Good morning!

Today's report will be equipment hire themed - as I report below on the profit warning today from Speedy Hire (LON:SDY) and I'll also circle back to the profit warning from HSS Hire (LON:HSS) a couple of days ago. Is something funny happening in equipment hire? Or are these two companies just executing badly? Let's have a look!

Speedy Hire (LON:SDY)

Share price: 48.7p (down 31.1% today)

No. shares: 521.9m

Market Cap: £254.2m

Profit warning - today's disappointing trading statement has come completely out of the blue. Checking the archive here, I last reported on 15 Apr 2015, when SDY reported positively, that it would be "slightly ahead of market expectations" for the year ended 31 Mar 2015, at the adjusted profit level. I concluded that at 73p the share was too expensive, being on a PER of 20.4, and with a lousy yield too.

The trouble is, if you pay up - a PER of 20 seems to be the norm at the moment for reasonably decent companies - then you've got no safety margin if something goes wrong. So as in this case, holders who cheerfully paid a PER of 20 are now nursing a 31% loss, that could take a long time to recover. Risk:reward just isn't good when you pay a full price for a share, if the company is only an ordinary company, as seems to be the case with SDY.

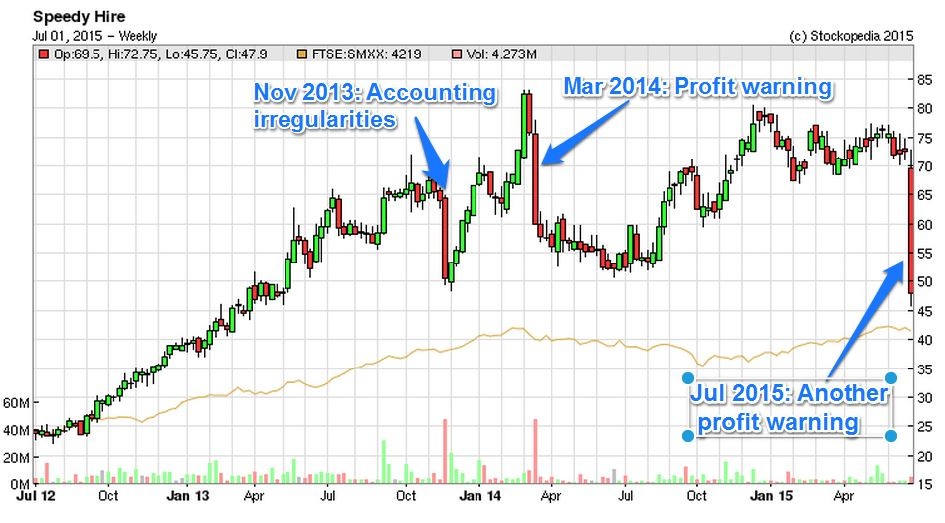

Looking further back in the archive, I didn't report on the profit warning in Mar 2014, but I did report on the accounting irregularities & resignation of the CEO in Nov 2013, here.

So all in all, shareholders must be feeling pretty cheesed off with what seems to be an incredibly accident-prone company. So it's difficult to see this share regaining its previously toppy rating any time soon.

What's gone wrong this time then?

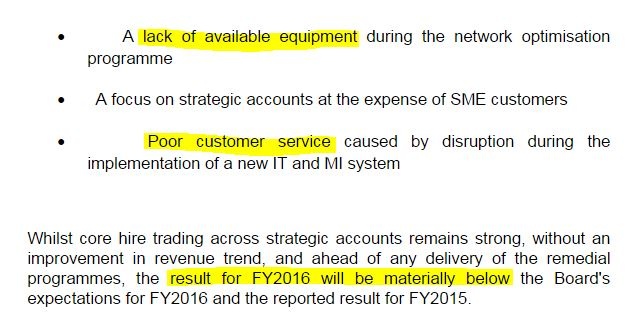

The company flags a "slower than expected start to the current financial year" (i.e. Apr-Jun 2015, inclusive), giving the following reasons:

Furthermore, the disposal of their M.East business has now fallen through, with discussions terminated with the potential buyer. It's operating at breakeven now, so a setback rather than a disaster.

CEO resignation - the CEO has fallen on his sword, rightly so, as these look like basic mistakes in running the business. So the business has chewed up & spat out two CEOs now in under two years.

The Non-Exec Chairman, Jan Astrand, has temporarily moved up to Exec Chairman, and the FD, Russell Down, has become the new CEO (whilst also retaining the FD role temporarily, so he'll be a busy & stressed-out chap then).

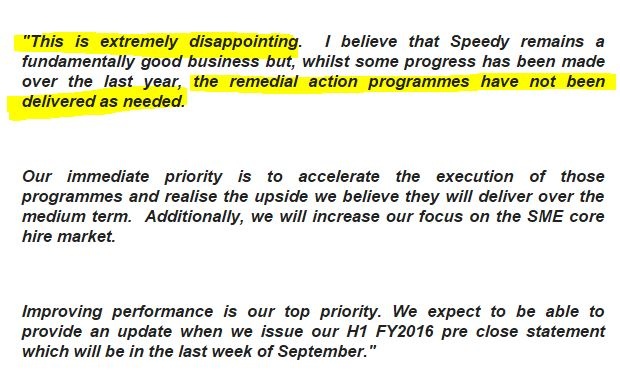

Directorspeak - the Chairman tells it how it is today, which is good - shareholders will no doubt want action to fix things, not excuses.

My opinion - these look like schoolboy errors in running what is fundamentally a fairly simple business, which hires out equipment. Management are paid to manage the business, so that errors like this don't happen.

Whilst the CEO has fallen on his sword, in my experience the CEO just sits on top, and there is an army of middle managers who actually run most businesses. So my concern with SDY is that, after three mishaps (see chart below) in under two years, maybe the business is just a poor quality business, with incompetent middle management? It looks like that to me, reading between the lines.

However, the problems all look like things that are fixable, so at some point this share could make a nice recovery play. My instincts tell me to steer clear for the time being, with more bad news possible. After all, if they are saying that the full year results will be "materially below" expectations and last year's performance, when they are only at the end of Q1, then that suggests to me that there are ongoing problems.

Equipment hire companies are very operationally geared - the depreciation charges go through the P&L each month regardless of whether any customers have hired the equipment at all. So if operational problems mean that you own the wrong kit, or it's in the wrong place at the wrong time, or you just have warehouses full of kit that customers don't want to hire, because your prices are too high, then there's a big problem.

Will the market be so forgiving after the third plunge in share price? I doubt it.

EDIT: I haven't reviewed their balance sheet recently, but it's important when a highly geared company warns on profits, to check the debt position, and the banking covenants. Even if those are not disclosed, it's easy enough to make an assumption, and calculate how typical bank covenants would look on the revised broker forecasts, like net debt:EBITDA, interest cover, etc.

HSS Hire (LON:HSS)

Share price: 128p (down 5% today)

No. shares: 154.8m

Market Cap: £198.1m

(at the time of writing I hold a long position in this share)

Profit warning - this is actually from two days ago, but I didn't get round to looking at it in detail on Monday 29 Jun, so as it ties in nicely with the warning from Speedy Hire today, let's have a look at it now.

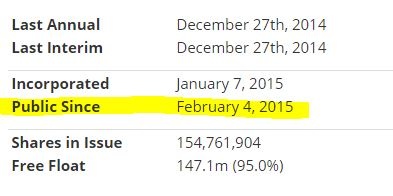

Firstly, I note that Stockopedia has added a useful couple of dates into the StockReport, showing when a share first listed on the stock market - that's really handy, as it saves me having to look it up from the RNS.

As you can see on the left, HSS was listed recently, on 4 Feb 2015, so it's only been a public company for five months, and has just warned on profits. I'm sorry, but that's pathetic. It is inexcusable for a company to list, and then warn on profits within just a few months, but it's an ever-lengthening list I'm afraid of new floats which have done just that.

It makes me ever more sceptical about new issues - and sadly I think the companies & advisers that float these things are possibly more interested in lining their own pockets than in giving investors a fair deal. It stands to reason really doesn't it? If the existing owner of a business (who knows it best) chooses the time, and the price for his exit (or to raise fresh funds), then to take the other side of that trade, you're probably going to be fleeced! That's why I rarely indulge in buying IPO stocks, with only the rare exception occasionally, if I find something really good and sensibly priced.

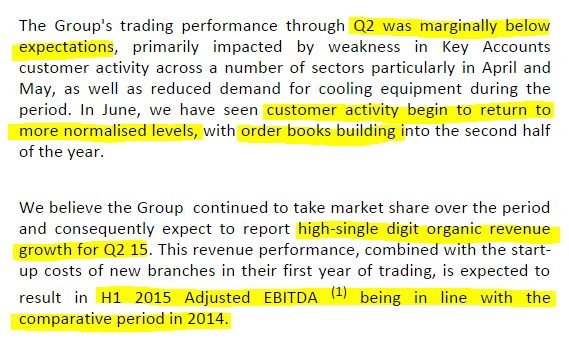

Current trading - reading it again, it seems to send very mixed messages. If Q2 was only "marginally below expectations", why have the shares been smashed down so far this week?

As FT Alphaville pointed out on Monday, the current trading & outlook comments in the last update on 27 May 2015 didn't give any indication that anything was wrong, so questions are being asked about whether the company has adequate internal controls & timely reporting?

Broker downgrades - although the trading update sounds very mild, it seems to have a leveraged impact on the bottom line. So a reminder again as to how operationally geared tool hire companies are.

One broker has reduced their 2015 EPS forecast by a considerable 18% to 10.1p, and 2016 has also been reduced by 16% to 13.7p. If it's only temporary factors in a couple of slightly slow months, I am puzzled as to why forecasts have been downgraded by such a lot for the current and future years.

Another broker seems to have reduced their forecasts by less, but I don't have full details of that.

Balance sheet - this is tricky, as the only accounts available are pre-IPO, so they show a balance sheet groaning with debt, as the company used to be structured on a corporation tax-avoiding private equity basis.

Taxation - note that HSS only paid £2.8m corporation tax in 2013, and £121k in 2014, due to the massive finance charges on the P&L. This structure disgusts me - it's ludicrously easy for private equity people to avoid corporation tax at companies they own. When is this loophole going to be closed?! Who would pay for public services, if all companies went down this tax avoiding route? It's shameful in my view. Anyway.

Net debt - I don't have any up-to-date figures on the indebtedness. At 27 Dec 2014, net debt was extremely high at £288.7m. As part of the IPO deal, the debt was restructured, and £103m (gross) of fresh equity was raised. So if that reduced to say £100m, then simplistically, net debt should have reduced to about £189m.

Net assets were negative -£11.5m at 27 Dec 2014, so add on say £100m net proceeds from the IPO equity raising, and pro forma net assets would be £88.5m. However, there's £170.4m in intangibles to write off, so that takes NTAV down to -£81.9m.

So it looks to me as if the balance sheet is probably quite weak, that the PE guys left HSS with too much debt perhaps?

IPO - I'm just having a quick thumb through the IPO prospectus, and note that the price of 210p was right at the bottom of the indicated 210-262p price range. Also I note that the selling shareholders only got away the absolute minimum of the existing shares they were offering - 5.1m to 44.6m was the range, and only 5.1m were placed.

So it looks like this IPO perhaps only happened by the skin of its teeth? There is now probably a big overhang (37.4% of the company) from the major shareholder, Exponent Private Equity, once their lock-in expires. Although whether they would sell now at 132p is unknown.

Good grief, I've just discovered from page 17 of the Prospectus, that the IPO costs were not £3m as I estimated, they were a mind-boggling £13.5m! That is outrageous!!

Anyway, it would take me all afternoon to work out all the figures on this, so I'll wait until the interim results come out instead!

Vauation - I'm not really sure how to value it, to be honest. All I would say is that the profit warning doesn't sound a disaster by any means, so having the opportunity to buy the shares about 37% below the IPO price, actually looks fairly interesting.

The current share price is about 10 times 2016 forecast earnings, which seems fairly reasonable, although I suspect the balance sheet might be weaker than I would like.

So I took a bit of a punt on it this week, and have bought some averaging 134p. It's not a conviction buy, and I've not fully researched the figures, but it's more of a punt on it being a fundamentally sound company, which has been around a long time, and that generates plenty of cashflow.

Have any readers looked at this company? If so, I would love to hear your views. Is it a bargain, or a dangerous falling knife? I'm not sure at the moment, but am leaning towards it possibly being a fall which has been overdone a bit? Time will tell!

Look how wide the candlesticks are below, which reinforces just how little time this company has been listed. It's bound to take time for sentiment to recover. BooHoo is still languishing 6 months after its profit warning, soon after its float for example.

Topps Tiles (LON:TPT)

Share price: 145p

No. shares: 193.7m

Market Cap: £ 280.9m

Q3 trading update - the share price is level on the day, so it looks as if this update is what the market was expecting.

Q3 sales are up a very impressive 5.9% on a like-for-like basis. All the more impressive, given that it adds to a 6.3% LFL sales increase last year.

On profitability, they say: "management remain comfortable with current market expectations for the year as a whole".

Directorspeak - says they "remain well positioned to continue to grow our market share in the remainder of the year".

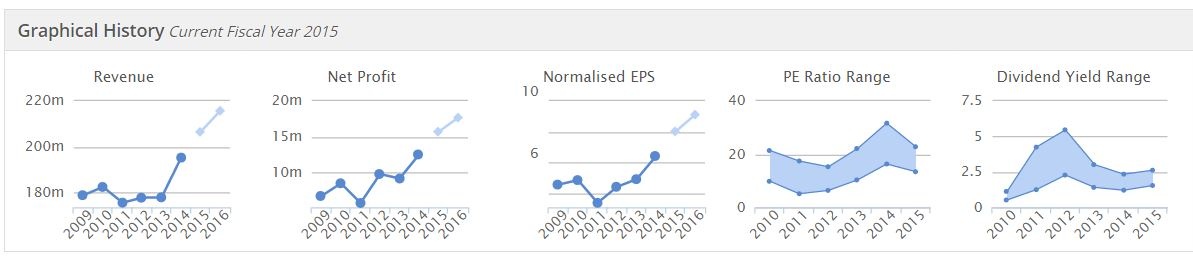

Valuation - this is the tricky bit! As you can see below, Topps is demonstrating a good progression of sales & profits, and it undoubtedly has macro factors providing a tailwind at the moment, and probably for at least a couple of years, I would guess:

So valuing the company really depends on these questions;

- Will the company meet or beat broker forecasts?

- What pricing multiple are you comfortable with?

- Where are we in the economic cycle?

Given that LFL sales are so strong, I would imagine there is a good chance the company could beat broker forecasts. So you could value it based on say 10p EPS forecast for next year (ending 30 Sep 2016).

What multiple? Who knows?! I would be comfortable with 15, but some people are happy to pay pretty wacky multiples right now, so might go up to 20, or even more?

Economic cycle? I think there is plenty more growth to come, as consumer confidence improves, and real incomes rise.

So overall, I'm coming out at a valuation of about 150p, or slightly ahead of the current 145p share price. If you're more bullish than me, and the market agrees with you, then there could possibly be further upside on the share price, but it's not something I would want to buy at the current level, since the price looks about right to me.

Quartix Holdings (LON:QTX)

Share price: 190p

No. shares: 46.9m

Market cap: £89.1m

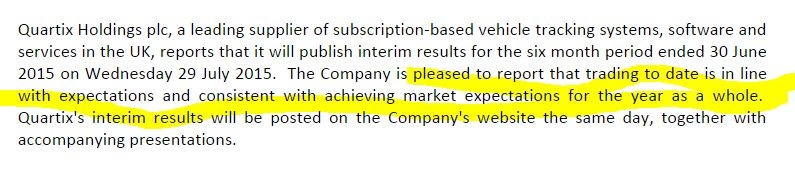

Trading update - this is a recent float which seems to be behaving itself a lot better than many! Today's update looks reassuring:

(apologies for the very wonky highlighting, I've just changed to a vertical mouse, as suggested by two readers, to help ease my RSI, but I haven't quite got the hang of it yet. Will come back & replace this picture when I've got the hang of it).

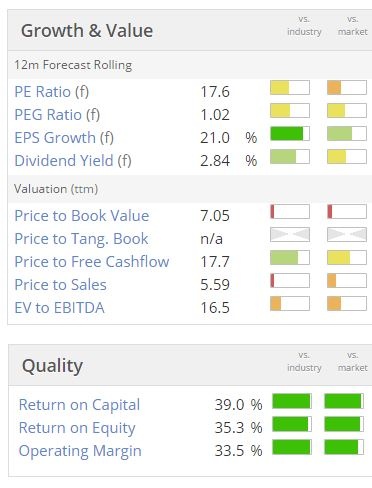

Valuation - considering the good growth this company has achieved, the valuation seems justified. Also note the excellent quality scores, and a dividend yield that's worth having:

My opinion - I'm not familiar with this company, but it looks potentially interesting, and definitely worth a deeper look I think, as a GARP candidate.

Vislink (LON:VLK)

Directors' Awards - in my view the scheme that has been announced today is an absolute disgrace, and should be rejected by shareholders.

It seems that very generous remuneration packages are not enough to motivate the Executive Directors at Vislink. Chairman John Hawkins was paid £438k in 2014, and £459k in 2013, a helluva lot considering the level of profitability of the group, but apparently it seems this is not enough.

We find out today that, to incentivise him, and two other Directors, to create shareholder value, they want to be given a staggering 15.38% of the market cap of the company, beyond a "hurdle" figure of £85m (which is only 20% more than the current market cap, so over a three year period this only means a target of minimum 6.67% p.a. growth in mkt cap).

Just like huge bonuses incentivised bank employees to take the risks which caused the credit crunch, so I could imagine this crazy incentive scheme at Vislink will incentivise Hawkins to go on an acquisition frenzy, gear the company up to the hilt, ramp the shares to high heaven, so that he can get a massive payday.

Some time afterwards, the company will probably collapse, because so many bad decisions had been made to trigger the incentive scheme payments.

This is an absolutely hare-brained plan in my view, and seems a sure-fire way to destroy the company. As one friend commented this morning, this is a "parody of capitalism".

I really hope shareholders kick Hawkins into touch, or even kick him out altogether. In my view he's a financial engineer, not a talented manager, and this incentive scheme is a good example of reckless, untamed greed.

I'll leave it there for today, and get some practice in using my new vertical mouse! See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in HSS and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These articles are Paul's opinions only. They are NOT recommendations, or financial advice. The emphasis here is on readers doing your own research).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.