The stock market is showing signs of stability and a return to normal after a brutal two day battering. Like most of you, I suspect, both my personal portfolio and the SIF portfolio are showing considerable losses.

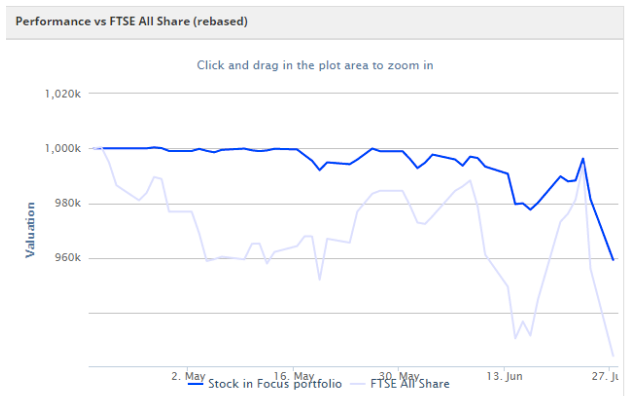

It’s early days yet, but I’m pleased that the SIF portfolio has so far managed to stay ahead of its benchmark, the FTSE All Share:

In my view it’s too soon to say how the UK’s Brexit vote will affect either the domestic economy or the stock market. I certainly don’t want to get into a debate about the pros and cons here. As an investor my main interest is in taking a level-headed view at the companies in the portfolio. Has the outlook changed materially since last week?

For the majority of the companies in the portfolio, I’d say the answer is no. For the most part, they’ve performed how I would have expected them to in a sudden sell off.

GlaxoSmithKline & BAE Systems

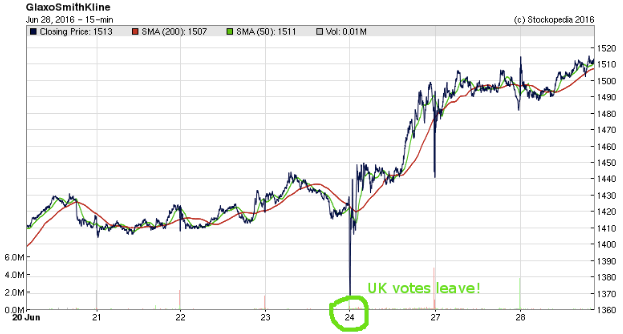

These two defensive heavyweights were always intended to offset the cyclical risks posed by some of the other stocks in the SIF portfolio. BAE and Glaxo have both performed well following the referendum. In classic defensive style, Glaxo has actually climbed 9% over the last week. Profits from non-UK sales should be boosted by the weaker pound. Over the same period, BAE has fallen by just 2.5%.

GlaxoSmithKline since the referendum

Go-Ahead Group

I had hoped that Go-Ahead would serve as a pseudo-defensive stock, thanks to its focus on public transport. So far, this experiment has failed. However, Go-Ahead has only fallen by 5% since the referendum. The majority of the 28% decline we’ve seen since Go-Ahead joined the SIF portfolio is the result of a downgrade to profit forecasts for the firm’s rail business.

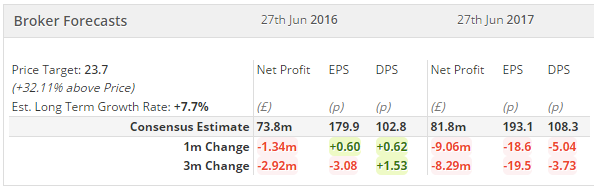

Yet despite this reaction, Go-Ahead hasn’t issued a profit warning. Earnings growth is expected to continue next year, albeit at a lower rate:

I’ve discussed this previously, but in essence I’m less worried than the market. Most of Go-Ahead’s profit comes from bus operations, not rail. With the shares now trading on about 9.5 times forecast earnings, I think the downside is priced in. The resulting 5%+ yield could now attract buyers.

Pan African Resources

The price of gold has risen…