Good morning from Paul & Graham!

A huge thank you to Roland who did a brilliant job holding the fort yesterday. Unfortunately I lost my flat keys over the weekend in London, came home late on Monday unable to get into my own home due to lack of available locksmiths. So I had to book into a local budget hotel, and got caught up in a coach party of pensioners, on a 1950-60s rock 'n roll themed seaside break, singing along to Eddie Cochran and the like in the hotel bar, performed by a one-man tribute act who could sing, play the guitar, and do an occasional flourish on the keyboard too. Not bad, but also not how I had planned my evening. Anyway, I eventually got into my flat late morning yesterday, having been relieved of nearly £300 by the locksmith, which was fair enough as he was here a while. At least the hotel did a good full english, the only highlight in an otherwise stressful & unproductive day for me.

Roland very much rescued things, with summary coverage of a large list of companies reporting, and some main sections too. Great work Roland!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

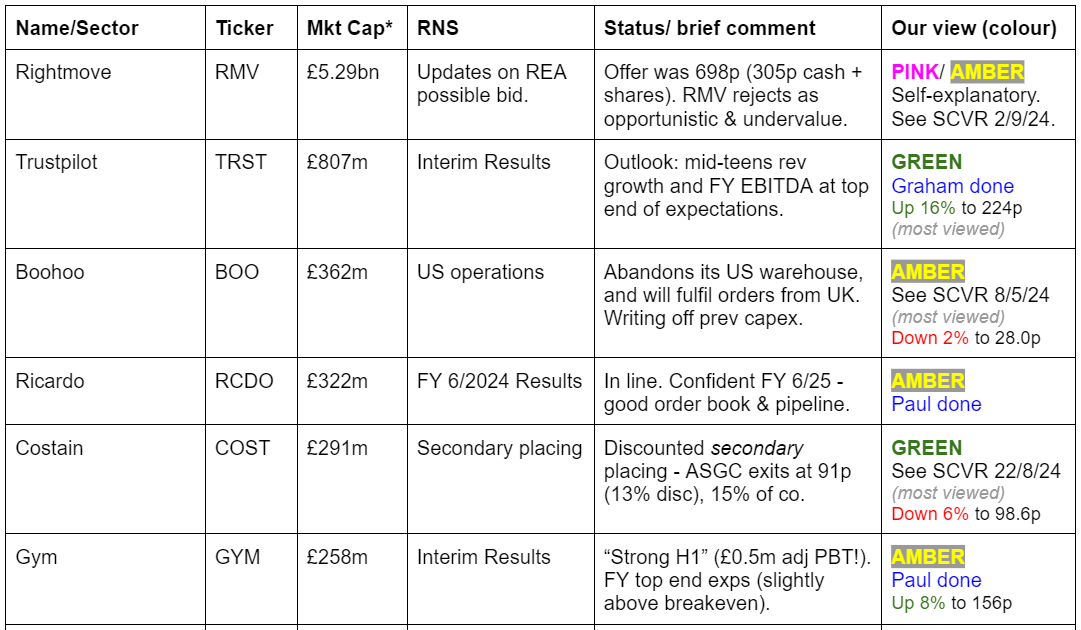

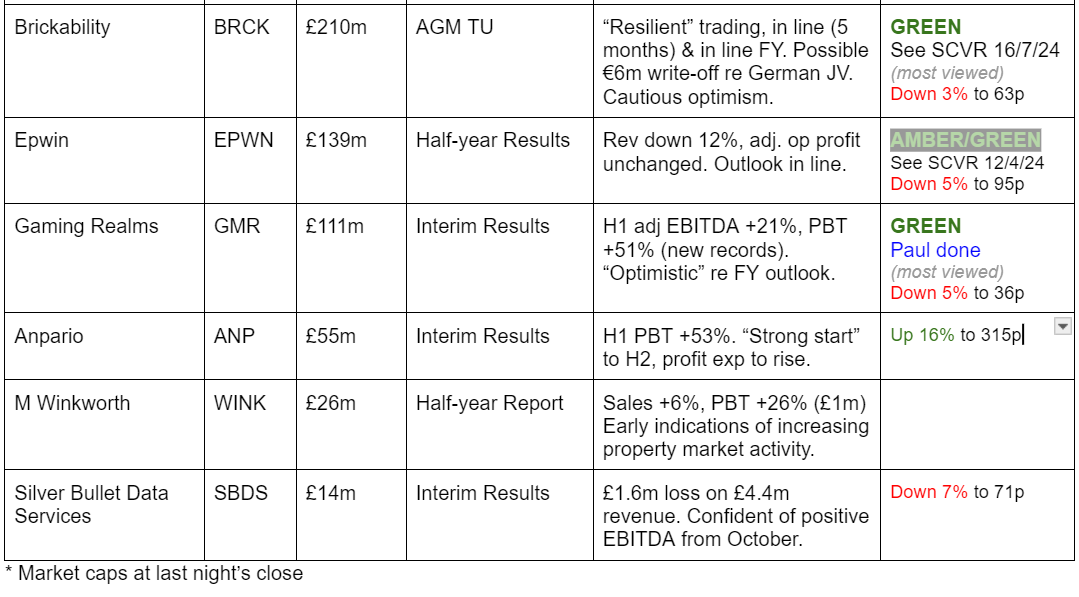

Companies Reporting

Other mid-morning movers (with news)

Rentokil Initial (LON:RTO) - down 17% to 394p (£9.95bn) - Trading Update [Profit warning] - Paul - BLACK

Softer revenues (£20m profit impact) & cost over-runs (£50m profit impact) in key USA market. Forex headwind c. £10m profit impact. Revised guidance FY 12/2024: £700m adj PBT. FY 12/2023 actual was £766m adj PBT.

Paul’s view - I checked it out here on 7/3/2024, and was surprised at how weak the balance sheet is, with c.£(3)bn negative NTAV. Add a profit warning today, and a high PER, and it’s difficult to see any attraction to this share. Just a quick look, hence no colour coding from me.

WH Smith (LON:SMWH) - up 11% to 1,366p (£1.79bn) - Trading Update [in line] - Paul - NO COLOUR

Strong peak Q4 trading (to 31/8/2024), but FY 8/2024 only in line with expectations. £50m share buyback. Received £85m from pension scheme buyout, with no future liabilities.

Paul’s view - looks fully priced after today’s rise, I’m not sure that in line justifies an 11% rise. Good to know pension scheme now gone. I dislike the geared balance sheet, with NTAV negative £(173)m.

Pebble Beach Systems (LON:PEB) - up 18% to 13.0p (£16m) - Mentions NVIDIA! - Paul - AMBER

“Pebble announces support for NVIDIA Holoscan for Media to drive flexible, cost-effective and sustainable media architectures.”

No indication of any financial effect from the two companies presenting jointly at a exhibition in Amsterdam shortly.

“The PRIMA platform works seamlessly with Holoscan for Media, and teams from both companies will be on hand at IBC to discuss the potential of the integrated technologies.”

Paul’s view - I don’t understand this announcement. But it sounds good, mentioning NVIDIA, which seems to have triggered some buying interest in PEB shares.

Summaries

Trustpilot (LON:TRST) - up 9% to 210.5p (£881m / $1153m) - Half Year Report - Graham - GREEN

Pleasant news for shareholders as we learn that adj. EBITDA is trending towards the top end of market expectations for the full year, thanks to the beneficial effects of operating leverage (costs becoming smaller as a percentage of revenues). A new £20m/$26m buyback is announced and I remain happy with my positive stance.

Gaming Realms (LON:GMR) - down 4% to 36.2p (£107m) - Interim Results - Paul - GREEN

Strong H1 results, but a vague outlook comment introduces a little doubt. They need to improve how these statements are drafted. It's an impressive growth company, on a remarkably modest rating, so it has to be GREEN again. I hope we haven't missed anything, with my only slight question mark being re cashflow, as explained below.

Ricardo (LON:RCDO) - down 2% to 508p (£316m) - Preliminary Results [FY 6/2024] - Paul - AMBER

FY 6/2024 results are in line with expectations. Most of the underlying profit comes from another year of heavy restructuring adjustments. Declines to say whether outlook is in line or not. Balance sheet just about OK, I'd like to see further debt reduction. Cashflow not as good as they make out. So even though I have a perception that this is a good business, the numbers don't excite me. Could be a takeover target, as this sector has seen generous bids before.

GYM (LON:GYM) - up 8% to 156p (£279m) - Interim Results - Paul - AMBER

I try to consider the bull arguments, as well as the obvious bear points (it doesn't make any profit being the main one). Overall it's a weak business model, and over-priced in my view, so only a very grudging AMBER, reflecting that the bank situation is now sorted, and trading is improving.

Paul's Section:

GYM (LON:GYM)

Up 8% to 156p (£279m) - Interim Results - Paul - AMBER

Leading low cost gym operator, The Gym Group, announces its interim results for the six month period ended 30 June 2024.

The investment arguments here are very simple -

Bull - see comment below from BurntOnions. Price rises for customers (+9%), and increased customer numbers (+3%) gives operational gearing (gross margin almost 100%), sticky customers, savings on energy costs, strong cash generation. Shares in a nice up-trend. Improving broker forecasts (now reached breakeven EPS).

Bear - doesn’t make any profit once large depreciation costs are taken into account. Rolling out a format that isn’t profitable - why? Capital-intensive. No barriers to entry, and lots of competition. Little to no economies of scale.

As you can see from the highlights, it’s just about achieved breakeven at PBT -

A useful reduction in net bank debt, through restricting new site openings (and the relevant heavy capex) to 4 in H1.

Bank facility is £90m, signed in June 2024.

Outlook - sounds upbeat -

Trouble is, this EBITDA translates into zero profit. You can’t just ignore depreciation charges, that makes no sense at all to me. Operating at breakeven, all that means is the company is slowly recouping the cost of the site fit-outs & equipment, and nothing more. So why would you keep opening more sites, knowing that your return on investment is basically nil overall?

Cash generation is not actually that good in H1. Operating cashflow of £52.0m is a fantasy number. The following cash flows use up most of it - £3.3m capitalised development spend or software, £15.2m + £7.7m lease repayments, £3.4m bank interest, and £12.2m physical capex, leaves £10.2m remaining cash generation in H1.

It says in a table that £11.2m of the capex is expansionary, implying only £1m is maintenance capex, which surprises me, as that seems very low.

Hence why the company gets to a higher free cashflow number of £24.5m, because it doesn’t include the cost of expansionary capex in that number. Fair enough, I suppose.

An employee benefit trust is buying up free shares for Directors, a £1.5m cash outflow in H1.

Balance sheet - NTAV is a modest £36m. Note that it has favourable working capital, with little inventories or receivables, but a fair bit in current liabilities, so the suppliers help fund the business. Ignoring depreciation doesn’t stack up for me. The accounting policies are very clear - fixed assets are depreciated over their estimated useful lives, so there shouldn’t be much (if any) up-front effect that BurnedOnions suggests, in my view -

From the last annual report, I see that £94m cost gym equipment is now heavily depreciated at NBV of £26.8m, suggesting that its equipment is now generally quite old, and hence there could be a hefty repair & replacement cycle coming up.

The bulk of fixed assets are leasehold improvements (NBV £140m at end 2023), but if you can’t agree a higher rent with the landlord at lease renewal, then you have to hand in the keys and walk away.

Paul’s opinion - unchanged really, it’s not a very good business model. It didn’t make consistent profits before covid, and it’s only just reached breakeven after covid. The breakeven being a good result as it’s cash generative argument doesn’t stack up. You have to recoup the cost of your fixed assets as a bare minimum, not as a satisfactory level of performance. There’s a reason GYM has paid hardly any dividends in its whole life - because it doesn’t generate cash beyond the cost of its capex.

The bull case I could see working is if GYM is able to significantly grow revenues further, which on almost 100% gross margin could transform the bottom line eventually maybe. At £279m market cap, that positive outcome is already priced-in, but hasn’t happened yet (and may never happen).

The bull case doesn’t stack up for me, but the market likes it, and the shares are going up, so it doesn’t matter what I think!

I upped it to AMBER last time, since the bank debt situation is now sorted out, and trading is improving. But I still fundamentally think this is a lousy business model, and the shares are over-priced now. So it’s a distinctly unenthusiastic, grudging AMBER.

Since listing, it's been a share that comes in & out of fashion with investors, plus of course got badly walloped by the pandemic -

Ricardo (LON:RCDO)

Down 2% to 508p (£316m) - Preliminary Results [FY 6/2024] - Paul - AMBER

Not the clearest of self-descriptions -

“Ricardo plc is a global strategic, environmental, and engineering consulting company, listed on the London Stock Exchange. With over 100 years of engineering excellence and circa 3,000 employees in more than 20 countries, we provide exceptional levels of expertise in delivering innovative cross-sector sustainable outcomes to support energy transition and environmental services, together with safe and smart mobility. Our global team of consultants, environmental specialists, engineers, and scientists support our clients to solve the most complex and dynamic challenges to help achieve a safe and sustainable world. Visit www.ricardo.com “

It says performance is “in line with the board’s expectations”.

Order intake - fell 5%, but from record levels in the prior year.

Volatility in some markets.

Revenue (continuing ops) up 7% to £475m.

Automotive & Industrial returned to profit in H2.

Underlying PBT of £30.5m, up 9%

Statutory PBT only £4.3m, so lots of adjustments

Basic underlying EPS 35.9p (up 7.5%) = PER 14.2x

Total divis up 6.2% to 12.7p (yield an unremarkable 2.5%)

Net bank debt £59.6m (reduced 4%) - c.19% of the market cap. At 1.25x it’s well within the covenant limit of 3.0x

Adjustments do seem considerable, in both the most recent years - so it’s up to you to decide how real the adjusted profits are - or if it’s one of these people businesses that seems to be constantly doing expensive reorganisations? -

Outlook - another case where they duck the question of performance versus market expectations for the new financial year, choosing more vague language -

“Looking forward

Ricardo is gaining good momentum to deliver its five-year strategic plan communicated in May 2022. We enter the new fiscal year with a similar order book level to the record one we achieved last year, and, through our solid pipeline visibility, we have good confidence in performance as we enter FY 2024/25.

With our expertise in environmental and energy transition, there is a real opportunity for us to do even more in supporting governments and the private sector in delivering a net zero pathway for future generations.

We also know that for us to be a pivotal part of change, we have to continue to grow and improve our business. By doing so, we can extend our reach, supporting even more clients and ensuring that our teams across the world continue to deliver meaningful work, knowing that the projects are delivering maximum impact.

The more we can do to accelerate our transformation, the more value we can create for all our stakeholders.”

Balance sheet - no better than adequate I’d say. NAV £165m includes £130m of goodwill & similar, so £35m NTAV.

Gross bank debt looks too high at £107m, although partly offset with cash of £49m - but cash is often window-dressed for year end dates remember. I’d prefer to see borrowings come down further.

Good news is that the pension deficit contributions seem to have ended.

Cash generation - improved, thanks to squeezing receivables a bit. But it’s not an impressive cash generator. There was £8m capex in FY 6/2024, nearly all of that being capitalised development costs. Take off leases, and divis, and there’s nothing much cash remaining. So a question mark over fairly weak cash generation. Strangely though, Panmure Liberaum heads its update note today with “Strong cash generation”, which is not what the figures I’m looking at say to me. Cashflow is better than the previous year, but not impressive overall in my view. It would make more sense to suspend divis and focus on building up the balance sheet, and reduce debt somewhat in my view, because debt is expensive now - note that £8.5m finance costs in FY 6/2024 consumed two thirds of the £12.8m statutory operating profit.

Paul’s opinion - I’ve always had a generally positive view of RCDO as a decent quality business, but seeing all the adjustments today does remind me that it seemed to get itself into quite a pickle which has taken several years to sort out. Are all those exceptionals going to suddenly stop? I don’t know.

Liberum has today slightly lowered forecast EPS for FY 6/2025, from 42.1p to 40.3p (down 4%) and a similar drop of 5% for the following year. That gives a new year PER of 12.6x, which looks reasonably attractive value to me. Add on the bank debt though, and it would be higher. Priced about right perhaps?

These consultancy firms can attract surprisingly high takeover bids, we had a flurry of those a few years ago at full valuations. I see Gresham House holds 18.4%, and I think they agitated for a takeover bid at something else they held recently.

Overall, it looks quite interesting, probably no more than an AMBER for me - which is a clean bill of health remember, not a negative.

Gaming Realms (LON:GMR)

Down 4% to 36.2p (£107m) - Interim Results - Paul - GREEN

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, is pleased to announce its interim results for the six months to 30 June 2024 (the "Period" or "H1'24").

Mixed growth, but the core revenues are up an impressive 28% (all organic growth), and very good overall profit growth -

Brand licensing - why has this smallest activity dropped -67%? The explanation provided has left me none the wiser -

“Brand licensing revenue reduced 67% to £0.3m (H1'23: £1.0m) due to two brand deals completed in the same period of the previous year”

Thinking about it, these might be saying that last year saw some one-off deals that haven’t repeated perhaps? Does it matter? Not really, as it’s the core (growing) revenue stream that matters. This is recurring revenue and seems to consistently grow each period, due to the popularity of the Slingo game.

Ah the fog has cleared! Further down the announcement it gives a clearer explanation -

“Revenues from the Group's brand licensing activities, which are non-core, were £0.3m in the period (H1'23: £1.0m). This reduction is a result of two brand deals completed in the previous period, including a one-off £0.6m that did not repeat in H1'24.”

Cash continues to accumulate on the balance sheet -

“Net cash at period end up 28% to £9.6m (Dec'23: £7.5m) with continued strong cash generation”

Post period end - strong growth continued -

“Licensing revenue increased 33% in the two months post period-end compared to the same period in 2023”

Outlook - GMR doesn’t seem to realise that investors usually want a clear statement confirming full year expectations. Instead we get a rather waffly & unclear alternative, which is bound to raise questions amongst investors, which is probably why the share price is down 4% at the time of writing -

“Looking ahead, the Group is well placed to capitalise on this momentum and deliver further growth in new and existing markets.

Our focus for the remainder of the year is to further expand our international presence in new markets, while continuing to grow in existing markets with our partners.

In August we launched our content in West Virginia, the fifth regulated iGaming state the Group's content is distributed in. After the period end, the Group was also granted an iGaming supplier license in British Columbia, where we expect to launch our content shortly.

These market expansions will be supplemented by premium game launches in the second half of 2024 including Slingo Fowl Play and Slingo Press Your Luck.

The Board remains optimistic around FY24 financial performance.”

Is that in line with expectations? Who knows.

Have brokers changed forecasts today? The next port of call when uncertainty has been created in an RNS.

Canaccord says this morning that it’s leaving forecasts unchanged, and that they look “well underpinned”.

FY 12/2024 forecast is £27.1m revenues, adj PBT of £8.8m (up 63% on 2023), and adj EPS of 2.33p (up 15%).

I’ve tried to find out why EPS is only forecast to grow +15% in 2024, when PBT is +63%. Must be something to do with tax, because the number of shares in issue hasn’t changed much (the only other factor that could impact EPS). The H1 results in 2024 do show a £253k corp tax charge, vs a £160k credit in H1 2023. So it looks as if tax could be normalising after previously using up brought forward tax losses? Yes here we are, the FY 12/2023 results showed a £758m tax credit that took PBT of £5.17m and made it a larger PAT of £5.93m. So a reversal of that in 2024 looks likely the reason forecast EPS growth is modest.

Valuation - using the 2.33p Canaccord 12/2024 forecast, at 36.2p/share, the PER is currently only 15.5x - that seems remarkably cheap to me, but this share has looked strangely cheap for some time. I’m not sure why.

Balance sheet - is strong, and this is a capital-light business model remember.

NAV of £28.1m becomes £14.3m NTAV once I remove intangible assets. This includes £9.6m of gross and net cash. All creditors are only £3.8m, so it’s more than adequately funded.

Cashflow statement - is healthy, with £4.46m post tax operating cashflow in H1. Although capitalised development spend consumes just over half this, at £2.43m, giving a free cashflow of £2.13m in H1.

Paul’s opinion - every time I look at this share, I’m scratching my head as to why the valuation is so modest for such an impressive growth company. Strong, repeated organic growth like this usually comes at a large premium, yet here we are being asked to pay 15.5x PER.

What have we missed? I can’t think of anything, other than the cash generation not being as good as profit, due to capitalised development spend exceeding the amortisation charge, but that’s not a deal-breaker.

It has to be GREEN from me, with this popular game being further rolled out to more & more customers, generating a growing high margin revenue stream. Lots to like here, providing nothing unforeseen goes wrong. There are some presentational issues with this results statement too, which seem minor own goals.

Graham’s Section:

Trustpilot (LON:TRST)

Up 9% to 210.5p (£881m / $1153m) - Half Year Report - Graham - GREEN

Financial performance at Trustpilot just keeps going from strength to strength.

Please note that we covered the corresponding H1 update in July, here.

Here are some of the highlights from today’s interim report:

Revenue +18% (£99.8m)

Adj. EBITDA +86% (£10.6m) is ahead of expectations.

Operating profit £1.8m (last year: £2.1m loss)

The strong EBITDA result is attributed to “improved operating leverage across the cost base, but particularly in general and administrative expenses”.

The full-year adj. EBITDA result is now expected to come in “towards the top end of market expectations”, with those expectations being for adj. EBITDA of $18 - 22m.

CEO comment:

“When I joined Trustpilot a year ago, I said that I aimed to bring greater strategic clarity, rigorous execution, and increasing profitability. We have made good progress across these areas.

“Our strategy is clear. We are an open, trusted review platform for consumers to help each other make the right choices, and provide insights for businesses to build trust, grow and improve. By targeting key focus markets and verticals, we maximise the inherent network effects of the platform…”

I’ve been bullish on this one because I see it as a potential monopoly, with those network effects keeping it growing and profitable. The simple argument is that the more people (and businesses) who use Trustpilot, the more useful it becomes, making it even more difficult for competitors to make progress.

A KPI worth particular mention: Annual Recurring Revenue is up 17% to $211m. In the absence of meaningful profits, this is a metric I tend to focus on.

Cash finished the period at $76m, down over the six month period as Trustpilot spent $26m buying back its own shares.

With this strong cash pile behind it and worth more cash generation expected, the company announces today a new $26m buyback.

Regional breakdown - Trustpilot’s success is most advanced in the UK, and the UK contributed 40% of bookings in H1. But booking growth is good even outside the UK: there is 23% growth in North America, and 16% growth in “Europe and Rest of the World”.

Taxes - are complicated by the recognition of prior losses as an asset. So it’s fine to completely ignore the after-tax profit numbers published today.

Graham’s view

I can’t change my stance on this after a strong interim report with full-year results now heading for the top end of market expectations.

Just take a look at the trend in market expectations. This is before today’s news:

Sometimes you have to let momentum run. In this case, as an analyst, I’m happy to let my winner run and stay positive on it.

But I’m not completely ignoring the valuation. We have the following multiples:

Enterprise value to trailing ARR: 5.1x according to my calculations.

Price to sales: 6x, according to Stockopedia.

Yes, it’s expensive, but I don’t consider these to be “bubble” valuations. Given the quality and momentum of the business, I think they remain attractive.

But as I said last time, if growth slows or if valuation were to change dramatically, (e.g. P/S of 10x), then I would change my stance. But for now I remain comfortable with GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.