Good morning! It's finally here!

We'll be following today's Budget news with a dedicated section inside this report, as it happens.

Spreadsheet accompanying this report: link (last updated to: 10th November).

Budget Live Stream (now finished)

12:34: The Chancellor begins her statement, with the OBR's analysis having already been published on their website!

12.39: Strong words on economic stability and debt reduction as a percentage of GDP.

12.41: Notes that the economic growth forecast at the OBR increased from 1% (at the start of the year) to 1.5%. Lower productivity forecasts from the OBR are blamed on the other political party.

12.44: Widens eligibility for EIS/VCT schemes so they can stay with companies for longer. 3-year exemption from Stamp Duty for companies who list in the UK.

12.46: Big ISA news: from April 2026, £8k of the £20k ISA allowance will be designated for investment rather than cash. Over-65s will still have their full cash allowance.

12.52: First small modular nuclear reactors to be built with Rolls-Royce in Anglesey.

12.55: Government debt c. £2.6 trillion , 83% of GDP. Deficit is £28.8bn, and deficits are planned until a surplus in 2028/2029. Debt is planned to be down by the end of the forecast period.

13.02: Pensioners whose schemes were rescued by the Pension Protection Fund will now enjoy inflation indexation.

13.07: Digital ID to crack down on tax evasion and fraud.

13.10: Welfare reform: face-to-face assessments for disability payments. Changes to universal credit to get more people back to work.

13.12: Abolishes access to Class 2 National Insurance contributions for people living abroad, and requires a minimum of 10 years of contributions to access the State pension.

13.13: Income taxes: freezes to personal tax thresholds for three years, to 2031.

13.15: Taxes on Investments: Increases basic and higher rate of tax on savings, dividends and property income by 2%.

13.18: Council Tax surcharge: an additional £2,500 to £7,500 will be charged on homes worth more than £2 million.

13.19: Salary sacrifice: from 2029, there will be a £2,000 cap on salary sacrifices into a pension.

13.19: CGT relief on employees of businesses will fall from 100% to 50% relief.

13.25: Gambling taxes: Increases remote gaming duty from 21% to 40%. Increases online betting duty from 15% to 25%. Abolishes bingo duty.

13.26: Will not increase NI, Income Tax or VAT rates.

13.31: Two-child benefit cap is scrapped.

13.34: National Living Wage: as previously reported, it is set to increase from £12.21 to £12.71.

13.39: It's done!

13.44: Response by Kemi Badenoch: describes the Budget as a tax raid on working people to fund handouts. Higher taxes on workers, savers, investors, cars, pensioners, etc. "All it delivers is higher taxes and out-of-control spending".

Graham's summary: the FTSE is up 0.6% today, the pound is little changed against the dollar, and there's no meaningful change in the 10-year gilt yield. So as far as markets are concerned in the short-term, this has turned into a non-event.

Looking at the particular measures, the one that stands out is the ISA change. Most people reading this are likely to be far more interested in an S&S ISA rather a cash ISA anyway, but perhaps this measure will cause more money to flow into AIM/Main Market shares? Although there is no introduction of a "British ISA" that would have forced people to do this rather than invest internationally.

The National Living Wage increase is not new or surprising.

The freezes to tax thresholds may affect the consumer in the medium-term, but there is no immediate direct effect on businesses.

Higher taxes on investment income will affect small businesses and landlords, which I assume will mean more investors leaving the buy-to-let sector.

In gambling, the 888/Evoke share price (I hold this one) is down 13% in response to higher taxes. The land-based Rank casino group is up 12%.

An interesting Budget: not as dramatic as it might have been, but with plenty for us to chew on in the days and weeks ahead.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Intertek (LON:ITRK) (£7.1bn | SR71) | Acquired PTL, a “leading flooring products testing company” in North America. PTL has 26 employees and generated £4.3m of revenue in 2024. | ||

Energean (LON:ENOG) (£1.69bn | SR42) | Q3 pre-tax profit -30% to $268.2m. Q3 prod 151 kboepd (85% gas), slightly below 156 kboepd in the prior year, but in line with FY guidance of 145-155 kboepd. FY outlook unchanged except net debt now exp $3.1-$3.2bn (prev. $2.9-$3.1bn). | ||

Pets at Home (LON:PETS) (£937m | SR81) | Rev -1.3%, pre-tax profit -29% to £36.2m. Interim divi held at 4.7p. Vet revenue +6.7%, retail revenue -2.3%. FY outlook unchanged for adj PBT of £90-100m. | AMBER ↑ (Roland) [no section below] In The Week Ahead last Friday I explained why I was starting to think that PETS could be a potential contrarian situation. The stock has suffered a four-year share price decline and multiple profit warnings over the last 12 months. But today’s results are in line with expectations and do not seem to suggest any fresh problems to me. Cash generation remains strong and while margins are lower due to lower volumes, operating cost growth seems to have been manageable in H1. I don’t think there’s anything fundamentally wrong here. PETS still has nearly 8m loyalty club members and sharpening up its retail execution ought to create some opportunity for improved performance, in my view. Now that the pandemic pet boom has washed out of the sales figures and the equity valuation, I am starting to feel this business could be worth a closer look. A forward P/E of 13 and still-covered 5.8% dividend yield could represent a sensible entry point in my view. The caveat to this is that the company’s last profit warning and the unscheduled departure of its former CEO are still relatively recent and near-term performance could still disappoint. To reflect this I’m switching to neutral today and will await further updates with interest. | |

Elementis (LON:ELM) (£893m | SR59) | Acquires Alchemy Ingredients for c.$22m. This business develops rheology modifier ingredients for cosmetics and skin care products and is expected to generate $6m of sales this year. | ||

Workspace (LON:WKP) (£702m | SR40) | Sold three properties in London for £41.7m, in line with Sept 25 valuation and at a net initial yield of 7.9%. All were identified as “low conviction buildings” in a recent review. Asset sales now total £94.1m so far this year. | ||

Auction Technology (LON:ATG) (£349m | SR64) | Rev +9%, adj EBITDA -4% to $76.8m. Reported operating loss of $(134.2)m due to impairment. FY26 performance to be in line with market exps, with revenue growth of 4%-5%. | ||

Judges Scientific (LON:JDG) (£309m | SR29) | CEO David Cicurel steps up to non-exec chair. Group Business Development Director becomes CEO. Existing chair becomes deputy chair. | AMBER = (Graham) [no section below] Founder and major shareholder (8%) David Cicurel has without a doubt been one of the best CEOs on AIM. Now age 75, he ran an acquisition strategy that multiplied shareholders’ wealth many times over. Unfortunately, the JDG share price did get overheated about five years ago. On top of that, the company became a victim of its own success, as its size required it to find larger targets that could move the needle. In recent times, it has also experienced weak demand in the scientific research sector. So there hasn’t been any further share price progress since late 2019. That’s the backdrop to Mr. Cicurel’s move to the position of non-Exec chair. His successor as CEO is not a surprise: Dr. Tim Prestidge joined JDG from Halma in 2023 and has been working under Mr. Cicurel as Group Business Development Director. I think this is a fine appointment but I am going to remain neutral on JDG shares for the time being. It will be worth watching for signs of a strategy reboot that could get this moving again. | |

Helical (LON:HLCL) (£244m | SR43) | EPRA NAV per share 349p (H1 25: 348p). Total EPRA Accounting Return 1.0%. LTV 28.2% (March 25: 20.9%. EPRA EPS 2.4p, interim dividend 1.5p. | ||

Begbies Traynor (LON:BEG) (£172m | SR86) | Real estate consultancy Kirkby Diamond acquired for £8.25m. In FY25, Kirkby Diamond generated £6.2m of revenue and adj PBT of £1.1m. Will integrate with BEG’s Eddisons business. | AMBER/GREEN ↑ (Graham) I’ve gone back and forth on this one this morning. On balance, I think it deserves an upgrade. Even though it’s trading at a PER of 10x, which I generally consider to be its fair value, its quality metrics have improved and I think they can continue to do so. While it’s not a quality compounder in the traditional sense, its M&A strategy does appear to be working well. So I’m a bit more optimistic on this one. | |

Mobico (LON:MCG) (£133m | SR8) | YTD revenue +5.4%, “large scale cost reduction programme underway”. Outlook: adj op profit towards lower end of £180-195m range. | ||

Speedy Hire (LON:SDY) (£117m | SR71) | Revenue +0.8%, adj PBT loss of £(7.2)m. “Subdued market conditions”. Outlook: FY26 expectations remain unchanged with H2 weighting to revenue and profit. FY26E adj EPS 2.6p (-9% vs 2.8p previously) | AMBER = (Roland) [no section below] My cautious view on this equipment hire business is largely unchanged from my comments in early October. But I think it’s worth highlighting that despite management’s unchanged outlook statement, broker Panmure Liberum has cut its EPS forecasts today (see left) – our thanks for making these forecasts available. While EBIT expectations from the core UK business are unchanged, PanLib now sees lower (zero!) profits from a JV in Kazakhstan due to contract delays. The broker also expects to see higher interest costs than previously, due to increased leverage of 2.2x EBITDA (net debt £119m). PanLib’s forecasts for FY27 have been left unchanged for now, but I wouldn’t bet against a further disappointment in JV profits – I don’t really understand why a small UK company like Speedy Hire would get involved with an overseas JV of this kind. I think I can hang on to my previous neutral view here today, but only just. | |

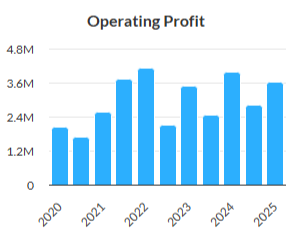

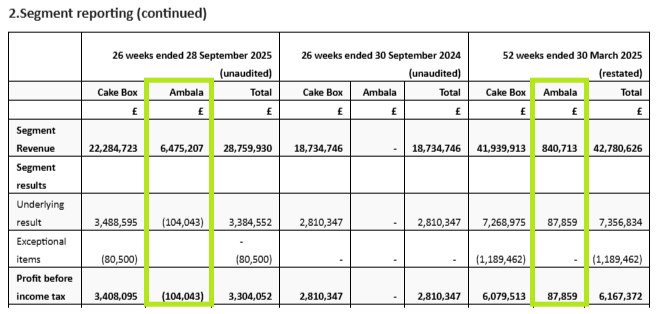

Cake Box Holdings (LON:CBOX) (£92m | SR57) | Rev +53.5%, adj EBITDA +33%, due to maiden contribution from Ambala Foods. Adj pre-tax profit -4.5% to £2.7m due to increased finance costs following acquisition. FY outlook: in line with exps, with seasonal H2 weighting. | AMBER ↓ (Roland - I hold) Today’s results show strong top line growth, but a much larger rise in costs means that bottom line profits actually fell in H1. I think it’s possible that enhanced H2 seasonality will mean this situation reverses in H2 and allows the company to meet full-year forecasts. But I’m not entirely convinced and am also a little wary about the increased risk from higher leverage. On balance, the share price looks about right to me at current levels, so I’m moving down one notch to a neutral view today. | |

Avation (LON:AVAP) (£87m | SR54) | "Demand for passenger air travel remains strong… This encouraging backdrop supports our ability to place the remaining aircraft from our orderbook on lease at attractive terms and successfully transition aircraft between airlines as and when leases conclude.” | ||

Strix (LON:KETL) (£82m | SR72) | SP -2% Revenue £64.6m, net debt £70.3m, leverage 2.5x, for 6-month period ended 30 September 2025. Group is trading broadly in line with market expectations for FY26. The company also announces an “accelerated debt reduction programme", as it seeks to reduce Chinese inventory by £8m. It has also started factoring its debts in Italy (i.e. selling its invoices at a discount for immediate cash). Key sentences: “the Board is assessing a variety of operational and corporate actions to enhance stakeholder value”. There is “ongoing supportive and open dialogue with the existing lending group”. Target leverage is 1.5x in the next 12-18 months. CEO steps down “by mutual agreement” from May 2026. | BLACK (RED =) (Graham) [no section below] We turned RED on this kettle controls producer in July after a profit warning. We’ve had concerns about the debt load and the company also appears to be concerned as it makes debt/leverage reduction a top priority. The current leverage multiple of 2.5x is on the high side for most industries and a £70m debt load does seem substantially larger than Strix can comfortably carry. As for the core kettle controls business, it’s in a fight against copycats to protect its IP - the current value and the longevity of its patents were always the core assets here in my view. The company has to prove that these are still intact while also growing its newer divisions (Billi water filtration and its “Consumer Goods” division). And they will have to find a new CEO to do it. Equity Development today cuts its PBT and EPS estimates for the company by 10%, as a “broadly in line” trading update is, unsurprisingly, a profit warning in reality. Our RED appears to be the correct call for now. | |

Spectra Systems (LON:SPSY) (£61m | SR66) | Five-year service agreement with a customer for the maintenance of existing sensors as well as the new generation sensors which are replacing them. Service revenue approx. $6.7m revenue from 2026-2030. | ||

Arrow Exploration (LON:AXL) (£32m | SR50) | Update on operational activity at the Mateguafa Attic field on the Tapir Block in the Llanos Basin of Colombia. Testing results of M-6 Well indicate it is capable of higher rates; ultimate flow rate will be determined in the first few weeks of production. | ||

FIH (LON:FIH) (£31m | SR66) | Revenue +4%. Net cash before leases £16.1m. Challenges in the FIC (Falkland Islands Company), expected to continue to significantly impact the performance of the division for the remainder of the year. | ||

iomart (LON:IOM) (£29m | SR45) | H1 results in line with the October trading update. Revenue +25%, organic revenue down. Net debt £109.6m. Outlook within the range of current market expectations. | RED (Roland) [no section below] I haven’t looked at this web hosting and IT services business for a while and am shocked at how far the situation has deteriorated. Today’s interims show a near-10% decline in organic revenue “due to previously disclosed customer churn”, with overall revenue only propped up by the acquisition of Atech in October last year – a £57m deal priced at 17x EBITDA, which looks to have been expensive and potentially misguided to me. Even with the contribution from Atech, Iomart’s adjusted EBITDA fell by 34% YoY in H1, while the accounts show an H1 operating loss of £1.8m. The icing on the cake is that the acquisition plus further cash outflows in H1 mean that net debt has more than doubled to £109.6m over the last year. That’s three times the market cap and gives a leverage multiple of 3.1x EBITDA. The turnaround story is that Atech could help Iomart to become a strong player in providing Microsoft Solutions to UK SMEs. I’m not yet convinced. Broker Cavendish is forecasting a tentative return to profit in FY27 (y/e March), but with negative cash flow and this level of leverage, I think there’s some risk to the equity until leverage falls or profitability improves. Personally, I am not sure Iomart has the scale, technical capacity or pricing power needed to return to its former level of success, so I’m going to take a negative view today. | |

Tungsten West (LON:TUN) (£21m | SR20) | Has signed heads of terms with Duo Group for the Engineering Procurement and Construction works package for the New Build Crushing, Screening and Ore Sorter Facility at Hemerdon. | ||

RTC (LON:RTC) (£12m | SR90) | “Despite a challenging UK economy which has impacted recruitment generally, and the significant additional cost burdens imposed by the government's decision to increase employers' national insurance contributions in the Autumn Budget 2024, the Group's expects to deliver [results] that are broadly in line with last year." | ||

Genedrive (LON:GDR) (£10m | SR4) | Notes the recent media coverage of its Genedrive® MT-RNR1 ID Kit, which reduces the risk of deafness in newborn babies. Introduced initially by NHS Greater Glasgow and Clyde. |

Graham's Section

Begbies Traynor (LON:BEG)

Up 1% to 108.65p (173m) - Acquisition - Graham - AMBER/GREEN ↑

Begbies already announced a small acquisition yesterday, which we didn’t comment on due to its small size. But let’s quickly do that now: it was the £1m acquisition of Network Auctions, a property auctioneer:

The addition of Network Auctions will add scale to our existing auctions business and further develop our national coverage in the south east of England.

Network Auctions will get folded into the Eddisons group.

Today’s announcement is a bit meatier:

Kirkby Diamond (real estate consultancy) is bought for £8.25m

Cash-free and debt-free purchase.

Kirkby Diamond will also join up with Eddisons.

5 locations, 62 staff.

This acquisition extends Eddisons' strategic footprint to cover the entire M1 corridor, and aligns with our strategy to strengthen our service offering and expand our market coverage.

Key financials: Kirkby Diamond generated £6.2m revenue and “normalised” PBT of £1.1m in FY January 2025. Net assets £1.4m.

Valuation is 10x normalised after-tax profits, which is perhaps on the high side for a smaller business in this sector? But:

Deal structure: £5m up front,of which £3.5m is cash and the rest is new BEG shares. Earn-out of up to £3.25m if profits are maintained and increased in the coming years.

Let me revise what I just said: the valuation is probably reasonable, given the conditions attached in the earn-out!

The MD of Eddisons says “Kirkby Diamond is a great fit with Eddisons, culturally and strategically, and I look forward to taking forward the growth opportunities that the deal presents."

Ric Traynor says:

"Kirkby Diamond has excellent relationships with a broad range of clients and a strong track record of growth and we very much look forward to working with them as part of the group. The acquisition is in line with our strategy to develop our property advisory and transactional services division by enhancing and broadening our service offerings and geographical coverage. It takes the division to an annualised revenue run rate in excess of £50m derived from a wide range of property services and nationwide coverage."

Graham’s view

I’ve always had a lot of respect for Begbies, and I’ve found it interesting as a hedge against economic weakness (due to its restructuring/insolvency services).

However, it has expanded and diversified over the years, so it’s less of a pure-play on economic difficulties now than it was before. Which is perhaps not a bad thing, for investors who prefer a smoother performance.

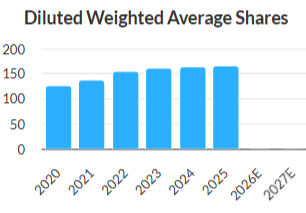

As noted by Roland previously, the use of its own shares has caused gradual dilution:

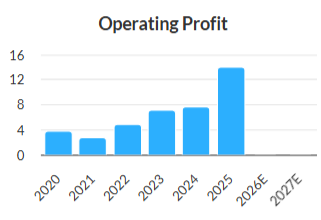

But the company has also been delivering the profits to justify its strategy:

From a chart perspective, these shares first hit 108p in March 2020. They have taken a long time to grow into this valuation:

I’ve talked about the major factors at play here many times, as have Mark and Roland. See Dec 2024 for the last time I went over them. At the time, I said that a PER of 10x made sense for a large professional services business like this.

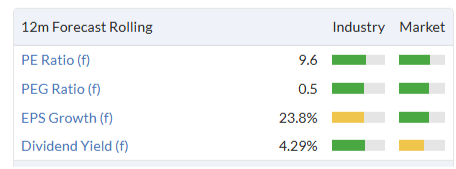

Today’s valuation:

Estimates: Equity Development are forecasting adjusted EPS of 10.8p in FY April 2026, and then 11.5p in FY April 2027.

So the market is very much sticking to a 10x P/E ratio (10.8p EPS forecast vs. 108p current share price).

I think this could offer some nice upside if the company continues to perform as expected.

Is it a quality compounder? Perhaps not in the traditional sense, though I’m sure management would point to their successful M&A strategy as evidence that it is.

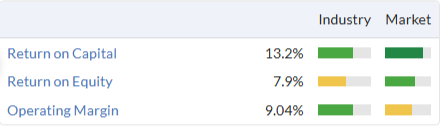

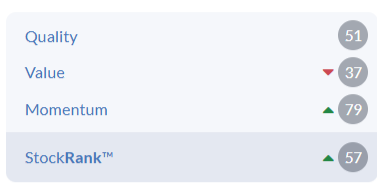

I have noticed that their quality metrics have improved since last year, and I think they could improve further depending on the heaviness of the adjustments to this year’s results.

These Stockopedia quality metrics are based on the unadjusted figures, so the adjusted figures would be even better:

And the StockRank has risen to an impressive 86:

Putting it all together, I think I’ve seen just enough to raise my stance on this to AMBER/GREEN. It's still trading around the level that I considered to be fair value, but I trust the M&A strategy to keep delivering. So I think an extra dose of optimism is justified.

Roland's Section

Cake Box Holdings (LON:CBOX)

Down 1.4% to 207p (£91m) - Half Year Results - Roland - AMBER

(At the time of publication, Roland has a long position in CBOX.)

Today’s results from egg-free cake specialist Cake Box appear to be something of a mixed bag. The market reception has also been uncertain. I’ve been digging through the accounts and have found a few points I think are worth highlighting.

HY26 results summary

Let’s start at the top with a look at the headline figures. These accounts cover the half year to 28 September 2025:

Group revenue up 53.5% to £28.8m

-> Cake Box sales up 18.9% to £22.3m

-> Initial contribution from Ambala acquisition of £6.5m

Pre-tax profit down 7.4% to £2.6m

Underlying EPS down 11.5% to 4.58p per share

Interim dividend +5.9% to 3.6p per share

Revenue & sales: I think progress here looks broadly positive. At Cake Box, like-for-like sales rose by 6.3% (HY25: 2.0%), suggesting above-inflation sales growth in the seasonally weaker first half.

Total franchise sales rose by 14.6% to £47.6m while franchisee online sales rose by 25.9% to £11.3m (remember these are franchise sales, from which Cake Box receives a share).

The gap between LFL growth and total growth was bridged by 11 new store openings (9 Cake Box, 2 Ambala), taking the total to 284 at 28 September 2025.

Marketing efforts also seem to be bearing fruit. Traffic to the company’s website rose by 18% to 2.6m for the half year, while its email and SMS databases grew by around one third to 990k and 390k respectively.

Profitability & Leverage: the picture here looks a little more mixed to me.

While revenue rose by 53.5%, the accounts show a much larger 73.6% increase in overheads, to £12.6m.

As a result, H1 operating margin fell to 11.5% (HY25: 15.0%).

My hope is that stronger sales in the seasonally-important H2 will offset this increase in costs, so that the annualised impact is lower. But it’s certainly something I’ll be watching – the initial impact of the acquisition of Ambala appears to have been dilutive to margins.

Dropping down to pre-tax profit reveals another headwind. The company borrowed significantly to fund the acquisition of Amabala and is now paying hefty levels of interest. Finance expenses in H1 were £729k, up from £130k in the prior year.

As a result of this and the reduction in operating margin, Cake Box’s pre-tax profit fell by 7.4% in H1, despite a 50%+ increase in sales! Not ideal.

Net debt of £11.6m (excluding leases) does not look unmanageable to me, in itself. But this is an increase from the £9.0m reported at the end of March, despite the Ambala acquisition falling into the prior year.

Looking ahead, my feeling is that deleveraging might be quite slow as the company plans to spend £5m over the next three years on the construction of a new warehouse.

Current leverage works out at around 1.2x adjusted EBITDA, so doesn’t look too high on this measure.

Using my preferred comparison with net profit gives a multiple of around 3x – that’s also within my comfort zone, but I wouldn’t really want to see it much higher.

Accounting errors!

Scrolling down to the footnotes revealed some accounting restatements that have had the unfortunate effect of reducing last year’s reported profits.

These corrections were prompted by errors the company has discovered in its accounting for the acquisition of Ambala:

£270k of fees associated with the acquisition were capitalised into goodwill when they should have been expensed;

A £157k liability relating to deferred consideration should have been released in the FY25 results but was not;

A £506k corporation tax refund was recognised in the accounts, but the company is obliged to pass this amount to the sellers so should also have recorded a corresponding liability. The impact of correcting this is that FY25 reported pre-tax profit has been restated at £5.88m (previously £6.15m).

In terms of impact and severity, none of this is a disaster. But it seems a bit sloppy and I think it’s also disappointing that these errors were overlooked by Cake Box’s auditor at the end of last year.

Checking back to June, I see that the FY25 results were delayed due to an audit requirement for more time to cover the acquisition of Ambala – but they still missed some errors.

This is not the first time Cake Box has suffered accounting errors, albeit the 2022 events were under a previous CFO and different auditor.

Outlook

Looking ahead, the momentum of the first half has continued into the second half of the year and we are on track to deliver full year performance in line with our expectations despite the consumer environment remaining challenging.

Today’s in line outlook statement implies a significant H2 weighting to results. The company’s H2 adjusted EPS of 4.6p still leaves nearly 10p per share to be earned in H2 to meet consensus forecasts of 14.3p.

There’s been a debate on how credible this is in the comments this morning. I can understand why investors might be sceptical – a big weighting to the second half of the year is often a sign of a possible miss.

In this case, it’s worth noting that Cake Box’s business has always had a significant H2 weighting for obvious seasonal reasons.

Crunching the numbers shows me that the H2 weighting last year was around 60%.

Applying the same calculations to this year suggests an implied H2 weighting of around 68%.

That’s a big increase, but my impression from today’s results is that the acquisition of Asian confectionary business Ambala may actually have increased the seasonality of this business. Management say that the Eid and Diwali celebrations – both in H2 – have always been a significant driver of profitability for Ambala.

Checking today’s segmental results shows that Ambala was loss-making in H1, but generated a pre-tax profit margin of 10.5% during the partial H2 period trading post-acquisition last year:

Management had a sensible opportunity to introduce some flexibility into full-year guidance today, but they chose not to. Make of that what you will.

Personally, I think there’s an increased level of uncertainty, but I can see a plausible case for Cake Box still making its full-year forecasts based on today’s guidance.

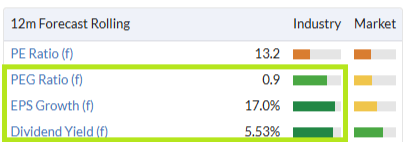

Estimates

House broker Shore Capital has taken its cue from Cake Box’s management and left its forecasts completely unchanged today:

FY26E adj EPS: 14.3p

FY27E adj EPS: 16.7p

FY28E adj EPS: 19.2p

These estimates suggest earnings growth could outperform the wider sector, potentially justifying a low-teens earnings multiple:

Roland’s view

I hate to sit on the fence, but I think I’m going to mirror the StockRanks and cut my view by one notch to neutral after today’s half-year results.

I can see both opportunity and risk here, but on balance I am not sure I’d want to pay all that much more for Cake Box shares without some evidence that profitability and growth remain on track following the acquisition of Ambala. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.