Pre 8 a.m. comments

Good morning! Fairly quiet today, as it usually is on Fridays, but there are a few interesting announcements to flag up.

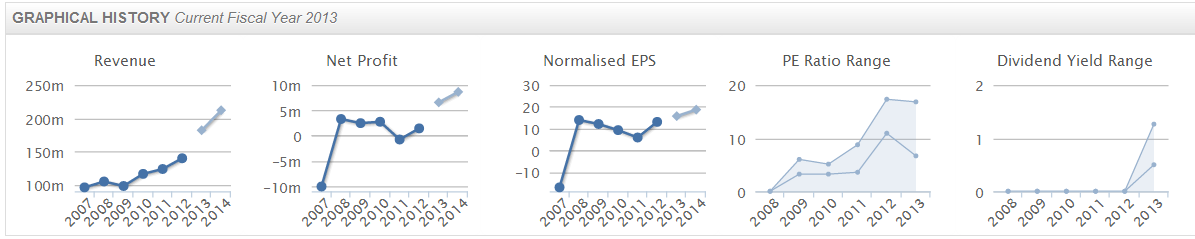

Games Workshop (LON:GAW) have issued a refreshingly brief IMS for the period from 3 Dec 2012 to 7 Apr 2013, which looks a rather strange period, but given that their year end is 3 Jun 2014, this represents their second half (H2) to date, i.e. four months. They simply say that, "trading has been broadly in line with the board's expectations", so slightly below then.

I will buy shares in the first company to issue a trading statement which actually says "slightly below" instead of "broadly in line", as that would demonstrate putting honesty before spin.

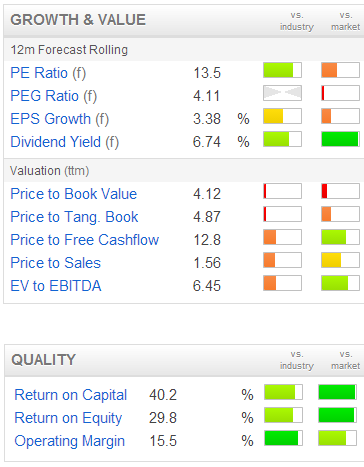

Stockopedia shows broker consensus for this year as being 47.6p EPS, down from 50.8p last year, which translates to a PER of 14.1 (an Earnings Yield of 7.1%). The dividend is forecast at 45p, meaning that almost all earnings are being paid out in dividends, for an attractive but barely covered dividend yield of 6.7%.

Note how useful the Earnings Yield is (it's the inverse of the PER. So in this case where the share price is 673p and EPS is 47.6p, then the PER is 673/47.6 = 14.1.

Flip those round to calculate the Earnings Yield, which is EPS of 47.6p/673p share price = 7.1%.

Why bother using earnings yield? Well because you can then compare it with the dividend yield of 6.7%, and instantly see by comparing the two figures what the dividend cover is. I think that's so useful, that I'll be mentioning earnings yield from now on.

You can also then compare company valuations with any other asset class (e.g. Bonds, property, cash in the bank), pretty much all of which are expressed as yields, rather than price multiples of yield.

GAW looks like a mature business to me, and the shares have done well in the last year, so I doubt there is much (if any) upside on the current share price for the time being, so it doesn't interest me. Although I do note the strong green bars in the "quality" section above, indicating quite a high operating margin, and good return on capital employed.

Regenersis (LON:RGS) announce a small bolt-on acquisition in S.Africa for £1.5m (paid for in cash I presume, although it doesn't specifically say that), in line with their stated strategy of targeting emerging markets where margins are better, and growth stronger than in Europe. It looks to me a good growth company at a reasonable rating, even though the shares have had a very good run it still doesn't look over-priced (forecast PER of 12.3 this year, falling to 10.3 next year).

Post 8 a.m. comments

Airline, package holidays, and logistics group, Dart (LON:DTG) issues a positive trading update, saying that pre-tax profits for the year ended 31 Mar 2013 will be ahead of current market expectations due to lower than expected winter losses.

Broker consensus is for 20.1p EPS this year, so at 149p the shares still look good value at 149p, for a PER of 7.4 (earnings yield of 13.5%). Although you have to be careful with airlines & travel businesses, as they often fund themselves using advance payments from customers, which has always struck me as unethical. Surely customer monies should be segregated & not used to finance the rest of the business? But they're not usually.

I've just checked Dart's balance sheet, and it actually seems OK - their net cash balance is almost all customer's cash, but at least they are not dipping into it to finance the planes (which was the case a few years ago when I last looked at it, because I remember querying that very point with them).

We're in more buoyant markets, and bullish signs are proliferating - e.g. the IPO market coming back, and new issues going to a premium on day one, such as Cambridge Cognition Holdings (CCH) which started trading yesterday and went to about a 10% premium.

As such, I'm relaxing my £10m minimum market cap requirement somewhat, as I think the risk of de-Listing is reducing, for companies which are profitable. So I'd tentatively go down to perhaps £5m market cap if the company itself looks sound & makes money. Although liquidity gets pretty ridiculous at that level, but a proper telephone broker can usually work orders for you and get round those problems. It's certainly a false economy using a discount online broker for small & micro caps in my experience.

With this in mind, I'm going to start looking at some smaller companies for the first time, and Dods (Group) (LON:DODS) is one such company. They have issued a trading update today, saying that the extended period of 15 months to 31 Mar 2013 will deliver turnover in line with expectations of £18.7m, and adjusted EBITDA of £0.4m. Order intake has improved.

Dods provide political information. It hasn't made any significant profit since 2006, and dividends fizzled out by 2011, so it's difficult to see why the shares are still Listed. Hence I wouldn't be interested in this, unless some catalyst for growth emerges. There must be a high risk of it de-Listing, which is disastrous for the share price. The market cap is about £6.5m.

An interesting situation has developed at VSA Capital (LON:VSA), a tiny Listed broker, where the announcement of it intending to de-List smashed the share price from 4p to less than a penny! This is why it's so vital to avoid such micro caps where there is a risk of de-Listing. The biggest risk factors to avoid?

- I would say £10m market cap is a good threshold above which de-Listings are rare.

- Dominant shareholdings of over say 20% for Directors (in aggregate), or any other large shareholder, as this might make it too easy for them to force through a de-Listing.

- Financial problems, which mean that the cost of Listing (typically £100-200k p.a. all told, even for a very small company) can no longer be justified. So profits under say £500k would be a warning sign.

Actually, thinking about it, I think I've just convinced myself that my £10m minimum market cap limit was a good idea, and should remain!

Following on from Dart Group's positive trading update, another aviation share, Flybe (LON:FLYB) announces a rather poor trading update. They are expected to be loss-making, but it's a lot of business for only £30m market cap. So the question is whether they can turn it around? To see how badly wrong things have gone for Flybe, just compare their three year chart with that of Dart Group above:

I'm tempted to look into it as a potential turnaround, as the percentage gains available from turnarounds can be spectacular, but looking at their last balance sheet I would be worried about the level of debt, and what the banking covenants are over that debt? Certainly too high risk to be able to understand quickly, this one would need a lot of research to properly understand the risks, and I've got better & simpler opportunities to research elsewhere, so will pass on this one I think.

Right, that's me done for today and the week. Thank you for taking the time to read my morning ramblings, I hope you find them useful & interesting. It's only ever one person's opinions of course, but hopefully provides a catalyst for some ideas to research yourself in more depth?

Have a good weekend all!

Regards, Paul.

(of the shares mentioned today, Paul holds no long or short positions in any of them)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.