Good morning! Do have a play with the new "Ranks" tab on the black menu above - it's great!I was experimenting last night, it's a new page to allow you to browse the stock ranking system here.

Trifast (LON:TRI)

Share price: 113.3p

No. shares: 116.2m

Market Cap: £131.7m

Trading update - this looks positive - note the "ahead of ... expectations" bit (although that refers to organic growth, not profitability - although they should mean the same thing);

The update also refers to improved efficiency driving higher margins, and the potential for more growth through acquisitions.

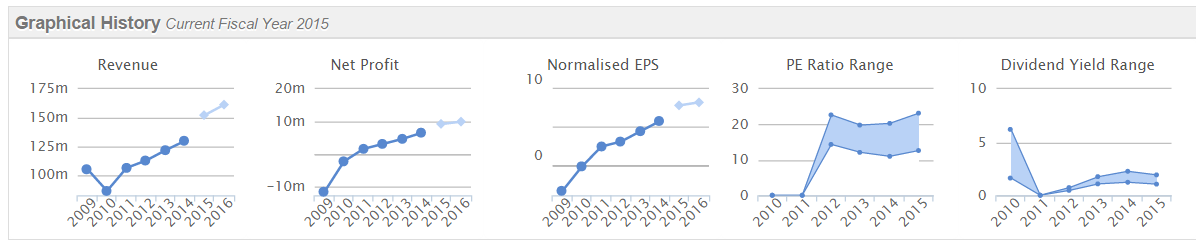

My opinion - I've previously been sceptical about the valuation here, but given the positive news this morning, and what now looks like a fair valuation, I'm considering buying a few of these shares at 113p. The company has a good track record (see the Stockopedia graphs below), and seems reasonably priced for a company that has been consistently meeting or beating expectations in the last few years;

I didn't take to management when they presented at a Mello event a couple of years ago, but it looks like I misjudged them, as the business has performed well since.

DP Poland (LON:DPP)

Share price: 12p (up 27% today)

No. shares: 95.4m

Market Cap: £11.4m

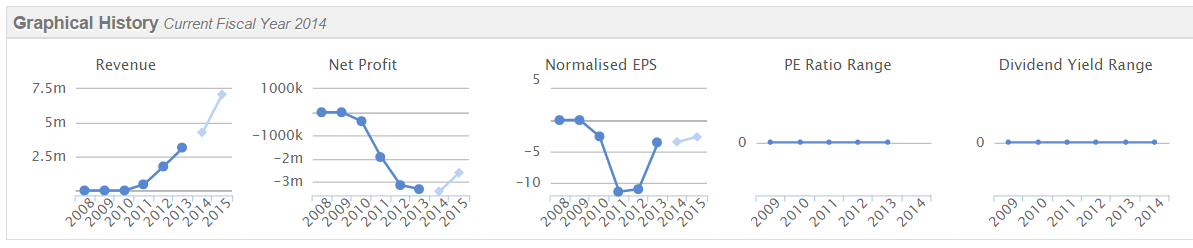

Trading update - this company has exclusive rights over Dominos Pizza in Poland, so the hope has always been that the company could replicate its huge success in the UK. So far the company hasn't even come close, with terrible financial performance to date.

The company operates 12 branches in Warsaw & Krakow, with a further 6 franchised branches. Like-for-like ("LFL") sales were up 19% in 2014, which is very good (but from a low base).

The top 3 stores moved from EBITDA losses of avg. £13k in 2013, to positive £24k in 2014. That's a good improvement, but throwing a bucket of cold water over bulls, I would point out that capex is not paid for by the tooth fairy! The fit-out for this type of store is about £400k in the UK, so whilst it might be cheaper in Poland, you would still be looking at a significant amount. Therefore the depreciation charge is almost certainly bigger than EBITDA, meaning that the top 3 branches are actually still loss-making!

Bear in mind this doesn't even start considering what Head Office costs are. You need plenty of store contribution (i.e. branch profit) in order to fund all the overheads at Head Office. So if your stores are all losing money (as these still are), then you have nothing to cover your H.O. costs - every penny is additional cash burn.

The company made a £1.6m pre-exceptional loss in the six months to 30 Jun 2014, on turnover of only £1.9m. So based on today's statement, if we add say 20% to turnover, and guess that incremental turnover might be on a say 75% gross margin, then that would have added about £285k to profit. Thus H1, in 2015, if trading 20% ahead of H1 2014, would still be a loss of £1.3m on turnover of £2.3m.

In other words, the 19% sales growth the company is crowing about this morning would only reduce its losses a little, but still leave a yawning gap between where the company is currently trading, and breakeven (let alone profits).

My opinion - this company is taking far too long to establish the Dominos name in Poland, and whilst it has made some progress, is still heavily loss-making, even allowing for today's improved sales figures.

I suppose you could argue that sales growth might snowball, and result in it being decently profitable in future, but the figures to date make it look very much like an uphill struggle. It might eventually succeed, but it's difficult to see why investors would get excited about such a hesitant retail roll-out, when there are far more exciting, and profitable retail growth stories out there.

Cash burn is high, and it looks as if the company will be running low on cash by the end of 2015, by my calculations. So yet another Placing on the cards late this year, early 2016 probably. So a share for eternal optimists only.

Porta Communications (LON:PTCM)

Share price: 7.0p

No. shares: 267.6m

Market Cap: £18.7m

Trading update - after a brief initial surge, the shares are now negative on the day. There is clearly an overhang from a seller. It's as if the seller forgets about Porta in between announcements, and only remembers to start selling again when there is an RNS, irrespective of what the RNS says!

All very frustrating, but in the long run none of that will matter. Companies which are trading well will re-rate, even if a seller can delay that process for a year or more sometimes, with small caps.

Either that, or the company is not being honest in how it presents its performance. That has certainly been the case here before, when Porta wildly exaggerated its performance in 2013, claiming to be highly profitable, when it wasn't at all - they came up with a ludicrous definition of EBITDA, which stripped out trading losses for any subsidiary which had been open less than two years.

So I think it's possibly a case that the market disregards the company's trading updates, and will just judge the shares on real performance. So I will reserve judgement until the 2014 results are published.

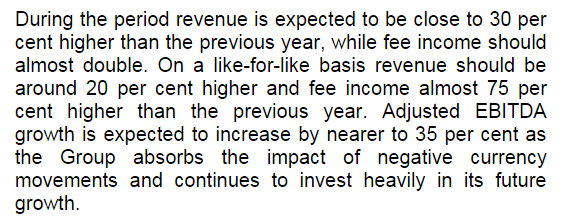

Today's update sounds positive, although negative currency movements haven't helped, and "investing heavily in its future growth" basically means running at a loss!;

My opinion - I think there is something potentially interesting at this group. However, management blew their credibility by putting way too much spin on previous results, which gave a misleading impression of how the group was actually performing. So they need to deliver proper profits, in order to rebuild credibility, rather than trying to massage the numbers to show a profit where there isn't really a profit. PR people just can't help themselves sometimes!

I'm prepared to be patient with this share though, as they are expanding rapidly, and have some interesting & quite high profile companies within the group. What do readers think of Porta? Your views are welcome in the comments below.

Tangent Communications (LON:TNG)

Shares are down 25% this morning on a downbeat trading update.

"Underlying profit" is expected to halve to £1.2m for the year ending 28 Feb 2015. The divi is being passed. Oh dear.

On the other hand, they have net cash of £1.4m at year end, so it still looks a viable business.

There might be a bottom fishing possibility here at some point, but looking at the market cap of c. £10m, it doesn't look cheap enough yet to tempt me. The key questions for me would be why is profitability falling? It surely must be down to competitive pressures. I'm not keen on investing in low margin, highly competitive sectors like this.

It reminds me a lot of £GRA which struggled to make progress in this very competitive sector (printing). That said, if you can time it well, there is the scope to catch a strong rebound with this type of stock. However, as we have seen with Grafenia, the big surge in price didn't hold, and it's slipping back down again.

Hate to say it, but I think both companies are probably quite low quality businesses offering little upside to investors, unless you get lucky and manage to buy at the lows, before a spike up. I'd rather buy into a small business that is putting out strong trading updates, than try to bottom fish ones that are disappointing.

Red24 (LON:REDT)

A positive trading update this morning - saying that the year ending 31 Mar 2015 is "ahead of expectations", and that momentum is expected to carry through into the following year. All very good.

These shares are now up about 50% in the last few weeks. We discussed it here not long ago, I seem to recall, and several of us liked the company.

Latchways (LON:LTC)

Only time for a very brief comment. I've been monitoring this stock for a while, and the trading update today shows the first signs that things might be stabilising, and have potential to improve, after a period of under-performance.

Trading for y/e 31 Mar 2015 is in line with expectations, and the Directorspeak sounds as if there is a more optimistic outlook.

The company has a strong balance sheet with net cash, and pays good dividends. So although it doesn't exactly look cheap, I've dipped my toe in with a small initial purchase this morning. I'm worried it might be too early to jump in, hence have kept my initial buy very small. I'll look at adding if the next trading statement confirms things are improving.

DYOR as usual, and please do let me know your views on this stock too, as I know opinion is divided on it.

Gotta dash, off for an investor lunch, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PTCM and LTC, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.