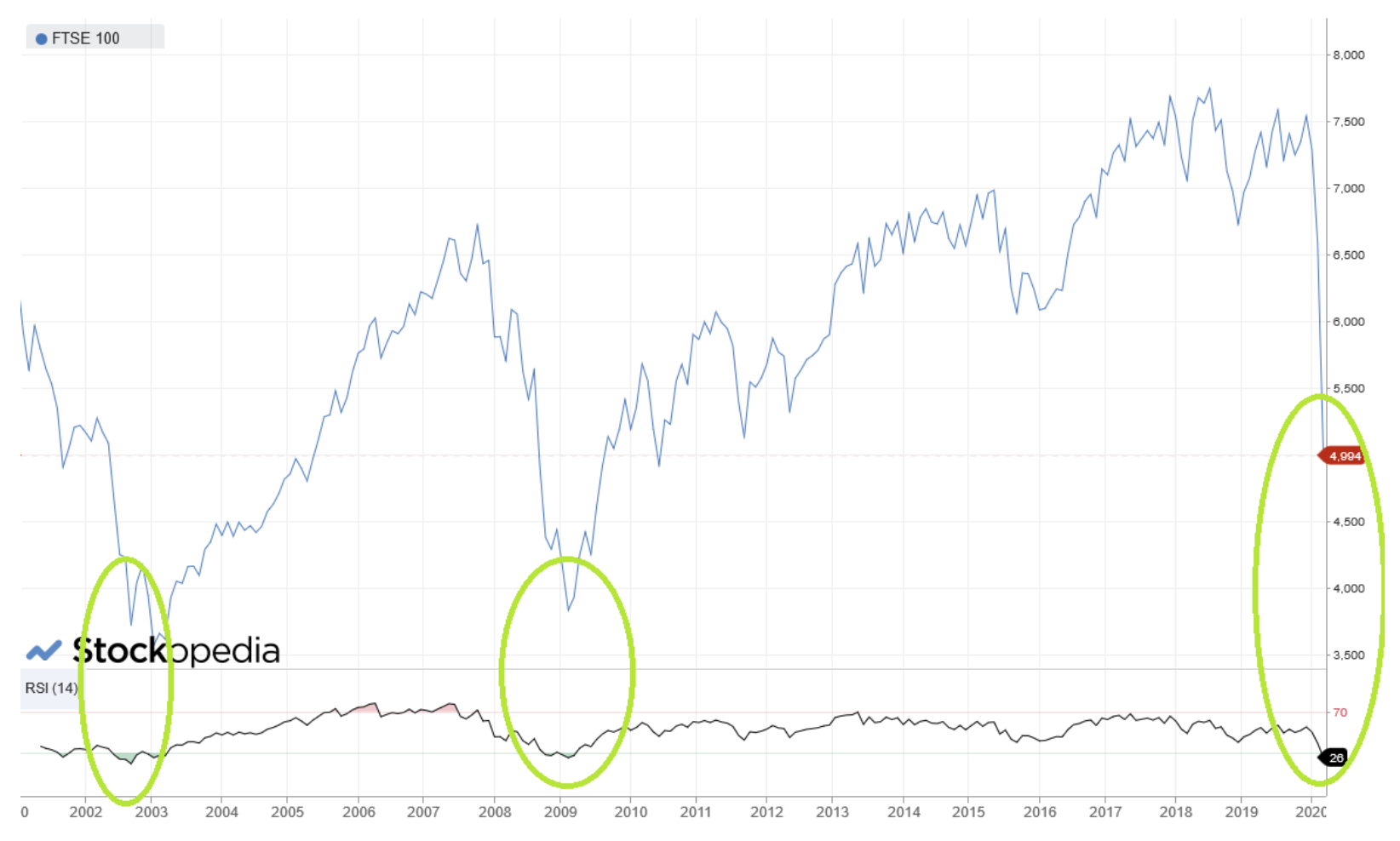

The carnage is continuing in the markets, but I’m starting to wonder if the FTSE 100 is building a base at around 5,000. On a monthly chart, the last time the index was this oversold was in 2009. Prior to that it was 2002.

We will see. In any case, I plan to continue buying shares for the SIF folio as long as suitable candidates are available.

Fortunately, my SIF stock screen is continuing to provide new shares for me to consider. As I discussed last week, the SIF Folio’s sizeable cash balance means that I’m able to take advantage of what I believe are attractive opportunities.

I’ll take another look at the performance of the portfolio in my usual month-end review next week. The format of this review might be slightly different to usual - watch this space.

This week I’m going to look at German commercial property landlord Sirius Real Estate. Shares in this firm have tanked after a country-wide ban came into force on Sunday, preventing social gatherings of more than two people.

Sirius Real Estate (LON: SRE)

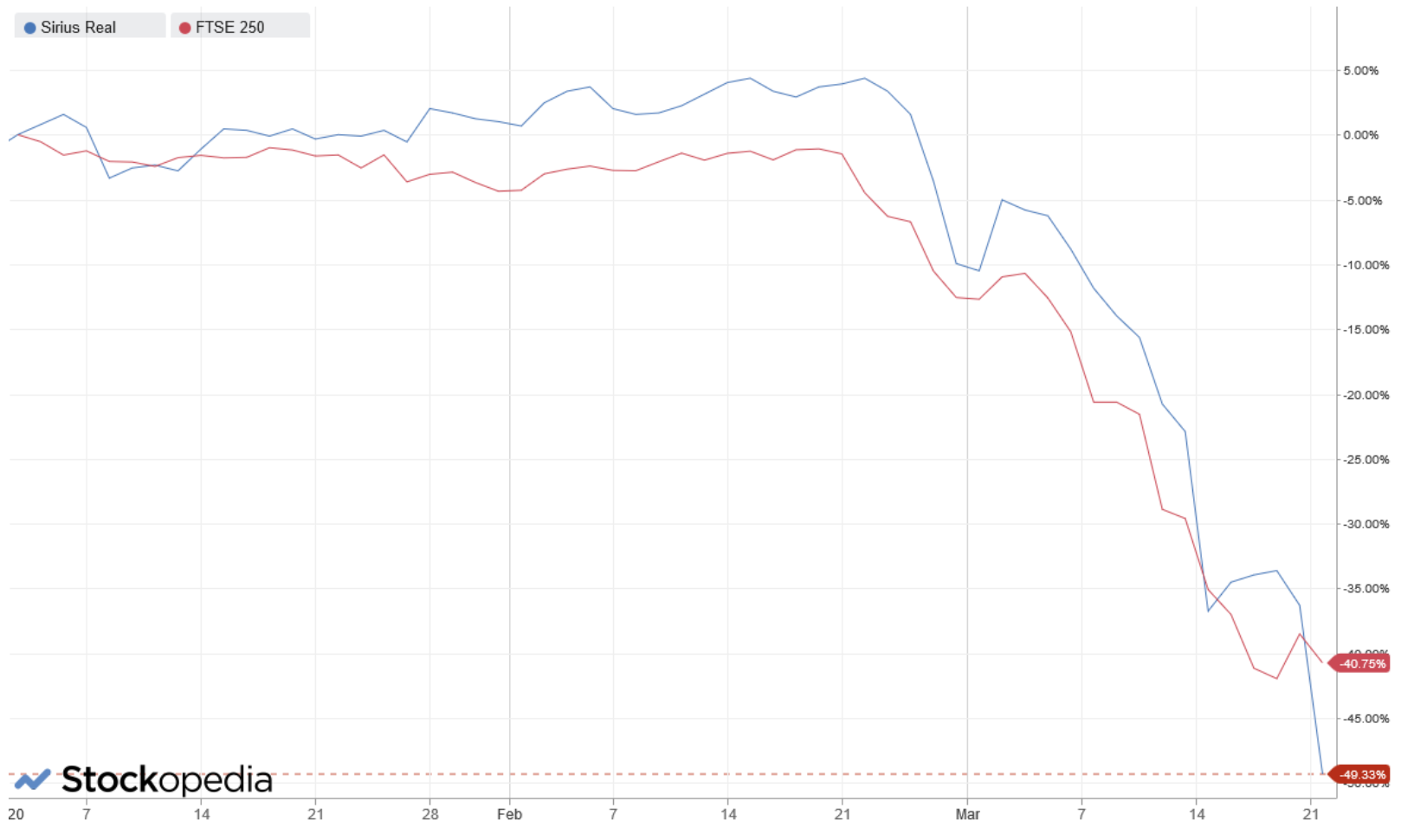

News of Germany’s new social distancing restrictions seem to have had a big impact on German business park landlord Sirius Real Estate (LON: SRE). The FTSE 250 property firm’s share price fell by around 20% on Monday, taking its year-to-date decline to nearly 50%:

Sirius Real Estate has already been in the SIF folio on two previous occasions, in 2017 (+29%) and 2018/19 (0%). I’ve admired this group’s progress, but I did feel that its valuation had become quite rich towards the end of last year.

The stock has now made its third appearance in my screening results, so it’s time for a fresh look. Stockopedia currently ranks Sirius as a Super Stock with a StockRank of 95:

I imagine that many of Sirius’s tenants will now have suspended their operations or switched to home working. Although I believe things will return to normal, It’s not possible to know when this will happen or what the wider economic backdrop might be.

As a result, I think we…

.JPG)