Good morning. Avanti Communications (LON:AVN) have issued a trading update this morning. They operate satellites. I've looked at this company many times in the past, and have never been able to find a satisfactory way of valuing it. At 246p a share, the market cap is £275m, and it has a fair bit of debt, since the enterprise value is £416m, yet it has never made a profit - so the valuation hinges entirely on expectations of future profits, which is really not my cup of tea at all.

For the year ended 30 Jun 2013 they say that revenues were below market consensus, due to "timing movements of certain contracts", which in non-RNS-speak personally I would call "delays".

They have £42m in the order book for the current financial year, ending 30 Jun 2014, which compares with forecasts for £63.7m turnover this year, delivering around breakeven. They say they were operating cashflow positive in June 2013.

So it reads like a profits warning for the year ended 30 Jun 2013, but with lots of positive commentary about the future outlook to soften the blow.

After hearing a programme on Radio 4 all about how the many fragments of man-made space junk are orbiting the earth, and putting satellites in peril, I think that was enough to put me off getting involved in anything related to space. I know nothing about the satellite sector, so I will re-enter the atmosphere and look at something terrestrial.

The futures are indicating a slightly softer open, with the FTSE 100 down about 23 points to 6,500 - still a pretty remarkable recovery given that we were knocking on the door of 6,000 recently.

Myself and a ShareSoc Director met with the Chairman of Vianet (LON:VNET) yesterday, and had an excellent meeting. I'll do a more detailed write-up at some point over the next week, but suffice it to say that the company has very much taken on board criticisms about its investor relations towards private investors, and is now striving to improve in that area. I found the Chairman open & straightforward.

Also I was encouraged by what they said about the regulatory threat from the Government's proposed Statutory Code. Whilst it is still a risk, legal advisers have indicated that banning beer flow monitoring equipment would be illegal under 3 counts of EU law, 3 counts of Human Rights law (!), and that the case for retaining flow monitoring is very strong. In particular, it protects Government tax revenues (VAT and corporate taxes, and arguably PAYE/NICs too, since it prevents leakage into the cash economy from illicitly supplied beer).

The company feels that the Govt have listened to whoever shouted loudest to begin with, and not given a fair hearing to their side. Anyway, Vianet are lobbying hard to get their point of view across, and their full submission document will be posted on their own website shortly. As they point out, it would be very difficult for the Govt to legally intervene in commercial, arms length contracts, where all parties are freely consenting adults.

If the Govt regulatory challenge is fought off, then Vianet shares would be excellent value at the current price of 69p, since they have a sustainable yield of 8.3% at that level. Normally such a high yield is a sign of it being unsustainable, but in this case it's binary - if the regulatory threat goes away as expected, then the dividend can be maintained from long-term recurring revenues.

Personally I certainly won't be selling any more, and could see myself buying on any dips from this point onwards. As always, no advice intended, this is just my personal opinion, and please always DYOR.

Yikes, I see that Avanti Communications (LON:AVN) are down 83p to 164p, a 33% drop. Looks to me like it's the curse of the spread bets again - geared clients probably being forced out on the spike down. I see from IG's platform that they have over 51 clients, 100% long in this stock. As mentioned in yesterday's report, these more speculative stocks are simply not suitable for spread bets, especially where a lot of punters bunch together in the same stock.

There was a hideous profits warning last night from computer games company Zattikka (LON:ZATT). It is clear that the company is in serious trouble, and is now "evaluating all strategic options", and is dependent on the continued support of creditors. Hence the 41% share price fall today to 16p if anything looks like an under-reaction. If I held these shares, I'd be dumping them as fast as possible today, because surely a deeply discounted Placing is on the cards now, or even insolvency if nobody is prepared to support it.

Zattikka only Listed in April 2012, at 100p. So to get into serious trouble in just 15 months after Listing is a very poor show. It once again calls into question the quality of companies listing on AIM. Nobody benefits from speculative, early stage companies getting a Listing & then blowing the cash raised in just over a year, it just brings the whole market into disrepute.

Another point with Zattikka is that they had previously stated that results would be heavily weighted towards H2. In my experience this is often a deferred profits warning, or at least it greatly increases the likelihood of a subsequent profits warning. So it's a big red flag generally when companies state that trading is expected to be H2 weighted.

Mission Marketing (LON:TMMG) is next on the list to look at. Their shares have also dropped this morning, by 12% to 23p, following the publication of a trading update. As usual with this company's RNSs, one has to pick through a certain amount of waffle before reaching the substance. In this case it seems they've lost a major client, B&Q, and another Aviva, has cut back. That has resulted in restructuring charges, and a profits warning for H1 results, which will be lower than last year.

They "anticipate significant growth in the second half of the year and expected adjusted profit before tax for the year to be around £5m". So a big thumbs up for clarity in this particular paragraph anyway! I do like companies that specifically state what current year profits are likely to be - why can't everyone do that, it would make life so much easier, instead of having to de-code trading statements & make guesstimates.

The market cap is currently about £18m, and they have reduced debt usefully to £9m at 30 June, so this is actually looking potentially interesting. Especially as they also state an "intention to re-instate a dividend at the time of our interim results".

I'm warming to this one actually, and will forgive them for the waffle about the curate's egg in today's statement! I'll add this to my watch list for further research.

I've been asked to look at the trading update from Sprue Aegis (OFEX:SPRP) in the comments section below. I don't normally look at ISDX Listed companies (the next market below AIM), as there are enough liquidity problems on AIM, but Sprue Aegis is a good, profitable company, with a market cap of £35m at 90p per share.

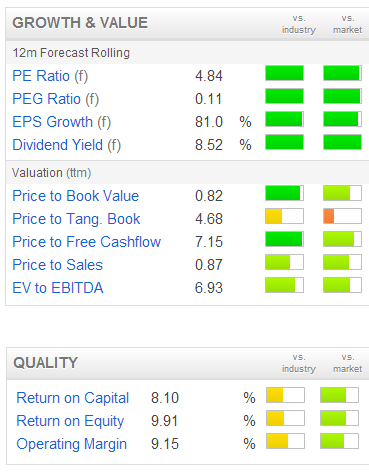

Having had a quick review of the Stockopedia page for this company, I have to say it looks excellent value, and if I had any spare funds, I'd buy some.

Their pre-close trading update today sounds very good - they report strongest ever H1, with sales up 28% versus last year to £21.4m for the six months. They confirm full year profit expectations, which is for 10.8p, so at 90p the shares are on a current year PER of only 8.3, which looks cheap for a company that is growing EPS strongly against last year.

The icing on the cake is a generous dividend yield of 4.4% for last year, and broker forecast is for a whopping 6.7% yield this year. The icing on the icing is that they also have a useful amount of net cash, £6.2m at the last results. They make smoke & fire alarms. The outlook sounds very good, with them saying that "the company's forward order book has never been so strong ...".

So this one gets a big thumbs up from me. I hope I haven't missed anything negative about it, so do please let me know if I've missed anything important.

STILL no news from Silverdell (LON:SID) following the suspension of the shares on 2 July 2013. I was told that there would be an announcement last week, so the silence is odd.

Regardless of any other factors, shareholders own the business, so have a right to expect prompt communcations, and to be informed as to what is going on. So an RNS is needed urgently, even if it contains incomplete details. Suspending the shares and then saying nothing really isn't on.

The last I heard was that one subsidiary, Kitson's was in Administration, but not the other group companies. Therefore the Listed entity can & should issue an urgent update to shareholders.

There's a reassuring trading update today from Regenersis (LON:RGS) for the year ended 30 Jun 2013. They say that trading has been in line with market expectations, so that means 15.7p EPS, which at 211p means the shares are on a PER of 13.4 for the year just ended. That's not expensive for a group which is delivering "double digit organic sales growth".

I like that they state net debt at 30 Jun 2013 is "substantiall better than market estimates", which is good, although I don't have any broker notes to hand on this company, so am not sure what level of net debt was forecast? It was fine at the last set of results, at £7.7m net debt, which is modest for a group with a market cap of £105m.

The outlook sounds good, with my eye particularly drawn to the last sentence of today's statement, where they say;

"Our ongoing strategic development, investment in senior people and continuing good results underpin the Board's expectation for further double digit growth next financial year and beyond."

It's not a share in my portfolio, I missed the boat on this one unfortunately, despite spotting the shares being good value when they were just under a quid. Sometimes you look at so many companies that you just forget to buy shares in things, even when you spot good value. Just an occupational hazard I guess!

One of Mark Slater's favourite shares, Restore (LON:RST) announces an in line with expectations trading update today, for the six months to 30 Jun 2013. So that looks like EPS of 10.5p for the year ending 31 Dec 2013, so a share price of 122p gives a PER of 11.6. Not bad for a growth company, although I'd need to check net debt, as they are growing through acquisitions.

Mark Slater explained at a spring shares conference that Restore is buying small documents storage companies cheaply, and consolidating them. It's cheaper for firms like lawyers & companies, to store documents rather than having them all electronically scanned. It didn't excite me much at the time, but with the comfort of a bang up-to-date trading statement, and a PER of 11.6, it's starting to look quite interesting. If time permits, I might have a closer look at this.

Consensus forecast for 2014 is for EPS to rise to 12.2p, so the PER would fall to 10, which does seem good value. The dividend is unexciting at a yield of only 1.5%, but it's in the growth phase, so that's understandable.

I'd want to investigate how sustainable profits are, and that they haven't boosted profits from any one-off contracts?

Finally, readers might like to have a look at Animalcare (LON:ANCR). They have also issued an in line with expectations trading update today, for the year ended 30 Jun 2013. The figures look reasonably good here - a forecast PER of about 12, yield of 3.7%, net cash on the balance sheet, and a decent operating profit margin.

They mention delivering future sustainable growth, so could be interesting, I've only given it the most cursory of glances though, as run out of time & my 11 a.m. email is going out now.

See you from 8 a.m. tomorrow, as usual!

Cheers, Paul.

(of the companies mentioned today, Paul has a long position in VNET, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.