Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries -

Duke Royalty (LON:DUKE) - up 8% to 32p (£134m) - TU - Graham - GREEN

A solid trading update from Duke as monthly recurring revenue reaches £2m for the first time. I believe these shares are offering decent value at a yield of 10% and with the company’s prospects having been improved by the opening of a far superior credit facility.

Paul's Section:

Bakkavor (LON:BAKK) - down 2% y’day to 90p (£520m) - Q1 Trading Update - Paul - RED

Bakkavor Group plc (the "Company") and its subsidiaries ("Bakkavor" or "the Group"), the leading international provider of fresh prepared food ("FPF"), today updates on trading for the 13 weeks to 1 April 2023 ("Q1 2023").

Revenues of £529m in Q1, up 9% (mostly organic growth), so a sizeable business doing roughly £2bn+ annualised revenues.

UK is by far its largest market, being 83% of total revenues.

Inflation - “largely mitigated” by price rises, and other measures.

Outlook - sounds encouraging -

With momentum expected to continue in all three regions, Group adjusted operating profit expected to be at the upper end of the range of market expectations2

Based on company compiled consensus ("Consensus") which includes; Citi, Goodbody, HSBC, Investec, Kepler, Numis and Peel Hunt, Adjusted operating profit Consensus for 2023 of £82.9m, with a range of £80.0m to £85.0m.

That sounds great, but remember that forecasts have been declining -

Also note that finance costs were hefty, at £20.8m in FY 12/2022, and with higher interest rates in 2023, I imagine that would rise (although it does mention having interest rate swaps). Hence I’d prefer the company to use adj PBT as its profit measure, not operating profit (which of course excludes finance charges).

There are no broker notes available, so let’s assume it might achieve c.9p EPS in FY 12/2023. That would give us a PER of 10.0x - seems reasonable, until you look at the debt position…

Balance sheet - this is where it falls apart for me, I’m afraid.

NAV is £618m, but includes £664m of intangible assets. Reverse those out, and NTAV is negative, at £(46)m. Hardly a disaster if it was a capital-light business, but it isn’t. Fixed assets (PPE) are large, at £548m, which is financed by a considerable amount of debt. It refers to net bank debt as operational debt, and it’s a substantial £285m at Dec 2022. That’s too high I think, especially now interest rates are rising so quickly.

Paul’s opinion - I don’t want to take any risk with highly geared companies at the moment. It’s surprising how many larger companies have what I would consider uncomfortably high debt at the moment, and this is one of them.

That makes me suspicious of the 7.6% dividend yield, which personally I would view as at risk. I’d much rather have a 3% yield from something like BMY, which is copper-bottomed with net cash, and well-covered, than a higher yield from BAKK that could be slashed at any time.

I like the products though - fresh ready meals are convenient, but also better value for money in this higher food inflation world, where for smaller households it’s far more cost-effective to buy prepared food, rather than pay more to buy all the ingredients separately, or order an expensive takeaway. BAKK is only making a slim profit margin, once finance charges are taken into account.

I don’t see any obvious appeal to this share, or the food sector generally. The heavy net debt burden, in a time of high interest rates, moves me from amber to red I’m afraid. I can’t see why anyone would want to take the risk, when there are much more soundly financed companies at similar valuations.

Upside could however come from its restructuring programme, and I see that the USA and China operations combined were loss-making, so a turnaround there could improve group results maybe?

Bloomsbury Publishing (LON:BMY) - unch at 410p y’day (£335m) - Audited preliminary results - Paul - GREEN

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces audited results for the year ended 28 February 2023.

Harry Potter is its biggest title, does anyone know how much of its profit comes from that, I wonder? Other divisions are making good profits too.

The company headline with these results looks good -

Record sales and profit ahead of recently upgraded expectations

Adj PBT is up a creditable 16.3%, to £31.1m

Outlook comments are nicely quantified -

Trading for 2023/24 has started in line with the Board's expectations and the Board is confident in its ability to achieve continued long-term success. Bloomsbury plans to invest in further acquisitions and organic growth."

Note

The Board considers current consensus market expectation for the year ending 29 February 2024 to be revenue of £272.1 million and profit before taxation and highlighted items of £32.2 million.

That’s slightly up on £31.1m actual adj PBT for FY 2/2023, so only a slight increase in profit for FY 2/2024, which hopefully might mean more earnings upgrades as the year progresses?

Adjustments to profit are quite large, at £5.7m, but of that most (£5.2m) is goodwill amortisation, which is customary to adjust out, so that’s fine by me.

Adj diluted EPS is 30.6p for FY 2/2023, giving a PER of 13.4x which looks reasonable.

Dividends are forecast at 2.9%, nothing special, but covered 2.5x, so it has higher dividend paying capacity.

Balance sheet - is very healthy. There’s NAV of £188m, which includes £87m of intangible assets, hence £101m of NTAV, including net cash of £51.5m.

This gives the company lots of options - it could be more generous with divis & buybacks, as well as self-funding more acquisitions. I was quite surprised to read in the commentary that it has done 19 acquisitions since 2018, with more in the pipeline. Perhaps at some point the stock market might give it a higher rating for this good growth track record, which has involved very little equity dilution.

Paul’s opinion - we’ve been reporting positively here on BMY for a long time. Looking through today’s strong results, and solid outlook comments, I’d say this looks an excellent GARP share, but on a value rating. An enthusiastic thumbs up from me.

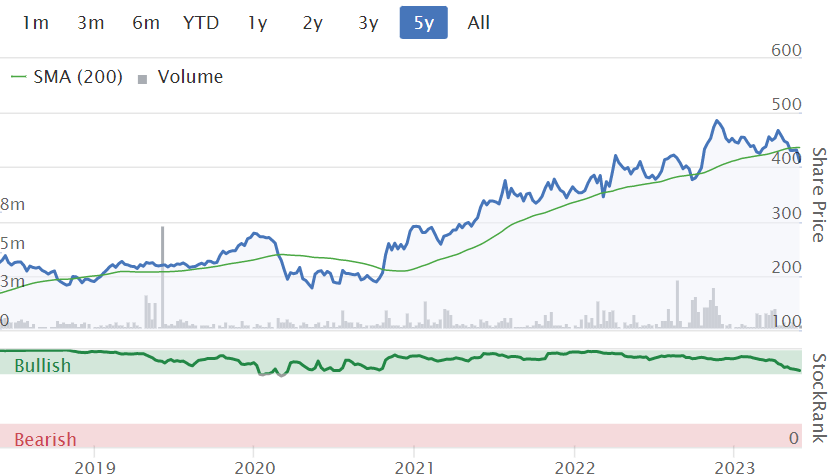

Given all the macro problems of the last 5 years (covid, inflation, energy crisis), this looks a decent chart (with dividends on top too) -

Graham’s Section:

Duke Royalty (LON:DUKE)

Share price: 32p (+6%)

Market cap: £134m

This is “a provider of alternative capital solutions to a diversified range of profitable and long-established businesses in Europe and North America”.

I’m a former shareholder at this company, and I wrote out a list of positive and negative points on it back in an SCVR of August 2022.

It provides royalty financing - an unusual type of financing for non-resource companies outside of the United States.

Today we have a trading update for Q4 (to March) and guidance for Q1 (June).

Key points:

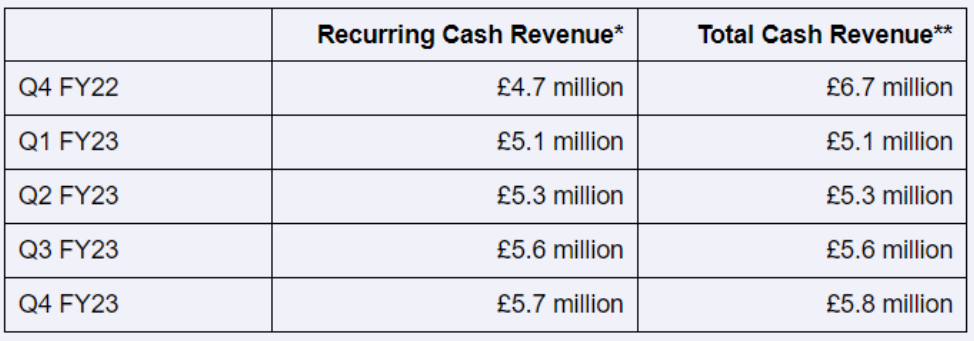

Q4 recurring cash revenue £5.7 million.

Total cash revenue only slightly higher at £5.8 million.

As a reminder, the recurring cash revenue is the revenue received from investees excluding one-off transactions.

The company publishes a table showing a pleasant increase in quarterly recurring cash revenue over the past year, and advises the market that it should reach £6m in Q1 FY24.

New credit facility - I like this development for a couple of reasons. One of my bear points from last August was that Duke was paying 7.25% above the overnight rate to borrow. Now Duke is only paying a margin 5%. Its new facility is also much larger (£100m vs. £55m) and it’s from Fairfax Financial.

Fairfax is frequently thought of as Canada’s answer to Berkshire Hathaway (in which Graham has a long position).

So on all counts, this new credit facility is excellent news, but saving millions of pounds in annual interest costs is probably the best part of it!

New $8.75 million investment in California-based Instor Solutions, which is “a California-based product reseller and service provider for work related to the build-out and migration of data centres”.

Follow-on £1.75m investment in inTEC Solutions.

CEO comment:

With the forthcoming quarter looking robust in terms of recurring cash revenue, we have confidence in continuing to deliver in the months to come and our pipeline remains strong. The current climate serves to accentuate the attractive qualities of royalty finance, and our supportive model has demonstrated its ability to help partners weather macroeconomic turbulence.

Graham’s view

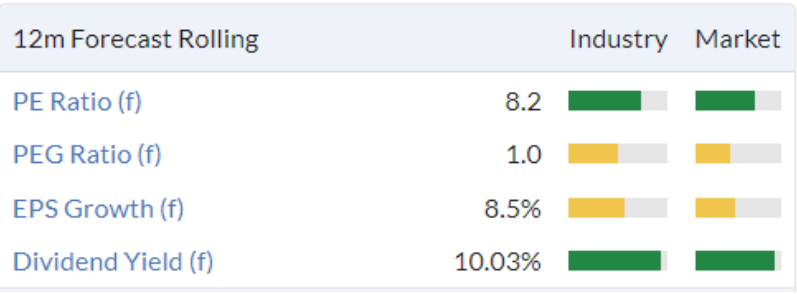

I see that Stockopedia is loving the value on offer here:

Scrolling back to the interim results (to September 2022), I see that the company reported balance sheet net assets of £157m, and earned after tax net income of £10.3m. The profit figure matched the royalty cash income for the six-month period of £10.2m.

On the face of it, then, this is looking rather good value at a market cap of £134m.

Personally, I was lucky enough to get out of this one before the Covid collapse, and I note that it remains stuck below the levels it reached in 2019:

I’m going to give this stock the green light because it has been around for long enough now, including the Covid period, to prove that its business model has merit. It has had surprisingly few mishaps so far.

The news on the credit facility is also really impressive to my eyes, with a prestigious partner offering it much improved terms relative to its prior facility. That removes one of the major bear points I worried about.

And the valuation is reasonable, assuming that there is no major catastrophe lurking in the portfolio somewhere.

Personally, however, I don’t think I’ll be investing in this one again.

While I do like to receive a modest income from my investments, I don’t need a yield as high as 10%. And that’s particularly true when we are talking about a company that has such a strong propensity to raise fresh equity.

Duke last raised equity in May 2022, selling £20m of shares at 35p. Apart from FY 2021, it has issued new shares every year since 2017.

Improved size and diversification of its portfolio does help to reduce its risk levels, and it’s important that the company keeps growing to continue the process of diversification. It just doesn’t seem very efficient to me, to pay out enormous dividends while also regularly raising fresh equity. Most companies would do one or the other, not both!

I assume that Duke does still intend to raise large amounts of money from the market, as it still has only c. £200m of assets.

But Duke’s investors are obviously happy with the approach of paying out a large chunk of the proceeds from its existing investments to shareholders, and then using fundraisings to accelerate growth. If you have no issues with that strategy, then maybe this is worth a second look.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.