Good morning!

Getech (LON:GTC)

I nearly fell off my chair when reading the latest announcement from Getech. Remember that they put out another profit warning yesterday, due to contract delays. Well this morning they've announced a major contract win, for $2m. Oh by the way, the hyperlinks I put into these reports link to the relevant announcement on investegate.co.uk, to make it easy for you to open up the announcement and read it in a separate tab in your browser (if you right click on the link & select new tab).

Encouragingly, this contract win is for the second period of their Globe programme, from 2014-17, which bolsters confidence that, although contact wins are lumpy & unpredictable in timing, the company does seem to have a viable product with continuing appeal to clients. It should be noted that the revenue recognition is such that it doesn't affect the profit warning yesterday for the current financial year (ending 31 Jul 2014).

I was lucky in buying some stock yesterday, as I would imagine today's announcement is good enough to take the shares back up to around 50p or near to that anyway.

The company's CEO summarises things as follows;

This order is from an existing Globe client and although the income had been substantially factored into our expectations, we are extremely pleased that the contract is now signed. We remain confident that further significant contracts will also be signed in the near future. This brings the value of new contracts signed in the period since mid-May 2014 to over $3m and, given that much of the income will be recognised after this year, contributes to providing a sound base for the future.

Therefore I suspect this is probably the turning point for these shares, where investor confidence is likely to start returning. Although given previous disappointments, I also suspect that there is probably limited upside for the time being, as it will take time to fully rebuild investor confidence. Perhaps investors will just have to accept that this is a volatile share, with limited forward visibility, and rate the shares a bit lower to alllow for that fact.

It's worth noting that Getech has a sound Balance Sheet, with current assets being 241% of current liabilities (a very healthy position), including £3.6m of net cash. Also there are negligible long term creditors, and no sign of any nasties in the accounts (e.g. no pension deficit).

Note from the Stockopedia graphs below, it was modestly loss-making in two years (2009-10), but has been profitable the rest of the time. So it seems as if, even in a bad year, the company is not likely to make serious losses. Combine that with a strong Balance Sheet, and you have a company that looks financially secure - which is what you want when revenues are unpredictable & lumpy - Balance Sheet strength is vital in such a situation, as then a company can ride out a lean patch and live to fight another day.

Flybe (LON:FLYB)

This regional airline has had an interesting history as a Listed company. The original management made a total hash of it, to be blunt, with multiple profit warnings, and the company came close to going bust. However, new management (ex-Easyjet) are implementing a remarkable turnaround, and I'll make no secret of the fact that I like this stock as a strong turnaround situation.

The other key point is that they did a £150m fundraising at 110p per share in Mar 2014. So the Balance Sheet reported today has moved from net debt last year, to £116.9m net funds - highly significant for a company with a market cap of £288m (with 216.6m shares in issue, at a share price of 133p currently).

It's surprising that the shares have gone down this morning (down 5% to 133p) because today's results for the year ended 31 Mar 2014 are slightly ahead of expectations. It's not really about this year's figures, which are a small profit. The shares are all about how the figures will look in the current financial year and beyond, once a full year of reduced costs comes through to the P&L.

2013/14 shows an adjusted profit of £1.7m (2012/13: loss of £23.6m), but much higher figures are likely for this year, mainly due to drastic cost-cutting, involving shedding 20% of the workforce, selling overly expensive airport slots, and beginning to better match the fleet of planes to the routes they serve.

One broker has forecast that profits could be as high as £48m next year. Certainly if you look at Flybe's turnover of £620m, and apply the sort of profit margin that Easyjet makes (c.11%), then Flybe would justify a share price of more than double where it is at the moment. That's probably too simplistic, since Flybe operates on shorter haul routes mostly, where less time is spent in the air, so it may not get quite that far. Although given that new management are ex-Easyjet, they clearly know exactly what to do in turning around Flybe, and that's what's happening.

Another broker feels that the shares have already priced-in recovery to date, and that they may need to pause for breath for the time being. Bottom line for me, is that the results today are in line with expectations (slightly ahead actually). On outlook they say;

We have made a good start to FY15, in line with our expectations.

We are moving to build on our early success. We have a plan and we have the firepower. The Group is now well-placed to become Europe's best local airline.

I don't normally invest in any companies connected with aviation, as so many turn out to be awful investments. The only airline I can recall investing in before was Dart (LON:DTG), which was a very good investment. In the case of Flybe, there is a clearly defined turnaround plan underway, results today are in line with that, but I've not gone through all the detail of the numbers, as this year is a transitional year that is not reflective of how the business will look thereafter.

Sorry, this section is not great, I might re-write it later, been distracted with lots of other things going on.

Quindell (LON:QPP)

I closed my short on Quindell a few weeks ago, as it seemed to have settled at around 20p. I've never liked this company, and have been subjected to some appalling abuse from misguided "investors" on bulletin boards elsewhere. It has a horrible business model, that doesn't generate any cash, and has never clearly explained where its huge profits (which pile up on the Balance Sheet in debtors) actually come from - because in reality a lot of the profit comes from whiplash claims.

There have been numerous red flags from this company, which investors ignored at their peril. Then there was the Gotham City bear raid, which as with a similar attack at Blinkx (LON:BLNX), seemed to contain enough material of concern to do permanent damage to the share price. Remember that shorters will only attack companies with dubious accounts, and business models.

Quindell has been hyping up its planned move from AIM to the Premium Listing on the Main Market, and bulls expected this to mean that tracker funds would become forced buyers of the shares. Well it's all come unstuck this morning, with an announcement that this move cannot happen because;

Considering the significant growth of the Group in recent years the Company has today been advised that it has not been able to satisfy Listing Rule 6.1.3 at this time, and particularly, the criteria in Listing Rules Guidance Note 6.1.3E (5) which states that an applicant may not be eligible if its business has undergone a significant change in its scale or operations during the period of the historical financial information, being the last three years' audited accounts.

So it looks like a technical reason, and it begs the question why did nobody check this in advance?

Surely a pretty major schoolboy error from the company & its advisers?

Although where the shares are Listed doesn't alter the fundamental value of the business in the long run, so if you like the company then a 26% drop today to 12.75p could be a buying opportunity?

Sadly I expect that a lot of the drop today will be Spread Betting companies forcing out margined punters who are not able to meet the margin calls. Once again these mug punters are toast - is it any wonder that a typical spread bet account has a lifespan of about six months? Anyone who takes leveraged positions in stocks with roaringly busy bulletin boards is just setting themselves up for a fall. These tend to be the most speculative, over-hyped shares, where punters group together. They nearly always end in tears. I hope no readers here have been caught on this one, I've warned about it often enough, and in the strongest terms.

I've picked up a little stock in QPP at today's low, purely as a small trading punt for the bounce. Even though my view of the company & management is unchanged, where it's Listed is not really that important in the long run. So such a big drop could be followed by a bounce. We'll see. I'm targetting 20p, then will get out as soon as possible. I'm only mentioning this because I'm obliged to disclose my personal positions in stocks here.

M&C Saatchi (LON:SAA)

This advertising/marketing company has issued an in line trading update today;

2014 has started well and trading is in line with expectations.

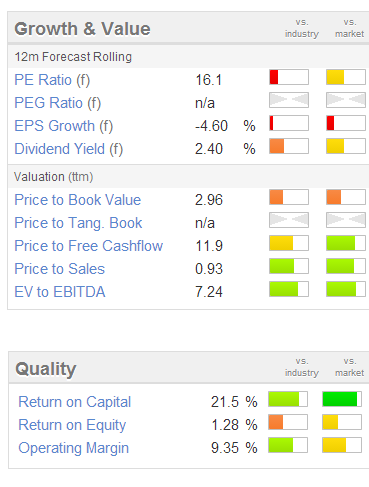

I see that the shares have been in a down-trend this calendar year to date, so this might be a good time to pick up a bargain? Although quickly checking the Stockopedia valuation graphics, it looks a tad expensive. A forward PER of 16 seems demanding, given that this stock was on a PER of about 10 for a while not that long ago. A hike of 6 points in the PER is too much for me. Maybe the brand name doesn't have quite the cachet that it used to have either?

The StockRank is an unimpressive 52, so I'll quickly pass on this one.

Signing off for the day, see you tomorrow as usual.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in GTC, FLYB, and QPP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.