Good morning!

Speedy Hire (LON:SDY)

Share price: 31.75p (up 9.9% today)

No. shares: 522.0m

Market cap: £165.7m

(at the time of writing, I hold a long position in this share)

Interim results to 30 Sep 2015 - the shares are trying to rally this morning, although (so far) on little reported volume. Mind you, larger orders are often being worked in the background, and are reported later, on a delayed basis. So tracking the small retail trades during the day only gives you part of the overall picture.

I've held this share for several weeks, as a potential turnaround situation. So far, SDY has had a dire 2015 - with 2 profit warnings, in Jul and Sep. It's still not entirely clear what went wrong, but from what I can tell, it seems to just have been the basics of running the business that went haywire. There could be an element of sector problems, as HSS Hire (LON:HSS) also warned on profit around the same time.

The nice thing about SDY is that it has a solid balance sheet, so it shouldn't have any solvency issues whilst it sorts things out. Whereas the same cannot be said for HSS, which has a terrible balance sheet, and is hence not a stock I would go near.

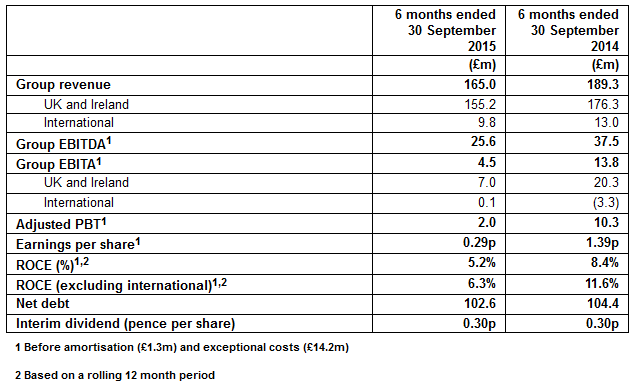

The highlights box (below) from today's interim results demonstrates the operational gearing. So although EBITDA is down by a third, adjusted PBT is down by over 80%, since the big depreciation charge and financing costs are effectively fixed costs, so the impact of top line underperformance becomes more marked the further down the P&L you go.

So a lousy half year, but the market already knew that was coming, so it was priced-in.

It's all about looking for signs of recovery. In that regard, I find today's results moderately reassuring, in particular that full year expectations are confirmed;

...confirms that the Group expects to deliver a result for the full year in line with the Board's expectations, as detailed in the Company's trading update published on 28 September 2015.

Clear actions to remedy underperformance seem in hand;

Remedial actions to address legacy performance issues are starting to deliver results;

o Reductions in administrative costs expected to deliver full year savings of c.£13m from prior year

o Redistribution of assets across depot network improving asset availability

o Ongoing IT system upgrades providing enhanced management information and an improved customer experience ·

Programmes to improve customer retention and acquisition being implemented;

o Emphasis on improved customer service provision

o Focus on innovation and differentiation

o Sales function aligned to better address the needs of both Strategic and SME customers

Full benefits of remedial actions will be realised over the medium term

The CEO comments also indicate that a turnaround is underway, although note the mention of medium term several times - clearly they are reining in expectations of a rapid turnaround;

These are early days in the Group's recovery and the full benefits will only be realised over the medium term. However, remedial actions implemented to date have started to stabilise our revenue base and we are expecting to see an improvement in the second half.

Whilst our markets remain competitive, Speedy remains a fundamentally good business which in a more lean, efficient and customer-focussed form, has the potential to once again deliver sustainable profitable growth."

Dividends - can often provide an important clue as to how confident management are about a turnaround, and also how secure the finances are. In this case the interim divi is maintained at 0.3p, so the yield is about 2.2%, if the final divi is also maintained.

Bank financing - the comments today are reassuring, and confirm my view that the balance sheet looks fine. Yes there is a fair bit of bank debt, as you would expect for a hire company, but net debt is only about half the book value of the hire fleet, which seems fine to me;

As at 30 September 2015, net debt was £102.6m (30 September 2014: £104.4m) giving a net debt to EBITDA ratio of 1.69x (2014: 1.38x), on a rolling basis.

The Group continues to operate well within its banking facilities having last year undertaken a re-financing which secured a new £180m 5-year asset-based revolving facility at an improved margin and with agreements in place to support additional funding, if required.

Oulook - comments today sound reassuring - it has the feel of a business which is over the worst of a bad patch, in my view;

These are early days in the Group's recovery and the full benefits will only be realised over the medium term. However, remedial actions implemented to date have started to stabilise our revenue base and we are expecting to see an improvement in the second half.

Whilst our markets remain competitive, Speedy remains a fundamentally good business which in a more lean, efficient and customer-focussed form, has the potential to once again deliver sustainable profitable growth.

My opinion - I quite like it as a turnaround. There's always the risk that more bad news might come out though. A full turnaround should get EPS back up to c.4p that was originally forecast for this year, before various problems emerged. That could command a PER of say 12, so a price target of 48p is the ballpark that I think could be achievable in say 1-2 years.

Not massively exciting, but if achieved, then that would give 51% upside on the current price, with divis paid whilst we wait too. So overall, worth a look I think, for people who can tolerate a bit of risk.

Densitron Technologies (LON:DSN)

Shares suspended - the company has asked for its shares to be temporarily suspended, so I looked into it, worried that the company might be in financial trouble. However, it turns out that I missed previous announcements saying that a maker of gaming machines called Quixant (LON:QXT) has bid for Densitron, at 11p per share.

It looks a good outcome for Densitron shareholders, as the company wasn't really going anywhere on a standalone basis, and the price paid looks fair to me.

Globo (LON:GBO)

Update - there's another short update from the Administrators of the plc. The aIM listing will be cancelled on 1 Dec 2015, which is a formality as we already know that the shares are worth nothing. This is confirmed again today;

The Joint Administrators do not anticipate that there will be any return from the administration for the shareholders of Globo Plc, and therefore they consider that it is appropriate that the securities are cancelled.

Given that the Administrators have now, several times, confirmed that there will be nothing for shareholders, then the Spread Bet/CFD companies really have no excuse for withholding client monies (both on the long & short side, both of which are margined at 100% at IG, for example).

This all begs the question, what happened to the cash pile which Globo claimed to have? Who stole it, and where is the cash, and the people who stole it? Or was the cash just burned up in day-to-day losses over several years, whilst fictitious revenues were put through the books to give the impression of profits?

Other interesting points from today's update - there will be a report published, which should answer the burning questions as to what on earth happened here, and who was responsible? Also, I think everyone wants to know where the Directors are hiding? Have they been arrested yet?

In accordance with paragraph 49 of Schedule B1 of the Insolvency Act, the Joint Administrators are required to submit their proposals to creditors within 8 weeks of their appointment and shareholders are also entitled to receive a copy of the report. This report will be made available to creditors and shareholders at www.thecreditorgateway.co.uk (password: Globo) in due course.

Note further that it's only the group holding company, the plc, which is in Administration. The operating subsidiaries are not. So that should mean jobs can be saved at operating subsidiaries. I imagine that the operating subsidiaries will be kept operating (if they are viable), and sold off - with the proceeds being used to cover the Administration costs, and anything left over going to the secured creditor (the Bank). If those costs are covered in full (very unlikely), then the next in line would be unsecured creditors. Only after all those are settled would any money be available for shareholders.

Clearly the Administrator has done the sums, and worked out that there's not going to be any chance of monies being available for shareholders, so that's that then.

The Administration relates to Globo Plc, and not any of the Company's direct or indirect subsidiaries, which remain under the control of their respective statutory directors.

What a sorry end to yet another overseas company that listed on AIM. AIM really does seem to be a magnet for conmen, doesn't it? That's the trouble I suppose, when you create a market with little to no effective regulation, and where nothing happens when people break the rules and rip off investors.

Once again it is demonstrated that shorters are the only effective regulation this market has. Once again, the City advisers seem to have turned a blind eye, as long as the fees kept rolling in. It's disgusting really, isn't it?

Pressure Technologies (LON:PRES)

Share price: 181.5p (up 23.9% today)

No. shares: 14.4m

Market cap: £26.1m

Full year trading update - covering the year ended 3 Oct 2015. It's surprisingly good actually, considering the sector - oil services, which as we all know is on its knees due to the ongoing low oil price.

As a result of strong performances across certain of the Group's Divisions adjusted EBIT (subject to audit) will be slightly ahead of market expectations. This is particularly pleasing given the conditions in our main oil and gas market and reflects the positive actions initiated in the first half of the year to integrate acquisitions and significantly reduce our operational cost base. We believe we have preserved our core skills, which will place the Group in a strong position when the market returns.

Unfortunately, I can't find any broker estimates for this year, so can't quantify this at the moment.

Outlook - various other details are given, and the outlook comments could have interesting read-across for oil services generally - has the sector hit rock bottom now, and might be a good time to look for picking up some bargains, I wonder?

Along with many others in the sector, we do not foresee any signs of pick-up in our main oil and gas market during 2016, however we do not currently anticipate market conditions deteriorating further. As a result, we remain confident in our expectations for our Precision Machined Components, Cylinders and Engineered Products Divisions. The Alternative Energy Division is project based and consequently is subject to the timing of new contract awards, but we are pleased with the growing momentum in this business.

Although, if no pickup is anticipated in 2016, then perhaps there's no particular rush to get involved in this sector?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.