Q&A with Neil Woodford, at the LVIC, 20 May 2015

They saved the best until last at LVIC this year, with Neil Woodford ("NW") , the star fund manager doing a Q&A session with the day's host, David Shapiro, which ran for about an hour from 5:30 to 6:30pm. I took detailed notes, so below is close to verbatim. I hope this is useful & interesting, for people who were not able to attend the event in person.

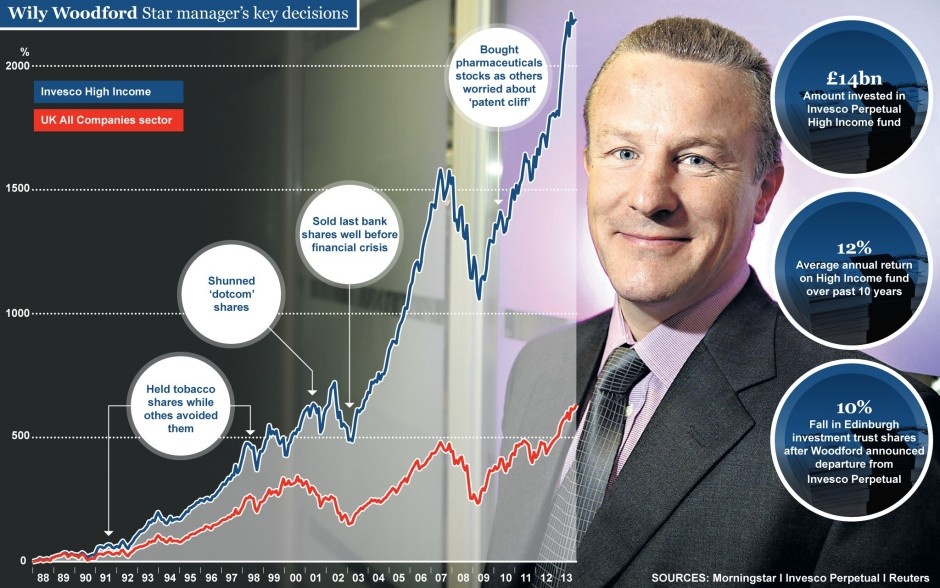

Woodford spent 25 years at Invesco Perpetual, taking it from a small boutique fund manager, to a big company. In 2014 he set up on his own firm, Woodford Inv Mgt, and has been highly successful raising funds, with a fresh approach including lower fees, and complete transparency (fund holdings are published in full).

(image courtesy of telegraph.co.uk)

Unfortunately David Shapiro ("DS") got a little carried away with his introduction, and it went on, and on, and on, with audience members and Woodford himself starting to look a little nonplussed! We're here to listen to Woodford, not you! I could hear myself think. Eventually Shapiro stopped talking, and Woodford paused for a moment, then quipped, "You want me to wade in?!"

Woodford said that he'd had a couple of jobs in fund management prior to Invesco, in the 1980s, but "wanted to run money myself, not by committee - that doesn't deliver what the clients want". "I wanted to be held accountable, and be recognised".

DS: What changed (at Perpetual)? (i.e. why was he happier at Invesco & stayed there 25 years)?

NW: The early 90's Budgets opened up the market for funds - tax changes. We started with just £14m in the Invesco High Income Fund in 1988. When I left it was £13bn! That wasn't all capital growth though! {chuckles from audience}. I learned a huge amount - you never stop learning.

DS: Did you enjoy things less once Invesco had become a big company?

NW: Yes. Fund management works best as a cottage industry. I mean active fund management anyway. A small, team-based infrastructure is best. Over time, the scale of Invesco Perpetual became displeasing.

DS: Did the asset base get too large at Invesco for decent returns?

NW: No. A large asset base is NOT an impediment to good absolute returns.

DS: Did you challenge the high fee structure over the last 25 years, when you were at Perpetual?

NW: As a fund manager working…