and transparency, which definitely helps to inspire confidence in their strategy.

Additionally, they’ve run a cash-rich balance sheet, which I see as a form of insurance policy against macro conditions (and well worth it).

My positivity is aligned with what the StockRanks are saying:

The shares continue to trade on a PER of around 10x and I don’t have any major objection to the company buying back its own shares at this level - perhaps they aren’t buying at an enormous discount to fair value, but I’d still argue that it’s a reasonable use of surplus cash.

Overall, then, no reason to change my positive stance after an “ahead” update. And we have yet another good reason to think that the UK consumer is not so weak after all!

Burberry (LON:BRBY)

Up 5% to £12.84 (£4.6 billion) - Third Quarter Trading Update - Graham - AMBER =

At the time of publication, Graham has a long position in Burberry.

I’ve been holding this through thick and thin, and it hasn’t been pleasant:

Fortunately there are some green shoots of recovery with this trading update. Importantly, the operating profit outlook is in line with consensus expectations.

Key points:

Retail revenue +3% at constant exchange rates, +1% at actual exchange rates.

Comparable stores sales +3% (compared to -4% last year)

Best performance in Greater China (6%) and Asia Pacific (+5%)

EMEIA region flat (Europe, Middle East, India and Africa!)

Americas +2%

For a company that has been on the back foot for some time, this is not a bad showing during the important Q3 period.

Also, the “quality of revenue” is said to have improved, with a “shorter, shallower and more discreet markdown period”.

The CEO comment strikes a triumphant tone:

During the festive quarter, we continued to build momentum with our Burberry Forward strategy, delivering sequential improvement in comparable sales growth and an improved quality of revenue across channels and geographies. Our customers responded to our immersive Timeless British Luxury campaigns and experiences while the continued strength in our core outerwear category is now extending into accessories and ready-to-wear. As we move into 170 years of Burberry, these results reaffirm the enduring strength of our iconic brand and give us confidence in the path ahead.

FY26 outlook:

As we move into the final quarter of the year, the impact of our initiatives continues to build, giving us increased confidence in the direction of the business. We expect adjusted operating profit to be in line with consensus for FY26*. We are confident that we can build on the progress we’ve made in quality of earnings, continuing to improve performance and driving sustainable long-term value.

Estimates: for a stock in the FTSE-100 (although it was temporarily dumped from this index last year), you expect decent information from the company itself re: estimates. Burberry provides:

Graham’s view

Unfortunately, the adjusted EPS figure for FY March 2026 doesn’t give rise to a sensible P/E ratio (the latest stock price is £12.84, vs. adjusted earnings per share of only 20p!).

As I noted in November, the stock is already pricing in a recovery of profits to more than double the current level. As I said then, we would realistically need clean after-tax profits over £200m+ to justify the current market.

Forecasts in the market do suggest that profitability is about to bounce back next year, with earnings per share of nearly 40p pencilled in for FY March 2027 (the financial year starting in less than two months).

From that perspective, the P/E multiple is a much more sensible 32x.

Even though I’m a holder of this stock, I’m inclined to leave our neutral stance unchanged here. Today's update is merely "in line", after all. And we will still need further progress in FY28 to justify the current market cap. There is plenty that could go wrong between now and then (if I’m not careful, I’m going to talk myself into selling out!).

So while I still count myself as an admirer of this business, I think caution remains justified.

The StockRanks agree, seeing little value to back it up at this level:

J D Wetherspoon (LON:JDW)

Down 6% to 691.2p (£763m) - Trading Update Announcement - Graham - AMBER/RED ↓

This one is always a bit of a guessing game, as we decipher the words of Sir Tim Martin. He tends to speak very plainly when it comes to his view of the government, but his company outlook statements can be rather cloudy.

Here are the key points from today’s update, for the 25 weeks to 18th January (roughly speaking, H1):

LfL sales +4.7%, which is better than we saw in Q1 (3.7%), as Q2 saw LfL sales up 6.1%.

Bar sales +6.9%, food +1.3%, slot/fruit machines +9.1%.

Total sales are only a little higher than LfL sales at 5.3%, as the estate is barely growing.

All of this is fine, but the big issue is costs, not sales.

Let’s hand it over to the Chairman:

"We are pleased with the sales growth in the financial year, and with the increased momentum in the second quarter.

"Costs have been higher than anticipated, with energy, wages, repairs and business rates, for example, increasing by £45 million in the first 25 weeks.

"Profits in the first half are likely to be lower than the comparable period in the previous financial year.

"If the current sales momentum continues, the company currently anticipates a full year trading outcome slightly below that achieved in FY25.

"We will provide updates as we progress through the financial year."

Graham’s view

Funnily enough, I don’t think the profit outlook published today is all that bad, compared to current estimates.

Last year, adjusted PBT was £81.4m, and adjusted operating profit was £146.4m.

I think that current forecasts already suggest that FY26 results will be similar to, or slightly below, these numbers.

But perhaps what has really spooked the market is the disclosure of £45m of additional costs across the four categories mentioned (energy, wages, repairs and rates).

It’s a reminder of just how operationally leveraged this business is. On sales of £2.2 billion+, earning a net profit margin of about 3%, these hikes in expenses could have a disproportionate impact on profits at some point.

That’s what I’ve been worried about, although I don’t see today’s update as a vindication of my stance.

But I am going to reduce us down to AMBER/RED, seeing as it comes on the back of another cautious trading update in November (which we categorised as “BLACK” that day). It appears that this stock remains vulnerable to more bad news.

Roland's Section

Volex (LON:VLX)

Up 6.5% at 435p (£822m) - Trading Update - Roland - AMBER/GREEN

Booming demand for AI Data Centres has allowed cabling manufacturer Volex to upgrade its full-year guidance today.

The company says that revenue and underlying operating profit for the full year are now expected to exceed previous consensus forecasts of $1,152.3m and $112.7m respectively.

By the numbers:

Strong trading reported in H1 continued into the company’s third quarter, which saw revenue rise by 14.8% on a constant currency basis. CEO Nat Rothschild says the company’s Data Centre business saw “elevated demand”, reflecting global investment in AI and digital infrastructure.

Growth from other industrial customers was said to be robust, with flatter performances in other markets such as Electric Vehicles, Medical and Consumer Electricals.

Operating margins are said to have remained strong, “around the upper end of the group’s 9-10% target range”. This result has been supported by price rises, cost control and efficiency gains.

Net debt is also said to have fallen, with covenant leverage now around 1.0x. This appears to address a concern I flagged in November.

Improved Outlook for FY26

With the year end approaching in March, Volex now has sufficient visibility to upgrade guidance:

With good momentum into the final quarter, we now expect to exceed current market expectations, thereby giving increased confidence in achieving our five-year plan targets.

Volex helpfully provides details of FY26 consensus forecasts in today’s update:

Revenue: $1,145.1m to $1,167.4m (average: $1,152.3m);

Underlying operating profit: $111.7m to $114.9m (average: $112.7m).

We already know that brokers upgraded forecasts following November’s half-year results:

Today’s upgrade should extend this positive trend. While I don’t have access to any updated broker forecasts this morning, the c.7% share price rise this morning suggests to me that we could see full-year results perhaps 5% above previous estimates.

Based on Stockopedia’s FY26 consensus earnings of 37.5 cents per share, I’d estimate updated forecasts could be 39-40 cents per share, equivalent to a FY26E P/E of 15.

Roland’s view

I highlighted Volex as a UK-listed beneficiary of the AI data centre boom in our Stockopedia Panel discussion at November’s Mello. The company reported an 80% rise in Data Centre-related sales during H1, driving 48% revenue growth in its Complex Industrial Technology division.

Q3 sales growth appears to be a little more measured than this, but was still strong. My impression from today’s update is that Data Centres were the only substantial area of growth during the quarter.

I continue to see both risk and opportunity here. While demand for Data Centre products remains strong, Volex seems well positioned to benefit.

However, weaker sales performances elsewhere highlight the risk of a slowdown at some point.

In November, I concluded that the valuation and outlook were both broadly positive. That view is unchanged today, so I’m going to remain at AMBER/GREEN.

Premier Foods (LON:PFD)

Up 6% at 179p (£1.57bn) - Q3 Trading Update - Roland - AMBER/GREEN =

The maker of brands such as Mr Kipling and Bisto is the top riser on the Main Market this morning after a strong Christmas trading update. Full year trading profit is now expected to be at the upper end of expectations.

By the numbers:

Q3 branded revenue up 5.2%, total revenue up 4.1%

Grocery Branded revenue up 5.8%, Sweet Treats Branded revenue up 3.1%

Market share gains in Grocery and Sweet Treats

Revenue from new categories up by 29%

International revenue up 10%

Recent acquisitions delivered double-digit sales growth

Why it matters:

As we’ve discussed recently, Tesco reported sales growth of 3.8% over the comparable period, while Sainsbury’s managed 4.9%.

This means that Premier Foods’ performance appears to have broadly matched that of its supermarket customers.

In the Grocery category, which includes Christmas staples such as Paxo, Bisto and Ambrosia, it looks like Premier Foods’ sales may have been ahead of the biggest supermarkets.

Double-digit sales growth from recent acquisitions such as FUEL10K and Merchant Gourmet is also encouraging. In addition to providing evidence of the company’s successful approach to buy-and-build, these brands (which sell various high protein/fibre products) are also seen as having good potential in the weight-loss drug era, as consumers seek out healthier products.

While International revenue remains below 10% of the group total (as of H1 26), my feeling is that this could be a promising route for growth beyond the natural limit the company’s UK-centric brands are likely to face in their home market.

Outlook & Broker Estimates

Outlook guidance for the year to March 2026 is upbeat:

Trading profit for the FY25/26 financial year is now expected to be at the upper end of market expectations.

Premier Foods helpfully cites previous market expectations for trading profit (adjusted operating profit) as being £193.0m to £198.2m, with an average of £195.3m.

This is already a fairly narrow range. This suggests to me that any upgrade to broker estimates will be fairly modest.

Indeed, house broker Shore Capital has left its FY26 forecasts unchanged today, commenting that its estimate for a trading profit of c.£197m is already “broadly within that guided zone”.

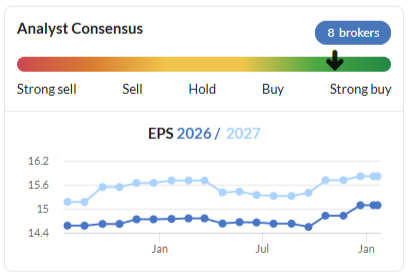

On this basis (and given its status as the house broker), it seems logical for me to use Shore’s earnings forecasts as a guide to updated expectations:

FY26E adj EPS: 15.0p

FY27E adj EPS: 15.5p

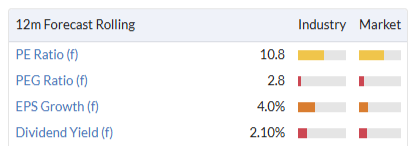

These numbers are already similar to the consensus numbers on the StockReport and leave Premier Foods trading on a FY26E P/E of 12 after this morning’s gains.

Roland’s view

After a strong four-year run, Premier stock has cooled recently:

Despite this, earnings estimates were already moving higher before today’s update:

Assuming limited increase to EPS estimates, today’s share price gain means investors have re-rated the stock modestly higher. The P/E of 12 implied by Shore Capital’s latest forecasts compares to a P/E of 11 prior to today:

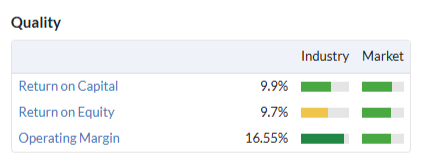

A QualityRank of 87 is encouraging, supported by mid-teens operating margins. But Premier Foods’ return on capital employed of <10% is a reminder that this is a relatively capital-intensive manufacturing business:

I would imagine that pricing will always be under pressure from the group’s much larger supermarket customers, too.

For these reasons, I wouldn’t want to pay a high multiple of earnings for this business. Looked at differently, the stock’s price/book ratio of 1.05 looks about right to me for a business generating a sub-10% return on equity.

This caveat aside, I am encouraged by progress and have a positive view of management. On balance, I’m going to leave our AMBER/GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.