Good morning!

Empresaria (LON:EMR)

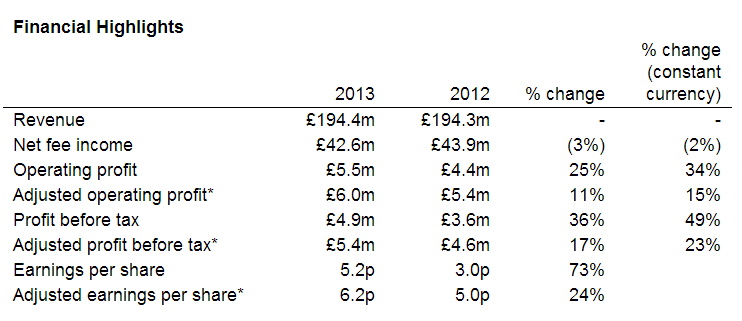

Results for calendar 2013 have been issued this morning from recruitment group Empresaria. The headline figures look good, so to save re-typing them, here's a screen shot from the results statement:

So an improved profit performance on flat turnover, which seems to have been mainly driven by cost savings in Germany and Austria.

I usually like to check to see what the excluded items are in defining adjusted EPS, to determine whether or not I'm happy to rely on adjusted EPS. In this case they have excluded the following items;

* adjusted to exclude amortisation of intangible assets, exceptional items, gain or loss on disposal of business and movements in the fair values of options

Those look fairly sensible to me, so by stripping those items out the company probably has shown the true underlying performance of the business. The trouble is, companies are stretching these definitions, and many groups now report exceptional restructuring charges every year - so you could argue that restructuring is just ongoing, and a normal part of business.

Anyway, I'm reasonably happy with using 6.2p adjusted EPS as the benchmark figure to value the business on. Put it on a PER of about 12, to come up with what the business might be reasonably valued at, i.e. 72p.

The shares are actually up 11% to 54p this morning, so at first glance they look cheap.

The problem with Empresaria is that it has too much debt. They also have a highly questionable method of reporting it, which I just think is plain wrong. The company reports £5.8m in net debt, which sounds reasonable. However, they have excluded from that figure a further £9.4m in non-recourse invoice financing.

This is presumably where the group has signed over its debtors to a bank, on a non-recourse basis, and they then net off that debt against trade debtors. That is an incorrect accounting treatment, as far as I'm concerned. The principle of no netting off, is one of the fundamental accounting principles! You have to show both the debit and the credit, separately on the Balance Sheet, within trade debtors (for the invoices), and creditors (for the money owed to the Bank).

I've never seen any other company use netting off in this way, and it really bothers me. The company might argue that because the invoice financing is non-recourse, then the bank has assumed all the risk. That's true, but what happens if the Bank then withdraw the facility? Shareholders would suddenly realise there's a hole in the Balance Sheet, and if they were not able to secure alternative financing, then the group might go bust.

So the way I look at the figures, Empresaria actually has £15.2m in net debt, which is highly material, because the group is only small, with a market cap of £24m at this morning's higher 54p share price.

Allowing for the real level of debt, then I think the market cap is probably high enough. It might run up further to say 60p, but that would take it to a PER of 10 times adjusted EPS, and the net debt is 63% of the market cap, so the debt-adjusted PER would then be nearer the mid-teens, which is not cheap.

Overall then, I think it looks superficially cheap, but once you properly take into account the high levels of debt it's probably priced about right at 54p per share. Bear in mind also that when interest rates rise, highly geared companies such as this will have to pay more in interest cost.

One thing I do like is how the company has very clearly spelled out what its Bank Covenants are, and what the level was at year-end. This shows that they seem to have plenty of headroom, although I think this might have excluded the invoice financing by the looks of it?

|

Covenant |

Target |

Actual |

|

Net debt:EBITDA |

< 2.5 times |

0.8 |

|

Interest cover |

> 3.0 times |

10.6 |

|

Debt service cover |

> 1.25 times |

3.4 |

Still, it's good that they have reported these numbers, as most companies don't disclose their Bank Covenants, which is a serious gap in the information investors need to assess the risk of the shares.

The Balance Sheet overall is weak, with too much debt, and net tangible assets which are negative to the tune of £1.3m. If I were the CEO here, I would do a Placing to raise £5-10m to strengthen the Balance Sheet. Lots of other companies are strengthening their Balance Sheets whilst the City is awash with cash, so now is the time to do it. Who knows what is around the corner? If China implodes, or the situation with Russia escalates, or the Euro wobbles again, then the window of opportunity could slam shut again.

The dividend yield is poor, at 0.8%, which reflects the weak Balance Sheet.

The outlook statement contains the key words "cautiously optimistic", so broker consensus of 6.4p EPS for 2014 looks realistic.

If the debt doesn't concern you, then these shares might be worth a further look. For me however, it's a little too high risk for my tastes. A very positive sign was a Director spending £1.16m buying shares at 36p in Dec 2013. That was a well-timed purchase, as he's already 50% up on the deal. I very much like large Director buys (6-figures or more), as it's usually a sign of good things in the pipeline.

Stadium (LON:SDM)

Next I've been looking at the preliminary results for calendar 2013 from niche electronics group, Stadium.

Checking back on my notes here, I see that on 10 Sep 2013 I reported on the unimpressive interim results to 30 Jun 2013, but noted the favourable outlook for H2. Pity I didn't buy any shares, as they are up about 50% from that point!

The company also put out an encouraging trading statement on 24 Jan 2014, saying that H2 was indeed significantly better, and hence the full year for 2013 was in line with expectations. I reported on that here.

Adjusted EPS for 2013 has come in at 5.3p (2012: 3.1p), so that seems to be above market consensus of about 4.5p, although you can never be entirely sure if you're comparing apples with apples. So I just make the assumption that broker consensus is based on adjusted EPS, which it usually is.

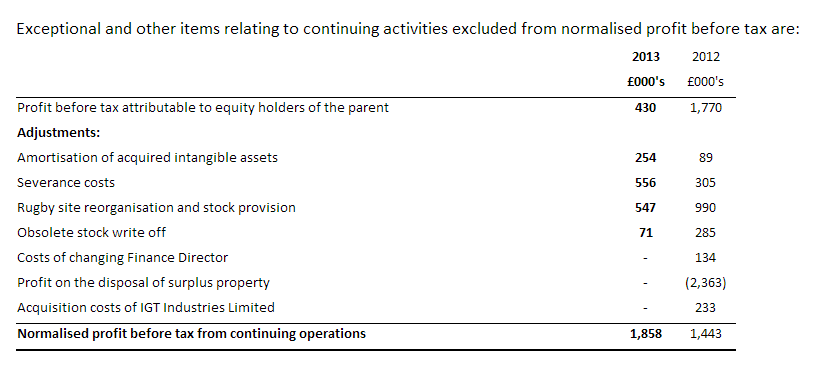

Helpfully, the company has included a reconciliation of profit before tax of £430k to adjusted profit before tax of £1,858k, as follows:

That all looks fairly sensible to me - those are clearly one-off site closure costs, as have been mentioned by the company in earlier updates in 2013.

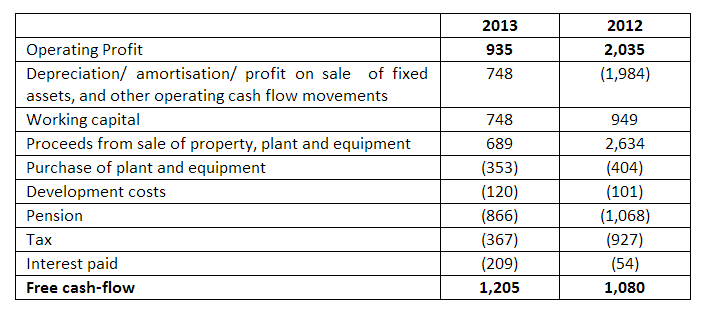

They also provide a useful table showing a reconciliation from operating profit to free cashflow (unusual, but very useful I think):

The figure that really jumps out of the page at me here is the £866k pensions funding cashflow. That's enormous relative to the profitability of the group! I've mentioned the pension deficit here before, and it is a quite major thorn in the side of the investing case here.

Additional funding is required, which has been agreed at £0.79m p.a. for the next three years. That's bound to limit what they can pay in dividends, and certainly needs to be factored into how you value the company, as it's a big drain on cashflow.

Apart from the pension deficit, otherwise their Balance Sheet looks alright, with a fairly solid working capital position, in my opinion. £120k in development spending was capitalised in the year, which is not significant in my view.

The main part of the outlook statement sounds reasonable, saying;

We have made a solid start to the new financial year, demonstrating the benefits from our self-help and restructuring activities. A positive book-to-bill ratio underlines the success of our integrated sales approach and commercial initiatives which are delivering new business from both existing and new customers. Consequently we continue to anticipate improving trading performance as we progress through 2014.

Broker consensus is for 7.6p adjusted EPS in 2014, so that puts the shares on a current year PER of 9.1, based on the current share price of 69p (down 4% on the day). Given the burden of the pension deficit, and the small size of the group, that's probably priced about right in my opinion.

Deltex Medical (LON:DEMG)

There seem to be some encouraging signs at specilialist medical product company, Deltex Medical. Their core product saw sales up 24% to £5.5m. However, the bottom line is still another £2m loss, although as the company point out, £1.2m of that is non-cash costs.

My feeling on this company is that it's taking too long to commercialise their products, and it's been taxiing along the runway for years now, never quite reaching take-off speed. Will it ever get there? Who knows? It's certainly true that the process of getting new products adopted in the medical world can be very slow. However, if there is a really large benefit from a new product, then in my view doctors find a way of making sure that they get it. So are this company's products really such a big breakthrough? I have my doubts, just from the slow speed of sales growth.

That said, if they do make the big breakthrough needed, then the shares could go a lot higher. The market cap of about £25m after this morning's 8% rise to 14.8p is already factoring in some further growth though.

Overall I'm pretty neutral on this one. The outlook statement sounds positive, but it always does. I think investors might be looking for fresher growth stories, this one is looking a bit stale now.

I have to leave it there for today, as am jumping on a train for a company meeting in Canary Wharf in a few minutes. See you back here from 8am tomorrow.

Regards, Paul.

(of the companies mentioned today. Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.